- Home

- »

- Next Generation Technologies

- »

-

Cyber Security Market Size, Share & Trends Report, 2030GVR Report cover

![Cyber Security Market Size, Share & Trends Report]()

Cyber Security Market Size, Share & Trends Analysis Report By Component, By Security Type, By Solution, By Services, By Deployment, By Organization Size, By Verticals, By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-115-3

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Cyber Security Market Size & Trends

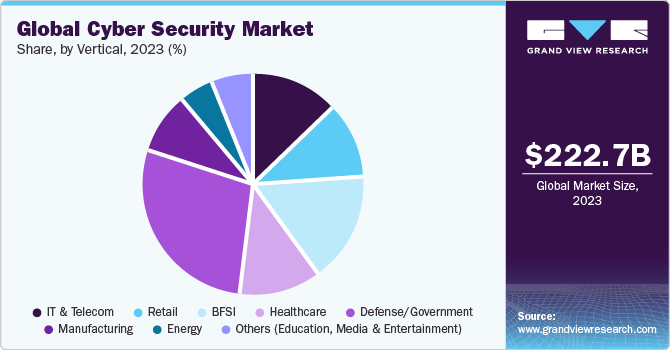

The global cyber security market size was estimated at USD 222.66 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 12.3% from 2023 to 2030. A growing number of cyber-attacks owing to the proliferation of e-commerce platforms, emergence of smart devices, and deployment of cloud are some key factors propelling market growth. Moreover, increasing usage of devices equipped with the Internet of Things (IoT) and intelligent technologies is expected to increase cases of cyber threats. As such, end-user organizations are anticipated to integrate advanced cyber security solutions to mitigate cyber-attack risk, supporting the cyber security market growth.

With cyber environment emerging as a highly integrated system, need for an adaptive, multi-layered, and self-learning security system has become imperative. In addition, factors such as emergence of mobile-networked devices, prevalence of electronic communications, growth of social media, and an increasing reliance on Big Data have created a need for defense cybersecurity system to be updated with the changing cyber threat scenario. Governments have increased their spending on cybersecurity solutions to protect devices and confidential data from cyberattacks, supporting market growth.

Advancements in emerging technologies, such as AI in cyber security, Machine Learning (ML), big data analytics, IoT, 5G, edge computing, and cloud computing, are allowing market players to introduce new solutions based on these technologies, attract potential business clients, and expand their revenue streams. For instance, in June 2021, Broadcom Inc. launched Adaptive Protection, a new security solution, as a part of Symantec’s Endpoint Security Solution. The solution is powered by ML technology and provides customized and automated enhanced security on cyber-attacks while saving customers' overhead costs by leveraging the power of AI to customize the endpoint security.

Globally, several employees are anticipated to continue working from remote premises or homes. Choose Your Own Device (CYOD) and Bring Your Own Device (BYOD) models allow employees to access business information through cloud platforms, making them vulnerable to data theft. Traditional cyber security solutions cannot protect devices from all forms of Advanced Persistent Threats (APT) or malware attacks, fueling demand for advanced cyber security solutions. Moreover, cyber security training market is booming, driven by the ever-increasing threat of cyberattacks. Businesses of all sizes are realizing the importance of investing in cybersecurity training for their employees, as even a single cyber attack can have devastating consequences.

Stringent regulations being drafted by various governments regarding data security and privacy protection & compliance are particularly expected to drive demand for enterprise cybersecurity solutions. In April 2019, European Union adopted “EU Cybersecurity Act”, which introduces a system of certification schemes across Europe and also strengthens & revamps EU Agency for Cybersecurity (ENISA) and EU Agency for Cybersecurity.

The surge in cyber threats has propelled the demand for cyber security jobs globally, driving the expansion in the cyber security market as organizations seek for skilled professionals to fortify their digital defenses and protect against evolving cyber risks. Further, key players in the market are also introducing free cyber security certifications courses to train your professionals and students to utilize the advanced security solutions in a more strategic manner. For instance, Google LLC announced a cyber security certification courses and scholarships to more than 20,000 students under the Japan Reskilling Consortium, an addition to existing partnerships with the Cyber Security Agency of Singapore and CERT-IN in India, through which the company aimed to offer 125,000 scholarships across Asia Pacific.

Market Characteristics & Concentration

The ongoing digitalization wave has resulted in significant changes across industries such as IT, BFSI, Healthcare, and Manufacturing. Businesses are investing in the latest technologies, such as 5G, IoT, AI, ML, and cloud, which is expected to generate enormous opportunities for the cyber security market. The integration of artificial intelligence (AI) and machine learning (ML) in cybersecurity solutions. These technologies enable more advanced threat detection and response capabilities by analyzing vast amounts of data to identify patterns and anomalies that may indicate potential security breaches. Thus, companies are taking significant steps to integrate advanced technologies in their security solution offerings.

Cloud technologies offer a wide array of benefits to telecom companies, such as helping in delivering a diverse set of applications and managing data. As such, several telecom companies are commercializing their respective “cloud as a user” services owing to cost flexibility associated with them and are also offering new solutions to their customers through cloud networks. Telecom companies are equally leveraging cloud platforms to develop new value propositions, which can potentially create new business models and enhance experience for subscribers. For instance, Etisalat and MTN Group have monetized their cloud offerings by providing a suite of cloud services that can potentially enable smaller businesses to scale up their operations.

The global cyber security market is also witnessing a high level of merger and acquisition initiatives by various leading and emerging players. For instance, in September 2023, Cisco Systems, Inc. a digital communication conglomerate and security solutions company announced the acquisition of Splunk Inc., an emerging cyber security solutions provider. This acquisition is expected to help organizations enhance their digital capabilities and accelerate Cisco Systems' strategy to securely connect everything possible. The integration of these two leaders in security, AI, and observability will offer greater and more secure solutions.

The global cyber security market is also subject to rules and regulations set by international, regional, and country-level regulatory bodies. In June 2022, the U.S. government passed two cybersecurity bills into their law. Under the first law, The State and Local Government Cybersecurity Act of 2022 is intended to strengthen collaboration between the Cybersecurity and Infrastructure Security Agency (CISA) and state, territorial governments, local, and tribal. Thus, these significant steps are expected to strengthen the cyber security market.

There are negligible direct substitutes for cyber security solutions as a cybersecurity suite comprises multiple solutions, ranging from network security to data protection. However, there are opportunities for internal substitution as organizations are expected to move from a prevention-centric approach to an analytics-driven, risk-based approach.

The demand for healthcare cyber security, BFSI cyber security, Aviation cyber security, and automotive cyber security is drastically increasing. The key factors including the emergence of IoT and connected technologies, rapid adoption of smartphones for digital payments, and use of unsecured networks for accessing organizational servers are some of the primary factors driving the demand for technologically advanced cyber security solutions among businesses.

Component Insights

Services segment accounted for the largest revenue share of 54.3% in 2022. Strong preference of organizations for deploying suitable cyber security solutions based on organizational structure is driving the adoption of cyber security services across several industries and sectors. Small and Medium-sized Enterprises (SMEs) have limited budgets due to which these organizations prefer consulting before implementing any solutions, supporting segment growth in the market. Several organizations are subscribing to cyber security services as part of their efforts to build a robust security structure for mitigating cyberattacks.

Hardware segment is expected to register the fastest CAGR of 14.8% over the forecast period as several organizations are implementing cybersecurity platforms and upgrading their existing platforms. Security vendors are developing cyber security solutions based on artificial intelligence and machine learning, which necessitate high-end IT infrastructure. With a notable increase in cyber threats from several anonymous networks, various end-user businesses and Internet Service Providers (ISPs) are anticipated to deploy advanced security hardware, such as encrypted USB flash drives, as Intrusion Prevention Systems (IPS).

Security Type Insights

Infrastructure protection segment accounted for the largest revenue share of 27.0% of the overall revenue in 2022. Infrastructure protection helps in ensuring the stability, security, and resilience of critical organization systems that support the functioning of an organization. Infrastructure protection systems help in securing physical and virtual assets including transportation networks, communication systems, and in-house operational assets. The market is witnessing greater collaboration among government agencies, private enterprises, and security professionals, developing comprehensive and adaptive protection frameworks to identify and respond to risks in a rapidly evolving threat environment.

Cloud security segment is expected to exhibit the fastest CAGR of more than 15.0% over the forecast period. Growing demand for managed security solutions and increasing adoption of cloud is expected to drive the demand for cloud security solutions. Major companies operating in the cloud security market are focusing on strengthening their product portfolios to attract potential business clients. For instance, in October 2022, Datadog, Inc., an IT security solutions company, launched a Cloud Security Management solution that combines capabilities from Cloud Workload Security (CWS) and Cloud Security Posture Management (CSPM) to assist security and DevOps teams in enhancing the security of cloud-native applications.

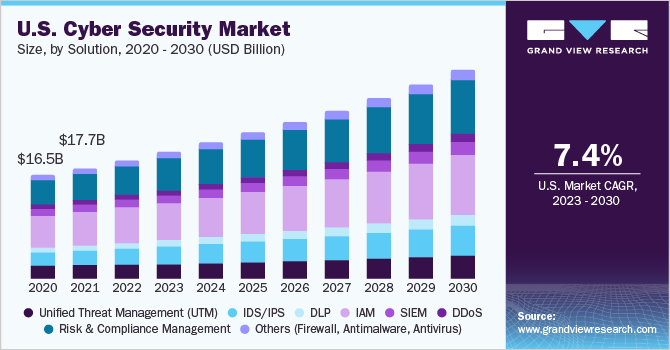

Solutions Insights

Identity and Access Management (IAM) segment accounted for the largest revenue share of 29.5% in 2022. IAM solutions mitigated identity theft through risk-based programs with features that focus on implementing entitlement management and logical access control. Increasing spending on security solutions by large-scale enterprises and government bodies to adhere to regulatory compliance and control identity theft is anticipated to boost segment growth. Growing unauthorized access is impelling various end-use companies to adopt IAM to mitigate digital security risks and provide a secure platform for sharing information within the organization.

Intrusion Detection Systems (IDS)/Intrusion Prevention Systems (IPS) segment is expected to exhibit the highest growth rate with a CAGR of more than 13% over the forecast period. Increasing adoption of network security products and growing IT security spending are expected to drive the segment growth over the forecast period. An IDS/IPS consistently monitors the entire traffic on the network and identifies any malicious behavior observed within a network.

Services Insights

Professional services segment held the highest market share of 72.3% in 2022, owing to rising demand for professional services, such as physical security testing, enterprise risk assessment, and penetration testing. Moreover, lack of skilled cybersecurity professionals is another key factor driving the segment's growth. End-user organizations prefer professional service providers' consultation and expertise to minimize enterprise security risks with the implementation of cost-effective security solutions.

Managed services segment is anticipated to expand at a CAGR of 12.4% during the forecast period due to a growing demand for IT security services to maintain security solutions. Managed services offer a cost-effective way to manage the organization's IT security workload without any need for the internal team. Furthermore, these service providers focus on enhancing security operations by observing threat patterns & managing security solutions to minimize cyber-attacks.

Deployment Insights

On-premises segment held the highest market share of 61.7% in 2022 and is expected to maintain its dominance over the forecast period. Majority of large enterprises focus on complete ownership of the solutions to ensure an optimum level of data security, which is driving segment growth. Moreover, on-premises security solutions reduce the dependency on third-party companies providing data monitoring and protection.

Cloud segment is anticipated to expand at a CAGR of 13.0% during the forecast period. The significant growth can be attributed to the migration of on-premises solutions to cloud platforms by enterprises. Furthermore, cloud-based solutions are cost-effective and easy to deploy & manage, which contributes to the segment growth. In addition, cloud technology allows solutions to access remotely across various devices, which is anticipated to drive the segment growth.

Organization Size Insights

Large enterprise segment held the highest revenue share of 68.5% in 2022. Increased spending by large enterprises on IT infrastructure to strengthen digital security to protect the large volumes of data storage is driving the market growth. Furthermore, large enterprises possess several servers, storage equipment, endpoints, & networks, which make them vulnerable to substantial monetary losses due to cyber-attacks. To avoid such issues, large enterprises are focusing on adopting cyber security solutions to secure their data, supporting market growth.

Small and Medium Enterprises (SMEs) segment is expected to register the highest growth rate of 13.3% over the forecast period. Due to budget constraints, SMEs are more vulnerable to cyber-attacks owing to their low level of security. Moreover, a lack of security policies and employee skills also makes them prone to cyber-attacks. To overcome these challenges, SMEs resort to cyber security insurance as it protects them from financial losses caused by malicious software attacks and data breaches, supporting the segment's growth.

Vertical Insights

Defense/government segment held the highest market share of more than 25% of the overall market in 2022. Cybersecurity solutions offer network integrity solutions to defense and government agencies, enabling them to ensure the security of their intellectual property, sensitive data & communications, and other intangible assets. Effective and multi-dimensional cybersecurity measures are necessary to prevent data breach threats in these areas. Several governments worldwide are investing heavily in strengthening the cyber security of their nations, which is eventually contributing to the defense cyber security market growth.

Healthcare segment is expected to hold the highest CAGR of more than 14.0% from 2023 to 2030. Market growth can be attributed to rising adoption of connected devices, smartphones, and cloud-based solutions for diverse information systems, such as Electronic Health Records (EHRs), e-prescribing systems, radiology information systems, clinical decision support systems, and practice management support systems. As such, companies operating in the healthcare sector are expected to adopt cybersecurity solutions to safeguard digital infrastructure, thereby driving healthcare cyber security market growth.

Regional Insights

North America held the highest market share of 34.9% in 2022. The North America cyber security market is expanding progressively in line with continued advances in latest technologies, such as big data and the Internet of Things (IoT). Furthermore, a proliferation of IT companies and their diversified businesses in the region is creating a need for protection of endpoint devices. Governments are also pursuing various initiatives to increase awareness about cyber security among organizations and to encourage and support them in adopting adequate cyber security measures. Thus, the above-mentioned factors are expected to drive the North America cyber security market.

Europe Cybersecurity Market

Cyber security market growth in Europe is driven by the increasing development of IT infrastructure, growing internet penetration, and proliferation of connected devices and numerous endpoints. Furthermore, U.K. cyber security market is rapidly growing in the owing to the fast-paced adoption of digital technologies and connected devices and the use of endpoint devices connected to large organizational networks.

U.K. Cyber Security Market

The cybersecurity market in U.K. was expected to hold a market share of approximately 22% in 2022. The growth of the cybersecurity market in the U.K. can be attributed to factors such as the fast-paced adoption of digital technologies and connected devices and the use of endpoint devices connected to large organizational networks. The recent trends, including remote work and hybrid work scenarios, have also significantly boosted the adoption of advanced security solutions among organizations to safeguard organizational networks, devices, and servers. In the U.K., the National Cyber Security Center (NCSC), a part of the Government Communications Headquarters (GCHQ), has been heading the nation’s cyber security mission since 2016.

Germany Cyber Security Market

Cyber security market in Germany was expected to register a growth rate of around 12.5% over the forecast period. The growth of the cybersecurity market in Germany can be attributed to the German government taking substantial steps to secure cyberspace and promote social and economic prosperity in the country. With the implementation of a cyber security strategy, the federal government is anticipated to primarily focus on a few strategic areas, such as protecting critical information structures, securing IT systems in the country, strengthening IT security in the public administration, setting up a National Cyber Response Center, and active controlling of crime. The need for effective cybersecurity solutions is expected to increase significantly in the country to achieve these objectives and measures.

France Cyber Security Market

Cyber security market in France was estimated to be valued at USD 8,916.6 million in 2022. The growth of the cybersecurity market in France can be attributed to the growing use of wireless networks serving mobile devices, which have also increased data vulnerability. As stated in HiscoxCyber Readiness Report 2022, France reported that about half (49%) of French firms faced cyberattacks more significantly compared to 2021 (34%). Furthermore, in February 2022, the government of France launched a new cybersecurity center in Paris. This center spans 20,000 square meters and is owned by 60 entities working in the cybersecurity space, which brings together cybersecurity specialists from the public and private sectors, including Thales Group, Sodexo, and Safran, to build an intense security center to protect France and French businesses from cyberattacks.

Asia Pacific Cyber Security Market

Asia Pacific is expected to register the fastest CAGR of more than 15.0% over the forecast period. Growth of Asia Pacific cyber security market can be attributed to a growing number of data centers, increasing adoption of cloud technologies, growing cyber security jobs, and proliferation of IoT devices. Furthermore, several organizations in the Asia cyber security market solutions with built-in capabilities to detect any potential vulnerabilities which is also creating a favorable environment for Asia Pacific cyber security market growth.

China Cyber Security Market

Cyber security market in China was expected to hold a market share of around 26% in the Asia Pacific cybersecurity market in 2022. The growth of the cybersecurity market in China can be attributed to the growing adoption of connected technologies and expanding manufacturing, healthcare, and BFSI sectors in the country are the major factors driving the adoption of robust security solutions among Chinese organizations. In recent years, the country has improved its cybersecurity measures by centralizing and clarifying the coordination of government cyber agencies and continuing to produce relevant cyber legislation.

India Cyber Security Market

Cyber security market in India was expected to hold a market share of around 18% in the Asia Pacific cybersecurity market in 2022. The growth of the cybersecurity market in India can be attributed to the adoption of mobile technologies and rapid digitization in industries such as BFSI, manufacturing, and healthcare are some of the factors increasing the intensity of cyberattacks in the country. Moreover, while the country's financial sector has witnessed drastic growth from the implementation of Digital India, UPI, and Jan-Dhan Yojana, it is also among the most exploited sectors by cybercriminals. The country witnessed more than 1.39 million cybersecurity attacks in 2022.

Japan Cyber Security Market

Cyber security market in Japan was expected to register a growth rate of approx.—15% over the forecast period. The growth of the cybersecurity market in Japan can be attributed to a rapid increase in the number of Small- and Mid-sized Businesses (SMBs) in Japan, and their focus on the implementation of advanced technologies and security capabilities to boost domestic and global businesses are driving market growth in the country. Furthermore, a series of cyberattacks targeted at the government and private organizations in the country, including the Nation Pension Administration, Mitsubishi, and Sony Corporation, have placed cybersecurity on the country's political agenda.

Middle East & Africa Cyber Security Market

The Middle East & Africa cyber security market was estimated to be valued at USD 11.94 billion in 2024. The MEA region is among the most targeted and exploited regions by cyber criminals. This can be attributed to the high pace of digitization, availability of large organizational and personal data, and rapid utilization of digital technologies among healthcare, BFSI, and energy & utility industries in the region. The losses suffered by MEA countries are increasing year by year. Based on IBM data for 2023, finance and insurance were the most targeted industries in the region, accounting for more than 44 percent of incidents; professional, business, and consumer services accounted for around 22 percent of cyberattacks; and manufacturing & energy held 11 percent of the total attacks in the region. Thus, the government and key companies in the market are taking significant steps to tackle these rising threats.

Saudi Arabia Cyber Security Market

Cyber security market in Saudi Arabia was expected to register a growth rate of approx.—12% over the forecast period. The growth of the cybersecurity market in Saudi Arabia can be attributed to the adoption of advanced technologies, such as IoT, AI, and ML, and the deployment of 5G technology. Organizations in Saudi Arabia are constantly deploying new technologies, such as cloud computing, artificial intelligence, and machine learning. As a result, the demand for outsourcing managed security services is also surging among organizations in the country.

Key Cyber Security Company Insights

Some of the key players operating in the market include Cisco Systems, Inc., Palo Alto Networks, Inc., and IBM Corporation.

-

Cisco Systems, Inc. is a technology solutions and service provider. The security product and solution offerings include network security, identity and access management, advanced threat protection, industrial security, and user device security.

-

Palo Alto Networks, Inc. is an American multinational cybersecurity company. Its offerings includes a next-generation firewall that offers user application, content visibility and control, along with protection against network-based cyber threats.

LogRhythm, Inc. and Proofpoint, Inc. are some of the emerging market participants in the cyber security market.

-

LogRhythm, Inc. is a security solutions provider that specializes in various security areas such as network monitoring, log management,user behavior and security analytics, security information and event management. Its platforms offer solutions for security and event management, file integrity monitoring, security analytics, and host and network forensics to effectively detect and neutralize cyber threats.

-

Proofpoint, Inc. is a cybersecurity company that offers next-generation solutions. The company offers cyber security services consisting of reputation, content inspection, key management and encryption, notification and workflow, dynamic malware analysis, and analytics and search.

Key Cyber Security Companies:

The following are the leading companies in the cyber security market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these cyber security companies are analyzed to map the supply network.

- BAE Systems Plc

- Broadcom, Inc.

- Centrify Corporation

- Check Point Software Technology Ltd.

- Cisco Systems, Inc.

- FireEye, Inc.

- Fortinet, Inc.

- IBM Corporation

- Lockheed Martin Corporation

- LogRhythm, Inc.

- McAfee, LLC.

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Sophos Ltd.

- Trend Micro Inc.

Recent Developments

-

In January 2023, Check Point Software Technologies Ltd. introduced Cloud Native Application Protection Platform, a new risk management solution. The latest solution enhancements encompass intelligent risk assessment, entitlement management, agentless scanning, and pipeline security.

-

In February 2023, Samsung partnered with Check Point Software Technologies Ltd. to develop a holistic security solution against the growing mobile attacks with close integration of Samsung Knox Manage and Check Point Harmony Mobile platform.

-

In March 2023, Palo Alto Networks announced the launch of the Cortex XSIAM module for identity threat detection and response. This threat detection and response solution enables organizations to quickly consolidate user identity and behavior data and deploy robust AI technology to unveil identity-driven attacks.

-

In November 2023, Accenture, a technology solution, and managed service company, acquired Innotec Security, a Europe based cyber security-as-a-service provider based with offerings including threat detection, simulation, cyber intelligence, response and incident management, application security, and security consulting. Based on this acquisition, Accenture aims to expand its presence, capabilities, and resources, along with meeting the rising demand for managed security services across Europe cyber security market.

-

In December 2023, IBM Corporation announced collaboration with Palo Alto Networks to strengthen the client’s end-to-end postures and navigate the security threats. The major focus of the partnership will focus on two key areas which includes securing cloud transformations and modernizing the security operations.

Cyber Security Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 222.66 billion

Revenue forecast in 2030

USD 500.70 billion

Growth rate

CAGR of 12.3% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, Security Type, Solution, Services, Deployment, Organization Size, Vertical, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; India; China; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

BAE Systems Plc; Broadcom, Inc.; Centrify Corp.; Check Point Software Technology Ltd.; Cisco Systems, Inc.; FireEye, Inc.; Fortinet, Inc.; IBM Corporation; Lockheed Martin Corp.; LogRhythm, Inc.; McAfee, LLC.; Palo Alto Networks, Inc.; Proofpoint, Inc.; Sophos Ltd.; Trend Micro Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cyber Security Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cyber security market report on the basis of component, security type, solution, services, deployment, organization, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Security Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Endpoint Security

-

Cloud Security

-

Network Security

-

Application Security

-

Infrastructure Protection

-

Data Security

-

Others (Wireless Security, Web & Content Security)

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Unified Threat Management (UTM)

-

IDS/IPS

-

DLP

-

IAM

-

SIEM

-

DDoS

-

Risk & Compliance Management

-

Others (Firewall, Antimalware, Antivirus)

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional Services

-

Risk and Threat Assessment

-

Design, Consulting, and Implementation

-

Training & Education

-

Support & Maintenance

-

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

Retail

-

BFSI

-

Healthcare

-

Defense/Government

-

Manufacturing

-

Energy

-

Others (Education, Media & Entertainment)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The professional service segment dominated the global cyber security market in 2022 with a revenue share of 72.25%. The significant market share can be attributed to the rising demand for professional services such as physical security testing, enterprise risk assessment, and penetration testing.

b. The global cyber security market size was estimated at USD 202.72 billion in 2022 and is expected to reach USD 222.66 billion in 2023.

b. The global cyber security market is expected to grow at a compound annual growth rate of 12.3% from 2023 to 2030 and to reach USD 500.70 billion by 2030.

b. The services segment dominated the global cybersecurity market in 2022 and accounted for a revenue share of 54.31%. The strong preference of organizations for deploying suitable cyber security solutions based on the organizational structure is driving the adoption of cyber security services across several industries and sectors.

b. The infrastructure protection segment dominated the global cyber security market in 2022 with a revenue share of 27.0%. The convergence of technologies increases the adoption of cloud-based services, and initiatives such as BYOD are expected to increase network security threats and vulnerability, supporting the segment growth.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Cyber Security Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Market Opportunity Analysis

3.4. Cyber Security Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Cyber Security Market Component Outlook

4.1. Segment Dashboard

4.2. Cyber Security Market Share by Component, 2022 & 2030 (USD Billion)

4.3. Hardware

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Software

4.4.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

4.5. Services

4.5.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

Chapter 5. Cyber Security Market Security Type Outlook

5.1. Segment Dashboard

5.2. Cyber Security Market Share by Security Type, 2022 & 2030 (USD Billion)

5.3. Endpoint Security

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Cloud Security

5.4.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

5.5. Network Security

5.5.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

5.6. Application Security

5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.7. Infrastructure Protection

5.7.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

5.8. Data Security

5.8.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

5.9. Others

5.9.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

Chapter 6. Cyber Security Market Solution Outlook

6.1. Segment Dashboard

6.2. Cyber Security Market Share by Solution, 2022 & 2030 (USD Billion)

6.3. Unified threat management (UTM)

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. IDS/IPS

6.4.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

6.5. DLP

6.5.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

6.6. IAM

6.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.7. SIEM

6.7.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

6.8. DDoS

6.8.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

6.9. Risk and Compliance Management

6.9.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

6.10. Others

6.10.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

Chapter 7. Cyber Services Market Services Outlook

7.1. Segment Dashboard

7.2. Cyber Security Market Share by Services, 2022 & 2030 (USD Billion)

7.3. Professional Services

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.1.1. Risk and Threat Assessment

7.3.1.1.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.1.2. Design, Consulting, and Implementation

7.3.1.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.1.3. Training and Education

7.3.1.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.1.4. Support and Maintenance

7.3.1.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Managed Services

7.4.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

Chapter 8. Cyber Security Market Deployment Outlook

8.1. Segment Dashboard

8.2. Cyber Security Market Share by Deployment, 2022 & 2030 (USD Billion)

8.3. Cloud-based

8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4. On-premises

8.4.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

Chapter 9. Cyber Security Market Organization Size Outlook

9.1. Segment Dashboard

9.2. Cyber Security Market Share by Organization Size, 2022 & 2030 (USD Billion)

9.3. SMEs

9.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4. Large Enterprises

9.4.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

Chapter 10. Cyber Security Market Vertical Outlook

10.1. Segment Dashboard

10.2. Cyber Security Market Share by Vertical, 2022 & 2030 (USD Billion)

10.3. IT & Telecom

10.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.4. Retail

10.4.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

10.5. BFSI

10.5.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

10.6. Healthcare

10.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.7. Defense/Government

10.7.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

10.8. Manufacturing

10.8.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

10.9. Energy

10.9.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

10.10. Others

10.10.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

Chapter 11. Cyber Security Market: Regional Outlook

11.1. Cyber Security Market Share by Region, 2022 & 2030 (USD Billion)

11.2. North America

11.2.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.2.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.2.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.2.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.2.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.2.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.2.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.2.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.2.9. U.S.

11.2.9.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.2.9.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.2.9.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.2.9.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.2.9.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.2.9.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.2.9.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.2.9.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.2.10. Canada

11.2.10.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.2.10.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.2.10.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.2.10.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.2.10.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.2.10.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.2.10.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.2.10.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.3. Europe

11.3.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.3.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.3.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.3.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.3.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.3.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.3.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.3.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.3.9. U.K.

11.3.9.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.3.9.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.3.9.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.3.9.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.3.9.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.3.9.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.3.9.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.3.9.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.3.10. Germany

11.3.10.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.3.10.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.3.10.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.3.10.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.3.10.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.3.10.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.3.10.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.3.10.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.3.11. France

11.3.11.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.3.11.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.3.11.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.3.11.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.3.11.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.3.11.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.3.11.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.3.11.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.3.12. Italy

11.3.12.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.3.12.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.3.12.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.3.12.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.3.12.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.3.12.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.3.12.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.3.12.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.3.13. Spain

11.3.13.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.3.13.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.3.13.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.3.13.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.3.13.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.3.13.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.3.13.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.3.13.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.4. Asia Pacific

11.4.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.4.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.4.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.4.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.4.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.4.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.4.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.4.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.4.9. China

11.4.9.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.4.9.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.4.9.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.4.9.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.4.9.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.4.9.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.4.9.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.4.9.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.4.10. India

11.4.10.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.4.10.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.4.10.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.4.10.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.4.10.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.4.10.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.4.10.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.4.10.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.4.11. Japan

11.4.11.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.4.11.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.4.11.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.4.11.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.4.11.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.4.11.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.4.11.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.4.11.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.4.12. Australia

11.4.12.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.4.12.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.4.12.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.4.12.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.4.12.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.4.12.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.4.12.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.4.12.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.4.13. South Korea

11.4.13.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.4.13.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.4.13.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.4.13.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.4.13.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.4.13.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.4.13.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.4.13.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.5. Latin America

11.5.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.5.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.5.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.5.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.5.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.5.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.5.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.5.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.5.9. Brazil

11.5.9.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.5.9.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.5.9.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.5.9.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.5.9.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.5.9.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.5.9.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.5.9.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.5.10. Mexico

11.5.10.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.5.10.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.5.10.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.5.10.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.5.10.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.5.10.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.5.10.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.5.10.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.5.11. Argentina

11.5.11.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.5.11.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.5.11.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.5.11.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.5.11.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.5.11.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.5.11.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.5.11.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.6. Middle East & Africa

11.6.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.6.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.6.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.6.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.6.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.6.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.6.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.6.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.6.9. UAE

11.6.9.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.6.9.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.6.9.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.6.9.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.6.9.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.6.9.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.6.9.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.6.9.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.6.10. Saudi Arabia

11.6.10.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.6.10.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.6.10.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.6.10.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.6.10.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.6.10.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.6.10.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.6.10.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

11.6.11. South Africa

11.6.11.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

11.6.11.2. Market estimates and forecast by component, 2018 - 2030 (USD Billion)

11.6.11.3. Market estimates and forecast by security type, 2018 - 2030 (USD Billion)

11.6.11.4. Market estimates and forecast by solution, 2018 - 2030 (USD Billion)

11.6.11.5. Market estimates and forecast by services, 2018 - 2030 (USD Billion)

11.6.11.6. Market estimates and forecast by deployment, 2018 - 2030 (USD Billion)

11.6.11.7. Market estimates and forecast by organization size, 2018 - 2030 (USD Billion)

11.6.11.8. Market estimates and forecast by vertical, 2018 - 2030 (USD Billion)

Chapter 12. Competitive Landscape

12.1. Recent Developments & Impact Analysis by Key Market Participants

12.2. Company Categorization

12.3. Company Market Positioning

12.4. Company Market Share Analysis

12.5. Company Heat Map Analysis

12.6. Strategy Mapping

12.6.1. Expansion

12.6.2. Mergers & Acquisition

12.6.3. Partnerships & Collaborations

12.6.4. New Product Launches

12.6.5. Research And Development

12.7. Company Profiles (Overview, Financial Performance, Product Overview, Strategic Initiatives)

12.7.1. BAE Systems, Inc.

12.7.1.1. Participant’s Overview

12.7.1.2. Financial Performance

12.7.1.3. Product Benchmarking

12.7.1.4. Recent Developments

12.7.2. Broadcom (Symantec Corporation)

12.7.2.1. Participant’s Overview

12.7.2.2. Financial Performance

12.7.2.3. Product Benchmarking

12.7.2.4. Recent Developments

12.7.3. Centrify Corporation

12.7.3.1. Participant’s Overview

12.7.3.2. Financial Performance

12.7.3.3. Product Benchmarking

12.7.3.4. Recent Developments

12.7.4. Check Point Software Technology Ltd.

12.7.4.1. Participant’s Overview

12.7.4.2. Financial Performance

12.7.4.3. Product Benchmarking

12.7.4.4. Recent Developments

12.7.5. Cisco Systems, Inc.

12.7.5.1. Participant’s Overview

12.7.5.2. Financial Performance

12.7.5.3. Product Benchmarking

12.7.5.4. Recent Developments

12.7.6. FireEye, Inc.

12.7.6.1. Participant’s Overview

12.7.6.2. Financial Performance

12.7.6.3. Product Benchmarking

12.7.6.4. Recent Developments

12.7.7. Fortinet, Inc.

12.7.7.1. Participant’s Overview

12.7.7.2. Financial Performance

12.7.7.3. Product Benchmarking

12.7.7.4. Recent Developments

12.7.8. IBM Corporation

12.7.8.1. Participant’s Overview

12.7.8.2. Financial Performance

12.7.8.3. Product Benchmarking

12.7.8.4. Recent Developments

12.7.9. Lockheed Martin Corporation

12.7.9.1. Participant’s Overview

12.7.9.2. Financial Performance

12.7.9.3. Product Benchmarking

12.7.9.4. Recent Developments

12.7.10. LogRhythm, Inc.

12.7.10.1. Participant’s Overview

12.7.10.2. Financial Performance

12.7.10.3. Product Benchmarking

12.7.10.4. Recent Developments

12.7.11. McAfee, LLC.

12.7.11.1. Participant’s Overview

12.7.11.2. Financial Performance

12.7.11.3. Product Benchmarking

12.7.11.4. Recent Developments

12.7.12. Palo Alto Networks, Inc.

12.7.12.1. Participant’s Overview

12.7.12.2. Financial Performance

12.7.12.3. Product Benchmarking

12.7.12.4. Recent Developments

12.7.13. Proofpoint, Inc.

12.7.13.1. Participant’s Overview

12.7.13.2. Financial Performance

12.7.13.3. Product Benchmarking

12.7.13.4. Recent Developments

12.7.14. Sophos Ltd.

12.7.14.1. Participant’s Overview

12.7.14.2. Financial Performance

12.7.14.3. Product Benchmarking

12.7.14.4. Recent Developments

12.7.15. Trend Micro Incorporated.

12.7.15.1. Participant’s Overview

12.7.15.2. Financial Performance

12.7.15.3. Product Benchmarking

12.7.15.4. Recent Developments

List of Tables

Table 1 List of Abbreviation

Table 2 Global cyber security market, 2018 - 2030 (USD Billion)

Table 3 Global cyber security market, by region, 2018 - 2030 (USD Billion)

Table 4 Global cyber security market, by component, 2018 - 2030 (USD Billion)

Table 5 Global cyber security market, by security type, 2018 - 2030 (USD Billion)

Table 6 Global cyber security market, by solution, 2018 - 2030 (USD Billion)

Table 7 Global cyber security market, by service, 2018 - 2030 (USD Billion)

Table 8 Global cyber security market, by deployment, 2018 - 2030 (USD Billion)

Table 9 Global cyber security market, by organization size, 2018 - 2030 (USD Billion)

Table 10 Global cyber security market, by vertical, 2018 - 2030 (USD Billion)

Table 11 North America cyber security market, by component 2018 - 2030 (USD Billion)

Table 12 North America cyber security market, by security type 2018 - 2030 (USD Billion)

Table 13 North America cyber security market, by solution 2018 - 2030 (USD Billion)

Table 14 North America cyber security market, by service 2018 - 2030 (USD Billion)

Table 15 North America cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 16 North America cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 17 North America cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 18 U.S. cyber security market, by component 2018 - 2030 (USD Billion)

Table 19 U.S. cyber security market, by security type 2018 - 2030 (USD Billion)

Table 20 U.S. cyber security market, by solution 2018 - 2030 (USD Billion)

Table 21 U.S. cyber security market, by service 2018 - 2030 (USD Billion)

Table 22 U.S. cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 23 U.S. cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 24 U.S. cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 25 Canada cyber security market, by component 2018 - 2030 (USD Billion)

Table 26 Canada cyber security market, by security type 2018 - 2030 (USD Billion)

Table 27 Canada cyber security market, by solution 2018 - 2030 (USD Billion)

Table 28 Canada cyber security market, by service 2018 - 2030 (USD Billion)

Table 29 Canada cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 30 Canada cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 31 Canada cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 32 Europe cyber security market, by component 2018 - 2030 (USD Billion)

Table 33 Europe cyber security market, by security type 2018 - 2030 (USD Billion)

Table 34 Europe cyber security market, by solution 2018 - 2030 (USD Billion)

Table 35 Europe cyber security market, by service 2018 - 2030 (USD Billion)

Table 36 Europe cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 37 Europe cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 38 Europe cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 39 Germany cyber security market, by component 2018 - 2030 (USD Billion)

Table 40 Germany cyber security market, by security type 2018 - 2030 (USD Billion)

Table 41 Germany cyber security market, by solution 2018 - 2030 (USD Billion)

Table 42 Germany cyber security market, by service 2018 - 2030 (USD Billion)

Table 43 Germany cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 44 Germany cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 45 Germany cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 46 U.K. cyber security market, by component 2018 - 2030 (USD Billion)

Table 47 U.K. cyber security market, by security type 2018 - 2030 (USD Billion)

Table 48 U.K. cyber security market, by solution 2018 - 2030 (USD Billion)

Table 49 U.K. cyber security market, by service 2018 - 2030 (USD Billion)

Table 50 U.K. cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 51 U.K. cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 52 U.K. cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 53 France cyber security market, by component 2018 - 2030 (USD Billion)

Table 54 France cyber security market, by security type 2018 - 2030 (USD Billion)

Table 55 France cyber security market, by solution 2018 - 2030 (USD Billion)

Table 56 France cyber security market, by service 2018 - 2030 (USD Billion)

Table 57 France cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 58 France cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 59 France cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 60 Italy cyber security market, by component 2018 - 2030 (USD Billion)

Table 61 Italy cyber security market, by security type 2018 - 2030 (USD Billion)

Table 62 Italy cyber security market, by solution 2018 - 2030 (USD Billion)

Table 63 Italy cyber security market, by service 2018 - 2030 (USD Billion)

Table 64 Italy cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 65 Italy cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 66 Italy cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 67 Spain cyber security market, by component 2018 - 2030 (USD Billion)

Table 68 Spain cyber security market, by security type 2018 - 2030 (USD Billion)

Table 69 Spain cyber security market, by solution 2018 - 2030 (USD Billion)

Table 70 Spain cyber security market, by service 2018 - 2030 (USD Billion)

Table 71 Spain cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 72 Spain cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 73 Spain cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 74 Asia Pacific cyber security market, by component 2018 - 2030 (USD Billion)

Table 75 Asia Pacific cyber security market, by security type 2018 - 2030 (USD Billion)

Table 76 Asia Pacific cyber security market, by solution 2018 - 2030 (USD Billion)

Table 77 Asia Pacific cyber security market, by service 2018 - 2030 (USD Billion)

Table 78 Asia Pacific cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 79 Asia Pacific cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 80 Asia Pacific cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 81 China cyber security market, by component 2018 - 2030 (USD Billion)

Table 82 China cyber security market, by security type 2018 - 2030 (USD Billion)

Table 83 China cyber security market, by solution 2018 - 2030 (USD Billion)

Table 84 China cyber security market, by service 2018 - 2030 (USD Billion)

Table 85 China cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 86 China cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 87 China cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 88 India cyber security market, by component 2018 - 2030 (USD Billion)

Table 89 India cyber security market, by security type 2018 - 2030 (USD Billion)

Table 90 India cyber security market, by solution 2018 - 2030 (USD Billion)

Table 91 India cyber security market, by service 2018 - 2030 (USD Billion)

Table 92 India cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 93 India cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 94 India cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 95 Japan cyber security market, by component 2018 - 2030 (USD Billion)

Table 96 Japan cyber security market, by security type 2018 - 2030 (USD Billion)

Table 97 Japan cyber security market, by solution 2018 - 2030 (USD Billion)

Table 98 Japan cyber security market, by service 2018 - 2030 (USD Billion)

Table 99 Japan cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 100 Japan cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 101 Japan cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 102 Australia cyber security market, by component 2018 - 2030 (USD Billion)

Table 103 Australia cyber security market, by security type 2018 - 2030 (USD Billion)

Table 104 Australia cyber security market, by solution 2018 - 2030 (USD Billion)

Table 105 Australia cyber security market, by service 2018 - 2030 (USD Billion)

Table 106 Australia cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 107 Australia cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 108 Australia cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 109 South Korea cyber security market, by component 2018 - 2030 (USD Billion)

Table 110 South Korea cyber security market, by security type 2018 - 2030 (USD Billion)

Table 111 South Korea cyber security market, by solution 2018 - 2030 (USD Billion)

Table 112 South Korea cyber security market, by service 2018 - 2030 (USD Billion)

Table 113 South Korea cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 114 South Korea cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 115 South Korea cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 116 Latin America cyber security market, by component 2018 - 2030 (USD Billion)

Table 117 Latin America cyber security market, by security type 2018 - 2030 (USD Billion)

Table 118 Latin America cyber security market, by solution 2018 - 2030 (USD Billion)

Table 119 Latin America cyber security market, by service 2018 - 2030 (USD Billion)

Table 120 Latin America cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 121 Latin America cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 122 Latin America cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 123 Brazil cyber security market, by component 2018 - 2030 (USD Billion)

Table 124 Brazil cyber security market, by security type 2018 - 2030 (USD Billion)

Table 125 Brazil cyber security market, by solution 2018 - 2030 (USD Billion)

Table 126 Brazil cyber security market, by service 2018 - 2030 (USD Billion)

Table 127 Brazil cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 128 Brazil cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 129 Brazil cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 130 Mexico cyber security market, by component 2018 - 2030 (USD Billion)

Table 131 Mexico cyber security market, by security type 2018 - 2030 (USD Billion)

Table 132 Mexico cyber security market, by solution 2018 - 2030 (USD Billion)

Table 133 Mexico cyber security market, by service 2018 - 2030 (USD Billion)

Table 134 Mexico cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 135 Mexico cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 136 Mexico cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 137 Argentina cyber security market, by component 2018 - 2030 (USD Billion)

Table 138 Argentina cyber security market, by security type 2018 - 2030 (USD Billion)

Table 139 Argentina cyber security market, by solution 2018 - 2030 (USD Billion)

Table 140 Argentina cyber security market, by service 2018 - 2030 (USD Billion)

Table 141 Argentina cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 142 Argentina cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 143 Argentina cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 144 Middle East & Africa cyber security market, by component 2018 - 2030 (USD Billion)

Table 145 Middle East & Africa cyber security market, by security type 2018 - 2030 (USD Billion)

Table 146 Middle East & Africa cyber security market, by solution 2018 - 2030 (USD Billion)

Table 147 Middle East & Africa cyber security market, by service 2018 - 2030 (USD Billion)

Table 148 Middle East & Africa cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 149 Middle East & Africa cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 150 Middle East & Africa cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 151 UAE cyber security market, by component 2018 - 2030 (USD Billion)

Table 152 UAE cyber security market, by security type 2018 - 2030 (USD Billion)

Table 153 UAE cyber security market, by solution 2018 - 2030 (USD Billion)

Table 154 UAE cyber security market, by service 2018 - 2030 (USD Billion)

Table 155 UAE cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 156 UAE cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 157 UAE cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 158 Saudi Arabia cyber security market, by component 2018 - 2030 (USD Billion)

Table 159 Saudi Arabia cyber security market, by security type 2018 - 2030 (USD Billion)

Table 160 Saudi Arabia cyber security market, by solution 2018 - 2030 (USD Billion)

Table 161 Saudi Arabia cyber security market, by service 2018 - 2030 (USD Billion)

Table 162 Saudi Arabia cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 163 Saudi Arabia cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 164 Saudi Arabia cyber security market, by vertical 2018 - 2030 (USD Billion)

Table 165 South Africa cyber security market, by component 2018 - 2030 (USD Billion)

Table 166 South Africa cyber security market, by security type 2018 - 2030 (USD Billion)

Table 167 South Africa cyber security market, by solution 2018 - 2030 (USD Billion)

Table 168 South Africa cyber security market, by service 2018 - 2030 (USD Billion)

Table 169 South Africa cyber security market, by deployment 2018 - 2030 (USD Billion)

Table 170 South Africa cyber security market, by organization size 2018 - 2030 (USD Billion)

Table 171 South Africa cyber security market, by vertical 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Cyber Security Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/3)

Fig. 9 Segment Snapshot (2/3)

Fig. 10 Segment Snapshot (3/3)

Fig. 11 Competitive Landscape Snapshot

Fig. 12 Cyber Security Market: Industry Value Chain Analysis

Fig. 13 Cyber Security Market: Market Dynamics

Fig. 14 Cyber Security Market: PORTER’s Analysis

Fig. 15 Cyber Security Market: PESTEL Analysis

Fig. 16 Cyber Security Market Share by Component, 2023 & 2030 (USD Billion)

Fig. 17 Cyber Security Market, by Component: Market Share, 2023 & 2030

Fig. 18 Hardware Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 Software Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 20 Services Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 21 Cyber Security Market Share by Security Type, 2023 & 2030 (USD Billion)

Fig. 22 Cyber Security Market, by Security Type: Market Share, 2023 & 2030

Fig. 23 End Point Security Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 24 Cloud Security Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 Network Security Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 26 Application Security Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 27 Infrastructure Protection Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 28 Data Security Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 Cyber Security Market Share by Solutions, 2023 & 2030 (USD Billion)

Fig. 31 Cyber Security Market, by Solutions: Market Share, 2023 & 2030

Fig. 32 Unified Threat Management (UTM) Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 33 IDS/IPS Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 34 DLP Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 35 IAM Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 36 SIEM Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 37 DDoS Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 38 Risk and Compliance Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 39 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 40 Cyber Security Market Share by Services, 2023 & 2030 (USD Billion)

Fig. 41 Cyber Security Market, by Services: Market Share, 2023 & 2030

Fig. 42 Professional Services Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 43 Managed Services Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 44 Cyber Security Market Share by Deployment, 2023 & 2030 (USD Billion)

Fig. 45 Cyber Security Market, by Deployment: Market Share, 2023 & 2030

Fig. 46 Cloud Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 47 On-premise Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 48 Cyber Security Market Share by Organization Size, 2023 & 2030 (USD Billion)

Fig. 49 Cyber Security Market, by Organization Size: Market Share, 2023 & 2030

Fig. 50 Large Enterprises Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 51 Small & Medium Enterprises Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 52 Cyber Security Market Share by Vertical, 2023 & 2030 (USD Billion)

Fig. 53 Cyber Security Market, by Vertical: Market Share, 2023 & 2030

Fig. 54 IT & Telecom Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 55 Retail Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 56 BFSI Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 57 Healthcare Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 58 Government/Defense Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 59 Manufacturing Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 60 Energy Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 61 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 62 Regional Marketplace: Key Takeaways

Fig. 63 North America Cyber Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 64 U.S. Cyber Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 65 Canada Cyber Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 66 Europe Cyber Security Market Estimates and Forecasts, 2018 - 2030 (USD Billion)