- Home

- »

- Next Generation Technologies

- »

-

Cross-border E-commerce Logistics Market Size Report 2030GVR Report cover

![Cross-border E-commerce Logistics Market Size, Share & Trends Report]()

Cross-border E-commerce Logistics Market (2024 - 2030) Size, Share & Trends Analysis Report By Delivery Type (Standard Delivery, Same-day Delivery), By End Use (Apparels, Consumer Electronics, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-426-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cross-border E-commerce Logistics Market Summary

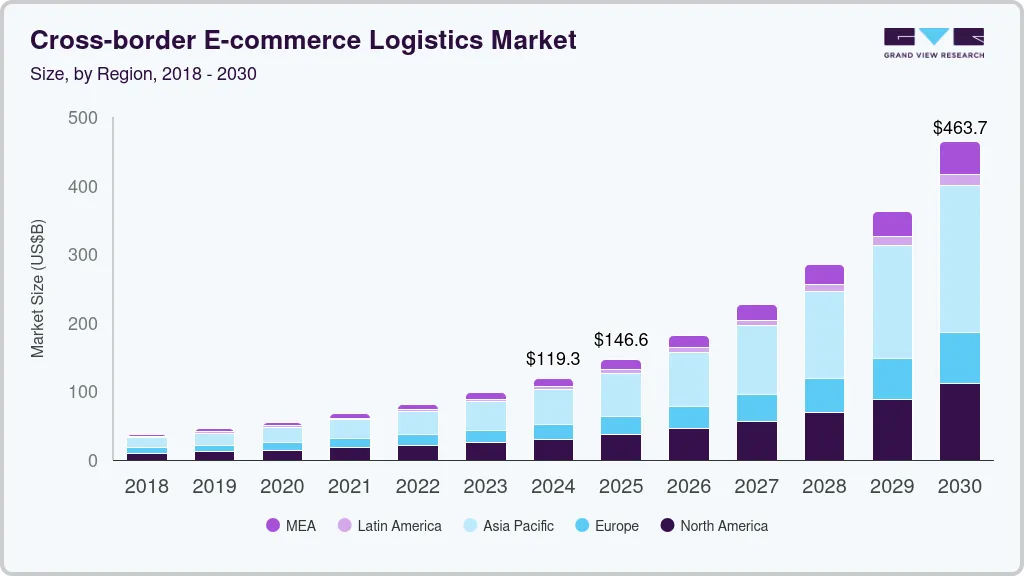

The global cross-border e-commerce logistics market size was estimated at USD 119,291.6 million in 2024 and is projected to reach USD 463,681.7 million by 2030, growing at a CAGR of 25.4% from 2025 to 2030. The market growth can be attributed to the rapid expansion of online retail, cross-border trade, and advancements in logistics technology.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, the U.S. is expected to register the highest CAGR from 2024 to 2030.

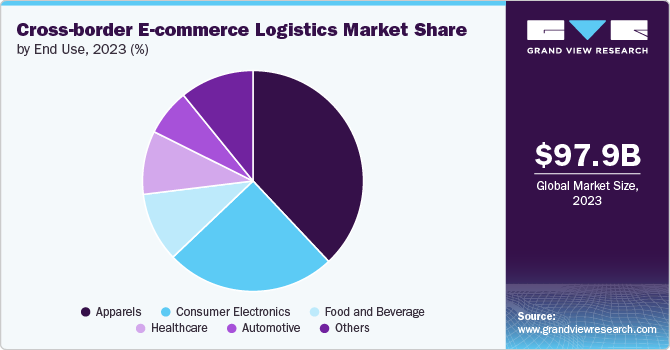

- In terms of segment, apparels accounted for a revenue of USD 97,852.9 million in 2023.

- Apparels is the most lucrative end use segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 119,291.6 Million

- 2030 Projected Market Size: USD 463,681.7 Million

- CAGR (2024-2030): 25.4%

- Asia Pacific: Largest market in 2023

Moreover, the increasing number of online shoppers, expansion of e-commerce platforms, and the rise of mobile commerce are anticipated to drive the growth of market.

The surge in cross-border e-commerce has necessitated the development of more sophisticated logistics networks to manage international shipments. This trend is particularly evident in regions such as Asia Pacific and Europe, where consumers increasingly purchase goods from foreign markets. Consumer expectations for fast delivery times have led to the rise of same-day and next-day delivery services. This demand has pushed logistics providers to invest in advanced technologies and optimize their supply chains to reduce transit times. For instance, Amazon.com, Inc. has set new standards in delivery speed, with Amazon Prime offering same-day delivery in several major markets.

The surge in cross-border e-commerce has necessitated the development of more sophisticated logistics networks to manage international shipments. This trend is particularly evident in regions such as Asia Pacific and Europe, where consumers are increasingly purchasing goods from foreign markets. Consumer expectations for fast delivery times have led to the rise of same-day and next-day delivery services. This demand has pushed logistics providers to invest in advanced technologies and optimize their supply chains to reduce transit times. For instance, Amazon.com, Inc. have set new standards in delivery speed, with Amazon Prime offering same-day delivery in several major markets.

The integration of digital technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) has revolutionized e-commerce logistics. These technologies enable real-time tracking, predictive analytics for demand forecasting, and automation in warehouses, thereby enhancing efficiency and reducing operational costs. Such factors are driving the growth of market across the globe.

Blockchain technology is gaining traction in the market to enhance transparency and security in supply chains. By providing decentralized and immutable ledger of transactions, blockchain can help reduce the risk of fraud, improve traceability, and streamline customs clearance processes. This technology is particularly valuable in cross-border trade, where multiple parties are involved in the transportation and delivery of goods.

One of the notable trends in the market is the shift towards the establishment of regional logistics hubs. These hubs are strategically located in key markets, enabling faster and more efficient delivery of goods to consumers. For instance, companies are increasingly setting up distribution centers in countries such as Singapore, UAE, and Germany, which serve as gateways to broader regional markets. This trend is driven by the need to reduce transit times, minimize costs, and enhance customer satisfaction.

Delivery Type Insights

The standard delivery segment dominated the market in 2023 and accounted for more than 79.0% share of global revenue. In terms of delivery type, the market is classified into standard delivery and same-day delivery. Standard delivery remains the most common option in cross-border e-commerce logistics, primarily due to its cost-effectiveness. The rise of online marketplaces has bolstered the standard delivery segment. Platforms like Amazon, Alibaba, and eBay have made it easier for sellers to reach international customers, who opt for standard delivery due to its affordability. Furthermore, the proliferation of free shipping offers, particularly for orders above a certain value, has further contributed to the popularity of standard delivery.

The same-day delivery segment is projected to register the highest growth rate from 2024 to 2030. This growth can be attributed to the rise of the instant gratification culture, where consumers expect their purchases to be delivered almost immediately. The COVID-19 pandemic has accelerated the adoption of same-day delivery, as consumers have increasingly turned to online shopping for essential goods, including groceries and medical supplies, which require faster delivery. Moreover, the competitive pressure among e-commerce platforms and logistics to differentiate themselves from form competitors and capture a larger share of the market is anticipated to propel the demand for the same-day delivery segment over the forecast period.

End Use Insights

The apparel segment dominated the market in 2023 and accounted for more than 37.0% share of global revenue. In terms of end use, the market is classified into apparel, consumer electronics, automotive, healthcare, food and beverage, and others. The rapid spread of fashion trends across borders has fueled the demand for international apparel brands. Social media platforms and influencers play a significant role in promoting these trends, driving consumers to seek products from different parts of the world. Advanced technologies like AI and big data are enhancing the consumer shopping experience by offering personalized recommendations and seamless cross-border transactions. Moreover, favorable trade agreements and reduced tariffs on clothing items are making cross-border e-commerce more accessible to consumers, thus driving the demand for the market in apparels segment.

The food and beverage segment is anticipated to register a significant growth rate from 2024 to 2030. The segment growth can be attributed to the growing consumer demand for exotic and specialty foods, health-conscious products, and convenience. Online platforms are offering a diverse range of products, from organic foods to gourmet beverages, catering to a global audience. Additionally, subscription services for food and beverages have gained popularity, allowing consumers to receive regular shipments of their favorite international products is anticipated to drive the growth of food and beverage segment.

Regional Insights

North Americacross-border e-commerce logistics market is projected to register a notable growth in from 2024 to 2030. The region has seen significant investment in logistics infrastructure and technology to handle the increasing volume of cross-border e-commerce. Companies are leveraging advanced technologies such as AI, automation, blockchain to enhance efficiency and transparency in the supply chain.

U.S. Cross-border E-commerce Logistics Market Trends

The cross-border e-commerce logistics market in the U.S. is expected to grow at a CAGR of 23.7% from 2024 to 2030. The increasing preference for international products among consumers has led to a surge in cross-border e-commerce transactions. The U.S. government’s support for digital trade agreements, such as United States-Mexico-Canada Agreement (USMCA), has also facilitated smoother cross-border trade by reducing trade barriers and enhancing customer procedures are anticipated to drive the market growth in the U.S.

Asia Pacific Cross-border E-commerce Logistics Market Trends

Asia Pacific cross-border e-commerce logistics market dominated the market in 2023 and accounted for a more than 42.0% share of global revenue. The region’s dominance is attributed to large and tech-savvy population, increasing disposable incomes, and the proliferation of online marketplaces. Furthermore, government initiatives to enhance trade facilitation, such as China’s Belt and Road Initiative (BRI), have also improved connectivity and logistics infrastructure, enabling smoother cross-border trade.

Europe Cross-border E-commerce Logistics Market Trends

The cross-border e-commerce logistics market in Europe is expected to grow at a notable CAGR of 22.7% from 2024 to 2030. The growth of the market in Europe is driven by strong consumer purchasing power and preference for international products. Furthermore, the rise of e-commerce marketplaces, such as Amazon and eBay, which have a strong presence in Europe, has driven the demand for efficient cross-border e-commerce logistics services.

Key Cross-border E-commerce Logistics Company Insights

Some of the key companies operating in the market include FedEx Corp., Amazon.com, Inc., United Parcel Service, Inc., Kuehne + Nagel Management AG, Deutsche Post AG, CEVA Logistics SA, A.P. Moller - Maersk, DSV A/S, SEKO Logistics, Aramex PJSC

-

FedEx Corp, the U.S. based transportation company. The company developed an extensive global network that covers 100 countries & territories. This expansive reach allows the company to efficiently manage cross-border logistics. The company has heavily invested in technology to improve logistics efficiency and customer experience.

Easyship, FlavorCloud, and Zonos are some of the emerging companies in the target market.

-

FlavorCloud, the U.S. based company engaged in providing cross-border logistics and shipping platform that integrates directly with e-commerce platforms. The platform offers features such as automated custom clearance, international shipping, and returns management.

Key Cross-border E-Commerce Logistics Companies:

The following are the leading companies in the cross-border e-commerce logistics market. These companies collectively hold the largest market share and dictate industry trends.

- A.P. Moller - Maersk

- Amazon.com, Inc.

- Aramex PJSC

- CEVA Logistics SA

- Deutsche Post AG

- DSV A/S

- FedEx Corp.

- Kuehne + Nagel Management AG

- SEKO Logistics

- United Parcel Service, Inc.

Recent Developments

-

In July 2024, A.P. Moller-Maersk launched a shipping service named SH3. The service commenced between China and Bangladesh to meet the rising trade demands in retail industry.

-

In May 2024, SEKO Logistics announced the opening of Perafita operation in Portugal. The new operations in Portugal include ground transportation between the U.S. and North Africa along with international ocean and air services.

-

In March 2024, A.P. Moller-Maersk opened a warehouse facility in Mexico. The facility targets cross-border trade for customers in the retail, automotive, lifestyle, and technology sectors who need cross-border capabilities.

Cross-border E-commerce Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 119.29 billion

Revenue forecast in 2030

USD 463.68 billion

Growth Rate

CAGR of 25.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Delivery type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; and South Africa

Key companies profiled

FedEx Corp.; Amazon.com, Inc.; United Parcel Service, Inc.; Kuehne + Nagel Management AG; Deutsche Post AG; CEVA Logistics SA; A.P. Moller - Maersk; DSV A/S; SEKO Logistics; Aramex PJSC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cross-border E-commerce Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cross-border e-commerce logistics market report based on transportation, delivery type, end use, and region.

-

Delivery Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Standard Delivery

-

Same-day Delivery

-

-

End Use Outlook (Revenue, USD Million; 2017 - 2030)

-

Apparels

-

Consumer Electronics

-

Automotive

-

Healthcare

-

Food and Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cross-border e-commerce logistics market size was estimated at USD 97.85 billion in 2023 and is expected to reach USD 119.29 billion in 2024.

b. The global cross-border e-commerce logistics market is expected to grow at a compound annual growth rate of 25.4% from 2024 to 2030, reaching USD 463.68 billion by 2030.

b. The standard delivery segment dominated the market in 2023 and accounted for more than 79.0% share of global revenue. Standard delivery remains the most common option in cross-border e-commerce logistics, primarily due to its cost-effectiveness. The rise of online marketplaces has bolstered the standard delivery segment. Platforms like Amazon, Alibaba, and eBay have made it easier for sellers to reach international customers, who opt for standard delivery due to its affordability.

b. Some of the companies operating in the cross-border e-commerce logistics market include FedEx Corp., Amazon.com, Inc., United Parcel Service, Inc., Kuehne + Nagel Management AG, Deutsche Post AG, CEVA Logistics SA, A.P. Moller - Maersk, DSV A/S, SEKO Logistics, Aramex PJSC

b. The market growth can be attributed to the rapid expansion of online retail, cross-border trade, and advancements in logistics technology. Moreover, increasing number of online shoppers, expansion of e-commerce platforms, and the rise of mobile commerce are anticipated to drive the growth of cross-border e-commerce logistics market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.