- Home

- »

- Next Generation Technologies

- »

-

Crop Insurance Market Size & Share, Industry Report, 2030GVR Report cover

![Crop Insurance Market Size, Share & Trends Report]()

Crop Insurance Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Multi-peril Crop Insurance, Crop-hail Insurance, Revenue Insurance), By Coverage, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-573-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Crop Insurance Market Summary

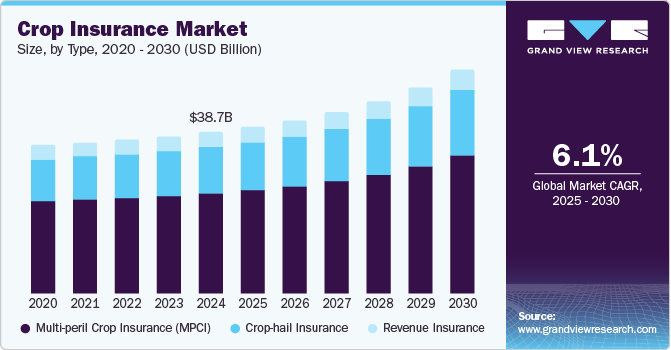

The global crop insurance market size was estimated at USD 38.70 billion in 2024 and is projected to reach USD 53.64 billion by 2030, growing at a CAGR of 6.1% from 2025 to 2030. The increasing unpredictability of climate patterns and the rising incidence of extreme weather events drive the market's growth.

Key Market Trends & Insights

- The North America crop insurance market accounted for the largest revenue share of 49.2% in 2024.

- The Asia Pacific crop insurance market is anticipated to grow at a CAGR of 7.2% during the forecast period.

- By type, the multi-peril crop insurance (MPCI) segment accounted for the largest share of 62.3% in 2024.

- By distribution channel, the insurance companies segment is projected to grow at a significant CAGR of 6.2% over the forecast period.

- By coverage, the revenue protection segment held the largest market share of 54.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38.70 Billion

- 2030 Projected Market Size: USD 53.64 Billion

- CAGR (2025-2030): 6.1%

- North America: Largest market in 2024

Farmers worldwide face growing risks from floods, droughts, hailstorms, and heat waves, which can severely damage crops and reduce agricultural output. This increasing climate volatility has made traditional farming riskier, pushing farmers to seek financial protection through insurance. Crop insurance provides a safety net by compensating for losses due to these natural calamities, enabling farmers to recover faster and continue operations.As climate change intensifies, the need for structured risk management tools like crop insurance is becoming more urgent, fueling market demand. Government support and subsidy programs also play a major role in boosting crop insurance adoption. In several countries, especially the U.S., India, and China, governments provide subsidized premiums or operate public insurance schemes to protect farmers from crop loss. These programs significantly lower the cost burden on farmers, making insurance accessible even to smallholders. Moreover, some government-backed schemes are mandatory for farmers to access financial assistance or agricultural loans, further increasing coverage. This proactive involvement by governments has expanded the crop insurance market by ensuring large-scale participation and economic viability.

In addition, the increasing importance of agricultural finance contributes to the market growth. Crop insurance is often a prerequisite for farmers to access bank loans or credit from financial institutions. By reducing the lender's risk, insurance enables farmers to secure the necessary capital for investing in seeds, fertilizers, and equipment. Many financial institutions even link loan eligibility directly to crop insurance coverage, making it a critical tool for credit access. This interdependence between agricultural financing and insurance is particularly impactful in developing economies, where formal credit access is expanding.

High administrative costs and complex claim processes restrain the growth of the market. Traditional crop insurance systems often involve cumbersome paperwork, manual verification, and slow claim settlement, which frustrates farmers and reduces satisfaction. In some government-run programs, payment delays or inadequate compensation further erode trust in the system. Insurers face operational challenges due to fragmented farm records, a lack of digitization, and difficulty reaching remote agricultural areas. These inefficiencies increase the cost of delivering insurance services and reduce the profitability and scalability of insurance schemes.

Type Insights

The multi-peril crop insurance (MPCI) segment accounted for the largest share of 62.3% in 2024. Its ability to provide broad, all-in-one protection against a wide range of perils fuels the segment's growth. Unlike crop-hail or revenue insurance, which cover specific risks, MPCI policies cover multiple causes of loss, including drought, flood, excessive rainfall, disease, pests, and even frost, under a single policy. This comprehensive nature significantly reduces farmers' uncertainty, making MPCI a preferred choice for those looking for robust risk management solutions.

The revenue insurance segment is expected to grow significantly during the forecast period. Revenue insurance is gaining popularity because it offers a dual layer of protection against yield losses and market price volatility. Unlike traditional crop insurance, which compensates only for physical loss of yield (due to weather, pests, etc.), revenue insurance accounts for price declines that can affect a farmer’s income even if yields are adequate. This comprehensive protection is increasingly attractive in volatile agricultural markets where commodity prices fluctuate due to global trade disruptions, supply chain issues, or geopolitical tensions.

Coverage Insights

The revenue protection segment held the largest market share of 54.9% in 2024. Increased market volatility and global uncertainty drive the segment's growth. The global agricultural market has become more volatile due to international trade disputes, supply chain disruptions, and geopolitical instability. Prices for key crops such as corn, wheat, and soybeans can fluctuate significantly within a single growing season. Revenue protection helps mitigate these risks by locking in revenue guarantees based on expected yields and commodity prices at the beginning of the season.

The price protection segment is expected to register the fastest CAGR of 8.3% during the forecast period. Commercial farmers' growing need for income stability fuels the segment's growth. As farming becomes more capital-intensive, commercial farmers and agribusinesses face higher fixed costs, such as equipment loans, land leases, and labor expenses, that require stable income to service. Price protection coverage is critical in stabilizing farm revenues by covering shortfalls due to price drops, not just yield loss. This assurance helps farmers manage financial planning more effectively, secure credit from lenders, and reduce default risk, making such coverage increasingly attractive in modern agriculture.

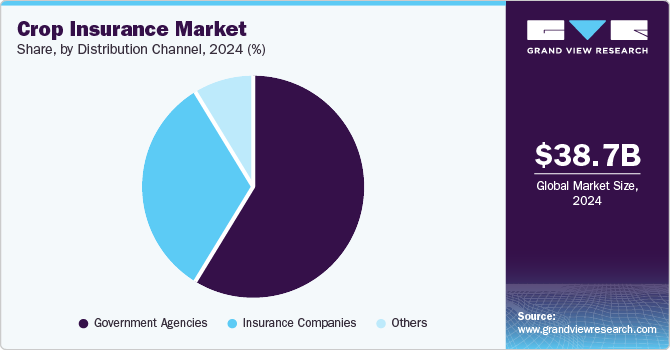

Distribution Channel Insights

The government agencies segment dominated the market in 2024. The direct financial support governments provide through premium subsidies drives the segment's growth. Governments cover a substantial portion of crop insurance premiums in countries such as the U.S., India, and China to make policies affordable for farmers, especially small and marginal ones. This reduces the cost burden on farmers and encourages mass enrollment. By absorbing part of the financial risk, governments ensure that even farmers with limited financial literacy or resources are included in the risk mitigation system, significantly expanding the market base for insurance.

The insurance companies segment is projected to grow at a significant CAGR of 6.2% over the forecast period. Governments in many countries are increasingly opening the crop insurance market to private insurance companies to expand coverage, improve service delivery, and reduce the fiscal burden. This trend is encouraging the growth of crop insurance through private channels. Insurance companies, often operating under public-private partnership (PPP) models, bring greater efficiency, risk assessment expertise, and scalability. As a result, farmers have more choices beyond government-only schemes, which boosts competition and innovation in product design and delivery.

Regional Insights

The North America crop insurance market held a significant share in 2024. Strong government support and subsidies drive the growth of the market in the region. The U.S. Department of Agriculture (USDA), through its Risk Management Agency (RMA), offers subsidized crop insurance under the Federal Crop Insurance Program (FCIP). This program significantly lowers the cost of premiums for farmers, making insurance more affordable and encouraging broad participation.

U.S. Crop Insurance Market Trends

The U.S. crop insurance market held a dominant position in 2024 due to its high agricultural productivity and output value. The U.S. is one of the world's largest producers and exporters of crops such as corn, soybeans, cotton, and wheat. Even minor disruptions can lead to significant financial losses, with billions of dollars at stake in annual harvests. Crop insurance safeguards yield and revenue protection, which is especially important for large-scale commercial farms.

Europe Crop Insurance Market Trends

The Europe crop insurance market was identified as a lucrative region in 2024. Europe’s diverse agricultural landscape, which includes various crops such as cereals, fruits, vegetables, and wine, contributes to the increasing demand for specialized crop insurance. As farmers diversify their crops to manage risk and take advantage of different market opportunities, they seek tailored insurance products that match the specific needs of each crop.

The UK crop insurance market is expected to grow rapidly in the coming years due to the transition to more market-oriented farming systems. Farmers are under increasing financial pressure to protect their crops from risks as the UK agricultural sector moves towards more market-driven systems, with increasing emphasis on profitability, efficiency, and sustainability. The transition to more commercial, market-oriented agriculture, combined with volatile commodity prices and trade uncertainties, has increased farmers' reliance on crop insurance.

The Germany crop insurance market held a substantial market share in 2024. Germany has a long history of agriculture, and its farmers have traditionally valued risk management strategies to protect their livelihoods. With a strong agricultural tradition, farmers are more familiar with the tools available to mitigate risk, and crop insurance is an essential part of modern farming practices.

Asia Pacific Crop Insurance Market Trends

The Asia Pacific crop insurance market is anticipated to grow at a CAGR of 7.2% during the forecast period. A large agricultural workforce and smallholder dominance fuel the market growth in the region. Asia Pacific is home to the largest agricultural labor force in the world, with a substantial proportion of farmers being smallholders who operate on thin profit margins. These small-scale farmers are particularly vulnerable to crop failure, making them highly reliant on external risk management mechanisms. Governments and development organizations in the region are promoting crop insurance as a safety net to ensure financial stability for rural populations. The size of the farming population presents a massive potential market, and targeted efforts to bring insurance to this demographic are driving adoption.

The Japan crop insurance market is expected to grow rapidly in the coming years. Japan is highly susceptible to natural disasters such as typhoons, earthquakes, floods, and heavy rains, frequently damaging agricultural lands and crops. The country's geographic position along the Pacific Ring of Fire and in the path of typhoons makes its agricultural sector particularly vulnerable. As climate change intensifies the frequency and severity of these disasters, farmers in Japan are increasingly seeking financial protection through crop insurance.

The China crop insurance market held a substantial market share in 2024. The shift from traditional subsistence farming to the cultivation of high-value commercial crops, such as vegetables, fruits, tea, and cash crops, has increased farmers' financial risks. Chinese farmers are turning to more comprehensive insurance solutions to protect these higher-value investments, including coverage for revenue losses and price fluctuations. This transition has opened new opportunities for insurance providers and contributed to the growth of tailored crop insurance products.

Key Crop Insurance Company Insights

Some of the key companies in the crop insurance market include QBE Insurance Ltd., Chubb, Sompo, Great American Insurance Company, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

QBE Insurance Group Limited is a multinational insurer and reinsurer, operating in 26 countries worldwide. QBE has evolved into a prominent provider of general insurance and reinsurance solutions, offering a comprehensive range of products, including commercial, personal, and specialty insurance and risk management services. The company’s portfolio covers property, motor, crop, public and product liability, professional indemnity, workers’ compensation, energy, marine, and aviation insurance.

-

Chubb is an insurance provider that offers a wide range of commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance, and life insurance across 54 countries and territories. Through its Rain and Hail and Chubb Agribusiness divisions, Chubb provides comprehensive crop insurance solutions that cover various risks for farmers, including protection against adverse weather, natural disasters, and other perils that can impact crop yields and farm income.

Key Crop Insurance Companies:

The following are the leading companies in the crop insurance market. These companies collectively hold the largest market share and dictate industry trends.

- Kshema General Insurance Limited

- QBE Insurance Ltd.

- Chubb

- Zurich

- Sompo

- Great American Insurance Company

- American International Group, Inc.

- Agriculture Insurance Company of India Limited

- Tokio Marine HCC

- FBL Financial Group, Inc

Recent Developments

-

In December 2024, the Agriculture Insurance Company of India Limited (AIC) launched a specialized insurance product called ‘Fal Suraksha Bima,’ designed exclusively for banana and papaya crops. This initiative, announced during AIC’s 22nd Foundation Day celebrations, demonstrates the company’s commitment to addressing the specific needs of Indian farmers by offering tailored crop protection solutions. ‘Fal Suraksha Bima’ aims to provide comprehensive risk coverage for banana and papaya growers, helping them mitigate potential losses due to natural calamities and other unforeseen events.

-

In September 2024, Alpha Omega secured a significant contract with the U.S. Department of Agriculture (USDA) to support its crop insurance programs, a move aimed at bolstering the resilience of American agriculture in the face of increasing climate variability. Under this partnership, Alpha Omega will leverage its expertise in digital modernization, artificial intelligence, and cybersecurity to enhance the USDA’s risk management systems.

Crop Insurance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.97 billion

Revenue forecast in 2030

USD 53.64 billion

Growth Rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, coverage, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Kshema General Insurance Limited; QBE Insurance Ltd.; Chubb; Zurich; Sompo; Great American Insurance Company; American International Group, Inc.; Agriculture Insurance Company of India Limited; Tokio Marine HCC; FBL Financial Group, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crop Insurance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global crop insurance market report based on type, coverage, distribution channel, and region.

-

Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Multi-peril Crop Insurance (MPCI)

-

Crop-hail Insurance

-

Revenue Insurance

-

-

Coverage Outlook (Revenue, USD Billion; 2018 - 2030)

-

Yield Protection

-

Revenue Protection

-

Price Protection

-

-

Distribution Channel Outlook (Revenue, USD Billion; 2018 - 2030)

-

Government Agencies

-

Insurance Companies

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global crop insurance market size was estimated at USD 38.70 billion in 2024 and is expected to reach USD 39.97 billion in 2025.

b. The global crop insurance market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 53.64 billion by 2030.

b. North America dominated the crop insurance market with a share of 46.2% in 2024. Strong government support and subsidies drive growth of the market in the region.

b. Some key players operating in the crop insurance market include Kshema General Insurance Limited; QBE Insurance Ltd.; Chubb; Zurich; Sompo; Great American Insurance Company; American International Group, Inc.; Agriculture Insurance Company of India Limited; Tokio Marine HCC; FBL Financial Group, Inc

b. The increasing unpredictability of climate patterns and the rising incidence of extreme weather events drives growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.