- Home

- »

- IT Services & Applications

- »

-

Customer Self-service Software Market Size Report, 2030GVR Report cover

![Customer Self-service Software Market Size, Share & Trends Report]()

Customer Self-service Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (Web Self-service, Virtual Assistants), By Service, By Deployment (Cloud, On premise), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-225-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Customer Self-service Software Market Summary

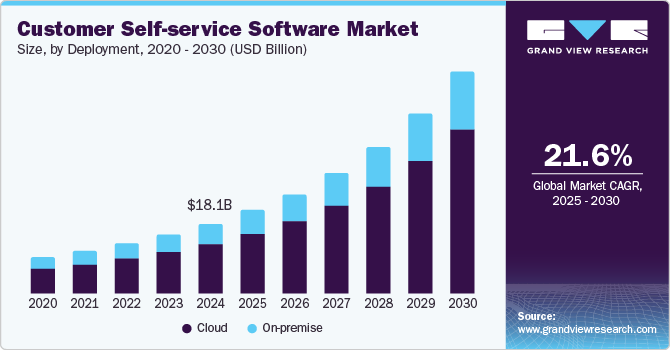

The global customer self-service software market size was estimated at USD 18.07 billion in 2024 and is projected to reach USD 57.21 billion by 2030, growing at a CAGR of 21.6% from 2025 to 2030. Enterprises increasingly recognize the significance of delivering instant information to customer queries, which helps improve productivity and operational efficiency. Moreover, companies are constantly competing to build strong relationships with customers to ensure their retention and attract new customers.

Key Market Trends & Insights

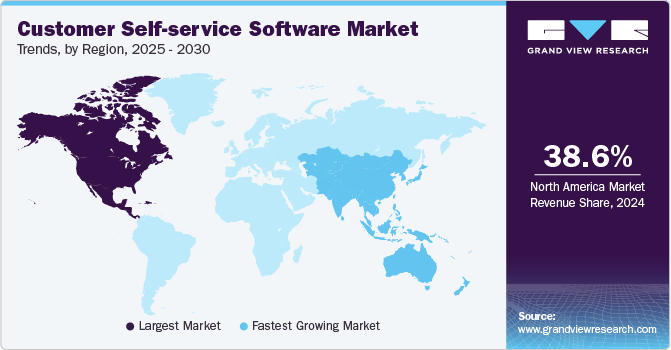

- North America customer self-service software market dolminated with a 38.6% of the global revenue share in 2024.

- Asia Pacific is projected to be the fastest-growing market during the forecast period.

- By solution, the web self-service segment held the largest revenue share of 30.6% in 2024.

- By end use, the healthcare segment is anticipated to witness the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 18.07 Billion

- 2030 Projected Market Size: USD 57.21 Billion

- CAGR (2025-2030): 21.6%

- North America: Largest market in 2024

This has created significant awareness regarding using advanced self-service solutions among businesses. Modern consumers expect immediate solutions to their queries and issues and 24/7 access to support. Self-service options are designed to meet such demands by allowing customers to resolve issues independently at any time. Moreover, consistent improvements in technologies such as artificial intelligence, machine learning, and natural language processing technologies make self-service tools more sophisticated, enabling better user interactions and more accurate responses.

The demand for customer self-service tools such as virtual assistants and interactive voice response (IVR) systems has increased substantially in recent years. Sectors such as manufacturing, retail, healthcare, and IT & telecom have become major end-users of these offerings. For instance, the need to improve service efficiency and boost customer engagement in the manufacturing industry has made integrating these solutions highly essential. This type of software empowers customers to access information easily, manage orders, and resolve issues independently. Customers can place, track, modify, and cancel orders through an online portal, improving transparency and reducing the need for direct support. Also, real-time visibility into inventory levels allows customers to check product availability and manage their supply requirements. Meanwhile, in the retail vertical, the use of self-service software has empowered customers to manage their shopping experiences independently, enhancing their convenience and satisfaction. This software enables customers to access information, make purchases, and resolve issues without requiring direct assistance from retail staff.

Organizations are deploying self-service software aggressively to boost their customer reach and ensure all-day support for their requests and queries. Enterprises can efficiently cater to evolving customer requirements, thereby substantially improving customer satisfaction and increasing the chance of customer retention. These types of software also help organizations manage employee relationships, by eliminating the need to procure specialized software for employee relationship management and customer relationship management. Businesses use analytics tools within self-service platforms to track customer interactions, identify trends, and improve the overall user experience based on feedback and usage patterns. With the continuously growing popularity of social media platforms, self-service options are extending to these channels, allowing customers to seek support and access information quickly. Moreover, the growing popularity of voice assistants has led some self-service solution providers to integrate voice recognition technology and enable customers to interact with systems using voice commands.

Solution Insights

The web self-service segment accounted for a leading revenue share of 30.6% in 2024 and is expected to maintain its position over the coming years. The segment’s demand has consistently increased owing to the rising popularity of digital support mechanisms that enable consumers and employees to assist themselves using relevant inputs. Web self-service refers to online systems that allow customers to access information, perform transactions, and resolve issues independently without the need for direct assistance from customer service representatives. This approach is increasingly becoming popular across various industries due to its convenience and efficiency. These solutions provide a seamless service experience to customers across different information channels. They ensure improved customer experience by enabling them to access services anywhere and anytime. This also allows organizations to allocate resources more effectively and lower their operational costs due to reduced need for live support.

The virtual assistants segment is anticipated to witness the fastest CAGR during the forecast period. These tools are often powered by artificial intelligence (AI) and are increasingly integrated into customer self-service solutions, providing a range of benefits that enhance customer experience and improve operational efficiency. Virtual assistants can operate continuously, allowing customers to access support and information anytime, irrespective of business hours. Virtual assistants instantly reply to customer inquiries, reducing wait times and improving satisfaction by addressing questions or issues in real-time. Virtual assistants can handle a high volume of inquiries simultaneously, allowing businesses to scale their customer service efforts without a corresponding increase in workforce or investments. Companies also focus on rapidly improving their capabilities in this space by integrating with other functions. For instance, in October 2024, 8x8, a leading Voice over IP product company in the U.S., announced that it had expanded the availability of AI-enabled voice capability for its 8x8 Intelligent Customer Assistant. This expansion is expected to drive better customer engagement by offering a highly personalized experience.

Service Insights

The professional services segment accounted for the largest revenue share in the market in 2024. The rapidly increasing popularity of analytics and Artificial Intelligence (AI) technologies in automation that can help enhance workforce efficiency is anticipated to drive segment growth. Professional services ease the configuration and deployment of self-service solutions for both on-premise and cloud environments. Businesses increasingly seek to leverage the knowledge and experience of professionals who understand the best practices for self-service deployment that can lead to a more effective implementation. Also, comprehensive testing and quality assurance minimize the risk of issues arising post-launch, leading to smoother operations. Organizations that develop self-service software, such as Zendesk, Salesforce, and Freshdesk, often provide professional services to assist with deployment.

On the other hand, the managed services segment is anticipated to expand at the fastest CAGR from 2025 to 2030. This approach involves outsourcing the management and maintenance of self-service systems to a third-party provider. This allows organizations to focus on their core business functions while benefiting from the expertise and resources of managed service providers (MSPs). MSPs bring specialized knowledge and experience in deploying and managing self-service solutions, leading to more effective implementation. Furthermore, they provide flexibility to scale self-service capabilities in accordance with business growth and evolving customer needs without significant investment in infrastructure. Platforms, including Zendesk and Freshdesk, generally offer managed services as part of their product suites, providing extensive support for implementation and ongoing management.

Deployment Insights

The cloud-based software segment accounted for a larger revenue share in the global market in 2024. Organizations are increasingly focusing on the modernization of their customer engagement processes through the adoption of cloud-based architecture. This deployment model facilitates seamless and secure data sharing across different functions. In recent years, a substantial increase in call volumes has compelled organizations to deploy AI-based virtual agents to offer client assistance. Cloud-based solutions can effectively handle the same intents as human agents. This helps the companies to deliver quality conversational experience, offer instant and on-demand services, and provide automated support. Additionally, cloud-based solutions can be accessed from anywhere with an internet connection, allowing customers to find information and resolve issues at their convenience. Platforms such as Zendesk offer a comprehensive cloud-based platform for customer support, including ticketing, chat, and a self-service portal. Meanwhile, the Salesforce Service Cloud integrates self-service capabilities with CRM, allowing customers to access resources, submit requests, and track issues.

The on-premise segment is anticipated to account for a substantial contribution to the overall market in the coming years. While on-premise solutions are witnessing lower demand compared to cloud-based offerings They provide specific advantages that have maintained their adoption, particularly among larger enterprises. Organizations can customize their software to meet specific needs and workflows while also having greater control over the flow of sensitive customer information. Moreover, these solutions can be easily integrated with legacy systems and existing databases within the organization. Market players have maintained a portfolio of both on-premise and cloud solutions to cater to a wider customer base. For instance, SAP provides on-premise solutions that allow businesses to manage customer service interactions and self-service capabilities internally. Another example is Microsoft Dynamics 365, which can be deployed on-premise, offering self-service features alongside robust CRM capabilities.

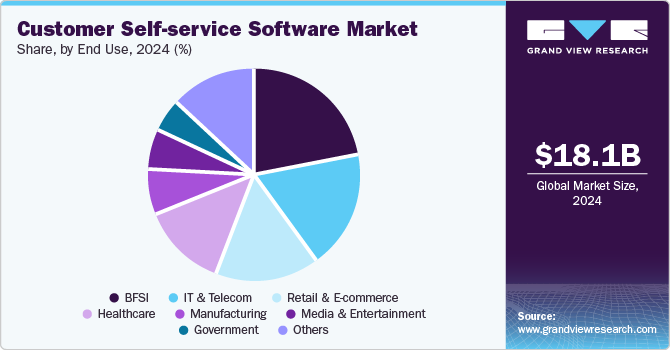

End Use Insights

The BFSI segment accounted for the largest revenue share in the market in 2024 and is expected to maintain its leading position during the forecast period. Self-service software has become increasingly important as financial organizations are seeking to enhance customer experience, improve efficiency, and reduce operational costs. Customers can access services and information anytime facilitating them to conveniently manage their accounts, apply for products, and get support without waiting for business hours. Moreover, they can apply for loans, credit cards, insurance policies, and other financial products through user-friendly online forms thus streamlining the application process. The use of AI-enabled chatbots and virtual assistants provide instant support for customer inquiries, guiding users through processes such as fund transfers, policy updates, or claims filing. This has helped to shape the demand for customer self-service solutions in this sector. A Corporate Insight survey carried out in October 2023 among consumers who had utilized applications from credit card companies found that around 24% of the respondents had interacted with virtual assistants in the preceding six months. This was a sharp increase from 4%, which was witnessed in October 2019, highlighting increased awareness regarding these services.

Meanwhile, the healthcare segment is anticipated to witness the fastest CAGR during the forecast period. The need to continuously improve patient interactions with healthcare providers and ensure better outcomes has resulted in an increased integration of self-service solutions in the healthcare ecosystem. Moreover, these solutions are also profitable for medical establishments, as they seek to enhance patient engagement, improve operational efficiency, and streamline administrative processes. Self-service tools empower patients to proactively manage their health and healthcare experiences. It also enables patients to make informed decisions by providing access to health information and resources whenever needed. Furthermore, they can help improve adherence to treatment plans and preventive care guidelines by providing timely reminders and educational resources. Services such as Teladoc and Amwell provide self-service solutions for scheduling virtual consultations with healthcare professionals. Healthcare providers are increasingly offering patient portals where individuals can access medical records, lab results, and educational materials all on a single platform. Such features ensure the provision of a more complete experience that benefits both patients and medical professionals.

Regional Insights

North America customer self-service software market with 38.6% of the global revenue share in 2024. The demand for customer self-service software in regional economies such as the U.S. and Canada has been steadily increasing. The growth of self-service software in these countries is aided by the growing preference of customers to receive quick and convenient solutions to their inquiries. Self-service alternatives, such as chatbots, knowledge bases, and FAQs, enable users to find answers without waiting for human assistance. Moreover, businesses' growing focus on reducing operational costs has driven demand for this software. Such software can handle a significant volume of queries, allowing companies to allocate human resources to more complex requirements. Furthermore, the extensive deployment of cloud-based offerings and high penetration of social media platforms are expected to ensure steady market growth in the region over the coming years.

U.S. Customer Self-service Software Market Trends

The U.S. customer self-service software market accounted for a dominant revenue share of the regional market in 2024, aided by the presence of several major players such as Microsoft, Oracle, Salesforce, and Verint Systems. The growing pace of digital transformation in the economy has led to the widespread integration of self-service solutions into broader customer engagement strategies, aligning with the shift toward online and mobile interactions. Increasing regulations around data privacy and security, such as the California Consumer Privacy Act (CCPA), the Health Insurance Portability and Accountability Act (HIPAA), and the Gramm-Leach-Bliley Act (GLBA), have compelled the use of self-service solutions. Organizations prioritize secure access to information and help businesses stay compliant while offering customer support. Extensive use of machine learning and AI technologies enables businesses to achieve optimum results, driving market growth.

Europe Customer Self-service Software Market Trends

Europe customer self-service software market accounted for a notable revenue share of the global market in 2024. European consumers increasingly value autonomy in managing their interactions with businesses. Self-service solutions allow customers to find information and resolve issues independently, thus enhancing their overall experience. Moreover, the region’s diverse linguistic landscape drives substantial demand for self-service solutions that can accommodate multiple languages and allow businesses to effectively cater to a wider audience. Companies are also integrating self-service options across multiple channels, including websites, mobile apps, and social media, to provide a seamless customer experience. Many companies are creating online communities where customers can support each other through forums and knowledge-sharing, thus complementing conventional self-service tools.

Asia Pacific Customer Self-service Software Market Trends

Asia Pacific is anticipated to emerge as the fastest-growing market during the forecast period, aided by the rapid pace of commercialization and urbanization in the region and extensive internet penetration. The sharp growth in smartphone usage in regional economies such as Japan, China, and India has allowed more customers to utilize online self-service options, making these tools more attractive to businesses. The booming e-commerce sector has also enhanced the appeal of self-service solutions that help customers track their orders, manage returns, and access support easily. As per industry experts, in 2023, 60% of the leading organizations in Asia are expected to incorporate generative AI-powered customer experience solutions by 2027. Their integration into existing processes is anticipated to boost customer satisfaction, retention, and service, highlighting the influence of such advanced technologies in driving industry developments.

Key Customer Self-service Software Company Insights

Some key companies involved in the customer self-service software market include Salesforce, Zendesk, and Avaya, among others.

-

Zendesk is a U.S.-based software-as-a-service (SaaS) product provider that caters to customer support, sales, and communications. Its customer service platform helps organizations efficiently manage one-on-one customer interactions, predict general questions and design answers or solutions, gather customer data, engage with customers based on data insights, and offer tools that enable them to understand customers better. Zendesk offers omnichannel support through the integration of various communication channels (email, chat, phone, and social media) into a single platform.

-

Avaya provides business communications solutions specializing in unified communications, contact center technologies, and collaboration tools. The company develops solutions that integrate voice, video, messaging, and collaboration tools to enhance communication within organizations. Avaya offers cloud-based communications and customer experience solutions, including Avaya Cloud Office, which combines collaboration and communication in one platform.

Key Customer Self-service Software Companies:

The following are the leading companies in the customer self-service software market. These companies collectively hold the largest market share and dictate industry trends.

- Salesforce, Inc.

- Oracle

- Microsoft

- SAP SE

- Zendesk

- Freshworks Inc.

- Avaya LLC

- Zoho Corporation Pvt. Ltd.

- HubSpot, Inc.

- Verint Systems Inc.

Recent Developments

-

In October 2024, Freshworks announced the launch of the Freddy AI Agent, a new generation of autonomous service agents. This offering brings several advantageous features to optimize both customer and employee experience, such as quick deployment without needing to code or train models and the provision of highly personalized services across multiple channels in multiple languages.

-

In September 2024, Verint launched the Verint Knowledge Automation Bot, which forms part of the company’s highly advanced portfolio of Agent Copilot Bots. The new offering automatically searches through different enterprise content sources and utilizes generative AI to provide a quick and easy-to-understand response to customer queries.

Customer Self-service Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.52 billion

Revenue Forecast in 2030

USD 57.21 billion

Growth rate

CAGR of 21.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Solution, service, deployment, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Salesforce, Inc.; Oracle; Microsoft; SAP SE; Zendesk; Freshworks Inc.; Avaya LLC; Zoho Corporation Pvt. Ltd.; HubSpot, Inc.; Verint Systems Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Customer Self-service Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global customer self-service software market report based on solution, service, deployment, end use, and region.

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Web Self-service

-

Mobile Self-service

-

Virtual Assistants

-

Email Engagement

-

Interactive Voice Response (IVR)

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Managed Services

-

Professional Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Manufacturing

-

Retail & E-commerce

-

Media & Entertainment

-

IT & Telecom

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.