- Home

- »

- Healthcare IT

- »

-

Healthcare CRM Market Size, Share & Growth Report, 2030GVR Report cover

![Healthcare CRM Market Size, Share & Trends Report]()

Healthcare CRM Market Size, Share & Trends Analysis Report By Functionality, By Deployment Mode (On-premise Model, Cloud/Web-based Model), By End-use, By AI-Powered Healthcare CRM, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-204-4

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Healthcare CRM Market Size & Trends

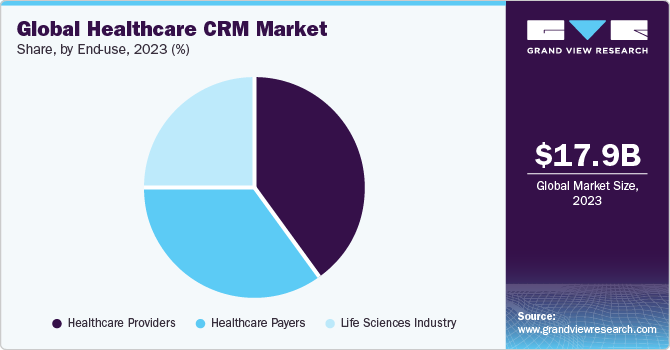

The global healthcare CRM market size was estimated at USD 17.87 billion in 2023 and is expected to grow at a CAGR of 7.7% from 2024 to 2030. The rising demand for structured data and automation in healthcare organizations is expected to drive market growth. Technological advancements, like AI integration in CRM solutions, enhance effectiveness and drive widespread adoption, coupled with the growing need to improve customer experience, fueling the adoption of healthcare customer relationship management (CRM) solutions.

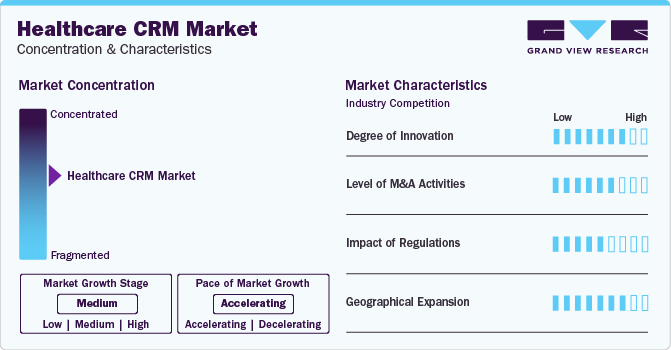

Market Concentration & Characteristics

The market is witnessing increased growth and significant innovation. For instance, in September 2023, Salesforce introduced next-gen Einstein AI, incorporating conversational AI into CRM and customer experience across various sectors, including healthcare

The market is experiencing a moderate level of merger and acquisition (M&A) activity. For instance, in January 2024, Innovaccer Inc. acquired Cured, a provider of digital marketing solutions and a CRM platform for the healthcare sector. This strategic acquisition enabled Innovaccer to expand its portfolio, adding over 20 health systems and digital health clients to its existing base of approximately 95 customers

The healthcare industry has seen a rise in region-specific regulatory activities, such as GDPR in the EU and HIPAA in the U.S. These regulations impose stringent policies on data storage, collection, and sharing. CRM solution providers are required to comply with these laws

AI-Powered Healthcare CRM Insights

In the healthcare industry, AI and ML integrated into CRM systems leverage vast data sets from diverse sources to provide actionable insights and recommendations, improving customer relationships and outcomes. For example, AI and ML applications within healthcare CRM predict customer behavior, preferences, and needs, enabling personalized communication and services.

Sales and marketing teams heavily rely on actionable insights, predictions, and targeted communication to enhance customer engagement. Automation streamlines tasks, scales operations, and accelerates time-to-market. AI-driven CRM systems revolutionize this process, allowing teams to focus on enhancing customer experience, delivering personalized services, and increasing customer lifetime value. By integrating AI into CRM operations, life sciences companies access predictions, optimal actions, predictive analytics, streamlined workflows, and personalized customer solutions.

Case Study Insights: Actium Health's AI Approach Drives 130% Revenue Boost and Enhances Heart Health for More Patients.

Solution: Virtua Health partnered with Actium to leverage its AI-powered tools. Machine learning models analyze millions of patient characteristics, replacing manual screening. The AI/ML model tailors data to Virtua Health, training on hospital-specific data. This customization identifies service needs beyond national datasets or manual filters.

Implementing this method enables a comparison of patient appointment rates between those who received outreach and those who did not within the same audience. The remaining holdout group members would then receive communication once its effectiveness was confirmed.

Results: Without Virtua's AI-driven outreach, over 4,000 individuals from the selected group would not have booked appointments and received attention.

Parameters

Company Performance

Industry Standard

Open Rate

35.00%

21.70%

Click Rate

3.30%

2.49%

-

Estimated revenue from AI-based campaign: USD 800,000

-

High-risk cardio patients who received the email: 16.3% booked cardio-related appointments

-

High-risk cardio patients who didn't receive the email: 13% booked appointments

Component Insights

Based on components, the market is segmented into software and services, with software being the dominant segment. The increasing preference for cloud-based healthcare CRM software, known for its flexibility, scalability, and ease of implementation, drives segment growth. In addition, these software solutions are increasingly integrated with other healthcare IT systems like electronic health records (EHR), practice management systems, and telehealth platforms. This integration facilitates seamless data exchange, enhances care coordination, and improves the patient experience. Moreover, software solutions are incorporating advanced analytics and AI to deliver personalized communication, targeted marketing campaigns, and proactive patient engagement, further boosting segment growth.

The service segment is expected to grow at a lucrative CAGR from 2024 to 2030 as healthcare organizations seek consulting and implementation services from CRM vendors and third-party providers for software selection, customization, deployment, and training. Training and support services are crucial for the successful adoption and utilization of healthcare CRM software. Providers offer comprehensive training programs, user manuals, online resources, and technical support to help organizations maximize the value of their CRM investment, driving segment growth.

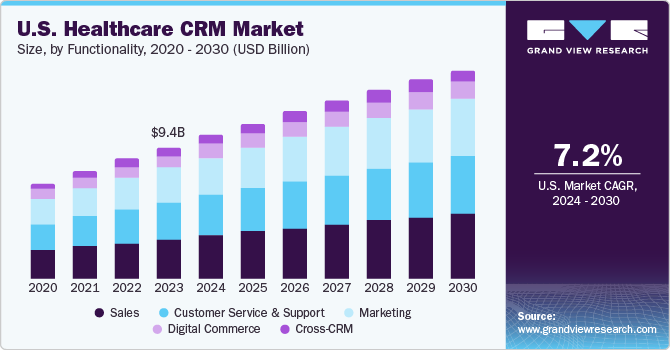

Functionality Insights

Based on functionality, the market is segmented into customer service & support, digital commerce, marketing, sales, and cross-CRM. In 2023, the sales segment led the market with a revenue share of 30.3% and is expected to grow at the fastest CAGR of 8.0% from 2024 to 2030. Healthcare CRM solutions streamline marketing and sales processes while ensuring compliance with healthcare security regulations.

Pegasystems offers Pega for Healthcare & Life Sciences, a low-code platform enhancing engagement and efficiency. Another example is HealtheCRM, jointly developed by Cerner (now Oracle) and Salesforce, aiming to improve collaboration between consumers and providers, enhance customer service, and elevate engagement and clinical outcomes. This integrated solution merges HealtheIntent with Salesforce Health Cloud and Marketing Cloud, providing stakeholders with a comprehensive view of consumers and enabling relevant and consistent experiences throughout the consumer journey.

Deployment Mode Insights

On the basis of deployment modes, the global market has been further bifurcated into on-premise and cloud/web-based deployment modes. In 2023, the cloud/web-based deployment segment dominated the market, accounting for a share of 81.2% in 2023. Cloud-based deployment not only enhances customer satisfaction but also provides rapid access to data, enabling simultaneous access from any device.

The rising preference for cloud-based CRM models among small- and medium-sized businesses is driving market growth. In addition, cloud-based CRM software offers cost-effectiveness, accessibility, and reduced hardware expenses, further fueling segment growth.

End-use Insights

On the basis of end-uses, the market has been further categorized into healthcare providers, healthcare payers, and life science. In 2023, healthcare providers held the largest market share at 40.2%. They are increasingly adopting healthcare CRM systems to enhance patient engagement, streamline workflows, improve communication, and optimize patient outcomes. On the other hand, the healthcare payer segment is anticipated to achieve the fastest CAGR from 2024 to 2030.

Healthcare CRM systems streamline claims and billing processes by automating workflows, tracking claims status, and resolving payment issues. This enables payers to enhance operational efficiency, minimize administrative costs, and optimize revenue cycle management through CRM-enabled claims processing. In addition, these systems offer analytics and reporting tools, empowering payers to gain insights into member behavior, utilization patterns, and cost drivers. Leveraging data analytics, payers can identify opportunities for cost savings, care enhancement, and strategic decision-making.

Regional Insights

The North America healthcare CRM market held the largest share of 58.0% of the overall revenue in 2023. The high share can be attributed to enhanced healthcare infrastructure and supportive government initiatives in the region.

U.S. Healthcare CRM Market Trends

The healthcare CRM market in the U.S. is expected to grow at a CAGR of 7.2% from 2024 to 2030 driven by the strong presence of market players focused on CRM solutions advancement and delivery. Notably, Microsoft, Salesforce, Inc., and IBM are some of the players, offering a wide product portfolio and serving a vast customer base. In April 2023, Salesforce launched Commerce data and CRM for life science companies.

Europe Healthcare CRM Market Trends

The Europe healthcare CRM market held the second-largest revenue share and it boasts significant development and a strong presence of healthcare providers & institutions, fueling demand for healthcare CRM solutions. Moreover, the region is making notable progress in the AI/ML domain, leading to increased demand for AI-integrated healthcare CRM solutions.

The healthcare CRM market in the UK is driven by the ongoing digitalization of healthcare processes and operations. For instance, as reported by NHS Digital (England) in September 2023, online practices received 48.3 online submissions per 1000 registered patients on average, with 4878 practices conducting at least one online consultation.

Asia Pacific Healthcare CRM Market Trends

The Asia Pacific healthcare CRM market is expected to register the fastest CAGR of 10.7% from 2024 to 2030 driven by government-led healthcare schemes. The region's focus on healthcare infrastructure and medical tourism is expected to enhance customer experience and promote market expansion. Factors, such as the growing aging population, increasing incidence of chronic diseases, and the burgeoning private health management and insurance sector contribute to market growth. Moreover, rising healthcare spending and demand for improved medical services are driving the adoption of advanced technologies in the region.

The healthcare CRM market in China dominated the Asia Pacific market in 2023. Its growth is driven by the rapid growth of the healthcare industry, increasing emphasis on patient experience, a focus on preventive healthcare, and population health management. In addition, digitalization and technological advancements, government support, policies promoting healthcare IT adoption, and expanding the private healthcare sector contribute to the market growth. These factors collectively drive the adoption of CRM solutions among healthcare providers, enabling them to enhance patient engagement, optimize operations, and improve healthcare delivery and outcomes.

The Japan healthcare CRM market is expected to grow at the fastest CAGR in the Asia Pacific market. The country has one of the world’s fastest-aging populations, which has led to increased demand for healthcare services, and has responded to this situation by investing in healthcare infrastructure, developing new technologies, and improving access to care.

Key Healthcare CRM Company Insights

The market is highly competitive, with key companies and stakeholders implementing strategic initiatives, such as portfolio expansion, product launches & upgrades, partnerships, regional expansions, and mergers & acquisitions. For instance, in September 2021, Salesforce introduced Health Cloud 2.0, a connected platform aimed at improving safety and health for customers, communities, and employees.

Key Healthcare CRM Companies:

The following are the leading companies in the healthcare CRM market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- Oracle (Cerner Corporation)

- IBM

- SAP

- Accenture

- Zoho Corporation

- hc1

- LeadSquared

- Salesforce

- Veeva Systems

- Talisma

- Alvaria

- NICE

- Verint Systems Inc.

- Creatio

- Cured (Acquired by Innovaccer Inc.)

Some other players in the AI-powered healthcare CRM market include:

- Actium Health

- Keona Health

- MediCRM.ai

Recent Developments

-

In October 2023,Salesforce introduced the Life Sciences Cloud, an AI-powered CRM platform tailored for pharmaceutical and medical technology industries. This platform aims to accelerate drug and device development, enhance patient recruitment and retention throughout the clinical trial process, and utilize AI to provide personalized experiences to customers

-

In April 2023, Salesforce unveiled new capabilities within its Commerce Cloud that adhere to HIPAA regulations, thus enhancing healthcare commerce experiences and reducing customer and patient service costs. When integrated with the Data Cloud, Salesforce's customer data platform, Commerce Cloud facilitates the creation of personalized experiences across all touchpoints by providing a unified, real-time perspective of each patient and provider

Healthcare CRM Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 19.69 billion

The revenue forecast in 2030

USD 30.65 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD Billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, functionality, deployment mode, end-use, and region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Norway; Sweden; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Microsoft; Cerner Corp. (Oracle); IBM; SAP; Accenture; Zoho Corp.; hc1; LeadSquared; Salesforce; Veeva Systems; Talisma; Alvaria; NICE; Verint Systems Inc.; Creatio; Cured (Acquired by Innovaccer Inc.); Actium Health; Keona Health; MediCRM.ai

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare CRM Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the healthcare CRM market report on the basis of component, functionality, deployment mode, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Functionality Outlook (Revenue, USD Billion, 2018 - 2030)

-

Customer Service and Support

-

Digital Commerce

-

Marketing

-

Sales

-

Cross-CRM

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise Model

-

Cloud/Web-based Model

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare Providers

-

Healthcare Payers

-

Life Sciences Industry

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare CRM market size was estimated at USD 17.87 billion in 2023 and is expected to reach USD 19.69 billion in 2024.

b. The global healthcare CRM market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 30.65 billion by 2030.

b. In 2023, Cloud/Web-based deployment dominated the Healthcare CRM market, accounting for 81.2% revenue share. The segment includes solutions that help manage data via third-party provider hosts on an as-needed basis with options to scale up or down. The surge in adoption of cloud technologies, rising digitalization across healthcare, and initiatives by key companies are some of the key factors propelling the segment's growth.

b. Some key players operating in the healthcare CRM market include Microsoft; Cerner Corporation (Oracle); IBM; SAP; Accenture; Zoho Corporation; hc1; LeadSquared; Salesforce; Veeva Systems; Talisma; Alvaria; NICE; Verint Systems Inc.; Creatio; Cured (Acquired by Innovaccer Inc.); Actium Health; Keona Health; MediCRM.ai

b. Key factors driving the healthcare CRM market growth include the rising demand for structured data and automation in healthcare organizations; rising healthcare consumerism, adoption of cloud technologies, and technological advancements, like AI integration in CRM solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."