- Home

- »

- Advanced Interior Materials

- »

-

Cross Laminated Timber Market Size, Forecast Report, 2030GVR Report cover

![Cross Laminated Timber Market Size, Share & Trends Report]()

Cross Laminated Timber Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Adhesive Bonded CLT, Mechanically Fastened CLT), By Application (Residential, Institutional), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-985-2

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cross Laminated Timber Market Summary

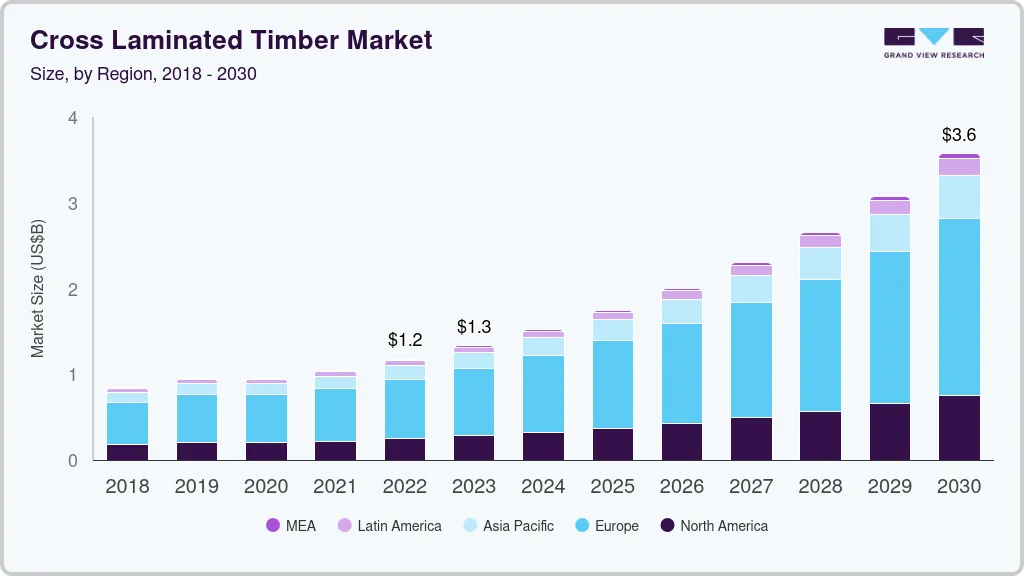

The global cross laminated timber market size was estimated at USD 1,174.2 million in 2022 and is projected to reach USD 3,569.1 million by 2030, growing at a CAGR of 14.9% from 2023 to 2030. Superior design flexibility and faster installation processes in comparison to other building materials are likely to benefit the industry over the forecast period.

Key Market Trends & Insights

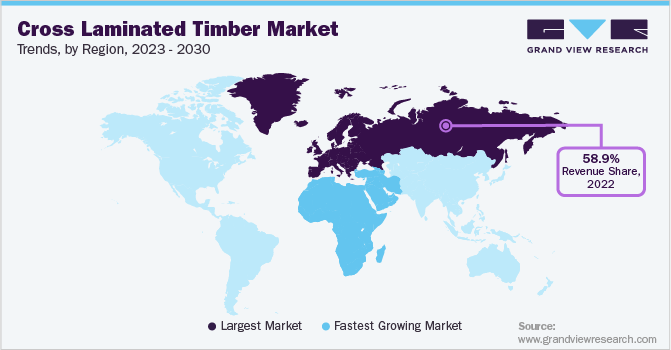

- Europe dominated the market and accounted for over 58.9% share of global revenue in 2022.

- By product, the adhesive bonded cross laminated timber product segment led the market and accounted for more than 88.2% share of the global revenue in 2022.

- By application, the residential application segment led the market and accounted for more than 45.6% of the global revenue share in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1,174.2 Million

- 2030 Projected Market Size: USD 3,569.1 Million

- CAGR (2023-2030): 14.9%

- Europe: Largest market in 2022

Cross laminated timber is increasingly used in construction applications owing to the rising awareness about the product benefits including design flexibility, fire resistance, superior thermal performance, cost-effectiveness, and others. In addition, a clean & noiseless construction process, reduced construction time, and low cost have increased the demand for the same.

The market in the U.S. is expected to exhibit growth owing to the high demand from the end-user segment. Factors such as high disposable income, large market size, the ability of established players to mass-produce, and an extensive range of products are expected to boost the cross laminated timber market growth in the region.

Cross laminated timber (CLT) products are also characterized by superior performance in terms of the generation of job site waste. Since most of the CLT panels are pre-fabricated, there is minimal waste generation on the site. In addition, manufacturers re-use scrap for the fabrication of stairs or other prefabricated components. Moreover, the proven strength, cost competitiveness, and structural performance provided by CLT are expected to increase opportunities for the product for expanding applications in a wider range of buildings.

CLT is increasingly being used for building and construction by replacing materials like steel or concrete, subsequently leading to higher energy conservation and significantly reduced environmental impact. In addition, businesses have realized the significance of adopting green or sustainable practices. Intangible gains, such as enhanced employee performance, better work satisfaction, and upgrades in the company’s image associated with these practices have induced every organization to adopt sustainable measures.

The rising demand for environment-friendly products that have a minimum adverse impact, as per the VOC regulations of the U.S. EPA, and green building initiatives are the major forces positively impacting the market. The growing awareness among consumers about the benefits of CLT in the construction industry is projected to drive the market’s growth.

CLT-based buildings have become common in North America and European regions. A majority of the constructions in these areas are now utilizing wood-based materials to improve the overall thermal performance and durability of the structure. Major construction companies across the globe are increasingly shifting toward CLT and other wood-based construction materials.

Product Insights

The adhesive bonded cross laminated timber product led the market and accounted for more than 88.2% share of the global revenue in 2022. The use of high-strength adhesives used for the bonding of planks is projected to propel its demand across various application industries including residential, institutional, commercial, and others.

The manufacturing cost of adhesive bonded CLT is less as compared to mechanically fastened CLT, owing to less usage of machinery. In addition, the adhesive bonded CLT panels can be converted to biofuel pellets at the end of their life cycle. These panels are custom manufactured to their final dimensions, as per the construction needs, leading to less wastage of wood.

Mechanically fastened CLT is produced by joining three or more layers of lumbers with nails and screws using mechanical systems. The making of such CLT does not involve the usage of adhesives and press machines. The mechanically fastened CLT market is still in its nascent stage and has limited adoption in some developed countries in Europe & North America.

The production of mechanically fastened CLT is highly complex, as compared to adhesive bonded CLT, due to the need for highly skilled labor for the operation of the fastening machines. The chances of raw material wastage are also high in this case, as the improper application of screws at one point may cause problems in the entire assembly.

Application Insights

The residential application segment led the market and accounted for more than 45.6% of the global revenue share in 2022. The rising use of eco-friendly construction materials and seismic bearing capacity is expected to result in increased consumption in earthquake-prone areas, such as Japan, India, and Mexico, over the forecast period.

The high structural strength and recyclability of cross laminated timber are expected to drive market growth in the residential sector. Rising investments by governments across various countries in Asia Pacific, North America, and Europe, toward the adoption of environment-friendly materials for reducing the carbon footprint of the construction industry, are expected to drive the market growth.

The cross laminated timber is used in various institutional places such as schools, colleges, and research institutes for building walls, floors, and ceilings in classrooms, libraries, laboratories, and amphitheaters. This is attributed to the excellent acoustic properties and aesthetic appeal of the material, thereby benefiting the market growth.

The usage of CLT in several commercial buildings such as offices, malls, hospitals, and restaurants is expected to rise over the forecasted period, owing to its wide benefits such as fast installation, design flexibility, and high fire resistance. CLT is prefabricated and its usage involves the installation of CLT at the required application, which reduces the construction time.

Regional Insights

Europe dominated the market and accounted for over 58.9% share of global revenue in 2022, owing to the green building movement initiated in the region. In addition, trends for using wooden products in construction applications are expected to support the market growth over the forecast period.

The cross-laminated timber market in North America is majorly driven by the demand from the U.S. Strong growth in application industries in Canada and Mexico is further likely to provide growth prospects to the regional demand for CLT products. However, various regulations about wood products have been issued in the region, thus may hamper the market growth.

The enforcement of green building codes by various governments in the Asia Pacific region is anticipated to aid the market growth. The region is generally characterized by high temperatures and extreme climatic conditions, thus consumers in the region prefer concrete construction over wooden construction, which is likely to restrict the market growth.

Expansion of commercial, residential, and industrial sectors on account of sustainable economic growth in the region is anticipated to upscale the construction activities, thereby driving the product demand. Flourishing tourism in the region has led to an increasing requirement for restaurants, resorts, and food chains, thereby driving the market growth.

Key Companies & Market Share Insights

The global cross laminated timber industry is less competitive owing to the presence of a limited number of manufacturers consolidated in the European region, serving major economies across the globe including North America and Asia-Pacific. These manufacturers compete based on product quality such as wood thermal resistance, surface finish, and prices to increase their applications

Some key players also own forest land and use it to source timber for the manufacture of their processed products. For instance, Mayr-Melnhof Holz Holding AG has achieved a high value-added chain with vertical integration by sourcing wood from its own forest and manufacturing engineered wood in its production facility to maintain the economies of scale to the highest level. Some prominent players in the global cross laminated timber market include:

-

Stora Enso Oyj

-

Mayr-Melnhof Holz Holding AG

-

Binderholz GmbH

-

XLam

-

Sterling Company

-

Schilliger Holz AG

-

KLH Massivholz GmbH

-

B&K Structures

-

Eugen Decker & WebMan

-

Structurlam Mass Timber Corporation

-

SmartLam NA

-

MEIKEN LAMWOOD Corp

Cross laminated Timber Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.33 billion

Revenue forecast in 2030

USD 3.56 billion

Growth rate

CAGR of 14.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in thousand cubic meters, Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Austria; Germany; Switzerland; Italy; New Zealand; China; Japan; Australia

Key companies profiled

Stora Enso Oyj; Mayr-Melnhof Holz Holding AG; Binderholz GmbH; XLam; Sterling Company; Schilliger Holz AG; KLH Massivholz GmbH; B&K Structures; Eugen Decker & WebMan; Structurlam Mass Timber Corporation; SmartLam NA. MEIKEN LAMWOOD Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cross Laminated Timber Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cross laminated timber (CLT) market report based on product, application, and region

-

Product Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million, 2018 - 2030)

-

Adhesive Bonded Cross Laminated Timber

-

Mechanically Fastened Cross Laminated Timber

-

-

Application Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Institutional

-

Commercial

-

Others

-

-

Regional Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Austria

-

Germany

-

Switzerland

-

Italy

-

-

Asia Pacific

-

New Zealand

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global cross laminated timber market size was estimated at USD 1.17 billion in 2022 and is expected to reach USD 1.33 billion in 2023.

b. The cross laminated timber market is expected to grow at a compound annual growth rate of 14.9% from 2023 to 2030 to reach USD 3.56 billion by 2030.

b. Residential application segment dominated the cross laminated timber market with a share of 45.0% in 2022, on account of rising adoption of eco-friendly construction materials as a substitute of non-biodegradable and recyclable materials.

b. Some of the key players operating in the cross laminated timber market include Stora Enso Oyj, Mayr-Melnhof Holz Holding AG, Binderholz GmbH, XLam, Sterling Company, Schilliger Holz AG, KLH Massivholz GmbH, B&K Structures, Eugen Decker & WebMan, Structurlam Mass Timber Corporation, SmartLam NA. MEIKEN LAMWOOD Corp.

b. The key factors that are driving the cross laminated timber market include increased product demand in building & construction applications and reduction in carbon emission through use of cross laminated timber.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.