- Home

- »

- Next Generation Technologies

- »

-

Data Discovery Market Size, Share, & Growth Report, 2030GVR Report cover

![Data Discovery Market Size, Share & Trends Report]()

Data Discovery Market (2023 - 2030) Size, Share & Trends Analysis Report By Offering (Solutions, Services), By Deployment (Cloud, On-premises), By Application, By End-use Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-160-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Discovery Market Size & Trends

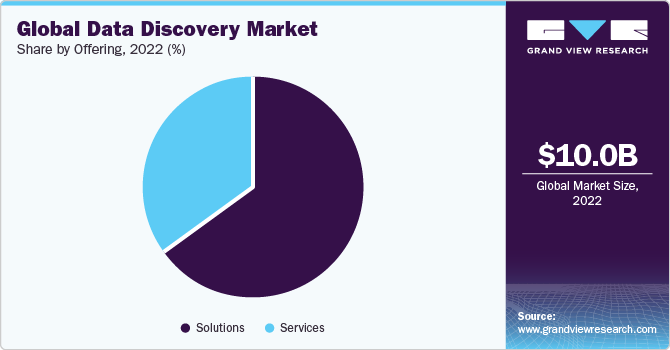

The global data discovery market size was estimated at USD 10.04 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 15.3% from 2023 to 2030. This growth is driven by the increasing volume and complexity of data encountered by the the organizations. Data discovery tools help organizations extract valuable insights from this data. In addition, there is a growing need for better data governance, and data discovery tools play a crucial role in implementing effective data governance practices. Moreover, the demand for self-service analytics is on the rise as business users seek the ability to analyze data independently, and data discovery tools facilitate this without requiring extensive training. The adoption of cloud-based data discovery solutions is also contributing to market growth due to their scalability, ease of use, and cost-effectiveness.

For instance, in January 2022, Ground Labs, a leading provider of data discovery solutions, launched its Data Discovery Network (DDN) to help partners address the increasing compliance requirements while bolstering recurring revenue streams.

The DDN is a global ecosystem of top technology vendors, consulting firms, distributors, integrators, and resellers, all committed to delivering solutions for data discovery. Thus, the launch of DDN highlights Ground Labs' dedication to collaborating with a diverse network of partners to meet the growing demand for data discovery services and compliance solutions.

The growing need to discover sensitive data, both in structured and unstructured formats, is a pivotal driver of the market's expansion. Structured data, found in organized formats like database tables, though easy to search and analyze, poses challenges in identifying sensitive information within it. Besides, unstructured data, encompassing text documents, images, and videos, are more challenging to search but may contain valuable insights, including sensitive data. The growing importance of sensitive data discovery is driven by compliance requirements, such as GDPR and CCPA regulations that mandate adherence. In addition, security concerns become critically important when sensitive data becomes a prime target for cyberattacks, necessitating robust identification and protection measures. Furthermore, effective risk management is imperative as businesses proactively address potential risks associated with sensitive data, encompassing data breaches and reputational damage.

The integration of AI and machine learning capabilities into data discovery tools is driving the growth of the data discovery industry. AI and ML automation streamline the data discovery process, enabling organizations to efficiently locate and analyze data, even on a large scale. These technologies offer several advantages, including automated data cataloging and classification, simplifying the organization and comprehension of data, particularly with extensive and complex datasets. AI and ML also excel in pattern detection and analysis, uncovering insights that are challenging to identify manually, thus aiding organizations in recognizing opportunities, managing risks, and enhancing operations. Furthermore, natural language processing (NLP) plays a crucial role in understanding the semantics of data, enabling more advanced data discovery tasks such as identifying relationships between data points, extracting insights from unstructured data, and generating reports in natural language.

Deployment Insights

The on-premises segment led the market in 2022 with a revenue share of over 54.0%. This dominance is attributed to several factors, including stringent security and compliance requirements that lead organizations to favor on-premises solutions for maintaining control over their data and infrastructure. On-premises deployments are highly adaptable, allowing customization to meet specific organizational data needs, which is particularly valuable for entities with intricate data requirements. In addition, on-premises deployments excel in providing superior performance in situations like real-time analytics, outperforming certain cloud-based alternatives.

The cloud segment is anticipated to witness substantial growth over the forecast period. The increasing adoption of cloud computing, favored by businesses of all sizes, is a significant driver, with more organizations transitioning their data and applications to the cloud, thereby elevating the demand for cloud-based data discovery solutions. The growing complexity of managing widely distributed cloud environments, where data and applications are spread across multiple providers and locations, has created a need for automated discovery and management. Cloud-based data discovery solutions address this challenge by providing a consolidated view of the data landscape. Moreover, cloud-based data discovery solutions can adapt to changing business needs, provide data access from any location at any time, and streamline deployment and management.

Application Insights

The security and risk management segment led the market in 2022 with a global revenue share of over 26.0%. The growth is attributed to the organizations' continued investments in data security and compliance. With the heightened awareness of safeguarding sensitive data against unauthorized access, theft, or loss, data discovery solutions have gained significance. They assist organizations in identifying and classifying sensitive data, evaluating data security risks, and implementing suitable risk mitigation measures. Moreover, with a growing emphasis on safeguarding sensitive data and meeting stringent regulations such as GDPR, HIPAA, and CCPA, data discovery solutions have become crucial for regulatory compliance and data protection.

Sales and marketing management segment is anticipated to witness significant CAGR over the forecast period. The increasing demand for data-driven decision-making across industries, associated with the escalating volume and complexity of data, highlights the need for businesses to identify trends and patterns within their data swiftly. Moreover, the rising adoption of cloud-based data discovery solutions has enhanced the ability of businesses to elevate their sales and marketing performance. This includes identifying new leads and prospects, more effective lead segmentation, precision in targeting marketing campaigns, accurate measurement of campaign effectiveness, and bolstering customer retention rates. Data discovery tools are becoming instrumental in empowering businesses to make data-driven, informed decisions that significantly impact their sales and marketing endeavors.

End-use Industry Insights

The BFSI segment led the market in 2022 with a global revenue share of over 20.0%. The BFSI sector generates an immense volume of data, including customer information, transactions, and market data, and data discovery tools assist in extracting valuable insights from this data. Moreover, BFSI companies face growing regulatory compliance requirements, and data discovery tools aid in identifying and managing data risks to ensure adherence to relevant regulations. These tools also empower BFSI companies to harness data for better decision-making, identifying new opportunities, enhancing products and services, and reducing costs. They are instrumental in fraud detection, risk assessment, customer segmentation for targeted marketing, product development based on customer preferences, and improving operational efficiency by identifying and eliminating process inefficiencies. Thus, data discovery tools have become essential for BFSI companies in navigating their data, regulatory compliance, and strategic decision-making.

The healthcare sector is poised for substantial growth in the coming years. The escalating volume and complexity of healthcare data, encompassing electronic health records, medical imaging, and wearable device information, pose a significant challenge for healthcare organizations. Data discovery tools are becoming pivotal in aiding these organizations to identify and unify their scattered data, facilitating better insights and enhanced patient care. The increasing demand for value-based care models, which emphasize delivering high-quality care at reduced costs, is propelling the use of data discovery tools to identify efficiency improvements and cost reductions. Furthermore, the adoption of artificial intelligence (AI) and machine learning (ML) in healthcare applications, such as predictive analytics and personalized medicine, is on the rise. Data discovery tools are crucial for enabling these applications by providing access to the extensive and complex datasets required for training AI and ML models, contributing to improved patient outcomes and healthcare innovations.

Offering Insights

The solutions segment led the market in 2022 with a revenue share of over 65.0%. The segment's growth is attributed to the comprehensive and integrated approach offered by data discovery solutions, encompassing data preparation, visualization, and analysis tools. Solutions exhibit scalability and customizability, making them particularly well-suited for large enterprises. Moreover, the escalating demand for data-driven decision-making, with businesses increasingly relying on data to enhance their performance, is driving the segment's growth in the market. Furthermore, the mounting complexity of data, which is growing in volume and becoming more unstructured, is addressed effectively by data discovery solutions, aiding businesses in comprehending and utilizing their data, regardless of its format or complexity.

The services segment is poised for significant growth over the forecast years. The services encompass both professional and managed services segments. Professional services segment includes consulting, implementation, training, and support, which aid organizations in selecting the right data discovery solution, deploying it effectively, and training their staff for proficient usage. Managed services segment involves outsourcing data discovery solution management and maintenance to third-party providers, relieving internal resources and allowing organizations to focus on core business activities. Furthermore, the services segment is fueled by the complexity of data environments, the demand for self-service data analysis, and the essential support and maintenance needed to ensure data discovery solutions work effectively in the evolving data challenges.

Regional Insights

North America dominated the market in 2022 with a global revenue share of over 42.0%. The region's growth is attributed to the substantial presence of large enterprises known for their early adoption of innovative technologies such as data discovery. North America region also experiences a widespread surge in the demand for data-driven decision-making, cutting across diverse industries. Furthermore, a growing awareness of the essential value of data and the necessity for effective data management is contributing to the region's dominance. For instance, in November 2022, Wiz, Inc., a U.S.-based cloud security platform provider, expanded its partnership with BigID, a leading data platform aimed at enhancing visibility and control over enterprise data to prevent breaches. This collaboration combines Wiz, Inc's Cloud-Native Application Protection (CNAPP) platform with BigID's Data Security Posture Management (DSPM) platform, offering customers a comprehensive solution that addresses both cloud security and data protection needs.

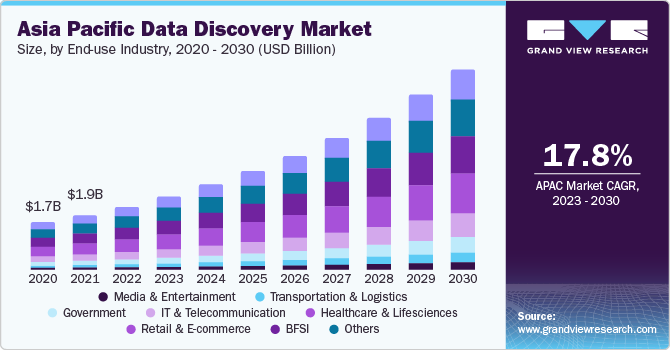

Asia Pacific region is anticipated to register the fastest CAGR over the forecast period, driven by a surge in digital transformation initiatives across various industries in the region. The adoption of digital technologies by businesses in Asia Pacific has led to a surge in data generation, necessitating effective data management and analysis. Data discovery tools play a pivotal role by automating the process of locating and comprehending data. Substantial investments in IT infrastructure, including cloud computing and data centers, have made it more accessible and cost-effective for businesses to handle vast amounts of data, spurring the adoption of data discovery tools. The proliferation of e-commerce, digital services, and government-led data-driven projects contributes to the need for data discovery tools, particularly in improving customer experiences, developing products and services, and facilitating better decision-making. Moreover, industries such as finance, healthcare, manufacturing, and education actively embrace data discovery to enhance decision-making, gain competitive advantages, and enhance operational efficiency.

Key Companies & Market Share Insights

Established and emerging players in the data discovery industry are strategically focusing on organic and inorganic growth approaches to expand their market presence and access new customer segments. These strategies include the development of new data discovery solutions and the enhancement of existing products to align with the changing requirements of their customer base. Collaborative efforts and partnerships with other technology vendors and service providers are on the rise to provide more comprehensive data discovery solutions and reach a broader customer audience.

-

For instance, in June 2023, OneTrust, LLC., a prominent trust intelligence provider, unveiled additional data discovery connectors, expanding the total to over 200 out-of-the-box connectors. These connectors enable organizations to scan, classify, inventorize, and address data from a wide range of data sources, enhancing their data management capabilities.

Key Data Discovery Companies:

- IBM Corporation

- Microsoft

- Oracle

- Salesforce, Inc.

- SAS Institute Inc.

- Amazon Web Services, Inc.

- Open Text

- MicroStrategy

- Cloudera, Inc.

Data Discovery Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.67 billion

Revenue forecast in 2030

USD 31.55 billion

Growth rate

CAGR of 15.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, deployment, application, end-use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

IBM Corporation; Microsoft; Oracle; Salesforce Inc.; SAS Institute Inc.; Google; Amazon Web Services, Inc.; Open Text; MicroStrategy; Cloudera, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Discovery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global data discovery market report based on offerings, deployment, application, end-use industry, and region.

-

Offering Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solutions

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Security & Risk Management

-

Asset Management

-

Sales and Marketing Management

-

Supply Chain Management

-

Others

-

-

End-use Industry Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT & Telecommunication

-

Government

-

BFSI

-

Retail & E-commerce

-

Media & Entertainment

-

Healthcare & Lifesciences

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data discovery market size was estimated at USD 10.04 billion in 2022 and is expected to reach USD 11.67 billion in 2023.

b. The global data discovery market is expected to grow at a compound annual growth rate of 15.3% from 2023 to 2030 to reach USD 31.55 billion by 2030.

b. North America dominated the market in 2022, accounting for over 42% share of the global revenue. The region's growth is attributed to the substantial presence of large enterprises known for their early adoption of innovative technologies such as data discovery.

b. Some key players operating in the data discovery market include IBM Corporation, Microsoft, Oracle, Salesforce, Inc., SAS Institute Inc., Google, Amazon Web Services, Inc., Open Text, MicroStrategy, Cloudera, Inc.

b. Key factors driving the data discovery market growth include the growing need to discover sensitive structured and unstructured data and the increasing investment in data privacy measures with the introduction of data privacy regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.