- Home

- »

- Network Security

- »

-

Cybersecurity Mesh Market Size, Industry Report, 2033GVR Report cover

![Cybersecurity Mesh Market Size, Share & Trends Report]()

Cybersecurity Mesh Market (2025 - 2033) Size, Share & Trends Analysis Report By Offering (Solution, Services), By Deployment (Cloud, On-Premise), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-089-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cybersecurity Mesh Market Summary

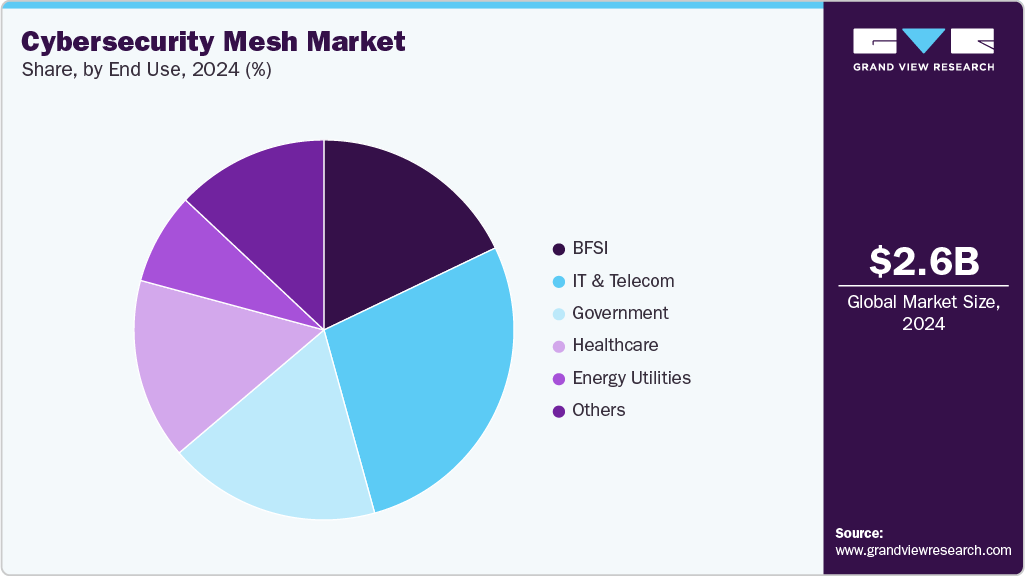

The cybersecurity mesh market size was estimated at USD 2.59 billion in 2024 and is projected to reach USD 7.03 billion by 2033, growing at a CAGR of 11.9% from 2025 to 2033. The increasing sophistication of cyberattacks, as well as the shift of assets to the hybrid multi-cloud, is driving the market growth.

Key Market Trends & Insights

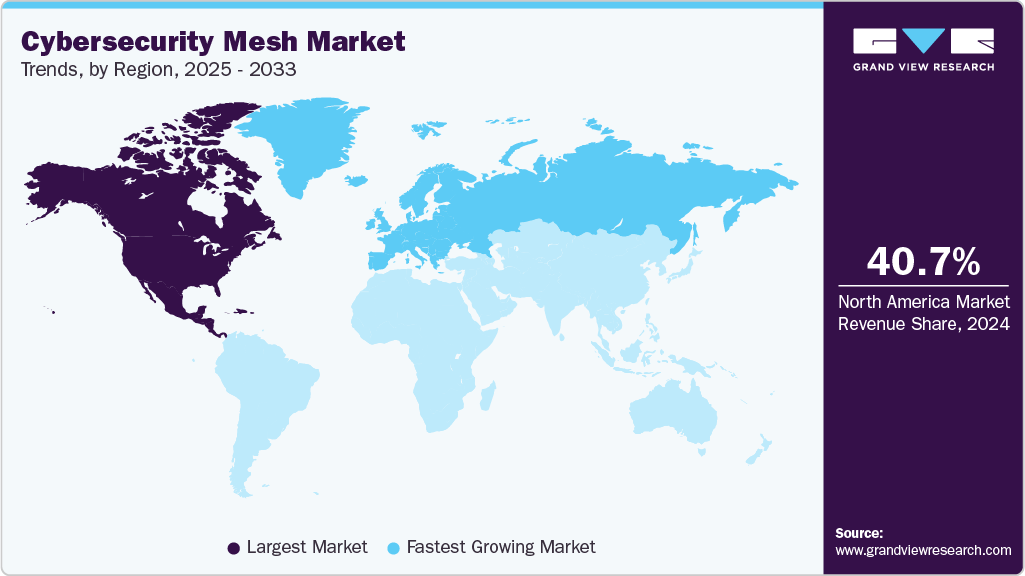

- North America dominated the cybersecurity mesh market with the largest revenue share of 40.7% in 2024.

- In the U.S., the rapid growth of cloud-native applications and multi-cloud environments across the country is accelerating the demand for cybersecurity mesh systems.

- By offering, the solutions segment led the market with the largest revenue share of 73.3% in 2024.

- By deployment, the cloud segment accounted for the largest market revenue share in 2024.

- By enterprise size, the large enterprises segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.59 Billion

- 2033 Projected Market Size: USD 7.03 Billion

- CAGR (2025-2033): 11.9%

- North America: Largest market in 2024

- Europe: Fastest growing market

The increasing adoption of zero-trust principles is driving demand for cybersecurity mesh frameworks. Zero trust emphasizes continuous verification of users, devices, and network traffic, regardless of where they originate.Cybersecurity mesh provides the architectural support for zero trust by allowing context-aware, identity-centric access control to be extended across dynamic and distributed environments. By enabling security to be applied closer to the identity and asset in question, mesh architectures make zero-trust implementations more practical and scalable. As regulatory frameworks and industry best practices increasingly recommend or mandate zero-trust adoption, organizations are turning to cybersecurity mesh as a way to operationalize these policies effectively.

Cybersecurity mesh architecture is a scalable and modular solution to extending security controls, even to widely dispersed assets. Because of its versatility, it is particularly well suited for more modular strategies that are compatible with hybrid multi-cloud systems. A more modular, adaptable, and robust security ecosystem is made possible by Cybersecurity Mesh Architecture (CSMA). A cybersecurity mesh allows technologies to communicate with one another through a number of supporting layers, such as security intelligence, centralized policy management, and identity fabric, as opposed to each security tool operating in a separate silo. These beneficial factors are expected to propel the demand of the market in future years.

Further, with the help of CSMA, people and machines can securely communicate from various places, across channels, different generations of apps, and hybrid and multi-cloud settings. At the same time, all the company's digital assets are protected. This promotes a more constant security posture to support more agility for the composable company. In order to facilitate the integration of security solutions, CSMA offers a number of enabling services, including security analytics, distributed identity fabric, intelligence, automation, and triggers, as well as centralized policy administration and orchestration.

The identity and security architectures cannot meet the continuously shifting needs at present, as they currently stand. All assets, whether they are on-premises, in data centers, or the cloud, may be secured with the help of CSMA, which helps to offer a standard, integrated security structure and posture. By standardizing how the tools link, CSMA enables standalone solutions to cooperate in complementary ways to enhance the overall security posture. For instance, it helps shift control points closer to the assets intended to safeguard and centralizes policy management. The above aspects are expected to fuel the demand for the cybersecurity mesh industry across regions during the forecast period.

Offering Insights

The solution segment led the market with the largest revenue share of 73.3% in 2024. Cybersecurity mesh solutions have been made possible by the emergence of technologies like edge computing, machine learning, and artificial intelligence. These technologies boost the entire security posture by enabling intelligent threat detection, behavior analytics, and automated responses at the edge. Strict regulatory and compliance standards relating to data security and privacy are applicable to many businesses. By applying security controls at the device level, cybersecurity mesh solutions allow organizations to prove compliance with these standards more thoroughly and granularly. This is expected to boost the demand for cybersecurity mesh solutions among the end-use industries over the forecast period.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. The adoption of cybersecurity mesh services has been affected by the move towards a zero-trust architecture. Zero trust strongly emphasizes every person and device being verified and authorized, regardless of their location or network. Cybersecurity mesh services reduce dependency on network-level security by offering security protections at the individual device level, which aligns with the zero-trust philosophy.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024, owing to the scalability, flexibility, and affordability of cloud computing, businesses are adopting it with increasing frequency. Strong security measures become increasingly important as more vital corporate operations and data are moved to the cloud. With the help of a cybersecurity mesh in the cloud, cloud environments may be secured in a distributed and scalable manner, ensuring that security measures are uniformly applied to all cloud resources.

The on-premise segment is anticipated to grow at the fastest CAGR during the forecast period. Critical resources and sensitive data are kept in on-premises environments by many organizations. It is essential to safeguard these assets against unauthorized access, data breaches, and insider threats. Cybersecurity mesh in on-premises deployments enables businesses to apply security rules directly to specific endpoints and devices, offering granular protection for vital assets and reducing risks.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. Large businesses are frequent targets of cyberattacks because they may contain significant data and resources. Enterprises must employ cutting-edge security measures due to the growing complexity and sophistication of cyberattacks. Cybersecurity mesh systems provide improved security by putting security controls in place directly on individual devices, allowing for in-the-moment threat detection, reaction, and containment.

The small & medium enterprises (SMEs) segment is anticipated to grow at the fastest CAGR during the forecast period. SMEs are not immune to cyberattacks, and they are frequently singled out since it is speculated that they may have less robust security measures than bigger companies. SMEs now understand the need for strong cybersecurity measures due to the rising frequency and sophistication of cyberattacks, such as ransomware, phishing, and data breaches. SMEs may protect their digital assets and sensitive data with the help of cybersecurity mesh solutions, which provide them with sophisticated security capabilities.

End Use Insights

The IT and telecom segment accounted for the largest market revenue share in 2024. The IT and telecom sectors have quickly adopted cloud computing and virtualization technologies to improve agility, scalability, and cost-effectiveness. However, these technologies pose particular security issues, like data privacy, multi-tenancy, and virtual machine vulnerabilities. Cybersecurity mesh solutions offer an integrated security framework to the IT & Telecom sector that covers virtualized infrastructure and cloud environments, enabling consistent security controls and policies to safeguard data and applications. This is expected to increase the demand for the cybersecurity mesh industry across the IT and telecom sectors.

The healthcare segment is anticipated to grow at the fastest CAGR during the forecast period,owing to the importance of securing patient health records and the healthcare industry's vulnerability to cyberattacks. Ransomware, data breaches, and targeted attacks are just a few examples of rising cyber threats. Organizations in the healthcare industry are aware of the importance of having strong security measures in place to safeguard patient information, vital infrastructure, and treatment continuity. Cybersecurity mesh offers an adaptive and distributed security method to reduce the growing dangers in this area.

Regional Insights

North America dominated the cybersecurity mesh market with the largest revenue share of 40.7% in 2024. The cyber threat landscape in North America is complex and constantly changing. Attacks on key infrastructure, corporations, government agencies, and people are all increasingly being conducted via cyberspace. Strong cybersecurity measures are essential to safeguard sensitive data, vital systems, and infrastructure. In North America, data breaches have grown to be a big problem, with many high-profile events affecting both corporations and people. The disclosure of private data undermines confidence and causes privacy concerns. Through granular security controls and encryption techniques, cybersecurity mesh solutions assist organizations in protecting sensitive data, assuring data privacy, and ensuring regulatory compliance.

U.S. Cybersecurity Mesh Market Trends

The cybersecurity mesh market in the U.S. accounted for the largest market revenue share in North America in 2024. The growing use of smart technologies and connected devices in sectors like manufacturing, healthcare, and critical infrastructure is further accelerating demand for mesh-based cybersecurity solutions in the U.S. As the number of endpoints increases, ranging from industrial sensors and medical devices to autonomous systems and smart building controls, so too does the need for distributed, device-level security. Cybersecurity mesh, by contrast, enables localized policy enforcement and identity-based security controls that can be deployed close to the edge. This capability is crucial for securing operational technology (OT) environments that cannot tolerate high latency or downtime.

Europe Cybersecurity Mesh Market Trends

The cybersecurity mesh market in Europe is expected to grow at the fastest growing CAGR of 13.9% over the forecast period. Ransomware assaults, data breaches, and targeted attacks are some of the sophisticated cyber dangers that Europe is facing on a regular basis. Government agencies, healthcare providers, financial organizations, and essential infrastructure are just a few organizations that are increasingly targeted. Cybersecurity mesh offers improved security capabilities by offering dispersed security controls, threat intelligence sharing, and incident response coordination to counter these changing threats.

The UK cybersecurity mesh market is expected to grow at a substantial CAGR during the forecast period. The increasing adoption of cloud-native and edge technologies by UK enterprises is further boosting demand for cybersecurity mesh solutions. As more businesses migrate workloads to cloud platforms and deploy applications closer to users and devices, whether through IoT, 5G, or edge computing, they need security models that can protect digital assets outside traditional perimeters. Mesh frameworks deliver identity-based, adaptive security at the point of access, allowing UK companies to maintain control over sensitive data and systems in a highly decentralized architecture. This is particularly valuable in industries such as finance, healthcare, and manufacturing, where operational integrity and regulatory compliance must be balanced with rapid digital innovation.

Asia Pacific Cybersecurity Mesh Trends

The cybersecurity mesh market in Asia Pacific is expected to register at a moderate CAGR during the forecast period. The expansion of 5G networks across countries like China, South Korea, and India is also accelerating cybersecurity challenges. The ultra-low latency and high-speed connectivity offered by 5G are unlocking new possibilities for smart cities, autonomous systems, and industrial automation. However, these advancements also open new attack surfaces and increase the complexity of securing networked environments. Cybersecurity mesh frameworks offer adaptive policy enforcement and scalable monitoring mechanisms that are ideal for 5G-enabled architectures, helping enterprises secure both core and edge assets more effectively.

The China cybersecurity mesh market is projected to grow at the fastest CAGR during the forecast period. The rapid development of smart cities and IoT infrastructure is also stimulating the market growth in China. With a rising number of connected devices deployed in urban infrastructure, manufacturing plants, and logistics networks, there is an immense need for real-time data processing and intelligent analytics. These applications require distributed computing models where edge, regional, and core cloud platforms work in tandem. Cybersecurity mesh acts as the enabler of this architecture, providing the agility and scalability necessary to interlink diverse computing nodes and cloud services across large geographical areas, all while meeting latency, security, and reliability requirements.

Key Cybersecurity Mesh Company Insights

Some of the key companies operating in the market, include Fortinet, Inc., and Check Point Software Technologies Ltd., among others, are some of the leading participants in the cybersecurity mesh industry.

-

Fortinet, Inc., is a cybersecurity and network security solutions provider. The company’s flagship technology, FortiOS, is its proprietary operating system, which powers its FortiGate next-generation firewalls (NGFWs) and related security appliances. FortiOS converges networking and security functions such as SD-WAN, secure Wi-Fi (FortiSwitch and FortiAP), VPN, and advanced threat analytics within a unified management framework. Fortinet also develops custom-built ASICs (Security Processing Units), enabling high-performance throughput and industry-leading efficiency across its product portfolio.

-

Check Point Software Technologies Ltd. is a cybersecurity firm. The company operates with a strong focus on threat prevention, offering unified security management through its Infinity architecture. This architecture provides consolidated security across multiple environments, including networks, cloud, mobile, and endpoints through a single, integrated platform. Check Point’s portfolio includes advanced threat prevention tools, such as intrusion prevention systems (IPS), antivirus, anti-bot, zero-day protection, and advanced sandboxing technologies. These offerings are designed not just to detect threats but to proactively prevent them, ensuring minimal disruption to an organization’s operations.

AppNovi and SonicWall are some of the emerging market participants in the cybersecurity mesh industry.

-

Aryaka Networks, Inc. is a privately held technology firm. It specializes in delivering a cloud-first Unified Secure Access Service Edge (SASE) offering, combining software-defined wide-area networking (SD-WAN), application acceleration, global private network connectivity, and security-as-a-service into a single integrated platform.

-

SonicWall is a cybersecurity company offering advanced network security solutions such as next-generation firewalls, secure remote access, and unified threat management (UTM). SonicWall operates globally and supports a vast partner ecosystem that includes managed service providers (MSPs), value-added resellers, and system integrators. SonicWall has been actively transforming its product strategy to align with the emerging cybersecurity mesh architecture. This transformation is largely driven by a shift in enterprise IT environments toward distributed, cloud-based, and hybrid models, as well as the growing threat landscape.

Key Cybersecurity Mesh Companies:

The following are the leading companies in the cybersecurity mesh market. These companies collectively hold the largest market share and dictate industry trends.

- appNovi

- ARYAKA NETWORKS, INC.

- Cato Networks

- Check Point Software Technologies Ltd.

- Exium

- Forcepoint

- Fortinet, Inc.

- Ivanti

- Mesh Security ltd.

- Naoris Protocol

- Palo Alto Networks

- Quasius Investment Corp. GCA

- SailPoint Technologies, Inc.

- SonicWall

- Zscaler

Recent Developments

-

In May 2025, Check Point Software Technologies Ltd. acquired Veriti Cybersecurity, marking a major milestone in advancing its hybrid mesh security vision. This acquisition, along with the recently launched External Risk Management (ERM) solution, strengthens Check Point’s capabilities to offer comprehensive risk lifecycle management. It enables the company to proactively address both internal and external threats across the entire attack surface.

-

In April 2025, Fenix24 acquired appNovi. By combining Fenix24’s proprietary software with appNovi’s advanced application dependency analysis, Fenix24 customers will benefit from enhanced mapping and visualization of physical assets, providing deeper insight into network exposure and vulnerabilities.

-

In April 2025, Fortinet launched the FortiGate 700G series, a next-generation firewall (NGFW) to expand its hybrid mesh firewall Portfolio. The FortiGate 700G offers significant performance improvements and also features support for advanced networking capabilities, FortiGuard AI-Powered Security Services, and the latest FortiOS upgrades, such as post-quantum cryptography readiness, AI-based threat detection through FortiAI-Protect, and generative AI (GenAI) risk assessment.

-

In April 2025, Forcepoint acquired Getvisibility, enhancing its Data Security Everywhere platform with advanced capabilities for real-time data risk visibility and control across hybrid cloud and generative AI environments. This strategic acquisition enables Forcepoint to strengthen its AI Mesh and risk insight technologies, allowing organizations to proactively understand, adapt to, and protect their data before it is compromised or misused. By integrating Getvisibility’s AI-powered Data Security Posture Management and Data Detection and Response solutions, Forcepoint provides a unified, foundational layer for its security architecture, empowering customers to adopt innovation securely and confidently.

Cybersecurity Mesh Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.86 billion

Revenue forecast in 2033

USD 7.03 billion

Growth rate

CAGR of 11.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; UAE; Saudi Arabia; and South Africa

Key companies profiled

appNovi; ARYAKA NETWORKS, INC.; Cato Networks; Check Point Software Technologies Ltd.; Exium; Forcepoint; Fortinet, Inc.; Ivanti; Mesh Security ltd.; Naoris Protocol; Palo Alto Networks; Quasius Investment Corp. GCA; SailPoint Technologies, Inc.; SonicWall; and Zscaler

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cybersecurity Mesh Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cybersecurity mesh market report based on offering, deployment, enterprise size, end use, and region.

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

IT and Telecom

-

Healthcare

-

Government

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cybersecurity mesh market size was estimated at USD 2.59 billion in 2024 and is expected to reach USD 2.86 billion in 2025.

b. The global cybersecurity mesh market is expected to grow at a compound annual growth rate of 11.9% from 2025 to 2033 to reach USD 7.03 billion by 2033.

b. The solution segment dominated the cybersecurity mesh market with a market share of 73.3% in 2024. Cybersecurity mesh solutions have been made possible by the emergence of technologies like edge computing, machine learning, and artificial intelligence. These technologies boost the entire security posture by enabling intelligent threat detection, behavior analytics, and automated responses at the edge.

b. Some key players operating in the cybersecurity mesh market include appNovi, ARYAKA NETWORKS,INC., Cato Networks, Check Point Software Technologies Ltd., Exium, Forcepoint, Fortinet, Inc., Ivanti, Mesh Security ltd., Naoris Protocol, Palo Alto Networks, Quasius Investment Corp. GCA, SailPoint Technologies, Inc., SonicWall, and Zscaler.

b. Key factors that are driving the cybersecurity mesh market growth include the rapid expansion and increasing sophistication of cyberattacks as well as the shift of assets to the hybrid multi-cloud.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.