- Home

- »

- Advanced Interior Materials

- »

-

Cryocooler Market Size, Share And Growth Report, 2030GVR Report cover

![Cryocooler Market Size, Share & Trends Report]()

Cryocooler Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Gifford-Mcmahon, Pulse-Tube) By Heat Exchanger Type (Regenerative, Recuperative), By Application, By Region And Segment Forecasts

- Report ID: GVR-4-68040-021-4

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cryocooler Market Summary

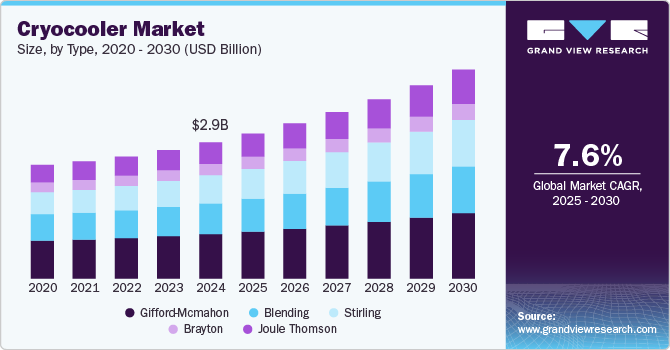

The global cryocooler market size was estimated at USD 2.87 billion in 2024 and is projected to reach USD 4.41 billion by 2030, growing at a CAGR of 7.6% from 2025 to 2030. The adoption of cryocooler is increasing due to their use in cooling down power systems, superconducting magnets, and semiconductors.

Key Market Trends & Insights

- The North America Cryocooler market held a significant share of 34.8% in 2024.

- The cryocooler market in Asia Pacific is expected to grow significantly over the forecast period.

- Based on heat exchanger type, the growth of the regenerative segment is expected to grow at a significant CAGR of 7.9% from 2025 to 2030.

- In terms of application, the military & defense segment dominated the market in 2024, accounting for a 21.3% market share.

- Based on type, the Gifford-Mcmahon segment dominated the market in 2024, accounting for a 32.7% market share.

Market Size & Forecast

- 2024 Market Size: USD 2.87 Billion

- 2030 Projected Market Size: USD 4.41 Billion

- CAGR (2025-2030): 7.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Cryocooler are also used in the defense sector in night vision technology and ground-mounted and airborne military applications. Therefore, the large-scale demand from defense is expected to drive the market growth over the forecast period. Cryocooler play a pivotal role in space exploration, facilitating a range of critical functions in spacecraft and scientific instruments. They are essential components in remote sensing satellites, where they cool infrared sensors to enhance their sensitivity for Earth observation tasks

Drivers, Opportunities & Restraints

MRI machines extensively utilize cryocoolers to maintain the superconducting magnets at extremely low temperatures, typically below 4 Kelvin (-269°C). These cryocooled magnets generate the strong magnetic fields essential for imaging human tissue with high resolution and clarity. These factors are anticipated to fuel the demand for cryocooler in the coming years.

The availability of substitutes, such as thermoelectric coolers and Stirling coolers, has improved efficiency and performance in recent years, making them more viable options for certain applications. This factor is expected to restrain market growth over the forecast period.

The semiconductor industry has seen a significant increase in investment in recent years, with more companies and governments investing in developing cutting-edge semiconductor technologies. This investment increase drives the demand for advanced cooling technologies, such as cryocooler.

Type Insights

“Stirling is expected to grow at a significant CAGR of 9.1% from 2025 to 2030 in terms of revenue.”

This trend can be linked to the increasing use of infrared focal panels in the military and defense sectors. Stirling cryocoolers are commonly employed in military applications to meet the cooling needs of infrared sensors mounted on the ground, in the air, and on ships. The heightened demand for night vision cameras driven by increased thefts and criminal activities further boosts the market.

The Gifford-Mcmahon segment dominated the market in 2024, accounting for a 32.7% market share. This cryocooler's affordable price and distinct characteristics contribute to its appeal. In recent years, Gifford-Mcmahon cryocoolers have become increasingly popular due to the limitations of nitrogen liquefiers, cryo vacuum devices, helium recondensation systems, and cryogenic setups used in a range of scientific research.

Application Insights

“The healthcare segment is expected to expand at a significant CAGR of 8.7% from 2025 to 2030 in terms of revenue.”

This trend can be linked to the increasing use of infrared focal panels in the military and defense sectors. Stirling cryocoolers are commonly employed in military applications to meet the cooling needs of infrared sensors mounted on the ground, in the air, and on ships. In addition, the heightened demand for night vision cameras driven by increased thefts and criminal activities further boosts the market.

The military & defense segment dominated the market in 2024, accounting for a 21.3% market share. This cryocooler's affordable price and distinct characteristics contribute to its appeal. In recent years, Gifford-McMahon cryocoolers have become increasingly popular due to the limitations of nitrogen liquefiers, cryo vacuum devices, helium recondensation systems, and cryogenic setups used in a range of scientific research.

Heat Exchanger Type Insights

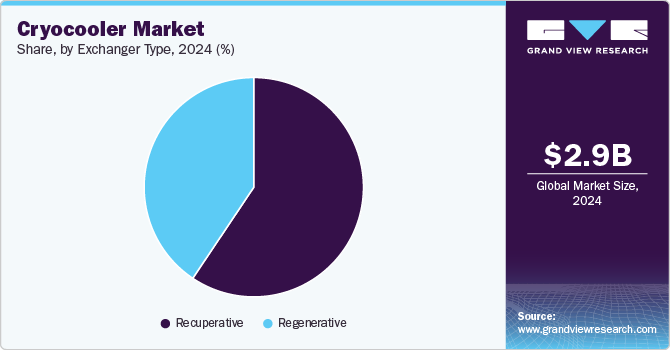

“The growth of the regenerative segment is expected to grow at a significant CAGR of 7.9% from 2025 to 2030 in terms of revenue.”

In recent years, applications involving high temperatures have increased, leading to the widespread use of regenerative heat exchangers, driven by the growing demand for waste heat recovery. This type of system allows fluids to flow over heat-storage materials to enhance heat transfer efficiency, subsequently boosting market demand.

The recuperative segment held a 40.6% market share in 2024. The demand for recuperative heat exchangers is rising due to their ability to improve energy efficiency by recovering and reusing waste heat in industrial processes. As industries focus on reducing energy consumption and operating costs, these heat exchangers offer a cost-effective solution for enhancing system performance and sustainability.

Regional Insights

In North America, the market growth is largely propelled by the increasing demand from sectors such as aerospace, defense, medical, and energy. The region's well-established space exploration programs and advancements in quantum computing and medical imaging are key drivers. Moreover, the presence of major players and ongoing investments in research and development are further fueling the market's expansion.

U.S. Cryocooler Market Trends

The cryocooler market in the U.S. accounted for 47.9% of the North American market in 2024 due to advancements in aerospace and defense technologies, where cryocoolers are essential for satellite cooling and space exploration. Furthermore, the growing demand for medical applications, particularly in MRI machines and other diagnostic equipment, is pushing market growth. Another significant driver is the focus on energy-efficient solutions, particularly in the semiconductor and electronics industries. The U.S. also benefits from a well-established research and development ecosystem, further spurring innovation and adoption of cryocoolers.

Europe Cryocooler Market Trends

The cryocooler market in Europe is expected to witness significant growth due to its focus on cutting-edge technologies in industries like healthcare, automotive, and electronics. The adoption of cryocoolers for applications such as MRI machines, particle accelerators, and energy-efficient refrigeration systems is on the rise. Moreover, stringent environmental regulations encourage the shift toward more efficient cooling systems, boosting demand for low-noise, eco-friendly cryocooler solutions.

France cryocooler market is expected to expand at a fast-paced CAGR of 9.0% over the forecast period, propelled by the defense and aerospace industries, where these cooling systems are critical for the operation of satellites and advanced technologies. The country’s focus on expanding its space exploration capabilities and military defense systems is a primary factor driving demand. In addition, Russia’s vast natural gas and oil industry requires cryogenic cooling for efficient processing, creating a strong market for cryocoolers in the energy sector.

The cryocooler market in Russia accounted for 22.4% of the market share in 2024, propelled by the defense and aerospace industries, where these cooling systems are critical for the operation of satellites and advanced technologies. The country’s focus on expanding its space exploration capabilities and military defense systems is a primary factor driving demand. Furthermore, Russia’s vast natural gas and oil industry requires cryogenic cooling for efficient processing, creating a strong market for cryocoolers in the energy sector.

Asia Pacific Cryocooler Market Trends

The cryocooler market in Asia Pacific is expected to grow significantly over the forecast period. Rapid industrialization, increasing investments in the semiconductor and electronics industries, and a growing emphasis on renewable energy technologies are key factors contributing to market growth in Asia Pacific. Countries like China, Japan, and India are witnessing substantial demand for cryocoolers, particularly in electronics manufacturing, where cryogenic cooling is essential for maintaining system performance. The region's expanding space and defense sectors also contribute to the rising adoption of cryocoolers for satellite cooling and other advanced applications.

China cryocooler market is expected to expand at a significant CAGR of 25.1% over the forecast period owing to its booming electronics and semiconductor industries, which require cryogenic cooling for efficient operation and enhanced performance. China’s heavy investments in space exploration and the military sector are also key drivers, with cryocoolers essential for satellite cooling. Moreover, the growing demand for medical devices such as MRI machines and the country's increasing focus on renewable energy technologies are contributing to the adoption of cryocoolers in various sectors. China's rapid industrialization and infrastructure development support the demand for efficient, high-performance cooling systems.

The cryocooler market in India is projected to expand at a rapid CAGR of 9.7% over the forecast period, largely driven by the increasing use of cryocoolers in healthcare, especially for medical imaging and diagnostics, which are becoming more widespread in the country’s expanding healthcare infrastructure. India's growing electronics and semiconductor industries also contribute to market growth, as cryocoolers are essential for cooling sensitive components. Moreover, the rise of space and defense programs in India creates additional demand for cryocoolers in satellite and aerospace applications.

Middle East Cryocooler Market Trends

The cryocooler market in the MEA is expanding due to the rapid development of oil and gas infrastructure, and investments in research and technology. Cooling systems, including cryocoolers, are essential for maintaining performance in extreme heat environments, particularly in the oil and gas sector, where maintaining equipment at optimal temperatures is crucial. In addition, the region’s growing healthcare and electronics industries are increasing the demand for cryocoolers in medical imaging and semiconductor cooling applications.

Latin America Cryocooler Market Trends

The cryocooler market in Latin America is seeing a gradual rise in demand, driven by increasing healthcare infrastructure and the need for cooling solutions in industries such as mining and energy. As the region looks to develop its renewable energy potential, there is growing interest in cryocoolers for energy-efficient applications in power plants and wind turbines. However, the market remains relatively nascent, with growth fueled primarily by the adoption of medical and industrial applications.

Key Cryocooler Company Insights

Some of the key players operating in the market include Sumitomo Heavy Industries, Ltd. and RIX Industries.

-

RIX Industries specializes in manufacturing a diverse range of products, including gas generation systems, precision compressor solutions, and cryogenic cooling technologies. Its comprehensive capabilities involve production, design, engineering, assembly, and testing. The company's extensive offerings serve multiple markets, including marine, aerospace, industrial, medical, energy, and critical infrastructure.

-

Sumitomo Heavy Industries, Ltd. is a comprehensive manufacturer specializing in various products, including cryocoolers. The company manufactures cryocoolers for use in medical devices like MRI machines, advanced scientific fields such as physics and chemistry, and cryopumps for creating ultra-high vacuum environments for semiconductor production

Key Cryocooler Companies:

The following are the leading companies in the cryocooler market. These companies collectively hold the largest market share and dictate industry trends.

- Sumitomo Heavy Industries, Ltd.

- RIX Industries

- Northrop Grumman

- Bluefors Oy

- RICOR

- AMETEK, Inc.

- ULVAC CRYOGENICS, INC.

- CryoSpectra GmbH

- Lihan Cryogenics Co., Ltd.

- CSSC Pride (Nanjing) Cryogenic Technology Co., Ltd

- Edwards Vacuum

Recent Developments

-

In January 2024, the SHI Cryogenics Group unveiled the RJT-100 4K GM-JT Cryocooler. This cutting-edge Gifford-McMahon/Joule-Thomson (GM-JT) Cryocooler represents SHI's latest and most powerful 4K Cryocooler, boasting a capacity of up to 9.0 W at 4.2 K (50/60 Hz).

-

In March 2023, Bluefors Oy acquired Cryomech, a leading cryocooler technology company based in Syracuse, New York, U.S. This strategic move unites nearly 600 experts across multiple countries, enabling Bluefors Oy to enhance its service to customers in quantum technology, physics research, and industrial applications. The acquisition aligns with Bluefors Oy' growth strategy to advance ultra-low temperature cooling technology in R&D and industrial sectors.

Cryocooler Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.05 billion

Revenue forecast in 2030

USD 4.41 billion

Growth rate

CAGR of 7.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; Russia; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Sumitomo Heavy Industries, Ltd.; RIX Industries; Northrop Grumman; Bluefors Oy; RICOR; AMETEK, Inc.; ULVAC CRYOGENICS, INC.; CryoSpectra GmbH; Lihan Cryogenics Co., Ltd.; CSSC Pride (Nanjing) Cryogenic Technology Co., Ltd; Edwards Vacuum

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cryocooler Market Report Segmentation

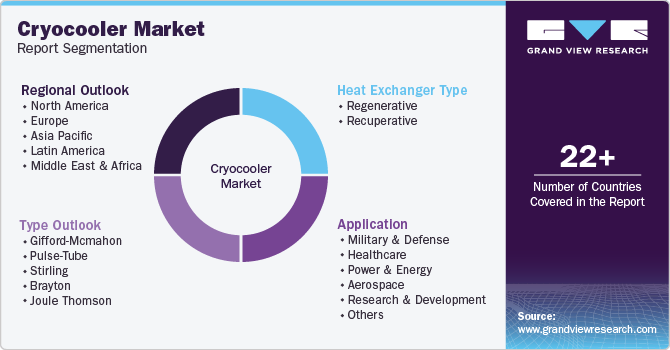

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cryocooler market based on type, heat exchanger type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gifford-Mcmahon

-

Pulse-Tube

-

Stirling

-

Brayton

-

Joule Thomson

-

-

Heat Exchanger Type (Revenue, USD Million, 2018 - 2030)

-

Regenerative

-

Recuperative

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Military & Defense

-

Healthcare

-

Power & Energy

-

Aerospace

-

Research & Development

-

Transport

-

Mining & Metals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cryocoolers market size was estimated at USD 2.87 billion in 2024 and is expected to reach USD 3.05 billion in 2025

b. The global cryocoolers market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 4.41 billion by 2030.

b. The Gifford-Mcmahon segment dominated the market in 2024 accounting for 32.7% of overall revenue share. The growing demand for Gifford-McMahon cryocoolers is driven by their efficiency and reliability in applications requiring low temperatures, such as in aerospace, medical imaging, and scientific research. Their ability to deliver stable cooling at cryogenic temperatures with relatively low maintenance makes them a preferred choice in both industrial and laboratory settings

b. Some of the key players operating in the cryocoolers market are Mepaco, Minerva Omega Group s.r.l., Tomra Systems ASA, JBT., Nemco Food Type, LTD., RAM Regenerative Type, LLC, The Middleby Corporation¸Marel, Equipamientos cárnicos, S.L. (MAINCA), Bettcher Industries, Inc., and Fortifi Food Processing Solutions

b. Key factors driving the cryocoolers market include the increasing demand for efficient cooling solutions in aerospace, healthcare, and semiconductor industries. Technological advancements, such as the development of compact, energy-efficient systems, along with growing investments in space exploration and renewable energy, are also fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.