- Home

- »

- Pharmaceuticals

- »

-

Cytotoxic Drugs Market Size & Share Analysis Report, 2030GVR Report cover

![Cytotoxic Drugs Market Size, Share & Trends Report]()

Cytotoxic Drugs Market Size, Share & Trends Analysis Report By Type (Branded, Generic), By Route Of Administration (Oral, Parenteral), By Drug Type, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-186-6

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Cytotoxic Drugs Market Size & Trends

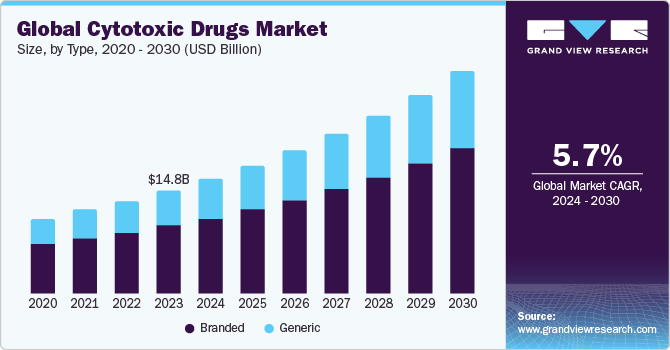

The global cytotoxic drugs market size was valued at USD 14.8 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2030. The growing global burden of cancer, the aging population, and advancements in cancer therapies are some of the notable factors driving the market growth. Continuous advancements in cancer research led to the discovery of novel cytotoxic drugs with improved efficacy and reduced side effects, offering new avenues to the overall market growth. The growing number of product approvals among several countries to combat the cancer burden will further boost product demand for better patient outcomes.

The COVID-19 pandemic negatively impacted the cytotoxic drugs market. During the initial phase of the pandemic, disrupted global supply chains, the closure of manufacturing units affected the overall production and distribution of cytotoxic drugs. Moreover, the shift towards COVID-19 patient management led to postponement or delayed cancer diagnosis and treatment procedures such as surgeries and chemotherapy, thereby restricting demand for cytotoxic drugs. Further, delayed or postponed clinical trials for new cytotoxic drugs affected the overall industry growth potential of the market.

Type Insights

Based on the type, the cytotoxic drugs market is segmented into branded and generic. The branded drugs segment held the largest market share in 2023. High research and development (R&D) investments by pharmaceutical companies to discover and develop new cytotoxic drugs are driving segmental demand. Branded segment growth is driven by patent protection, and strong branding contributes to the continued development and availability of advanced cytotoxic drugs for cancer treatment.

Drug Type Insights

On the basis of drug type, the market is classified into alkylating agents, antitumor antibiotics, antimetabolites, plant alkaloids, and others. The antimetabolites segment held a majority of revenue share in 2023. Oral cytotoxic drugs offer patients greater convenience than intravenous or injectable forms. Patients can administer medications at ease, reducing the need for frequent hospital visits and enhancing the quality of life for cancer patients by minimizing the discomfort and inconvenience associated with traditional intravenous chemotherapy.

Route of Administration Insights

On the basis of the route of administration, the market is segmented into oral and parenteral. The oral segment dominated the market in 2023. Antimetabolites are utilized in the treatment of several cancer ailments, including leukemia, lymphoma, breast cancer, colorectal cancer, and other tumors, owing to their effectiveness against rapidly dividing cells. Thus, the high prevalence of several types of cancer drives the segmental demand.

Distribution Channel Insights

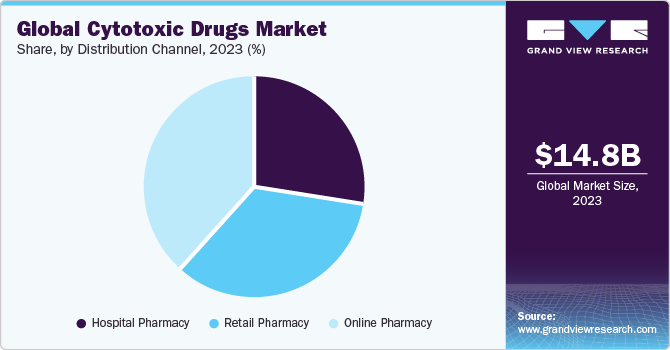

Based on distribution channels, the cytotoxic drugs market is segregated into retail pharmacies, hospital pharmacies, and online pharmacies. The hospital pharmacy segment held a significant market share in 2023. The segment market growth is attributed to the rising patient influx for effective cancer management in hospital settings which is driving the segmental growth. Additionally, rising healthcare spending, favorable reimbursement scenarios, and the presence of specialty staff are a few other factors contributing to segmental demand.

Regional Insights

North America held the largest market share in 2023. This is attributed to the high prevalence of cancer and the strong presence of industry participants coupled with high research and development investments. For instance, as per the American Cancer Society, more than 1.9 million new cancer patients were diagnosed in the U.S. in the year 2021. Thus, the growing cancer disease burden in the region will spur the need for effective therapeutics, positively impacting market demand. Furthermore, growing awareness regarding cancer and early cancer diagnostics and treatment, and favorable reimbursement policies, are accelerating overall market revenue growth potential.

Key Companies & Market Share Insights

Key players operating in the market are Merck KGaA, Eli Lilly and Company, Celgene, Sanofi, GlaxoSmithKline Plc, Pfizer, Inc., Johnson & Johnson Services Inc., F. Hoffmann La Roche Ltd., Lonza, Amgen, Fresenius Kabi AG, Teva Pharmaceuticals, and Novartis AG. The key players in the market undertake several strategic initiatives, such as new product launches, partnerships, mergers, and acquisitions, to gain a competitive edge over their competitors.

-

In January 2023, Merck KGaA received approval for its KEYTRUDA (pembrolizumab) as a platinum-based chemotherapy drug by the U.S. FDA to treat stage IB, II, and IIIA non-small cell lung cancer (NSCLC). Through this approval, the company gained a competitive advantage in the cytotoxic drugs market.

-

In January 2022, Gilead Sciences, Inc., collaborated with Merck KGaA for clinical trials to evaluate the combination of Trodelvy, a Trop-2 targeting antibody-drug conjugate, with KEYTRUDA, an anti-PD-1 therapy for the treatment of metastatic non-small cell lung cancer (NSCLC). This collaboration offered developmental capabilities to both firms in the significant market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."