- Home

- »

- Next Generation Technologies

- »

-

Dark Fiber Network Market Size, Share, Industry Report 2033GVR Report cover

![Dark Fiber Network Market Size, Share & Trends Report]()

Dark Fiber Network Market (2026 - 2033) Size, Share & Trends Analysis Report By Fiber (Single Mode, Multi-mode), By Network (Metro, Long-haul), By Material (Glass, Plastic), By Application (Telecom, Oil & Gas, BFSI, Medical), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-556-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dark Fiber Network Market Summary

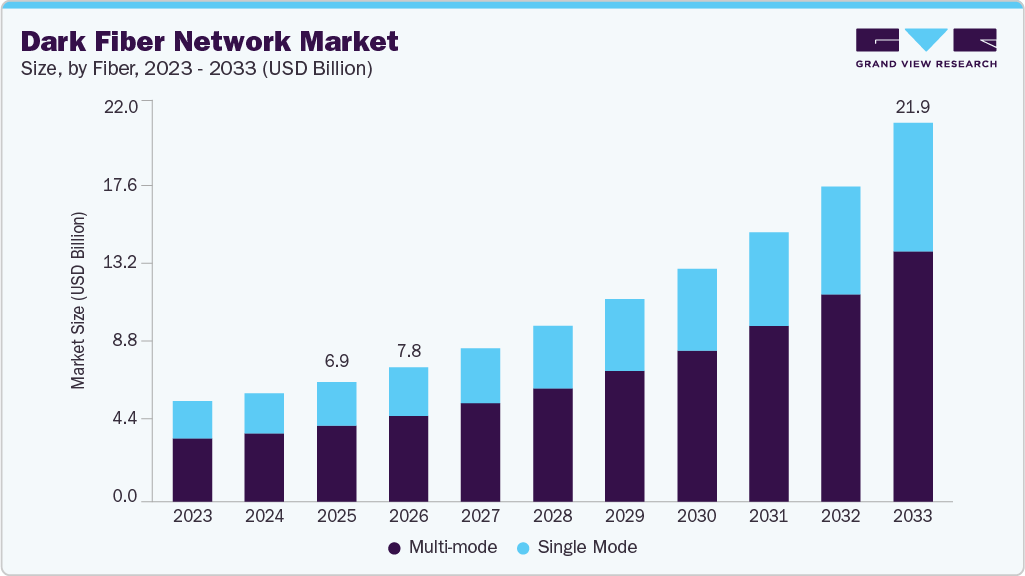

The global dark fiber network market size accounted for USD 6.90 billion in 2025 and is projected to reach USD 21.88 billion by 2033, growing at a CAGR of 15.9% from 2026 to 2033. Technology has emerged as a sustainable solution for various organizations that are focusing on enhanced communication and network management.

Key Market Trends & Insights

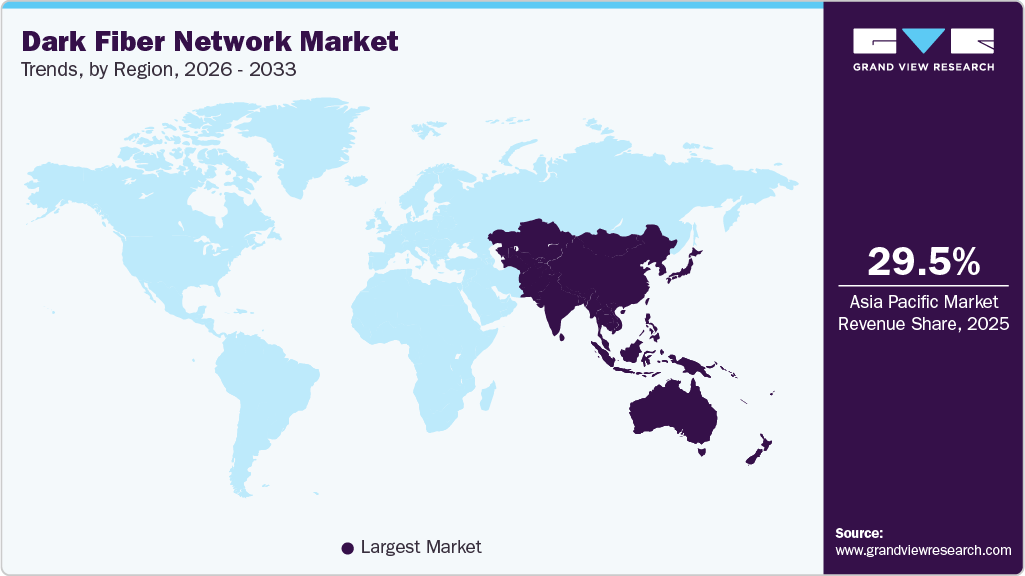

- The Asia Pacific dark fiber network industry accounted for a 29.5% share of the overall market in 2025.

- The dark fiber network industry in China held a dominant position in 2025.

- By fiber, the multi-mode segment accounted for the largest share of 63.5% in 2025.

- By material, the glass segment held the largest market share in 2025.

- By network, the metro segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.90 Billion

- 2033 Projected Market Size: USD 21.88 Billion

- CAGR (2026-2033): 15.9%

- Asia Pacific: Largest market in 2025

Continuously increasing penetration of internet services over the period has paved the way for the high demand for internet bandwidth. This demand is expected to remain rampant over the forecast period. This is the most significant factor responsible for market growth across the globe. The market is strongly supported by companies with a high reliance on internet connectivity. These networks are highly beneficial for organizations with a high volume of data flow in their operation. These benefits include reduced network latency, scalability, reliability, and enhanced security.

In fiber optic communications, fiber optic cables that are not yet put in service by a provider or carrier are termed dark fiber or unlit fiber (sometimes known as fiber). These cables are not connected to any optical device and are installed to be used at some point in the future. It is also called a new fiber construction project to be owned by a customer or service provider. In the current market scenario, network service providers are leasing these unused fiber optic cables.

During the late 90s, the telecommunications industry was booming, and huge capital were poured into building these fiber-optic networks. That period saw the aggressive laying down of fiber networks along with highways and rail lines (i.e., long-haul network). Similarly, a thousand miles of local or regional network (metro network) were laid across large cities and population centers. At the turn of the century, the telecom sector witnessed a meltdown, and these billion-dollar unused fiber network (dark fiber) infrastructures were sold at a meager price by telecom providers to avoid bankruptcy.

Due to the increasing demand for mobile data and the launch of 5G services, telecom service providers are now buying up the available dark fiber and also focusing on building their own. Other factors, such as the ever-increasing bandwidth demand of handheld device user audience and mandatory conversion to HD video quality for cable operators, are expected to fuel the market growth over the forecast period.

The pricing for dark fiber in the U.S. is based on the routes and locations, and is sometimes plainly arbitrary. Also, it relies on several other parameters, such as market competition, market demand, and construction costs in a particular location. Generally, the U.S. dark fiber network pricing has been bifurcated into two major parts, including metro-area and long-haul area fiber.

The dark fiber prices in the metro area are considerably higher than in the long-haul area on a per-mile basis. More urban areas’ routes have considerably higher pricing in the metro area than the suburban and exurban areas’ routes. This is due to the rising demand for a fiber network in urban areas. Occasionally, owing to the glut of fiber, the prices of dark fiber networks push down in the urban areas. Moreover, it has been observed that the dark fiber prices in the long-haul areas are more consistent than the metro-area routes.

Fiber Insights

The multi-mode segment dominated the market in 2025 and accounted for a 63.5% share of the global revenue and is expected to grow at the fastest CAGR during the forecast period. It is also expected to continue leading the market over the forecast period. Multi-mode fiber is highly effective in applications requiring reliable, high-speed data transmission over relatively short spans, making it an ideal choice for industries such as video surveillance and Local Area Network (LAN) systems. Its broad adoption stems from its cost-effectiveness, ease of installation, and ability to support multiple data streams simultaneously. The segment's demand for efficient network infrastructure in urban environments and industrial settings further bolsters the segment’s prominence. With the proliferation of smart cities, IoT devices, and advanced security systems, multi-mode fibers are increasingly being utilized to enhance connectivity and operational efficiency.

Single-mode fiber, on the other hand, is best suited for longer transmission distances. It is mainly used in multi-channel television broadcast systems and long-distance telephony. The single-mode segment is expected to experience significant growth over the forecast period. This product type is used for long-distance installations ranging from 2 meters to 10,000 meters. It offers lower power loss in comparison to multi-mode. However, it is costlier than multi-mode fibers.

Material Insights

The glass segment led the market in 2025. Its leadership can be attributed to its superior optical properties, durability, and widespread adoption across various industries. Glass fibers offer exceptional clarity and low signal attenuation, making them the preferred choice for high-speed data transmission in telecommunications, data centers, and broadband networks. In addition, the glass segment is driven by its versatility and reliability in harsh environments, where resistance to temperature fluctuations and chemical exposure is crucial.

The plastic segment is projected to grow at the fastest CAGR over the forecast period, driven by its unique advantages and expanding application areas. Plastic fibers are lightweight, flexible, and cost-effective, making them a popular choice for short-distance data transmission and consumer electronics. Their ease of installation and resilience in environments where flexibility and lower costs are prioritized contribute to their growing adoption in automotive systems, medical devices, and home networking solutions. In addition, advancements in plastic fiber technology, including improved bandwidth and durability, are enhancing their appeal in emerging markets.

Network Insights

The long-haul segment is anticipated to register the fastest CAGR over the forecast period. The segment continues to gather pace due to its capacity to connect over large distances at low signal intensity. Such long-haul terrestrial networks are widely applied in undersea cabling across long oceanic distances, thus attracting the participation of several organizations in terms of investments. For instance, in October 2021, Zayo Group, LLC completed three new long-haul dark fiber routes from Denver to Salt Lake City, Atlanta to Dallas, and Eugene to Reedsport. The long-haul network is driven by the development of smart cities, continuously growing investments, and strong competitive dynamics in the market.

The metro segment held the largest revenue share of global revenue in 2025, driven by the rising demand for reliable and high-speed connectivity in urban areas. This segment benefits from the increasing adoption of advanced telecommunication networks, including fiber-optic solutions, to support the growing data traffic generated by smart cities, IoT devices, and digital services. Metro networks play a critical role in bridging core and access networks, ensuring seamless data transmission over medium distances within metropolitan regions. As urbanization accelerates and digital transformation initiatives expand globally, the need for efficient metro networks to support bandwidth-intensive applications such as video streaming, cloud computing, and enterprise solutions continues to rise.

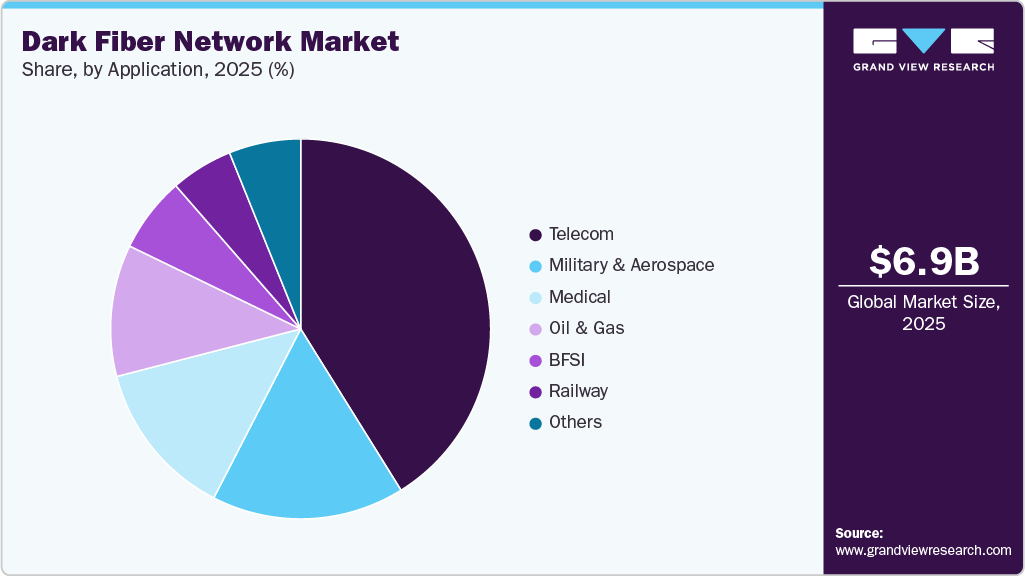

Application Insights

In terms of revenue, the telecom segment dominated the market in 2025 and is anticipated to retain its dominance in terms of market size by 2033. Telecommunication is anticipated to present promising growth prospects due to the growing adoption of the 5G technology in communication and data transmission services. Dark fiber enables high-speed data transfer services in both small and long-range communications.

The medical segment is anticipated to register the fastest CAGR over the forecast period. As healthcare systems become more digitized, the need for robust network infrastructure to support the seamless transfer of large volumes of sensitive data has grown exponentially. Dark fiber networks provide the bandwidth and security required to handle applications such as telemedicine, electronic health records (EHRs), and advanced imaging technologies. One of the key drivers of this growth is the rising adoption of telemedicine and remote patient monitoring solutions, which depend on uninterrupted data connectivity. Dark fiber networks offer low-latency, high-speed connections that ensure smooth operation of these services, particularly in rural and underserved areas.

Regional Insights

Asia Pacific dark fiber network industry dominated the global market with a share of 29.5% in 2025 and is expected to grow at the fastest CAGR during the forecast period. Asia Pacific is spearheading revenue growth owing to technological advancements and large-scale adoption of the technology in the IT, telecommunication, and administrative sectors. The high penetration of technology in the manufacturing sector and the expansion of the IT and telecom sectors across the Asia Pacific are strengthening the regional market's hold. Moreover, the increasing adoption of fiber networks in the medical sector is propelling growth across countries such as Japan, China, and India, thus propelling the overall demand at a significant pace.

China Dark Fiber Network Industry Trends

The dark fiber network industry in China held a dominant position in 2025. China's dark fiber network industry is driven by the government heavily investing in expanding digital infrastructure, including dark fiber networks, as part of its "Made in China 2025" strategy and the 14th Five-Year Plan. The government is promoting broadband connectivity in rural and underserved regions, with specific initiatives such as the "Broadband China" campaign aimed at building a nationwide fiber optic network. These efforts are expected to accelerate the deployment of dark fiber networks across the country.

India's dark fiber network industry is experiencing considerable growth, driven by the country's digital transformation initiatives, increased demand for broadband, and expanding telecom infrastructure. India has become a key destination for data center development, with companies like Microsoft, Amazon, and Google establishing massive data center hubs across the country. These facilities require high-bandwidth, low-latency connections, which dark fiber networks can provide. The growing demand for cloud services, big data analytics, and AI applications is further intensifying the need for reliable fiber optic infrastructure.

North America Dark Fiber Network Market Trends

North America dark fiber network industry is anticipated to register a significant growth rate over the projected period. Some of the most substantial expenditures in building 5G network infrastructure are taking place in the U.S. The country's strong investments in smart homes, smart industries, and smart city initiatives are likely to contribute to the growth of the regional market throughout the forecast period. Governments of developed countries, such as the U.S., are heavily investing in security infrastructure at the country level. Awareness is growing among the rapidly developing economies that aim to strengthen their hold at the global level.

The dark fiber network industry in the U.S. is driven by the deployment of 5G technology across the U.S. Major telecom providers, including AT&T, Verizon, and T-Mobile, are investing heavily in dark fiber infrastructure to support the high-speed, low-latency requirements of 5G. Urban areas are the primary focus, but rural deployments are also gaining traction through government-backed initiatives like the Rural Digital Opportunity Fund (RDOF).

Europe Dark Fiber Network Industry Trends

The Europe dark fiber network industry is driven by the smart city projects across Europe that are driving the adoption of dark fiber networks. Cities such as Barcelona, London, and Amsterdam are integrating dark fiber to support a range of IoT applications, including smart traffic management, energy efficiency, and public safety. These projects require high-bandwidth, low-latency connectivity to support real-time data processing and the growing number of connected devices. The European Union is also funding several smart city initiatives, boosting the demand for dark fiber infrastructure.

The UK dark fiber network industry is witnessing a growing trend towards edge computing, with the increasing adoption of IoT, AI, and real-time data processing in sectors such as manufacturing, retail, and healthcare. Dark fiber networks are essential for providing the low-latency, high-bandwidth connections needed to link edge data centers with central cloud infrastructure. In addition, data localization regulations in the UK are increasing the demand for dark fiber to support the storage and processing of data within the country.

Germany dark fiber network industry is known for its stringent data protection laws, particularly the General Data Protection Regulation (GDPR), which has reinforced the demand for secure and private communication networks. Dark fiber offers a dedicated, unlit connection, which provides a higher level of security compared to shared networks. With increasing concerns around data privacy, businesses in sectors such as banking, finance, healthcare, and government are adopting dark fiber solutions to meet their security requirements.

Key Dark Fiber Network Company Insights

To address the growing demand for dark fiber networks and ensure continued growth in a competitive environment, companies in the market adopt a combination of strategies, including mergers and acquisitions, product developments, partnerships, and geographic and vertical expansions. By improving their technological offerings, collaborating with key industry players, and entering new markets, dark fiber network providers are positioning themselves to meet the evolving demands of industries such as telecom, cloud computing, smart cities, and 5G. These strategies not only enhance their market position but also contribute to the broader growth and evolution of global digital infrastructure.

-

AT&T Inc. is a multinational telecommunications conglomerate based in the U.S., offering a wide range of services, including wireless communications, broadband internet, digital TV services, and advanced telecommunications solutions. The company primarily operates in the U.S., but it also provides services in several international markets, particularly in the form of enterprise solutions, cloud services, and network infrastructure. Its global footprint allows it to support multinational businesses with their telecom and IT needs.

-

GTT Communications, Inc. is a global cloud networking provider that delivers a range of communication solutions to businesses, carriers, and government agencies. It specializes in offering high-performance networking and cloud-based services to meet the needs of enterprises and service providers worldwide. The company provides a range of core services, including cloud networking solutions, high-speed internet and IP services, private line and MPLS solutions, unified voice services (VoIP and SIP trunking), and managed services.

Key Dark Fiber Network Companies:

The following are the leading companies in the dark fiber network market. These companies collectively hold the largest market share and dictate industry trends.

- AT&T Inc.

- Colt Technology Services Group Limited

- Comcast Corporation

- Consolidated Communications

- GTT Communications, Inc.

- Lumen Technologies, Inc.

- Verizon Communications, Inc.

- Windstream Intellectual Property Services, LLC

- Zayo Group, LLC

- Microscan

Recent Developments

-

In May 2025, AT&T Inc. agreed to acquire Lumen Technologies’ mass-market fiber business for $5.75 billion in cash. a transaction that will significantly expand AT&T’s fiber network footprint in major U.S. markets and enhance its broadband infrastructure.

-

In July 2023, Zayo Group, LLC unveiled a range of enhancements to its fiber network infrastructure. These include the improved fiber capacity for active routes, novel long-haul dark fiber routes, the new Internet Protocol (IP) points of presence (PoPs), and the integration of added 400 Gbps-enabled routes.

-

In January 2023, Summit Infrastructure Group entered Columbus, Ohio, with a purpose-built and fully underground dense dark fiber network that supported the growing data center and enterprise markets in the region.

-

In June 2022, Bandwidth Infrastructure Group launched its high-quality dark fiber in Greater Portland. The company's dark fiber connectivity solutions are currently extending into the rapidly growing region. The Hillsboro and Greater Portland area is rapidly emerging as one of the most prominent data center markets in the Pacific Northwest region in North America, with Bandwidth IG significantly contributing by delivering top-notch dark fiber connectivity to the region.

Dark Fiber Network Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 7.77 billion

Revenue forecast in 2033

USD 21.88 billion

Growth rate

CAGR of 15.9% from 2026 to 2033

Base Year

2025

Actual Data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Fiber, network, material, application, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

AT&T Inc.; Colt Technology Services Group Limited; Comcast; Consolidated Communications; GTT Communications, Inc.; Lumen Technologies, Inc.; Verizon Communications, Inc.; Windstream Intellectual Property Services, LLC; Zayo Group, LLC, Microscan

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail Customized purchase options to meet your exact research needs. Explore Purchase Options

Global Dark Fiber Network Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dark fiber network market based on fiber, network, material, application, and region:

-

Fiber Outlook (Revenue, USD Million, 2021 - 2033)

-

Single Mode

-

Multi-mode

-

Step-index Multimode Fiber

-

Graded-index Multimode Fiber

-

-

Network Outlook (Revenue, USD Million, 2021 - 2033)

-

Metro

-

Long-haul

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Glass

-

Plastic

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Telecom

-

Oil & Gas

-

Military & Aerospace

-

BFSI

-

Medical

-

Railway

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dark fiber network market size was estimated at USD 6.90 billion in 2025 and is expected to reach USD 7.77 billion in 2026.

b. The global dark fiber network market is expected to grow at a compound annual growth rate of 15.9% from 2026 to 2033 to reach USD 21.88 billion by 2033.

b. Asia Pacific dominated the dark fiber network market with a share of 29.5% in 2025. This is attributable to the increasing penetration of internet services in the region.

b. Some key players operating in the dark fiber network market include AT&T Inc.; Colt Technology Services Group Limited; Comcast; Consolidated Communications; GTT Communications, Inc.; Lumen Technologies, Inc.; Verizon Communications, Inc.; Windstream Intellectual Property Services, LLC; Zayo Group, LLC, Microscan.

b. Key factors that are driving the dark fiber network market growth include growing internet traffic worldwide, the need for enhanced network management & communication, and increasing bandwidth demand worldwide.

b. The multimode segment led the dark fiber network market in terms of revenue and held around 63.5% of the total market share in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.