- Home

- »

- Medical Devices

- »

-

Cryoablation Probe Market Size, Share, Industry Report 2030GVR Report cover

![Cryoablation Probe Market Size, Share & Trends Report]()

Cryoablation Probe Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Oncology, Liver Cancer, Dermatology), By End Use (Hospitals, Specialty Clinics, Ambulatory Surgery Centers (ASCs)), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-620-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cryoablation Probe Market Summary

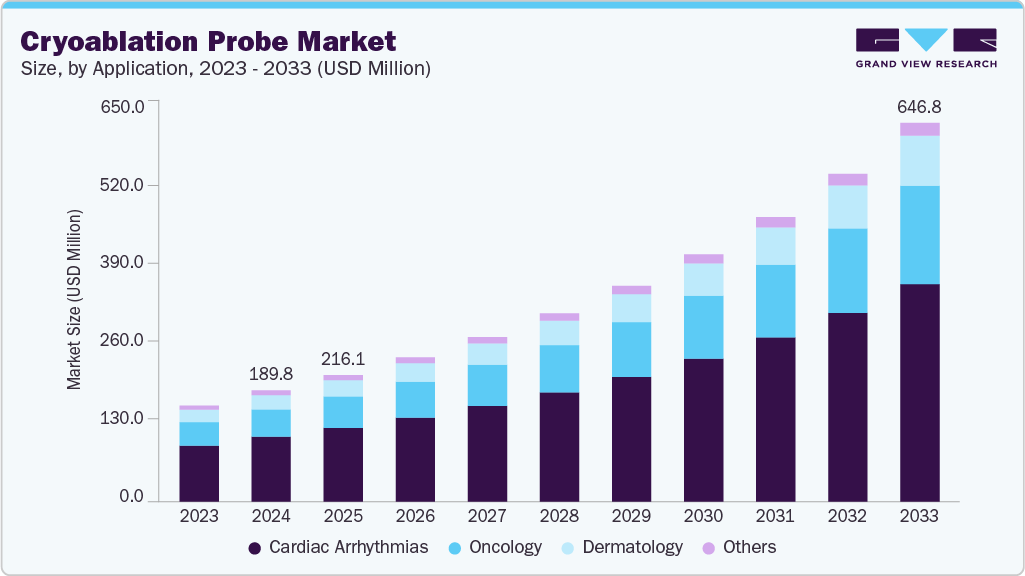

The global cryoablation probe market size was estimated at USD 189.80 million in 2024 and is projected to reach USD 646.84 million by 2033, growing at a CAGR of 14.69% from 2025 to 2033. The market's growth is attributed to the rising incidence of cancers such as prostate, liver, kidney, and lung, which increases the demand for effective, minimally invasive treatments.

Key Market Trends & Insights

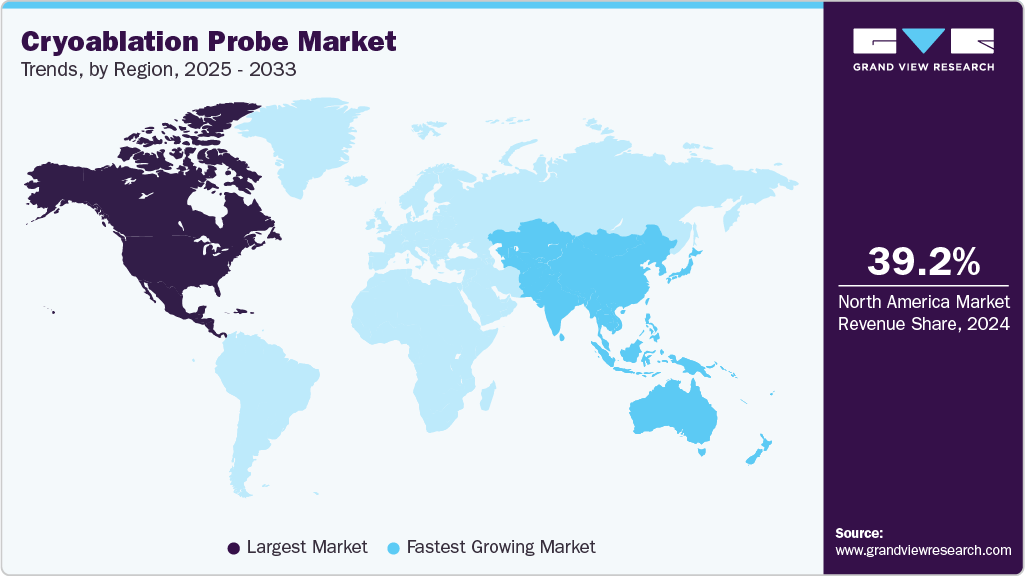

- North America dominated the cryoablation probe market with the largest revenue share of 34.84% in 2024.

- The cryoablation probe market in the U.S. accounted for the largest market revenue share of 78.20% in North America in 2024.

- Based on application, the cardiac arrhythmias segment led the market with the largest revenue share of 58.42% in 2024.

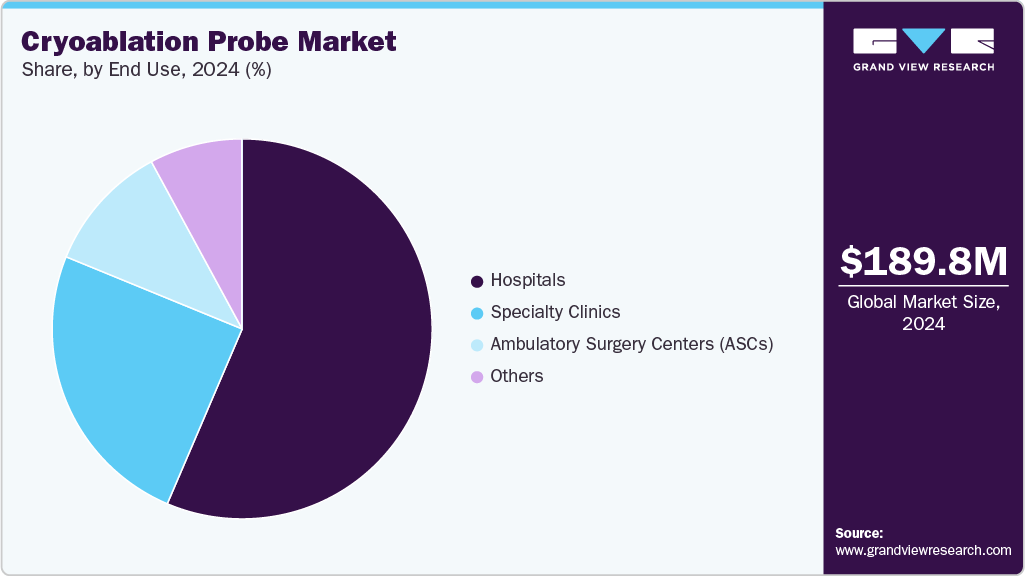

- By end use, the hospitals segment led the market with the largest revenue share of 56.68% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 189.80 Million

- 2033 Projected Market Size: USD 646.84 Million

- CAGR (2025-2033): 14.69%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Cryoablation is becoming a preferred option among patients and healthcare providers because it offers shorter recovery times, fewer complications, and better cosmetic results compared to traditional surgery. In addition, continuous advancements in probe design, imaging technologies like CT and MRI guidance, and improved cryogen control systems enhance the procedure's precision and safety, further supporting its widespread adoption in clinical settings.

The rising incidence of cancers, particularly prostate, liver, kidney, and lung, has become a key driver for the growing demand for cryoablation probes, as these cancers are often treatable with localized, minimally invasive techniques. With the global cancer burden increasing, there is a greater need for treatment options that are effective, safe, and less physically taxing, especially for patients who may not be suitable for traditional surgery due to age, other health conditions, or advanced disease stages. Cryoablation addresses this need by enabling precise targeting and destruction of cancerous tissue using extreme cold, while minimizing damage to surrounding healthy areas. These advantages make cryoablation an increasingly preferred option, fueling the demand for probes in such procedures.

Global Cancer Incidence Prediction from 2022-2050

Cancer Type

Year

2022

2025

2030

2035

2040

2045

Kidney

434,840

463,553

521,353

580,411

638,043

693,438

Prostate

1,467,854

1,570,067

1,829,988

2,098,052

2,364,054

2,626,735

Liver and intrahepatic bile ducts

866,136

924,186

1,045,601

1,171,576

1,295,164

1,412,526

Trachea, bronchus and lung

2,480,675

2,661,254

3,053,643

3,461,642

3,864,284

4,250,779

All Cancer

19,976,499

21,325,245

24,112,627

27,016,823

29,885,206

32,644,562

Source: IARC, Grand View Research

Technological advancements in cryoablation probes-such as improved probe design, enhanced imaging integration (like CT and MRI guidance), and more precise cryogen delivery systems-have significantly boosted the effectiveness and safety of cryoablation procedures. For instance, in April 2024, AtriCure launched its new CryoSphere+ cryoablation probe designed for the CryoIce platform. The CryoSphere+ features advanced insulation technology that decreases freeze times by 25% compared to the previous CryoSphere model. These innovations allow more accurate targeting of diseased tissue while minimizing damage to surrounding healthy areas, resulting in better patient outcomes and fewer complications. As a result, healthcare providers are more confident in adopting cryoablation as a preferred minimally invasive treatment option. This growing trust, combined with the ability to treat a wider range of conditions with improved precision, is driving increased demand for cryoablation devices and fueling the overall market growth.

Key Opinions of Leaders

Company Name

KOLs

Growth Opportunities

Atricure, Inc.

“I found the cryoSPHERE MAX probe to be easier to use in locating the rib/nerve and to maintain contact,” said Dr. Joseph Lamelas, Cardiothoracic Surgery, University of Miami Health System, Miami, FL. “The time to reach optimal temperature was very fast as well, as was the rapid disconnect, making the one-minute freeze very manageable.”

- Expansion in Nerve Block Procedures

- Adoption in Ambulatory Surgical Centers (ASCs)

- Integration in Enhanced Recovery After Surgery (ERAS) Protocols

Atricure, Inc.

“The cryoFORM probe works well in MI-MVR procedures and allows me to easily shape and position the probe inside the LA using endoscopic instruments,” said Nicolas Doll, MD, and Professor at Sana Herzchirugie in Stuttgart, Germany. “The probe is a great addition to the cryoICE family that I can rely on for fully transmural lesions.”

- Integration with Advanced Cardiac Therapies

- Adoption in Outpatient Settings

IceCure Medical

"This latest FDA regulatory clearance further validates the safety and efficacy of our platform cryoablation technology," commented Eyal Shamir, IceCure's Chief Executive Officer. "The next-generation XSense system is cleared for the same indications as our flagship ProSense system, and we believe it has future potential to address other indications in the U.S. for significant indications with unmet needs. Through our innovation, IceCure is a global leader in liquid nitrogen-based cryoablation systems that offer a new minimally invasive treatment with benefits for patients, doctors, and payors alike."

- Integration with Advanced Imaging Technologies

- Adoption in Outpatient and Ambulatory Settings

- Expansion into Emerging Markets

Source: IceCure Medical, Atricure, Inc., Grand View Research

Market Concentration & Characteristics

The cryoablation probe industry is characterized by a high degree of innovation, driven by continuous advancements in probe design, cryogen delivery systems, and imaging integration. Innovations such as improved insulation materials, miniaturized and more flexible probes, and real-time imaging guidance (CT, MRI, or ultrasound) have significantly enhanced procedural precision and safety. Furthermore, developments in faster freeze-thaw cycles and enhanced temperature control have improved treatment efficiency and patient outcomes. This ongoing innovation expands the range of treatable conditions, supports broader clinical adoption, and drives competitive differentiation among manufacturers.

Regulatory frameworks significantly influence cryoablation probes' development, approval, and commercialization, shaping the market's growth trajectory. In the U.S., the FDA classifies most cryoablation devices as Class II, requiring a 510(k) premarket notification to demonstrate substantial equivalence to existing devices. However, a more rigorous Premarket Approval (PMA) process is necessary for higher-risk applications, such as deep-seated tumors, involving extensive clinical trials and real-world performance data. Similarly, in the European Union, the Medical Device Regulation (MDR) mandates comprehensive clinical evaluations and post-market surveillance, which can lead to delays in market entry for new technologies. These stringent regulatory requirements ensure the safety and efficacy of cryoablation devices but can also increase development costs and time to market.

The cryoablation probe industry has experienced a moderate but strategic level of mergers and acquisitions (M&A), reflecting the industry's drive for innovation, expanded capabilities, and market consolidation. In August 2022, Medtronic acquired Affera Inc., a company specializing in cardiac ablation devices, including cryoablation technologies. This acquisition enhanced Medtronic's electrophysiology portfolio by integrating Affera's advanced cardiac mapping and navigation platform with radiofrequency and cryoablation technologies.

The cryoablation probe industry faces competition from several alternative treatment technologies that serve similar clinical purposes. Key substitutes include radiofrequency ablation (RFA), microwave ablation (MWA), laser ablation, high-intensity focused ultrasound (HIFU), and traditional surgical procedures. Radiofrequency ablation is a widely used minimally invasive technique that uses heat to destroy diseased tissue, making it a strong alternative to cryoablation. Similarly, microwave ablation offers faster heating and larger treatment zones, which can be preferable in certain cases.

The cryoablation probe industry is primarily concentrated among hospitals, specialty clinics, and ambulatory surgical centers, with hospitals being the largest end-users due to their advanced infrastructure and capacity to perform complex minimally invasive procedures. Specialty clinics, particularly those focused on oncology and cardiac care, also represent a significant market share as they adopt cryoablation for targeted treatments. Moreover, ambulatory surgical centers increasingly incorporate cryoablation technologies to offer outpatient procedures with faster recovery times. The concentration of end-users in these healthcare settings reflects the need for specialized equipment and trained professionals to perform cryoablation, driving demand in facilities equipped for advanced image-guided interventions.

Application Insights

Based on application, cardiac arrhythmias held the largest share of 45.08% in 2024. This growth can be attributed to their high and increasing prevalence globally. Cryoablation offers a highly effective, minimally invasive treatment option for these conditions, as it precisely freezes and destroys abnormal heart tissue responsible for irregular heartbeats, restoring normal rhythm. This growing patient pool, proven efficacy, favorable safety profile, and continuous advancements in cryoablation technology specifically designed for cardiac applications drive substantial demand for cryoablation probes in the cardiac arrhythmias segment, making it a leading revenue contributor and growth driver in the overall market.

The oncology segment is expected to grow fastest over the forecast period. Owing to the increasing global incidence of various cancers, such as liver, lung, kidney, prostate, and breast cancer. Cryoablation offers a highly appealing minimally invasive treatment option for these malignancies, allowing for precise tumor destruction with reduced patient trauma, shorter hospital stays, and faster recovery times compared to traditional surgery. Furthermore, continuous technological advancements in cryoablation probes, including improved targeting capabilities and real-time imaging guidance, enhance the safety and efficacy of cancer treatments, making it a preferred choice for a wider range of tumor types and patient profiles.

End Use Insights

Based on end use, the hospital segment dominated the market in 2024. This can be attributed to hospitals serving as central hubs for complex medical procedures, including those involving advanced cryoablation devices for conditions like cardiac arrhythmias and various cancers. They possess extensive infrastructure and specialized facilities, such as operating rooms, interventional suites, and dedicated imaging departments (CT, MRI, ultrasound), essential for performing cryoablation procedures safely and effectively. Moreover, hospitals are equipped with a large pool of highly skilled medical professionals, including interventional cardiologists, oncologists, radiologists, and surgeons, who have the necessary expertise and training to operate sophisticated cryoablation systems and manage patient care during and after these intricate procedures.

However, ambulatory surgery centers is projected to witness the fastest growth rate over the forecast period. ASCs offer more personalized care, reduced wait times, easier scheduling, and a less overwhelming environment than large hospitals, leading to higher patient satisfaction. Furthermore, a shift towards outpatient care is actively encouraged by regulatory bodies like the U.S. Centers for Medicare & Medicaid Services (CMS) through favorable reimbursement policies, which are continually expanding the list of procedures eligible for ASCs.

Regional Insights

North America dominated the cryoablation probe market with the largest revenue share of 39.22% in 2024. The rapid adoption of advanced equipment in the U.S. has allowed the region to account for a larger market share. The presence of leading manufacturers and the quick adoption of advanced products are projected to further boost the region’s growth. In addition, the rising prevalence of chronic diseases in the region is responsible for the regional market growth.

U.S. Cryoablation Probe Market Trends

The cryoablation probe market in the U.S. held the largest share of the North American market in 2024. The U.S. market is experiencing growth, driven by the rising prevalence of cancer and increasing demand for minimally invasive procedures. According to a report by the American Cancer Society, in 2025, the U.S. is expected to see approximately 2,041,910 new cancer cases diagnosed, along with an estimated 618,120 cancer-related deaths.

Estimated New Cancer Cases for the U.S. in 2025

Rank

Common Types of Cancer

Estimated New Cases 2025

Estimated Deaths 2025

1

Breast Cancer (Female)

316,950

42,170

2

Prostate Cancer

313,780

35,770

3

Lung and Bronchus Cancer

226,650

124,730

4

Colorectal Cancer

154,270

52,900

5

Melanoma of the Skin

104,960

8,430

6

Bladder Cancer

84,870

17,420

7

Kidney and Renal Pelvis Cancer

80,980

14,510

8

Non-Hodgkin Lymphoma

80,350

19,390

9

Uterine Cancer

69,120

13,860

10

Pancreatic Cancer

67,440

51,980

-

Cancer of Any Site

2,041,910

618,120

Source: U.S. Department of Health and Human Services, Grand View Research

Europe Cryoablation Probe Market Trends

The cryoablation probe market in Europe is growing rapidly, mainly because the number of elderly people is increasing. Older adults are more likely to have chronic diseases, so there is a higher need for effective treatments like cryoablation. In addition, government programs such as the European Cancer Observatory are helping by spreading awareness about advanced, less invasive surgeries and early diagnosis methods. This support is encouraging more use of cryoablation devices across Europe.

The UK cryoablation probe market is driven by the rising incidence of chronic diseases, especially various cancers (like prostate, kidney, liver, breast, and lung cancer), creates a constant need for effective treatment options, and cryoablation offers a compelling alternative to traditional surgery for many patients. Moreover, there's a growing and evident preference for minimally invasive procedures across the UK healthcare system, driven by benefits such as reduced pain, shorter hospital stays, faster recovery times, and fewer complications, which directly aligns witaligns with cryoablation's advantages expansion of cryoablation into new therapeutic areas beyond oncology, such as treating cardiac arrhythmias (like atrial fibrillation) and managing chronic pain, significantly broadens market reach and patient population, further accelerating its growth.

Asia Pacific Cryoablation Probe Market Trends

The cryoablation probe market in Asia Pacific is witnessing the fastest CAGR growth over the forecast period. This can be attributed to strong government support and medical innovations. For instance, programs like India’s Health Minister Cancer Patient Fund (HMCPF) help financially aid underprivileged cancer patients, making advanced treatments like cryoablation more accessible. At the same time, new technologies such as IceCure Medical’s ProSense System are improving treatment options and attracting more patients looking for the latest care.

China cryoablation probe market is experiencing strong growth driven by the rising prevalence of chronic diseases, particularly various types of cancer (such as liver, lung, and prostate cancer), and the increasing burden of cardiovascular diseases, including cardiac arrhythmias, among China's vast and aging population. This demographic shift, with a rapidly growing elderly segment, naturally leads to a higher demand for advanced and less invasive treatment options. According to data from the State Council of the People's Republic of China in October 2024, nearly 297 million people in China were aged 60 or older in 2023, representing 21.1% of the total population. Furthermore, there's a strong and rising preference for minimally invasive procedures among both patients and healthcare providers in China, as these procedures offer benefits like reduced trauma, shorter recovery times, less pain, and fewer complications compared to traditional open surgeries.

Latin America Cryoablation Probe Market Trends

The cryoablation probe market in Latin America is experiencing steady growth, driven by several key factors. The increasing prevalence of chronic diseases like cancer and cardiovascular conditions, particularly in an aging geriatric population, is making them more susceptible to these ailments. There's a growing preference for minimally invasive procedures among patients and healthcare providers in the region, driven by benefits such as shorter recovery times, reduced pain, and lower complication rates compared to traditional surgeries. Furthermore, improving healthcare infrastructure and increasing healthcare expenditure across Latin American countries enable hospitals and clinics to invest in and adopt advanced medical technologies like cryoablation probes.

Middle East Africa Cryoablation Probe Market Trends

The cryoablation probe market in the Middle East and Africa (MEA) is growing fast, mainly due to rising investments in healthcare. Countries like Saudi Arabia, the UAE, and South Africa are significantly improving their healthcare infrastructure, making advanced medical technologies like cryoablation probes more accessible and widely used.

Key Cryoablation Probe Company Insights

The market is extremely fragmented, with major and local competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority in the market, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants engage in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the market is predicted to grow during the forecast period.

Key Cryoablation Probe Companies:

The following are the leading companies in the cryoablation probe market. These companies collectively hold the largest market share and dictate industry trends.

- Atricure, Inc

- Varian, A Siemens Healthineers Company

- Medtronic

- Metrum Cryoflex

- HealthTronics, Inc.

- Erbe Elektromedizin GmbH

- Keeler

- Boston Scientific Corporation

- Bruker

- IceCure Medical

Recent Developments

-

In April 2024, AtriCure announced the launch of its new CryoSphere+ cryoablation probe designed for the CryoIce platform. The CryoSphere+ features advanced insulation technology that decreases freeze times by 25% compared to the previous CryoSphere model.

-

In July 2024, IceCure Medical Ltd., a company specializing in minimally invasive cryoablation technology, which eliminates tumors by freezing them as an alternative to surgery, announced that it has received FDA marketing authorization for its next-generation single-probe system, the XSense Cryoablation System with CryoProbes.

-

In May 2023, Varian, a Siemens Healthineers company, launched the Isolis cryoprobe, a single-use, disposable device developed for use with CryoCare systems. The probe is designed to enhance procedural precision and efficiency in cryoablation treatments.

Cryoablation Probe Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 216.09 million

Revenue forecast in 2033

USD 646.84 million

Growth rate

CAGR of 14.69% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Atricure, Inc.; Varian, A Siemens Healthineers Company; Medtronic; Metrum Cryoflex; HealthTronics, Inc.; Erbe Elektromedizin GmbH; Keeler; Boston Scientific Corporation; Bruker; IceCure Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cryoablation Probe Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cryoablation probe market report based onapplication, end use, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiac Arrhythmias

-

Oncology

-

Lung Cancer

-

Prostate Cancer

-

Breast Cancer

-

Kidney Cancer

-

Liver Cancer

-

-

Dermatology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgery Centers (ASCs)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. North America dominated the cryoablation probes market with a share of 34.84% in 2024. This is attributable to the rapid adoption of advanced equipment in the U.S. has allowed the region to account for a larger market share. The presence of leading manufacturers and quick adoption of advanced products are projected to boost the region’s growth further.

b. Some key players operating in the cryoablation probes market include Atricure, Inc; Varian, A Siemens Healthineers Company; Medtronic; Metrum Cryoflex; HealthTronics, Inc.; Erbe Elektromedizin GmbH; Keeler; Boston Scientific Corporation; Bruker; IceCure Medical.

b. Key factors that are driving the market growth include the rising prevalence of cancer and cardiac arrhythmias, along with increasing demand for minimally invasive procedures. Technological advancements in imaging and probe design further support market growth by improving treatment precision and outcomes.

b. The global cryoablation probes market size was estimated at USD 189.80 million in 2024 and is expected to reach USD 216.09 million in 2025

b. The global cryoablation probes market is expected to grow at a compound annual growth rate of 14.69% from 2025 to 2033 to reach USD 646.84 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.