- Home

- »

- Medical Devices

- »

-

Cystoscope Market Size And Share, Industry Report, 2030GVR Report cover

![Cystoscope Market Size, Share & Trends Report]()

Cystoscope Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Flexible Cystoscopes, Rigid Cystoscopes), By Application (Urology, Gynecology), By End Use (Hospitals), By Type (Video Cystoscopes), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-511-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cystoscope Market Size & Trends

The global cystoscope market size was estimated at USD 1.23 billion in 2024 and is projected to grow at a CAGR of 9.99% from 2025 to 2030. The demand for cystoscopes is increasing rapidly, driven by the growing geriatric population, which is more susceptible to urological conditions, and the increasing prevalence of urological and gynecological disorders globally. For instance, a study published by Elsevier Inc. in January 2024 highlighted that urinary tract infections (UTIs) are among the most common conditions, with 50%-60% of women having at least one UTI in their lifetime.

Cystoscopes play a crucial role in diagnosing and treating various urological disorders, including urinary tract infections (UTIs), bladder cancer, bladder stones, and urinary incontinence. The rising prevalence of urological conditions is expected to increase the demand for diagnostic tools, particularly cystoscopes. For instance, the data published by the Continence Foundation of Australia in March 2024 indicates that urinary incontinence affects approximately 25% of adults in Australia. Moreover, Merck & Co., Inc. reported in January 2025 that around 1% to 2% of adults in the U.S. are diagnosed with urinary tract stones annually, with about 1 in 1,000 requiring hospitalization.

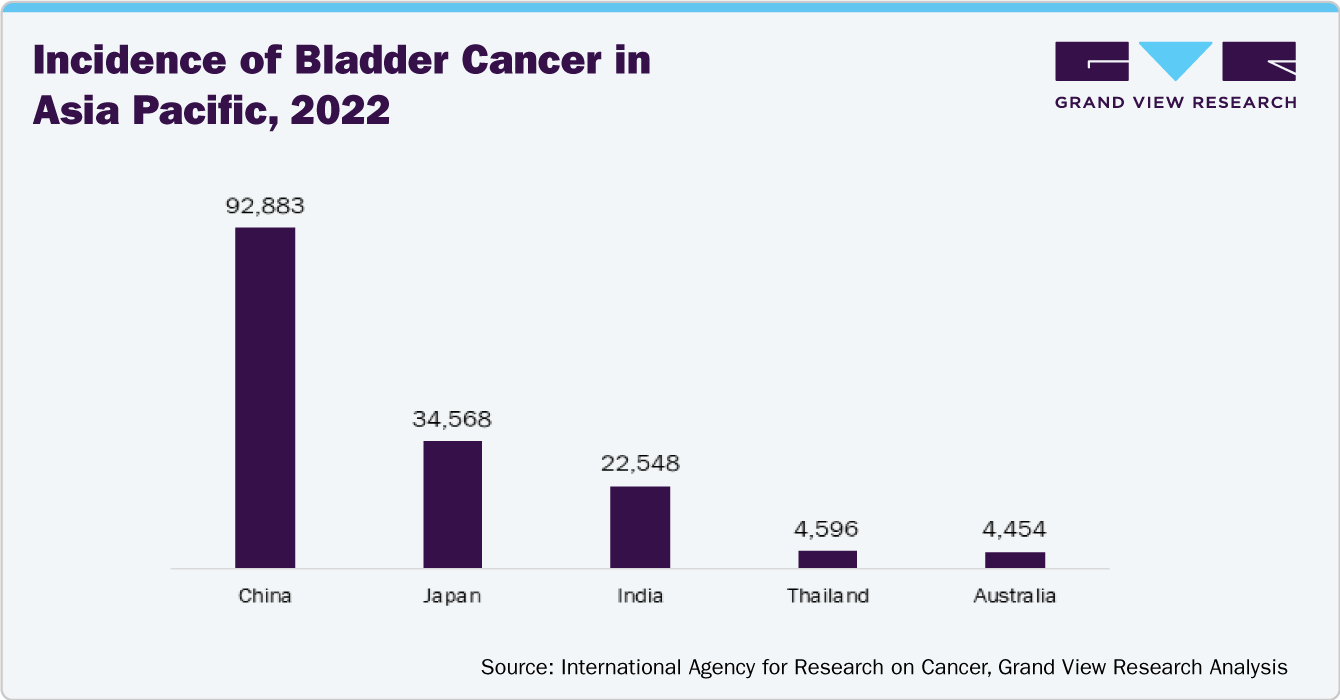

Furthermore, the International Agency for Research on Cancer revealed that in 2022, over 600,000 people worldwide were diagnosed with bladder cancer, resulting in more than 220,000 deaths. Bladder cancer presents significant challenges for diagnosis and treatment, primarily relying on cystoscopy. As a result, the increasing incidence of urological disorders and the crucial role of cystoscopy in their diagnosis is expected to drive market growth in the coming years.

Moreover, the growing older population, which is more susceptible to urological diseases, is a significant factor driving the growth of the cystoscope market. According to a WHO report published in October 2024, it is estimated that by 2030, around 16.66% of the global population will be aged 60 or older. Furthermore, the United Nations' World Social Report 2023 predicts that the number of individuals aged 65 and above will more than double, increasing from 761 million in 2021 to 1.6 billion by 2050. The demographic of those aged 80 and older is expected to grow even more rapidly.

The risk of urological disorders, including urinary incontinence, Benign Prostatic Hyperplasia (BPH), prostate cancer, bladder cancer, UTIs, and kidney and bladder stones, increases with age. According to data from Apollo Hospitals published in September 2024, urinary incontinence affects approximately 1 in 3 older adults. As a result, the rising prevalence of the older population and their increased risk of developing urological disorders are expected to drive demand for cystoscopes and boost market growth in the coming years.

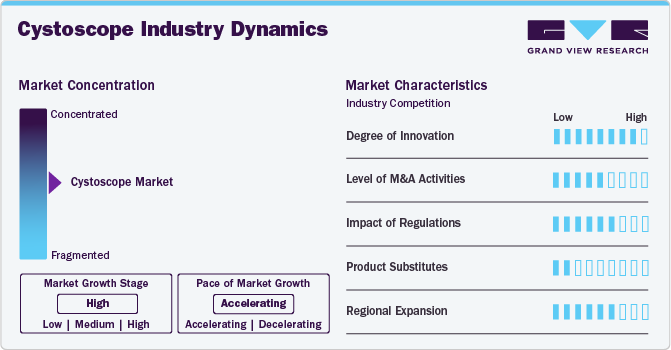

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The cystoscope market is characterized by growth owing to the rising prevalence of urological disorders, technological advancements, and the increasing prevalence of older people.

Industry players and researchers are focusing on developing patient-centered and advanced cystoscopes. For instance, in April 2023, UroViu Corp introduced the new Uro-GHD, a single-use, sterile cystoscope that can be used with an endoscopy platform. This cystoscope features an improved, softer, and more flexible cannula with a tapered tip for enhanced patient comfort. Such innovations are anticipated to boost the market growth over the forecast period.

Regulatory bodies such as the Food and Drug Administration (FDA), Health Canada, and the European Union establish standards for the quality and safety of medical devices, including cystoscopes. These devices are classified into various categories based on their associated risk levels, which affects the degree of regulatory scrutiny they undergo. For instance, the FDA categorizes cystoscopes and their accessories as Class 2 medical devices.

The cystoscope market is fragmented. This fragmentation can be attributed to the presence of numerous small, medium, and large firms offering various types of cystoscope products, such as flexible, rigid, video, and fiber-optic cystoscopes. For instance, Olympus Corporation offers flexible and video cystoscopes.

Companies in the cystoscope industry are strategically targeting regional expansion to seize emerging opportunities and enhance their market presence. The rising incidence of urological disorders in emerging markets such as India and China presents attractive prospects for industry players looking to establish a presence in these economies.

Product Insights

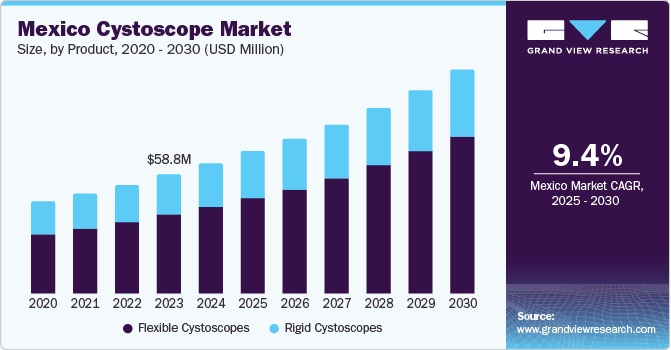

The flexible cystoscope segment dominated the market in 2024 in the product segment and is expected to register the highest CAGR of 10.93% during the forecast period. The primary advantages of flexible cystoscopes include their smaller size and enhanced patient comfort, making them ideal for routine flexible cystourethroscopy in office settings. In addition, the flexible tip allows for greater maneuverability, facilitating easier bladder inspection. These benefits are expected to drive significant growth in the flexible cystoscope segment in the coming years.

The rigid cystoscope segment is anticipated to experience significant growth during the forecast period. These non-flexible cystoscopes are primarily used for procedures such as biopsies and tumor removal. The rising incidence of bladder tumors is anticipated to support the growth of this segment further. According to data from the World Cancer Research Fund, 614,298 new cases of bladder cancer were reported in 2022. This increasing prevalence of bladder cancer is projected to drive the growth of the rigid cystoscope segment in the coming years.

Application Insights

The urology segment held the largest share in 2024 and is expected to grow with the highest CAGR of 10.56% in the coming years. An increasing prevalence of urological disorders, such as urinary incontinence, bladder cancer, urinary tract infections, and benign prostatic hyperplasia, is expected to drive the segment's growth. For instance, according to data published by NHS England in October 2023, over 1.8 million hospital admissions involving UTIs were made between 2018-19 and 2022-23. Thus, the large population suffering from urology disorders and the wide utilization of cystoscopes for diagnosing and treating these diseases are anticipated to support the market.

The gynecology segment is projected to experience substantial growth during the forecast period. Cystoscopes are vital in assessing bladder and ureteral integrity following gynecological surgeries. Gynecologists can use cystoscopes instead of hysteroscopes, as cystoscopy is essential for ensuring safe outcomes in complex procedures that may pose risks to the bladder and ureters. Therefore, the critical role of cystoscopes in gynecology is expected to drive growth in this segment in the coming years.

Type Insights

The video cystoscope segment is anticipated to dominate the market and is projected to grow at the fastest CAGR of 10.73% over the forecast period. The increasing launches and approvals of video cystoscopes are anticipated to boost the segment growth over the forecast period. For instance, in April 2021, Ambu Inc. obtained Health Canada approval for the aScope 4 Cysto, the company’s innovative video cystoscope platform for urology..

The fiberoptic cystoscope segment is anticipated to experience significant growth, driven by advancements in fiber optic technology and the rising prevalence of urological disorders with an aging population. In addition, with increasing focus of healthcare providers on patient-centered care and embracing technological innovations, the demand for fiberoptic cystoscopes is expected to grow substantially in the coming years.

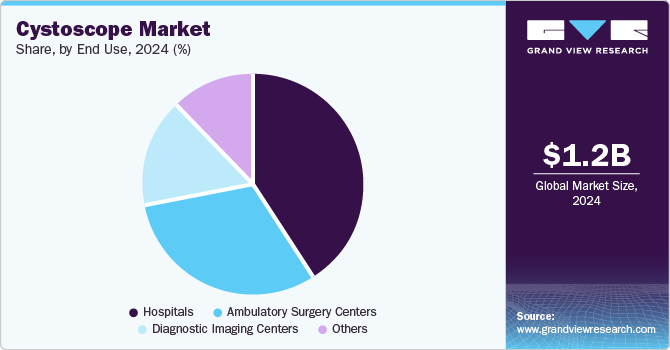

End Use Insights

The hospital segment held the largest share of 40.64% in 2024 and is expected to witness significant growth in the coming years. This growth is primarily driven by the rising incidence of urological disorders, such as bladder cancer and urinary tract infections, which has increased the demand for both diagnostic and therapeutic procedures in hospital environments. In addition, the growing number of hospitals and rising investments in hospital establishment and expansion are expected to further support the growth of this segment throughout the forecast period.

The ambulatory surgery centers segment is anticipated to grow fastest from 2025 to 2030. These settings offer a cost-effective alternative to traditional hospital settings, making them attractive for healthcare providers and patients. In addition, advancements in cystoscopy technology have made procedures more efficient and safer, further encouraging their use in ambulatory surgery centers. Furthermore, the emphasis on patient-centered care and the growing awareness of the benefits of outpatient surgery are expected to drive the expansion of the ambulatory surgery centers segment in the coming years.

Regional Insights

North America held the market's largest revenue share of more than 38.33% in 2024. The key drivers of growth in the region include an increasing patient pool, particularly in the U.S. In addition, the rising geriatric population, which is more prone to urological disorders, will further boost demand for cystoscopes. According to Statistics Canada, the proportion of individuals aged 65 and older in the total population is projected to grow from 18.9% in 2023 to between 21.9% (slow-aging scenario) and 32.3% (fast-aging scenario) by 2073.

U.S. Cystoscope Market Trends

The cystoscope market in the U.S. is expected to dominate the North American market over the forecast period due to the presence of key players and the increasing launches of products. Some players operating in the U.S. market include Olympus Corporation, Boston Scientific Corporation or its affiliates, Ambu Inc., NeoScope Inc., and Stryker, among others.

Europe Cystoscope Market Trends

The cystoscope market in Europe is projected to experience significant growth in the coming years, driven by an increasing prevalence of urological disorders, including bladder cancer and urinary tract infections, advancements in cystoscopy technology, growing focus on patient-centered care and the shift towards outpatient procedures in Europe are also contributing to market growth. Furthermore, supportive government initiatives and funding for healthcare infrastructure improvements are likely to bolster the expansion of the cystoscope market across the region.

The cystoscope market in the UK is anticipated to experience substantial growth in the coming years. This growth can be attributed to several factors, including an aging population and advancements in cystoscope technologies. In addition, increased healthcare investments, government initiatives, and a growing awareness of advanced diagnostic treatments are further driving demand in the cystoscope market.

France's cystoscope market is projected to grow during the forecast period, driven by the increasing prevalence of urological disorders and the growing adoption of technologically advanced products in clinical settings. Moreover, the rising investment in developing healthcare infrastructure is anticipated to drive the country's market growth in the coming years.

The cystoscope market in Germany is witnessing steady growth due to various factors, such as the increasing prevalence of urological and gynecological disorders. According to the data published by the Global Cancer Observatory, around 29,035 bladder cancer cases were found in 2022 in Germany. Bladder cancer was found to be the 5th largest cancer in Germany in 2022.

Asia Pacific Cystoscope Market Trends

The Asia Pacific region is anticipated to achieve the highest compound annual growth rate (CAGR) during the forecast period, fueled by substantial growth in the cystoscope industry. Key drivers include the rising demand for cystoscope products in emerging markets such as India and China. In addition, increasing healthcare expenditures in various Asian countries are expected to enhance market growth in the region further. The large patient populations in countries such as India, China, and Japan are expected to contribute to the market's expansion over the forecast period.

China's cystoscope market is expected to grow throughout the forecast period, driven by increasing demand for diagnostic tools such as cystoscopes to address the increasing incidence of urological conditions such as urinary tract infections, urinary incontinence, and bladder cancer. Furthermore, the rising prevalence of the aging population is anticipated to drive the country's market growth in the coming years.

The cystoscope market in Japan is expected to experience substantial growth during the forecast period, driven by several key factors, including rising awareness of urological health and the importance of early diagnosis. In addition, Japan's rapidly aging population is a substantial driver, as older individuals are more prone to urological disorders, urinary incontinence, and bladder cancer.

Middle East And Africa Cystoscope Market Trends

The Middle East and Africa cystoscope market is expected to grow significantly in the coming years due to the rising prevalence of urological disorders such as bladder cancer and urinary tract infections. Improved healthcare systems and increased healthcare expenditure drive the adoption of advanced medical technologies, including cystoscopy. For instance, the UAE Government earmarks a significant percentage of the federal budget for the healthcare sector every year. As per Federal budget data issued in June 2024, almost USD 1.33 billion was allotted for 2023, which grew to 1.36 billion in 2024.

The cystoscope market in Saudi Arabia is expected to expand during the forecast period. The rising incidence of urological and gynecological conditions, an aging population, and increased healthcare investments propel this growth. In addition, government initiatives aimed at enhancing healthcare infrastructure and growing awareness of advanced cystoscope technologies are further contributing to the market's expansion.

The cystoscope market in Kuwait is expected to grow over the forecast period due to the growing incidence of urologic diseases such as urinary incontinence and bladder cancer. Moreover, increasing healthcare expenditure propels the country's market growth.

The increasing prevalence and incidence of urological disorders, such as bladder cancer, is anticipated to drive the demand for cystoscopes, which are used for treating and diagnosing bladder cancer. The large patient pool in emerging economies such as India and China is expected to propel market growth in the coming years.

Key Cystoscope Company Insights

Olympus Corporation, Boston Scientific Corporation or its affiliates., Ambu Inc., KARL STORZ, Advin Health Care, Intuitive Surgical (SCHÖLLY FIBEROPTIC GMBH), Stryker, UroViu Corporation, NeoScope Inc., OTU Medical, and HOYA Corporation (Pentax Medical) are some of the major players in the cystoscope market. Companies are expanding their portfolios of cystoscopes to gain a competitive advantage in the coming years. Moreover, industry players are focusing on obtaining approvals for advanced cystoscopes to meet the growing demand in the coming years.

Key Cystoscope Companies:

The following are the leading companies in the cystoscope Market. These companies collectively hold the largest market share and dictate industry trends:

- Olympus Corporation

- Boston Scientific Corporation or its affiliates.

- Ambu Inc.

- KARL STORZ

- Advin Health Care

- Intuitive Surgical (SCHÖLLY FIBEROPTIC GMBH)

- Stryker

- UroViu Corporation

- NeoScope Inc.

- OTU Medical

- HOYA Corporation (Pentax Medical)

- BD (Becton, Dickinson and Company)

Recent Developments

-

In October 2024, Ambu Inc. has announced that its latest cystoscopy solution, the Ambu aScope 5 Cysto HD, has obtained FDA clearance, along with its two full-HD endoscopy systems, Ambu aBox 2 and Ambu aView 2 Advance. This clearance provides U.S. healthcare specialists with access to Ambu’s extended urology portfolio.

-

In January 2024, Boston Scientific has announced the limited market release of its VersaVue single-use flexible cystoscope, expanding its product offerings designed to assist clinicians in diagnosing and treating urinary tract conditions. Having received FDA clearance in October, this cystoscope provides clear visualization of the bladder and urethra lining, enabling healthcare professionals to perform various diagnostic procedures effectively.

Cystoscope Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.35 billion

Revenue forecast in 2030

USD 2.17 billion

Growth rate

CAGR of 9.99% from 2025 to 2030

Base year for estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; Boston Scientific Corporation or its affiliates.; Ambu Inc.; KARL STORZ; Advin Health Care; Intuitive Surgical (SCHÖLLY FIBEROPTIC GMBH); Stryker; UroViu Corporation; NeoScope Inc.; OTU Medical; HOYA Corporation (Pentax Medical); BD (Becton, Dickinson and Company)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cystoscope Market Report Segmnetation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cystoscope market report on the basis of product, application, end use, type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flexible Cystoscopes

-

Rigid Cystoscopes

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Urology

-

Gynecology

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Ambulatory Surgery Centers

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Video Cystoscopes

-

Fiberoptic Cystoscopes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cystoscope market was valued at USD 1.23 billion in 2024 and is expected to reach USD 1.35 billion by 2025

b. The global cystoscope market is estimated to grow at a compound annual growth rate (CAGR) of 9.99% from 2025 to 2030 to reach USD 2.17 billion by 2030.

b. North America dominated the cystoscope market and accounted for the largest revenue share of 38.33% in 2024. This can be attributed to the presence of key manufacturers in the region and the rising prevalence of urological disorders across North America.

b. Some key players operating in the cystoscope market include Olympus Corporation, Boston Scientific Corporation or its affiliates., Ambu Inc., KARL STORZ, Advin Health Care, Intuitive Surgical (SCHÖLLY FIBEROPTIC GMBH), Stryker, UroViu Corporation, NeoScope Inc., OTU Medical, and HOYA Corporation (Pentax Medical).

b. Advancements in cystoscopes, an increasing number of older individuals, and the rising prevalence of urological disorders propel the growth of the cystoscope market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.