- Home

- »

- Next Generation Technologies

- »

-

CubeSat Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![CubeSat Market Size, Share & Trends Report]()

CubeSat Market (2025 - 2033) Size, Share & Trends Analysis Report By Size (1 To 3U, 6 To 9U), By Application (Earth Observation, Meteorology), By Subsystem (Payloads, Attitude Determination & Control System), By End Use, By Region and Segment Forecasts

- Report ID: GVR-4-68040-652-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

CubeSat Market Summary

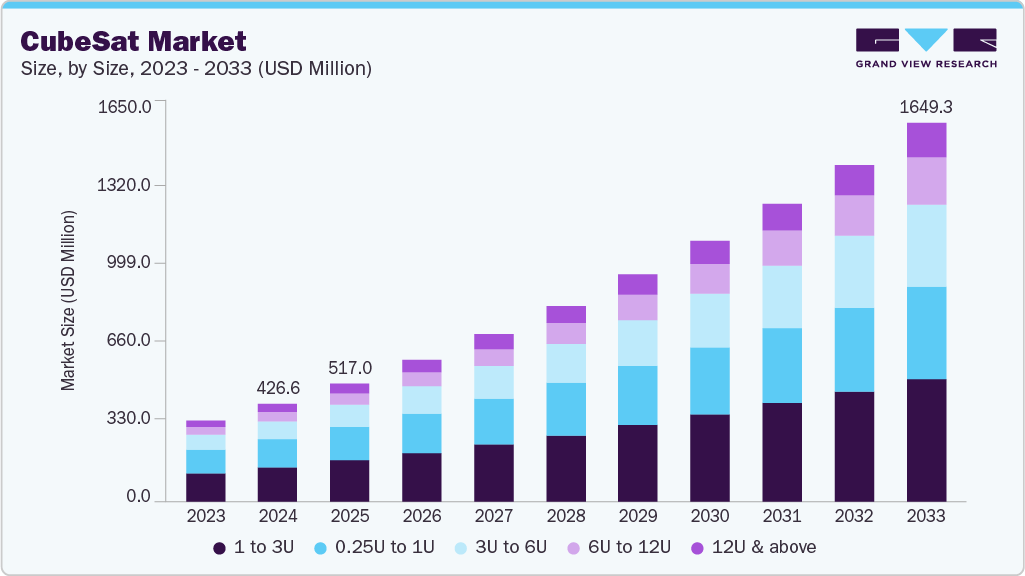

The global CubeSat market size was estimated at USD 426.6 million in 2024 and is projected to reach USD 1,649.3 million by 2033, growing at a CAGR of 15.6% from 2025 to 2033. The market growth is primarily driven by the increasing demand for low-cost satellite missions, rising adoption of CubeSats for Earth observation and remote sensing, and advancements in miniaturized satellite technologies.

Key Market Trends & Insights

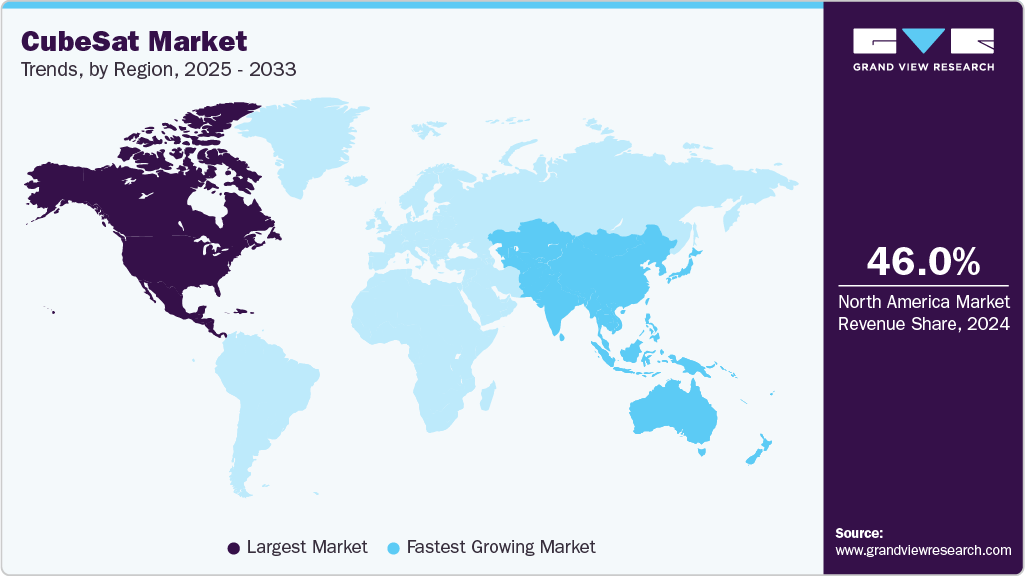

- North America dominated the global CubeSat market with the largest revenue share of 46.5% in 2024.

- The CubeSat market in the U.S. led the North America market and held the largest revenue share in 2024.

- By size, the 1 to 3U segment led the market, holding the largest revenue share of 35.2% in 2024.

- By application, the earth observation segment held the dominant position in the market and accounted for the leading revenue share of 41.8% in 2024.

- By end use, the commercial segment is expected to grow at the fastest CAGR of 18.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 426.6 Million

- 2033 Projected Market Size: USD 1,649.3 Million

- CAGR (2025-2033): 15.6%

- North America: Largest market in 2024

The surge in demand for earth observation and remote sensing is unlocking new revenue streams for the CubeSat industry. Government agencies and private firms are investing in compact satellites to monitor agricultural patterns, climate change, and urban development. These missions require cost-effective deployment without compromising data accuracy. The CubeSat industry is capitalizing on this momentum through high-resolution payload integration and rapid constellation launches.Rising interest in space-based Internet of Things (IoT) applications is accelerating the development of CubeSat constellations. Industries like agriculture, maritime, and energy are increasingly relying on satellite connectivity for asset tracking in remote locations. The need for low-latency communication and persistent coverage is pushing innovation in networked CubeSat architectures. This shift is enabling the CubeSat industry to play a pivotal role in the global IoT infrastructure expansion.

Military and defense sectors are scaling their reliance on CubeSats for rapid-response surveillance and tactical intelligence. The demand for agile, deployable systems that enhance situational awareness and secure communications is shaping procurement strategies. Governments are allocating dedicated budgets toward space-based ISR (Intelligence, Surveillance, and Reconnaissance) capabilities through CubeSat platforms. Consequently, the CubeSat industry is becoming integral to national security frameworks and modern defense infrastructure.

Regulatory evolution and frequency allocation policies are shaping operational norms in the CubeSat industry. Global regulatory bodies are streamlining licensing and orbital debris mitigation frameworks to accommodate the rapid growth in small satellite deployments. Improved governance is fostering investor confidence and long-term scalability. The CubeSat industry is responding with enhanced compliance protocols and sustainable deployment strategies.

Size Insights

The 1 to 3U segment dominated the market with a revenue share of over 35% in 2024, owing to its balance between compact size and functional capability. This size of CubeSat segment has remained a preferred choice for a wide range of Low-Earth orbit missions. This form factor is widely adopted for Earth observation, scientific experiments, and communication applications due to its lower launch costs and quicker development timelines. Advancements in miniaturized payloads and integrated subsystems are enhancing mission versatility within this size class. However, as demand shifts toward higher-performance and multi-payload missions, the segment may face increasing competition from larger CubeSat configurations.

The 6U to 12U segment is expected to register the fastest CAGR of over 19% from 2025 to 2033, driven by the increasing demand for high-performance payloads and multi-functional mission capabilities. The 6U to 12U CubeSat segment is experiencing rapid growth. This size class offers greater power, onboard storage, and space for advanced instruments, making it ideal for high-resolution imaging, secure communications, and autonomous operations. Government agencies and commercial operators are adopting 6U to 12U platforms for more complex and longer-duration missions. The segment is emerging as a strategic choice for next-generation CubeSat deployments that require enhanced functionality without transitioning to full microsatellite platforms.

Application Insights

Earth observation dominated the market in 2024, driven by growing demand for real-time environmental intelligence. This application segment remains the largest application area in the CubeSat market. Governments, commercial enterprises, and NGOs are increasingly leveraging CubeSats for monitoring climate change, agriculture, urban development, and disaster response. The miniaturization of imaging sensors and advancements in onboard data processing are enabling more frequent, cost-effective Earth observation missions. Nevertheless, as other applications like communication and space situational awareness gain traction, the segment's overall market share is expected to decline, despite continued growth in absolute terms gradually.

The communication segment is expected to grow at the fastest CAGR in the coming years, fueled by the rising need for global connectivity and low-latency data services. This segment is emerging as the fastest-growing application in the CubeSat market. Operators are deploying CubeSat constellations to deliver broadband internet, IoT connectivity, and secure communication links in underserved and remote regions. Advancements in miniaturized antennas, software-defined radios, and inter-satellite links are making CubeSats increasingly viable for mission-critical communication infrastructure. As the demand for real-time data transmission and resilient networks accelerates, the Communication segment is set to play a central role in the future of space-based services.

Subsystem Insights

The payloads segment dominated the market in 2024, driven by the need for advanced sensing, imaging, and communication capabilities. The segment continues to hold a dominant position in the CubeSat market. As missions become more specialized, demand is increasing for high-performance payloads such as hyperspectral cameras, AI-based processors, and radar systems. Technological advancements are enabling miniaturization without compromising functionality, allowing more complex payloads to be integrated into smaller form factors. With CubeSats being deployed across diverse sectors-from Earth observation to national security-the Payloads segment remains critical to unlocking mission value and return on investment.

The attitude determination & control systems (ADCS) segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing need for precise satellite orientation and stabilization. This segment is gaining strong traction in the CubeSat market. Accurate attitude control is essential for high-resolution imaging, laser communication, and scientific payload alignment, making ADCS a critical subsystem in mission success. Advancements in miniaturized sensors, gyroscopes, and control algorithms enable CubeSats to perform complex maneuvers with greater autonomy. As mission sophistication grows across commercial, research, and defense applications, demand for robust and scalable ADCS solutions is expected to accelerate.

End Use Insights

The government & defense segment dominated the market in 2024, driven by the increasing demand for rapid, cost-effective, and mission-flexible space assets in this sector. Defense and space agencies are turning to CubeSats for applications such as reconnaissance, early warning systems, and secure communications. These compact satellites offer accelerated deployment timelines and enhanced adaptability for evolving national security objectives. With rising geopolitical tensions and growing interest in space-based situational awareness, government investment in CubeSat programs is set to expand significantly.

The commercial segment is expected to grow at the fastest CAGR in the coming years, primarily driven by the surge in demand for real-time data services, Earth observation, and global connectivity. This segment is emerging as the fastest-growing end-user in the CubeSat market. Startups and private space companies are leveraging CubeSats for applications ranging from precision agriculture and asset tracking to broadband delivery and IoT integration. Lower launch costs, standardization, and scalable manufacturing have made CubeSats a commercially viable platform for space-based innovation. As commercial space ecosystems mature and investor interest accelerates, this segment is expected to lead the next wave of CubeSat deployments.

Regional Insights

North America CubeSat market dominated the market with a revenue share of over 46.0% in 2024, owing to the maturity of its space infrastructure and growing demand for low-orbit connectivity solutions. Companies are developing advanced payload integration systems to support use cases ranging from wildfire detection to maritime surveillance. Demand for resilient communication architecture is prompting the deployment of multi-orbit constellations. This level of mission diversity is positioning North America as a critical hub for both innovation and global CubeSat deployment.

U.S. CubeSat Market Trends

The U.S. CubeSat market dominated the market with a revenue share of over 66% in 2024, as collaboration between tech startups and research institutions continues to expand. Educational institutions are securing NASA grants and DARPA contracts to test CubeSat payloads for interplanetary navigation and AI-driven analytics. This academic-commercial synergy is fast-tracking innovation in propulsion, miniaturized sensors, and autonomous mission capabilities. The resulting IP generation and commercialization pipeline is reinforcing U.S. dominance in advanced space tech.

Europe CubeSat Market Trends

The Europe CubeSat market is expected to grow at a CAGR of 14.0% from 2025 to 2033, fueled by climate-focused satellite missions and pan-European collaborative programs. ESA-backed projects are prioritizing data gathering for sustainability goals, ranging from biodiversity mapping to carbon emission monitoring. Increased availability of rideshare launches from Ariane and Vega carriers is making deployment more feasible. These initiatives are reinforcing Europe's push toward digital sovereignty in space-based.

The Germany CubeSat market is expected to grow at a significant rate in the coming years, with increased interest from industrial players aiming to monitor logistics, infrastructure, and environmental assets. Innovation in thermal and power management systems is becoming a focal point for satellite developers. The rise of tech incubators and cross-border alliances is strengthening Germany’s role in collaborative space missions. These developments are creating long-term commercial pathways for satellite scalability and export.

The UK CubeSat market is expected to grow at a significant rate in the coming years, driven by government-backed spaceport initiatives and funding accelerators. The UK Space Agency is expanding support for CubeSat-centric missions in defense, maritime tracking, and precision agriculture. The nation is also investing in orbital debris mitigation and mission insurance frameworks to support sustainable satellite operation. These enablers are transforming the UK into a preferred launch site and R&D base for small satellite ventures.

Asia Pacific CubeSat Market Trends

The Asia Pacific CubeSat market is expected to grow at the fastest CAGR of 20.1% from 2025 to 2033, owing to rapidly advancing national space programs and increasing commercial launch frequency. Countries like India and South Korea are scaling indigenous satellite development while also serving as low-cost launch hubs. The demand for real-time agricultural data, disaster monitoring, and national defense applications is propelling deployment. Regional alliances and public-private partnerships are further accelerating innovation timelines.

China CubeSat market is driven by strategic investments in national defense and private-sector space exploration. State-sponsored companies are deploying low-Earth orbit constellations for encrypted communications and wide-area surveillance. Universities and commercial ventures are also contributing to mission diversity through dual-use technologies. This alignment between state priorities and private innovation is significantly scaling launch frequency and system complexity.

Japan CubeSat market is witnessing strong momentum, fueled by growing interest in deep-space missions and asteroid exploration. Leading research institutions are actively launching CubeSats for interplanetary navigation, leveraging advanced propulsion systems and thermal control technologies. Government policies are promoting mission versatility and fostering international partnerships to expand scientific and commercial reach. These developments are establishing Japan as a key player in next-generation space exploration initiatives.

Key CubeSat Company Insights

Some of the key players operating in the market include Planet Labs Inc., GomSpace, and others.

-

Planet Labs Inc. is a global leader in Earth observation, operating one of the largest commercial fleets of CubeSats in orbit. The company specializes in high-resolution imaging and daily data capture for sectors like agriculture, defense, climate monitoring, and disaster response. Its “Dove” and “SuperDove” CubeSats are known for delivering continuous, near-real-time insights at scale. Planet Labs is a dominant force in the market, pioneering the use of CubeSats for large-scale commercial satellite constellations.

-

GomSpace, headquartered in Denmark, is a prominent manufacturer and integrator of CubeSat platforms and advanced subsystems. The company specializes in propulsion systems, attitude determination and control systems (ADCS), radios, and power systems. GomSpace serves both governmental and commercial clients across Europe, Asia, and North America. Its strong portfolio and technical capabilities have positioned it as a go-to supplier for reliable CubeSat solutions.

EnduroSat and Space Inventor are some emerging market participants in the CubeSat market.

-

EnduroSat is an emerging European company known for its modular CubeSat platforms and integrated subsystems. It specializes in shared satellite services, allowing multiple clients to fly their payloads on a single mission-an approach that reduces cost and increases accessibility. The company has rapidly gained traction for its mission flexibility and simplified satellite operations interface. EnduroSat is becoming a preferred partner for academic, commercial, and IoT-focused space missions.

-

Space Inventor is a Danish startup making waves in the CubeSat and small satellite ecosystem through its high-performance modular platforms. It focuses on subsystems such as EPS (Electrical Power Systems), structures, and ADCS, targeting both commercial and governmental applications. The company emphasizes mission reliability, scalability, and rapid customization. With a growing international footprint, Space Inventor is quickly gaining recognition as a trusted provider of advanced nanosatellite technologies.

Key CubeSat Companies:

The following are the leading companies in the CubeSat market. These companies collectively hold the largest market share and dictate industry trends.

- Blue Canyon Technologies

- CU Aerospace L.L.C.

- EnduroSat

- GomSpace

- Innovative Solutions In Space B.V.

- L3Harris Technologies Inc.

- Planet Labs Inc.

- Pumpkin Space Systems

- Space Inventor

- SpaceX

Recent Developments

-

In April 2025, KULR Technology Group partnered with AstroForge to develop a custom 500Wh KULR ONE Space (K1S) battery pack for space missions. The K1S battery integrates NASA-approved cells and architectures to deliver high energy density and mission-specific performance. It also features KULR’s advanced Battery Management System and marks the third format of the KULR ONE Space design. This collaboration strengthens KULR’s position in the growing space battery market, supporting applications from CubeSats to deep-space missions.

-

In March 2025, Exolaunch expands its global customer base, providing cost-effective launch solutions for Canada's CUBICS student-led satellite projects. The company was selected by the Canadian Space Agency to deploy nine 3U CubeSats developed by Canadian universities. The mission is set to launch no earlier than mid-2026 using Exolaunch’s EXOpod Nova separation system. This collaboration supports STEM education and strengthens Exolaunch’s presence in the North American space market.

-

In January 2025, NASA launched the Technology Education Satellite 22 (TES-22) CubeSat to study Earth's thermosphere. The satellite features key technologies including a deployable Exo-Brake, a radiation detector, and a solid-state battery test. TES-22 aims to reduce deorbit time and gather data on atmospheric drag and solar effects. This mission is part of NASA’s CubeSat Launch Initiative, supporting cost-effective space research for educational institutions.

CubeSat Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 517.0 million

Revenue forecast in 2033

USD 1,649.3 million

Growth rate

CAGR of 15.6% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Size, application, subsystem, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

Blue Canyon Technologies; CU Aerospace L.L.C.; EnduroSat; GomSpace; Innovative Solutions In Space B.V.; L3Harris Technologies Inc.; Planet Labs Inc.; Pumpkin Space Systems; Space Inventor; SpaceX.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global CubeSat Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global CubeSat market report based on size, application, subsystem, end use, and region:

-

Size Outlook (Revenue, USD Million, 2021 - 2033)

-

0.25U to 1U

-

1 to 3U

-

3U to 6U

-

6U to 12U

-

12U & above

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Earth Observation

-

Meteorology

-

Space Observation

-

Communication

-

Scientific Research

-

-

Subsystem Outlook (Revenue, USD Million, 2021 - 2033)

-

Structures

-

Payloads

-

Power Systems

-

Command & Data Handling (C&DH)

-

Attitude Determination & Control Systems (ADCS)

-

Propulsion Systems

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Government & Defense

-

Commercial

-

Research Institutions and Non-Profit Organizations

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global CubeSat market size was estimated at USD 426.6 million in 2024 and is expected to reach USD 517.0 million in 2025

b. The global CubeSat market is expected to grow at a compound annual growth rate of 15.6% from 2025 to 2033 to reach USD 1,649.3 million by 2033.

b. North America dominated the CubeSat market with a share of over 46.0% in 2024, fueled by technological advancements in miniaturized electronics, increasing commercial applications in Earth observation and communication, and expanding launch opportunities that make CubeSats more accessible and cost-effective.

b. Some key players operating in the CubeSat market include Blue Canyon Technologies, CU Aerospace L.L.C., EnduroSat, GomSpace, Innovative Solutions In Space B.V., L3Harris Technologies Inc., Planet Labs Inc., Pumpkin Space Systems, Space Inventor, and SpaceX.

b. Key factors that are driving the market growth include rapid advancements in miniaturized electronics and propulsion systems, enhancing capabilities, growing adoption for commercial applications like Earth observation and IoT communication, and increasing availability of cost-effective launch services, enabling wider access and deployment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.