- Home

- »

- Consumer F&B

- »

-

Cultured Meat Market Size And Share, Industry Report, 2030GVR Report cover

![Cultured Meat Market Size, Share & Trends Report]()

Cultured Meat Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Poultry, Beef, Seafood, Pork, Duck), By End-use (Nuggets, Burgers, Meatballs, Sausages, Hot Dogs), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-925-4

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cultured Meat Market Summary

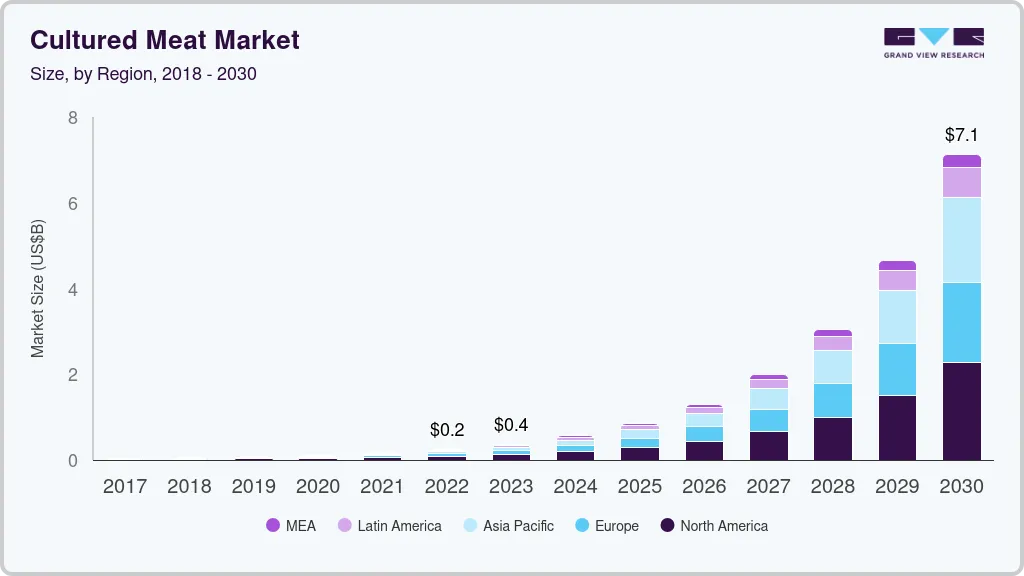

The global cultured meat market size was estimated at USD 246.9 million in 2022 and is projected to reach USD 6.9 billion by 2030, growing at a CAGR of 51.6% from 2023 to 2030. The growing technological advancements in the alternative proteins space are driving a shift toward sustainable food systems globally.

Key Market Trends & Insights

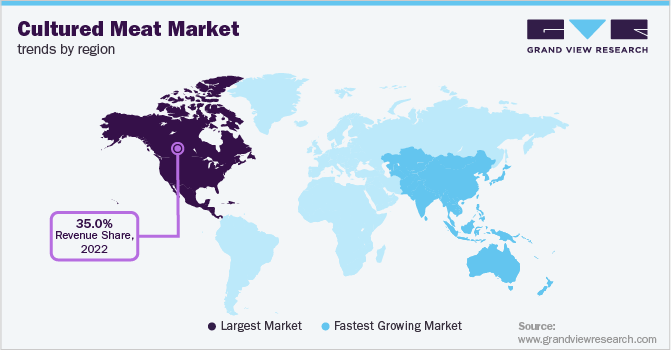

- North America dominated the cultured meat market with a share of over 35% in 2022.

- Asia Pacific is expected to witness the fastest CAGR of 52.9% from 2023 to 2030.

- In terms of revenue, poultry dominated the market with a share of over 39% in 2022.

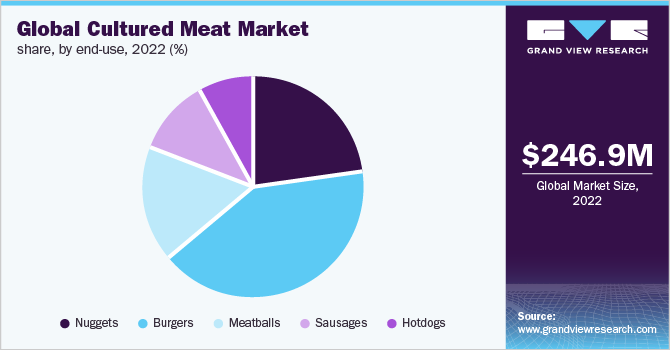

- In terms of revenue, burgers dominated the market with a share of around 41% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 246.9 million

- 2030 Projected Market Size: USD 6.9 Billion

- CAGR (2023-2030): 51.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Meat substitutes and alternative proteins are gaining global attention with the growing need to overcome meat shortages against the growing population and environmental impact. The awareness of environmental sustainability and rising focus on securing meat supply are among the factors responsible for the growth of the cultured meat industry globally. The outbreak of COVID-19 and the resultant lockdowns disrupted supply channels globally. The widespread disruption in supply chains also influenced cultivated meat production. The procurement of equipment was delayed due to trade barriers. Bioreactors are important processing equipment for the cultivated meat industry, providing an appropriate environment for cultivating animal cells.

There was an increased demand for bioreactors from the pharmaceutical industry for COVID-19 vaccine production. This resulted in delayed lead times for bioreactors.However, the cultivated meat industry observed huge growth post-2020. 2021 was a key year for the cultivated meat industry, marking various technological advancements, product launches, increased investments, and funding.

The growing vegan population and consumer sentiment toward animal welfare are factors projected to contribute to the growth of cultured meat. Although the market is at its nascent stage, research & development are underway for the production of cultured meat on a large scale. Major market participants are focused on obtaining regulatory approvals for commercializing cultured meat products.

The increased federal funding toward cellular agriculture in developed countries such as the U.S. will provide opportunities for growth in demand for cultivated meat in the country. The support from regulatory bodies and governments in certain countries to push investment and funding toward the cultured meat sector will be significant to the approval and commercialization of cultivated meat.

Factors including funds raised by key players, growing meat demand, innovative product launches, and awareness for environmental protection put together are projected to massively change the outlook of the meat industry and the way meat is manufactured. However, persistent technical challenges in manufacturing, the requirement of skilled labor & scientific expertise, and regulatory requirements related to labeling of cultured meat will remain some of the market challenges during the forecast period.

The growing demand for proteins along with a fast-growing population has resulted in an increasing need for technological developments to cater to the global protein demand in the upcoming decade. The growing population coupled with increased meat demand will drive changes in the technological landscape to reduce the shortage of meat supply globally.

Source Insights

In terms of revenue, poultry dominated the market with a share of over 39% in 2022. Chicken consumption has increased in North America during the past 50 years. It is the most consumed meat in the U.S., with over 8 billion chickens slaughtered for food each year. Globally, more than 50 billion chickens are raised every year. The rise in the number of startups and market entrants investing in cellular agriculture technology to develop poultry-cultivated products is favoring the growth of the poultry segment.

Pork is projected to register a CAGR of 52.6% from 2023 to 2030. Pork, classified as red meat by the United States Department of Agriculture (USDA), is one of the most popular meats consumed in the world.The demand for pork substitute products was primarily fueled during the coronavirus outbreak, which also highlighted the risks associated with the entire meat industry and the weaknesses in a food supply chain that is centered on animals. The expansion of the pork segment is also attributed to the increasing number of startups and established companies in the sector experimenting with cultivated meat produced from pig cells.

End-use Insights

In terms of revenue, burgers dominated the market with a share of around 41% in 2022. The cultured burger segment is expected to gain traction owing to growing consumer preference for sustainable and ethical meat alternatives. Cultured meat burgers have the potential to reduce the environmental impact of the meat industry.Several startups and key players are experimenting with cultivated meat, which is also expected to support the growth of the segment. In January 2020, the maker of the world’s first cultured meat hamburger, Mosa Meat, announced a partnership with animal nutrition company Nutreco, which will provide Mosa Meat with a nutrient-filled liquid to produce meat.

The meatballs segment is estimated to grow at the fastest CAGR of 52.5% over the forecast period. Processed meat products such as meatballs are purchased on a large scale in supermarkets by consumers. Additionally, the growing awareness regarding the perceived health benefits of cultured meats has increased the consumer base of the industry.Shifting consumer preference toward clean meats and alternatives, coupled with the growing demand for meatballs, is anticipated to drive the growth of the cultured meatball segment over the forecast period.

Regional Insights

North America dominated the cultured meat market with a share of over 35% in 2022. Increased demand for sustainable meat and poultry products, coupled with the presence of key players in the region, is supporting the growth. Several U.S.-based companies such as Fork & Goode and BlueNalu are gradually investing in cell-agriculture technologies to produce cultivated meats in the region.

Furthermore, favorable government regulations for cultured meat in the region are fueling the demand for cultured poultry products. In March 2019, the U.S. Department of Agriculture (USDA) and the Food and Drug Administration (FDA) agreed to oversee the production of poultry and meat products that are made using cultured cells of poultry and livestock.

Asia Pacific is expected to witness the fastest CAGR of 52.9% from 2023 to 2030. Factors such as steady meat consumption and rising disposable income in the region are supporting the growth of the market. In 2021, according to the Food and Agricultural Organization (FAO), the Asia Pacific region witnessed a rise in per capita beef consumption.

Furthermore, the rise in investments in lab-grown seafood is driving the market growth. In addition, favorable government initiatives in countries such as Singapore and China are supporting the cultivated meat industry growth. In December 2020, the Singapore Food Agency (SFA) approved Eat Just for selling cultivated chicken in Singapore.

Key Companies & Market Share Insights

The market is characterized by the presence of various startups and emerging companies. Companies have been implementing various strategies such as mergers & acquisitions, expansion of production facilities, investing in research and development, and new product launches to gain a competitive advantage.

-

Avant Meats Company Limited announced its series A funding of around USD 10.8 million by S2G Ventures, a direct investment arm of an impact platform company, Builders Vision. This helped the company commercialize marine protein and cultivated fish, scale up production, and sell high-quality products to consumers

-

Mosa Meat and Nutreco announced the European REACT-EU recovery assistance program awards their joint ‘Feed for Meat’ project with a grant of almost USD 2.17 million to advance cellular agriculture and bring cultivated beef to the EU market. The program will fund R&D to specifically address the ‘basa’ or base media in which the beef cells grow.

Some prominent players in the global cultured meat market include: -

-

Aleph Farms

-

Avant Meats Company Limited

-

Biftek INC

-

Mosa Meat

-

BlueNalu, Inc.

-

BioFood Systems Ltd

-

WildType

-

New Age Eats

-

Shiok Meats Pte Ltd

-

SuperMeat

-

Meatable

-

Finless Foods, Inc

-

Fork & Good, Inc.

-

Future Meat Technologies Ltd

-

UPSIDE Foods

-

Mission Barns

Cultured Meat Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 373.1 million

Revenue forecast in 2030

USD 6.9 billion

Growth Rate

CAGR of 51.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Russia; Italy; China; Japan; India; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Aleph Farms; Avant Meats Company Limited; Biftek INC; Mosa Meat; BlueNalu, Inc.; BioFood Systems Ltd ;WildType ; New Age Eats; Shiok Meats Pte Ltd; SuperMeat; Meatable; Finless Foods, Inc.; Fork & Good, Inc.; Future Meat Technologies Ltd; UPSIDE Foods; Mission Barns

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Cultured Meat Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cultured meat market report based on source, end-use, and region:

-

Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Poultry

-

Beef

-

Seafood

-

Pork

- Duck

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Nuggets

-

Burgers

-

Meatballs

-

Sausages

-

Hotdogs

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cultured meat market size was estimated at USD 246.9 million in 2022 and is expected to reach USD 373.1 million in 2023.

b. The global cultured meat market is expected to grow at a compound annual growth rate of 51.6% from 2023 to 2030 to reach USD 6.90 billion by 2030.

b. North America dominated the cultured meat market with a share of 35.8% in 2022. Increased demand for sustainable meat and poultry products, coupled with the presence of key market players in the region, is supporting the growth of the cultured meat market in the region.

b. Some key players operating in the cultured meat market include Aleph Farms; Avant Meats Company Limited; Biftek INC; Mosa Meat; BlueNalu, Inc.; BioFood Systems Ltd; WildType; New Age Eats; Shiok Meats Pte Ltd; SuperMeat; Meatable; Finless Foods, Inc.; Fork & Good, Inc.; Future Meat Technologies Ltd; UPSIDE Foods; and Mission Barns.

b. Key factors that are driving the cultured meat market growth include the growing vegan population and consumer sentiment toward animal welfare along with the growing technological advancements in the alternative proteins space.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.