- Home

- »

- IT Services & Applications

- »

-

Data Center Outsourcing Market Size, Industry Report, 2030GVR Report cover

![Data Center Outsourcing Market Size, Share, & Trend Report]()

Data Center Outsourcing Market (2025 - 2030) Size, Share, & Trend Analysis By Service Type (Managed Hosting Services, Colocation Services), By Deployment Type (Cloud, On-premise, Hybrid), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-570-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Outsourcing Market Trends

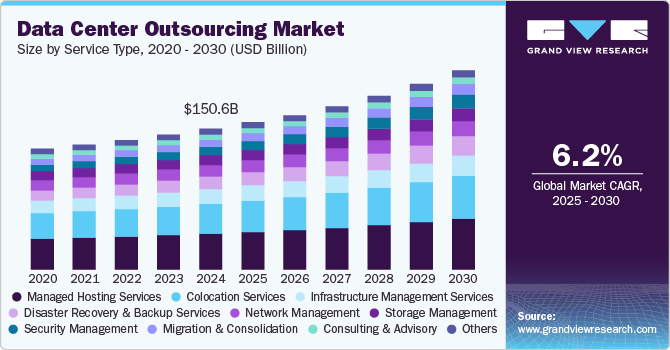

The global data center outsourcing market size was estimated at USD 150.60 billion in 2024 and is anticipated to grow at a CAGR of 6.2% from 2025 to 2030. The growing demand for digital transformation across industries is a major driver of the data center outsourcing market. As enterprises shift towards cloud-based operations, AI-driven services, and big data analytics, there is an increasing need for flexible, scalable, and cost-effective IT infrastructure. Many organizations are finding it more strategic to outsource data center operations to specialized providers, allowing them to focus on core competencies while ensuring high levels of uptime, security, and compliance.

Moreover, the rapid evolution of digital transformation strategies among businesses is intensifying demand for flexible and scalable IT infrastructure, further fueling data center outsourcing adoption. The growing complexity of managing hybrid IT environments combining on-premises systems with cloud-based resources, is encouraging companies to seek external expertise. Outsourcing partners provide not only infrastructure management but also advanced capabilities in areas such as cybersecurity, disaster recovery, and regulatory compliance, which are becoming critical in today's increasingly regulated and risk-sensitive environments.

Another major growth driver is the rising adoption of emerging technologies such as artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), and edge computing. These technologies require highly specialized data handling capabilities and robust IT ecosystems, which many enterprises prefer to manage through outsourcing partnerships rather than building in-house. In addition, the global push toward sustainability and green IT initiatives is prompting companies to collaborate with data center providers that offer energy-efficient facilities and carbon-neutral solutions, further stimulating demand in the outsourcing data center outsourcing industry.

Service Type Insights

The managed hosting services segment dominated the market and accounted for the revenue share of over 25.0% in 2024 due to the growing need for cost efficiency. As enterprises face pressure to reduce operational expenses, outsourcing data center management and hosting services has become a more attractive option. By leveraging managed hosting services, organizations can reduce capital expenditures associated with purchasing hardware and data center space, while also minimizing staffing costs for in-house IT teams.

The security management services segment is anticipated to grow at a CAGR of 8.6% during the forecast period owing to the rising frequency and sophistication of cyberattacks. Hackers are constantly evolving their methods, making it difficult for traditional security measures to keep up. Data breaches, ransomware attacks, Distributed Denial-of-Service (DDoS) attacks, and insider threats are just a few examples of the growing security risks that organizations face.

Deployment Type Insights

The on-premises segment dominated the market in 2024. For businesses that operate in sectors requiring real-time data processing, such as trading platforms, gaming companies, and industrial automation, minimizing latency and maximizing processing speeds are of the utmost importance. On-premises data centers provide the advantage of lower latency by keeping data processing close to where it is generated, avoiding the delays that can be associated with cloud-based infrastructures that may involve remote data centers. This makes on-premises solutions ideal for applications that demand high-performance computing, low-latency networking, and rapid data throughput.

The cloud segment is expected to grow at a significant CAGR over the forecast period, driven by the increasing adoption of cloud technologies across industries. Cloud deployment offers organizations the ability to offload the responsibility of managing their own data center infrastructure, resulting in a flexible, scalable, and cost-effective solution for businesses seeking to optimize their IT operations. The key growth drivers for the cloud deployment type segment can be attributed to factors such as cost efficiency, scalability, security, and the increasing reliance on cloud-based applications.

Organization Size Insights

The large enterprises segment dominated the market in 2024. Large organizations often experience fluctuating resource demands due to business growth, mergers and acquisitions, seasonal spikes in data usage, or global expansion. Outsourcing data center services allows these enterprises to scale their infrastructure seamlessly without the need to invest heavily in physical hardware or manage the complexities of internal data center expansion.

The small and medium-sized enterprises (SMEs) segment is expected to grow at a significant CAGR over the forecast period. In addition to cost and scalability, access to advanced technologies is a significant factor driving SMEs toward data center outsourcing. As digital transformation becomes essential for businesses of all sizes, SMEs need to leverage cutting-edge technologies such as cloud computing, big data analytics, artificial intelligence (AI), and machine learning (ML) to stay competitive in the market.

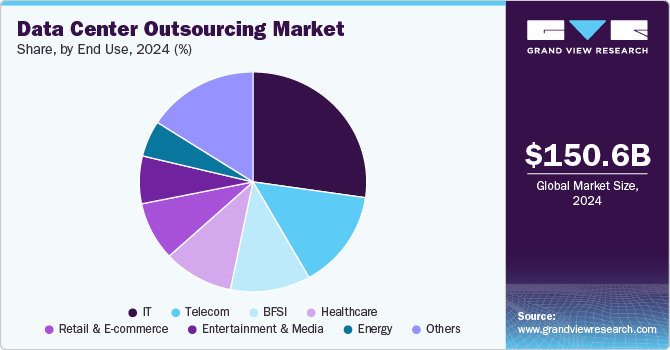

End Use Insights

The IT segment dominated the market in 2024 due to the increasing demand for cloud computing services. With businesses of all sizes increasingly adopting cloud-based platforms, the need for scalable, reliable, and cost-efficient data centers has become more prominent. Data center outsourcing provides IT companies with access to flexible cloud services, allowing them to scale their infrastructure according to demand without the need for significant capital investment.

The telecom segment is expected to grow at a significant CAGR over the forecast period owing to the expansion of 5G networks. As telecom providers continue to roll out 5G infrastructure globally, they require vast amounts of data processing power and storage to support the increased data traffic and connectivity demands. The roll-out of 5G requires not only the establishment of new network infrastructure but also a significant increase in data processing capabilities at the edge of networks to handle real-time data transmission and processing. Data center outsourcing provides telecom companies with access to the necessary infrastructure to support the increased demand for data storage, compute power, and connectivity.

Regional Insights

The data center outsourcing market in North America held a significant share of nearly 39.0% in 2024, driven by the region’s rapid cloud-first adoption strategies and a maturing managed services ecosystem. Many enterprises are moving beyond traditional infrastructure outsourcing toward integrated, cloud-centric models that emphasize agility and service innovation. This evolution is creating strong demand for outsourcing providers that can deliver hybrid cloud management, multi-cloud orchestration, and seamless migration services, beyond conventional hosting or colocation.

The data center outsourcing market in the U.S. is expected to grow significantly at a CAGR of 6.2% from 2025 to 2030. The sharp rise in data privacy regulations, including the enforcement of laws such as the California Consumer Privacy Act (CCPA) and the expansion of cybersecurity compliance requirements across industries, is significantly driving outsourcing growth. Companies increasingly rely on third-party providers with certified data centers and specialized regulatory expertise to mitigate legal risks and ensure adherence to complex compliance mandates.

Europe Data Center Outsourcing Industry Trends

The data center outsourcing market in Europe is anticipated to register a considerable growth from 2025 to 2030, driven by the region’s advancing focus on digital sovereignty and data localization requirements. With regulatory frameworks such as the General Data Protection Regulation (GDPR) and the emergence of national and regional data protection laws, European enterprises are increasingly seeking outsourcing providers with local data center footprints and demonstrable compliance expertise.

The UK data center outsourcing market is expected to grow rapidly in the coming years. With programs such as the UK Government Digital Service (GDS) strategy and increasing mandates for public sector digitalization, there is a rising demand for specialized outsourcing partners capable of supporting critical government infrastructure while ensuring strict compliance with public sector standards.

The data center outsourcing market in Germany held a substantial market share in 2024, driven by Germany’s leadership in Industry 4.0 and the widespread integration of smart manufacturing and industrial IoT technologies. These innovations require resilient, low-latency, and scalable IT infrastructures to manage the explosion of data generated by connected devices and automated production lines.

Asia Pacific Data Center Outsourcing Market Trends

Asia Pacific is expected to register the highest CAGR of 7.2% from 2025 to 2030, fueled by the exponential expansion of digital economies across the region. Countries such as China, India, Indonesia, Vietnam, and the Philippines are witnessing rapid digitalization across banking, retail, education, and healthcare sectors. This surge in digital services is pushing enterprises to outsource data center operations to providers who can offer scalable, secure, and cost-effective infrastructure capable of handling massive data volumes and supporting millions of users in increasingly mobile-first economies.

The Japan data center outsourcing market is expected to grow rapidly in the coming years. As Japan’s large enterprises move toward Industry 4.0, automation, and AI-driven operations, the demand for agile, high-performance, and scalable IT infrastructure is intensifying. Outsourcing data center management allows organizations to leverage specialized capabilities, such as AI-based operations, without incurring the high costs of in-house IT development, further accelerating DCO market growth.

The data center outsourcing market in China held a substantial market share in 2024. The rise of China’s e-commerce, digital entertainment, and fintech industries is driving demand for robust, scalable data center outsourcing solutions. Companies in these sectors handle vast amounts of consumer data and require IT infrastructure that can handle spikes in traffic, ensure high availability, and maintain stringent security standards. Outsourcing data center operations enables these organizations to maintain optimal service levels without overburdening internal resources, thus fostering long-term partnerships with specialized outsourcing providers.

Key Data Center Outsourcing Company Insights

Key players operating in the data center outsourcing industry are Amazon Web Services (AWS), Fujitsu, Microsoft Azure, Google Cloud, and NTT Communications. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In March 2025, NTT DATA, Inc. unveiled its Agentic AI Services for Hyperscaler AI Technologies, a groundbreaking suite designed to help organizations integrate, build, manage, and scale AI-powered agents. These services aim to improve operational efficiency, drive innovation, and enhance employee and customer experiences, ultimately maximizing the return on AI investments.

-

In September 2024, Amazon Web Services (AWS) and Oracle launched Oracle Database AWS. This new offering allows access to Oracle Autonomous Database and Oracle Exadata Database Service hosted on dedicated infrastructure within AWS. This service provides a seamless experience between AWS and Oracle Cloud Infrastructure (OCI), simplifying database administration, customer support, and billing, It also helps customers to easily connect their Oracle Database to applications running on AWS Analytics services, Amazon EC2, and AWS’s AI and machine learning tools, including Amazon Bedrock, enhancing their ability to utilize data for advanced analytics and AI applications.

Key Data Center Outsourcing Companies:

The following are the leading companies in the data center outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Amazon Web Services (AWS)

- Atos

- Capgemini

- Cognizant

- DXC Technologies

- Fujitsu

- Google Cloud

- HCL

- IBM Corporation

- Microsoft Azure

- NTT DATA, Inc.

- Orange

- Tata Consultancy Services (TCS)

- Verizon Communications

- Wipro

Data Center Outsourcing Market Report Scope

Report Attribute

Details

Market size in 2025

USD 157.58 billion

Revenue forecast in 2030

USD 213.16 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service type, deployment type, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Accenture; Amazon Web Services (AWS); Atos; Capgemini; Cognizant; DXC Technologies; Fujitsu; Google Cloud; HCL; IBM Corporation; Microsoft Azure; NTT DATA, Inc.; Orange; Tata Consultancy Services (TCS); Verizon Communications; Wipro

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Outsourcing Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the data center outsourcing market report based on service type, deployment type, enterprise size, end use, and region.

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Managed Hosting Services

-

Colocation Services

-

Infrastructure Management Services

-

Disaster Recovery and Backup Services

-

Network Management Services

-

Storage Management Services

-

Security Management Services

-

Migration and Consolidation Services

-

Consulting and Advisory Services

-

Others

-

-

Deployment Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-Premises

-

Cloud

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT

-

Telecom

-

Healthcare

-

BFSI

-

Retail & E-commerce

-

Entertainment & Media

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center outsourcing market size was estimated at USD 150.60 billion in 2024 and is expected to reach USD 157.58 billion in 2025.

b. The global data center outsourcing market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 213.16 billion by 2030.

b. The managed hosting services segment dominated the market and accounted for the revenue share of over 25.0% in 2024 due to the growing need for cost efficiency. As enterprises face pressure to reduce operational expenses, outsourcing data center management and hosting services has become a more attractive option.

b. Some key players operating in the data center outsourcing market include Accenture, Amazon Web Services (AWS), Atos, Capgemini, Cognizant, DXC Technologies, Fujitsu, Google Cloud, HCL, IBM Corporation, Microsoft Azure, NTT DATA, Inc., Orange, Tata Consultancy Services (TCS), Verizon Communications, Wipro

b. The growing demand for digital transformation across industries is a major driver of the data center outsourcing market. As enterprises shift towards cloud-based operations, AI-driven services, and big data analytics, there is an increasing need for flexible, scalable, and cost-effective IT infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.