- Home

- »

- Next Generation Technologies

- »

-

5G Infrastructure Market Size & Share, Industry Report, 2033GVR Report cover

![5G Infrastructure Market Size, Share & Trends Report]()

5G Infrastructure Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Services), By Type (Public, Private), By Spectrum (Sub-6 GHz, mmWave), By Network Architecture, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-234-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

5G Infrastructure Market Summary

The global 5G infrastructure market size was estimated at USD 41.39 billion in 2025, and is projected to reach USD 133.19 billion by 2033, growing at a CAGR of 13.1% from 2026 to 2033. The market is expanding rapidly, driven by rising data consumption, growing demand for low-latency connectivity, and the increasing adoption of connected devices across consumer and enterprise environments.

Key Market Trends & Insights

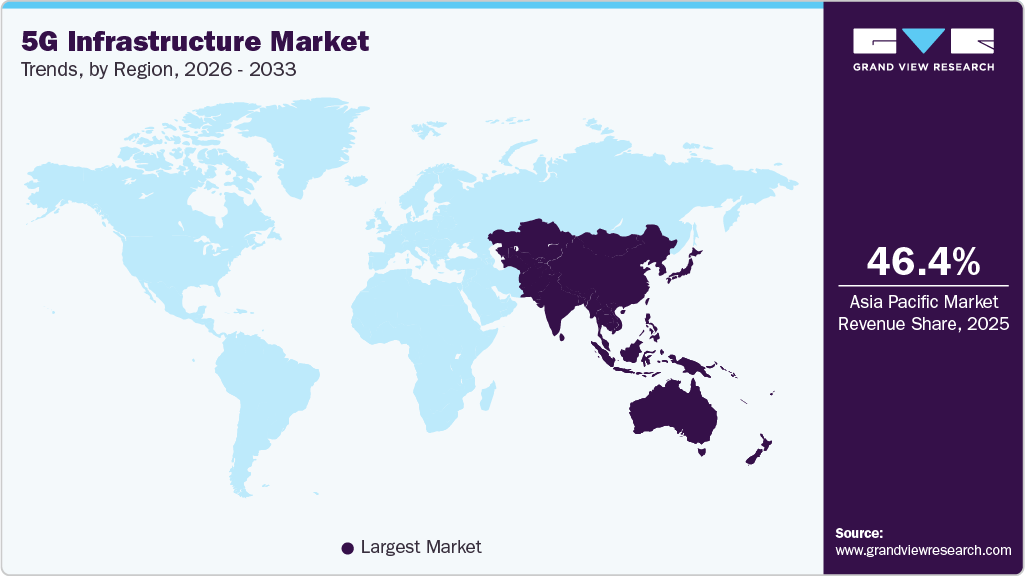

- Asia Pacific 5G infrastructure market accounted for a 46.4% share of the overall market in 2025.

- The 5G infrastructure industry in the China held a dominant position in 2025.

- By component, the hardware segment accounted for the largest share of 77.6% in 2025.

- By type, the private segment held the largest market share in 2025.

- By spectrum, the Sub-6 GHz segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 41.39 Billion

- 2033 Projected Market Size: USD 133.19 Billion

- CAGR (2026-2033): 13.1%

- Asia Pacific: Largest market in 2025

The proliferation of IoT applications, cloud services, and real-time digital platforms are accelerating the need for enhanced mobile broadband and reliable network performance. Industries such as manufacturing, automotive, logistics, and healthcare are transitioning toward automation and digital operations, creating strong demand for advanced network capabilities. These factors collectively support sustained deployment of 5G radio access, core networks, and edge infrastructure.

Significant technological advancements, including the adoption of virtualized and cloud-native architectures, massive MIMO technology, and network slicing, are reshaping the market. The shift toward Open RAN is enabling greater vendor diversification, interoperability, and cost efficiencies for operators. Edge computing is becoming a central component of 5G deployments, supporting latency-sensitive applications and distributed processing environments. In addition, advancements in millimeter-wave technology and spectrum-sharing techniques are enabling higher throughput and more efficient utilization of available bandwidth.

Despite strong momentum, the 5G infrastructure market faces notable restraints, primarily related to high deployment costs, spectrum pricing pressures, and the complexity of network integration. Operators encounter challenges in upgrading existing infrastructure to support higher frequencies, densification requirements, and cloud-native operational models. Supply chain disruptions, rising equipment costs, and geopolitical restrictions on certain vendors further complicate procurement decisions. Moreover, slow adoption of enterprise 5G in some markets and uncertainties around ROI can delay large-scale investments.

Component Insights

The hardware segment accounted for the largest share of 77.6% in 2025. The growth of the segment is attributed to the accelerated nationwide and regional 5G rollouts. Mobile network operators are investing heavily in next-generation radio access equipment, massive MIMO antennas, small cells, and 5G core hardware to address the rising demand for connectivity and meet their coverage obligations. These deployments require extensive physical infrastructure upgrades, which directly expand the demand for 5G hardware across emerging, developing, and developed markets.

The services segment is expected to grow at the fastest CAGR during the forecast period. Rising adoption of managed services for 5G network operations is fueling growth of the segment. Telecom operators are increasingly outsourcing network operations, maintenance, and lifecycle management due to the high cost and expertise required to operate 5G networks. Managed service providers deliver continuous monitoring, performance analytics, fault management, and predictive maintenance. The complexity of multi-vendor 5G ecosystems and the need for 24/7 uptime are accelerating demand for specialized managed services.

Type Insights

The private type segment held the dominating share in the market in 2025. The rising demand for ultra-reliable low-latency connections for Industrial Internet of Things (IIoT) applications, such as industrial cameras, collaborative robots, and industrial sensors, is the main factor driving the segment growth. A private 5G network offers enhanced security for businesses, ensuring that their infrastructure and data are protected from attacks. In addition, it is anticipated to become a crucial component when information secrecy is of the greatest importance.

The public type segment is expected to grow at the fastest CAGR during the forecast period. The benefits offered by public 5G networks, such as better coverage, high resilience on multiple operators, scalability, and data security, are driving the segment growth. A public 5G network is often designed to offer large bandwidths for data-intensive applications, such as video telephony and streaming video. High bandwidth is a major selling point for mobile service providers currently deploying 5G in several nations worldwide. Users in urban areas can get very large bandwidths through small radio cells and high frequencies. The growing demand for high-speed and ultra-low latencies is driving the demand for public 5G infrastructure.

Spectrum Insights

The sub-6 GHz segment dominated the market in 2025. Sub-6 GHz networks operate within a frequency range of up to 6 GHz, with the widely used 3.5 GHz frequency being a common choice worldwide. Sub-6 GHz provides a lower frequency range of approximately 1 GHz to 6 GHz, offering broader coverage despite limitations in speed. This makes it a practical option for real-world implementation. Additionally, the sub-6 GHz spectrum has been utilized in previous-generation networks, making it a cost-effective and accessible approach for implementing 5G. The segment is further bifurcated into the low band (below 1 GHz), which offers greater coverage but lower speed, and the mid-band (1 GHz - 6 GHz), which strikes a balance between speed and coverage.

The mmWave segment is anticipated to grow at the fastest CAGR from 2026 to 2033, owing to the higher radio frequency bands ranging from 24 GHz to 40 GHz, which offer super-fast 5G and deliver faster than usual internet speeds. The FCC in the United States has introduced several mmWave frequencies, including 47.2-48.2 GHz, 24.25-24.45 GHz, 38.6-40 GHz, and 24.75-25.25 GHz, to enable low-latency connectivity for applications such as autonomous vehicles. Moreover, other countries, such as South Korea, Japan, and Italy, have also released mmWave frequencies to boost their data services. The concerted efforts of governments worldwide in releasing mmWave frequencies are expected to drive the segment growth in the forecast period.

Network Architecture Insights

The non-standalone segment dominated the market in 2025. Non-standalone network architecture is a cost-effective solution that leverages existing 4G infrastructure to enhance Enhanced Mobile Broadband (eMBB) services without necessitating a complete infrastructure overhaul. It has played a crucial role in the initial rollouts of 5G networks, providing customers with higher data transfer speeds and acting as a transitional platform for both customers and carriers. The segment's growth is driven by the widespread adoption of non-standalone networks globally. Leading service providers such as Verizon Communication, Inc., AT&T, Inc., and China Mobile Ltd. have already implemented 5G non-standalone networks for various applications, including UHD videos and cloud-based AR/VR gaming.

The standalone segment is expected to grow at the fastest CAGR over the forecast period. Standalone 5G networks utilize a dedicated 5G core to handle critical functions such as connectivity, mobility, and user authentication. Unlike non-standalone architectures that rely on 4G LTE infrastructure, standalone networks enable the full range of 5G features and capabilities. The demand for standalone networks is expected to increase over the forecast period as industries embrace digitalization and seek uninterrupted machine-to-machine connectivity. There is also a growing need for ultra-reliable, low-latency connectivity, especially for applications in transportation and logistics. These factors drive the demand for 5G infrastructure, as businesses across various industries require faster data speeds to support their operations.

Vertical Insights

The enterprise/corporate segment dominated the market in 2025. The enterprise/corporate segment is experiencing significant growth due to the increasing need for higher data bandwidth in various corporate businesses. A wide range of use cases, such as virtual meetings, cloud computing, and the adoption of IoT-based smart workplaces, drives this surge in demand. These applications rely on robust and uninterrupted connectivity to facilitate efficient communication and data exchange. As a result, enterprises are seeking enhanced connectivity solutions to meet their growing bandwidth requirements and ensure seamless operations.

The industrial segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by the critical need for uninterrupted communication in various industrial applications, such as Automated Guided Vehicles (AGVs), wireless cameras, and collaborative/cloud robots, among other technologies. As industries transition toward implementing Industry 4.0, which relies on advanced connectivity, the demand for robust network infrastructure is expected to rise. The emphasis on seamless communication in industrial settings, coupled with the growing adoption of Industry 4.0 principles, creates favorable conditions for the expansion of the industrial segment.

Regional Insights

The North America 5G infrastructure market held a significant share in 2025. The growth of the market in the region is supported by strong investments from leading telecom operators, technology companies, and cloud providers. The region benefits from early adoption of advanced network technologies, widespread fiberization, and active deployment of small cells and millimeter-wave systems.

U.S. 5G Infrastructure Market Trends

The U.S. 5G infrastructure market held a dominant position in 2025. The growth in the region is driven by large-scale investments from major operators such as Verizon, AT&T, and T-Mobile. Substantial capital expenditure is directed toward expanding mid-band and mmWave coverage, supported by government-led spectrum auctions and innovation-focused policies.

Europe 5G Infrastructure Industry Trends

The Europe 5G infrastructure market was identified as a lucrative region in 2025. The market growth is supported by coordinated regulatory frameworks, significant government funding programs, and the strategic push toward digital transformation. European nations are prioritizing secure, diversified network infrastructure with a strong emphasis on Open RAN, cloud-native architectures, and cross-border interoperability.

5G infrastructure market in Germany is expected to grow rapidly in the coming years, driven by accelerated deployments from major operators alongside strong industrial demand for private 5G networks. The country’s leadership in manufacturing, automotive, and industrial automation creates substantial opportunities for 5G-enabled applications.

Italy 5G infrastructure market is witnessing steady growth in 5G infrastructure investments as operators expand coverage across urban and semi-urban regions. National recovery and digitalization programs are promoting the modernization of telecom networks and encouraging deployments aligned with EU connectivity objectives.

Asia Pacific 5G Infrastructure Market Trends

The Asia Pacific 5G infrastructure market is expected to grow at the fastest CAGR of 14.3% over the forecast period. The growth in the region is supported by large-scale operator investments, government-led digital transformation agendas, and rapidly expanding mobile broadband demand. The region is characterized by a mix of highly advanced markets and emerging high-growth economies, all investing heavily in 5G deployment.

5G infrastructure industry in China is expected to grow rapidly in the coming years. China leads the global 5G infrastructure market in terms of deployment scale, equipment production, and technology adoption. State-led policies and significant investments from major operators underpin nationwide coverage expansion.

India’s 5G infrastructure market is undergoing rapid development, supported by aggressive rollout plans from leading telecom operators and strong policy support from the government. The country is prioritizing nationwide coverage expansion, spectrum optimization, and development of indigenous 5G technologies.

Key 5G Infrastructure Market Company Insights

Some of the key companies in the 5G infrastructure market include Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Nokia Corporation, Telefonaktiebolaget LM Ericsson, ZTE Corporation, CommScope Inc., and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Samsung Electronics Co., Ltd., is a technology provider with major operations in consumer electronics, semiconductors, telecommunications, and digital media. In the realm of 5G infrastructure, Samsung has established itself as a key innovator and provider, developing cutting-edge network equipment including base stations, virtualized RAN (vRAN) solutions, and massive MIMO technologies that support high-speed, low-latency connectivity. The company invests heavily in R&D to advance 5G capabilities alongside AI and IoT, powering deployments for telecom operators worldwide and holding significant market share in radio access network hardware.

-

Nokia Corporation is a telecommunications provider specializing in network infrastructure, including 5G core, radio access networks, and cloud-native solutions that power high-performance connectivity for service providers and enterprises. The company drives 5G adoption through innovations such as private 5G networks for industrial AI, Fixed Wireless Access (FWA), and integrations with edge computing and AI.

Key 5G Infrastructure Companies:

The following are the leading companies in the 5G infrastructure market. These companies collectively hold the largest market share and dictate industry trends.

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- CommScope Inc.

- Cisco Systems, Inc.

- NEC Corporation

- Hewlett Packard Enterprise Development LP

- Mavenir

Recent Developments

-

In December 2025, SOLiD, a cellular in-building coverage provider, unveiled the next-generation BTS Interface Unit (nBIU), the fourth-generation headend for its ALLIANCE 5G distributed antenna system (DAS) platform designed for multi-operator networks in high-capacity venues such as arenas, stadiums, and airports. The nBIU doubles the RF port and optical capacity of prior generations, offering up to 16 fiber-optic and 32 RF connections per chassis, while shrinking the design to a compact three-rack-unit size, achieving up to 70% space reduction with support for redundant power supplies, direct edgeROU remote connections, and one-sector 2x2 MIMO or two-sector SISO configurations.

-

In December 2025, Nokia and Tampnet, an offshore communications provider, are partnering to modernize and expand 5G private wireless connectivity across the Gulf of Mexico, deploying Nokia's 5G AirScale Radio Access equipment over Tampnet's network of 120 active base stations and expanding coverage to 350-400 FPSO units, platforms, rigs, wind farms, and vessels. This initiative builds on the autonomous private 5G edge network deployed on a Norwegian offshore platform in early 2025, enabling advanced applications such as enhanced worker safety, predictive maintenance, real-time remote monitoring, scalable automation, and ultra-low latency operations, all supported by Tampnet's subsea fiber infrastructure.

5G Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 56.32 billion

Revenue forecast in 2033

USD 133.19 billion

Growth rate

CAGR of 13.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, spectrum, network architecture, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Huawei Technologies Co., Ltd.; Samsung Electronics Co., Ltd.; Nokia Corporation; Telefonaktiebolaget LM Ericsson; ZTE Corporation; CommScope Inc.; Cisco Systems, Inc.; NEC Corporation; Hewlett Packard Enterprise Development LP; Mavenir

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G Infrastructure Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global 5G infrastructure market report based on component, type, spectrum, network architecture, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Radio Access Network (RAN)

-

Core Network

-

Backhaul & Transport

-

FrontHaul

-

MidHaul

-

-

Services

-

Consulting

-

Implementation & Integration

-

Support & Maintenance

-

Training & Education

-

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Public

-

Private

-

-

Spectrum Outlook (Revenue, USD Million, 2021 - 2033)

-

Sub-6 GHz

-

Low Band

-

Mid Band

-

-

mmWave

-

-

Network Architecture Outlook (Revenue, USD Million, 2021 - 2033)

-

Standalone

-

Non-standalone

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Enterprise/Corporate

-

Smart City

-

Industrial

-

Energy & Utility

-

Transportation & Logistics

-

Public Safety & Defense

-

Healthcare Facilities

-

Retail

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G infrastructure market size was estimated at USD 41.39 billion in 2025 and is expected to reach USD 56.32 billion in 2026.

b. The global 5G infrastructure market is expected to grow at a compound annual growth rate of 13.1% from 2026 to 2033 to reach USD 133.19 billion by 2033.

b. Asia Pacific dominated the 5G infrastructure market with a share of over 46.0%% in 2025. The regional market's growth can be attributed to increasing initiatives by the governments of several countries to enhance the digital and network infrastructure owing to growing internet penetration

b. Some key players operating in the 5G infrastructure market include Altiostar; HUAWEI TECHNOLOGIES CO., LTD.; Nokia Corporation; Samsung Electronics Co., Ltd.; Telefonaktiebolaget LM Ericsson; ZTE Corporation; Airspan Networks Holdings Inc.; Fujitsu Limited; CommScope Inc.; Corning; NEC Corporation; CISCO SYSTEMS, Inc.; Hewlett Packard Enterprise Development LP; CERAGON; CASA SYSTEMS; Mavenir; Comba Telecom Systems Holdings Ltd.

b. Key factors that are driving the 5G infrastructure market growth include Continuing rise in data traffic and resulting need for network capacity expansion, increasing deployment of 5G network infrastructure for smart city use-case applications, and rising adoption of internet of things (IoT) technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.