- Home

- »

- Next Generation Technologies

- »

-

Customer Experience Management Market Size Report 2030GVR Report cover

![Customer Experience Management Market Size, Share & Trends Report]()

Customer Experience Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Analytical Tools, By Touch Point Type, By Deployment, By Organization Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-502-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Customer Experience Management Market Summary

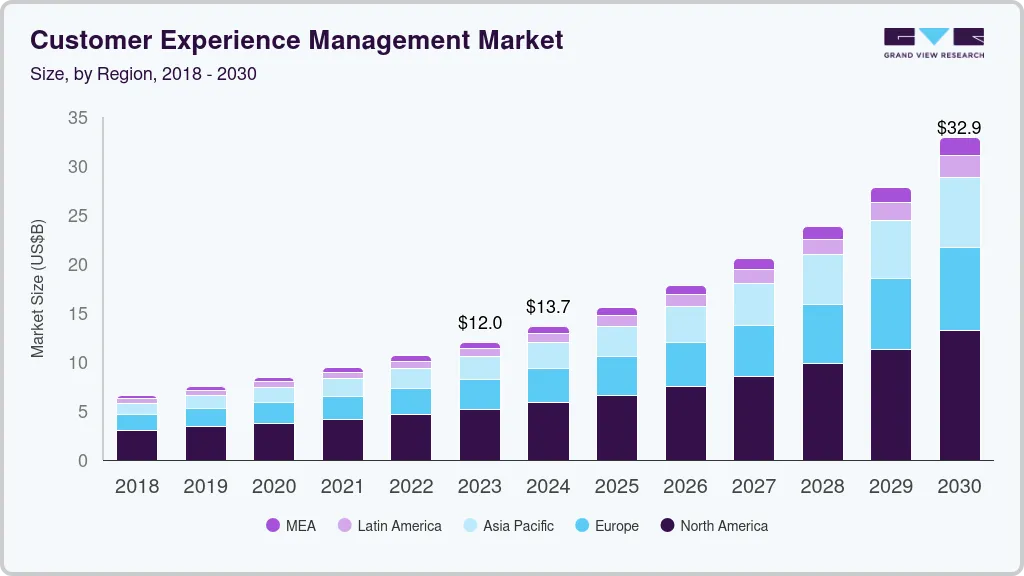

The global customer experience management market size was estimated at USD 12.04 billion in 2023 and is projected to reach USD 32.87 billion by 2030, growing at a CAGR of 15.8% from 2024 to 2030. The market growth can be attributed to the rising importance of understanding customer behavior and their preferences, which drives various brands and organizations to implement customer experience strategies, such as regularly communicating and engaging with customers, developing a long-term program, and utilizing automation, to provide the best service performance to customers in real-time.

Key Market Trends & Insights

- The North America customer experience management marketaccounted for a share of over 43.0% in 2023 and is expected to grow at a CAGR of 14.6% from 2024 to 2030.

- The customer experience management market in the U.S. is projected to grow at a CAGR of 13.6% from 2024 to 2030.

- By analytical tools, the text analytics segment accounted for a revenue share of around 39.0% in 2023.

- By touch Point type, The call centers segment accounted for the largest market share of around 31.0% in 2023.

- By deployment, The on-premises segment accounted for a market share of 49.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 12.04 Billion

- 2030 Projected Market Size: USD 15.24 Billion

- CAGR (2024-2030): 15.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The increasing use of digital technology tools is likely to set the pace for digital transformation and digital optimization in both existing and new businesses. These developments are expected to increase the use of cloud technology and work collaboration tools, thereby supporting customer experience management (CEM) market growth.

The market is expected to witness an increasing share of work delivered through digital engagement models based on collaboration platforms and tools. The rapid proliferation of smart technologies, such as Machine Learning (ML), Artificial Intelligence (AI), and the Internet of Things (IoT), among others has declined the cost of computing and storage power. For instance, automakers are using AI and analytics to provide maintenance services with in-vehicle sensors that can tell when a customer needs any service. This development would further drive the market growth. The continued digital transformation across various industries is prompting companies to replace the existing solutions required to create, manage, and enhance the digital presence with a unified solution that can serve all purposes.

The Digital Transformation Initiative of the World Economic Forum expects platform-driven interactions to account for almost 2/3rd of the USD 100 trillion digitalization economy by 2025. As such, the continued integration of Artificial Intelligence (AI) and Machine Learning (ML) into CEM solutions is expected to drive industry growth. Understanding customer behavior is essential for businesses of all sizes. Given that the general public frequently spends quality time on various social networking platforms, such as Twitter, Facebook, Pinterest, LinkedIn, and Snapchat, among others, organizations have recognized that social networking platforms can provide a great opportunity to gauge changing customer behavior and the way customers interpret information about products or services. Social customer relationship management (CRM) can particularly assist businesses at this stage in positively engaging customers and increasing brand awareness.

These developments would further drive market growth. Supply chain disruptions and the implementation of new regulations would also have a significant impact on industry growth. Moreover, as more people turn to the Internet for online shopping, the B2C market is expanding rapidly. Healthcare and information technology & telecommunications are likely to see growth opportunities. As the demand for medicinal products and medicines has grown exponentially, effective and efficient change management has become increasingly important in the life sciences industry. A strong push for learning and development supported by AR/VR for remote training & demonstration for both employees & customers, as well as AR/VR-led remote troubleshooting for the energy & utility, retail, and telecom industries, would result in an improved customer experience, reduced time-to-serve, and reduced costs.

Market Concentration & Characteristics

The market growth stage is high and the pace of its growth is accelerating. Customers in the technology-driven world want to communicate with businesses via their preferred channels, such as voice, email, online, mobile, SMS, and social media, whenever and wherever they choose. Companies are encouraging client interactions across these many channels to stay competitive. However, offering a seamless customer experience is still hampered by the fact that these channels operate in silos, limiting an organization's ability to provide an omnichannel experience to customers. The omnichannel CEM solution tracks the complete customer journey across channels, resulting in a consistent and optimal experience.

The CEM market is also characterized by a high level of merger and acquisition (M&A) activities by the leading players. Through acquisitions, companies enhance their services portfolio and expand in untapped market regions.

The use of CEM solutions often involves access to confidential customer data, thereby driving the need for adequate data security and privacy protection initiatives. The European Union's General Data Protection Regulation (GDPR) gives control over individuals' personal data to the respective individuals. Companies operating in California are required to comply with the California Consumer Privacy Act (CCPA). The ISO/IEC 27000 series of standards apply to all companies involved in processing personal data to enhance the security of information assets.

There are no direct substitutes for CEM solutions in the market at present. Hence, the threat of external substitutes can be considered as low. However, the threat of internal substitutes remains high as several CEM application tools specific to business requirements are available. These tools include customer data platforms, sentiment analysis tools, feedback management tools, UX testing tools, A/B testing and personalization tools, and tag management systems. Moreover, the increasing inclination toward tailored customer experience applications is opening numerous opportunities for service-based enterprises. Hence, the threat of substitutes can be considered as moderate.

The market is expected to see moderate growth with moderate buyer power. This means companies will prioritize cost-effective solutions like self-service options and data-driven CX improvements but, still invest in personalization and value-driven experiences to win over customers who have some sway over pricing. This balance between cost-efficiency and strong customer focus will likely shape the future of the CEM market.

Analytical Tools Insights

The text analytics segment accounted for a revenue share of around 39.0% in 2023. The growing need for social media analytics and demand for sorting customer interactions or Voice of the Customer (VoC) across various digital touchpoints has contributed to the overall segment growth. Furthermore, text analytics enables predictive analytics with accurate sentiment data analysis and assists users in making critical business decisions by analyzing current and historical data to predict future outcomes. As a result of these factors, the segment growth is expected to be driven by the demand for predictive analytics among organizations over the forecast period.

The speech analytics segment is expected to witness a significant growth of 18.4% from 2024 to 2030. Speech analytics helps businesses gain deeper insights into customer sentiment, needs, and pain points. By analyzing call recordings, businesses can identify recurring themes and areas for improvement. This empowers them to tailor their products, services, and support to better meet customer expectations. Speech analytics can be used to evaluate agent performance and identify areas for coaching and development. By analyzing call recordings, businesses can identify strengths and weaknesses in communication skills, product knowledge, and problem-solving abilities. This data helps ensure agents are equipped to deliver exceptional customer service.

Touch Point Type Insights

The call centers segment accounted for the largest market share of around 31.0% in 2023 due to increased adoption of advanced contact center technologies and cloud-based & virtual contact center solutions, the emerging role of social media in contact center operations, and streamlined customer interactions to achieve high customer satisfaction. Furthermore, the growing popularity of call centers has impelled businesses to invest in technologies that aid in improving call resolution rates, customer satisfaction rates, and multi-channel performance, among others. These technologies include self-service workforce management solutions, speech technology, analytical tools, case management solutions, and email response management systems. These developments would further supplement the demand for advanced call centers.

The web services segment is expected to grow at a CAGR of 17.4% from 2024 to 2030. Web CEM enables organizations to deliver responsive, powerful, mission-critical customer experiences across omnichannel touch points that meet the needs of many enterprise information platforms, social & rich media, languages, and devices. Web CEM is a sophisticated platform that uses cutting-edge web technologies to facilitate integration with existing enterprise systems. Businesses use CEM to create a web presence that incorporates video, text, images, and documents while adhering to the principles of providing an optimized, social, and non-disruptive experience. These benefits would further drive segment growth.

Deployment Insights

The on-premises segment accounted for a market share of 49.0% in 2023. A large number of companies are shifting from manual systems to automated systems for carrying out a variety of operations. According to a customer relationship management buyer survey conducted by SelectHub, several larger enterprise groups have preferred on-premises as compared to cloud-based deployment. Due to the increasing demand for data privacy, the demand for on-premises CEM solutions has increased.

The cloud segment is expected to witness a significant CAGR of 18.3% from 2024 to 2030. The demand for cloud CEM solutions, owing to their ease of accessibility and integration, is increasing due to the growing implementation of AI, big data, IoT, and connected devices. Organizations are increasingly preferring cloud-based deployment of a variety of CEM solutions as they are hosted on the vendor’s server and can be remotely accessed from any location. These solutions help boost employee productivity, enhance customer engagement and retention, and offer various other business benefits.

Organization Size Insights

The large enterprises segment accounted for a market share of over 60% in 2023. Large organizations have multiple operational departments, due to which they widely use CEM solutions to integrate customer data with business process management features, enabling users to coordinate with their sales, marketing, and customer support processes. Moreover, vendors offering scalable features in their solutions to meet the needs of large organizations are also expected to drive the demand for CEM solutions in this segment. Furthermore, the growing applications of big data, artificial intelligence, and its applications in large enterprises are expected to drive the adoption of customer experience management solutions.

The SME segment is expected to witness a highest CAGR from 2024 to 2030. The rising number of government initiatives through digital Small and Medium Enterprise (SME) campaigns, such as video marketing, social media, and search engine marketing, across the regions is expected to drive the growth of the segment over the forecast period. With benefits ranging from predictive lead scoring to anticipating customer needs across major functions like sales, marketing, and customer service is leading towards growth of the segment over the forecasted period.

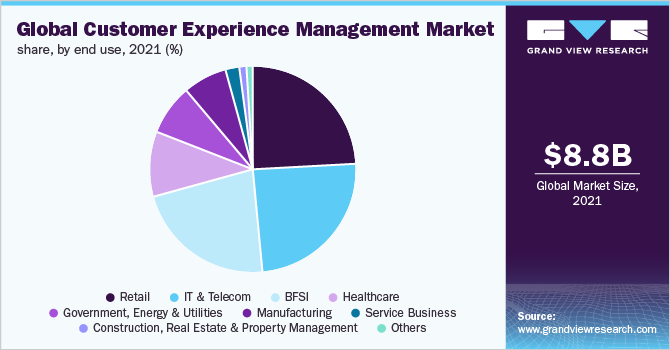

End-use Insights

The retail segment accounted for the largest share of around 24.0% in 2023. The retail sector invests heavily in marketing and promoting products to attract customers and increase sales. However, the retail sector faces various challenges in delivering customer services. Retail companies use structured analytics CEM solutions to maintain detailed information about their customers, such as their preferences and social media activity. They can understand customer preferences by collecting this information from different touchpoints, such as websites, smartphone applications, social media platforms, and physical stores/branches, and analyzing it. These capabilities would further supplement the demand for CEM solutions in the retail sector.

The BFSI segment is anticipated to witness a significant CAGR of 17.1% from 2024 to 2030. The segment expansion can be attributed to increased demand for CEM solutions, particularly in contact centers. This has prompted BFSI firms to invest in and implement analytical tools with multi-channel customer experience management features to effectively meet customer expectations. Furthermore, CEM solutions enable BFSI businesses to maintain quality standards while reducing internal inefficiencies. These benefits provided by analytical solutions will drive demand for CEM solutions in the BFSI sector.

Regional Insights

The North America customer experience management marketaccounted for a share of over 43.0% in 2023 and is expected to grow at a CAGR of 14.6% from 2024 to 2030. The growing investments in digital channels and marketing by the U.S. and Canadian organizations are contributing to the regional market growth. Social media is emerging as a potential channel for enterprises to share & receive feedback & product reviews and increase brand awareness. Solutions, such as social middleware, social management, social monitoring, and social measurement, are evolving and enabling enterprises to establish customer engagements and increase their brand presence among customers. Companies, such as Salesforce.com and Adobe, are making technological advancements to create social media campaigns for developing online brand communities. This results in regional enterprises spending heavily on digital channels.

U.S. Customer Experience Management Market Trends

The customer experience management market in the U.S. is projected to grow at a CAGR of 13.6% from 2024 to 2030 as the country is home to several key vendors, including Oracle Corporation, IBM, and Adobe Systems Inc., which are controlling a major market share and are driving the growth of this domestic market.

Asia Pacific Customer Experience Management Market Trends

The Asia Pacific customer experience management market is projected to grow at a CAGR of 17.5% from 2024 to 2030. As a result of the advances in the latest technologies and continued development of AI-based tools and self-service capabilities, such as chatbots, IVR, web self-service, and online communities, are allowing enterprises to better understand the changing customer behavior, provide instant support, and initiate proactive actionable responses.

The customer experience management market in China is projected to grow at a CAGR of 17.5% from 2024 to 2030. The market in China is vast but complicated owing to a diverse culture and differences in the levels of customer maturity. Hence, vendors are developing CEM solutions, particularly for the Chinese market.

The Japan customer experience management market is projected to grow at a CAGR of 17.1% from 2024 to 2030. In Japan, the advanced IT infrastructure has enabled high-speed digital connectivity, which is allowing vendors to provide both on-premises and hosted CRM solutions. The high adoption of smartphones and other connected devices is also making it easier for organizations in Japan to draft innovative marketing strategies and boost sales.

The customer experience management market in India is projected to grow at a CAGR of 17.5% from 2024 to 2030. Indian businesses are increasingly recognizing the importance of customer retention for sustainable growth. CEM solutions empower companies to personalize interactions, address customer needs proactively, and ultimately retain a loyal customer base.

Europe Customer Experience Management Market Trends

The Europe customer experience management market is expected to register a CAGR of 16.2% from 2024 to 2030. In Europe, the diversity of businesses stemming from multi-currency transactions and a multi-regional user base is encouraging the adoption of CEM solutions.

The customer experience management market in the UK is likely to grow at a CAGR of 16.7% from 2024 to 2030. Factors, such as the growing emphasis on the adoption of analytical tools and customer engagement software to support sales, customer service, and marketing activities across all the industry verticals, are driving the market growth. In February 2023, Virgin Atlantic, a UK-based airline, selected Conduent, a global technology and CEM company, to provide CEM services. This includes managing rebookings, providing general customer support, and live agent support. Conduent’s human-centric approach to customer service is expected to improve customer satisfaction for Virgin Atlantic.

The Germany customer experience management market is projected to record a CAGR of 16.0% from 2024 to 2030. Increasing investments to implement digital transformation initiatives, such as Industry 4.0, coupled with the growing use of process automation tools powered by the latest technologies, such as Artificial Intelligence (Al) and Machine Learning (ML), are expected to drive the need for CEM software to automate processes, minimize variations, and improve customer experience across Germany.

The customer experience management market in France is estimated to grow at a CAGR of 17.4% from 2024 to 2030. France is experiencing a paradigm shift in the retail economy from transactional to experiential, and brands with good customer experience have managed to attain 1.5 times higher sales than their competitors. Hence, companies in France are readily investing in CEM solutions.

Middle East & Africa Customer Experience Management Market Trends

The Middle East & Africa customer experience management market is anticipated to witness a CAGR of 16.3% from 2024 to 2030. Contact centers in this region are investing aggressively in digital technologies, cloud-based solutions, and analytical tools to provide real-time customer support and enhance customer satisfaction levels. This, in turn, will support market growth

The customer experience management market in KSA is anticipated to witness a significant CAGR of 17.3% from 2024 to 2030. BPO providers are analyzing large volumes of customer data, determining patterns, predicting trends, and establishing targeted strategies that connect with individual preferences, behaviors, and expectations; thereby fostering customer satisfaction, loyalty, and representation in a competitive and dynamic market environment.

Key Customer Experience Management Company Insights

Some of the key players operating in the market include International Business Machines Corporation, Oracle Corp., SAP SE, and Adobe.

-

International Business Machines Corp. manufactures computer hardware, develops middleware & other software, and offers infrastructure hosting and consulting services. The company also provides support services from nanotechnology to mainframe computers. The company is more focused on providing software-defined networking solutions. The company’s IBM Cloud is getting particularly popular among the incumbents of various industries and industry verticals owing to the flexible software and secure hardware of its features

-

Oracle Corp. offers products and services for information technology platforms, applications, and infrastructure. The company markets and sells its offerings to enterprises of all sizes, government agencies, resellers, and educational institutions. The company operates through three business segments, namely hardware, cloud & license, and services. The cloud & license segment offers next-generation cloud computing solutions through delivery modes, such as Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS). The hardware segment’s offerings include Oracle Engineered Systems, storage, servers, and industry-specific products. The services segment offers consulting, educational, and advanced customer support services

Freshworks Inc., Mriraway, and Zendesk are some of the emerging market participants in the customer experience management market.

-

Freshworks Inc. is engaged in the development and sales of customer engagement software solutions for enterprises of all sizes. The company offers software solutions for call centers, information technology service management, customer support, and sales & marketing professionals. The company also provides a load-balancing engine named Omniroute for multi-channel customer inquiries. The company’s easy-to-use solutions are adopted by SMEs, large enterprises, e-commerce companies, healthcare companies, and academic institutions

-

Zendesk is a provider of customer service software solutions that help solve customer engagement and customer relationship problems. The company’s areas of expertise include customer community, help desks, customer support, SaaS, and customer service. Zendesk Support, the company’s flagship product, allows organizations to prioritize, track, and resolve customers’ support tickets raised across multiple channels while bringing customer interactions and information in one place. The company’s products that can be integrated with Zendesk Support include Zendesk Talk, Zendesk Chat, Zendesk Guide, and Zendesk Connect. The company also offers Zendesk Suite, an omnichannel offering that combines Chat, Support, Talk, and Guide

Key Customer Experience Management Companies:

The following are the leading companies in the customer experience management market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Inc.

- Avaya Inc.

- Clarabridge

- Freshworks Inc.

- Genesys

- International Business Machines Corp.

- Medallia Inc.

- Miraway

- Open Text Corp.

- Oracle Corporation

- Qualtrics

- SAP SE

- SAS Institute Inc.

- Service Management Group (SMG)

- Tech Mahindra Ltd.

- Verint

- Zendesk

Recent Developments

-

In March 2024, Adobe Inc. launched a new set of suites aimed at the enterprise sector, enabling brands to achieve individualized personalization on a large scale by leveraging generative AI and instantaneous insights. Adobe Inc.’s recent offerings enhance the Customer Experience Management (CXM) solutions that companies have depended on for integrating data, and content. Moreover, Adobe Inc. is offering a strategy for brands to utilize AI in creating customer value and seizing the vast potential in executing personalization at a large scale

-

In November 2023, International Business Machines Corp. and NatWest collaborated on a Generative AI initiative to enhance customer experience. IBM's engineering and AI expertise is expected to be employed to provide augmented customer-focused functionality through Cora, NatWest's virtual assistant. This collaboration is integral to NatWest's primary generative AI strategy, which harnesses the capabilities of WatsonX, IBM's enterprise AI platform

-

In September 2023, Oracle Corp., a CEM solutions provider, launched new capabilities powered by generative AI to enhance the development of connected customer information between its Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems for improved customer experience

Customer Experience Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.66 billion

Revenue forecast in 2030

USD 32.87 billion

Growth rate

CAGR of 15.8% from 2024 to 2030

Historic year

2018 - 2022

Base year

2023

Forecast year

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Analytical tools, touch point type, deployment, organization size, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; New Zealand; Brazil; UAE; KSA; South Africa

Key companies profiled

Accenture Plc; Amdocs; Capgemini; CBRE; Cognizant; Delta BPO Solutions; Go4Customer; HCL Technologies Ltd.; Infosys Ltd. (Infosys BPM); International Business Machines Corp.; NCR Corp.; SODEXO; Teleperformance SE; TTEC Holdings, Inc.; Wipro

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Customer Experience Management Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global customer experience management market report on the basis of analytical tools, touch point type, deployment, organization size, end-use, and region:

-

Analytical Tools Outlook (Revenue; USD Billion, 2018 - 2030)

-

EFM Software

-

Speech Analytics

-

Text Analytics

-

Web Analytics & Content Management

-

Others

-

-

Touch Point Type Outlook (Revenue; USD Billion, 2018 - 2030)

-

Stores/Branches

-

Call Centers

-

Social Media Platform

-

Email

-

Mobile

-

Web Services

-

Others

-

-

Deployment Outlook (Revenue; USD Billion, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Retail

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Government, Energy & Utilities

-

Construction, Real Estate & Property Management

-

Service Business

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global customer experience management market size was estimated at USD 12.04 billion in 2023 and is expected to reach USD 13.66 billion in 2024.

b. The global customer experience management market is expected to grow at a compound annual growth rate of 15.8% from 2024 to 2030, reaching USD 32.87 billion by 2030.

b. The text analytics segment dominated the global customer experience management market in 2023, accounting for a revenue share of over 39.37%. The growing need for social media analytics and demand for sorting customer interactions or Voice of the Customer (VoC) across various digital touchpoints has contributed to the overall segment growth. Furthermore, text analytics enables predictive analytics with accurate sentiment data analysis and assists users in making critical business decisions by analyzing current and historical data to predict future outcomes. As a result of these factors, the segment is expected to be driven by the demand for predictive analytics among organizations over the forecast period.

b. The call centers segment led the global CEM market in 2023 and accounted for a revenue share of over 31.71%. The key driving factors include the drive for growth of the segment, the rising adoption of advanced contact center technologies, the growing adoption of cloud-based and virtual contact center solutions, the emerging role of social media in contact center operations, and streamlined customer interactions to achieve high customer satisfaction. Furthermore, the snowballing popularity of call centers has impelled businesses to invest in technologies that aid in improving call resolution rates, customer satisfaction rates, and multi-channel performance, among others.

b. The market growth can be attributed to the mounting importance of understanding customer behavior and preferences. This drives various brands and organizations to implement customer experience strategies, such as regularly communicating and engaging with customers, developing a long-term program, and utilizing automation to provide the best service performance to customers in real-time.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.