- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Cryogenic Gases Market Size & Share, Industry Report, 2030GVR Report cover

![Cryogenic Gases Market Size, Share & Trends Report]()

Cryogenic Gases Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Nitrogen, Oxygen, LNG, Argon), By Application (Healthcare, Manufacturing, Metallurgy & Glass, Food & Beverage, Retail, Chemical & Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-524-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cryogenic Gases Market Size & Trends

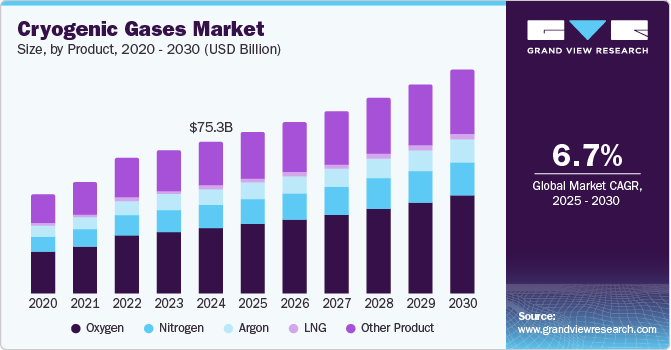

The global cryogenic gases market size was estimated at USD 75.28 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. The move towards liquefied natural gas (LNG) as a cleaner energy source is a significant factor driving market growth. LNG produces less CO2 than traditional fossil fuels, making it an appealing choice for power generation and industrial applications. This trend is especially noticeable in regions like Asia-Pacific and North America, where investments in LNG infrastructure are growing rapidly.

The demand for cryogenic gases in the healthcare sector is increasing, particularly medical gases such as liquid nitrogen and oxygen. These gases are used in biobanking, cryosurgery, and other medical procedures requiring ultra-low-temperature storage. Additionally, the growth of petrochemicals, pharmaceuticals, and food processing drives the need for effective cryogenic storage and transportation solutions. Cryogenic tanks and pumps are crucial in managing gases at extremely low temperatures in these sectors.

The manufacturing process of cryogenic gases involves several key steps to achieve efficient separation and liquefaction at low temperatures. First, air is drawn into a multi-stage compressor, where impurities like moisture and hydrocarbons are removed. The purified air is then cryogenically cooled and processed in heat exchangers to separate nitrogen and oxygen, typically between -165°C and -269°C. Advanced materials like aluminum and stainless steel are used to prevent embrittlement. Finally, the gases are stored in insulated tanks to maintain their cryogenic state for industrial applications.

Drivers, Opportunities & Restraints

A key driver for the cryogenic gases industry is the rising demand from the healthcare and medical industries, particularly for liquid oxygen and nitrogen used in medical treatments and cryopreservation. The expanding healthcare sector, along with advancements in biotechnology and pharmaceuticals, is fueling market growth. Additionally, the increasing use of cryogenic gases in industrial applications, such as metal fabrication, electronics, and food processing, further drives demand. Growing investments in infrastructure for liquefied natural gas (LNG) storage and transportation also contribute to market expansion.

The high initial investment required for cryogenic equipment can discourage small and medium enterprises from entering the market, which limits the overall adoption of the technology despite its advantages. The ongoing operational and maintenance costs associated with cryogenic systems can also be significant. These expenses may create obstacles to sustained usage, especially for industries with tight budget constraints.

The cryogenic gases market presents significant opportunities driven by increasing demand in healthcare, electronics, and energy sectors. The growing adoption of liquefied natural gas (LNG) as a cleaner fuel is boosting demand for cryogenic storage and transportation solutions. Advancements in medical applications, including cryosurgery and biotechnology, further create growth prospects. Additionally, expanding industrial applications, such as metal processing and food preservation, offer new opportunities for market expansion.

Product Insights

The oxygen segment accounted for the largest revenue share of 63.8% in 2024 and is expected to continue to dominate the industry over the forecast period. The oxygen segment in the cryogenic gases market is driven by its critical applications in healthcare, metal fabrication, and chemical processing. Liquid oxygen is widely used in medical treatments, respiratory therapies, and surgical procedures, fueling market growth. Additionally, increasing demand from the steel and manufacturing industries, where oxygen enhances combustion efficiency, further supports the expansion of this segment.

The growth of the nitrogen segment is driven by the product’s widespread use in food preservation, electronics manufacturing, and industrial processes. Liquid nitrogen is essential for freezing and storing perishable goods, ensuring extended shelf life in the food industry. Additionally, growing demand in the semiconductor and pharmaceutical sectors, where nitrogen is used for inerting and cryopreservation, is a key driver fueling market growth.

Application Insights

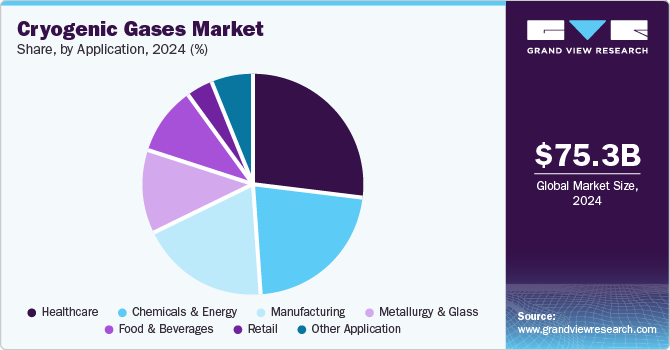

The healthcare segment dominated the market with a share of 26.9% in 2024, during the forecast period. The healthcare segment’s growth is driven by the increasing use of medical gases like liquid oxygen and nitrogen in respiratory treatments, cryotherapy, and surgical procedures. Cryogenic gases play a crucial role in preserving biological samples, supporting advancements in biotechnology and regenerative medicine. Additionally, the growing prevalence of chronic respiratory diseases and the expanding healthcare infrastructure are key drivers fueling demand.

The chemical and energy segment in the cryogenic gases market is driven by the growing demand for industrial gases in chemical processing, refining, and energy production. Cryogenic gases like nitrogen and oxygen are essential for enhancing combustion efficiency, inerting, and cooling applications in petrochemicals and power generation. Additionally, the increasing adoption of liquefied natural gas (LNG) as a cleaner energy source is a key driver boosting market growth.

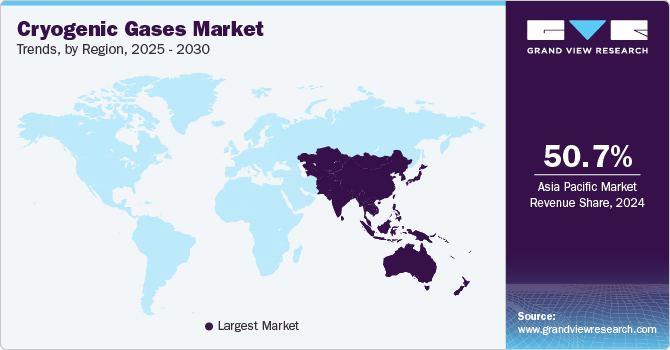

Regional Insights

The Asia Pacific region is a major manufacturing hub, with substantial investments in industries that rely on cryogenic gases for applications such as metal treatment and cryogenic machining. This industrial growth is driving market expansion, further supported by the region’s shift toward sustainable energy solutions. As countries prioritize cleaner energy sources and invest in infrastructure, the demand for specialized cryogenic gases is expected to rise steadily in the coming years.

The China cryogenic gases market is expected to witness growth during the forecast period. The rapid industrialization in metallurgy, chemicals, and food and beverage sectors is increasing the demand for cryogenic gases. These industries rely on cryogenic technologies for processes such as cooling and preservation, further boosting market growth.

North America Cryogenic Gases Market Trends

The North America cryogenic gases industry is experiencing growth, due to rise in construction activity, increasing automotive production and demand for product in the market for cryogenic gases.

The U.S. is a key player in the cryogenic gases industry, driven by a well-established industrial base and advancements in healthcare, energy, and manufacturing. Strong demand for cryogenic gases in sectors such as aerospace, biotechnology, and metal processing support market growth. Additionally, the country's transition toward cleaner energy solutions, including liquefied natural gas (LNG) and hydrogen production, is further fueling demand. With continued investments in infrastructure and technological innovation, the U.S. market for cryogenic gases is poised for steady expansion.

Europe Cryogenic Gases Market Trends

Europe is a significant market, driven by its strong industrial base, advanced healthcare sector, and commitment to sustainable energy solutions. The region's increasing adoption of liquefied natural gas (LNG) and hydrogen as cleaner energy sources is fueling demand for cryogenic storage and transportation. Additionally, the expanding pharmaceutical and biotechnology industries further support market growth. With stringent environmental regulations and continued investments in industrial innovation, Europe’s market for cryogenic gases is set for steady expansion.

Latin America Cryogenic Gases Market Trends

Latin America cryogenic gases industry’s growth is driven by growing industrialization, expanding healthcare infrastructure, and increasing energy sector investments. The rising adoption of liquefied natural gas (LNG) as a cleaner fuel is boosting demand for cryogenic storage and distribution. Additionally, the region’s strengthening manufacturing and metal processing industries further support market growth. With ongoing infrastructure development and a shift toward sustainable energy solutions, Latin America’s market for cryogenic gases is poised for steady expansion.

Middle East & Africa Cryogenic Gases Market Trends

The Middle East & Africa cryogenic gases industry is driven by expanding industrial activities, growing healthcare investments, and the rising demand for energy-efficient solutions. The region's strong focus on liquefied natural gas (LNG) and hydrogen production is fueling demand for cryogenic storage and transportation. Additionally, increasing applications in metal processing, petrochemicals, and medical sectors further support market growth. With continued infrastructure development and a shift toward cleaner energy sources, the market for cryogenic gases in the Middle East & Africa is set for steady expansion.

Key Cryogenic Gases Company Insights

Some of the key players operating in the market include Linde Plc and Honeywell International Inc.

-

Linde plc is a global leader in industrial gases and engineering, providing high-purity gases, technologies, and solutions across various industries, including healthcare, manufacturing, energy, and chemicals. Headquartered in the UK, the company operates in over 100 countries, delivering essential gases such as oxygen, nitrogen, and hydrogen. Linde is also a key player in carbon capture, hydrogen energy, and sustainable industrial solutions. Its advanced engineering division specializes in cryogenic and gas processing technologies. With a strong focus on innovation and sustainability, Linde continues to drive efficiency and environmental progress in the global industrial sector.

-

Honeywell International Inc. is a global technology and manufacturing company specializing in aerospace, building technologies, performance materials, and industrial solutions. In the cryogenic gases sector, Honeywell provides advanced technologies for gas processing, liquefied natural gas (LNG) production, and cryogenic storage. Its solutions enhance efficiency in gas separation, purification, and transportation for industries such as energy, healthcare, and manufacturing. Honeywell’s expertise in automation and process control further optimizes cryogenic gas operations.

Key Cryogenic Gases Companies:

The following are the leading companies in the cryogenic gases market. These companies collectively hold the largest market share and dictate industry trends.

- Linde Plc

- Cryofab Inc.

- Emerson Electric Co.

- Acall-GAs, S.A.

- Acme Cryogenics Inc.

- INOXCVA Inc.

- Nikkiso Co Ltd

- Sumitomo Heavy Industries Ltd

- Wessington Cryogenics

- Honeywell International Inc.

Recent Developments

-

In August 2024, NASA announced the development of low-leakage cryogenic disconnects aimed at enhancing fuel transfer and long-term storage solutions for space missions. This innovation is critical for safe and efficient fuel transfers in extreme environments, reflecting the industry's focus on improving cryogenic fuel systems.

-

In October 2024, Linde Engineering agreed with NEXTCHEM to supply its HISORP CC carbon capture technology for ADNOC's Hail and Ghasha project in the UAE. This project is among the world's most significant offshore sour gas developments and aims to achieve net-zero emissions. Linde's adsorption-based HISORP CC solution efficiently captures and purifies carbon dioxide for sequestration, targeting the capture of 1.5 million tonnes of CO₂ annually. Unlike traditional chemical-based systems, HISORP CC is electrically driven and can be powered entirely by renewable energy, achieving CO₂ capture rates exceeding 99% without increasing the carbon footprint.

Cryogenic Gases Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 79.85 billion

Revenue forecast in 2030

USD 110.3 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Linde Plc; Honeywell International Inc.; Emerson Electric Co.; Acall-GAs, S.A.; Acme Cryogenics Inc.; INOXCVA Inc.; Nikkiso Co Ltd; Sumitomo Heavy Industries Ltd; Cryofab Inc.; Wessington Cryogenics

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cryogenic Gases Market Report Segmentation

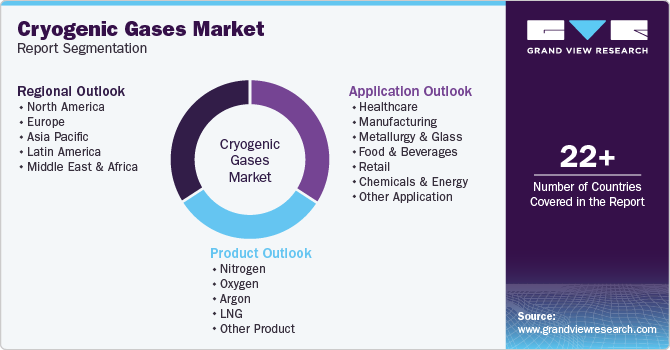

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cryogenic gases market report on the basis of product, application and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Nitrogen

-

Oxygen

-

Argon

-

LNG

-

Other Product

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Manufacturing

-

Metallurgy & Glass

-

Food & Beverages

-

Retail

-

Chemicals & Energy

-

Other Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cryogenic gases market size was estimated at USD 75.28 billion in 2024 and is expected to reach USD 79.85 billion in 2025.

b. The global cryogenic gases market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 110.3 billion in 2030.

b. Asia Pacific dominated the clean label mold inhibitors market in the food & beverages market with a share of 50.7% in 2024. The Asia Pacific region is dominant in the cryogenic gases market, Rapid industrialization in the region is anticipated to increase the demand for cryogenic gases market.

b. Some key players operating in the polyurethane market include Linde Plc, Honeywell International Inc., Emeron Electric Co., Acall-GAs, S.A., Acme Cryogenics Inc., INOXCVA Inc., Nikkiso Co Ltd, Sumitomo Heavy Industries Ltd, Cryofab Inc., Honeywell International Inc., Oriental International (Pvt) Ltd., and Wessington Cryogenics.

b. The move towards liquefied natural gas (LNG) as a cleaner energy source is a significant factor driving market growth. LNG produces less CO2 than traditional fossil fuels, making it an appealing choice for power generation and industrial applications. This trend is especially noticeable in regions like Asia-Pacific and North America, where investments in LNG infrastructure are growing rapidly

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.