- Home

- »

- IT Services & Applications

- »

-

Deep Packet Inspection & Processing Market Report, 2030GVR Report cover

![Deep Packet Inspection & Processing Market Size, Share & Trends Report]()

Deep Packet Inspection & Processing Market Size, Share & Trends Analysis Report By Component, By Installation Type, By Deployment Mode, By Organization Size, By Applications, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-437-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

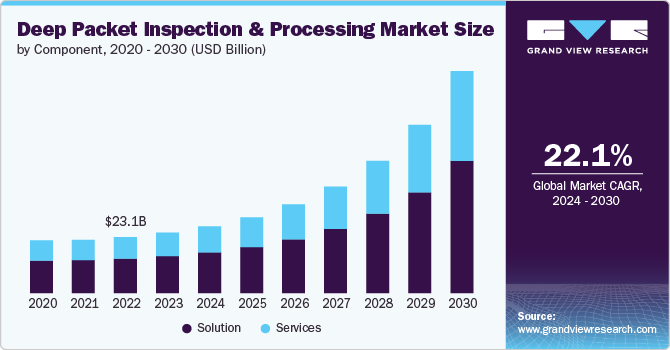

The global deep packet inspection & processing market size was estimated at USD 24.88 billion in 2023 and is anticipated to grow at a CAGR of 22.1% from 2024 to 2030. The market growth is driven by the increasing demand for advanced network security solutions and the rising volume of data traffic across networks due to the proliferation of cloud services, IoT devices, and 5G technology. As cyber threats become more sophisticated, organizations adopt deep packet inspection (DPI) solutions to analyze network traffic in real-time, detect anomalies, and prevent data breaches. In addition, regulatory requirements for data privacy and network monitoring, particularly in banking, telecommunications, and healthcare industries, fuel the adoption of DPI technologies. The growing emphasis on optimizing network performance and bandwidth management, especially in the context of expanding digital services and applications, further accelerates the demand for DPI and processing solutions.

Component Insights

The solution segment accounted for the largest market share of 61.27% in 2023. DPI solutions are essential for enhancing network security, optimizing traffic management, and ensuring compliance with regulatory requirements. As cyber threats become more sophisticated, organizations increasingly deploy DPI tools to gain deeper visibility into their network traffic, detect anomalies, and protect against potential attacks. This heightened need for advanced security measures is a major growth driver for the DPI solutions segment.

The service segment is anticipated to grow at the fastest CAGR over the forecast period. The proliferation of IoT devices and the growing complexity of network environments are significant drivers behind the expansion of the DPI services segment. As networks become more heterogeneous and data volumes increase, organizations require advanced DPI solutions to manage and secure their network infrastructure effectively. Service providers are also focusing on offering tailored solutions that address specific industry needs, such as telecom, finance, and healthcare, where the stakes for network performance and security are particularly high. This customization, coupled with advancements in machine learning and AI for real-time analytics, is fueling the demand for DPI services and contributing to the overall market growth.

Installation Type Insights

The integrated segment accounted for the largest market share of 53.41% in 2023. The rising demand for enhanced cybersecurity measures is fueling the growth of integrated DPI solutions. With the increasing prevalence of cyber threats and the need for real-time detection, integrated systems offer comprehensive security features to analyze and respond to potential threats more effectively. This capability is crucial for protecting sensitive data and ensuring network resilience, driving greater adoption of integrated DPI solutions across various industries.

The standalone segment is anticipated to grow significantly over the forecast period. Standalone DPI systems are gaining demand in the telecommunications industry, where the need to manage large amounts of real-time data and ensure low-latency network performance is critical. As telecom providers roll out 5G infrastructure, the demand for dedicated DPI tools that can handle the high-speed, high-volume data environment is increasing, further boosting the growth of the standalone segment in the DPI market.

Deployment Mode Insights

The on-premise segment accounted for the largest market share of 43.24% in 2023. On-premise DPI solutions offer greater customization and control compared to cloud-based alternatives. Enterprises can tailor DPI systems to meet specific needs, integrate them with existing infrastructure, and configure them according to unique security policies and network requirements.

The cloud segment is anticipated to grow at the fastest CAGR over the forecast period. This growth is driven by the expanding adoption of cloud services across various industries. As organizations increasingly migrate their data and applications to the cloud, there is a growing need for advanced DPI solutions to ensure security, optimize network performance, and manage the vast amounts of data transmitted across cloud environments.

Organization Size Insights

The large enterprises segment accounted for the largest market share of 58.72% in 2023. Large enterprises are deploying DPI solutions to gain granular visibility into network traffic, enabling them to detect and respond to sophisticated cyber threats more effectively. By analyzing packet-level data, enterprises can identify and mitigate security vulnerabilities, ensure compliance with regulatory requirements, and prevent data breaches, which is crucial given the complex and high-stakes nature of their operations.

The SMEs segment is anticipated to grow at the fastest CAGR over the forecast period. The cost-effective and scalable nature of DPI solutions makes them accessible to SMEs, allowing these businesses to implement advanced network management and security measures without requiring extensive investment. As SMEs continue to embrace digital transformation, the demand for sophisticated DPI and processing solutions is expected to grow, driven by the need for enhanced security, performance, and compliance.

Applications Insights

The intrusion detection & prevention (IDS/IPS) segment accounted for the largest market share of 25.26% in 2023. The increasing adoption of cloud computing and the need to protect sensitive data in sectors like BFSI further contributed to the growth of the IDS/IPS applications segment. Cloud-based DPI solutions offer enhanced scalability, resource optimization, and real-time threat response capabilities, making them a preferred choice for organizations seeking agile and efficient intrusion detection and prevention mechanisms.

The network performance management segment is anticipated to grow at the fastest CAGR over the forecast period. As networks become more congested with increasing numbers of devices and applications, DPI solutions are essential for identifying congestion points and optimizing traffic flow to maintain network performance and reliability. In addition, businesses that rely on service level agreement (SLA) to guarantee network performance need DPI tools to monitor compliance with SLA terms. These tools provide detailed insights into network performance metrics, helping organizations meet their contractual obligations and maintain customer satisfaction.

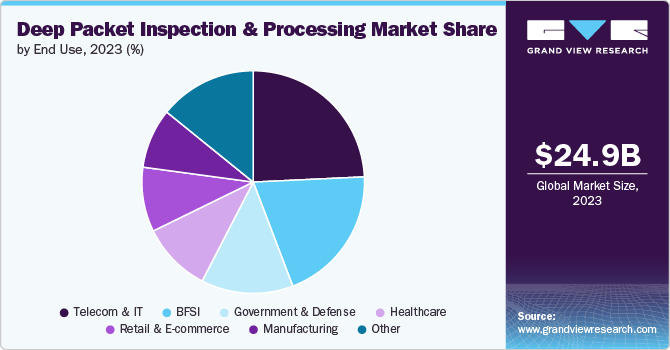

End Use Insights

The telecom and IT segment accounted for the largest market share of 24.26% in 2023. The telecom and IT sector's shift towards more data-intensive applications and services, such as streaming, cloud computing, and Internet of Things (IoT) solutions, is fueling the demand for advanced DPI and processing capabilities. These technologies are essential for managing the complexities of modern networks, ensuring compliance with regulatory requirements, and optimizing the user experience. The need for real-time analytics and actionable insights into network traffic patterns drives investments in DPI solutions, which can offer enhanced visibility and control over data flows.

The government and defense segment is anticipated to grow at the fastest CAGR over the forecast period.Implementing stringent data protection laws and regulations fuels the demand for DPI solutions within these sectors. Compliance with these regulations necessitates the adoption of technologies that can provide detailed insights into network traffic, ensuring that data handling practices meet legal standards. As governments strive to protect citizen data and uphold national security, the role of DPI in facilitating compliance and enhancing overall security frameworks becomes increasingly vital.

Regional Insights

The deep packet inspection & processing market in North America held a share of 34.95% in 2023. The rapid growth of e-commerce and digital transformation initiatives across North America is another significant factor contributing to the DPI market's expansion. The increasing reliance on online platforms for business operations has amplified the need for effective traffic management and security solutions. DPI technologies help organizations optimize their network performance, ensuring seamless user experiences while managing the complexities of digital traffic. As e-commerce platforms like Amazon and Walmart continue to thrive, the demand for robust DPI solutions that can handle increased data flows becomes essential.

U.S. Deep Packet Inspection & Processing Market Trends

The deep packet inspection & processing market in the U.S. is expected to grow significantly from 2024 to 2030. Regulatory requirements also play a crucial role in the growth of the DPI market in the U.S. With stringent data protection laws and industry regulations, such as those enforced by the Federal Communications Commission (FCC) and the Federal Trade Commission (FTC), organizations are compelled to adopt technologies that facilitate compliance. DPI solutions provide detailed traffic analysis, ensuring adherence to data protection laws and enhancing overall network transparency. This regulatory landscape drives demand for DPI technologies as organizations seek to safeguard consumer data and avoid potential penalties.

Europe Deep Packet Inspection & Processing Market Trends

The deep packet inspection & processing market in Europe is growing significantly at a CAGR of 22.8% from 2024 to 2030.The ongoing digital transformation across Europe is another critical factor driving the growth of the DPI market. The rise of remote work and the increasing adoption of cloud services have amplified the need for effective traffic management and application visibility. DPI technologies allow network operators to analyze and prioritize data packets in real-time, ensuring efficient bandwidth utilization and optimal performance for digital applications. As organizations adapt to new working models and digital infrastructures, the demand for DPI solutions to support these changes is expected to grow.

Asia Pacific Deep Packet Inspection & Processing Market Trends

The deep packet inspection & processing market in Asia Pacific is growing significantly at a CAGR of 25.1% from 2024 to 2030. Investments in telecommunications infrastructure and data center expansion across APAC drive demand for DPI solutions. As new network infrastructures are developed, DPI technologies are incorporated to ensure robust security and efficient traffic management.

Key Deep Packet Inspection & Processing Company Insights

Key players operating in the market include Cisco Systems, Inc., Huawei Technologies Co., Ltd., Palo Alto Networks, Inc., Juniper Networks, Inc., and Fortinet, Inc. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Deep Packet Inspection & Processing Companies:

The following are the leading companies in the deep packet inspection & processing market. These companies collectively hold the largest market share and dictate industry trends.

- Allot Ltd.

- BAE Systems

- Blue Coat Systems, Inc. (Symantec)

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Fortinet, Inc.

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- NetScout Systems, Inc.

- Palo Alto Networks, Inc.

- Qosmos (Enea)

- Sandvine Corporation

- SolarWinds Worldwide, LLC

- Symantec Corporation (Broadcom Inc.)

- Viavi Solutions Inc.

Recent Development

-

In September 2023, Viavi Solutions Inc. introduced NITRO AIOps on Google Cloud, a collaborative solution that merges Viavi's network analytics with the native services of Google Cloud. This innovative platform is specifically designed to address the significant challenges faced by Communication Service Providers (CSPs) while unlocking new opportunities for improved network intelligence and optimization. By leveraging advanced analytics and AI capabilities, NITRO AIOps aims to enhance network performance, facilitate real-time anomaly detection, and enable predictive maintenance, ultimately leading to better service quality and operational efficiency for CSPs.

-

In March 2023, Cisco Systems, Inc. announced its acquisition of Lightspin, a cloud security firm based in Tel Aviv, to enhance its security offerings for cloud infrastructures.Integrating Lightspin's capabilities aims to help organizations identify, prioritize, and remediate vulnerabilities within their cloud environments more efficiently without requiring extensive configuration. This move is aligned with Cisco's broader goal of unifying its security portfolio and addressing the evolving cybersecurity needs of its customers in an increasingly complex digital landscape.

Deep Packet Inspection & Processing Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.50 billion

Revenue forecast in 2030

USD 91.19 billion

Growth rate

CAGR of 22.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, installation type, organization size, deployment mode, applications, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; Palo Alto Networks, Inc.; Juniper Networks, Inc.; Fortinet, Inc.; Symantec Corporation (Broadcom Inc.); Sandvine Corporation; Check Point Software Technologies Ltd.; Blue Coat Systems, Inc. (Symantec); BAE Systems; Viavi Solutions Inc.; Qosmos (Enea); Allot Ltd.; NetScout Systems, Inc.; SolarWinds Worldwide, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Deep Packet Inspection & Processing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global deep packet inspection & processing market report based on component, installation type, organization size, deployment mode, applications, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Service

-

-

Installation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integrated

-

Standalone

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-Premise

-

Cloud

-

Hybrid

-

-

Applications Outlook (Revenue, USD Billion, 2018 - 2030)

-

Intrusion Detection & Prevention (IDS/IPS)

-

Traffic Management & Control

-

Data Loss Prevention (DLP)

-

Network Performance Management

-

Regulatory Compliance

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Telecom and IT

-

BFSI

-

Government and Defense

-

Healthcare

-

Retail & E-commerce

-

Manufacturing

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global deep packet inspection & processing market size was estimated at USD 24.88 billion in 2023 and is expected to reach USD 27.50 billion in 2024.

b. The global deep packet inspection & processing market is expected to grow at a compound annual growth rate of 22.1% from 2024 to 2030 to reach USD 91.19 billion by 2030.

b. North America dominated the high-speed data converter market with a market share of 35.0% in 2023. The rapid growth of e-commerce and digital transformation initiatives across North America is another significant factor contributing to the DPI market's expansion. The increasing reliance on online platforms for business operations has amplified the need for effective traffic management and security solutions.

b. Some key players operating in the deep packet inspection & processing market include Cisco Systems, Inc., Huawei Technologies Co., Ltd., Palo Alto Networks, Inc., Juniper Networks, Inc., Fortinet, Inc., Symantec Corporation (Broadcom Inc.), Sandvine Corporation, Check Point Software Technologies Ltd., Blue Coat Systems, Inc. (Symantec), BAE Systems, Viavi Solutions Inc., Qosmos (Enea), Allot Ltd., NetScout Systems, Inc., and SolarWinds Worldwide, LLC.

b. Several key factors drive the growth of the deep packet inspection & processing market. The increasing demand for advanced network security solutions and the rising volume of data traffic across networks due to the proliferation of cloud services, IoT devices, and 5G technology. As cyber threats become more sophisticated, organizations are adopting DPI solutions to analyze network traffic in real-time, detect anomalies, and prevent data breaches

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."