- Home

- »

- Next Generation Technologies

- »

-

Data Wrangling Market Size And Share, Industry Report, 2033GVR Report cover

![Data Wrangling Market Size, Share & Trends Report]()

Data Wrangling Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment (Cloud, On-premises), By Enterprise Size (SMEs, Large Enterprises), By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-075-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Wrangling Market Summary

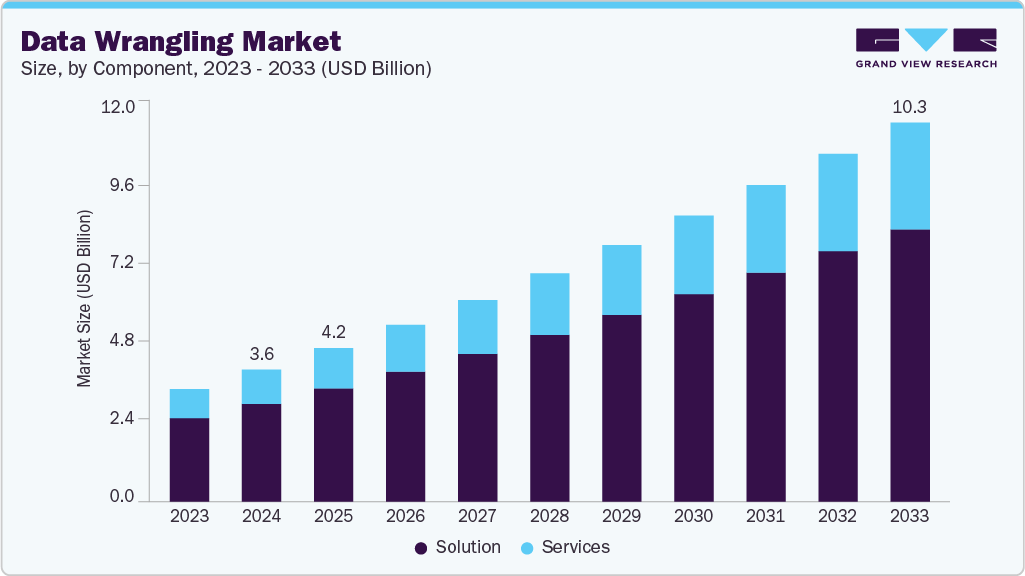

The global data wrangling market size was estimated at USD 3,594.3 million in 2024 and is projected to reach USD 10,315.9 million by 2033, growing at a CAGR of 12.0% from 2025 to 2033. Data wrangling market growth is anticipated to be significantly accelerated by increasing concerns about data loss and theft, rising to bring your device (BYOD) trends, and workplace mobility.

Key Market Trends & Insights

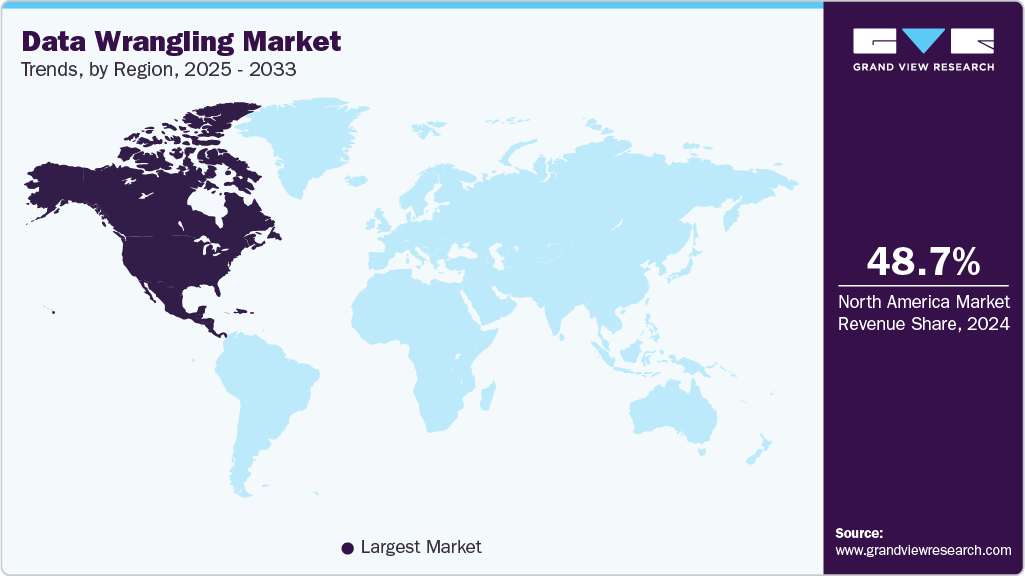

- North America dominated the global data wrangling market with the largest revenue share of 48.7% in 2024.

- The data wrangling market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, the solution segment led the market, holding the largest revenue share of 74.07% in 2024.

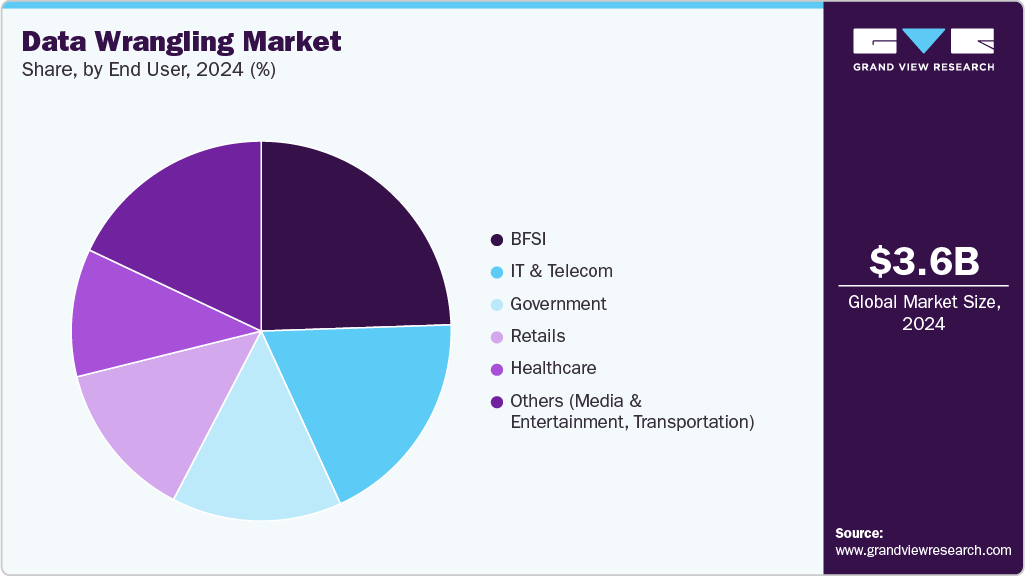

- By End User, the BFSI segment held the dominant position in the market and accounted for the leading revenue share of 24.46% in 2024.

- By end user, the IT & telecom segment is expected to grow at the fastest CAGR of 12.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 3,594.3 Million

- 2033 Projected Market Size: USD 10,315.9 Million

- CAGR (2025-2033): 12.0%

- North America: Largest market in 2024

The proliferation of artificial intelligence has transformed digital architectures, compelling IT leaders to address critical questions regarding data relevance, use cases, operations, skills, processes, and tools. The success of AI investments hinges on the ability to manage data effectively, ensuring it is not disparate, purposeless, or lacking in relevant context. To harness AI's potential, organizations must establish strong relationships with their data, incorporating relevant context and controls. This involves leveraging tools that provide comprehensive visibility into IT architecture and data, facilitating the identification of pertinent data sources regardless of their location. Furthermore, the volume and velocity of data, along with technological developments in artificial intelligence and machine learning, are the other drivers for the expansion of the data wrangling market.

The amount of data being generated by businesses and individuals is growing exponentially. This data comes in many different formats and sources, making it challenging to manage and analyze. Data wrangling tools are designed to help organizations deal with this complexity, making it easier to clean, transform, and structure data for analysis which in result help the businesses to make faster and informed decisions. Moreover, data analytics has become a critical tool for organizations looking to gain insights and make data-driven decisions. However, data must be properly managed and structured to use data analytics effectively. Data wrangling tools help businesses prepare their data for analysis, making it easier to gain insights and make decisions based on data.

In addition, Data wrangling can help businesses identify anomalies and errors in real-time data, enabling them to quickly correct issues and avoid potential problems useful for real-time Deployments. For instance, a recent Tealium study reveals that 81% of Customer Data Platform (CDP) users report high satisfaction with their platform's support for AI and machine learning projects indicating that organizations experience faster deployment and superior data quality, while non-CDP users often struggle with data wrangling and compliance challenges. Furthermore, 91% of CDP user’s express confidence in handling changes to data privacy regulations, compared to 76% of non-CDP users, highlighting a significant advantage in managing compliance requirements.

Component Insights

The solutions segment led the market in 2024, accounting for over 74.07% of global revenue due to the strong growth and innovation, including in end-to-end data wrangling components that incorporate various tools and technologies for data integration, preparation, and analysis. Moreover, many data wrangling components are now being integrated with cloud-based analytics platforms, such as Microsoft Aazure, Amazon Web Services, and Google Cloud Platform. This enables organizations to leverage the power of cloud computing to scale their data processing capabilities and gain deeper insights from their data.

The services segment is expected to grow at the highest CAGR during the forecast period as the data wrangling market is expected to continue to grow and evolve as organizations seek to optimize their data wrangling processes and gain a competitive advantage through improved data-driven decision-making. The services segment of the data wrangling market includes professional services, such as consulting, implementation, and training that help organizations optimize their data wrangling processes. Many data wrangling service providers are focusing on ensuring the security and privacy of their client's data which includes implementing best practices for data encryption, access controls, and compliance with data privacy regulations.

Deployment Insights

The on-premises segment accounted for the largest market revenue share in 2024, due to the deployment of data wrangling tools and components on local infrastructure rather than in the cloud. As data privacy and security concerns continue to grow, on-premises deployment are likely to become more attractive to organizations that need to comply with strict regulations and data protection laws. Moreover, on-premises deployments allow organizations to customize and control their data wrangling processes and workflows to meet their specific needs, which is especially important for organizations that deal with sensitive or complex data.

The cloud segment is expected to grow at the highest CAGR over the forecasted period, driven by the increasing demand for cloud-based deployment offering scalability, flexibility, and cost-effectiveness. Organizations are increasingly adopting multi-cloud and hybrid cloud strategies to take advantage of different cloud providers' benefits and avoid vendor lock-in. Moreover, cloud-based data wrangling deployment that leverage automation and AI technologies to streamline data preparation and accelerate data analysis are likely to become more popular. These deployments can help organizations reduce costs, improve productivity, and gain insights quickly.

Enterprise Size Insights

The large enterprises segment leads the market with the revenue share in 2024 due to the use of data wrangling tools and deployments by large organizations with significant data volumes and complex data infrastructure. Moreover, large enterprises typically have complex data infrastructures with multiple data sources and systems. Data-wrangling components can easily integrate with these systems and provide a unified view of the data. Moreover, large enterprises are increasingly adopting AI and machine learning technologies to automate data wrangling tasks and gain insights from their data.

The SME segment is expected to grow at the highest CAGR over the forecast period, due to the smaller data volumes than large enterprises, but their data needs can grow quickly. Data wrangling components can scale up or down based on demand and are affordable for SMEs with limited budgets are likely to become more popular. Moreover, SMEs may need more resources to process and analyze their data manually. Data wrangling components that leverage automation and AI technologies to streamline data preparation and accelerate data analysis.

End User Insights

The BFSI segment accounted for the largest market revenue share in 2024 due to the industry handling sensitive data and is subject to strict regulations. Data-wrangling components provide strong data security features and comply with data protection regulations. Moreover, BFSI companies require strong data governance and management frameworks to ensure data accuracy, reliability, and compliance. Data wrangling components provide data governance and management features, such as data lineage, metadata management, and data cataloging.

The IT and Telecom segment is anticipated to grow at the highest CAGR during the forecast period. This segment companies often operate in complex environments with diverse data sources and systems. Data wrangling tools help integrate and consolidate data from different sources, such as CRM systems, billing systems, network logs, and customer support platforms. This integration gives organizations a holistic view of operations, improves data quality, and enhances decision-making processes. Moreover, telecom companies face the challenge of optimizing network performance, ensuring high-quality service delivery, and reducing downtime. Data wrangling tools assist in processing network data to identify bottlenecks, analyze usage patterns, and predict network capacity requirements. By efficiently managing and analyzing network data, IT and telecom companies can improve their infrastructure, enhance customer experience, and optimize operations.

Regional Insights

North America dominated the data wrangling industry with a revenue share of over 48.7% in 2024, driven by the increasing adoption of automated technologies and AI components, which enhance data processing capabilities. The region's dominance in the market is attributed to a strong presence of technology companies and a strong focus on data-driven decision-making across various industries, including finance, retails, and e-commerce.

U.S. Data Wrangling Market Trends

The U.S. data wrangling market is expected to grow significantly in 2024, driven by the increasing volume and complexity of data across industries. This growth is fueled by the widespread adoption of big data analytics and the need for businesses to transform raw data into actionable insights efficiently. Organizations are increasingly utilizing data wrangling tools to streamline their data preparation processes, enabling faster decision-making without heavy reliance on IT teams.

Europe Data Wrangling Market Trends

The Europe data wrangling market is witnessing steady growth over the forecast period. The European Union's General Data Protection Regulation (GDPR) has increased the importance of data governance and compliance, leading to a greater need for data wrangling tools. Moreover, the adoption of cloud computing and regulatory frameworks aimed at enhancing data security is expected to bolster the market's expansion. As businesses across various sectors, including retails and finance, increasingly recognize the importance of data wrangling for effective decision-making, the technology is set to become integral to corporate strategies.

Asia Pacific Data Wrangling Market Trends

The data wrangling market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period due to the increasing adoption of digital technologies, rising internet penetration, and the emergence of big data analytics have contributed to the demand for data wrangling tools and services. Industries such as telecommunications, e-commerce, retails, and finance are driving the market growth in this region. Moreover, the Asia Pacific region has been at the forefront of digital transformation, with countries such as China, Japan, India, and South Korea making significant advancements in technology adoption. This has led to a massive influx of data from various sources, creating a need for efficient data wrangling tools to extract insights and drive business value.

Key Data Wrangling Company Insights

Some key companies in the data wrangling industry are Altair Engineering Inc.,

Datameer, Inc., SAS Institute Inc., and Oracle Corporation.

-

Altair Engineering Inc. is a major company in the data wrangling industry, focused on enhancing enterprise decision-making through innovative components. The company specializes in integrating data science with AI-powered simulation, enabling organizations to quickly validate ideas and realize their potential benefits. Altair's offerings include advanced analytics, data visualization, and simulation tools that streamline data management processes. By leveraging these technologies, Altair empowers businesses to harness the full value of their data, facilitating informed decision-making and driving operational efficiency. Their vision emphasizes the importance of speed and accuracy in demonstrating the value of bold ideas, positioning them as a key player in transforming how enterprises operate.

-

Oracle Corporation is a significant player in the data wrangling industry, recognized for its comprehensive suite of database management tools and cloud services. The company offers the Oracle autonomous database, which is notable for its self-patching, self-tuning, and self-managing capabilities, revolutionizing how organizations handle data. Oracle's cloud infrastructure supports businesses in various sectors by providing integrated, automated tools that enhance data processing and analytics.

Key Data Wrangling Companies:

The following are the leading companies in the data wrangling market. These companies collectively hold the largest market share and dictate industry trends.

- Altair Engineering Inc.

- Alteryx, Inc.

- Datameer, Inc.

- Hitachi Vantara Corporation

- International Business Machines Corporation

- Impetus Technologies, Inc.

- Oracle Corporation

- Paxata, Inc.

- SAS Institute Inc.

- TIBCO Services Inc.

- Teradata Corporation

Recent Developments

-

In April 2025, Exploratory has introduced a new AI-driven, prompt-based Data Wrangling feature that allows users to transform and prepare data using simple natural language instructions. This advancement streamlines data preparation by eliminating the need for coding, making the process more intuitive and accessible. By generating R code suggestions in response to user prompts, the feature boosts productivity and makes Data Wrangling more approachable for a wider range of analysts.

-

In September 2024, Oracle announced the introduction of the Oracle Intelligent Data Lake, a key component of its Oracle Data Intelligence Platform, aimed at enhancing data integration and analytics capabilities. This new offer will support open data formats and provide a unified catalog, enabling organizations to manage both structured and unstructured data seamlessly. The Intelligent Data Lake is designed to facilitate real-time data processing and analytics, leveraging tools such as Apache Spark and Jupyter Notebook for improved developer experiences.

-

In May 2023, Informatica Inc. released Claire GPT, a new product that combines its proprietary augmented intelligence engine with generative AI capabilities. With such capabilities, the company's customers can manage their data using natural language. With the integration of Claire GPT, the number of datasets to be trained would increase, thus accelerating the growth of the Data Wrangling market.

Data Wrangling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,176.4 million

Revenue forecast in 2033

USD 10,315.9 million

Growth rate

CAGR of 12.0% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil and Mexico; KSA; UAE South Africa

Key companies profiled

Altair Engineering Inc.; Alteryx, Inc.; Datameer, Inc.; Hitachi Vantara Corporation; International Business Machines Corporation; Impetus Technologies, Inc.; Oracle Corporation; Paxata, Inc.; SAS Institute Inc.; TIBCO Services Inc.; Teradata Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Wrangling Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global data wrangling market report based on the component, deployment, enterprise size, end user, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

SMEs

-

Large Enterprises

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Government

-

Retail

-

Retails

-

IT & Telecom

-

Others (Media & Entertainment, Transportation)

-

-

Market Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data wrangling market size was estimated at USD 3,594.3 million in 2024 and is expected to reach USD 4,176.4 million in 2025.

b. The global data wrangling market is expected to grow at a compound annual growth rate of 12.0% from 2025 to 2033 to reach USD 10,315.9 million by 2033.

b. North America dominated the data wrangling market with a share of 48.7% in 2024. This is attributable to the presence of major technology hubs and a strong emphasis on data-driven decision-making.

b. Some key players operating in the data wrangling market include Altair Engineering Inc.; Alteryx, Inc.; Datameer, Inc.; Hitachi Vantara Corporation; International Business Machines Corporation; Impetus Technologies, Inc.; Oracle Corporation; Paxata, Inc.; SAS Institute Inc.; TIBCO Services Inc.; Teradata Corporation

b. Key factors driving the data wrangling market growth include increasing concerns about data loss and theft, rising to Bring Your Device (BYOD) trends and workplace mobility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.