- Home

- »

- Next Generation Technologies

- »

-

Cross Border Payments Market Size, Industry Report, 2030GVR Report cover

![Cross Border Payments Market Size, Share & Trends Report]()

Cross Border Payments Market (2025 - 2030) Size, Share & Trends Analysis Report By Transaction Type (B2B, C2B, B2C, C2C), By Channel (Bank Transfer, Money Transfer Operator, Card Payment), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-573-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cross Border Payments Market Summary

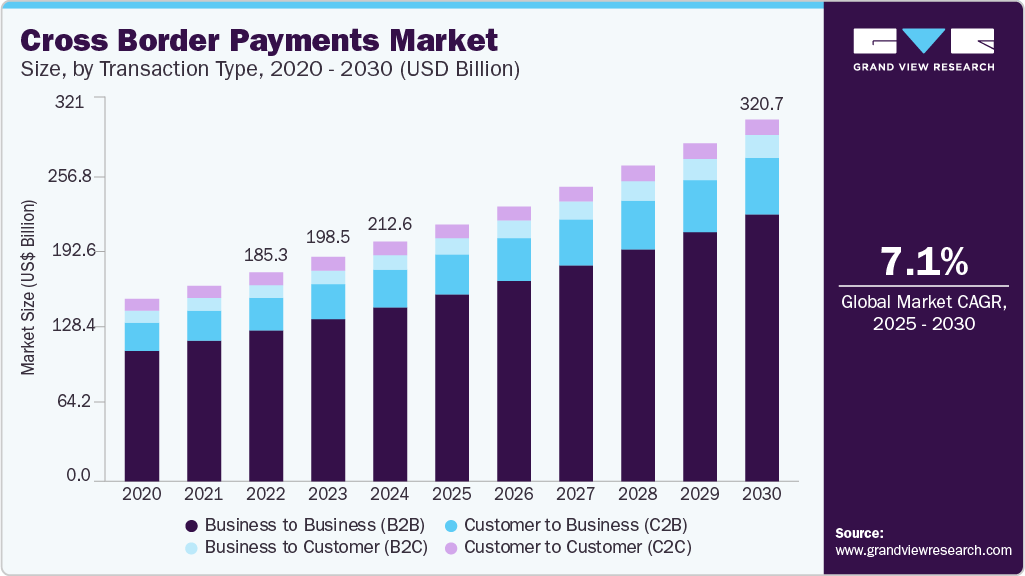

The global cross border payments market size was estimated at USD 212.55 billion in 2024 and is projected to reach USD 320.73 billion by 2030, growing at a CAGR of 7.1% from 2025 to 2030. Cross-border payments remain high-cost and slow, driving reforms.

Key Market Trends & Insights

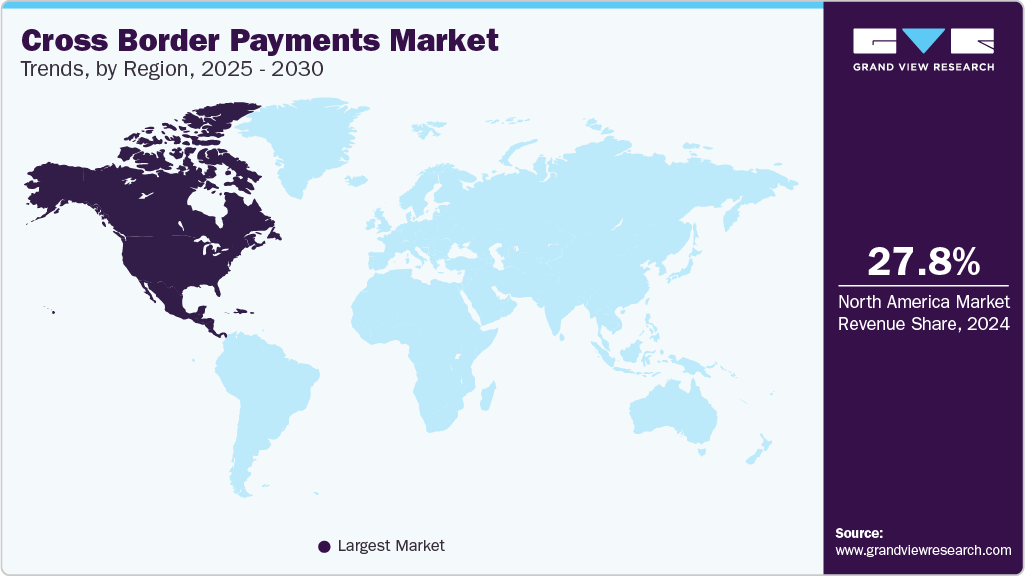

- The North America cross border payments market accounted for a 27.8% share of the overall market in 2024.

- The U.S. cross border payments industry held a dominant position in 2024.

- By transaction type, the Business to Business (B2B) segment accounted for the largest share of 72.6% in 2024.

- By channel, the Money Transfer Operator (MTO) segment is expected to grow at a significant CAGR during the forecast period.

- By enterprise size, the large enterprise segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 212.55 Billion

- 2030 Projected Market Size: USD 320.73 Billion

- CAGR (2025-2030): 7.1%

- North America: Largest market in 2024

The World Bank reports an average cost of about 6.2-6.3% for sending USD 200 in 2023, far above the 3% Sustainable Development Goal. Even within regions, costs vary widely. For example, the World Bank notes remittance fees to South Asia averaged 6-7% in 2023, while fees into Africa often exceed 7%. These inefficiencies are due to multiple correspondent steps and manual checks, which have prompted G20/FSB initiatives setting targets for “faster, cheaper, more transparent, and more inclusive” cross-border payments. Central banks and institutions are analyzing corridor-level fees (e.g., Turkey-Bulgaria at >50%) and tracking progress on G20 Roadmap goals. In short, reducing friction and costs is a major trend. International bodies like the IMF and FSB stress lowering remittance and trade payment fees as a priority.

To meet cost/speed goals, industries are upgrading systems. The adoption of the ISO 20022 messaging standard for payments is accelerating. For instance, in 2023, the UK’s CHAPS system completed ISO 20022 migration, and the Bank of England confirmed plans to harmonize CHAPS with the BIS/CPMI ISO 20022 “data requirements” by 2025. Globally, the consistent ISO 20022 message formats streamline processing and straight-through processing, reducing delays and errors. Another modernization is real-time payment connectivity; more than 70 national fast-payment systems (FPS) now operate worldwide, and interlinking them is seen as highly promising. This states that the cross-border linking of FPS enables near-instant transfers between countries. In sum, upgrading rails and messaging (ISO 20022, RTGS/FPS interlinking) is a key trend driving the growth of the cross border payments industry, backed by central bank initiatives and FSB/CPMI guidance.

Central banks and the private sector are actively exploring digital currencies. The Federal Reserve notes that over 90% of central banks are researching Central Bank Digital Currencies (CBDCs), and pilot projects are underway in many jurisdictions. CBDCs, in theory, provide new secure settlement rails for cross-border flows. Alongside CBDCs, interest in stablecoins and tokenized payments is rising, though official bodies urge caution. The stablecoins are considered a “future scenario” for cross-border payments, but none yet meet regulatory standards. Some jurisdictions (China, some EMDEs) are actively piloting stablecoin or digital yuan cross-border use, while others (e.g. EU) regulate stablecoins tightly to safeguard financial stability. In practice, digital innovation from blockchain-based remittance networks to cross-border mobile money is a major focus, even as policymakers work to align regulations internationally.

Addressing cross-border frictions has become a global priority. In late 2024, the FSB launched a Forum on Cross-Border Payments Data to align regulations and data frameworks across jurisdictions. The Forum will tackle issues like inconsistent KYC/AML requirements and data privacy rules that slow payments. For example, the Bank of England highlights that mismatched compliance rules cause payouts to stall at beneficiary banks. The FSB forum (Mar 2025) and CPMI guidance aim to harmonize these standards. In essence, a trend is greater global coordination, G20/FSB roadmaps, OECD, and FATF work, and shared guidance are being developed so that cross-border chains are smoother and more interoperable.

Cross-border payments aren’t just big banks and corporations - consumer use is exploding. Remittance alone was around USD 669 billion to developing countries in 2023, and money sent via online platforms and mobile wallets is growing. The World Bank reports that remittances now exceed the sum of foreign direct investment and foreign aid for many countries. This underlines financial inclusion as a driver, migrants and diaspora rely on efficient remittances. At the same time, cross-border e-commerce and travel drive consumer-to-business (C2B) payments worldwide. The Bank of England notes that cross-border payments span wholesale and retail (including person-to-person and person-to-business) and are integral as goods/services flow globally. Overall, expanding volume and diversity of cross-border transactions from gig economy transfers to SME trade payments is a key trend prompting service innovation and boosting market growth.

Transaction Type Insights

The Business to Business (B2B) segment accounted for the largest share of 72.6% in 2024. Corporate cross-border payments represent the vast majority of total value. Multinational companies pay suppliers, service providers, and subsidiaries through global treasury networks and SWIFT messaging. Growth drivers include expanding international trade and supply-chain finance. Much of recent cross-border growth has been driven by B2B transactions, due to global trade expansion and improved payments infrastructure. Large banks (Citi, HSBC, JPMorgan, etc.) dominate this segment via correspondent banking and treasury portals, but new entrants (like Visa B2B Connect) are entering the space.

The Customer to Business (C2B) segment is expected to grow at a significant CAGR during the forecast period. This retail-oriented segment covers consumers paying foreign merchants (e.g., online shopping, subscriptions) and travelers paying abroad. C2B flows have surged with global e-commerce. It is prominent that consumer-initiated cross-border payments will grow rapid pace in the coming years. Fintech and card networks facilitate most of these payments, and digital wallets and card schemes allow consumers to pay overseas businesses in their home currency. For instance, PayPal, Apple Pay, and Alipay enable shoppers worldwide to buy from international vendors with one click.

Channel Insights

The bank transfer segment held the largest market share in 2024. Traditional banks remain the backbone channel for cross-border payments, especially for large transactions. Most high-value corporate and retail payments still route through SWIFT-based wire transfers and domestic clearing systems. Banks are modernizing these flows; for example, SWIFT’s GPI network now allows many banks to track transfers in real time. These bank channels benefit from global reach and regulatory trust, but are being challenged on cost and speed. Many institutions are investing in newer standards (ISO 20022 messaging) and partnerships (e.g., linking SWIFT with instant-payment systems) to upgrade their cross-border offerings.

The Money Transfer Operator (MTO) segment is expected to grow at a significant CAGR during the forecast period. MTOs specialize in consumer remittances and small-value transfers. They combine agent networks with digital interfaces. These providers have large existing customer bases and infrastructure (Western Union has 500,000+ agent locations worldwide). To stay competitive, MTOs are aggressively digitizing and partnering. For example, Western Union’s 2024 agreement with Visa lets U.S. customers send money directly to Visa cards and bank accounts in 40 countries. MoneyGram has joined Mastercard’s Move cross-border platform for 38 markets and has launched blockchain-based wallets for remittances. Overall, the MTO channel is evolving to offer faster, online-friendly services while leveraging its global cash-out network.

Enterprise Size Insights

The large enterprise segment dominated the market in 2024. Large enterprises hold a significant share of the cross-border payments. Multinational firms use innovative treasury systems and have access to premium banking services (e.g., dedicated payment platforms, multi-currency accounts, liquidity pools). These customers demand integrations with ERP and cash-management tools. Significantly, large enterprises’ cross-border payment volumes will grow faster than those of smaller companies. Many global banks now provide real-time FX pricing and instant payment options to corporates. Partnerships like Visa and Mastercard linking with remitters also target large merchants and payroll disbursements.

The Small & Medium Enterprises (SMEs) segment is projected to grow at the fastest CAGR over the forecast period. SMEs have historically been underserved in cross-border payments due to cost and complexity. However, they are now a focus of fintech innovation. E-commerce platforms (e.g., Shopify, eBay) and fintech providers (Wise Business, PayPal for Business) enable small exporters and importers to transact internationally easily. Some of the SME pain points: for instance, Mexicans lost about $446 million in hidden fees on cross-border transfers in 2024. Fintechs are addressing this by offering transparent fees and local currency accounts tailored to SMEs. While large firms still dominate value, SME cross-border trade is a rapidly growing segment as global supply chains democratize.

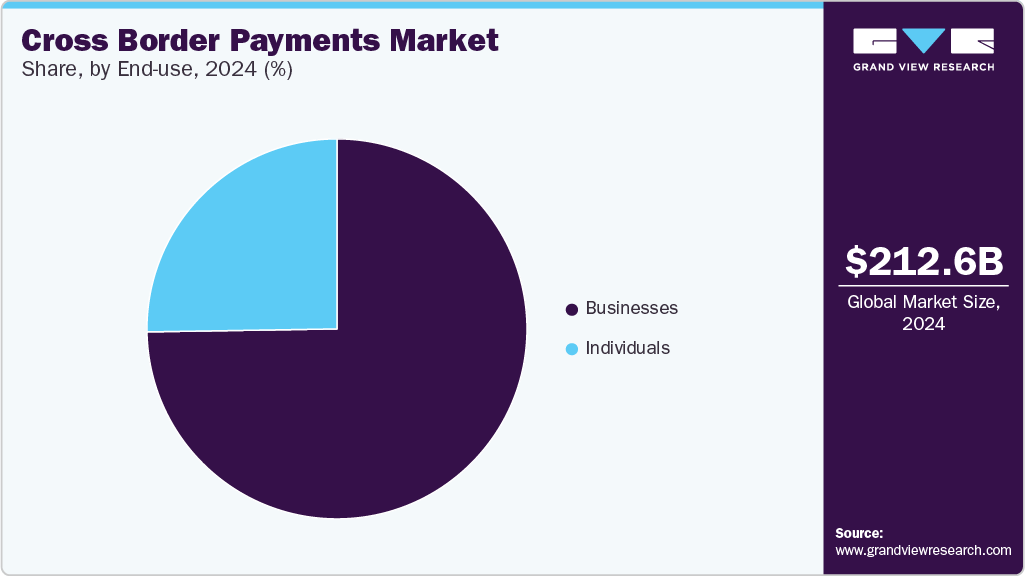

End Use Insights

The business segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. On the business side, cross-border payments include B2B transactions, cross-border e-commerce by merchants, and branch/shareholder transfers, due to which this segment is growing rapidly. Notably, cross-border B2C and B2B differ mainly in the sender; even when a small business pays a foreign supplier or gets paid by a foreign customer, the payment infrastructure is similar. Providers are responding with business-focused accounts (multi-currency wallets, API payment solutions) to capture this growing corporate use case.

The Individuals segment is projected to grow at a significant CAGR over the forecast period. Cross-border payments for personal use include remittances to family, foreign tuition, healthcare, travel, and online purchases. Despite economic headwinds, migration and diaspora flows keep remittances resilient. Consumers expect low-cost, on-demand services. Hence, many migrants now use apps (Remitly, WorldRemit, Xoom) or banks’ transfer services on mobile. However, costs are still high: the global average cost to send $200 was 6.4% in late 2023. This has driven the uptake of cheaper digital channels, which cost about 5% on average.

Regional Insights

The North America cross border payments market accounted for a 27.8% share of the overall market in 2024. North America is focusing on modernizing its cross-border payment systems to enhance efficiency and reduce costs. The U.S. Federal Reserve has been exploring improvements in payment infrastructures, including initiatives like the FedNow Service, aimed at facilitating instant payments. These efforts are part of a broader strategy to address the challenges associated with traditional cross-border payment methods.

U.S. Cross Border Payments Market Trends

The U.S. cross border payments industry held a dominant position in 2024. The United States is prioritizing the development of faster and more transparent cross-border payment solutions. The Federal Reserve's initiatives, such as the FedNow Service, are designed to provide real-time payment capabilities, which can significantly improve the speed and reliability of cross-border transactions. These advancements aim to address the inefficiencies and high costs associated with traditional correspondent banking systems.

Europe Cross Border Payments Market Trends

The Europe cross border payments industry was identified as a lucrative region in 2024. European countries are working towards integrating their cross-border payment systems to facilitate seamless transactions across borders. The European Central Bank (ECB) has been involved in initiatives to enhance the interoperability of payment systems within the Eurozone, aiming to reduce fragmentation and improve the efficiency of cross-border payments.

Germany cross border payments market is expected to witness growth during the forecast period. Germany is adopting real-time cross-border payment solutions to meet the growing demand for faster and more efficient international transactions. The Deutsche Bundesbank has been participating in initiatives to modernize payment infrastructures, focusing on enhancing the speed and reliability of cross-border payments.

Cross border payments market in the UK is anticipated to register growth over the forecast period. The United Kingdom is developing innovative frameworks to improve cross-border payment processes. The Bank of England has been exploring the use of new technologies and regulatory approaches to enhance the efficiency and security of international payments, aiming to position the UK as a leader in the global payments landscape.

Asia Pacific Cross Border Payments Market Trends

The APAC region is witnessing increased collaboration among countries to integrate cross-border payment systems. Initiatives like the linkage between Thailand's PromptPay and Singapore's PayNow enable instant, low-cost mobile transfers between the countries. Such collaborations aim to create a more interconnected and efficient payment ecosystem across the region.

China cross border payments market is expected to grow over the forecast period. China is expanding the international use of the yuan by promoting its Cross-Border Interbank Payment System (CIPS). CIPS facilitates yuan-denominated cross-border transactions, offering an alternative to the SWIFT system. As of March 2025, CIPS has connected financial institutions in 119 countries, processing significant volumes of international payments.

Cross border payments market in India is anticipated to witness growth during the forecast period. India is expanding its Unified Payments Interface (UPI) globally and promoting rupee-based cross-border transactions. The Reserve Bank of India (RBI) has eased forex regulations to facilitate international trade in rupees. India has also established UPI linkages with countries like Singapore, enabling real-time cross-border transactions.

Key Cross Border Payments Company Insights

Some of the major players in the cross border payments market include PayPal, Western Union Holdings, Wise Payments Limited, MoneyGram, Visa, and Mastercard. They are major players in the global market due to their vast global networks, high transaction volumes, and strong brand trust. They offer diversified services from digital wallets and instant transfers to multi-currency accounts, catering to both individuals and businesses. Their leadership is further reinforced by continuous innovation, regulatory compliance across markets, and strategic investments or acquisitions. These strengths allow them to provide fast, secure, and scalable cross-border solutions across multiple regions and use cases.

-

PayPal is a global digital payments leader, and its Xoom service is a top platform for remittances and small cross-border transfers. With over 400 million users worldwide, PayPal’s network effects and brand trust make it highly relevant. Strategically, PayPal leverages both consumer wallets and enterprise rails (it recently launched PayPal Complete Payments in China to serve businesses’ cross-border needs). Its senior management emphasizes blockchain too. In 2024, Xoom began settling transfers via PayPal USD (a stablecoin) to speed up remittances. PayPal’s positioning is as an integrated payments platform, consumers can hold multiple currencies, and merchants use PayPal for global e-commerce. This broad footprint from micro-remittances to online marketplaces keeps PayPal at the forefront of cross-border payments.

-

Wise Payments Limited is a fintech specialist in low-cost international money transfers and multi-currency accounts. It has processed hundreds of billions of dollars in global payments to date. The company’s appeal lies in transparent pricing (typically 0.5-1% fee) and direct local currency settlement. Wise has aggressively expanded its network: in 2024, it obtained direct access to Japan’s clearing system (Zengin), cutting fees for Japan-bound transfers. In early 2025, Wise Payments Limited launched services in Mexico, tapping into a massive remittance corridor. Financially, Wise Payments Limited continues to grow, and it reported +22% cross-border volume growth to USD 185.2 Bn (£145 Bn) in FY2025 and is targeting double-digit profit margins by 2026. Wise Payments Limited’s strategic positioning is as the “borderless” account for individuals and businesses, capturing customers frustrated with high bank FX rates.

Key Cross Border Payments Companies:

The following are the leading companies in the cross border payments market. These companies collectively hold the largest market share and dictate industry trends.

- PayPal

- Western Union Holdings

- Wise Payments Limited

- MoneyGram

- Visa

- Mastercard

- Stripe, Inc.

- Payoneer Inc.

- Worldpay LLC

- Airwallex

- Rapyd Financial Network Ltd.

Recent Developments

-

In September 2024, PayPal launched PayPal Complete Payments in China, which is a one-stop cross-border platform for businesses, marking its formal entry into the Chinese market. PayPal has also pursued crypto, and it integrated with Yellow Card in Africa to support PYUSD, and formed a partnership with Yellow Card and Cebuana Lhuillier for blockchain remittances. These moves demonstrate PayPal’s push to accelerate and diversify cross-border rails with blockchain and global expansion.

-

In October 2024, Wise Payments Limited became the first foreign firm authorized on Japan’s domestic Zengin payment system, enabling cheaper yen transfers. In January 2025, Wise Payments Limited launched services in Mexico, targeting a large remittance corridor, and Mexico is the world’s 2nd-largest remittance recipient. Financially, Wise Payments Limited reported rapid growth, and preliminary FY2025 figures (announced April 2025) showed active customers up 21% to 15.5 million and cross-border volumes up 22% to USD 185.2 Bn (£145 Bn). In early 2025, Wise Payments Limited set profit targets (double-digit margins by 2026) on the strength of these expansions. Wise also continues to align with industry initiatives (e.g., contributing remittance fee data to G20 efforts).

Cross Border Payments Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 227.63 billion

Revenue forecast in 2030

USD 320.73 billion

Growth rate

CAGR of 7.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Transaction type, channel, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

PayPal; Western Union Holdings; Wise Payments Limited; MoneyGram; Visa; Mastercard; Stripe, Inc.; Payoneer Inc.; Worldpay LLC; Airwallex; Rapyd Financial Network Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cross Border Payments Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cross border payments market report based on transaction type, channel, enterprise size, end use, and region:

-

Transaction Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Business to Business (B2B)

-

Customer to Business (C2B)

-

Business to Customer (B2C)

-

Customer to Customer (C2C)

-

-

Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Bank Transfer

-

Money Transfer Operator

-

Card Payment

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Individuals

-

Businesses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cross border payments market size was estimated at USD 212.55 billion in 2024 and is expected to reach USD 227.63 billion in 2025.

b. The global cross border payments market size is expected to grow at a significant CAGR of 7.1% to reach USD 320.73 billion in 2030.

b. North America held the largest market share of 27.8% in 2024. North America is focusing on modernizing its cross-border payment systems to enhance efficiency and reduce costs. The U.S. Federal Reserve has been exploring improvements in payment infrastructures, including initiatives like the FedNow Service, aimed at facilitating instant payments.

b. Some of the key players in the cross border payment market include PayPal ; Western Union Holdings; Wise Payments Limited, MoneyGram International, Inc, Visa, Mastercard, Stripe, Inc., Payoneer Inc., Worldpay LLC, Airwallex , Rapyd Financial Network Ltd.

b. The cross-border payments market is driven by rising demand for real-time, low-cost, and digitally-enabled international transactions fueled by fintech innovations and e-commerce growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.