- Home

- »

- Clothing, Footwear & Accessories

- »

-

Decorated Apparel Market Size, Share & Trends Report 2030GVR Report cover

![Decorated Apparel Market Size, Share & Trends Report]()

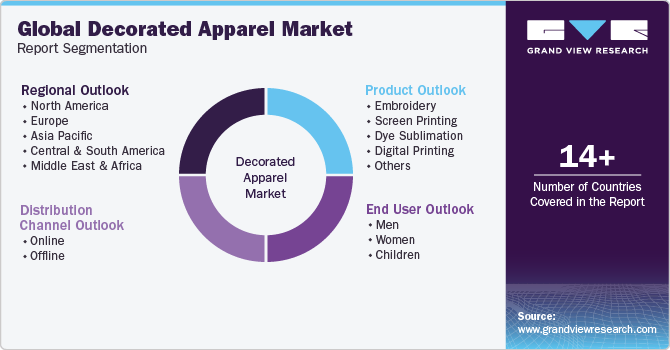

Decorated Apparel Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Embroidery, Screen Printing, Dye Sublimation, Digital Printing, Others), By End User, By Distribution Chanel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-199-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Decorated Apparel Market Summary

The global decorated apparel market size was estimated at USD 28.98 billion in 2023 and is projected to reach USD 68.17 billion by 2030, growing at a CAGR of 13.0% from 2024 to 2030.Increasing demand for embroidery, screen printing, sublimation, and heat transfer works on clothing is driving the growth of the market around the world.

Key Market Trends & Insights

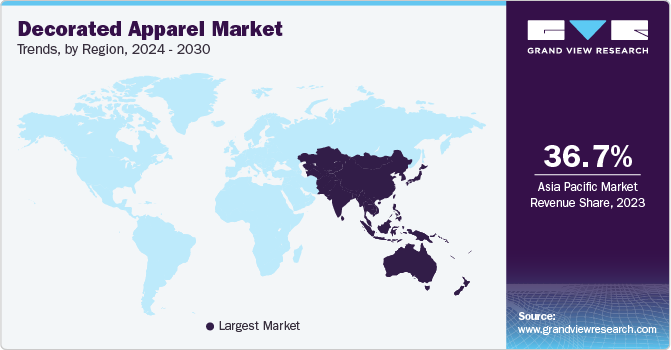

- Asia Pacific held a share of over 36.7% of the global market in 2023.

- The decorated apparel market in the U.S. is projected to grow at a CAGR of 13.2% during the forecast period.

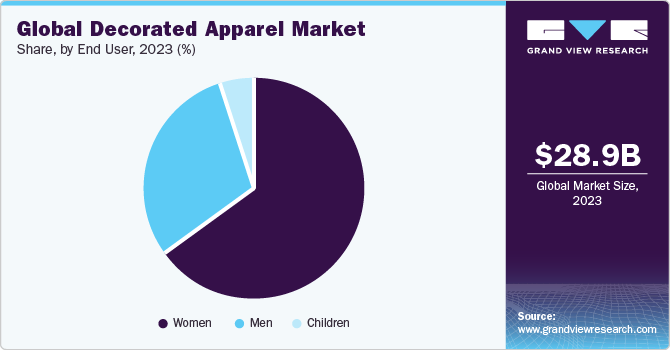

- By end-user, decorated apparel for women accounted for a share of around 65% of the global revenues in 2023

- By distribution channel, the sales through offline channels accounted for a share of over 65% of the global revenues in 2023.

- By product, embroidery accounted for a share of over 40% of the global revenues in 2023.

Market Size & Forecast

- 2023 Market Size: USD 28.98 Billion

- 2030 Projected Market Size: USD 68.17 Billion

- CAGR (2024-2030): 13.0%

- Asia Pacific: Largest market in 2023

The growing demand for a reflective finish in clothes has also given the potential for industry participants to flourish. Furthermore, increased demand for graphic t-shirts and other clothing due to shifting trends will boost product sales throughout the projection period. Given the growing popularity of branded clothes among customers globally, the expanding trend of luxury clothing as a status symbol among individuals is promoting the use of adorned garments.The demand in the custom clothing industry has been growing among consumers as they are more willing to add a personal touch to their outfits. This trend has significantly influenced the growth of the personalized apparel market in recent years. Personalized attire is often decorated with personalized designs, logos, or other unique features which contribute to market growth. Many consumers who are looking for customized clothing items also want to add unique design elements, such as embroidery or screen printing, to create a personalized look thus boosting the customized apparel market. Furthermore, consumers are increasingly seeking unique clothing items and view embellishments as a way to add individuality and style to their clothing, making it a popular choice for both personal and commercial use further driving the adoption of embellished apparel.

The evolution from the screen printing industry to digital has been very significant, most notably in the t-shirt printing industry. Many textile/fabric business owners are investing in digital printing technology as fabric printing transitions to modern forms of printing. The market dynamics are anticipated to be significantly impacted by technological advancements in digital textile printing. With a preference for cotton, silks, and polyester as the main substrates, fabric providers offer a wide variety of textiles for digital textile printing, which has an impact on the value chain. Several factors such as reduced environmental footprint and greater personalization flexibility have led to a rise in the demand for digitally printed clothing from business owners as well as consumers. High-resolution prints and patterns are increasingly becoming popular in the decorated apparel market. The introduction of inkjet technology has a broader impact on fashion seasons, business models, and the supply chain.

Noticing a rising demand for creative or innovative designs in clothing, decorators worldwide have been focusing on technological advancement over the years. Innovations within the market have centered mainly on machinery in the areas of direct-to-garment digital printing, embroidery, embellishment attachment, laser decoration, and conventional sewing, among others. The development of novel decoration techniques has also been widening the range of economical decoration options for both apparel manufacturers and designers worldwide. Technological advancement is not only evident in the decorated apparel space but also in the retailing sector. Retailers worldwide are increasingly employing the Three-Dimensional Visual Merchandising System to help customers choose products in a virtual 3D retail environment. Such advancements in the field of technology are expected to bolster the demand for decorated apparel over the forecast timeframe.

Recent years have witnessed key innovations in apparel decoration technologies worldwide. For instance, DTG Digital Europe, a U.K.-based direct-to-garment (DTG) supplier, recently developed a technology to reduce the banding appearance at low printing resolutions. In another instance, Gemfix Inc., a U.S.-based gemstone supplier, recently developed a machine to attach embellishments of varied sizes and shapes onto garments, thereby providing garment manufacturers and decorators the ability to create more complex and interesting decorated motifs. Also, computer-aided design and manufacturing (CAD/CAM) has emerged as a revolutionary tool in the decorated garment space. In this regard, software such as Gerber, Adobe, Tukatech, Lectra, CorelDraw, Digital FashionPro, and Illustrator are being extensively employed in fashion.

Numerous issues continue to challenge the global market, most notably in the manufacturing space. While decorated apparel has been gaining traction among consumers worldwide, ensuring product quality and consistency continues to pose a hurdle for decorated apparel brands. Ensuring consistency is mainly an issue when brands, most notably small-and medium-sized enterprises, focus on launching a new product. Some of the other prominent challenges in the market are high import duties on clothing-most notably luxury apparel products, the threat of counterfeiting, and the lack of substantial retail space. Pertaining to retail floor space, decorated clothing brands are being discouraged from expanding their presence in the Asia Pacific markets.

Market Concentration & Characteristics

The growth of this market can be attributed to increasing consumer spending on handcrafted and designer apparel owing to the growing preference for high-quality clothing and for making a fashion statement. However, the rapidly changing consumer preferences and needs encourage manufacturers to innovate, improve, and diversify their product offerings to meet the changing demands of consumers worldwide.

Companies focus on strategic acquisitions to expand their presence overseas and reinforce their position in the market. Over the next few years, internationally reputed companies are likely to acquire small-and medium-sized companies operating in the industry in a bid to facilitate regional expansion.

Ethical concerns pose a threat to the decorated apparel market as brands offer leather- and fur-based products made using animal skin and hair. From an apparel designing standpoint, bans on the use of animal-derived materials to manufacture products could translate into shrinking profit margins in the near term. Furthermore, the transition to sustainable production would also mean substantial investments in production equipment owing to the change in the process of decorated apparel manufacturing process.

End-user Insights

Decorated apparel for women accounted for a share of around 65% of the global revenues in 2023. Availability and demand for different products, such as t-shirts, tops, kurtas, and gowns drive the growth of this segment. Moreover, product innovations in the women’s wear category due to changing consumer demand are driving the demand for products such as graphic t-shirts, which have gained popularity as semi-formal as well as casual attire. Rising instances of social gatherings among the younger population and the influence of social media have provided the masses with access to information on different types of clothing for various occasions depending on the season, functionality, and fashion trends. This scenario is likely to drive the demand for decorated clothing for women such as printed t-shirts for everyday use, embroidered shorts and dresses for vacations, and dye sublimation for formal wear.

The men’s category is projected to grow at a CAGR of 14.2% from 2024 to 2030. Rising product availability with a range of unique designs, color combinations, prints, and other decorations in graphic t-shirts, hoodies, coats, and designer blazers for men drive the scope of the market. Rising applications of printing and embroidery on apparel logos for sportswear such as youth baseball teams, school spirit wear, or walk/run fundraisers drive the demand for decorated clothing among men. Moreover, visibility of embroidery decoration on men’s jackets, shirts, t-shirts, and trousers encourages clothing manufacturers to add these features to the clothes they offer. Furthermore, the increased preference among men for shirts monogrammed with the brand logo or with their initials in order to add distinction has resulted in higher penetration of decorated apparel for men.

Product Insights

Embroidery accounted for a share of over 40% of the global revenues in 2023. The growing prominence of embroidery being done over a multitude of silhouettes, without gender distinction is creating significant growth opportunities for embroidery-based decorated apparel. Usage of threads varying in width, color, and finishes and adding trims from small beads to big patches proposes diversified functionality which is also attracting consumers. Embroidered clothing is gaining traction in the market as it offers high quality, value addition, and a statement finish to the clothing.

Screen printing is anticipated to expand at a CAGR of 14.6% from 2024 to 2030. The screen-printing technique is a trending printing method owing to the resultant crisp and durable prints that withstand long washes. However, this method requires a huge setup cost and can be expensive when the orders are not in bulk. The change from manual to automatic screen-printing presses has accelerated the rise of screen-printing technology. Screen printing is one of the most common printing processes worldwide. Companies like Oregon Screen Impressions and Deluxe Screen Printing are some of the famous companies for screen printing.

Distribution Channel Insights

The sales through offline channels accounted for a share of over 65% of the global revenues in 2023. Consumers often prefer to physically see and touch the product before making a purchase decision, especially when it comes to clothing items. In-store experiences provide the opportunity for customers to try on clothes and get a sense of the quality and fit of the product. In addition, these channels offer a personal touch and the opportunity for face-to-face interactions with sales staff, who can provide advice and recommendations to customers. Moreover, offline retail stores often offer a wider range of products, and customers can view and compare different options in one place. This makes it easier for customers to make informed decisions and find the product that best suits their needs. Thus, the aforementioned factors are some of the key factors contributing to segment growth.

The online channel is projected to grow at a CAGR of 14.9% over the forecast period. The convenience of online shopping allows customers to purchase products from the comfort of their own homes at any time, without having to visit a physical store. Additionally, online retail stores often offer competitive prices and promotions, making it easier for customers to find deals and discounts on their favorite products. Furthermore, advancements in technology and logistics have made it easier for online retailers to provide fast and reliable shipping options, ensuring that customers receive their products quickly and efficiently thus surging the segment growth over the forecast period.

Regional Insights

Asia Pacific held a share of over 36.7% of the global market in 2023. The increasing disposable income of the middle-class population has driven the number of first-time buyers of high-end decorated apparel in this region. Consumers are increasingly inclined toward decorated clothing owing to a preference for high-quality products and the growing influence of social media in terms of fashion trends. In addition, the expansion of international players in the region is acting as a major driver for market growth. The way consumers dress up in Asia Pacific countries is very different from the rest of the world. Kimonos in Japan, qipao in China, and saris & kurtas in India are traditionally embroidered. Additionally, these types of clothes are widely being adopted across the world and contributing to the rise in fusion wear. This, in turn, is driving the market for decorated apparel in Asia Pacific.

Decorated apparel manufacturers have a wide range of opportunities in countries such as China and India, as the production costs for apparel are relatively low due to the abundance of raw materials and high production capacity. Moreover, China is the largest producer and exporter of textiles and apparel in the world further contributing to the further growth of the market. According to data published by the Observatory of Economic Complexity (OEC), the country exported textiles worth close to USD 19.9 billion in 2020.

India decorated apparel market

The decorated apparel market in India is expected to grow at a CAGR of 15.9% during the forecast period, as a result of factors such as increasing disposable income, improving quality of life, global exposure to professional yet fashionable office wear trends, and rising expansion of clothing companies in the country.

The market in Europe is expected to grow at a CAGR of 14.4% from 2024 to 2030. The growing tendency of consumers of all age groups to spend more on comfortable and decorated clothing is driving the demand for embroidered trucker jackets, long-sleeved shirts, and cardigans. Several fashion designers in the region, such as Karl Lagerfeld, Nicolas Ghesquière, Stella McCartney, and Phoebe Philo, offer customized luxury apparel in neutral color palettes and wearable designs, which are rapidly gaining popularity. With the growing trend of customized t-shirts and tops, patchwork, and retro logo designs, the demand for apparel decoration has been increasing among working women. The segment growth is attributed to the increase in the number of women in the workforce in the region, which has stimulated a modest rise in their disposable income.

Moreover, the apparel market in the U.K. is largely influenced by the popularity of celebrities and social media influencers. Retro designs and patterns have become a fashionable trend again, and these designs are available in various price ranges to cater to consumers across different income groups. For instance, According to British GQ, for Spring/Summer 2021, every menswear brand and designer has widely used prints, patterns, and designs that are 70’s inspired and are being adopted by consumers in the U.K.

Furthermore, the R&D spending for textile and apparel materials such as conductive fabric with antistatic properties, antimicrobial fibers, and electronic textiles, which are used in the manufacturing of innovative decorated apparel, is high in the U.S. These factors are expected to have a positive impact on the market in North America. Moreover, the rise in print-on-demand has accelerated the growth of e-commerce for decorated apparel in the U.S. According to Forbes, companies like Printify saw a rise in sales during the outbreak of the COVID-19 pandemic, owing to an increased demand for thematic apparel based on the U.S. elections and the pandemic.

U.S. decorated apparel market

The decorated apparel market in the U.S. is projected to grow at a CAGR of 13.2% during the forecast period. Driven by a significant consumer shift towards sustainable products, a large number of decorated apparel manufacturers in the country are adopting specialized eco-friendly fabrics and dyes to produce organic cotton and lyocell, among others.

Key Companies & Market Share Insights

The global decorated apparel market is characterized by the presence of a few well-established players such as Gildan, Hanesbrands Inc., and Fruit of the Loom, Inc. Medium and small players include Downtown Custom Printwear, Master Printwear, Delta Apparel, Target Decorated Apparel, Advance Printwear Limited, Lynka, and New England Printwear. The market players face intense competition from each other as some of them are among the top apparel manufacturers with diverse product portfolios for decorated apparel. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both, regional and international consumers.

Key Decorated Apparel Companies:

- Gildan

- Fruit of Loom, Inc.

- Downtown Custom Printwear

- Hanesbrands Inc.

- Master Printwear

- Delta Apparel, Inc.

- Target Decorated Apparel

- Advance Printwear Limited

- Lynka

- New England Printwear

Recent Developments

-

In January 2023, at the Impressions Expo in Long Beach, California, Gildan unveiled its newest positioning and marketing strategies for its three core brands: Gildan, American Apparel, and Comfort Colors. The move was aimed at enabling the brands to evolve and expand their global reach.

-

In November 2022, Lynka launched its newest division, PODIOM, which focuses on Print-on-Demand (POD), one of the fastest-growing segments in the imprinted textile market. PODIOM boasts the most extensive on-site inventory of any POD provider in Europe, with more than 1.8 million goods in stock at the same location as its 10,000 m2 garment decoration unit

-

In March 2022, Delta Apparel, Inc. announced the expansion of its digital print business through the installation and usage of its recently developed digital print technology. The technology was developed to meet the demand for "Digital First", an offering by DTG2Go. DTG2Go is a premium provider of Direct-to-Garment (DTG) printing, and the technology is deployed in four of its current digital print facilities through a collaboration with Fanatics, a major provider of legally licensed sports merchandise and a global digital sports platform.

-

In February 2022, Target collaborated with Bridgeforth Farms, one of the 1.5% Black-owned farms in the U.S., as part of its commitment to spend USD 2 billion on Black-owned businesses by the end of 2025. The Minneapolis-based retailer will create a variety of unique Black History Month T-shirts using cotton that was responsibly cultivated by Bridgeforth Farms

-

In April 2021, Delta Apparel announced a technology partnership with Autoscale.ai to integrate its product design, marketplace listings, and advertising management functions for better online retail processes

-

In February 2021, Hanes entered into a licensing agreement with Belle International to introduce Champion footwear and accessories in China. As per the agreement, Belle International will distribute the new collection designed for consumers in China Link:

-

In February 2021, Hanes announced a multi-year collaboration with G.O.A.T., an Authentic Brands Group company, for the development of the Muhammad Ali collection under the former’s portfolio of Champion Athleticwear

Decorated Apparel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 33.14 billion

Revenue forecast in 2030

USD 68.17 billion

Growth Rate (Revenue)

CAGR of 13.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, U.K., Spain, Italy, France, China, India, Japan, South Korea, Australia & New Zealand, Brazil, Argentina, South Africa, UAE, Saudi Arabia

Key companies profiled

Gildan; Fruit of Loom, Inc.; Downtown Custom Print wear; Hanes brands Inc.; Master Print wear; Delta Apparel; Target Decorated Apparel; Advance Print wear Limited; Lynka; New England Print wear

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Decorated Apparel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global decorated apparel market report on the basis of product, end user, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Embroidery

-

Screen Printing

-

Dye Sublimation

-

Digital Printing

- Others

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North Americ

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global weight loss supplement market size was estimated at USD 29.96 billion in 2023 and is expected to reach USD 33.14 billion in 2024.

b. The global weight loss supplements market is expected to grow at a compound annual growth rate of 13.70% from 2024 to 2030 to reach USD 71.59 billion by 2030.

b. The vitamins & minerals segment dominated the weight loss supplements market with a share of 54.88% in 2023.

b. Some key players operating in the weight loss supplement market include Glanbia PLC, GlaxoSmithKline PLC, Herbalife Nutrition Ltd, Abbott, NutriSport Pharmacal, Inc, Amway Corporation, and Nestle

b. Key factors that are driving the weight loss supplements market are rapidly rising global obesity levels and the increasing prevalence of obesity-related disorders such as diabetes, hypertension, and cardiovascular diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.