- Home

- »

- Clinical Diagnostics

- »

-

COVID-19 Sample Collection Kits Market Size Report, 2030GVR Report cover

![COVID-19 Sample Collection Kits Market Size, Share & Trends Report]()

COVID-19 Sample Collection Kits Market Size, Share & Trends Analysis Report By Product (Swabs, Viral Transport Media), By Application, By Site of Collection, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-539-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2020 - 2021

- Industry: Healthcare

Market Size & Trends

The global COVID-19 sample collection kits market size was estimated at USD 5.82 billion in 2022 and is expected to decline at a compound annual growth rate (CAGR) of -18.27% from 2023 to 2030. SARS-CoV-2 sampling is the most critical step in the effective diagnosis of active infection. False and imprecise specimen collection may lead to wrong or misleading test results. As a result, the Centers for Disease Control and Prevention (CDC) and other healthcare organizations have introduced standard procedures and guidance for effective specimen collection and streamlining the usage of COVID-19 sample collection solutions, thereby driving the growth.

In October 2021, the FDA granted Labcorp an Emergency Use Authorization (EUA) for a combination home collection kit that may detect COVID-19 plus influenza A/B in children as young as two years old. Those who match clinical standards, such as having symptoms, being contacted by someone with COVID-19, or being requested to be diagnosed by a health care physician, will receive the kit free of charge.

The key stakeholders have collaborated with regional authorities and suppliers for preserving the manufacturing conditions and accelerating the company’s growth in swabs and the viral transport medium market. With the ongoing surge in demand due to the COVID-19 outbreak, companies are concentrating their efforts on strategic products to maximize product output and supply. Moreover, there have been 424,822,073 confirmed cases of COVID-19 till February 2022, as per the WHO. As the number of COVID-19 cases rises, more COVID-19 collection kits are required, thereby boosting the total market in the forecast period.

Furthermore, despite the high vaccination rate, contaminated patients can still transfer the disease, driving the transmission. Moreover, ongoing virus mutation generates variations in the viral structure, making vaccinations ineffective. As a result of these circumstances, demand for COVID-19 detection kits rises, boosting the total market growth. For instance, in February 2023, The Rockefeller Foundation, announced its plan to extend its Access Covid Tests (Project ACT) program to provide additional at-home testing and diagnostic kits for COVID-19 in the U.S.

The availability of swabs in various configurations for advanced infection detection is one of the key market drivers. For instance, in November 2020, researchers at the University of South Florida (USF) Health have introduced a 3D printed nasal swab prototype for commercial usage. As of 25th November 2020, the organization has developed 100,000+ products, and hospitals across the globe have implemented their 3D files to develop tens of millions more swabs for use in a point-of-care setting.

Furthermore, the advent of antigen tests to fill the timeline and capacity gaps in the testing landscape is anticipated to spur the usage of Nasopharyngeal (NP) swabs across the globe. The U.S. government signed a USD 760 million deal with Abbott over its BinaxNOW COVID-19 Ag Card in August 2020. With this, the government aimed at tripling the national testing capacity. Such collaborations between the diagnostic players and government bodies are anticipated to greatly benefit the swab suppliers in the country.

In September 2021, Quidel Corporation has stated that their non-prescription QuickVue In-Home OTC corona-virus Test will be available to more than 7,000 CVS Pharmacy branches nationwide as well as online at cvs.com. Two self-administered fast antigen tests are included per shelf-stable packet.

Product Insights

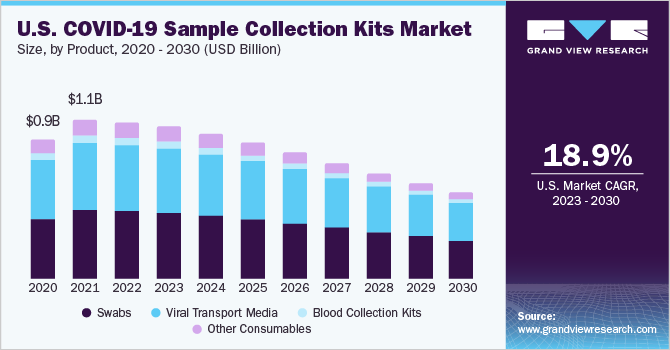

The swabs segment captured the highest revenue share of 40.95% in 2022 owing to the reliance on a substantial number of approved diagnostic products on the use of NP swabs. According to the CDC, other samples from the respiratory tract can also be collected when the use of NP swabs alone is not sufficient. These include an oropharyngeal swab or a swab from a nostril. Key players have adopted several measures to accelerate the production and supply of products for COVID-19 sampling. For instance, in November 2020, Puritan received a fund of USD 11.6 million for expansion of its swab manufacturing capabilities to meet the supply of 3 million swabs per month. This additional funding was offered by the Paycheck Protection Program and Health Care Enhancement Act. In India, for example, Abbott announced the Panbio Covid Antigen Rapid Test in July 2021. This test is used to identify COVID-19 contamination in both adults and children. It is used to identify infection in asymptomatic individuals and provides findings in 15 minutes. It is 93 percent sensitive. Over, 300 million of these tests have been distributed worldwide. As a result, the higher testing requirement for new product releases will drive market growth. Furthermore, because COVID-19 is a respiratory disease, most COVID-19 detection tests need a nasopharyngeal specimen for increased specificity, which benefits the business.

On the other hand, the blood collection kits segment is expected to register highest CAGR during the forecast period due to approvals of blood-based serology tests/antibody detection tests for SARS-CoV-2, the demand for blood collection products is increasing. For instance, Puritan Medical Products was granted USD 110 million by the Department of Defense, in collaboration well with the Department of Health and Human Services, on January 8, 2021, to purchase production equipment in order to increase the national manufacturing capacity of foam tip swabs for use in vital COVID-19 diagnostic tests. The rise of COVID-19 cases throughout the world continues to have an influence on diagnostic test producers as well as the supply chains that facilitate specimen collecting & testing.

Application Insights

The diagnostic segment held market share of use of 69.89% in 2022. This is due to the continuous approvals of diagnostic tests for SARS-CoV-2. As of 1st December 2020, a total of 1,295 tests have been approved by the U.S. FDA under EUAs; out of which 227 are molecular tests, 61 are antibody tests, and 7 are antigen tests for the detection of COVID-19 infection. Furthermore, continuous development to advance the use of swabs for disease diagnosis is driving the segment. In August 2021, Hardy Diagnostics released HardyCHROM Group A Strep agar, their newest chromogenic medium. It is for the specific cultivation as well as identification of Group A Streptococcus (S. pyogenes) from clinical specimens. Moreover, in June 2020, researchers from the Southern University of Denmark (SDU) developed a fully automated robot, i.e. swab robot in collaboration with Lifeline Robotics for swab sampling from the patient. This development is aimed at simplifying the sample extraction process without exposing health care professionals to the risk of infection.

The research segment accounts for low penetration in the global market in terms of revenue generation. However, an increase in the number of R&D programs that deploy sample collection kits to examine the effectiveness of various diagnostic tests is expected to drive the segment. Furthermore, extensive funding to support research on SARS-CoV-2 pathogenesis further boosts the revenue generation in this segment. In 2021, Tempus would produce a research use-only (RUO) amplicon-based next-generation sequencing kit for detecting SARS-CoV2 viral variants.

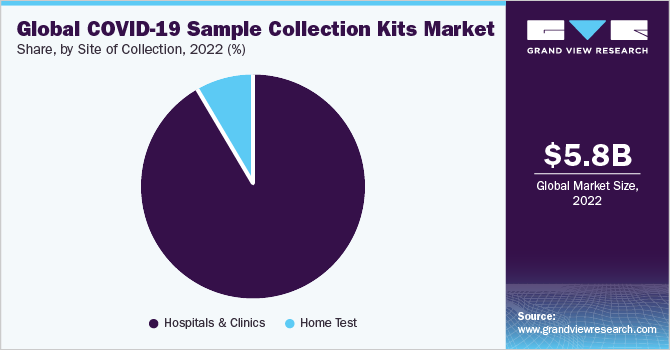

Site of Collection Insights

The hospitals & clinics segment is estimated to account for the largest revenue share of 91.99% in 2022 due to the exponential increase in number of hospitalizations related to the coronavirus. In response to the rising cases of COVID-19 cases, many hospitals expanded their testing capacities for SARS-CoV-2 virus detection. This is directly impacting the use of specimen collection products in the hospital settings, thus resulting in the dominance of this segment.

Several states in the U.S. have reported the challenges of inadequate testing capacity. In Maryland, hospitals’ 86% capacity is already occupied with 1,583 COVID-19 patients statewide as of 1st December 2020. As a result, country officials and local hospitals have begun taking initiatives to ensure sufficient testing capacity to keep pace with a rising number of hospital admissions.

COVID-19 sample collection market for home settings is expected to grow lucratively during the forecast period, as the companies are aiming at patient comfort and safety of healthcare personal. For instance, in November 2020, Mybiopassport, a Swiss biotechnology company, launched its e-Commerce platform for online ordering of the “COVID-19 & Immunity Profile” test, an at-home blood collection test. The test helps determine if the individual has been previously infected by the COVID-19.

Regional Insights

Europe dominated the market with a 39.3% revenue share in the global 2022 market. In November 2020, the U.K. government announced the plan of new laboratories to double the testing capacity in the early next year. Asia Pacific is expected to decline at the compounded annual rate of -17.25% over the forecast period. This is because pandemics tend to hit the countries with fragile and underfunded healthcare systems hardest, as there is an inherent disparity between the need and purchase power for infection prevention measures such as vaccines.

Government bodies are actively engaged in disease management in the region, which contributes to the revenue growth in the region. For instance, in April 5, 2022, the Shanghai city was placed under complete lockdown. The decision was made in support of the national "dynamic zero COVID" strategy, which calls for widespread testing and strong quarantine measures to stop the recurrence of COVID-19. On April 11, Shanghai recorded over 23 000 new cases of COVID-19. Only around 1000 of these instances had symptoms. During the latest wave, which is being driven by the highly communicable omicron form, the city has not recorded any deaths from COVID-19.

Key Companies & Market Share Insights

The presence of a substantial number of well-established, small, and medium-sized players has led to an increase in market competition. Each player is undertaking multiple business strategies to gain a competitive edge in the market. Some key market participants include Puritan Medical Products; Thermo Fisher Scientific, Inc.; Becton, Dickinson, and Company; COPAN and Diagnostics. With the outbreak of COVID-19, Puritan Medical Products & COPAN Diagnostics have witnessed lucrative growth in their revenue. For instance, COPAN UniVerse aids in the implementation of a recently launched streamlined approach to pooled serial screening testing programs. Moreover, in April 2021, Puritan keeps innovating by receiving two new patents for its HydraFlock and PurFlock Ultra swabs.

These two companies are recognized as the key solution providers in the 2020 global health disaster. Both companies have increased their production capacity to meet the demand for swabs in the U.S. The companies have reported working overtime to effectively address the challenge of swabs shortage. Some other companies that contribute considerably to the market are Quidel Corporation, Trinity Biotech, Formlabs, Trinity Biotech, US Cotton, LabCorp, Quest Diagnostics, Cepheid, and others.

The companies are making constant efforts to ensure that the products are transported and distributed efficiently and quickly as possible. This includes monitoring the global logistics and transportation network as well as taking required actions to overcome the capacity and border constraints in the production and delivery of COVID-19 sample collection products. For instance, in 2021 several product launches to flourish the market such as, through cooperation with Vault Health and Everlywell, Door Dash declared the debut of on-demand delivery of the COVID-19 PCR test collection kit. This kit assists users in diagnosing COVID-19 at home. Moreover, COVID-19 home collection sample kit was launched by Tempus in 2021. This sample kit would be for self-collection of specimens at home for COVID-19 testing. Furthermore, EmpowerX introduced the COVID-19 home detection sample kit on Amazon in 2021. This product be supplied to your door for COVID-19 diagnostics. Some prominent players operating in the COVID-19 sample collection kits market include:

-

Puritan Medical Products

-

COPAN Diagnostics

-

Becton, Dickinson and Company

-

Thermo Fisher Scientific, Inc.

-

Laboratory Corporation of America Holdings

-

Lucence Diagnostics Pte Ltd.

-

Hardy Diagnostics

-

Trinity Biotech

-

Quidel Corporation

-

Quest Diagnostics

-

Danaher Corporation

-

Vitagene Inc.

-

Formlabs

-

HiMedia Laboratories

-

VIRCELL S.L.

COVID-19 Sample Collection Kits Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.17 billion

Revenue forecast in 2030

USD 1.26 billion

Growth rate

CAGR of -18.27 from 2023 to 2030

Base year for estimation

2022

Historical data

2020 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, site of collection, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Germany, U.K., France, Italy, Spain, Russia, Sweden, Denmark, Norway, China, India, South Korea, Australia, Japan, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Puritan Medical Products; COPAN Diagnostics; Becton, Dickinson and Company; Thermo Fisher Scientific, Inc.; Laboratory Corporation of America Holdings; Lucence Diagnostics Pte Ltd.; Hardy Diagnostics; Trinity Biotech; Quidel Corporation; Quest Diagnostics; Danaher Corporation; Vitagene Inc.; Formlabs; HiMedia Laboratories; VIRCELL S.L.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global COVID-19 Sample Collection Kits Market Report SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study and based on the data available 2022, Grand View Research has segmented the global COVID-19 sample collection kits market report based on product, application, site of collection, and region:

-

Product Outlook (Revenue, USD Million, 2020 - 2030)

-

Swabs

-

Nasopharyngeal (NP) Swabs

-

Oropharyngeal (OP) Swabs

-

Nasal Swabs

-

-

Viral Transport Media

-

Blood Collection Kits

-

Other Consumables

-

-

Application Outlook (Revenue, USD Million, 2020 - 2030)

-

Diagnostics

-

Research

-

-

Site of Collection Outlook (Revenue, USD Million, 2020 - 2030)

-

Hospitals & Clinics

-

Home Test

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Australia

-

Japan

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global COVID-19 sample collection kits market size was estimated at USD 5.82 billion in 2022 and is expected to reach USD 5.17 billion in 2022.

b. The global COVID-19 sample collection kits market is expected to witness a compound annual growth rate of -18.27% from 2023 to 2030 to reach USD 1.26 billion by 2030.

b. The swabs segment is anticipated to lead the COVID-19 sample collection kits market and account for around 42.76% share of the global revenue in 2022. This is attributable to the high usage as well as supply rate of Nasopharyngeal (NP) swabs for effective COVID-19 testing.

b. Some key players in the COVID-19 sample collection kits market are Thermo Fisher Scientific, Inc; Puritan Medical Products; COPAN Diagnostics; Becton, Dickinson and Company; Laboratory Corporation of America Holdings; Lucence Diagnostics Pte Ltd.; Hardy Diagnostics; BNTX Inc., and others.

b. Technological developments with respect to test performance, efficiency, timeline; introduction of home-based tests, shortage of swabs & transport media, and active role of government bodies in combating the global COVID-19 crisis are some key driving factors of the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."