- Home

- »

- Clothing, Footwear & Accessories

- »

-

Sportswear Market Size, Share And Trends Report, 2030GVR Report cover

![Sportswear Market Size, Share & Trends Report]()

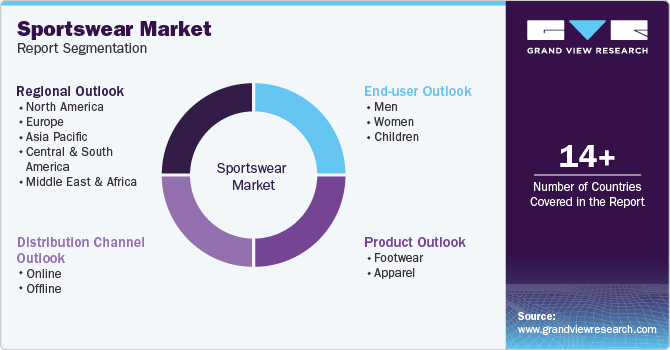

Sportswear Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Footwear, Apparel), By End-user (Men, Women, Children), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-109-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sportswear Market Summary

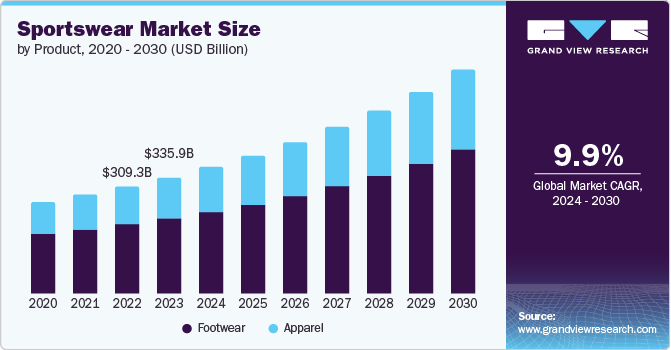

The global sportswear market size was estimated at USD 335.92 billion in 2023 and is projected to reach USD 646.01 billion by 2030, growing at a CAGR of 9.9% from 2024 to 2030. The global market is driven by factors such as rising health consciousness, increasing participation in sports and fitness activities, and the growing trend of sports clothes, where athletic clothing is worn in casual settings.

Key Market Trends & Insights

- The sportswear market in North America accounted for a revenue share of 33.3% in 2023.

- The sportswear market in the U.S. is expected to grow at a CAGR of 9.6% from 2024 to 2030.

- By product, the sports footwear segment market accounted for a revenue share of 64.8% in 2023.

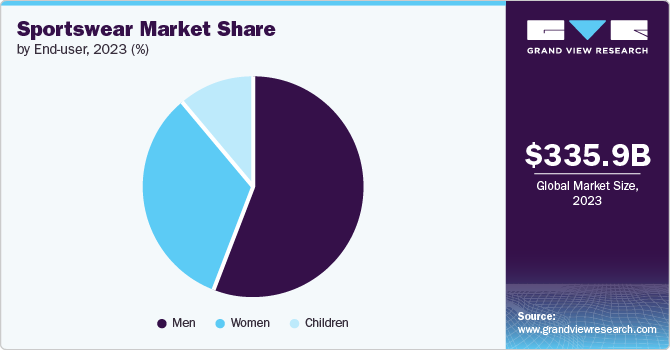

- By end user, the men’s sportswear segment accounted for a revenue share of 55.6% in 2023

Market Size & Forecast

- 2023 Market Size: USD 335.92 Billion

- 2030 Projected Market Size: USD 646.01 Billion

- CAGR (2024-2030): 9.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Advances in fabric technology, such as moisture-wicking, odor control, and temperature regulation, enhance the functionality and appeal of sportswear. Additionally, the influence of social media and celebrity endorsements has amplified brand visibility and consumer interest. The expansion of e-commerce platforms has made sportswear more accessible, while the emphasis on sustainability and eco-friendly materials resonates with environmentally conscious consumers.

The increasing health consciousness among consumers is one of the primary drivers of the global sportswear market. The growing awareness of the importance of maintaining a healthy lifestyle has led to a surge in participation in various physical activities, including running, yoga, gym workouts, and team sports. According to a report by the World Health Organization, the number of people engaging in regular physical activity has risen significantly over the past decade, contributing to the heightened demand for sportswear. This shift towards a healthier lifestyle is not just limited to younger demographics but also includes older adults who are adopting fitness regimes to improve their overall well-being.

The athleisure trend, where athletic apparel is worn in non-athletic settings, has significantly boosted the sportswear market. Athleisure blurs the lines between gym wear and casual wear, making it acceptable to wear sports clothing in everyday activities. This trend is particularly popular among millennials and Gen Z, who prioritize comfort and style. Brands like Nike, Adidas, and Lululemon have capitalized on this trend by launching stylish and versatile sportswear collections that can be worn both in and out of the gym.

Innovations in fabric technology and design have played a crucial role in the growth of the sportswear market. Manufacturers are constantly developing new materials that enhance performance, such as moisture-wicking fabrics, anti-odor treatments, and temperature-regulating textiles. These advancements improve comfort and functionality, making sportswear more appealing to consumers. For instance, Under Armour's HeatGear and ColdGear lines are designed to keep athletes comfortable in extreme temperatures. Similarly, Nike's Dri-FIT technology helps wick sweat away from the body, keeping athletes dry and comfortable during workouts.

The influence of social media and celebrity endorsements cannot be overstated when it comes to driving the sportswear market. Platforms like Instagram, TikTok, and YouTube have become powerful marketing tools for sportswear brands, allowing them to reach a vast audience quickly. Celebrity endorsements and collaborations with influencers have also proven effective in boosting brand visibility and credibility. For example, Adidas' collaboration with Kanye West for the Yeezy line has been immensely successful, attracting both sports enthusiasts and fashion-forward consumers. These endorsements help create buzz and drive consumer interest in sportswear products.

The increasing focus on sustainability and environmental consciousness has influenced consumer preferences in the sportswear market. Consumers are becoming more aware of the environmental impact of their purchases and are seeking eco-friendly alternatives. Sportswear brands are responding to this demand by incorporating sustainable practices into their manufacturing processes and using eco-friendly materials. For instance, Adidas' Parley collection features products made from recycled ocean plastic, while Nike's Move to Zero initiative aims to achieve zero carbon and zero waste across its supply chain. These efforts not only attract environmentally conscious consumers but also enhance brand reputation.

Product Insights

The sports footwear market accounted for a revenue share of 64.8% in 2023 due to its essential role in various athletic activities and the significant technological advancements in this segment. Athletes and fitness enthusiasts require specialized footwear designed to enhance performance, provide comfort, and prevent injuries. The demand for running shoes, basketball shoes, soccer cleats, and other sports-specific footwear has surged as more people engage in sports and fitness routines. Additionally, innovations such as cushioned soles, lightweight materials, and improved traction have attracted consumers looking for optimal support and functionality. Major brands like Nike, Adidas, and Under Armour have consistently invested in research and development to introduce cutting-edge technologies, such as Nike's Flyknit and Adidas' Boost, which have garnered significant consumer interest. The rise of athleisure has also contributed to the popularity of sports footwear, as many consumers now seek versatile shoes that can be worn both for athletic activities and casual outings.

The sports apparel market is expected to grow at a CAGR of 10.2% from 2024 to 2030 owing to several factors, including increasing health consciousness, the rising popularity of fitness activities, and the growing trend of athleisure. As more people adopt active lifestyles, there is a greater demand for comfortable, high-performance clothing suitable for both exercise and everyday wear. Innovations in fabric technology, such as moisture-wicking, temperature control, and antimicrobial properties, have enhanced the appeal of sports apparel by offering superior comfort and functionality. Additionally, the influence of social media and fitness influencers has popularized stylish workout gear, encouraging more consumers to invest in high-quality sportswear. The ongoing expansion of e-commerce platforms has made it easier for consumers to access a wide range of sports apparel options, further driving market growth. Brands like Lululemon, Gymshark, and Athleta have capitalized on these trends by launching fashionable and functional sportswear lines that cater to diverse consumer needs.

End-user Insights

Men’s sportswear accounted for a revenue share of 55.6% in 2023 due to higher participation rates in various sports and fitness activities. Historically, sports and physical activities have been more popular among men, leading to greater demand for sportswear tailored to their needs. This trend is reflected in the product offerings of major sportswear brands, which often focus on men's athletic apparel and footwear. Additionally, male consumers tend to invest more in sports gear and equipment, driven by a strong interest in performance enhancement and brand loyalty. The influence of male athletes and sports celebrities also plays a significant role in driving demand, as endorsements and sponsorships by well-known figures like LeBron James, Cristiano Ronaldo, and Roger Federer boost the visibility and desirability of sportswear brands. However, the market dynamics are gradually shifting, with increasing female participation in sports and fitness activities.

The women's sportswear market is expected to grow at a CAGR of 10.2% from 2024 to 2030. The growing popularity of activities like yoga, pilates, running, and gym workouts has led to higher demand for women-specific sportswear. Moreover, the athleisure trend, which combines athletic and casual wear, has gained considerable traction among women, contributing to the growth of this segment. Brands are increasingly recognizing the potential of the women’s market and are launching products that cater specifically to women's preferences in terms of design, fit, and functionality. For instance, companies like Lululemon and Athleta have built their brands around stylish, high-performance sportswear for women. Additionally, the influence of female athletes and fitness influencers on social media platforms has played a crucial role in driving awareness and interest in women’s sportswear.

Distribution Channel Insights

The sales of sportswear through sporting goods retailers accounted for a revenue share of 34.2% in 2023 due to their specialized focus on sports and fitness products, which attracts a dedicated consumer base. These retailers offer a wide range of sportswear, footwear, and equipment, providing a one-stop shop for consumers looking for quality products. Their expertise and knowledgeable staff enhance the shopping experience, helping customers find the right gear for their specific needs. Additionally, sporting goods stores often feature branded sections or dedicated areas for major sportswear brands, giving consumers access to the latest products and innovations. The strategic location of these stores in malls and shopping centers further boosts foot traffic and sales. Companies like Dick's Sporting Goods, Decathlon, and Foot Locker have established strong brand reputations and customer loyalty by consistently offering high-quality sportswear and superior customer service.

The sales of sportswear through online channel are expected to grow at a CAGR of 11.5% from 2024 to 2030 owing to the increasing preference for online shopping, driven by convenience, a wider product selection, and competitive pricing. The COVID-19 pandemic accelerated the shift towards e-commerce, as consumers sought to avoid crowded stores and shop from the safety of their homes. Major sportswear brands and retailers have invested heavily in their online platforms, offering user-friendly websites, mobile apps, and seamless shopping experiences. Additionally, online stores often provide detailed product information, customer reviews, and virtual try-on features, helping consumers make informed purchase decisions. The integration of AI and data analytics allows for personalized recommendations and targeted marketing, enhancing customer engagement and satisfaction. Companies like Nike, Adidas, and Under Armour have seen significant growth in their online sales, prompting further investment in digital channels.

Regional Insights

The sportswear market in North America accounted for a revenue share of 33.3% in 2023, due to its strong sports culture, high disposable income, and advanced retail infrastructure. The region's consumers are highly engaged in various sports and fitness activities, leading to sustained demand for sportswear. The presence of major sports leagues, such as the NFL, NBA, and MLB, and their associated merchandise also boost the market. Additionally, North America is home to some of the largest sportswear brands, including Nike and Under Armour, which drive innovation and set trends in the industry. The region's consumers have a high propensity to spend on premium sportswear, driven by a combination of health consciousness, fashion trends, and brand loyalty. The extensive network of retail stores, both physical and online, ensures easy access to a wide range of sportswear products. Furthermore, the influence of social media and celebrity endorsements is particularly strong in North America, enhancing brand visibility and consumer engagement.

U.S. Sportswear Market Trends

The sportswear market in the U.S. is expected to grow at a CAGR of 9.6% from 2024 to 2030. American consumers are highly engaged in various sports and fitness activities, from professional sports to recreational exercises, creating a consistent demand for sportswear. The influence of major sports leagues, such as the NFL, NBA, and MLB, and their associated merchandise, further boosts the market. Additionally, the athleisure trend, which blends athletic wear with casual fashion, has gained immense popularity in the U.S., driving demand for versatile and stylish sportswear. The rise of fitness influencers and social media marketing plays a crucial role in promoting sportswear brands and trends. Innovations in fabric technology, such as moisture-wicking and compression materials, also attract consumers seeking high-performance sportswear.

Asia Pacific Sportswear Market Trends

The Asia Pacific sportswear market is expected to grow with a CAGR of 10.5% from 2024 to 2030. Countries like China, India, and Japan are witnessing a surge in sports and fitness activities, fueled by government initiatives to promote physical health and the growing popularity of sports events. The younger population in these countries is increasingly adopting active lifestyles, driving demand for sportswear. The expanding middle class, with its increasing purchasing power, is also contributing to market growth. Additionally, the proliferation of smartphones and internet connectivity has boosted online shopping, making sportswear more accessible to a broader audience. International brands are increasingly focusing on the Asia Pacific market, launching region-specific products and expanding their retail presence.

Europe Sportswear Market Trends

Europe sportswear market is expected to grow at a CAGR of 9.9% from 2024 to 2030. due to increasing health awareness, a strong sports culture, and a rising trend of athleisure. European consumers are becoming more health-conscious and are actively engaging in sports and fitness activities, driving the demand for sportswear. The region is known for its rich sporting heritage and hosts numerous prestigious sports events, which boost the popularity of sportswear. Additionally, the athleisure trend is particularly strong in Europe, with consumers seeking comfortable yet stylish clothing that can be worn both for sports and casual occasions. Major sportswear brands like Adidas, Puma, and Reebok have a strong presence in Europe, continuously introducing innovative products to cater to evolving consumer preferences.

Key Sportswear Company Insights

The global sportswear market is characterized by the presence of numerous players such as Nike, Inc.; Adidas AG; LI-NING Company Limited; Umbro Ltd.; and Under Armour, among others. These companies, along with several emerging players, contribute to a competitive landscape that fosters continuous innovation. Major brands invest heavily in research and development to introduce advanced materials, cutting-edge designs, and new technologies that enhance performance, comfort, and style. They also engage in strategic partnerships, sponsorships, and endorsements with athletes and sports teams to strengthen their market presence and brand recognition. Furthermore, these companies are increasingly focusing on sustainability, incorporating eco-friendly materials and ethical production practices to meet the growing consumer demand for sustainable products.

Key Sportswear Companies:

The following are the leading companies in the sportswear market. These companies collectively hold the largest market share and dictate industry trends.

- Nike, Inc.

- Adidas AG

- LI-NING Company Limited

- Umbro Ltd.

- Puma SE, Inc.

- Fila, Inc.

- Lululemon Athletica Incorporation

- Under Armour

- Columbia Sportswear Company

- Anta Sports Products Limited, Inc.

Recent Developments

-

In June 2024, Reebok introduced its first ever pickleball shoe, the Nano Court. Designed for sports such as pickleball, padel, and tennis, the shoe prioritizes grip, stability, and durability. It features Flexweave Pro uppers, incorporating Reebok’s most resilient Flexweave knit yet, with zoned stability yarns for targeted support. Additionally, the shoe includes ToeTection Guard at the toe box for enhanced durability, along with a 360 Comfort Booty anatomical upper construction for a secure fit.

-

In June 2024, Stack Athletics, a leading brand in pickleball-specific performance apparel, unveiled its Summer 2024 performance collection tailored for pickleball enthusiasts. The collection introduces new colors, patterns, and pieces featuring innovative technology, such as the Men's Flowstate Zip Tee, Women's Rush Skirt, and Men's Tourney Short. These garments are designed to regulate body temperature and enhance agility with lightweight fabrics, keeping players swift on the court.

-

In February 2024, Puma entered into a long-term partnership with Bundesliga soccer club RB Leipzig, commencing from the 2024/25 season, to provide equipment for all men's, women's, and youth teams. Puma CEO Arne Freundt acknowledged RB Leipzig's rapid rise to prominence, both domestically and internationally. In addition to supplying kits for the teams, Puma has secured various sponsorship, merchandising, and matchday advertising rights at the Red Bull Arena and RB Leipzig Football Academy.

Sportswear Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 365.81 billion

Revenue forecast in 2030

USD 646.01 billion

Growth rate

CAGR of 9.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, U.K., Germany, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Nike, Inc.; Adidas AG; LI-NING Company Limited; Umbro Ltd.; Puma SE, Inc.; Fila, Inc.; Lululemon Athletica Incorporation; Under Armour; Yasso; Columbia Sportswear Company; Anta Sports Products Limited, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sportswear Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global sportswear market report on the basis of product, end-user, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Footwear

-

Apparel

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sportswear market size was estimated at USD 335.92 billion in 2023 and is expected to reach USD 365.81 billion in 2024.

b. The global sportswear market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 646.01 billion by 2030.

b. North America dominated the sportswear market with a share of 33.3% in 2023. This is attributable to the strong performance of internationally-reputed sportswear brands, including Nike and Adidas, within the region.

b. Some key players operating in the sportswear market include Nike, Inc., Adidas AG; LI-NING Company Ltd; Umbro Ltd.; Puma SE, Inc.; Fila, Inc.; Lululemon Athletica Inc.; Under Armour; Columbia Sportswear Company; and Anta Sports Products Ltd., Inc.

b. Key factors that are driving the sportswear market growth include rapidly evolving fashion trends and the furtherance of sportswear manufacturing technology paired with the rising global demand for premium sportswear.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.