- Home

- »

- Renewable Chemicals

- »

-

Crude Sulfate Turpentine Market Size, Industry Trend Report 2019-2025GVR Report cover

![Crude Sulfate Turpentine Market Size, Share & Trends Report]()

Crude Sulfate Turpentine Market Size, Share & Trends Analysis Report By Product (Carene, Camphor, Alpha-pinene, Beta-pinene), By Application (Additives, Personal/Home Care), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-759-9

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Specialty & Chemicals

Report Overview

The global crude sulfate turpentine market size was valued at USD 633.0 million in 2018 and is projected to expand at CAGR of 3.5% during the forecast period. This growth is attributed to the increased scope of applications across aroma chemicals and personal and home care products. Moreover, rising product demand in Asia Pacific is likely to boost the market development.

Shifting preference toward eco-friendly CST derivatives as a substitute to the petrochemical derivatives is anticipated to drive the industry further. Crude sulfate turpentine , a byproduct obtained in pulp making process, can be sourced at a fixed price based on the yearly or six-monthly contracts. Manufacturers directly source the materials from mills. It is a volatile amber liquid that offers major products including alpha and beta pinenes, which are the building blocks for various natural flavors and fragrances.

Moreover, these products are reacted into poly-terpenes, which are used in adhesives, specialty inks, electronic solvents, vitamins, pharmaceuticals, disinfectants, and other products. The concentration of the products varies with the change in geographical areas owing to variation in the genus Pinus in the pine tree.

Manufacturers are focusing on securing sustainable raw materials with an efficient manufacturing process. They are shifting towards renewable bio content to the product manufacturing. For instance, Kraton is implementing high bio-renewable content (BRC) by nature maintaining the overall performance of the tires produced.

Product Insights

Beta-pinene was the leading product segment in 2018 and accounted for over 40% of the overall volume share owing to its presence in higher amounts among the derivatives obtained during the Kraft pulping process. In addition, the product can be directly sold to multiple industries, while alpha-pinene requires further processing before using it in final products.

Alpha-pinene is a colorless liquid derived from CST and is mainly used to synthesize linalool, terpineol, and sandalwood fragrance. Pure alpha-pinene is extracted from various sources, such as sage, citrus, eucalyptus, rosemary, conifer trees, and turpentine trees. Of all products, alpha-pinene is the most common and concentrated terpene.

Carene is likely to witness the highest CAGR of over 3% owing to its increasing application as a raw material in perfumes, cosmetics, flavors, and in the production of terpene resins. It is also used in various therapeutic and medicinal applications like sedative, memory stimulator, anti-inflammatory, antifungal, and speedy bone healing.

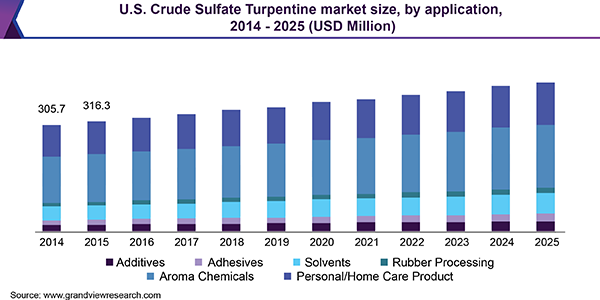

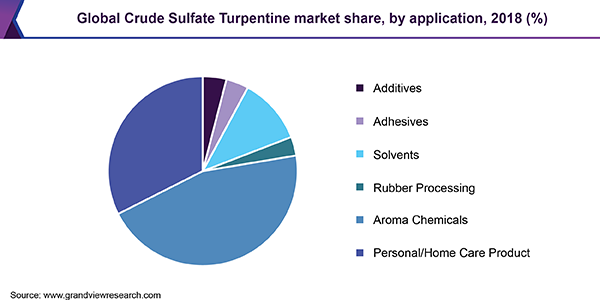

Application Insights

Aroma chemicals application segment accounted for the highest volume share in 2018. Extensive usage of these derivatives, as it is naturally sourced, in the manufacturing of various flavors and fragrances is likely to drive the segment further during the forecast years. Moreover, increasing per capita income levels, particularly in the developing regions like India and China are expected to have a positive impact on the demand for fragrances and flavors.

Camphene derived from turpentine is widely used as a food additive to improve taste and appearance, as well as to preserve food products. These products are used as feedstock for manufacturing multiple products including flavors and fragrance and as ingredients in the pharmaceutical industry. They are also used in the production of polymer additives, turpentine oil, fragrances, pine oil, and pinenes.

Turpentine being naturally sourced product, has a huge potential in the personal care industry. Carene, terpineol, camphor, pure alpha-pinene, and beta-pinene are used as raw materials in manufacturing of personal and home care products, such as cosmetics, liquid cleaners, phenyls, and soaps.

Regional Insights

North America emerged as the largest regional market in the past owing to presence of the major exporters. The region is anticipated to maintain its dominance during the forecast years. Europe also held a significant industry share in 2017 and will expand in the coming years due to high demand for natural ingredients in cosmetics and personal care products. Presence of a robust personal care manufacturing base in countries, such as U.K., France, and Germany, is further expected to be a favorable factor for the market.

Asia Pacific is projected to be the fastest-growing regional market in the years to come owing to rising product demand in cosmetics and personal care industry from developing countries, such as China and Japan. China is the largest producer of turpentine across the globe, as a result, most of the turpentine requirements in the country are met by regional production units.

Key Companies & Market Share Insights

Major companies in the industry collaborate with the distributor across different regions to improve the industry foothold. For instance, DRT expanded its network with Quimidroga France EURL as its distributor in France for all the resins intended for industrial applications.

Another key strategy undertaken by industry participants is R&D investments. For instance, ORGKHIM Biochemical Holding and Ilim Group joined hands for an innovative biochemical production project with a 50-50% partnership. Some of the prominent companies include DRT; Ingevity; Kraton Corporation; ORGKHIM Biochemical Holding; Pine Chemical Group; and International Flavors & Fragrances, Inc. (IFF).

Crude Sulfate Turpentine Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 652.6 million

Revenue forecast in 2025

USD 806.2 million

Growth Rate

CAGR of 3.5% from 2019 to 2025

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Finland, Russia, Sweden, France, China, Japan, Australia, Brazil, and South Africa

Key companies profiled

Les Dérivés Résiniques et Terpéniques-DRT, Ingevity, Kraton Corporation, ORGKHIM Biochemical Holding, Pine Chemical Group, International Flavors & Fragrances, Inc. (IFF)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global crude sulfate turpentine market report on the basis of product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Thousand, 2014 - 2025)

-

Carene

-

Terpineol

-

Camphor

-

Pinane Hydroperoxide

-

Pure alpha-pinene

-

Beta-pinene

-

Terpene Resins

-

Limonene

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2014 - 2025)

-

Additives

-

Adhesives

-

Solvents

-

Rubber Processing

-

Aroma Chemicals

-

Personal/Home Care Product

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Finland

-

Russia

-

Sweden

-

France

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global crude sulfate turpentine market size was estimated at USD 652.6 million in 2019 and is expected to reach USD 682.0 million in 2020.

b. The global crude sulfate turpentine market is expected to grow at a compound annual growth rate of 3.5% from 2019 to 2025 to reach USD 806.2 million by 2025.

b. North America dominated the crude sulfate turpentine market with a share of 59% in 2019. This is attributable to increasing application of the product in additives, adhesives, solvents, rubber processing, aroma chemicals, and personal & home care

b. Some key players operating in the crude sulfate turpentine market include Les Dérivés Résiniques et Terpéniques-DRT, Ingevity, Kraton Corporation, ORGKHIM Biochemical Holding, Pine Chemical Group, International Flavors & Fragrances, Inc. (IFF)

b. Key factors that are driving the market growth include increasing usage of CST derivatives such as alpha-pinene and beta-pinene as flavorings and fragrances in food & beverage and aroma chemical applications

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."