- Home

- »

- IT Services & Applications

- »

-

Customer Success Platforms Market Size Report, 2030GVR Report cover

![Customer Success Platforms Market Size, Share & Trends Report]()

Customer Success Platforms Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-376-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Customer Success Platforms Market Summary

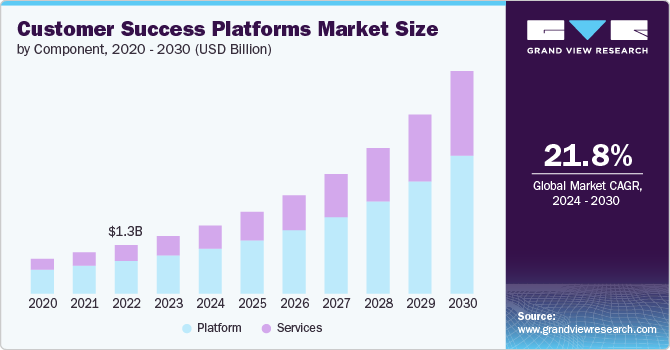

The global customer success platforms market was valued at USD 1.52 billion in 2023 and is projected to reach USD 5.89 billiion, growing at a CAGR of 21.8% from 2024 to 2030. The increasing emphasis on enhancing customer experience and retention in a competitive business landscape is prompting companies to invest in customer success solutions.

Key Market Trends & Insights

- The North America region held the largest market share, accounting for 36.01% of the total market revenue in 2023.

- By component, the platform segment dominated the market in 2023 and accounted for a 66.7% share of the global revenue.

- By deployment, the cloud segment dominated the market in 2023 and accounted for a 50.4% share of the global revenue.

- By enterprise size, the large enterprises segment dominated the market in 2023 and accounted for 57.9% a share of the global revenue.

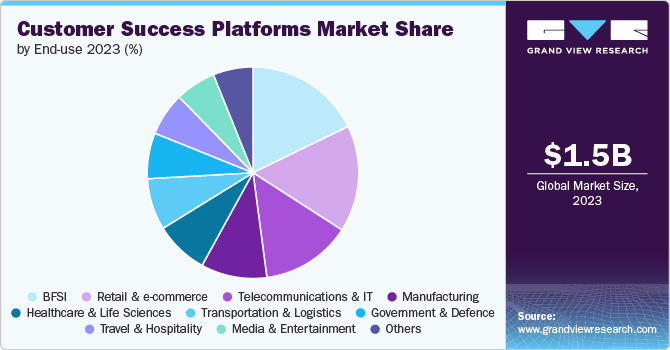

- By end use, the banking, financial services, and insurance (BFSI) segment dominated the market in 2023 and accounted for a 17.8% share of the global revenue.

Market Size & Forecast

- 2023 Market Size: USD 1.52 Billion

- 2030 Projected Market Size: 5.89 Billion

- CAGR (2024-2030): 21.8%

- North America: Largest Market in 2023

In addition, the rising adoption of cloud-based services and the integration of artificial intelligence and machine learning into customer success platforms are improving their efficiency and effectiveness. The demand for actionable insights from customer data to drive business strategies is also fueling market growth.

The customer success platforms are designed to help businesses proactively manage customer relationships, increase retention rates, and maximize customer lifetime value. These platforms integrate various functionalities, such as customer analytics, engagement tools, and automated workflows, to enhance the overall customer experience. As companies recognize the importance of retaining existing customers and fostering long-term relationships, they are investing in technologies that enable them to deliver personalized experiences and proactive support. Customer success platforms provide the infrastructure needed to monitor customer health, predict churn, and intervene effectively to prevent customer dissatisfaction.

The rising demand for data-driven decision-making has become a basis of new business strategies, particularly in customer success initiatives. Customer success platforms play a crucial role in this landscape by leveraging sophisticated data analytics to gather insights into various aspects of customer behavior, preferences, and satisfaction levels. Data-driven decision-making fosters a culture of continuous improvement within organizations. By regularly analyzing customer data, businesses can iterate on their customer success strategies, test new approaches, and measure the impact of changes over time. This iterative process allows businesses to optimize their operations, reduce inefficiencies, and ultimately drive better business outcomes.

Artificial intelligence and machine learning advancements are transforming customer success platforms by enabling more sophisticated predictive analytics and automation capabilities. These technologies allow businesses to automate routine tasks, personalize customer interactions at scale, and proactively address potential issues before they escalate. As AI evolves, customer success platforms are expected to become even more integral to businesses looking to optimize customer engagement and retention strategies. For instance, in July 2023, ChurnZero introduced Customer Briefs, a new AI feature designed to aggregate essential information, engagement history, and activities of customers into one succinct, useful summary at the click of a button. This tool is powered by ChurnZero's own innovative CS AI (Customer Success AI), marking the first time a generative AI assistant has been integrated directly into a Customer Success platform. Offering an unprecedented blend of qualitative and quantitative insights, Customer Briefs aims to provide users with the most current and accurate context for any form of customer engagement, whether it be meetings, renewal discussions, strategy advisories, or other interactions.

Component Insights

The platform segment dominated the market in 2023 and accounted for a 66.7% share of the global revenue. As businesses digitize their operations and interactions with customers, there is a growing need for integrated platforms that can support these initiatives. Customer success platforms streamline internal processes and enable businesses to deliver consistent and personalized experiences across digital channels. This alignment with digital transformation strategies positions platform-based solutions as essential investments for businesses.

The services segment is projected to witness significant growth from 2024 to 2030. The ongoing need for technical support and maintenance is a critical factor driving growth of the services segment. As businesses rely more heavily on customer success platforms for customer retention and engagement strategies, technical issues or downtime can have significant negative impacts. Support services assure businesses that they can promptly address and resolve any problems that arise, ensuring the platform's reliability and performance. These services often include troubleshooting, software updates, and regular maintenance, which are vital for the smooth operation of the platform. For instance, in March 2024, Yext, a U.S.-based digital presence platform company launched a new customer success program that takes a proactive approach to services and support. The program aims to help Yext customers accelerate business results by leveraging the platform and expert insights to identify and resolve issues before they become problems and seize opportunities faster.

Deployment Insights

The cloud segment dominated the market in 2023 and accounted for a 50.4% share of the global revenue due to the increasing adoption of cloud computing across industries. As businesses shift their IT infrastructure to the cloud, they are leveraging the scalability, flexibility, and cost-effectiveness that cloud-based solutions offer. Customer success platforms deployed on the cloud enable companies to easily scale their operations, adding or reducing resources as needed without the constraints of physical hardware.

The on-premise segment is projected to witness significant growth from 2024 to 2030 owing to the growing focus on data security and privacy. In industries such as finance, healthcare, where handling sensitive data is routine, stringent regulatory requirements often necessitate keeping data within the organization’s own infrastructure. On-premise customer success platforms enable these organizations to maintain full control over their data, ensuring compliance with regulations such as GDPR, HIPAA, and others. The ability to implement customized security measures and have direct oversight of data storage and management processes makes on-premise solutions particularly attractive to these sectors.

Enterprise Size Insights

The large enterprises segment dominated the market in 2023 and accounted for 57.9% a share of the global revenue due to the increasing complexity of products and services offered by large enterprises. As these companies expand their offerings and enter new markets, they face the challenge of ensuring consistent and high-quality customer support. Customer success platforms facilitate seamless coordination across different departments and regions, ensuring that customers receive timely and effective assistance regardless of the complexity of their needs. This capability is particularly valuable for large enterprises with diverse product portfolios and global operations.

The SMEs segment is projected to witness significant growth from 2024 to 2030. The increasing awareness of the long-term benefits of customer success strategies is driving adoption among SMEs. This growing awareness encourages more SMEs to invest in these platforms, recognizing that proactive customer success management can lead to improved business performance, higher customer lifetime value, and greater scalability. According to the U.S. Chamber’s Empowering Small Business report published in September 2023, around 95% of small businesses in the U.S. incorporate at least one form of technology platform into their operations. There is a notable correlation between the adoption of advanced technologies and an increase in sales, employment opportunities, and overall profitability.

Application Insights

The sales & marketing optimization segment dominated the market in 2023 and accounted for a 25.2% share of the global revenue driven by the advancement in data analytics and artificial intelligence (AI) technologies. Sales and marketing optimization platforms leverage these technologies to provide deep insights into customer behavior, campaign effectiveness, and market trends. By utilizing AI-driven predictive analytics, businesses can forecast customer needs, tailor marketing messages, and prioritize sales efforts more accurately. This capability enhances the efficiency of sales and marketing teams and improves the precision of targeting and personalization, leading to higher conversion rates and customer satisfaction.

The risk & compliance management segment is projected to witness significant growth from 2024 to 2030. The growing emphasis on corporate governance and ethical practices is propelling the demand for risk and compliance management solutions. Stakeholders, including investors and customers, are increasingly holding companies accountable for their governance practices. Customer success platforms with compliance management functionalities allow businesses to demonstrate transparency and accountability. They provide audit trails, documentation, and reporting tools that support governance initiatives and foster a culture of compliance throughout the organization.

End-use Insights

The banking, financial services, and insurance (BFSI) segment dominated the market in 2023 and accounted for a 17.8% share of the global revenue. In the BFSI sector, acquiring new customers is often more costly than retaining existing ones. Customer success platforms play a crucial role in boosting customer retention by identifying at-risk customers and implementing strategies to re-engage them. By leveraging data analytics, these platforms can predict churn and provide actionable insights to prevent it. For instance, in May 2024, Mashreq, a financial institute in the Middle East region collaborated with Silent Eight, a Singapore-based technology company leveraging AI to create compliance platforms aimed at enhancing its capabilities in screening names and managing alerts for adverse media in compliance with sanctions and regulations against money laundering. This strategic move, leveraging Silent Eight’s innovative platform, promises to accelerate Mashreq's processing capabilities while minimizing onboarding delays for new customers.

The media and entertainment segment is projected to witness significant growth from 2024 to 2030. With the rise of streaming services, on-demand content, and digital platforms, traditional media companies are transitioning from one-time transactions to ongoing subscription models. Customer success platforms enable these companies to monitor and analyze user engagement, preferences, and satisfaction levels in real-time. This data-driven approach helps media companies personalize content recommendations, optimize user experiences, and reduce churn, thereby enhancing customer lifetime value.

Regional Insights

The North America regiondominated the customer success platforms market in 2023 and accounted for a 36.01% share of the global revenue due to growing adoption of Software as a Service (SaaS) models across various industries. As businesses transition to subscription-based models, the need to ensure ongoing customer satisfaction and retention becomes paramount. Customer success platforms offer tools and insights to manage and enhance customer relationships, reducing churn and driving long-term value. This shift towards SaaS has prompted many organizations to invest in these platforms to better understand and serve their customer base, ultimately leading to higher levels of customer loyalty and repeat business.

U.S. Customer Success Platforms Market Trends

The customer success platforms market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The shift towards cloud-based customer success platforms is a major growth driver in the U.S. market. Cloud-based solutions offer greater scalability, flexibility, and accessibility, making them attractive to businesses of all sizes.

Asia Pacific Customer Success Platforms Market Trends

The customer success platforms market in Asia Pacific is expected to grow at the highest CAGR of 23.8% from 2024 to 2030. The APAC region is at the forefront of adopting advanced technologies such as artificial intelligence (AI) and automation. Businesses in the region are increasingly leveraging these technologies to enhance their customer success efforts, such as automating customer support, personalization, and predictive analytics. This trend is expected to continue, fueling the growth of the customer success platforms market in the APAC region.

Europe Customer Success Platforms Market Trends

The Europe region is expected to witness notable growth from 2024 to 2030, driven by several key factors. With more European companies moving their operations to the cloud, there is a rising demand for software solutions that can be accessed and used from anywhere, at any time. Cloud-based customer success platforms offer flexibility and scalability, making them an attractive option for companies of all sizes.

Key Customer Success Platforms Company Insights

Key players operating in the network emulator market include ChurnZero, Cisco Systems, Inc., ClientSuccess, Freshworks Inc., Gainsight, HubSpot, Inc., Medallia Inc., Salesforce.com, Inc., SmartKarrot, and Totango. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, ClientSuccess revealed acquisition of Baton, a platform for customer onboarding and implementation that aims to offer fast, scalable solutions for customer integration, improve the management of customer-centric projects, and boost customer interaction. This move significantly propels ClientSuccess's aim to providing unmatched solutions in customer onboarding and implementation, available both as an independent solution and as a fully integrated option within its premier customer success platform.

-

In February 2024, Totango and Catalyst, a customer growth platform based in the U.S., have announced their merger to create a formidable customer growth platform. This combined solution aims to cover the entire customer lifecycle comprehensively, enabling organizations to demonstrate value and enhance revenue generation from their customer base. By integrating their strengths, this merger offers a platform that significantly enhances customer experiences at an enterprise level, focusing on post-sale revenue activities such as account management, renewals, adoption, and upsell and cross-sell opportunities. This integration provides businesses with artificial intelligence tools to deeply understand their customers and pinpoint opportunities for revenue expansion.

-

In April 2024, Workato, a U.S.-based enterprise automation platform, entered into a strategic partnership with AWS, a move designed to strengthen customer success through collaborative cloud investments. This initiative seeks to offer intuitive and secure AI-driven automation solutions to current and prospective customers of AWS and Workato worldwide. The partnership emphasizes the mutual dedication of Workato and AWS towards making automation and integration solutions more accessible, especially in the critical areas of security and governance.

Key Customer Success Platforms Companies:

The following are the leading companies in the customer success platforms market. These companies collectively hold the largest market share and dictate industry trends.

- ChurnZero

- Cisco Systems, Inc.

- ClientSuccess

- Freshworks Inc.

- Gainsight

- HubSpot, Inc.

- Medallia Inc.

- Salesforce.com, inc.

- SmartKarrot

- Totango

Customer Success Platforms Market Report Scope

Attribute

Details

Market size value in 2024

USD 1.81 billion

Revenue forecast in 2030

USD 5.89 billion

Growth rate

CAGR of 21.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, end-use, region

Regional scope

North America, Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ChurnZero; Cisco Systems, Inc.; ClientSuccess; Freshworks Inc.; Gainsight; HubSpot, Inc.; Medallia Inc.; Salesforce.com, Inc.; SmartKarrot; Totango

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Customer Success Platforms Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global customer success platforms market report based on component, deployment, enterprise size, application, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sales & Marketing Optimization

-

Customer Service

-

Risk & Compliance Management

-

Reporting & Analytics

-

Customer Segmentation & Onboarding

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Retail and E-commerce

-

Telecommunications and IT

-

Manufacturing

-

Transportation and Logistics

-

Government and Defense

-

Healthcare and Life Sciences

-

Media and Entertainment

-

Travel and Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global customer success platforms market size was estimated at USD 1.52 billion in 2023 and is expected to reach USD 1.81 billion in 2024.

b. The global customer success platforms market is expected to grow at a compound annual growth rate of 21.8% from 2024 to 2030 to reach USD 5.89 billion by 2030.

b. The platform segment held the largest share, 66.7% in 2023. As businesses digitize their operations and interactions with customers, there is a growing need for integrated platforms to support these initiatives.

b. Some key players operating in the customer success platforms market include ChurnZero, Cisco Systems, Inc., ClientSuccess, Freshworks Inc., Gainsight, HubSpot, Inc., Medallia Inc., Salesforce.com, inc., SmartKarrot, and Totango

b. The increasing emphasis on enhancing customer experience and retention in a competitive business landscape is prompting companies to invest in customer success solutions. Additionally, the rising adoption of cloud-based services and the integration of artificial intelligence and machine learning into customer success platforms are improving their efficiency and effectiveness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.