- Home

- »

- IT Services & Applications

- »

-

Deck Software Market Size, Share & Trends Report, 2030GVR Report cover

![Deck Software Market Size, Share & Trends Report]()

Deck Software Market (2023 - 2030) Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Application (Residential, Commercial), By End-use (Architects & Builders, Remodelers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-150-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Deck Software Market Size & Trends

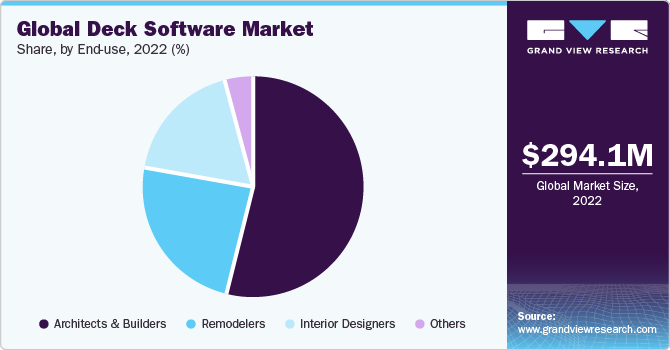

The global deck software market size was estimated at USD 294.1 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.8% from 2023 to 2030. The market is experiencing significant growth driven by several key factors. There is a rising demand for deck software solutions that can streamline and enhance the efficiency of deck design processes. Moreover, the adoption of advanced technologies such as artificial intelligence, virtual reality, and cloud computing within the architectural industry is playing a pivotal role in propelling the market’s expansion. There is a growing need for collaborative and integrated platforms that can facilitate improved communication and coordination among professionals in the architecture and construction industries, including architects, engineers, and other stakeholders.

The deck software allows users to choose every component of their new deck and contrast several colors and materials from the software application. The software automatically creates a materials list, a pricing estimate, and a printable depiction for them to share with potential contractors if they are satisfied with their design. The deck program builds on Augmented Reality (AR) or Virtual Reality (VR) technologies. It works with most of the web browsers and guides users through the deck design process. Thus, the implementation of AR/VR applications in the deck software is expected to drive the growth of the deck software sector.

With the growing complexity of real estate projects, market players are trying to involve multiple stakeholders with narrower areas of unique expertise. Real estate companies are also opting for various building software, such as 3D modeling tools, deck designing tools, and computer-aided design tools, as part of their efforts to simplify business processes and boost efficiency. 3D deck software can potentially provide multiple options for wood and other materials, user-friendly tools, and apparent new structural choices that work together more seamlessly than standalone deck software. 3D measurements provide an edge to the planners to acquaint the installers with all the essential details that make the design suitable as per the client's requirements.

Deck design software makes it easier for designers to design, save, and print the plans designed. Additionally, the features of the software can be altered based on the users’ preferences. Although there are several digital design packages available in the market planners and designers are seeking advanced software, beyond standard graphic designing software, for deck designing. At this juncture, dedicated deck design software allows project planners to design their versions quickly and easily add, delete, edit, or upgrade whenever required. Therefore, there is a growing demand for the deck software globally.

The popularity of deck design software is increasing with the need for a simpler process to create deck structures and automatically generate detailed reports of the design and floor plans, along with bills of materials. These benefits offer more time and cost-saving benefits compared to the traditional process of hand drafting. These factors are collectively driving the market’s growth. Residential landscaping programs and the expansion of backyards and gardening areas at optimized costs have contributed to the adoption of deck design software. Furthermore, the growing trend among homeowners to create elaborative decks with water features, fire pits, pergolas, walls, and outdoor kitchens is expected to drive the demand for the deck software industry over the forecasted period.

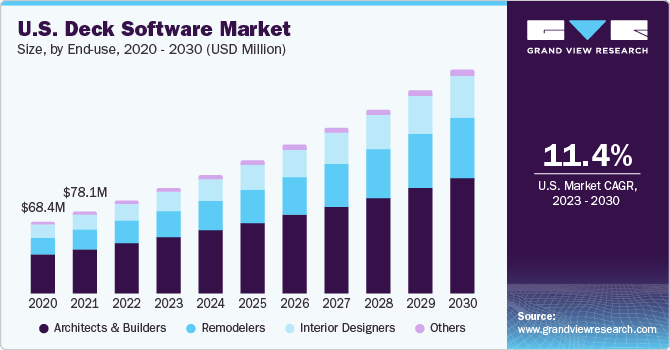

End-use Insights

The architects & builders segment accounted for the largest market share of over 53.0% in 2022. With changing customer requirements and the rising complexity of constructing projects, architects play a crucial role in the design, planning, and visual representation of deck structures and specifications. Architects are required to undertake tasks such as matching deck materials to design, drawing blueprints to meet rising sustainability and compliance requirements, and incorporating various client requirements into the deck plan. The complex demands of modern deck projects compel architects and architectural firms to use technologically advanced and user-friendly software solutions to design, visually represent, and draft specific product requirements of deck designing. Thus, these factors are collectively driving the architects & builders segment’s growth.

The remodelers segment is expected to exhibit the highest CAGR of 14.4% over the forecast period. The demand for deck software is constantly growing among remodelers owing to the need to change structural designs, specifications, and utilization of existing space more effectively. Deck software helps remodelers utilize the existing space, choose the right materials, and incorporate different specifications of the homeowner into the deck blueprint. The deck software helps remodelers draw and import deck layouts from the layout gallery, customize the size, shape, and dimensions of deck designs, and recreate the existing backyard and outdoor space.

Deployment Insights

The cloud segment accounted for the largest market share of 51.0% in 2022. Cloud deck software providers offer automatic updates, remote access, scalability, mobility, cost-saving, and on-demand support. This reduces the need to purchase, manage, and maintain software and hardware at users’ locations, as the SaaS provider supplies a package of data storage, software, and support on a term and usage basis. Cloud-based SaaS solutions generally run remotely on the cloud solution provider’s servers in the cloud environment and can be accessed by users using internet connectivity.

The on-premise segment is expected to register a considerable growth with a CAGR of 11.4% over the forecast period. The demand for on-premise deck software is increasing owing to the rising emphasis of organizations on compliance and data security. On-premise software is installed and runs on the customer’s hardware infrastructure and is hosted locally. The increasing need for specifications, customizations, and data security is encouraging customers to look for software that offers higher flexibility, security, and ease of operations. On-premise deck software solutions offer better flexibility for customizations, greater control over integration with other systems and sensitive data, and help users ensure adherence to industry regulations.

Regional Insights

North America held the highest market share of over 37.0% in 2022. The growth can be attributed to the fast-paced development of residential and commercial projects in the region. Rising trends such as house gatherings, outdoor barbeque, pool parties, and outdoor events are encouraging the development and installation of decks in residential and commercial properties, fuelling the regional growth of the market. Furthermore, rising investments in the renovation & redevelopment of construction projects, and the rising adoption of cloud-based technologies across the region are some of the key factors expected to drive the regional growth of the market.

Asia Pacific is expected to register the fastest CAGR of over 14.0% during the forecast period. As the construction industry is evolving in the region at a significant rate, there is a rise in the development of new residential and commercial projects, which generally include the development of outdoor living spaces, including decks, balconies, and rooftops. Railings, walls, staircases, and floorings are among the crucial aspects that require higher detailing and specifications, depending upon the clients’ requirements. With the help of deck software, developers and architects can present a list of decking product vendors, material quality, cost, and designs, among other aspects to their clients. Deck software helps in drafting a more precise and transparent deck-building process, which propels its demand in the region.

Application Insights

The residential segment accounted for the largest market share of 55.3% in 2022. Deck software solutions are witnessing increased demand from residential project developers, contractors, and interior designers. A residential construction project involves the development of residential duplexes, bungalows, independent houses, and apartments. The growing custom requirements of house owners related to detailing, color, material, and designs are making it crucial for designers to create and design a blueprint that matches the exact specifications of the homeowner. Deck software offers superior capabilities such as 2D and 3D representation of layouts, size, shape, and small detailing that is expected to go into the final deck development.

The commercial segment is expected to exhibit considerable CAGR of 12.1% over the forecast period. The deck software helps commercial project developers represent the visual layouts, sizing, floor area, safety, and security tools, among other details, in a presentation or movie format. It offers features such as 2D and 3D representation, deck templates for inspiration, and customization tools for designing staircases, railings, claddings, fasteners, and other accessories. Thus, the deck software helps define a more structured, detailed, and realistic project outline for undertaking the development of commercial deck projects.

Key Companies & Market Share Insights

The key companies maintain an exhaustive product portfolio and are employed to maintain a competitive edge, product offering, the applications segment they serve, the sophistication of their technology, their strategy to differentiate their products, and their industry impact. The key strategies include collaborations, partnerships, agreements, new product development, capability expansion, mergers & acquisitions, and research & development initiatives.

In May 2023, Trex Company, Inc., a manufacturer of wood-alternative composite decking, introduced the Trex Deck Design Tool & Online Deck Planner, to visualize and create a deck design. The solution helps users with budgeting and creating blueprints for permits and creates a shopping list of materials. By choosing materials, measurements, colors, and hardware, deck planner users can quickly and easily create a deck in a few minutes. Once the deck is designed, they may participate in an interactive augmented reality experience within the deck design. Thus, the implementation of AR/VR applications in the deck software is expected to drive market growth.

Key Deck Software Companies:

- Autodesk Inc.

- Cedreo

- Chief Architect, Inc.

- Dassault Systemes

- Deckorators, Inc.

- Delta Software International LLC.

- Drafix Software, Inc.

- Idea Spectrum, Inc.

- MoistureShield

- RoomSketcher AS

- Simpson Strong-Tie Company, Inc.

- SmartDraw, LLC

- The AZEK Company Inc.

- Trex Company, Inc.

- Trimble Inc.

Deck Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 337.1 million

Revenue forecast in 2030

USD 782.7 million

Growth rate

CAGR of 12.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Autodesk Inc.; Delta Software International LLC.; Chief Architect, Inc.; Dassault Systemes; Deckorators, Inc.; Drafix Software, Inc.; Trimble Inc.; Idea Spectrum, Inc.; MoistureShield; RoomSketcher AS; Simpson Strong-Tie Company, Inc.; SmartDraw, LLC; Cedreo; Trex Company, Inc.; The AZEK Company Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

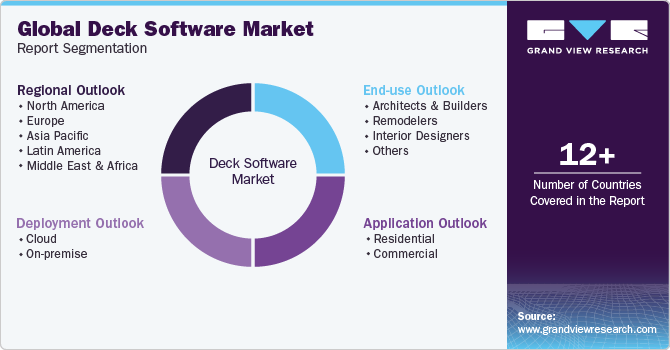

Global Deck Software Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global deck software market report based on deployment, application, end-use, and region.

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Architects & Builders

-

Remodelers

-

Interior Designers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global deck software market size was estimated at USD 294.1 million in 2022 and is expected to reach USD 337.1 million in 2023.

b. The global deck software market is expected to grow at 12.8% from 2023 to 2030 to reach USD 782.7 million by 2030.

b. The cloud segment accounted for the largest revenue share in 2022, contributing 51.0% of the overall revenue. Cloud deck software providers offer automatic updates, remote access, scalability, mobility, cost-saving, and on-demand support. This reduces the need to purchase, manage, and maintain software and hardware in users’ locations, as the SaaS provider supplies a package of data storage, software, and support on a term and usage basis. Cloud-based SaaS solutions generally run remotely on the cloud solution provider’s servers in the cloud environment and can be accessed by users using internet connectivity.

b. The key players in the Deck Software Market are Autodesk Inc., Cedreo, Chief Architect, Inc., Dassault Systemes, Deckorators, Inc., Delta Software International LLC., Drafix Software, Inc., Idea Spectrum, Inc., MoistureShield, RoomSketcher AS, Simpson Strong-Tie Company, Inc., SmartDraw, LLC, The AZEK Company Inc., Trex Company, Inc., and Trimble Inc.

b. There is a rising demand for deck software solutions that can streamline and enhance the efficiency of deck design processes. Moreover, the adoption of advanced technologies such as artificial intelligence, virtual reality, and cloud computing within the architectural industry is playing a pivotal role in propelling market expansion. Furthermore, there is a growing need for collaborative and integrated platforms that can facilitate improved communication and coordination among professionals in the architecture and construction industries, including architects, engineers, and other stakeholders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.