- Home

- »

- Advanced Interior Materials

- »

-

Decorative Laminates Market Size And Share Report, 2030GVR Report cover

![Decorative Laminates Market Size, Share & Trends Report]()

Decorative Laminates Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (High Pressure Laminates, Low Pressure Laminates), By Application (Furniture, Wall, Flooring), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-259-3

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Decorative Laminates Market Summary

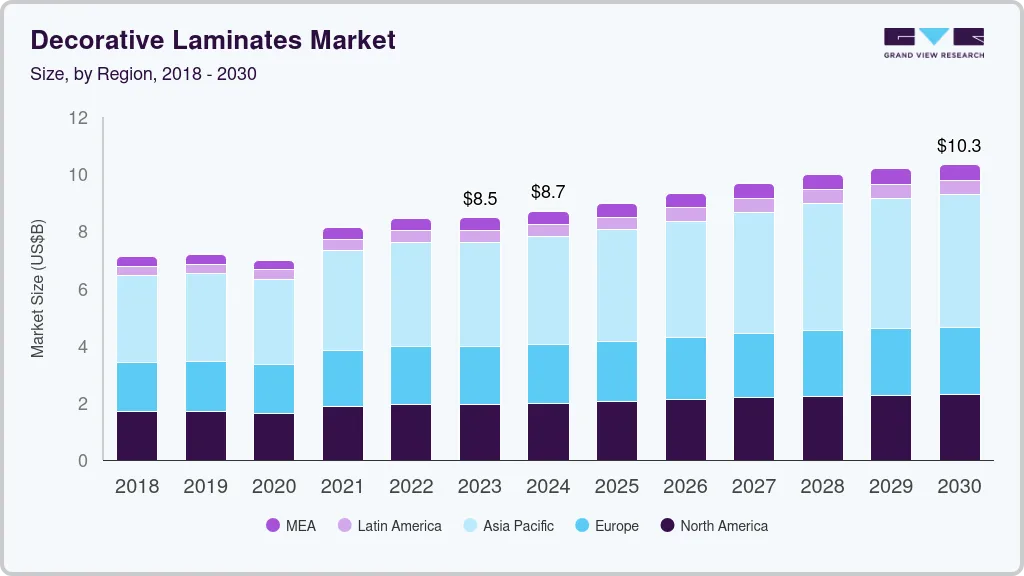

The global decorative laminates market size was estimated at USD 8.47 billion in 2023 and is projected to reach USD 10.34 billion by 2030, growing at a CAGR of 2.9% from 2024 to 2030. This industry is expected to witness rapid growth due to increasing middle-income population and increased disposable income in developing countries in around the world.

Key Market Trends & Insights

- North America dominated the decorative laminates market with a revenue share of about 23.0% in 2023.

- The decorative laminates market in U.S. is dominated by increasing demand for decorative light-weight panels in furniture applications.

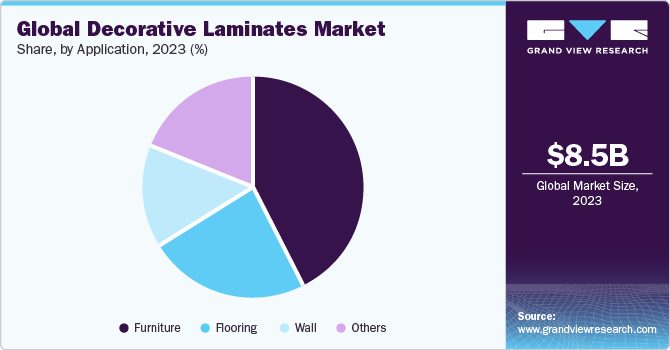

- Based on application, the furniture application segment led the market with the largest revenue share of 42.9% in 2023.

- Based on product, the high pressure laminates segment led the market with the largest revenue share of 83.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.47 Billion

- 2030 Projected Market Size: USD 10.34 Billion

- CAGR (2024-2030): 2.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Decorative laminates are a highly preferred choice for furniture manufacturers on account of their versatility, durability, and cost-effectiveness. Laminates are used to surface various types of furniture such as tables, desks, cabinets, shelves, wardrobes, and storage units. The wide range of colors, patterns, and textures available in laminates allows furniture designers to create visually appealing and functional pieces for residential, commercial, and hospitality settings.

Increasing environmental awareness and sustainability concerns have led to the development of eco-friendly decorative laminates made from recycled materials, renewable resources, or certified sustainable sources. Consumers are increasingly seeking sustainable and environmentally responsible products for their interior spaces, driving demand for decorative laminates with eco-friendly credentials. In addition, manufacturers are investing in eco-friendly production processes, materials, and certifications to meet consumer demand for green building products, contributing to the market growth of sustainable decorative laminate.

The market in U.S. is expected to be riven on account of growing refurbishment and redevelopment activities in the urban and sub-urban regions in the country. Moreover, the affordability of decorative laminates allows consumers to experiment with different design concepts, update interior spaces more frequently, and achieve high-end looks within budget constraints, contributing to market growth.

Decorative laminates offer a wide range of colors, patterns, textures, and finishes, allowing consumers to customize and enhance the aesthetic appeal of interior spaces. With advancements in printing and manufacturing technologies, laminates can replicate the look and feel of natural materials such as wood, stone, metal, and fabric, providing design versatility and flexibility. This is expected to drive the adoption of this product in developing countries in Asia Pacific and Middle East & Africa regions.

Laminates are ideal for use in different surface applications including kitchen countertops, cabinets, furniture, wall panels, ceilings, and doors. Moreover, these are very low maintenance and are prefinished products as unlike paints these don’t require any excessive finishing touches after applications. This further saves any excessive cost for installation, making them a cost effective alternative to conventional paints. Consumers seek decorative laminates to achieve specific design themes, styles, and trends, whether it's a modern, rustic, industrial, or minimalist aesthetic, thereby driving demand for a diverse range of laminate designs.

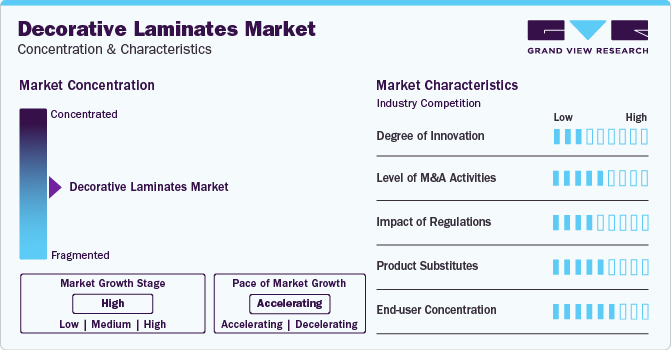

Market Concentration & Characteristics

The market growth stage is low, and pace of the market growth is accelerating. Furthermore, the market is moderately fragmented in nature owing to the presence of several large and medium scale players operating in the market. Many of the regional players are focused on expanding their production capacities and strengthening their industry presence by increasing their regional reach.

Prominent manufacturers have been adopting various strategies including investments, agreements, partnerships, contracts, production capacity expansion, joint ventures, and collaborations to enhance their industry presence and to cater to the changing requirements of application industries. The industry is subject to scrutiny by regulations approved by several bodies such as European Standards, and International Organization for Standardization (ISO). These standards defined by these bodies are followed by a majority of the industry players operating across the globe.

The top market players are investing heavily in research and development activities to develop low cost and high-value products. The regulatory guidelines which promote green, and energy efficient buildings are expected to drive the demand for the market growth. With the increase in focus on eco-friendliness and energy efficiency the companies are investing towards the development of green building products.

Major players are involved in technological innovations for developing new products in order to consolidate their presence in the market. Rising consumer demand and a shift in consumer preference toward high-quality products are projected to open up growth avenues for the new entrants in the market over the forecast period.

Application Insights

Based on application, the furniture application segment led the market with the largest revenue share of 42.9% in 2023. This segment is also expected to grow at a significant CAGR over the forecast period. This is on account of growing home decoration and renovation trends in emerging economies across the globe.

Decorative laminates are also used for wall panels, partitions, ceilings, flooring, and cabinetry in transportation interiors to provide durable, easy-to-clean surfaces that withstand heavy use and maintain aesthetics over time. Within transportation industry, laminates are utilized for interior surfaces in vehicles such as trains, buses, airplanes, and ships. Many of these laminates also offer fire-resistant properties, making them suitable for compliance with safety regulations in transportation applications.

Furthermore, the outbreak of COVID-19 has resulted in a change in working patterns and a rapid rise in remote working culture around the world. This has resulted in an increase in demand for home-office furniture along with rise in spending on interior designing and modification among the urban population. This change in market trends is expected to propel the demand for these products in furniture production and enhancement over the coming years.

Product Insights

Based on products, the high pressure laminates segment led the market with the largest revenue share of 83.6% in 2023. High-pressure laminates are commonly used for interior surfaces in commercial buildings such as offices, retail stores, hotels, and restaurants. HPL offers exceptional durability and resistance to wear, making it a preferred choice for surfaces that experience heavy use and require long-term performance. The durability and ease of cleaning of HPL surfaces make them suitable for meeting strict hygiene standards and infection control requirements in healthcare and laboratory environments.

Furthermore, high-pressure laminates offer a cost-effective surfacing solution compared to natural materials like stone or wood, making them accessible to a wide range of consumers and projects. The availability of a wide range of colors, patterns, and textures allows designers to create customized and visually appealing interiors that meet the unique requirements of different spaces and applications.

Regional Insights

North America dominated the decorative laminates market with a revenue share of about 23.0% in 2023. High pressure laminates are ideal in both horizontal and vertical applications, hence can be used in flooring, furniture, and wall treatments. These are durable and thus well-suited for surfaces in high traffic areas in a residential buildings, as well as commercial settings.

U.S. Decorative Laminates Market Trends

The decorative laminates market in U.S. is dominated by increasing demand for decorative light-weight panels in furniture applications. This country has high disposable income among the younger population in the urban and sub-urban areas, resulting in high spending on interior modifications for commercial and residential buildings.

Asia Pacific Decorative Laminates Market Trends

The decorative laminates market in Asia Pacific accounted for the largest revenue share of 44.2% in 2023. The industry demand for decorative laminates in Asia Pacific region is expected to be driven by increasing spending in new construction activities for residential and non-residential buildings in developing countries such as China, India, South Korea and Vietnam. Moreover, the developed economies in this region such as Japan and Australia are spending heavily on modifying of old buildings and revamping old furniture, thus boosting the demand for decorative panels to be used in furniture, walls and flooring applications.

The China decorative laminates market is expected to be driven by, increased demand for furniture in residential and non-residential buildings due to ongoing investment in industrialization in this country. Several companies around the world have their production facilities and offices in China due to lost set up and production cost in the country. This propels industry demand for decorative laminates to make furniture and wall panels in the urban areas in China.

Europe Decorative Laminates Market Trends

The decorative laminates market in Europe accounted for the largest revenue share of 23.8% in 2023. Decorative panels such as laminates are light-weighted, durable and cost effective solutions to enhance the furniture in residential as well as non-residential settings. Due to this, these panels are highly preferred in decorating furniture, walls and flooring application in Europe.

The Germany decorative laminates market is anticipated to grow at a significant CAGR over the forecast period. This is on account of its characteristics such as light-weight and durability & longevity, and cost effectiveness which are expected to promote adoption of decorative laminates in different application sectors.

Central & South America Decorative Laminates Market Trends

The decorative laminates market in Central & South America is expected to grow at a rapid CAGR over the forecast period, on account of increasing use of high pressure laminates on account of its characteristics such as ease of maintenance, moisture and stain resistance and cost-effectiveness. This is expected to propel the demand for high pressure laminates at a significant CAGR of 3.1% over the forecast period.

The Brazil decorative laminates market is expected to grow at a rapid CAGR over the forecast period. This is on account of growing construction investments in the country along with government initiatives to support construction industry in the country. This is expected to propel the demand for this product in construction as well as interior decoration applications.

Middle East & Africa Decorative Laminates Market Trends

The decorative laminates market in Middle East & Africa is expected to grow at the significant CAGR of 4.0% over the forecast period. This is on account of growing construction and infrastructural development investments in the region.

The Saudi Arabia decorative laminates market is expected to grow at the fastest CAGR during the forecast period, due to account of increasing economic development and building construction activities on account of growing foreign investments in this country

Key Decorative Laminates Company Insights

Some key players operating in this industry include Greenlam Industries Limited and OMNOVA North America Inc

-

Greenlam Industries Limited is involved in the production of laminates for different sectors including healthcare, education, and hospitality, commercial, retail and residential. This company also has a through network of distributors and dealers along with large production capacity

-

OMNOVA North America Inc. is engaged in the manufacturing of decorative laminates in North America and Asia Pacific region. This company also produces performance films, coated fabric upholstery and digitally printed wall murals

Abet Laminati SpA, and STYLAM INDUSTRIES LIMITED are some of the emerging market participants in the industry.

-

Abet Laminati SpA is involved in the production of decorative laminates in different materials, colors, textures, and patterns. The company operates in several countries including Australia, Belgium, China, France, Germany, Netherlands, Poland, Russia, Spain, Switzerland, and United Kingdom

-

STYLAM INDUSTRIES LIMITED is a manufacturer of wide range of interior and exterior designing products including laminates, prelam boards, exterior cladding, and acrylic solid surface

Key Decorative Laminates Companies:

The following are the leading companies in the decorative laminates market. These companies collectively hold the largest market share and dictate industry trends.

- Greenlam Industries Limited

- OMNOVA North America Inc.

- Abet Laminati SpA

- STYLAM INDUSTRIES LIMITED

- Wilsonart LLC

- Merino Laminates Ltd.

- FunderMax

- Airolam decorative laminates

- Archidply

- Bell Laminates

- Broadview Holding (Formica Group)

Recent Developments

- In June 2022, Greenlam Industries Limited acquired a laminate manufacturing facility in Gujarat, with the production capacity of 3.4 million sheets per annum. This will help the company strengthen their market position and provide demographic advantage to this company

Decorative Laminates Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.71 billion

Revenue forecast in 2030

USD 10.34 billion

Growth rate

CAGR of 2.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea; Brazil; Saudi Arabia

Key companies profiled

Greenlam Industries Limited; OMNOVA North America Inc; Abet Laminati SpA; STYLAM INDUSTRIES LIMITED; Wilsonart LLC; Merino Laminates Ltd; FunderMax; Airolam decorative laminates; Archidply; Bell Laminates; Broadview Holding (Formica Group)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

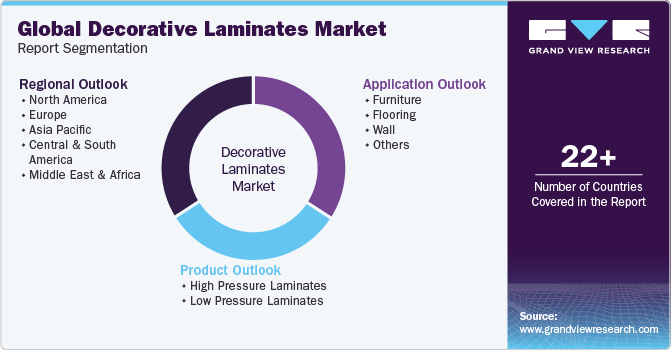

Global Decorative Laminates Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the decorative laminates market based on product, application, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

High Pressure Laminates

-

Low Pressure Laminates

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Furniture

-

Flooring

-

Wall

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Central & South America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global decorative laminates market size was estimated at USD 8.47 billion in 2023 and is expected to reach USD 8.71 billion in 2024.

b. The global decorative laminates market is expected to grow at a compound annual growth rate of 2.9% from 2024 to 2030 to reach USD 10.34 billion by 2030.

b. Furniture application segment led the market and accounted for over 42.9% share of the revenue in 2023. This is on account of growing demand for growing demand for construction and interior designing materials in the market

b. Some of the key players operating in the decorative laminates market include Greenlam Industries Limited, OMNOVA North America Inc, Abet Laminati SpA, STYLAM INDUSTRIES LIMITED, Wilsonart LLC, Merino Laminates Ltd, FunderMax, Airolam decorative laminates, Archidply, Bell Laminates, and Broadview Holding (Formica Group)

b. The key factors that are driving the global decorative laminates market include growing construction activities in the developing countries in Asia Pacific

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.