- Home

- »

- Next Generation Technologies

- »

-

Decentralized Finance Market Size, Industry Report, 2033GVR Report cover

![Decentralized Finance Market Size, Share & Trends Report]()

Decentralized Finance Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Blockchain Technology, Decentralized Applications (dApps), Smart Contracts), By Application (Payments, Data & Analytics, Decentralized Exchange), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-976-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Decentralized Finance Market Summary

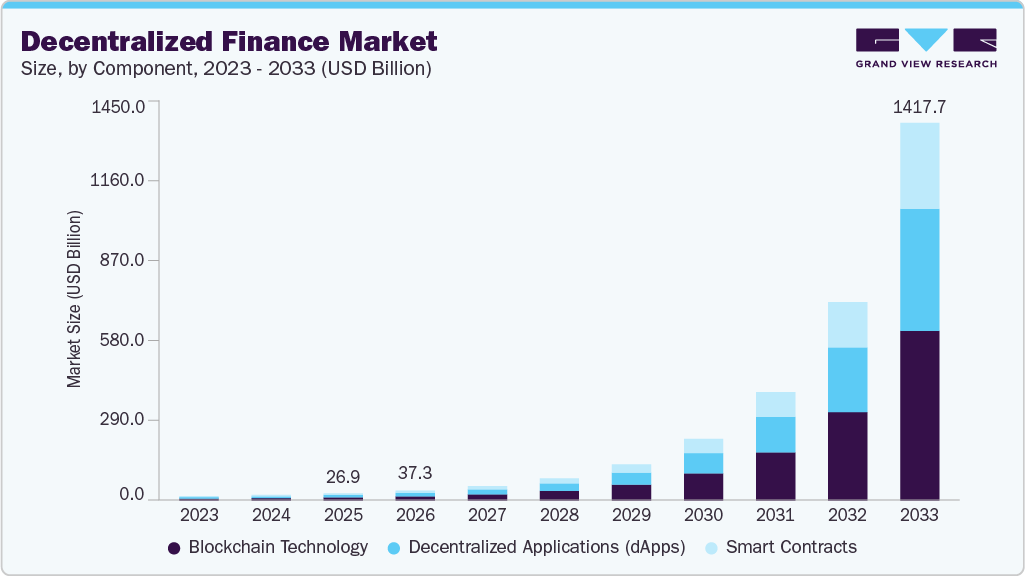

The global decentralized finance market size was estimated at USD 26.94 billion in 2025 and is projected to reach USD 1,417.65 billion by 2033, growing at a CAGR of 68.2% from 2026 to 2033. The widespread acceptance of DeFi has brought about a significant revolution in the financial sector, becoming a key driver for market growth.

Key Market Trends & Insights

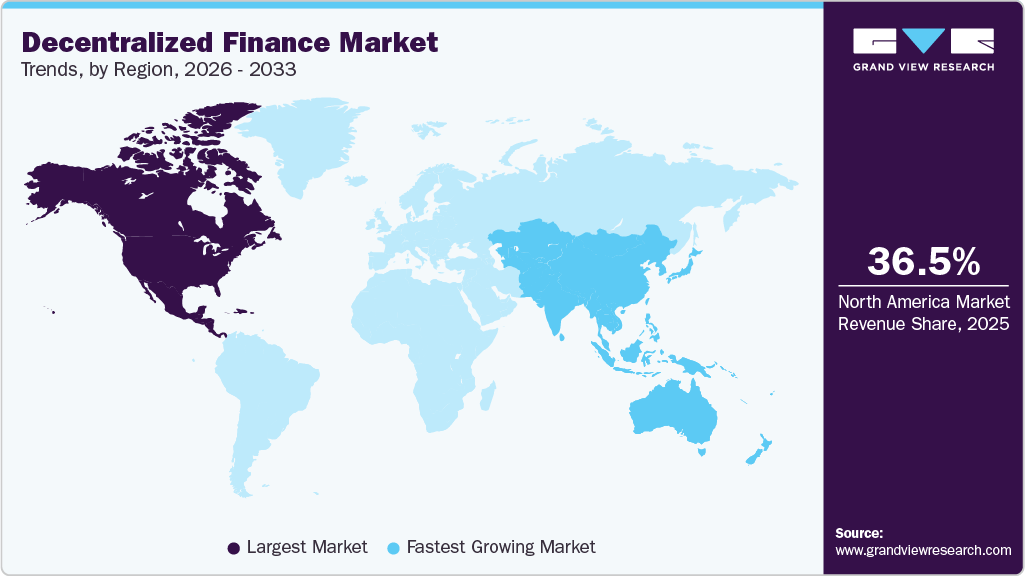

- The North America decentralized finance market accounted for a 36.5% share of the overall market in 2025.

- The decentralized finance industry in the U.S. held a dominant position in 2025.

- By component, the blockchain technology segment accounted for the largest share of 42.5% in 2025.

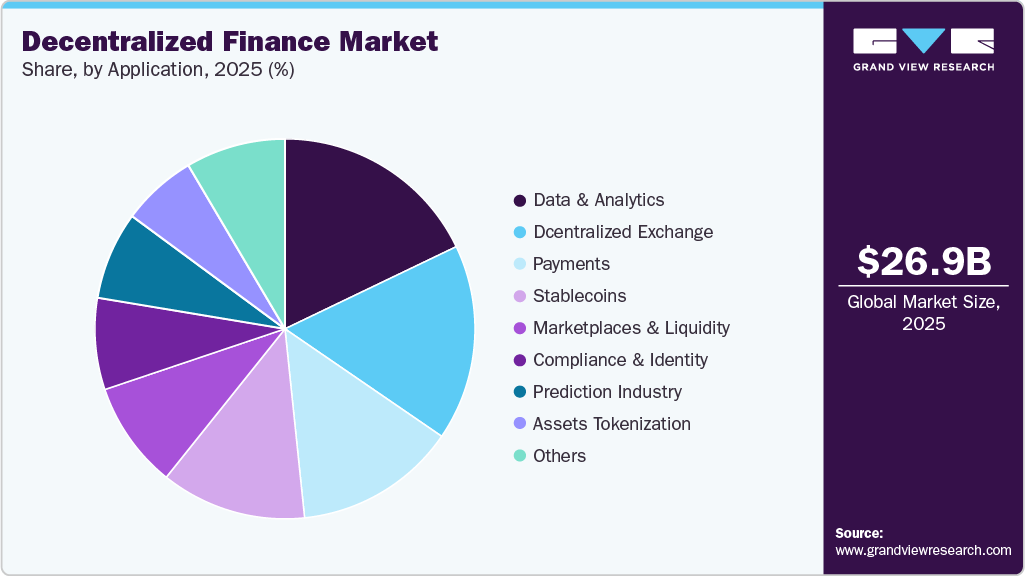

- By application, the data & analytics segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 26.94 Billion

- 2033 Projected Market Size: USD 1,417.65 Billion

- CAGR (2026-2033): 68.2%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Over the past few years, the integration of DeFi with decentralized blockchain platforms has gained immense popularity. The increasing adoption of DeFi can be attributed to its capability to remove intermediaries from financial processes. Particularly in the insurance industry, the impact of DeFi has been remarkable, as it addresses the challenges posed by complex procedures, paperwork, and audit systems in traditional systems. By leveraging DeFi platforms, the insurance industry has become more efficient, thereby contributing to the market's overall growth.The market growth is driven by the numerous advantages offered by DeFi technology providers. One of the key advantages is the elimination of centralized financial institutions, such as banks, which traditionally exercise control over money, financial products, and services. Furthermore, DeFi systems eliminate the fees imposed by banks and other financial institutions to access their services. In addition, the user-friendly nature and easy accessibility of DeFi platforms are expected to boost their adoption further, as they can be accessed by anyone with an internet connection without the need for authorization.

The rise of e-sports and gaming has emerged as a significant catalyst for the growth of DeFi platforms, as developers increasingly utilize DeFi tokens for in-app purchases. Furthermore, trading games and collectibles have gained popularity as genres on the blockchain, empowering users to trade tokens and build their unique ecosystems. An example is Augur, a DeFi platform that enables users to place bets on various world events, sports, and economic outcomes. The advent of blockchain-based prediction solutions is expected to unlock new opportunities for decentralized finance industry expansion in the foreseeable future.

DeFi platforms offer a range of features that contribute to their market growth. These include the ability to send money globally, securely store funds in cryptocurrency wallets, and trade tokenized assets such as stocks and mutual funds. The convenience of accessing these platforms through smartphones adds to their revenue potential. In addition, DeFi platforms have witnessed increasing popularity among cryptocurrency enthusiasts, attracting investors from various countries, which is projected to drive further growth in the market.

While DeFi platforms offer numerous innovative advantages but also have certain risks, currently, the infrastructure and regulations surrounding DeFi are still in development, meaning that investments in DeFi are not subject to the same level of regulation and insurance as traditional banking. Furthermore, DeFi loans rely on additional crypto assets as collateral, which can experience significant value declines or even liquidation during market downturns. However, the DeFi industry is actively working to enhance its functionality, security, and scalability to accommodate the growing number of participants in the digital asset space. This evolution is already underway with the transition to the Ethereum 2.0 network. It is expected that DeFi platforms and exchanges will continue to enhance privacy and independence in cryptocurrency trading, thus driving the advancement of decentralized finance and the underlying systems supporting it.

Component Insights

Blockchain technology segment accounted for the largest share of 42.5% in 2025. Blockchain technology can replace existing decentralized business model foundations by lowering transaction costs, fostering distributed trust, and empowering decentralized platforms. Blockchain technology enables the emergence of decentralized financial services in the financial sector, typically more innovative, interoperable, decentralized, borderless, and transparent. Decentralized financial services driven by blockchain technology can increase financial inclusion, provide open access, promotes innovation, and open up new business and innovation prospects.

The smart contracts segment is expected to grow at a significant CAGR over the forecast period. Smart contracts are the foundation of DeFi protocols and applications. A smart contract can operate as a custodian with specific rules for when, how, and who can receive these assets. Moreover, it speeds up decentralized financial operations, including investing, lending, banking, and insurance. In addition, centralized finance platforms can become decentralized through smart contracts, which is anticipated to create unique opportunities for the segment’s growth.

Application Insights

The data & analytics segment held the largest market share in 2025. DeFi protocols offer significant benefits for decision-making and data analysis. Owing to DeFi protocols' openness in data and network activity, DeFi protocols help in risk management and generate business opportunities. With the help of the capabilities offered by DeFi platforms, users can compare yield and liquidity and evaluate platform risks using various dashboards and tools.

The payments segment is expected to register the fastest CAGR during the forecast period. Peer-to-peer payment is the fundamental use case for the DeFi industry and the blockchain ecosystem as a whole. Users may securely and directly exchange cryptocurrencies with one another using blockchain technology, thereby eliminating the need for intermediaries. DeFi payment solutions assist large financial institutions in optimizing market infrastructure and better serving their wholesale and retail customers. Furthermore, it also fosters a more open economic system for underbanked and unbanked communities.

Regional Insights

The North America decentralized finance market held the largest market share of 36.5% in 2025. North America, particularly the United States and Canada, has been at the forefront of blockchain technology adoption. The region's advanced technological infrastructure and widespread familiarity with digital innovations have provided a strong foundation for the growth of decentralized finance (DeFi).

U.S. Decentralized Finance Market Trends

The U.S. decentralized finance industry held a dominant position in 2025 due to the rise of Web3 technologies in the country. The integration of DeFi protocols with other decentralized applications (e.g., NFTs, decentralized identity solutions, and metaverse platforms) enhances user engagement and expands the ecosystem. Web3 advancements enable seamless interoperability and user-friendly interfaces, which drive mass adoption of DeFi services.

Europe Decentralized Finance Market Trends

The Europe decentralized finance industry was identified as a lucrative region in 2025. Europe has made substantial progress in establishing regulatory frameworks that support blockchain and DeFi innovation while ensuring consumer protection. The European Union’s Markets in Crypto-Assets (MiCA) regulation is a notable example, providing clarity and uniformity across member states. Regulatory initiatives encourage businesses to develop DeFi solutions and attract global DeFi platforms to expand into the region, boosting market growth and innovation.

The UK decentralized finance market is expected to grow rapidly in the coming years due to economic uncertainty, including inflation and fluctuating interest rates. It has led individuals in the country to explore decentralized financial tools for hedging and wealth preservation. DeFi platforms offer a range of options, such as yield farming, staking, and synthetic assets, which allow users to diversify their portfolios and mitigate risks in traditional financial markets.

The Germany decentralized finance industry held a substantial market share in 2025 owing to growth in cryptocurrency adoption among retail and institutional investors in Germany. With the legalization of crypto funds for institutional investment, German banks and asset managers have started incorporating cryptocurrencies into their portfolios. This increased acceptance of digital assets has created demand for DeFi platforms.

Asia Pacific Decentralized Finance Market Trends

The Asia Pacific decentralized finance market is anticipated to grow at the fastest CAGR during the forecast period. The increasing adoption of cryptocurrencies such as Bitcoin and Ethereum in Asia Pacific has significantly contributed to the growth of DeFi. Cryptocurrencies are a key component of DeFi platforms, serving as collateral for lending, borrowing, and staking. The rising number of crypto investors and the expansion of cryptocurrency exchanges in the region have amplified the demand for DeFi services.

Japan decentralized finance market is expected to grow rapidly over the forecast period. Japan has established itself as a global leader in cryptocurrency regulation, fostering a favorable environment for the decentralized finance (DeFi) market. The country was one of the first to recognize Bitcoin as a legal means of payment in 2017 and continues to provide regulatory clarity through the Financial Services Agency (FSA).

The China decentralized finance market held a substantial market share in 2025 owing to its position as a global trade leader. It creates a strong demand for efficient cross-border payment systems. Traditional methods are often slow and costly, while DeFi platforms offer low-cost, near-instant international transactions through blockchain technology. Businesses and individuals engaged in international trade are turning to DeFi solutions to streamline their payment processes.

Key Decentralized Finance Company Insights

Some of the key companies in the decentralized finance market include Compound Labs, Inc., Aave Uniswap, Balancer, Bancor Network, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Compound Labs, Inc. is an open-source software development company focused on creating innovative tools and services for the decentralized finance (DeFi) sector. It is known for its flagship product, the Compound protocol, which facilitates decentralized lending and borrowing of cryptocurrencies through algorithmically determined interest rates based on market demand. The platform allows users to lend their idle assets in exchange for interest and cTokens, which represent their holdings and accrue value over time.

-

Uniswap is a decentralized finance (DeFi) protocol. It operates as an automated market maker (AMM) on the Ethereum blockchain, enabling users to swap various ERC-20 tokens without the need for traditional intermediaries. The platform utilizes smart contracts to manage liquidity pools, which facilitate seamless trading by maintaining a constant product formula that ensures efficient price discovery.

Key Decentralized Finance Companies:

The following are the leading companies in the decentralized finance (DeFi) market. These companies collectively hold the largest Market share and dictate industry trends.

- Compound Labs, Inc.

- MakerDAO

- Aave

- Uniswap

- SushiSwap

- Curve Finance

- Synthetix

- Balancer

- Bancor Network

- Badger DAO

Recent Developments

-

In October 2024, Uniswap Labs unveiled Unichain, an Ethereum-based Layer 2 blockchain aimed at enhancing the decentralized finance (DeFi) ecosystem. Designed to facilitate faster and more cost-effective transactions, Unichain leverages the Optimism Superchain technology to improve liquidity and interoperability across various blockchains. With initial block times of one second and future optimizations targeting 200-250 milliseconds, Unichain promises a near-instant transaction experience for users.

-

In April 2024, Copper and Truflation announced a strategic partnership aimed at driving innovation within the decentralized finance (DeFi) space. Copper, a digital asset custodian known for its institutional-grade custody and collateral management solutions, will collaborate with Truflation, a provider of real-time financial data and indexing for Real World Assets (RWA). This alliance seeks to enhance transparency and connectivity in the DeFi ecosystem by leveraging Copper's expertise in secure asset management alongside Truflation's cutting-edge data solutions.

Decentralized Finance Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 37.27 billion

Revenue forecast in 2033

USD 1,417.65 billion

Growth rate

CAGR of 68.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Compound Labs, Inc.; MakerDAO; Aave; Uniswap; SushiSwap; Curve Finance; Synthetix; Balancer, Bancor Network; Badger DAO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

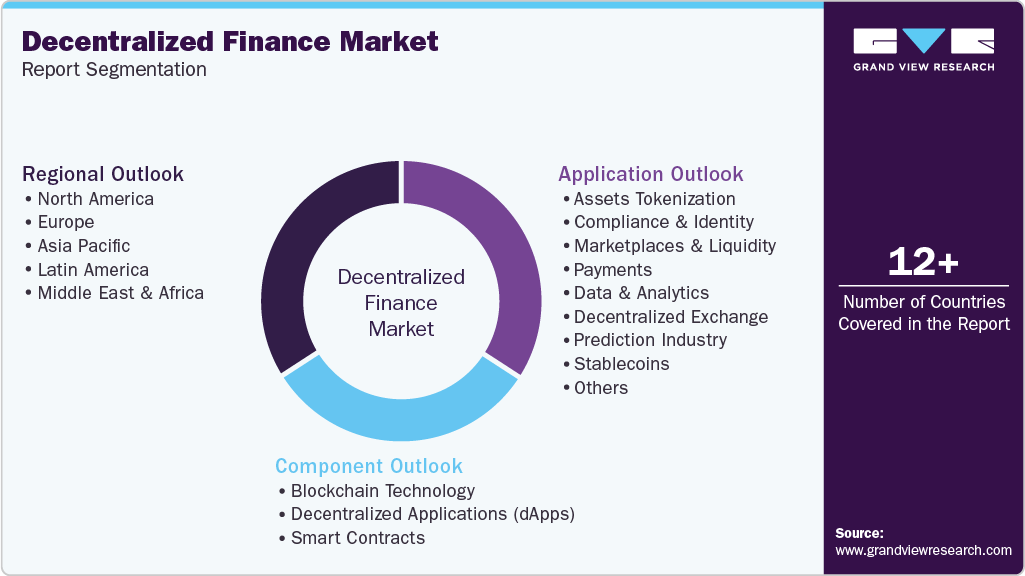

Global Decentralized Finance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global decentralized finance market report based on component, application, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Blockchain Technology

-

Decentralized Applications (dApps)

-

Smart Contracts

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Assets Tokenization

-

Compliance & Identity

-

Marketplaces & Liquidity

-

Payments

-

Data & Analytics

-

Decentralized Exchange

-

Prediction Industry

-

Stablecoins

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global decentralized finance market size was estimated at USD 26.94 billion in 2025 and is expected to reach USD 37.27 billion in 2026.

b. The global decentralized finance market is expected to grow at a compound annual growth rate of 68.2% from 2026 to 2033 to reach USD 1,417.65 billion by 2033.

b. North America dominated the decentralized finance market with a share of 36.5% in 2025. The dominance can be ascribed to the presence of prominent players such as Compound and Uniswap. Additionally, North America is one of the world’s largest crypto markets, which bodes well for adopting the DeFi market.

b. Some key players operating in the decentralized finance market include Compound Labs, Inc.; MakerDAO; Aave; Uniswap; SushiSwap; Curve Finance; Synthetix; Balancer, Bancor Network; Badger DAO.

b. Key factors that are driving the decentralized finance market growth include the Increasing adoption of blockchain technology and the Increasing adoption of digitized financial services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.