- Home

- »

- Food Safety & Processing

- »

-

Crop Micronutrients Market Size & Share Report, 2028GVR Report cover

![Crop Micronutrients Market Size, Share & Trends Report]()

Crop Micronutrients Market (2022 - 2028) Size, Share & Trends Analysis Report By Form (Chelated, Non-chelated), By Type (Zinc, Boron, Iron, Manganese, Molybdenum, Copper), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-931-8

- Number of Report Pages: 86

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Crop Micronutrients Market Summary

The global crop micronutrients market size was valued at USD 5.54 billion in 2021 and is projected to reach USD 9.11 billion by 2028, growing at a compound annual growth rate (CAGR) of 7.3% from 2022 to 2028. This can be credited to the rising soil deficiencies in cultivated lands.

Key Market Trends & Insights

- The Asia Pacific holds the majority of industry share, owing to most crop production being done across the region.

- The Middle East & Africa (MEA) region is expected to expand at a 9.8 percent CAGR from 2022 to 2028.

- Based on form, the chelated segment contributed to the highest share of over 70% of the global market revenue in 2021.

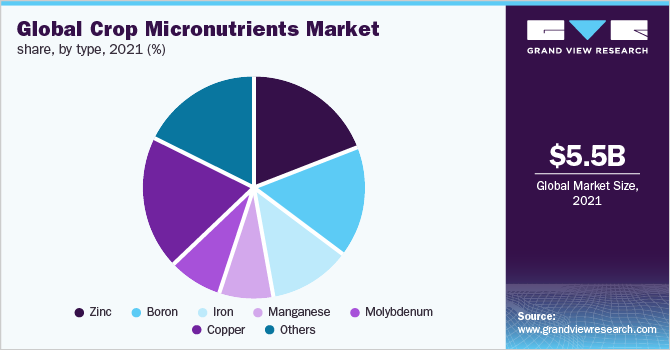

- Based on type, the copper segment contributed a share of around 20% of the global crop micronutrients market revenue in 2021 due to its increasing demand.

- Based on application, the soil segment contributed to the highest share of around 65% of the global market revenue in 2021.

Market Size & Forecast

- 2021 Market Size: USD 5.54 Billion

- 2028 Projected Market Size: USD 9.11 Billion

- CAGR (2022-2028): 7.3%

- Asia Pacific: Largest market in 2021

Crops micronutrients are crucial for the growth of plants and their metabolic activities. They aid in the development of roots by strengthening them, making them grow larger, and providing them with organic compounds and proteins. Furthermore, crop micronutrients promote better immunity to crops. All these factors are expected to boost market growth during the forecast period.

Factors such as increasing awareness among people regarding the benefits of crop micronutrients for crop productivity and yields are driving the growth of the crop micronutrients market. Also, growing consciousness concerning food security among people coupled with rising incidences of deficiencies of micronutrients in soils across the globe is expected to propel the market’s growth during the forecast period.

Increasing investment by key players to launch new products is further expected to boost the industry sales. However, the availability of counterfeit or more economical products and also a lack of knowledge among farmers regarding the proper application of doses of micronutrients for plants may hamper the chelated crop micronutrients market. Additionally, the demand for the industry has decreased due to the COVID-19 pandemic. As a result of the ongoing lockdown, the micronutrients production and supply chain have been affected, hampering the market growth.

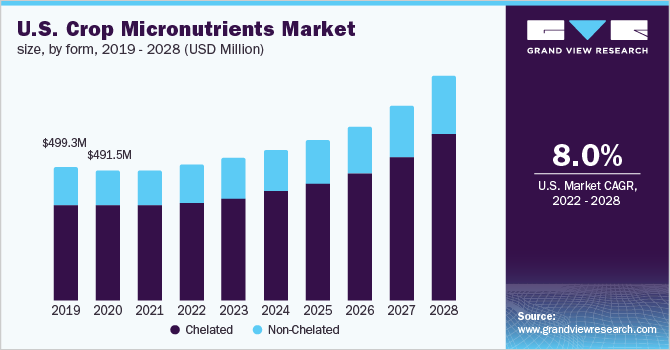

Form Insights

The chelated form segment contributed to the highest share of over 70% of the global market revenue in 2021. Chelated micronutrients are widely used in farming and are also partially promoted by fertilizer manufacturers. They are inorganic nutrients that are enclosed by an organic molecule. They are also more stable than their counterpart in non-chelated micronutrients. These factors have made them popular in farming, thus boosting this segment over the coming years. Furthermore, the non-chelated segment will register the second highest growth during the forecast period due to its growing demand. They are also helpful as chelated forms by providing plants with boron, zinc, copper, etc. Thus, this segment is also estimated to showcase momentous growth during the forecast period.

Type Insights

The copper segment contributed a share of around 20% of the global crop micronutrients market revenue in 2021 due to its increasing demand. Copper-type micronutrients catalyze reactions by activating enzymes in plants for the successful synthesis of proteins. They also help to overcome vitamin A production in plants, which is expected to drive the growth of this segment.

The zinc type is the fastest-growing market, with large growth projected during the forecast period. Due to increasing soil shortages of zinc globally, the segment is predicted to expand at a CAGR of 7.9% from 2022 to 2028, increasing segment demand throughout the forecast timeline.

Application Insights

The soil application segment contributed to the highest share of around 65% of the global market revenue in 2021. Soil mode of application is a common form widely used for the application of micronutrients in agriculture. With the conventional equipment for the application of fertilizers, this segment allows uniform distribution of micronutrients to plants. Owing to the aforementioned factors, soil mode of application is widely used in farming and thus expected to boost this segment over the coming years.

The fertigation segment will experience significant growth during the forecast period due to its growing application for micronutrients. In this method, micronutrients are incorporated by drip system within the irrigation system of water, resulting in an overall increase in fertilizer efficiency of 80% to 90%.

Crop Type Insights

The cereals & grains crop type segment contributed to the highest share of around 50% of the global market revenue in 2021. Consumption of cereals across the globe is high. Additionally, the consumption of food is on the rise owing to the growing population worldwide. Thus, it is essential to maintain nutrient levels in the soil to enrich the growth and productivity of the cereals. As a result, micronutrients play a prime role in nutrient-rich food production.

The fruits & vegetable segment will register the highest growth during the forecast period due to increasing demand for fruits. The latest trend of consumption of fruits has increased, coupled with a rise in exports of vegetables and fruits, which has led to an increase in the plantation area of crops. Henceforth, the micronutrients enriching fruits and vegetables are expected to witness significant growth during the forecast timeframe.

Regional Insights

The Asia Pacific holds the majority of industry share, owing to most crop production being done across the region. Growing demand for high-quality products and rising farming practices are chief factors that drive the growth of the crop micronutrients market. The direct use of micronutrients for plant deficiencies treatments will support the industry's demand even more.

The Middle East & Africa (MEA) region is expected to expand at a 9.8 percent CAGR from 2022 to 2028. This is supported by rising food demand and an increase in crop cultivation of land in this region. Furthermore, fertilizer consumption in this region has increased significantly.

Key Companies & Market Share Insights

Key players are focusing on R&D and also launching new products to meet the increasing demand for crop micronutrients. Furthermore, key players are investing in new production plants to increase their product folio along with the expansion of their presence in the market. Some of the prominent players in the global crop micronutrients market include:

-

BASF SE

-

DowDuPont Inc.

-

Nutrien Ltd

-

Corteva Agriscience

-

Yara International ASA

-

The Mosaic Company

-

Akzo Nobel N.V

-

Nouryon

-

Nufarm Ltd

-

Compass Minerals International

-

Western Nutrients Corporation

Crop Micronutrients Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 5.70 billion

Revenue forecast in 2028

USD 9.11 billion

Growth Rate

CAGR of 7.3% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD Million/Billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, type, application, crop type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Germany, U.K., France, China, India, Africa, Brazil

Key companies profiled

BASF SE; DowDuPont Inc.; Nutrien Ltd; Corteva Agriscience; Yara International ASA; The Mosaic Company; Akzo Nobel N.V; Nouryon; Nufarm Ltd; Compass Minerals International; Western Nutrients Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global crop micronutrients market based on form, type, application, crop type, and region:

-

Form Outlook (Revenue, USD Million, 2017 - 2028)

-

Chelated

-

Non-Chelated

-

-

Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Zinc

-

Boron

-

Iron

-

Manganese

-

Molybdenum

-

Copper

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Soil

-

Foliar

-

Fertigation

-

Others

-

-

Crop Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Cereals & Grains

-

Fruits & Vegetables

-

Pulses & Oilseeds

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Africa

-

-

Frequently Asked Questions About This Report

b. The global crop micronutrients market size was estimated at USD 5.54 billion in 2021 and is expected to reach USD 5.70 billion in 2022.

b. The global crop micronutrients market is expected to grow at a compound annual growth rate of 7.3% from 2022 to 2028 to reach USD 9.11 billion by 2028.

b. The Asia Pacific dominated the crop micronutrients market with a share of 53.1% in 2021. This is attributable to the growing demand for high-quality products, and rising farming practices are chief factors.

b. Some key players operating in the crop micronutrients market include BASF SE; DowDuPont Inc.; Nutrien Ltd; Corteva Agriscience; Yara International ASA; The Mosaic Company; Akzo Nobel N.V; Nouryon; Nufarm Ltd; Compass Minerals International; and Western Nutrients Corporation.

b. Key factors that are driving the crop micronutrients market growth include the rising soil deficiencies for cultivated lands and increasing awareness among people regarding the benefits of crop micronutrients for crop productivity and yields across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.