- Home

- »

- Network Security

- »

-

Deep Packet Inspection Market Size And Share Report, 2030GVR Report cover

![Deep Packet Inspection Market Size, Share & Trends Report]()

Deep Packet Inspection Market Size, Share & Trends Analysis Report By Enterprise Size, By Component, By Deployment, By Installation, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-035-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Deep Packet Inspection Market Trends

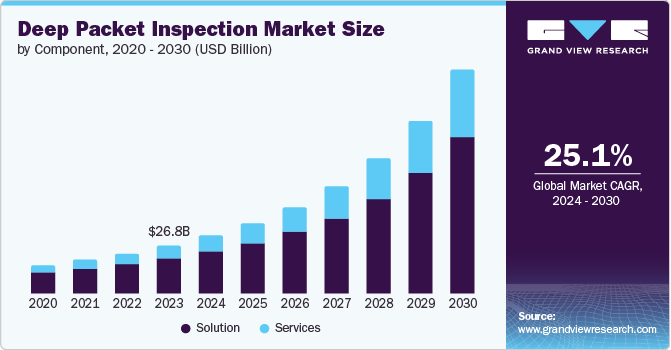

The global deep packet inspection market size was valued at USD 26.83 billion in 2023 and is projected to grow at a CAGR of 25.1% from 2024 to 2030. Deep packet inspection (DPI) refers to the technology that allows network operators to inspect data packets as they pass through a network, enabling detailed analysis and control over network traffic. One significant driver of this demand is the rapid expansion of digital services and applications across various sectors, including telecommunications, finance, healthcare, and entertainment.

In telecommunications, the proliferation of high-bandwidth applications such as video streaming, online gaming, and cloud services has intensified the need for efficient traffic management and network optimization. DPI provides granular insights into network usage patterns, enabling operators to prioritize and manage bandwidth more effectively. This ensures a seamless user experience amid increasing data consumption rates.

Furthermore, cybersecurity concerns have become paramount in an era of sophisticated cyber threats and evolving regulatory requirements. DPI enables deep-level inspection of network traffic, facilitating the detection of malicious activities, unauthorized access attempts, and potential data breaches. As organizations strive to safeguard their sensitive information and maintain regulatory compliance, DPI is critical for improving network security posture and incident response capabilities.

Moreover, the advent of technologies such as 5G networks and Internet of Things (IoT) devices has further fueled the demand for DPI. These technologies introduce network management and security complexities due to their diverse traffic characteristics and the sheer volume of connected devices. DPI helps operators manage network congestion, ensure quality of service, and enforce policies tailored to different types of IoT applications.

Lastly, the growing adoption of cloud and edge computing models has decentralized data processing and storage, necessitating DPI to monitor and manage traffic flows between distributed computing nodes. This capability is essential for optimizing resource allocation, improving application performance, and maintaining compliance with data privacy regulations.

Component insights

The solutions segment held the largest market revenue share of 72.9% in 2023. The need for robust DPI solutions becomes important as digital traffic grows exponentially across networks. These solutions are essential for network operators and service providers to efficiently manage and secure their networks against evolving threats such as cyberattacks and unauthorized access. Additionally, advancements in technology have expanded the capabilities of DPI solutions, allowing them to offer more sophisticated functionalities. These include real-time traffic analysis, application identification, and quality of service (QOS) management, which are vital for optimizing network performance and ensuring a seamless user experience. As businesses and consumers increasingly rely on high-speed, reliable internet connectivity, DPI components help improve network efficiency and reliability.

The services segment is expected to grow at the fastest CAGR of 26.9% over the forecast period. With growing digital transformation across industries, there is an increasing need for robust network security solutions. DPI protects network integrity by inspecting and filtering data packets in real time, identifying potential threats such as malware, intrusion attempts, and unauthorized access. This heightened security requirement drives the demand for DPI services that offer comprehensive threat detection and mitigation capabilities. Moreover, the complexity of network environments continues to grow with the proliferation of IoT devices, cloud services, and virtualized networks. These diverse and dynamic infrastructures require DPI solutions that are not only capable of handling large volumes of traffic but also adaptable to evolving network architectures. Service providers in the DPI market offer customization, integration, and maintenance services to optimize the performance and efficiency of DPI components within such complex environments. .

Deployment Insights

The on-premises deployment segment held the largest market revenue share in 2023. On-premises deployment offers organizations greater control over their data and network security. This control is important for industries and enterprises that handle sensitive information and must adhere to strict regulatory requirements. On-premises DPI solutions provide faster processing speeds and lower latency than cloud-based alternatives for applications requiring real-time analysis and response, such as network monitoring and threat detection. Data privacy and sovereignty drive many organizations to opt for on-premises deployments, where they can ensure that sensitive data remains within their physical or virtual boundaries. Lastly, the customization and integration capabilities of on-premises DPI solutions allow organizations to tailor the technology to fit specific operational needs and existing IT infrastructure seamlessly.

The cloud deployment segment is expected to grow at fastest CAGR over the forecast period. Cloud-based DPI solutions offer scalability and flexibility, allowing businesses to expand their network capabilities faster without significant infrastructure investments. This scalability is essential as data traffic grows exponentially, driven by increasing internet usage and the proliferation of connected devices. Cloud deployment enables quicker implementation and updates of DPI solutions, ensuring businesses can adapt swiftly to evolving cybersecurity threats and regulatory requirements. Cloud-based DPI solutions typically offer lower upfront costs and reduced maintenance compared to traditional on-premises deployments.

Installation Insights

The integrated installation segment held the largest market revenue share in 2023. The demand for the integrated segment is increasing primarily due to its efficiency and cost-effectiveness. Integrated DPI solutions combine multiple functionalities into a single platform, offering network operators and enterprises a consolidated approach to traffic analysis, security enforcement, and network management. This integration reduces the complexity of deploying and managing separate DPI components, thereby lowering operational costs and streamlining network performance monitoring. Additionally, integrated DPI solutions often provide enhanced scalability and flexibility, allowing organizations to adapt more readily to evolving network demands and security threats.

The standalone installation segment is expected to grow at fastest CAGR over the forecast period. Standalone DPI solutions offer distinct advantages, including greater flexibility and control over network traffic monitoring and security. Unlike integrated DPI solutions embedded within other network devices like routers or firewalls, the standalone DPI systems can be deployed independently, allowing organizations to tailor their DPI capabilities more precisely to their specific needs. This flexibility is crucial in environments where customized or specialized DPI functionality is required, such as in large-scale enterprise networks or service provider infrastructures. Moreover, standalone DPI solutions often provide advanced features like detailed traffic analysis, application identification, and real-time threat detection, which are essential for maintaining network security and optimizing performance.

Enterprise Size Insights

The large enterprises segment held the largest market revenue share in 2023. Large enterprises handle vast amounts of data flowing through their networks, often encompassing a wide array of applications and services. DPI technology allows these enterprises to monitor and analyze network traffic at a granular level, providing insights into application usage, security threats, and overall network performance. This level of visibility is crucial for ensuring network efficiency, identifying and mitigating security risks, and complying with regulatory requirements. As large enterprises expand their digital footprint and adopt more complex IT infrastructures, the need for DPI becomes necessary not only for operational efficiency but also for maintaining robust cybersecurity measures and ensuring regulatory compliance across their networks.

Small and medium enterprises (SMEs) is expected to grow at fastest CAGR over the forecast period.The increasing demand for cybersecurity drives the segment growth. DPI offers advanced traffic analysis capabilities that help SMEs detect and mitigate potential threats such as malware, phishing attempts, and data breaches more effectively than traditional security measures. Robust network visibility and control become necessary as SMEs expand their digital footprint through cloud services, remote working environments, and online transactions. DPI provides granular insights into network traffic, allowing SMEs to optimize bandwidth usage, ensure regulatory compliance, and enhance overall network performance. Lastly, the affordability and scalability of DPI solutions have improved over time, making them more accessible to SMEs with limited IT budgets and resources.

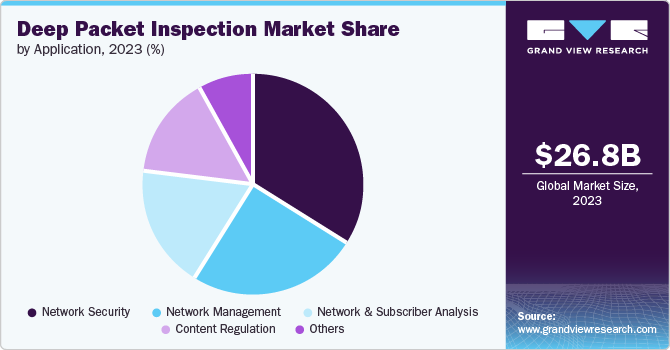

Application Insights

The network security segment held the largest market revenue share in 2023. The growing reliance on cloud services, mobile applications, and IoT devices increases the demand for network security. These technologies significantly expand the attack surface for cyber threats, necessitating robust DPI solutions to inspect and filter network traffic at a granular level. Additionally, regulatory requirements for data protection and privacy, such as GDPR in Europe and CCPA in California, drive organizations to implement DPI to monitor and enforce compliance within their networks. The rise of sophisticated cyber threats, including malware and advanced persistent threats (APTs), requires DPI capabilities to detect and mitigate these threats in real-time.

The content regulation segment is expected to witness the fastest CAGR over the forecast period. As digital communication and online activities grow exponentially, there's a heightened concern over security threats such as malware, phishing, and data breaches. DPI technology enables precise inspection of data packets in real-time, allowing network administrators to detect and mitigate these threats effectively. With the rise of streaming services, social media platforms, and cloud applications, there's a critical need for bandwidth management and Quality of Service (QOS) optimization. DPI helps prioritize traffic and ensure a seamless user experience by regulating content delivery based on application types and user-defined policies. Lastly, regulatory compliance mandates regarding data privacy and content filtering necessitate robust DPI solutions that enforce policies and ensure adherence to legal requirements.

End-use Insights

Banking, Financial Services, and Insurance (BFSI) dominates the segment with a significant revenue share in 2023. The BFSI industry's expansion in the deep packet inspection (DPI) market is fueled by the necessity to boost security measures, adhere to regulatory requirements, identify and thwart fraudulent activities, and enhance network efficiency. DPI enables real-time monitoring and analysis of network traffic, helping institutions detect and prevent cybersecurity threats such as malware, phishing attacks, and data breaches. With financial transactions increasingly migrating to digital platforms, there is a critical need for robust network visibility and control. DPI provides granular insights into network traffic patterns, facilitating efficient bandwidth management and ensuring optimal service delivery. Lastly, with the rise of mobile banking and fintech innovations, BFSI organizations require DPI solutions to enhance user experience through prioritized traffic handling and to comply with data privacy regulations.

The retail segment is expected to have a significant growth over the forecast period. Retail companies increasingly rely on digital platforms for customer engagement, sales, and operations. DPI technology allows these companies to monitor and analyze network traffic in real time, enabling them to optimize customer experiences, detect and prevent cybersecurity threats, and ensure network efficiency. Retail environments have become more complex with the integration of IoT devices and mobile applications; DPI provides critical visibility into network activities, helping to manage bandwidth usage and prioritize network traffic for seamless operations.

Regional Insights

North America held the largest market revenue share of 39.1% in 2023. The increasing complexity and volume of internet traffic have increased the demand for deep packet inspection. DPI enables network operators to manage and prioritize this traffic effectively, ensuring optimal performance and user experience. Additionally, heightened concerns over cybersecurity threats, including data breaches and cyberattacks, have prompted organizations across various sectors in North America to invest in DPI technologies. These solutions allow for real-time monitoring and analysis of network traffic patterns, helping to detect and mitigate potential threats before they escalate. Moreover, regulatory requirements in North America, particularly concerning data privacy and compliance with industry standards, further underscore the necessity for robust DPI capabilities.

U.S. Deep Packet Inspection Market Trends

The U.S. deep packet inspection market dominated the regional market with a higher share in 2023. The increasing demand for deep packet inspection in the U.S. is driven by its pivotal role in enhancing cybersecurity measures, ensuring regulatory compliance, and optimizing network performance amidst growing digitalization trends. DPI allows for granular analysis of network traffic, enabling organizations to monitor and manage data flows more effectively. Moreover, DPI is integral to regulatory compliance efforts in sectors such as telecommunications and finance. Regulatory bodies in the US, such as the Federal Communications Commission (FCC) and the Federal Trade Commission (FTC), impose stringent requirements on network operators and service providers to safeguard consumer data. DPI enables compliance with these regulations by facilitating detailed traffic analysis and ensuring adherence to data protection laws.

Europe Deep Packet Inspection Market Trends

The Europe deep packet inspection (DPI) market is witnessed as a lucrative region in this industry. The demand for DPI in Europe is increasing primarily due to several key factors specific to the region. With the proliferation of advanced cyber threats and growing concerns over data privacy regulations such as GDPR (General Data Protection Regulation), European businesses and governments are investing more in DPI technology to enhance network security and ensure compliance with stringent data protection laws. Additionally, the rise in remote work and cloud adoption has amplified the need for robust traffic management and application visibility, which DPI enables by allowing network operators to analyze and prioritize data packets in real-time.

The U.K. market is anticipated to witness significant growth. The increase of internet-connected devices and the rising adoption of cloud services among businesses and consumers drives market growth. DPI allows for detailed analysis of data packets passing through networks, enabling providers to prioritize traffic, detect and mitigate network threats, and optimize service delivery. Additionally, as the U.K. continues to evolve its digital infrastructure to support initiatives like smart cities and 5G networks, DPI plays a crucial role in ensuring reliable and secure communication across these advanced networks. Moreover, regulatory requirements concerning data privacy and network neutrality further drive the demand for DPI solutions.

Germany market accounted for a remarkable market share in 2023.The rise of digital transformation across industries in Germany, there's a growing need to enhance network efficiency, ensure cybersecurity, and manage the quality of service (QOS) for various digital applications and services. This heightened demand for DPI reflects a broader trend toward integrating advanced network management solutions that comply with regulatory requirements and enhance operational efficiency and cybersecurity measures across German networks.

Asia Pacific Deep Packet Inspection Market Trends

The Asia Pacific deep packet inspection (DPI) market is expected to witness significant growth over the forecast period. With the rapid proliferation of digital services and the increasing adoption of cloud computing across sectors like finance, telecommunications, and e-commerce, there's a heightened need for advanced network traffic analysis and management. DPI offers precise insights into data flows, enabling companies to optimize network performance, enhance security protocols against evolving cyber threats, and ensure compliance with regional data privacy regulations, such as GDPR-like laws in countries like Japan and South Korea. Additionally, as mobile and broadband penetration rates soar in emerging economies like India, Indonesia, and Vietnam, DPI becomes essential for telecom operators to manage bandwidth efficiently and deliver quality service amidst growing data consumption.

India deep packet inspection market dominated the market in 2023. With the rapid expansion of digital services and increasing internet penetration, there's a heightened need for network operators to manage and optimize their networks efficiently. DPI enables providers to analyze network traffic at a granular level, helping to enhance network performance, ensure quality of service (QOS), and prioritize critical applications such as video streaming and VoIP services. Additionally, as India moves towards 5G implementation, DPI becomes crucial for managing next-generation networks' increased complexity and traffic demands. Furthermore, DPI plays a pivotal role in ensuring network security by identifying and mitigating threats, which is increasingly important given the rising cybersecurity concerns in the region.

China deep packet inspection market is experiencing a rapid expansion. DPI allows authorities to monitor and control internet traffic more effectively, aligning with China's stringent cybersecurity regulations. This technology enables detailed inspection of data packets, facilitating the detection of unauthorized protocols, malicious activities, and content filtering in compliance with government policies. Moreover, as China continues to advance its digital infrastructure, including deploying 5G networks and expanding IoT devices, DPI becomes crucial for optimizing network performance and ensuring cybersecurity. This heightened demand reflects China's proactive stance on regulating and securing its digital space, influencing governmental and commercial entities to adopt DPI solutions for enhanced network management and security measures.

Key Deep Packet Inspection Company Insights

Some of the key companies in the deep packet inspection market include Cisco Systems, Inc.; NexNet Solutions; and VIAVI Solutions Inc.

-

Cisco currently offers two hardware-based solutions to achieve deep packet inspection (DPI) functionality. These solutions include the Cisco Service Control Engine (SCE) product line and the recently introduced PISA hardware designed for the Cisco 6500/7600 Supervisor 32.

-

NexNet's Deep Packet Inspection Solution offers an advanced, comprehensive, and precise analysis of all IP traffic. This solution effectively extracts in-depth, high-quality application metadata, supports a wide range of protocols, facilitates real-time network flow, safeguards against unauthorized intrusions, and effectively detects attacks on firewalls or exploitation of IoT devices.

Key Deep Packet Inspection Companies:

The following are the leading companies in the deep packet inspection market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- ipoque GmbH

- ENEA

- NexNet Solutions

- Palo Alto Networks, Inc.

- Zoho Corporation Pvt. Ltd

- Sandvine

- Juniper Networks, Inc.

- VIAVI Solutions Inc.

Recent Developments

-

In June 2024, Palo Alto Networks announced the expansion of its cloud location in Indonesia. This move aims to enhance the region's cloud services and cybersecurity capabilities, catering to the increasing demand for secure cloud solutions among Indonesian businesses.

-

EEnea announced partnership with Zyxel to streamline network security solutions for small office/home office (SOHO) workers. The collaboration aims to simplify the deployment and management of network security, leveraging Enea's technology with Zyxel's networking products. This initiative targets enhancing cybersecurity for remote workers, addressing the growing need for robust and user-friendly security solutions in the SOHO segment.

Deep Packet Inspection Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.22 billion

Revenue Forecast in 2030

USD 123.40 billion

Growth rate

CAGR of 25.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, installation type, enterprise size, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Sweden; Denmark; China; Japan; Australia; South Korea; India; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cisco Systems, Inc.;ipoque GmbH;ENEA;NexNet Solutions;Palo Alto Networks, Inc.;Zoho Corporation Pvt. Ltd.;Sandvine;Juniper Networks, Inc.;VIAVI Solutions Inc..

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Deep Packet Inspection Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels, and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global deep packet inspection market report based on component, deployment, installation, enterprise size, application, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated

-

Standalone

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small And Medium Size Enterprises

-

Large Size Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Network Security

-

Network Management

-

Network & Subscriber Analysis

-

Content Regulation

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Banking, Financial Services and Insurance (BFSI)

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

Thailand

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."