- Home

- »

- Homecare & Decor

- »

-

Cycle Tourism Market Size & Share, Industry Report, 2033GVR Report cover

![Cycle Tourism Market Size, Share & Trends Report]()

Cycle Tourism Market (2026 - 2033) Size, Share & Trends Analysis Report By Group (Groups/Friends, Couples, Family, Solo), By Booking Mode (Direct, Travel Agent, Marketplace Booking), By Age Group (18 To 30 Years, 31 To 50 Years, Above 50 Years), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-025-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cycle Tourism Market Summary

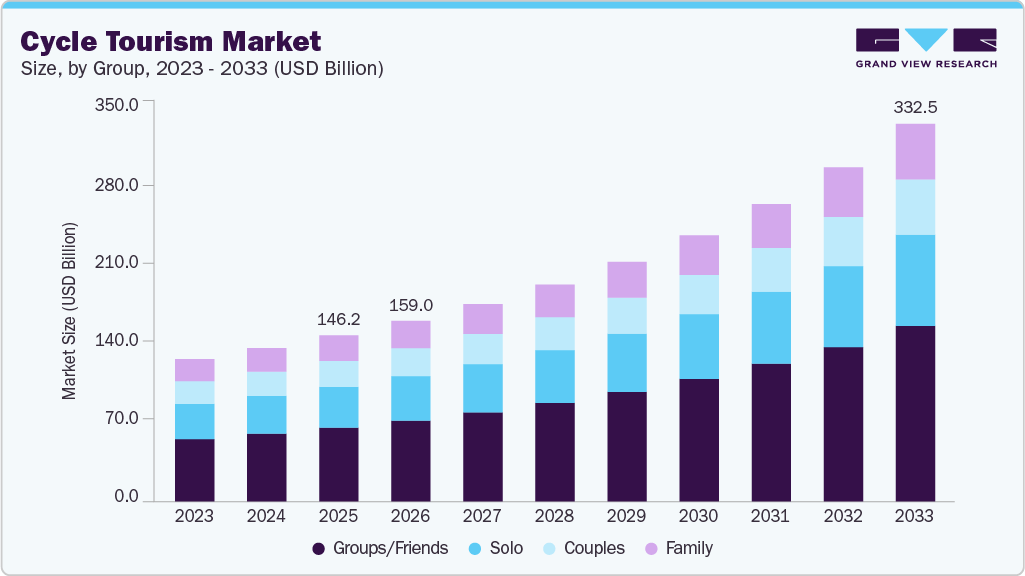

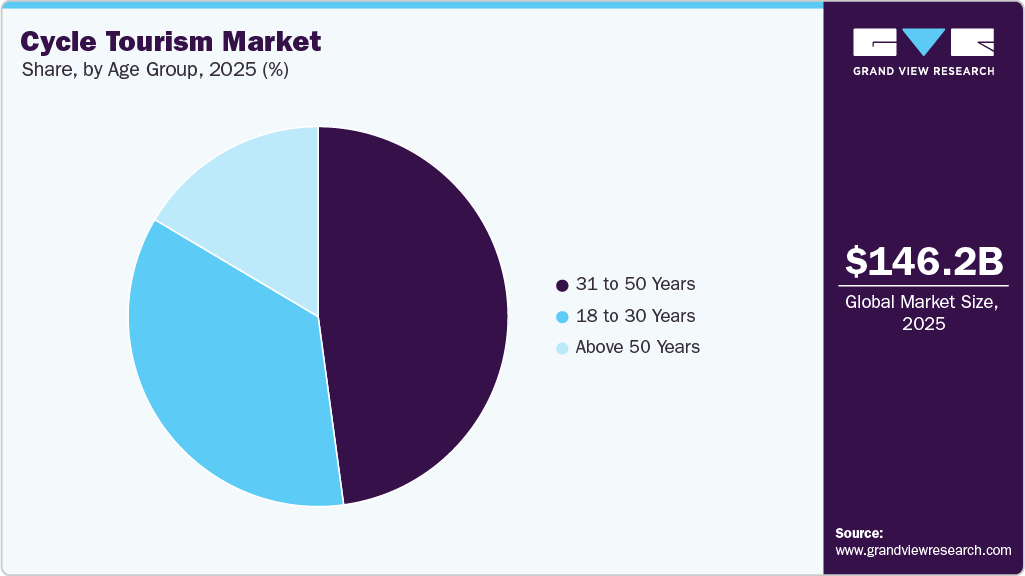

The global cycle tourism market size was valued at USD 146.19 billion in 2025 and is projected to reach USD 332.48 billion by 2033, growing at a CAGR of 11.1% from 2026 to 2033. As travelers seek sustainable and immersive travel experiences, the demand for cycle tourism is increasing.

Key Market Trends & Insights

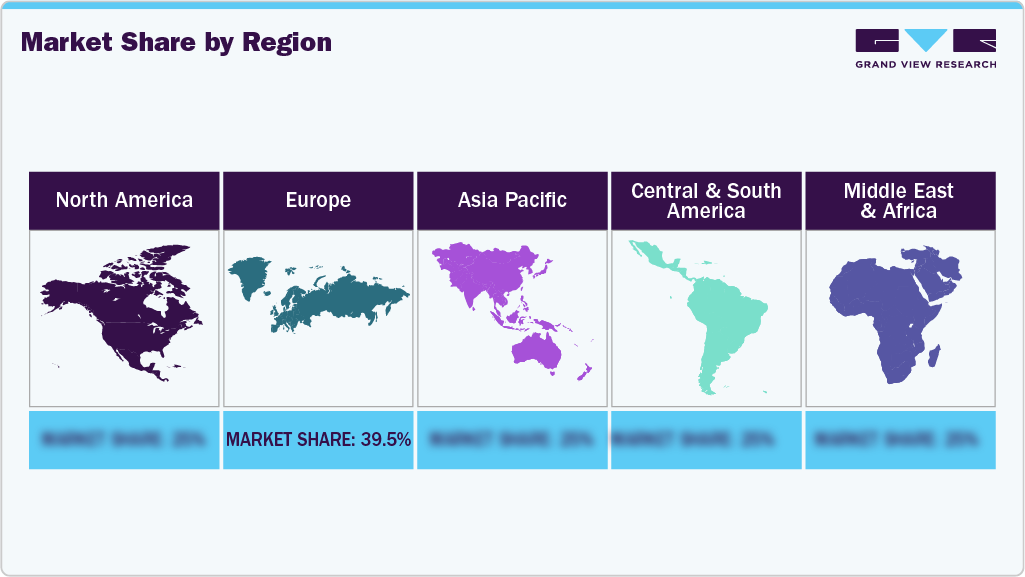

- Europe cycle tourism market accounted for a revenue share of 39.50% in 2025.

- The UK cycle tourism market accounted for a share of around 39.50% of the European industry in 2025.

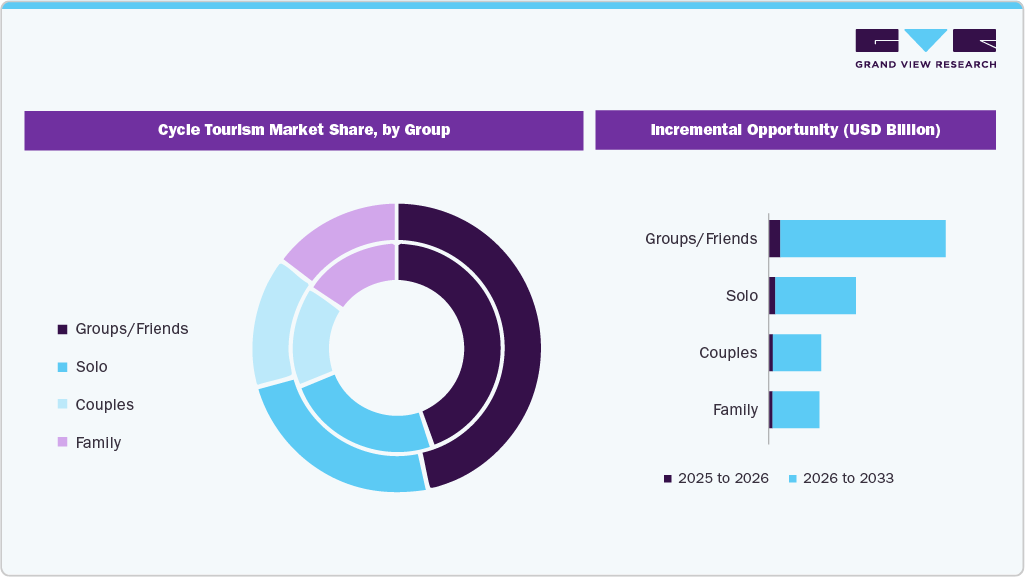

- By group, groups/friends accounted for a market share of 44.45% in 2025.

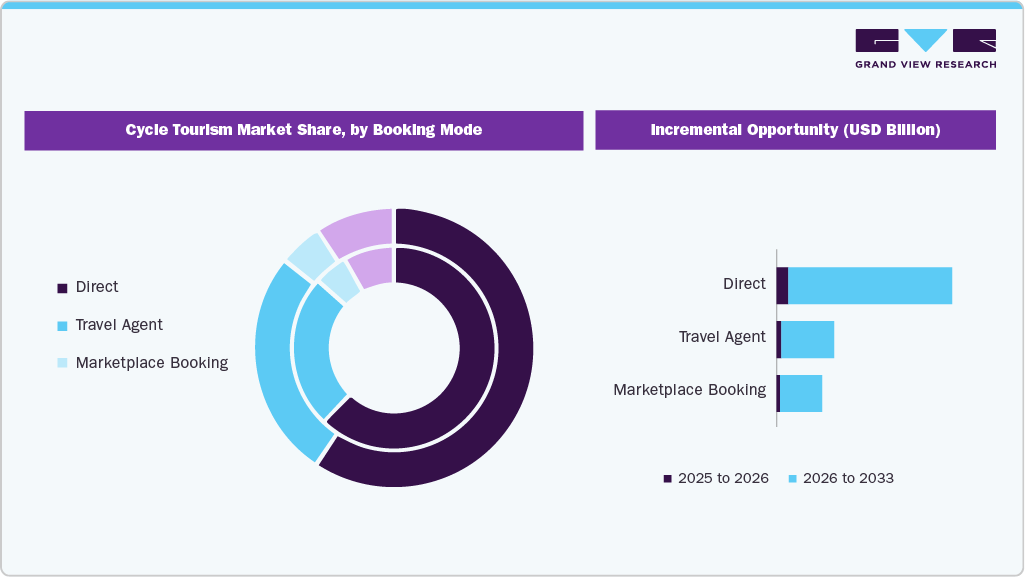

- By booking mode, direct bookings accounted for a market share of 63.00% in 2025.

- By age group, tourists aged between 31 to 50 Years age group held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 146.19 Billion

- 2033 Projected Market Size: USD 332.48 Billion

- CAGR (2026-2033): 11.1%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

With growing awareness of environmental issues and a shift toward eco-friendly tourism, cycling offers a low-carbon way to explore destinations without the environmental impact associated with traditional vehicles. Many travelers are prioritizing modes of transport that align with their commitment to sustainability, and cycle tourism presents an ideal option. By reducing dependency on cars and public transport, cycle tourism supports local environments and minimizes pollution, making it a favored choice among environmentally conscious tourists.Health and wellness trends further fuel the popularity of cycle tourism. People are more focused on maintaining active lifestyles and choosing travel experiences that integrate physical activity. Cycling is not only a low-impact form of exercise suitable for a broad range of fitness levels but also offers a more intimate experience with nature, as tourists can cover large areas while remaining connected to their surroundings. Whether exploring city landscapes or rural trails, cycle tourism allows travelers to enjoy physical exercise while immersing themselves in their destinations.

Moreover, the infrastructure supporting cycle tourism has significantly improved worldwide. Many destinations now have dedicated cycling trails, bike-sharing programs, and rental services that make cycling more accessible and enjoyable for tourists. Governments and tourism boards are investing in cyclist-friendly paths, especially in areas with natural or cultural significance, to attract tourists seeking an active way to explore. These enhancements make cycle tourism safer, easier, and more appealing, encouraging travelers to choose cycling as a core part of their travel plans.

Additionally, the increased demand for authentic and slow travel experiences also contributes to the growth of cycle tourism. Cycling allows tourists to explore places at their own pace, interact with locals, and discover hidden gems off the typical tourist paths. This sense of exploration and freedom resonates with travelers looking for more meaningful connections with their destinations. As a result, cycle tourism is flourishing as a global trend that satisfies the desire for sustainable, health-oriented, and deeply engaging travel experiences.

Brand Market Share Insights

The global cycle tourism industry is characterized by the presence of established tour operators and destination-led tourism bodies alongside a growing base of specialist cycling companies and experience-focused challengers, all competing to meet evolving traveler expectations around safety, authenticity, and experiential value. Market participants are increasingly developing next-generation cycling tourism offerings supported by improved route infrastructure, digital navigation tools, e-bike integration, and professionally guided services that reduce physical barriers and expand accessibility. These developments are designed to enhance travel comfort, route reliability, and overall journey quality across key formats such as leisure cycling holidays, long-distance touring, and adventure-based cycling experiences.

Some of the major companies operating in the global market are SpiceRoads Cycling, World Expeditions, Travel + Leisure Holdco, LLC, Exodus Travels Limited., Intrepid Travel, G Adventures, Himalayan Glacier Adventure and Travel Company, Sarracini Travel, Arbutus Routes, and Austin Adventures. These key companies are focusing on taking major initiatives to strengthen their market position and offer authentic and immersive travel experiences to travelers across the world.

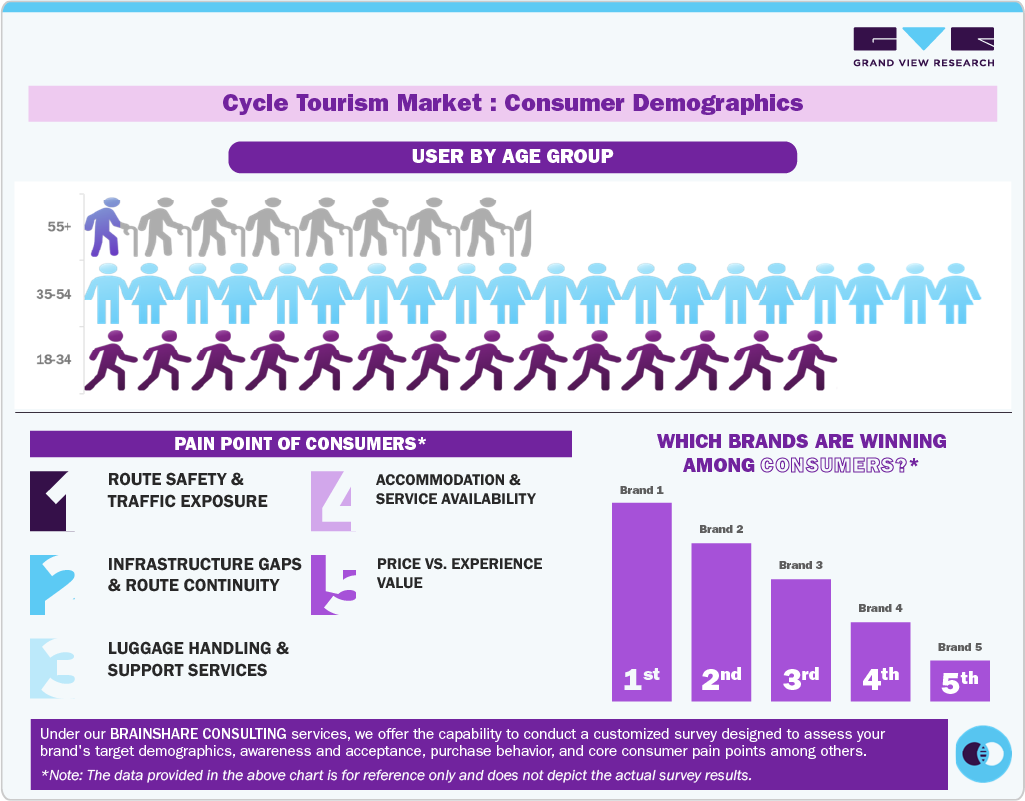

Consumer Insights

The industry is characterized by clear differences in traveler profiles, trip formats, and spending behavior. Entry-level and budget travelers typically participate in short-duration or domestic cycling trips, often self-guided and centered on well-marked trails, scenic routes, or weekend getaways. In contrast, higher-spending travelers favor premium, multi-day cycling experiences that combine guided routes, high-quality bicycles, luggage transfers, accommodation, and curated local experiences. For this segment, cycle tourism is positioned as a blend of active travel, wellness, and cultural immersion rather than purely a sport-focused activity.

Age and fitness levels strongly influence participation patterns. Travelers aged 25-44 form the core demand base, driven by interest in adventure travel, fitness-oriented holidays, and social-media-driven destination discovery. The 45-64 segment shows strong participation in organized and comfort-led cycling tours, valuing safety, route quality, and logistical support. Older travelers are increasingly entering the market through the adoption of e-bikes, which reduce physical barriers and expand accessibility. Despite growing interest, the market faces challenges such as uneven cycling infrastructure, safety concerns on mixed-traffic roads, limited bike-friendly accommodation in emerging destinations, and inconsistent availability of rental, repair, and support services. Addressing these gaps through infrastructure investment, standardized services, and destination-level coordination remains critical to sustaining long-term growth in cycle tourism.

Group Insights

The group/friends segment captured around 44.45% market share in 2025. Cycling as a group allows travelers to explore destinations in a fun, social setting, enhancing camaraderie and creating shared memories. Group cycling also provides a sense of safety and support, as members can encourage and motivate one another throughout the journey, especially on challenging routes. Furthermore, the rise of social media has popularized group adventure trips, inspiring people to organize cycling tours with friends as a way to bond and document their experiences together. This trend is also supported by tour operators who offer tailored group packages, accommodating diverse group sizes and skill levels, which further drives interest in group-based cycle tourism.

The solo segment is expected to grow at a CAGR of 10.9% from 2026 to 2033. Cycling solo allows tourists to set their own pace, explore destinations based on personal interests, and enjoy a deeper, more reflective travel experience. Many solo travelers are drawn to the freedom of navigating their paths, away from the pressures of group schedules, allowing them to connect more authentically with the environment and local culture. Additionally, the rise of digital connectivity and mobile technology has made solo travel safer and more accessible, as cyclists can rely on GPS navigation, mobile booking options, and online communities for support.

Booking Mode Insights

Direct booking mode accounted for a share of around 63.00% in 2025. By booking directly with tour providers, accommodation, and equipment rental services, cyclists can tailor their itineraries to better suit their personal preferences, choosing specific routes, accommodations, and experiences that fit their skill levels and interests. Direct booking often allows travelers to communicate directly with service providers, gaining insights, recommendations, and even exclusive offers that are not available through third-party platforms. Additionally, the convenience of online direct booking systems, combined with the rising trend of personalized and independent travel, makes it easier for cycle tourists to arrange seamless, flexible plans.

The marketplace booking segment is expected to grow at a CAGR of 12.5% from 2026 to 2033. Marketplace booking platforms aggregate various cycling tours, accommodations, and services, allowing tourists to browse and compare options all in one place. This setup streamlines the booking process, saving time for travelers who can review itineraries, pricing, and customer reviews to make informed decisions. Additionally, many marketplace platforms offer secure payment methods, customer support, and flexible cancellation policies, giving travelers peace of mind when booking.

Age Group Insights

The 31 to 50 age group segment accounted for a share of around 47.86% in 2025. People in this age group are often at a life stage where they seek active leisure options that align with their fitness goals, and cycling offers both physical exercise and adventure. Many in this age range have the financial stability to invest in travel. They are inclined toward experiential tourism, which allows them to explore new destinations in a fulfilling and active way. Additionally, cycling offers a sustainable and eco-friendly form of travel, which resonates well with the values of this age group.

The demand for cycle tourism among the 18 to 30-year age group is expected to grow at a CAGR of 11.7% from 2026 to 2033. This age group values experiential travel that offers authenticity and a chance to connect with nature, and cycling provides an ideal way to achieve both. Additionally, many young travelers are driven by environmental awareness, preferring eco-friendly travel options like cycling to minimize their carbon footprint. The flexibility and affordability of cycling trips appeal to younger tourists, who often prioritize budget-conscious travel while desiring unique, memorable experiences. Social media also plays a role, as sharing cycling adventures through platforms like Instagram and TikTok has popularized cycle tourism among young people looking to combine exploration with social engagement.

Regional Insights

The North America cycle tourism market accounted for a share of 27.44% in 2025. North America’s diverse geography, from scenic coastlines and mountain trails to national parks and rural landscapes, offers cyclists a variety of unique and visually stunning routes. Many cities and regions have invested in improved cycling infrastructure, creating bike lanes, trails, and safety measures that make cycling more accessible and enjoyable for tourists. Additionally, there is a rising trend of environmental awareness and wellness-focused travel, which cycling fulfills by providing an eco-friendly way to explore while supporting active lifestyles. North American destinations also appeal to both novice and seasoned cyclists, with tour operators offering customized packages and rentals that accommodate all skill levels, enhancing the continent’s attractiveness as a cycle tourism destination.

U.S. Cycle Tourism Market Trends

The cycle tourism market in the U.S. held a share of 77.36% of the North American market in 2025. Cycle tourism in the U.S. offers a wide variety of scenic cycling routes, from coastal highways and national park trails to historic countryside paths, appealing to both recreational and adventure cyclists. Many cities and states are investing in cycling infrastructure, such as dedicated bike lanes and safe trails, which enhances the appeal of cycling for tourists. Additionally, the growth of bike-sharing programs and easily accessible rental services makes it convenient for tourists to incorporate cycling into their travel plans, driving the popularity of cycle tourism across the U.S.

Canada cycle tourism market is expected to grow at a CAGR of 12.3% from 2026 to 2033. The cycle tourism market in Canada offers a diverse range of cycling experiences, including long-distance rail trails, national and provincial park routes, coastal paths, and scenic countryside corridors that attract both leisure cyclists and endurance-focused travelers. Growing investment by provincial and municipal governments in dedicated bike lanes, multi-use trails, and cycling-friendly tourism infrastructure is improving safety and accessibility for visitors.

In addition, the increasing availability of bike rentals, guided cycling tours, and e-bike services is making cycle tourism more accessible to a wider range of age groups and fitness levels. Urban centers and tourist regions are integrating cycling into broader tourism planning, allowing travelers to combine cycling with nature, culture, and wellness experiences.

Europe Cycle Tourism Market Trends

The cycle tourism market in Europe accounted for a share of around 39.50% in 2025. Europe boasts extensive cycling infrastructure, including dedicated bike lanes, scenic routes, and well-marked trails across cities and countryside, making it a highly accessible and attractive destination for cycle tourists. Many European regions promote sustainable tourism, encouraging travelers to choose low-impact travel options, and cycling aligns perfectly with this focus on environmental responsibility. Additionally, Europe’s rich history, diverse landscapes, and charming towns make cycling an ideal way to experience the continent at a leisurely pace, allowing tourists to connect with local cultures in an authentic, interactive way.

The UK cycle tourism market accounted for a share of around 39.50% of the European industry in 2025. Cycle tourism in the UK offers an expanding network of cycling routes, including popular paths like the National Cycle Network and scenic trails through the countryside, making it easier for cyclists to access and enjoy diverse terrains. Additionally, many travelers are drawn to the UK’s unique cycling experiences, such as coastal rides, countryside trails, and routes that pass through cultural landmarks. With growing environmental awareness, more tourists are choosing cycling as an eco-friendly alternative to driving while also benefiting from the health and wellness aspects of this form of travel. Supportive infrastructure, including bike rental stations, cycling-friendly accommodations, and local tour operators, further enhances the cycle tourism experience, making the UK an increasingly attractive destination for cyclists of all levels.

The cycle tourism market in Italy is expected to grow at a CAGR of 13.5% from 2026 to 2033. Cycle tourism in Italy is driven by the country’s strong alignment between cycling, cultural tourism, and regional travel economies. Italy’s compact geography and dense concentration of historic towns allow cyclists to combine short-distance routes with frequent cultural, culinary, and leisure stops, making cycling holidays attractive even to non-professional riders. Demand is particularly strong for themed routes linking wine regions, UNESCO heritage sites, and rural villages, where cycling is positioned as an experiential way to explore local identity rather than a sport-focused activity.

Asia Pacific Cycle Tourism Market Trends

The cycle tourism market in Asia Pacific is expected to grow at a CAGR of 11.8% from 2026 to 2033. Many Asia Pacific countries, including Japan, Thailand, and New Zealand, offer dedicated cycling routes that showcase historic sites, natural wonders, and vibrant local communities, making it possible for tourists to experience these destinations in an engaging, active way. The region’s strong emphasis on sustainability has further fueled interest in cycling as an eco-friendly travel option. Additionally, governments and tourism boards in the region have made efforts to promote cycle tourism by improving infrastructure, creating safe cycling trails, and offering rental and guided tour services that cater to all experience levels.

The China cycle tourism market accounted for a share of around 23.13% of the Asia Pacific market in 2025, driven by the rapid expansion of cycling infrastructure and strong domestic tourism participation. China has developed extensive urban greenways, long-distance cycle routes, and scenic corridors around lakes, rivers, and heritage towns, making cycling accessible to both recreational riders and long-distance tourists. Government-backed initiatives promoting low-carbon mobility and healthy lifestyles have further encouraged cycling as a leisure and tourism activity.

The cycle tourism market in Australia is expected to grow at a CAGR of 11.8% from 2026 to 2033. Cycle tourism in Australia benefits from extensive coastal routes, rail trails, and regional cycling corridors that attract domestic and international travelers seeking outdoor recreation and wellness-focused travel. Government support for trail development, maintenance, and safety infrastructure is improving route accessibility and reliability for touring cyclists. In addition, increasing availability of guided cycling tours, e-bike rentals, and cycle-friendly accommodations is broadening participation across age groups and fitness levels. Regional tourism boards are actively promoting cycling as a way to extend visitor stays and disperse tourism beyond major cities.

Central & South America Cycle Tourism Market Trends

The cycle tourism market in Central & South America is expected to grow at a CAGR of 9.8% from 2026 to 2033, supported by rising interest in adventure tourism and experiential travel across the region. Countries such as Chile, Colombia, Peru, and Brazil are attracting cyclists with diverse terrains that include mountain routes, coastal roads, rainforest trails, and high-altitude landscapes, offering unique cycling experiences that combine nature and culture. These destinations appeal strongly to international travelers seeking physically engaging and immersive travel formats.

Middle East & Africa Cycle Tourism Market Trends

The cycle tourism market in the Middle East & Africa is expected to grow at a CAGR of 10.1% from 2026 to 2033, driven by rising interest in outdoor, adventure, and endurance-based travel experiences. The region is gaining traction for cycle tourism through desert routes, coastal stretches, mountain trails, and wildlife-linked circuits that appeal to experienced cyclists and niche adventure travelers. Destinations across the Middle East are leveraging planned tourism zones and large-scale destination developments to introduce cycling as part of broader leisure and sports tourism offerings.

Key Cycle Tourism Companies Insights

Key players operating in the cycle tourism market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Cycle Tourism Companies:

The following key companies have been profiled for this study on the cycle tourism market.

- SpiceRoads Cycling

- World Expeditions

- Travel + Leisure Holdco, LLC

- Exodus Travels Limited.

- Intrepid Travel

- G Adventures

- Himalayan Glacier Adventure and Travel Company

- Sarracini Travel

- Arbutus Routes

- Austin Adventures

Recent Developments

-

In June 2025, Brand USA launched a campaign inviting travelers to explore the U.S. by bicycle, highlighting the country’s wide range of cycling experiences across urban routes, scenic trails, and adventure destinations. The initiative showcased opportunities to combine biking with cultural attractions, national parks, and local food scenes, positioning cycling as a flexible way to experience different regions. The campaign also aligned with upcoming milestone events such as America’s 250th anniversary, the FIFA World Cup, and the Route 66 Centennial, encouraging visitors to plan bike-centric trips around these occasions.

-

In February 2025, DuVine Cycling + Adventure Co. unveiled a series of new guided cycling itineraries for 2025-2026, expanding its portfolio with culturally immersive and experience-led tours. The company introduced updated European routes, including journeys through Germany, Austria, and Greece, alongside new chef-led culinary cycling trips in destinations such as the Basque Country, Provence, and Puglia. For 2026, DuVine also announced a limited set of special itineraries in northern Spain timed around the total solar eclipse, combining scenic cycling with luxury accommodations and curated local experiences.

Cycle Tourism Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 159.00 billion

Revenue forecast in 2033

USD 332.48 billion

Growth rate (revenue)

CAGR of 11.1% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Group, booking mode, age group, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; South Africa; Saudi Arabia; Brazil; Argentina

Key companies profiled

SpiceRoads Cycling; World Expeditions; Travel + Leisure Holdco, LLC; Exodus Travels Limited.; Intrepid Travel; G Adventures; Himalayan Glacier Adventure and Travel Company; Sarracini Travel; Arbutus Routes; Austin Adventures

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cycle Tourism Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cycle tourism market report on the basis of group, booking mode, age group, and region.

-

Group Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Groups/Friends

-

Couples

-

Family

-

Solo

-

-

Booking Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Direct

-

Travel Agent

-

Marketplace Booking

-

-

Age Group Outlook (Revenue, USD Billion, 2021 - 2033)

-

18 to 30 Years

-

31 to 50 Years

-

Above 50 Years

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the cycle tourism market include SpiceRoads Cycling; World Expeditions; Travel + Leisure Holdco, LLC; Exodus Travels Limited.; Intrepid Travel; G Adventures; Himalayan Glacier Adventure and Travel Company; Sarracini Travel; Arbutus Routes; and Austin Adventures.

b. Key factors that are driving the cycle tourism market growth include a significant rise in the number of cycling participants traveling a long distance, increasing penetration of adventure camping and adventure sports among millennials, and government initiatives to develop domestic and international tourism across the economies, growing awareness of environmental issues and a shift toward eco-friendly tourism.

b. The global cycle tourism market was estimated at USD 146.19 billion in 2025 and is expected to reach USD 159.00 billion in 2026.

b. The cycle tourism market is expected to grow at a compound annual growth rate of 11.1% from 2026 to 2033 to reach USD 332.48 billion by 2033.

b. Europe dominated the cycle tourism market with a share of 39.50% in 2025. This is owing to increased demand for cycle tourism as a form of physical activity, the rise in bicycle lanes, car-free city centers, and greater bike storage facilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.