- Home

- »

- Clinical Diagnostics

- »

-

Cancer Diagnostics Market Size, Share, Industry Report 2030GVR Report cover

![Cancer Diagnostics Market Size, Share & Trends Report]()

Cancer Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Type (IVD, LDT, Imaging), By Application (Breast Cancer, Lung Cancer), By End-use, By Test Type, By Coverage, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-213-6

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cancer Diagnostics Market Summary

The global cancer diagnostics Smarket size was estimated at USD 109.61 billion in 2024 and is projected to reach USD 155.07 billion by 2030, growing at a CAGR of 6.14% from 2025 to 2030. The growth of the cancer diagnostics market is attributed to growing prevalence of cancer, technological advancements in diagnostics procedures, and rising initiatives undertaken by private & public organizations.

Key Market Trends & Insights

- North America cancer diagnostics market dominated the global market with a revenue share of 41.17% in 2024.

- The cancer diagnostics market in the U.S. is expected to grow substantially over the forecast period.

- By product, consumables segment held the largest share of 58.4% of cancer diagnostics market in 2024.

- By type, in vitro diagnostics (IVD) segment dominated the cancer diagnostics market in 2023 with a share of 52.0%.

- By application, breast cancer segment dominated the application segment with a revenue share of 13.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 109.61 Billion

- 2030 Projected Market Size: USD 155.07 Billion

- CAGR (2024-2030): 6.14%

- North America: Largest market in 2024

- Asia Pacific:Fastest growing market

Moreover, increasing initiatives to develop novel imaging solutions for providing more accurate and precise diagnosis is anticipated to fuel market growth over the forecast period. For instance, in September 2022, Radiopharm Theranostics entered into collaboration with The University of Texas MD Anderson Cancer Center for launch of Radiopharm Ventures, LLC involved in the development of novel radiopharmaceutical products. Global rise in prevalence of cancer is one of the major factors facilitating market growth. For instance, according to PAHO, an estimated 20 million new cases and 10 million deaths are expected in 2023, and annual reported cases are expected to reach about 30 million by 2040. Need for development of diagnostics options that can detect the disease at an early stage, and help improve disease management & reduce mortality, is likely to propel the overall market growth. It is also indicated that one in six women and one in five men are likely to develop cancer at some point in their lives. In addition, the 5-year prevalence was around 50.5 million in 2020.

Personalized medicine is expected to change the diagnosis and care delivery landscape as treatment planning is based on data obtained through a holistic approach. Major companies operating in the personalized medicine space are involved in several investment programs pertaining to precision medicine. Furthermore, companies providing molecular decision support systems are combining genomic data with clinical data to minimize gaps in precision medicine practice.

However, cancer diagnostic tests are expensive, increasing the financial burden on families of patients. Government insurance framework is not well-defined in developing countries as they are in developed countries. Thus, middle-class patient population who are not covered under any insurance (private or government) cannot affordable these tests. Furthermore, many private insurance companies in developing countries do not cover the costs associated with diagnosis. As a result, high cost of diagnosis is limiting the adoption of screening tools, especially in developing countries.

Market Dynamics

Technological advancements in field of cancer diagnosis is another major factor for rising demand for diagnosis tools. FDA support for developing biomarkers & mass cytometry; launch of various flow cytometry reagents for diagnosis and drug discovery; technologically advanced miniaturized devices, facilitating portability & precision; developing cell- & bead-based flow cytometry techniques are major factors boosting market growth. Similarly, the use of AI in diagnosis has gained significant traction. According to the NCI, researchers are experimenting with AI to diagnose prostate cancer. AI tools are used to detect suspicious areas visible during an MRI scan, which necessitate biopsies to confirm the presence of malignant cells.

Increasing demand for noninvasive and minimally invasive tests for diagnosis at an early stage is encouraging market players to introduce novel testing products. For instance, demand for cfDNA tests, liquid biopsy, and LDTs is expected to experience significant growth in the coming years. Stringent regulatory frameworks across the globe pertaining to marketing approval of novel tests are expected to impede market growth. Players are introducing LDTs for the early-stage diagnosis of different types of cancers.

Factors such as lack of awareness about novel testing products, high cost of medical imaging systems, and limited availability or absence of professionals, especially in developing & underdeveloped countries, may adversely impact market growth over the forecast period.

Product Insights

Consumables segment held the largest share of 58.4% of cancer diagnostics market in 2024. Developing imaging diagnostic techniques or effective monoclonal antibody-based assays for detecting antigens and small chemicals generated by malignant cells would considerably improve diagnostic medicine. Although mAb technology is still in its early stages, new developments in recombinant antigen synthesis and antibody creation techniques have greatly expanded its potential in diagnosis.

Services segment is anticipated to grow at significant growth rate over the forecast period. This segment includes program interfaces used for operational diagnostic instruments, conducting analysis, and interpreting results. The FDA and other government bodies increased their focus on diagnostics service providers to provide more clarity on the approval process of diagnostics. In addition, growing adoption of technologically advanced platforms and diagnostics systems with analyzer software at diagnostic centers is anticipated to boost the market. For instance, in January 2021, Illumina announced the development of a novel cloud-based bioinformatics data platform and the launch of new cancer IVD tests to strengthen its oncology companion diagnostics segment.

Type Insights

In vitro diagnostics (IVD) segment dominated the cancer diagnostics market in 2023 with a share of 52.0% and is attributed to the increasing adoption of IVD owing to rise in testing amid COVID-19 pandemic. Development of automated IVD systems for hospitals & laboratories that offer accurate, efficient, and error-free diagnosis is expected to fuel market growth. For instance, in March 2019, BD announced receiving CE-IVD certification for the automated flow cytometry system, BD FACSDuet, which allows clinical laboratories to increase their efficacy and throughput over manual processes. Furthermore, launch of innovative IVD products has increased due to several R&D initiatives and partnership programs undertaken by players.

LDTs (Laboratory Diagnostic Tests) were estimated to grow at a highest CAGR over the forecast period. LDTs are important tools to rapidly incorporate new information and decide which drug to utilize for personalized therapy. They enable treatments to shift from a “one drug fits all” approach to a much more personalized approach based on the unique genetics of each person and their disease. Since they are generated and utilized in same facility, LDTs are launched into the market without independent regulatory assessment or FDA approval. For instance, in May 2022, Guardant Health launched Shield, a blood based LDT, to detect early signs of colorectal cancer in adult patients above 45 years.

Application Insights

Breast cancer segment dominated the application segment with a revenue share of 13.5% in 2024. Increased R&D in advanced screening tools for breast cancer is anticipated to boost the segment significantly. A research study published in Scientific Reports, in September 2019, studied a novel screening test that combined the expression of MMP-1 or matrix metalloproteinase-1 and miR-21 expression in urinary exosomes, which can help detect 95% of breast cancers without the development of metastasis. The study concluded that both markers provide specificity and sensitivity, therefore, can be used for screening of breast cancer.

Colorectal cancer is expected to grow at a fastest CAGR over the coming years. Early detection and diagnosis are pivotal in improving the survival rates and quality of life for patients with colorectal cancer. This has led to an increase in the demand for effective and accurate diagnostic tools & methods. An increase in research activities conducted by various private and public organizations to enhance the diagnosis of cancer is anticipated to drive the segment during the forecast period. In July 2024, the U.S. Food and Drug Administration (FDA) approved Guardant Health's Shield, a blood-based test for colorectal cancer screening in adults aged 45 and older at average risk.

End-use Insights

Laboratories segment dominated the cancer diagnostics market in 2024 with a share of 53.5%. Diagnostic laboratories are expected to show significant growth over the forecast period owing to increased testing and availability of resources for performing tests. There has been an improved reliance of hospitals on diagnostic laboratories for testing & evaluation, which further leads to accelerated growth. Increase in awareness of personalized medicine, technological advancements, and rise in demand for affordable services are some of the key factors expected to drive growth of diagnostic laboratory segment. Another major factor expected to drive growth is the increase in government initiatives to provide various facilities, such as compensation for diagnostic tests. Furthermore, regulatory authorities are undertaking initiatives to improve clinical laboratory diagnostic services and ease the process of diagnosis.

Others segment which includes home-based tests is anticipated to grow at the fastest CAGR of 7.16% over the forecast period due to increased adoption of home-based & technologically advanced treatments during COVID-19 pandemic, as well as the acknowledged need for new models in the cancer community and among payers to reduce unscheduled hospitalizations & emergency department visits. Acute home-based treatment offers a promising alternative to conventional outpatient clinics, emergency rooms, and inpatient hospital-based oncology care models. Moreover, key players operating in the market are focusing on developing home-based tests for easy accessibility, and enhanced acceptability further drives the demand for others segment.

Test Type Insights

The others segment dominated the cancer diagnostics market in 2024. Comparing panel-based tests to BRCA1/2 genetic testing can help determine the inherited risk of breast and ovarian cancers. The clinical value and yield of panel-based testing are higher for hereditary risk of other malignancies, such as pheochromocytoma-paraganglioma and colon cancer. Patients with genetic abnormalities linked to a hereditary cancer syndrome are more likely than the general population to experience the beginning of certain cancers earlier than is typical. Therefore, a need to provide early detection further propels demand for panel tests. For instance, Laboratory Corporation of America Holdings offers VistaSeq, a hereditary cancer panel developed to detect genetic mutations associated with more than 50 hereditary cancer syndromes.

Biopsy is estimated to grow at a fastest growth over the forecast period due to various benefits associated with the test, including early detection. In addition, biopsy helps determine the cancer's aggressiveness and likelihood of spreading to other organs. A biopsy helps in selection of a specific treatment plan, depending on the spread of cancer. Product launches are among the key factors responsible for market growth. For instance, in January 2023, OverC received FDA approval and was granted breakthrough device designation intended to be used in the detection of liver, esophageal, pancreatic, ovarian, & lung cancer.

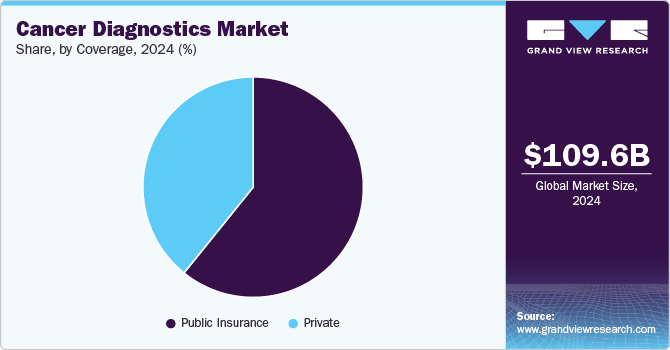

Coverage Insights

The public insurance segment dominated the cancer diagnostics market in 2024 and is expected to grow at the fastest CAGR over the forecast period. Governments and public health agencies are increasingly prioritizing cancer diagnostics within their healthcare policies to enable early detection, accurate diagnosis, and effective treatment planning. Public insurance programs worldwide are under increasing pressure to integrate cutting-edge technologies into routine cancer care pathways. As innovations such as liquid biopsies, AI-driven imaging, and NGS gain prominence, governments face the dual challenge of managing escalating healthcare costs while ensuring widespread access to these life-saving diagnostic tools.

Private insurance is expected to significantly grow over the coming years. In the U.S., private insurance is a dominant segment within the healthcare ecosystem, with major players such as UnitedHealthcare, Anthem, Aetna (CVS Health), and Cigna offering comprehensive cancer diagnostic coverage. These plans typically include a wide array of diagnostic tests, such as CT scans, PET scans, tumor marker analysis, and biomarker profiling, alongside specialized services such as genomic sequencing and targeted therapy guidance tests. Globally, private insurance is gaining traction in both developed and developing economies. In countries such as Germany, Australia, and Japan, private health insurance supplements public healthcare services by offering faster access to specialized cancer diagnostics and shorter waiting times for critical tests.

Regional Insights

North America cancer diagnostics market dominated the global market with a revenue share of 41.17% in 2024. Growing cancer burden in the U.S. and Canada, as well as the increasing focus of medical device companies on developing novel diagnostic devices that can detect tumor, are positively impacting market growth. Moreover, product launches are key factors influencing market growth. For instance, in July 2022, Nanostics Inc. announced the launch of a clinical investigation for bladder cancer, aimed at identifying the most effective indicators of the disease for early detection. The study aims to identify a minimally invasive liquid biopsy test to diagnose bladder cancer using Nanostics ClarityDX diagnostic platform.

U.S. Cancer Diagnostics Market Trends

The cancer diagnostics market in the U.S. is expected to grow substantially over the forecast period owing primarily to the high cancer prevalence in the country and launch of innovative products. In February 2024, Hologic, Inc. announced FDA clearance for its innovative Genius Digital Diagnostics System featuring the Genius Cervical AI algorithm. This marks the first FDA-cleared digital cytology system integrating deep-learning-based AI with advanced volumetric imaging to aid in identifying precancerous lesions and cervical cancer cells.

Europe Cancer Diagnostics Market Trends

Europe cancer diagnostics market was identified as a lucrative region in this industry. The market growth can be attributed to a growing biotechnology industry and rising investments in genomic sequencing in countries such as the UK & Germany. In February 2022, Invitae introduced its LiquidPlex Dx and FusionPlex Dx Cancer Testing Kit with the CE Mark for use in Europe.

The cancer diagnostics market in the UK is expected to grow over the forecast period due to the rising collaborations between key market players, and launch of novel products. Commercial partnerships between the government and key players for routine use of MCED tests in the country are likely to propel market growth further.

The cancer diagnostics market in Germany is expected to grow over the forecast period. intense competition between biotechnology companies, such as Epigenomics and Roche, is expected to boost market growth. Increasing collaborations between key market players in this region are expected to fuel market growth through an increase in R&D opportunities for better test procedures.

Asia Pacific Cancer Diagnostics Market Trends

Asia Pacific market is expected to grow at a fastest growth owing to various factors, such as increasing healthcare reforms. In Asia Pacific, cancer has drawn more attention as a result of demographic shifts brought on by urbanization, rapidly aging population, and economic expansion. Various established players are expanding their presence in Asia Pacific, which is expected to boost the region’s cancer diagnostics market. For instance, in June 2022, MGI collaborated with MiRXES to expand the region’s access to advanced spatial multiomics research capabilities. This agreement was expected to expand the reach of the companies.

The cancer diagnostics market in China is expected to grow over the forecast period. Various companies have entered into collaborations and partnership agreements to provide MCED tests in the country. For example, in July 2022, Guardant Health collaborated with Adicon Holdings Limited, a Hangzhou-based clinical lab company, to offer its liquid biopsy test, which can detect 96% of early-stage cancer with a single blood draw.

The cancer diagnostics market in Japan is expected to grow over the forecast period. The increase in cancer prevalence can be attributed to rapid growth in the geriatric population. Japan offers country-wide cancer screening programs to combat its growing prevalence. This program offers cancer screening to over 94% of the population.

Latin America Cancer Diagnostics Market Trends

Latin America cancer diagnostics market is anticipated to grow at a substantial growth rate over the forecast period owing to the increase in prevalence of various types of cancer in the region. Several surveys by various government and nonprofit organizations revealed that overall cancer mortality in Latin America is almost twice that of high-income countries.

The cancer diagnostics market in Brazil is expected to grow over the forecast period. Cancer incidence in the country is high, which has led to increased usage of various novel cancer screening tools such as liquid biopsy and gene panel testing. Brazil consider solid tumor biopsy the gold standard, as it offers a deep analysis of cancer mutation. However, in the past few years, Brazil has witnessed high growth in the adoption of liquid biopsy techniques owing to increasing collaborations between key market players and various initiatives being undertaken by several organizations for care.

MEA Cancer Diagnostics Market Trends

MEA cancer diagnostics market is estimated to grow over the forecast period as countries are increasingly adopting molecular and genetic testing into their diagnostic protocols. The Middle East & Africa holds major growth opportunities, as a majority of the market is untapped due to the unavailability of organized cancer screening programs in this region, especially in underdeveloped African economies.

The blood cancer diagnostics market in Saudi Arabia is competitive owing to the local presence of multiple global players and domestic manufacturers. Some of the leading liquid biopsy providers in the country are PathCare, Axaitech, QIAGEN, and Guardant Health. Moreover, the increasing demand for noninvasive diagnostic procedures owing to the numerous advantages offered by them is another factor propelling market growth.

Key Cancer Diagnostics Company Insights

Some of the key market players are adopting strategies such as acquisitions and collaborations to strengthen their presence in other regional markets. This can lead to improved product development, operational efficiencies, or expanded market reach.

-

In December 2024, Guardant Health, Inc. announced a partnership with Boehringer Ingelheim aimed at obtaining regulatory approval and advancing the commercialization of the Guardant360 CDx liquid biopsy. This collaboration focuses on using the liquid biopsy as a companion diagnostic (CDx) for zongertinib, a novel covalent tyrosine kinase inhibitor (TKI) that specifically targets HER2 while minimizing the impact on the epidermal growth factor receptor (EGFR) in non-small cell lung cancer (NSCLC).

-

In November 2024, Danaher Corporation announced the establishment of two new Centers of Innovation in Diagnostics aimed at advancing precision medicine development. The first center, located in Newcastle, UK, is scheduled to open in July and will serve as a hub for collaborative research with leading pharmaceutical and academic institutions. Hosted by Leica Biosystems, a Danaher subsidiary, this facility will operate as Danaher's first CLIA CAP* lab

-

In February 2023, F. Hoffmann-La Roche announced expanding its collaboration with Janssen to advance personalized healthcare by focusing on companion diagnostics.

-

In April 2023, Quest Diagnostics acquired Haystack Oncology in an all-cash deal to expand MRD testing services, initially targeting colorectal, breast, and lung cancers, aiming to enhance patient outcomes through early MRD detection after treatment.

-

In June 2023, Blue Earth Diagnostics received FDA approval for high-affinity radiohybrid (rh) Prostate-Specific Membrane Antigen (PSMA)-targeted PET imaging agent, POSLUMA, for prostate cancer detection and localization. It's based on innovative radiohybrid technology, providing accurate imaging and potential therapeutic applications.

Key Cancer Diagnostics Companies:

The following are the leading companies in the cancer diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- F. Hoffmann-La Roche Ltd

- GE Healthcare

- QIAGEN

- BD

- Koninklijke Philips N.V. (Philips)

- Siemens Healthcare GmbH

- Hologic, Inc.

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 115.09 billion

Revenue forecast in 2030

USD 155.07 billion

Growth rate

CAGR of 6.14% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end-use, test type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Abbott, F. Hoffmann-La Roche Ltd; QIAGEN; BD; Siemens Healthcare GmbH; Thermo Fisher Scientific, Inc.; Hologic, Inc.; Koninklijke Philips N.V. (Philips); Illumina, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the cancer diagnostics market on the basis of product, type, application, end-use, test type and regions:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instruments

-

Pathology-based Instruments

-

Slide Staining Systems

-

Tissue Processing Systems

-

Cell Processors

-

PCR Instruments

-

NGS Instruments

-

Microarrays

-

Other Pathology-based Instruments

-

-

Imaging Instruments

-

Others

-

-

Consumables

-

Antibodies

-

Kits & reagents

-

Probes

-

Others

-

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

IVD

-

By Type

-

Diagnosis

-

Early Detection

-

Therapy Selection

-

Monitoring

-

-

By Technology

-

Polymerase Chain Reaction (PCR)

-

In Situ Hybridization (ISH)

-

Immunohistochemistry (IHC)

-

Next-generation Sequencing (NGS)

-

Microarrays

-

Flow Cytometry

-

Immunoassays

-

Other IVD Testing Technologies

-

-

-

LDT

-

Imaging

-

Magnetic Resonance Imaging (MRI)

-

Computed Tomography (CT)

-

Positron Emission Tomography (PET)

-

Mammography

-

Ultrasound

-

Others

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Lung Cancer

-

Prostate Cancer

-

Skin Cancer

-

Blood Cancer

-

Kidney Cancer

-

Liver Cancer

-

Pancreatic Cancer

-

Ovarian Cancer

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Laboratories

-

Others

-

-

Test Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biopsy

-

Fine-needle Aspiration

-

Core Biopsy

-

Surgical Biopsy

-

Skin Biopsy /Punch Biopsy

-

Others

-

-

Others

-

-

Coverage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public Insurance

-

Private Insurance

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cancer diagnostics market size was estimated at USD 109.61 billion in 2024 and is expected to reach USD 115.09 billion in 2025.

b. The global cancer diagnostics market is expected to grow at a compound annual growth rate of 6.14% from 2025 to 2030 to reach USD 155.07 billion by 2030.

b. The breast cancer segment held the largest share of 13.5% in the overall market in 2024. The growth of R&D in advanced screening tools for breast cancer is anticipated to boost the segment significantly.

b. Major players competing in the cancer diagnostics market include GE Healthcare; Abbott; F. Hoffmann-La Roche Ltd; Qiagen N.V.; Becton Dickinson & Company; and Siemens Healthcare GmbH.

b. The rising prevalence of cancer cases, constant technological advancements in diagnostics, and increasing demand for effective screening tests are some of the prime factors spurring demand for cancer screening tools and techniques across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.