Market Size & Trends

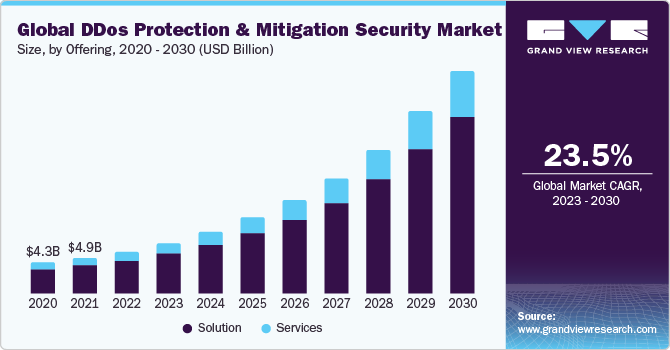

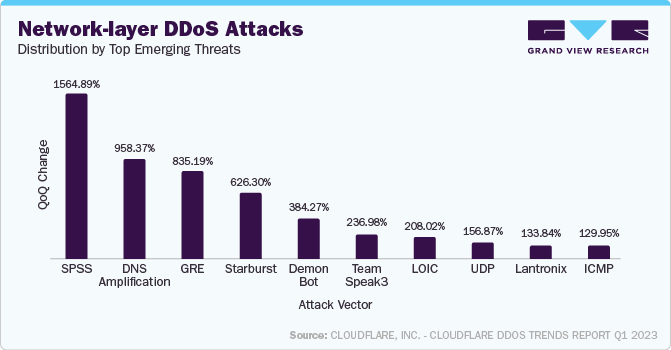

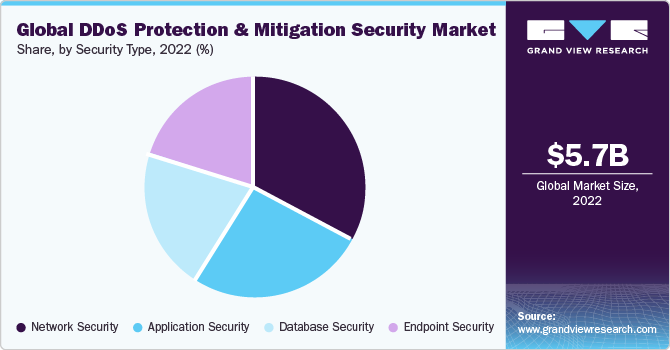

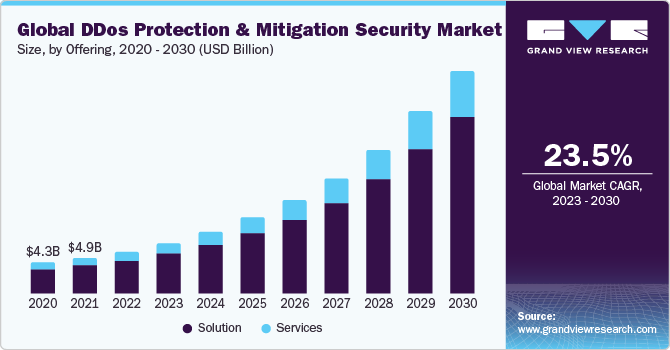

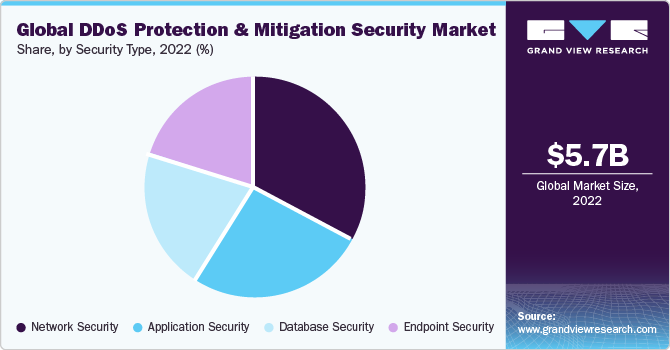

The global DDoS protection and mitigation security market size was valued at USD 5.68 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 23.5% from 2023 to 2030.The rise in multiple DDoS attacks through different vectors, growing traction towards DDoS as a hire service, and the substantial uptake of hybrid and cloud platform-based DDoS solutions are major factors contributing to the market growth. Organizations' increasing efforts to deliver safety and security convergence, secure IoT, intrusion/anomaly detection on networks, manage cyber and physical threats, mitigate through organizational and behavioral changes, and ensure supply chain security will contribute to an increase in demand for DDoS protection and mitigation.

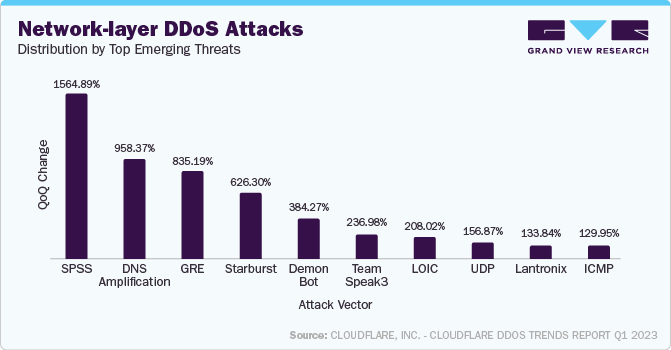

With the increase in online activities during the pandemic, the number of cyber-attacks also increased. According to Cloudflare, Inc., DDoS attacks in the 3rd quarter of 2020 were higher than 1st quarter and 2nd quarter of 2020. The company observed that attacks witnessed a consecutive increase, with the majority of attacks occurring under 500 Mbps and 1 Mpps, which is sufficient to disrupt services. Cloud service, delivery networks, and security vendors witnessed an increase in the number of attacks against their infrastructure. These attacks promoted cyber security service providers to enhance their product offerings in order to protect against unlawful use of data and disruption of services.

Telecommunications service providers are constantly developing stronger connectivity in order to improve the speed and responsiveness of wireless networks. The introduction of IoT, Augmented Reality (AR), and Virtual Reality (VR) technologies, as well as smartphones, voice applications, and audio and video material, resulted in a steady increase in data traffic. The exponential growth in data traffic necessitates increased network bandwidth. When compared to 4G services, 5G services are expected to have a higher bandwidth of 1 Gbps. The increasing capacity of 5G networks allows DDoS attackers to launch large-scale DDoS attacks that can affect millions of mobile and IoT devices, thereby creating growth opportunities in the telecom sector.

Offering Insights

Based on the offering type, the DDos protection and mitigation security market is segmented into solutions and services. The solutions segment held the largest market share in 2022.The increasing focus of organizations on compliance and regulatory requirements is expected to drive the segment growth. Furthermore, an increase in the volume of the data stored on the public as well as private cloud is also expected to contribute to the segment growth over the forecast period.

Organization Size Insights

Based on the organization size, the DDos protection and mitigation security market is segmented into SMEs and large enterprises. The large enterprises segment held the largest market share in 2022. Large-scale organizations have a plethora of data through their CRM, ERP, marketing, and human resource departments. With rising concerns about data privacy and increased downtime in services, large organizations prefer to implement DDoS protection and mitigation solutions to protect their assets. They may either opt for private or public cloud deployment of the solution. In the face of imminent threats, DDoS protection and mitigation solutions are able to defend the sites and data of the organization, thereby avoiding severe service disruption, data theft, and revenue losses.

Deployment Type Insights

Based on the deployment type, the DDoS protection and mitigation security market is segmented into public cloud and private cloud. The public cloud segment held the largest market share in 2022. As cloud computing continues to evolve, service site platforms are becoming more vulnerable to DDoS attacks and data breaches. Several companies and banks are opting for public cloud deployment of DDoS security solutions owing to the high costs associated with private and on-premise deployment across the globe. Public cloud deployment of the solutions allows the company to access the data through a centralized location across different departments.

Vertical Insights

Based on the vertical, the DDos protection and mitigation security market is segmented into telecom & ITES, government, BFSI, retail & consumer, healthcare, manufacturing & automotive and others. The healthcare segment held the largest market share in 2022.The healthcare industry is rapidly utilizing innovative equipment and mobile devices made specifically for doctors and nurses. These technologies keep clinicians connected to their patients while also allowing them to communicate with colleagues and access a vast amount of medical data. As mobility has become a vital component of effective and precise care delivery, internet connectivity has also become a requirement. Furthermore, regulatory standards such as HIPAA, which mandate healthcare providers to secure personal patient information, are driving the increased deployment of DDoS protection and mitigation solutions in the healthcare industry.

Security Type Insights

Based on the security type, the DDos protection and mitigation security market is segmented into application security, endpoint security, network security, and database security. Network securityheld the largest market share in 2022. The increasing uptake of connected gadgets and IT systems is expanding as technology advances around the world. The digital infrastructure is being built to allow business data and applications to be exchanged across digital platforms, devices, and their users. As a result, hackers are increasingly using sophisticated and advanced hacking techniques to enter an organization's IT infrastructure and gain access to key business information. The increased attack on a company's network security through hackers poses a critical threat to data privacy and confidential information of the organization. To prevent such DDoS attacks at an early stage, proactive monitoring and enhanced alerting are paramount. Advanced DDoS prevention technologies can distinguish between human and bot traffic. To tackle the ever-changing attacks, signatures, and patterns, DDoS solution providers are implementing newer technology.

Regional Insights

Asia Pacific dominated the market in 2022 and is expected to witness the fastest CAGR over the forecast period. Based on a survey by Cyber Security Hub, more than 28 % of cyber security professionals working in the APAC region agreed that DDoS attacks are amongst the most impacting threat vectors of 2023. The increasing traction of cloud technologies adoption, digital payment tractions, and digitalization in almost every industry operating in Asia Pacific makes the region vulnerable to DDoS attacks. Moreover, many DDoS attack also results in data security breaches and service interruption, which could cause monetary losses. Therefore, the demand for DDoS protection and mitigation is also increasing in the region.

Key Companies & Market Share Insights

The key players operating in the augmented reality market are investing aggressively in research and development to deliver innovative AR solutions. They are forming strategic alliances as a part of their efforts for technological advancements to gain a competitive edge in the market. For instance, in May 2022, Magic Leap, Inc. announced a strategic partnership with a digital company, Globant, to accentuate the adoption of enterprise AR. The collaboration is aimed at expanding enterprise AR applications.

Key players operating in the market are NetScout Systems, Inc., Akamai Technologies, Radware Inc. Huawei Technologies, Fortinet, Link11 GmbH, Nexusguard, Imperva, Cloudflare, Inc., Allot Ltd., and A10 Networks. The market players typically resort to strategic initiatives such as product and service launches, mergers and acquisitions, partnerships, and research and development. The following are some instances of such initiatives.

-

In May 2023, Nexusguard announced the launch of a DDoS scrubbing center in Sao Paulo, Brazil. The newly established center is going to provide cyber security protection to the local operators and organizations against DDoS attacks. Combined with Nexusguard DDoS solution – Bastions, the scrubbing center will provide real-time mitigation and threat detection services.

-

In April 2023, Akamai Technologies, Inc. announced the launch of a prolexic network cloud firewall. The solution will allow customers to design and maintain their own access control lists in Akamai Prolexic, giving them additional freedom in securing their own network edge. The Prolexic network cloud firewall enables more efficient and adaptable defense against DDoS attacks, as well as expanding Prolexic's protection abilities beyond DDoS.