- Home

- »

- Biotechnology

- »

-

CRISPR And Cas Genes Market Size, Industry Report, 2030GVR Report cover

![CRISPR And Cas Genes Market Size, Share & Trends Report]()

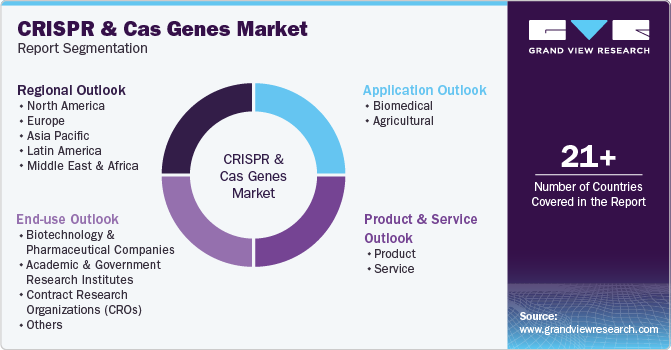

CRISPR And Cas Genes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Service (Kits & Reagents, Cell Line Engineering), By Application (Biomedical, Agricultural), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-375-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Crispr And Cas Genes Market Summary

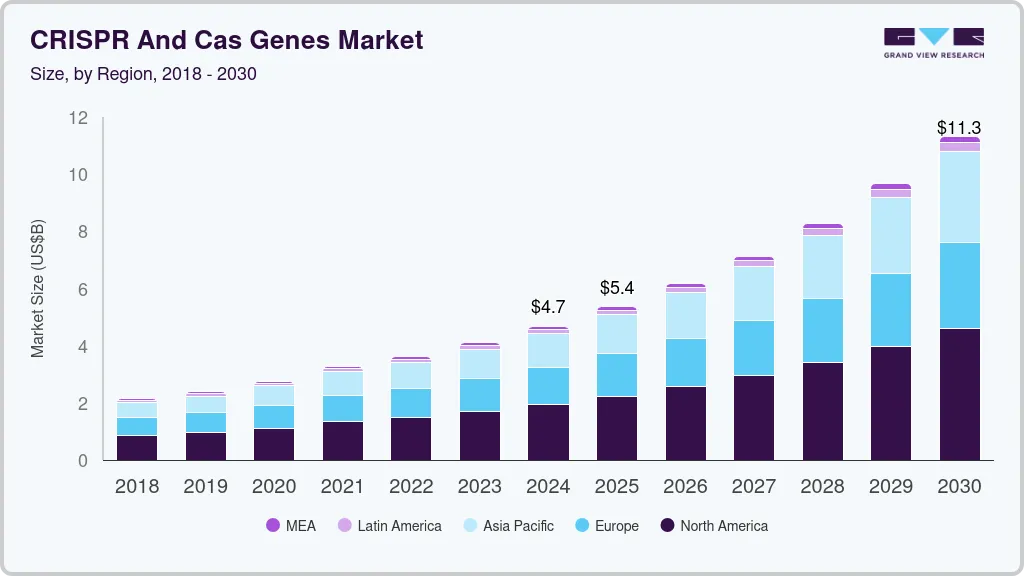

The global crispr and cas genes market size was estimated at USD 4.68 billion in 2024 and is projected to reach USD 11.33 billion by 2030, growing at a CAGR of 16.12% from 2025 to 2030. Recent breakthroughs in biotechnology have led to the broad adoption of CRISPR and Cas gene-editing systems, which are increasingly being used to enhance human health, both directly and indirectly.

Key Market Trends & Insights

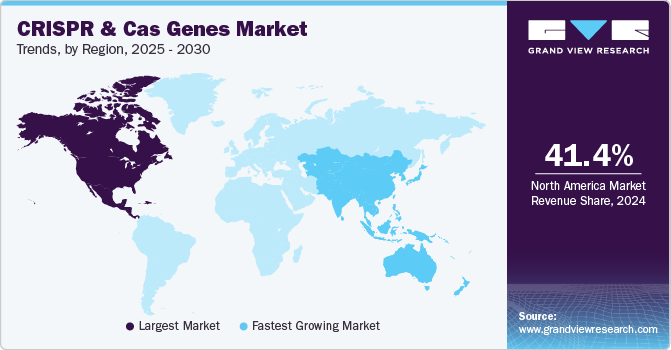

- North America CRISPR and CAS genes market accounted for the largest market share globally of 41.36% in 2024.

- The CRISPR and Cas genes market in the U.S. is driven by strong government support, including funding from the NIH and DARPA for gene-editing research.

- By product & service, the product segment dominated the market in 2024 and accounted for the largest market share.

- By application, the biomedical applications segment dominated the market in 2024.

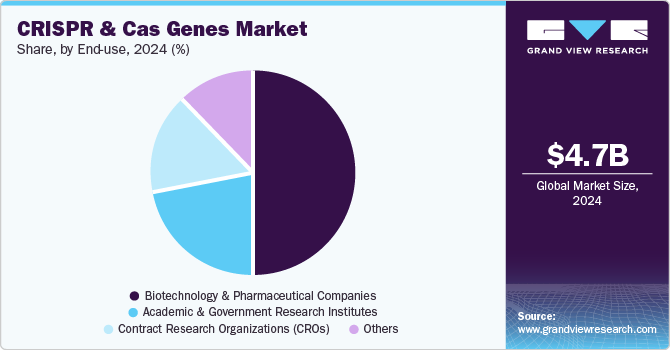

- By end use, the biotechnology and pharmaceutical companies dominated the market in 2024, accounting for 49.56% of overall revenue share.

Market Size & Forecast

- 2024 Market Size: USD 4.68 Billion

- 2030 Projected Market Size: USD 11.33 Billion

- CAGR (2025-2030): 16.12%

- North America: Largest market in 2024

One notable application is somatic gene editing, where an individual’s DNA is modified to treat conditions such as HIV, sickle-cell disease, and transthyretin amyloidosis. This technology is also expected to play a key role in developing new treatments for various cancers.

The advancements in CRISPR and Cas technologies have significantly transformed the field of cancer research and therapy, opening up new possibilities for targeted treatments.

The COVID-19 pandemic has significantly accelerated the use of CRISPR and Cas gene technologies, particularly in nucleic acid detection, due to their high reliability and sensitivity. Since CRISPR's emergence as a tool for DNA editing, it has been increasingly adopted by leading biotechnology and pharmaceutical companies for drug and therapy development. For example, in August 2022, iNtRON Biotechnology announced the creation of a custom CRISPR/Cas system designed for the genetic modification of bacteria and bacteriophages.

CRISPR technology is also enhancing the therapeutic efficacy of modified T-cells in treating various cancers. The development of Chimeric Antigen Receptor T (CAR-T) cells, a promising approach for cancer immunotherapy, is closely linked to CRISPR-based advancements. In May 2022, Caribou Biosciences presented findings on its chRDNA genome-editing technology, demonstrating its potential to improve the specificity and effectiveness of genome editing in primary human T-cells. This approach has shown promise in enhancing the efficacy of allogeneic cell therapies, which is expected to fuel further growth in the CRISPR and Cas genes industry.

In addition, innovations such as karyotyping, neonatal screening, and viral screening have increased the demand for gene editing techniques like CRISPR and Cas technology. The application of CRISPR in agriculture, including innovative breeding strategies to enhance crop yield, resistance to pests, and shelf life, has also driven wider adoption within the biotechnology industry. As these technologies continue to demonstrate their potential, they are expected to contribute significantly to market growth in the near future.

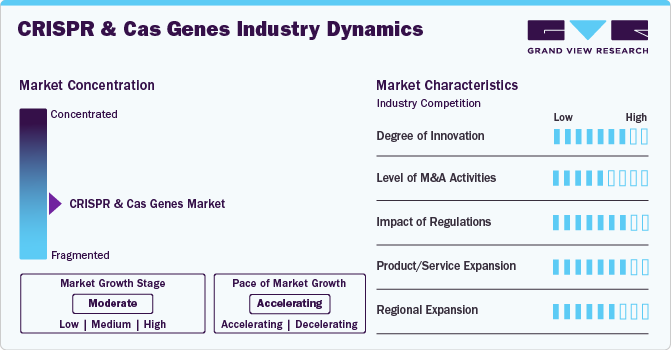

Market Concentration & Characteristics

The CRISPR and Cas genes industry is marked by rapid innovation, fueled by continuous advancements in biotechnology. Recent developments, such as base editing and prime editing, have significantly improved the precision of gene editing while minimizing off-target effects compared to conventional CRISPR techniques. For example, a study published by the National Library of Medicine in November 2021 on in vivo somatic cell base editing and prime editing showed that prime editing offers enhanced accuracy in correcting genetic mutations. This breakthrough holds promise for treating genetic disorders like sickle cell anemia and muscular dystrophy, highlighting the growing potential of CRISPR-based technologies in therapeutic applications.

Mergers and acquisitions (M&A) play a crucial role in the CRISPR market, enabling companies to consolidate resources and expertise to strengthen their competitive position. For example, in April 2021, Vertex Pharmaceuticals and CRISPR Therapeutics revised their collaboration agreement to accelerate the development and commercialization of CTX001, a CRISPR/Cas9-based gene therapy targeting the potential cure of sickle cell disease and transfusion-dependent beta-thalassemia. This strategic partnership enhances research and development capabilities, streamlines regulatory processes, and expands market reach, thereby driving growth in the CRISPR and Cas genes industry.

Regulatory frameworks play a crucial role in shaping the CRISPR and Cas genes industry by ensuring a balance between innovation and ethical standards. In the U.S., the FDA has established guidelines for gene editing therapies, focusing on the safety and efficacy of these treatments through comprehensive clinical trials. In Europe, the European Medicines Agency (EMA) regulates gene editing technologies with an emphasis on maintaining stringent safety protocols. Meanwhile, the National Institutes of Health (NIH) promotes responsible research practices in gene editing, encouraging transparency and public engagement. These regulatory measures not only protect patient welfare but also build investor and stakeholder confidence, thereby influencing the growth and development of the CRISPR industry.

The market is primed for substantial growth, driven by the continued advancement of biotechnologies that enhance gene editing capabilities. Companies can capitalize on this opportunity by introducing new tools, improving the precision of genome editing, and optimizing workflows through innovative product launches. This approach not only addresses increasing demand but also supports long-term, sustainable growth in the market.

The regional expansion of the CRISPR and Cas genes industry is gaining significant momentum, particularly in North America, Europe, and Asia-Pacific. North America, spearheaded by the U.S., leads the market, driven by a strong research and development infrastructure and substantial funding from both public and private sectors. The National Institutes of Health (NIH) has played a pivotal role by investing heavily in CRISPR research, accelerating the development of innovative therapies aimed at treating genetic disorders.

Product & Service Insights

The product segment dominated the market in 2024 and accounted for the largest market share. Several cutting-edge technologies, such as CRISPR gene editing kits, have been developed to meet the growing demands for genome editing solutions. The increased market share is due to the availability of enhanced individual products that can be used to achieve a variety of goals, including simple gene knockouts, selective genome cleavage, reduced off-target cutting, genome engineering, and higher specificity.

The service segment is expected to grow at the fastest CAGR of 17.21% from 2025 to 2030. Increased investments in gene editing research and development, along with the introduction of new applications, are expected to drive the growth of the service segment during the forecast period. For example, in July 2022, the British Heart Foundation, a UK-based charity, allocated USD 36 million to an international team to develop innovative gene-editing treatments for inherited heart diseases. Recent advancements in gene editing, especially CRISPR technology, have opened up new opportunities for tackling cardiovascular diseases, further fueling interest and investment in this field.

Application Insights

The biomedical applications segment dominated the market in 2024. The growing use of CRISPR gene-editing technologies across various fields of biological sciences has significantly contributed to higher revenues in this segment. The technology’s effectiveness and specificity have been improved through better delivery methods, including the use of nanocarriers. This has led to a marked increase in studies and publications focused on modifying the genomes of human somatic cells and induced pluripotent stem cells using CRISPR. In addition, several companies now offer commercial kits and services to support researchers working in this area, further driving the expansion of the market.

The agricultural segment is anticipated to register a significant CAGR over the forecast period.Advancements in agricultural production through the integration of innovative breeding technologies have expanded access to nutrition-rich foods worldwide. For example, in June 2019, researchers at Cold Spring Harbor Laboratory used CRISPR/Cas9 technology to induce mutations in the flowering suppressor gene of tomatoes. This modification led to earlier flowering, more compact growth, and ultimately, an accelerated yield, demonstrating the potential of CRISPR to improve crop productivity and efficiency.

End Use Insights

The biotechnology and pharmaceutical companies dominated the market in 2024, accounting for 49.56% of overall revenue share. It is also the fastest growing segment over the forecast period aspharmaceutical companies are utilizing these technologies to quickly identify and validate new therapeutic targets and to produce better biological models for human diseases in less time. The market is also anticipated to be further driven by the rising number of biotechnology companies using gene modification for both research and commercial purposes.

The Contract Research Organizations (CROs) segment is expected to grow at the fastest CAGR of 17.89% from 2025 to 2030. The segment is driven by the increasing demand for outsourcing research and development activities in the pharmaceutical, biotechnology, and medical device industries. As companies seek to reduce costs, expedite drug development, and access specialized expertise, CROs offer essential services in clinical trials, regulatory affairs, and data management. The rapid advancement of personalized medicine and biopharmaceutical innovations also drives the need for specialized research services. Moreover, the growing adoption of digital technologies, such as AI and data analytics, further enhances the capabilities of CROs, fueling their market expansion across global regions.

Regional Insights

North America CRISPR and CAS genes market accounted for the largest market share globally of 41.36% in 2024. The CRISPR and Cas gene industry in North America is rapidly growing, driven by advancements in gene editing technologies and increasing investments in biotechnology. The region leads in research, particularly in gene therapies, agriculture, and disease prevention. Key drivers include strong funding, collaborations between academic institutions and companies, and regulatory support, positioning North America as a global leader in gene editing innovations.

U.S. CRISPR And CAS Genes Market Trends

The CRISPR and Cas genes market in the U.S. is driven by strong government support, including funding from the NIH and DARPA for gene-editing research. Advancements in personalized medicine, a robust biotech ecosystem, and collaborations between top universities (like MIT and Harvard) and companies are accelerating innovation. In addition, regulatory pathways such as the FDA’s flexible stance boost market growth.

Europe CRISPR And CAS Genes Market Trends

The CRISPR and Cas gene market in Europe is primarily driven by increasing investments in agricultural biotechnology, especially in countries like the Netherlands and Spain, which focus on crop modification. In addition, Europe's regulatory environment, including the European Court of Justice’s rulings on gene-edited crops, and growing interest in precision medicine, particularly in Germany and the UK, are key market drivers.

The CRISPR and CAS genes market in the UK is driven by strong government backing for gene editing in agriculture, particularly following the recent regulatory changes allowing gene-edited crops. The UK’s world-class research institutions, like the Francis Crick Institute, foster innovation in gene therapies and personalized medicine. Moreover, the growing biotech sector and public-private partnerships are accelerating market development.

France CRISPR and CAS genes market is driven by the country's emphasis on medical research, particularly in rare genetic disorders and oncology. French biotech firms are increasingly collaborating with global players to develop CRISPR-based therapies. Furthermore, France's active participation in EU-funded research projects, coupled with local regulatory adjustments to support gene editing, fosters innovation and market growth.

The CRISPR and CAS genes market in Germany is fueled by significant investments in genomic research, especially in areas like cancer treatment and regenerative medicine. The country's leading pharmaceutical companies, such as Bayer and BioNTech, are heavily involved in gene-editing projects. Germany’s strong regulatory framework, which ensures rigorous safety standards, along with its emphasis on precision medicine, drives market expansion.

Asia Pacific CRISPR And CAS Genes Market Trends

The Asia Pacific CRISPR and CAS genes market is expected to grow at the fastest CAGR of 18.43% from 2025 to 2030. The market is driven by rapid advancements in biotechnology, particularly in China, Japan, and India. China’s heavy investment in gene-editing research and its relaxed regulatory approach foster innovation. Japan’s focus on regenerative medicine and gene therapies, combined with India's growing biotech sector and cost-effective research, further accelerate the region's market growth.

The CRISPR and CAS genes market in China is driven by substantial government funding for biotech innovation, particularly in agriculture and medicine. China’s regulatory flexibility for gene-editing research, coupled with rapid advancements in genetic therapies for diseases like cancer, positions it as a global leader. The country's strong academic institutions and biotech firms, such as BGI Group, further propel market growth.

Japan CRISPR and CAS genes market is fueled by strong government support for regenerative medicine and precision therapies, particularly in treating genetic disorders and cancer. Japan's innovative biotech companies, such as Takeda Pharmaceutical, are at the forefront of gene-editing research. In addition, Japan's regulatory environment, which facilitates clinical trials and gene therapy approvals, accelerates market development in the region.

MEA CRISPR And CAS Genes Market Trends

The MEA CRISPR and CAS genes market is driven by increasing investments in healthcare innovation, particularly in gene therapies for genetic disorders and cancer. Countries like Israel lead in biotech research and development, while the UAE and Saudi Arabia focus on building biotechnology hubs. Regulatory reforms and growing public-private collaborations further stimulate market growth in the region.

Saudi Arabia CRISPR and CAS genes market is driven by the government's Vision 2030 initiative, which emphasizes biotechnology as a key sector for economic diversification. Significant investments in healthcare infrastructure, along with collaborations with global biotech firms, accelerate gene-editing research. Saudi Arabia's focus on treating genetic disorders prevalent in the region and its expanding clinical research ecosystem foster market growth.

The CRISPR and CAS genes market in Kuwait is emerging, driven by government interest in advancing biotechnology for healthcare. The country’s efforts to establish itself as a regional medical hub, combined with investments in genetic research, particularly in areas like inherited diseases, are key growth drivers. Collaborations with international institutions and growing healthcare infrastructure also support the development of gene therapies.

Key CRISPR And Cas Genes Company Insights

Companies in the CRISPR and Cas genes industry are focusing on expansion to enhance their product offerings. In addition, many players are acquiring smaller firms to strengthen their market presence, diversify service offerings, and improve overall capabilities.

Key CRISPR And Cas Genes Companies:

The following are the leading companies in the CRISPR and Cas genes market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Illumina

- Agilent Technologies

- Synthego

- Danaher

- Origene Technologies

- GenScript

- Lonza

- Revvity, Inc.

- Merck KGaA

Recent Developments

-

In November 2023, the United Kingdom's Medicines and Healthcare products Regulatory Agency (MHRA) granted approval for CASGEVY, a groundbreaking treatment for sickle cell disease and transfusion-dependent beta-thalassemia. This approval marks a significant milestone in the fight against these debilitating genetic disorders, offering new hope to patients who face severe health challenges and a diminished quality of life.

-

In August 2023, CrisprBits, a biotech startup from Bengaluru specializing in CRISPR gene-editing, partnered with Goa-based Molbio Diagnostics to enhance point-of-care diagnostics by integrating CRISPR into POCTs. This collaboration marked a significant milestone in advancing affordable, accurate, and accessible diagnostic testing. By combining their expertise, the two companies aimed to seize emerging market opportunities and drive innovation in frontline healthcare solutions.

-

In June 2021, QIAGEN launched the QIAprep CRISPR Kit and CRISPR Q-Primer Solutions. These new tools enable researchers to quickly and efficiently analyze edited genetic material, helping them assess how their CRISPR interventions have altered DNA function.

CRISPR And Cas Genes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.36 billion

Revenue forecast in 2030

USD 11.33 billion

Growth rate

CAGR of 16.12% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Thailand; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific; Illumina, Inc; Agilent Technologies; Synthego; Danaher; Origene Technologies; GenScript; Lonza; Revvity, Inc.; Merck KGaA

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

CRISPR And Cas Genes Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global CRISPR and Cas genes market report based on product & service, application, end use, and region.

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Product

-

Kits & Reagents

-

Cas Proteins & Enzymes

-

Guide RNA

-

Others

-

-

Libraries

-

Design Tool

-

Antibodies

-

Others

-

-

Service

-

Cell Line Engineering

-

gRNA Design & Synthesis & Synthesis

-

Screening Services

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomedical

-

Genome Engineering

-

Disease Model Studies

-

Functional Genomics

-

Epigenetics

-

Others

-

-

Agricultural

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology & Pharmaceutical Companies

-

Academic & Government Research Institutes

-

Contract Research Organizations (CROs)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global CRISPR and Cas genes market size was estimated at USD 4.69 billion in 2024 and is expected to reach USD 5.36 billion in 2025.

b. The global CRISPR and Cas genes market is expected to grow at a compound annual growth rate of 16.12% from 2025 to 2030 to reach USD 11.33 billion by 2030.

b. North America dominated the CRISPR and Cas genes market with a share of 41.36% in 2024. This is attributable to growing biopharmaceutical R&D as well as the involvement of several pharmaceutical corporations in the creation of novel therapeutics.

b. Some key players operating in the CRISPR and Cas genes market include Thermo Fisher Scientific; Illumina, Inc; Agilent Technologies; Synthego; Danaher; Origene Technologies; GenScript; Lonza; Revvity, Inc.; Merck KGaA

b. Key factors that are driving the market growth include the technological advancements in CRISPR & Cas gene system and increased investments in gene editing-based R&D. Moreover, innovative technologies such as karyotyping, neonatal screening, viral screening and others have boosted the demand for gene editing techniques like CRISPR & Cas gene technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.