- Home

- »

- Next Generation Technologies

- »

-

Creative Software Market Size, Share & Growth Report, 2030GVR Report cover

![Creative Software Market Size, Share & Trends Report]()

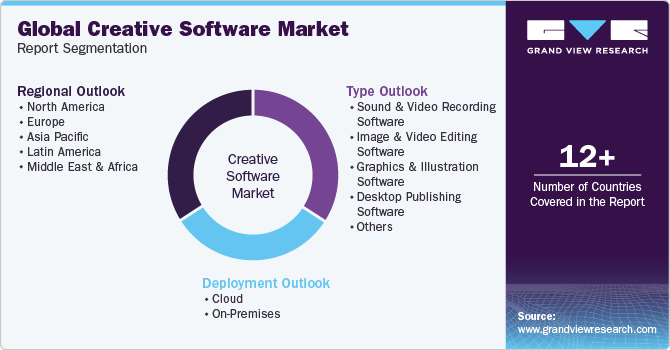

Creative Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Deployment, By Type (Sound & Video Recording Software, Image & Video Editing Software, Graphics & Illustration Software, Desktop Publishing Software), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-930-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Creative Software Market Summary

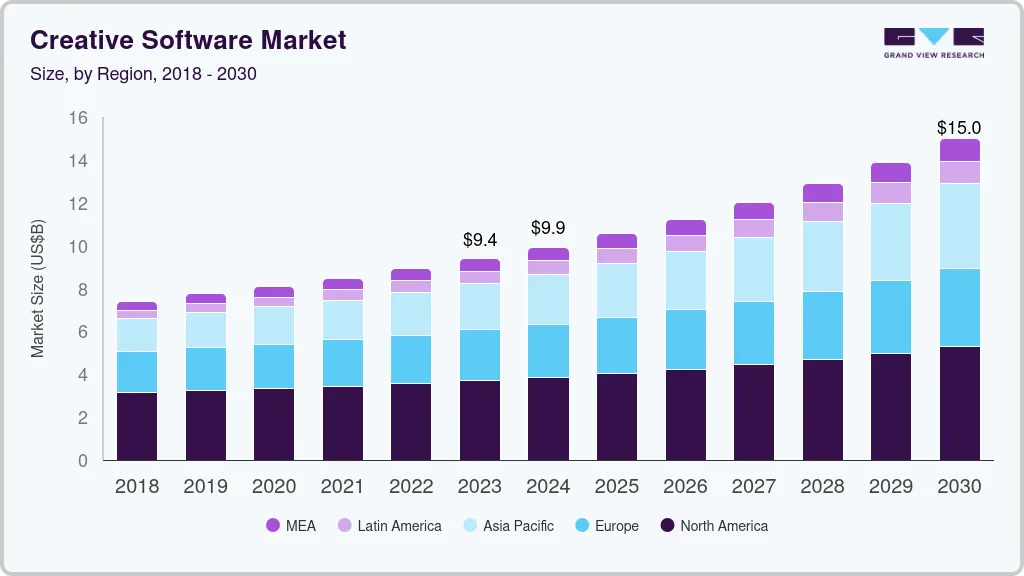

The global creative software market size was estimated at USD 9.93 billion in 2023 and is projected to reach USD 14.98 billion by 2030, growing at a CAGR of 7.1% from 2024 to 2030. The market expansion can be primarily attributed to the rising demand for transcoding methods for the efficient distribution of audio and video files to a vast user base.

Key Market Trends & Insights

- North America dominated the market and accounted for a 39.3% share in 2023.

- The creative software market in the U.S. is expected to grow substantially over the forecast period.

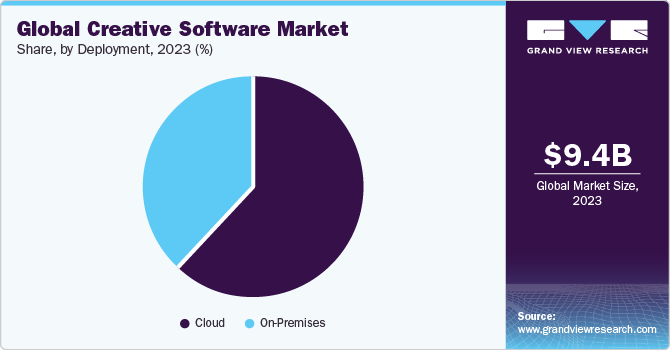

- By deployment, the cloud segment led the market and accounted for 64.1% of the global revenue share in 2023.

- By type, the sound & video recording software segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.93 Billion

- 2030 Projected Market Size: USD 14.98 Billion

- CAGR (2024-2030): 7.1%

- North America: Largest market in 2023

The widespread proliferation of online video and audio recording platforms and the increasing demand for on-demand services also contribute to this growth. Furthermore, substantial opportunities in small and medium-sized enterprises and the rapid expansion of the education sector are expected to offer significant market potential to creative software. As businesses acknowledge the need to remain competitive in the digital landscape, the incorporation of creative software has become a crucial component of their strategic initiatives.

Industries are experiencing a significant digital transformation, fundamentally transforming the way businesses engage and connect with their audiences. This widespread shift toward digitization is a primary factor fueling the increasing demand for creative software in the market. Within the marketing domain, enterprises are utilizing creative software to introduce compelling digital campaigns that resonate with the tech-savvy consumer. In terms of designing visually captivating advertisements and developing engaging social media content, creative software provides marketing teams with the capabilities to make a lasting impression in the ever-expanding digital landscape.

Furthermore, the growing demand for rich and immersive content experiences has driven the development of sophisticated tools, allowing both professionals and enthusiasts to generate high-quality multimedia content. Creative software plays a key role in this scenario, offering a wide range of capabilities from video editing and animation to the creation of interactive presentations. It has emerged as a critical element in boosting the narrative capabilities of businesses, enabling the establishment of meaningful connections with their intended audiences.

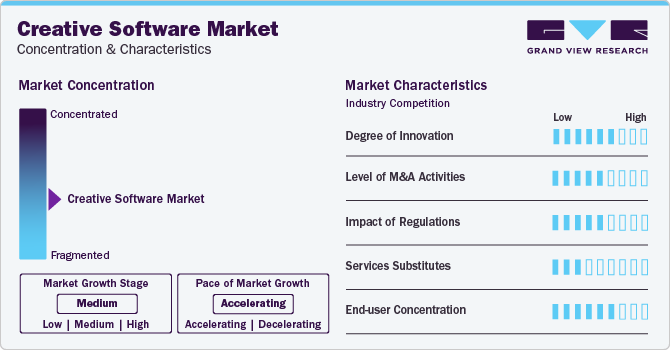

Market Concentration & Characteristics

The industry growth stage is moderate, and the pace of growth is accelerating. Moreover, the production of multimedia content, including videos, animations, and interactive experiences, relies heavily on creative software for design, editing, and post-production tasks. This encompasses a broad spectrum, ranging from video editing software for content creators on platforms such as YouTube to animation software for studios producing feature films or short animations. As consumer preferences shift toward more dynamic and interactive content, the demand for sophisticated creative tools continues to grow.

Companies are implementing mergers & acquisitions to join forces with regional players to expand their product and service offerings with advanced technology offerings. These strategies also enable companies to improve their channel reach in the respective regional markets. For instance, in June 2023, IBM Corporation acquired Agyla SAS, a prominent cloud professional services company based in France. The acquisition aims to enhance IBM's hybrid cloud consulting offerings in the French market. As a major player in hybrid cloud solutions, IBM's acquisition of Agyla bolsters its competitive edge in this sector.

With the rising threat of cyberattacks, there is an increasing emphasis on adhering to cybersecurity standards. Creative software providers need to implement robust security measures to protect user data against potential breaches. Many countries and regions have been strengthening regulations related to digital accessibility. Creative software developers need to ensure that their products meet accessibility standards, making them usable by individuals.

The creative software industry faces a moderate threat from substitutes. The threat of substitutes depends on the availability of alternative solutions to meet creative needs. For instance, if there are alternative creative software options or if creative tasks can be accomplished with non-software tools, the threat of substitutes increases from low to moderate. However, if the creative software offers unique features and functionality, the threat may be lower.

Deployment Insights

The cloud segment led the market and accounted for 64.1% of the global revenue share in 2023. Cloud-based sound and video recording software promote collaborative workflows by allowing multiple users to concurrently contribute to the same project, irrespective of their geographic location. This accessibility empowers professionals to engage in sound and video projects from any place with an internet connection, enhancing work flexibility and enabling effective remote collaboration. Cloud-based solutions optimize the editing process by efficiently managing the processing power required for rendering, thereby reducing the burden on local devices.

The on-premises segment is estimated to grow significantly over the forecast period. On-premises solutions for sound and video recording provide a crucial advantage by enabling extensive customization and seamless integration with existing in-house systems. This helps professionals customize the software according to their workflows, ensuring a finely tuned and efficient production process. The flexibility offered by on-premises solutions enhances the overall control and adaptability of professionals working in the dynamic field of sound and video recording. Graphics and illustration tasks require intricate designs, necessitating substantial computing power.

Type Insights

The sound & video recording software segment accounted for the largest revenue share in 2023. The rise of digital and social media platforms in recent years has increased the popularity and viewership of a variety of digital content, especially high-quality audio and video. To target this rapidly expanding consumer base, individuals and businesses are developing creative content for entertainment, marketing, education, and communication purposes, which is driving the need for sophisticated sound and video recording software.

The graphics & illustration software segment is predicted to foresee significant growth during the forecast period. Graphics and illustration software find applications in diverse industries, including graphic design, advertising, publishing, gaming, and web development. This versatility attracts a broad user base with different creative needs. For instance, Corel Corporation, a Canadian software company, developed CorelDRAW, a popular graphics and illustration software. The software is widely used by graphic designers, illustrators, and marketing professionals to create visually appealing content for multiple purposes, including digital marketing, print materials, and branding.

Regional Insights

North America dominated the market and accounted for a 39.3% share in 2023. This can be attributed to the rising demand for audio-video recording and editing platforms from the incumbents of the media & entertainment industry. The growing preference for audio and video streaming services is one of the significant factors contributing to the growth of the market. The demand for digital streaming services, which gained significant traction in the wake of the outbreak of the COVID-19 pandemic as people opted to stay indoors, shows no signs of abating, thereby driving the demand for high-quality audio and video editing software.

U.S. Creative Software Market Trends

The creative software market in the U.S. is expected to grow substantially over the forecast period. The U.S. is known for the early adoption of new, innovative solutions based on the latest technologies and creative software solutions are not an exception to those. The U.S. is also home to some of the leading technology companies, aggressive investors, and pioneers in video and audio platforms.

Europe Creative Software Market Trends

The growing preference of professionals and artists across Europe for cloud-based creative software solutions to record and edit audio, design images, and process videos bodes well for the growth of the market. The market is poised for continued growth as small- and medium-sized businesses increasingly opt for cloud-based creative software to create promotional content and communicate effectively with their respective clients.

The creative software market in the UK is expected to grow significantly over the forecast period. The creator economy, driven by YouTube, TikTok, and Instagram, among other platforms, is growing in the UK. The demand for specialist creative tools designed specifically for content creators looking forward to posting content on these platforms is subsequently rising. These tools include DaVinci Resolve, a video editing solution developed by a company based in the UK; Toon Boom Harmony, an animation software; F.L. Studio, a music production software; and Canva, a social media content creation platform.

France creative software market is expected to grow substantially over the forecast period. France is known for its strong, significant film & media industry and the emphasis the incumbents of this industry put producing high-quality visual content. Image and video editing software solutions remain vital to post-production processes, encouraging the incumbents of the film & media industry to opt for creative graphic design, video editing, and animation software to improve cinematic effects.

The creative software market in Germany held the largest share of the Europe market. In Germany, designers are opting for software tailored to specific needs, moving beyond the conventional, all-in-one tools. Specialized solutions for 3D modeling, architectural visualization, medical illustration, and other applications are turning out to be lucrative for users accustomed to high-precision, industry-specific workflows. The trend is particularly gaining traction in Germany, which is known for its strong manufacturing and engineering industries, where detailed and accurate graphic representations are crucial.

Asia Pacific Creative Software Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period, due to the region’s strong economic growth and rising demand for creative solutions among organizations and content creators. Organizations and businesses across developed and developing countries, including Japan, India, and China, Singapore and more are adopting video recording and editing solutions and technologies to simplify and optimize their commercial operations.

China creative software market is expected to grow significantly over the forecast period. The creative software industry in China features the presence of numerous domestic software companies, including axiusSoftware, Huawei Technologies Co., Ltd., and Alibaba.com. These companies often tailor their products to the specific needs of Chinese consumers, such as including features popular across Chinese social media platforms.

The creative software market in India is expected to grow substantially over the forecast period. With the rise of digitization, there has been an increasing demand for creative software solutions for applications such as graphics and illustration, sound and video recording, and video editing in India. The younger generation, especially millennials, is more inclined toward digital art and design.

Japan creative software market is expected to grow significantly over the forecast period. The shift toward cloud technology has allowed for greater collaboration and flexibility among creative software users in Japan. The affordability of cloud offerings has ensured increased accessibility to a range of creative software for smaller businesses and individual creators.

Middle East & Africa (MEA) Creative Software Market Trends

Professional media production entities, including entertainment companies, media outlets, broadcasting firms, and educational institutions, are among the leading users of video editing software solutions in the MEA region. This strong user base is anticipated to consistently offer stable market growth opportunities throughout the forecast period.

Gulf Cooperation Council (GCC) creative software market is expected to grow substantially over the forecast period. Young consumers in Saudi Arabia are technologically inclined, displaying a notable enthusiasm for smartphones and internet usage. This has sparked a rising fascination with digital content creation, especially catered to the younger demographic.

The creative software market in South Africa is expected to grow significantly over the forecast period. The distinctive cultural and linguistic diversity of South Africa has influenced the trajectory of the creative software market. Numerous companies have crafted software specifically designed to align with the preferences and requirements of South African users, considering aspects such as language, design aesthetics, and cultural references. This approach has contributed to fostering a more varied and inclusive market that addresses the diverse needs of a wide customer base.

Key Creative Software Company Insights

Prominent players have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in April 2023, TechSmith Corporation introduced Camtasia 2023, an enhanced version of its screen recording and video editing software. Camtasia 2023 focuses on elevating video creation with new, improved visual effects, catering to user requests for enhanced performance and streamlined workflows. Plans envisaged Camtasia 2023 being accessible to creators of all skill levels, empowering them to produce high-quality videos without the need for a dedicated video team.

Key Creative Software Companies:

The following are the leading companies in the creative software market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe.

- MAGIX Software GmbH.

- Corel Corporation

- CyberLink Corp.

- FXhome Limited

- TechSmith Corporation

- Nero AG

- Movavi Software Limited

- Sony Creative Software Inc.

- Wondershare

Recent Developments

-

In November 2023, TechSmith Corporation announced the launch of generative AI voiceover and scripting features, namely Generate Script and Generate Audio, in Audiate, the company’s solution for audio recording and text-based editing. The new functionalities were designed to enable creators of all skill levels to efficiently produce audio projects without the need for a writer or voice actor. Generate Script automatically generates a draft script from recorded audio or video, saving time on writing. Similarly, Generate Audio converts written script into a natural-sounding voiceover, eliminating the need for a separate voice actor.

-

In September 2023, Adobe Inc. partnered with the Government of India’s Ministry of Education to use Adobe Express to revolutionize creative expression in classrooms. Plans envisage introducing Adobe Express-based curriculums, training, and certification as part of the new creativity and digital literacy initiative that would potentially impact almost 500,000 educators and 20 million students. As an AI-first, all-in-one content creation app, Adobe Express would help enhance students’ creative skills by opening first-hand access to features and tools enabled by generative AI to create posters, animated videos, PDFs, and web pages.

-

In September 2023, Adobe Inc. introduced Adobe GenStudio, a solution that transforms the enterprise content supply chain with generative AI by integrating content ideation, creation, production, and activation. The solution combines applications such as Creative Cloud, Firefly, Express, Frame.io, Analytics, AEM Assets, and Workfront, facilitating seamless collaboration and content management.

Creative Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.93 billion

Revenue forecast in 2030

USD 14.98 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Brazil; Argentina; Mexico; GCC; South Africa

Key companies profiled

Adobe; MAGIX Software GmbH; Corel Corporation; CyberLink Corp; FXhome Limited; TechSmith Corporation; Nero AG; Movavi Software Limited; Sony Creative Software Inc.; Wondershare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Creative Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global creative software market report based on deployment, type, and region:

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Sound & Video Recording Software

-

Image & Video Editing Software

-

Graphics & Illustration Software

-

Desktop Publishing Software

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East and Africa (MEA)

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global creative software market size was estimated at USD 9.39 billion in 2023 and is expected to reach USD 9.93 billion in 2024.

b. The global creative software market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 14.98 billion by 2030.

b. North America dominated the creative software market with a share of 39.3% in 2023. The growth of the regional market can be attributed to the rising demand for audio-video recording and editing platforms from the incumbents of the media & entertainment industry.

b. Some key players operating in the creative software market include Adobe.; MAGIX Software GmbH.; Corel Corporation; CyberLink Corp.; FXhome Limited; TechSmith Corporation; Nero AG; Movavi Software Limited; Sony Creative Software Inc. ; Wondershare

b. Key factors that are driving the creative software market growth include ongoing digital transformation across various industries, and expanding entertainment industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.