- Home

- »

- Advanced Interior Materials

- »

-

Defense HVAC Systems Market Size, Industry Report, 2033GVR Report cover

![Defense HVAC Systems Market Size, Share & Trends Report]()

Defense HVAC Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Equipment (Air Handling Units, Chillers), By Type (Portable Climate Control Systems, Vehicle HVAC), By End Use, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-668-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Defense HVAC Systems Market Summary

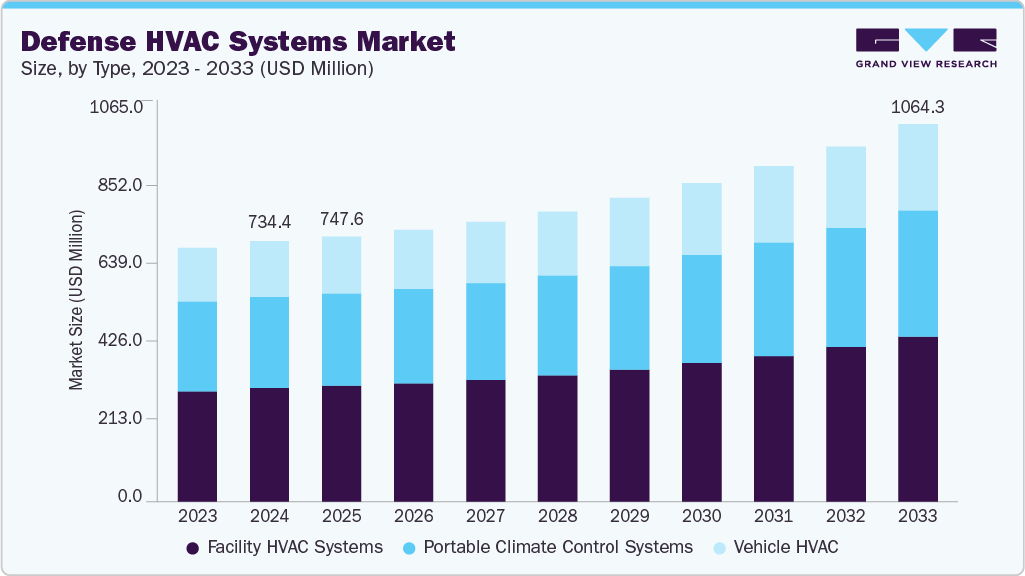

The global defense HVAC systems market size was estimated at USD 734.4 million in 2024 and is projected to reach USD 1,064.3 million by 2033, growing at a CAGR of 4.5% from 2025 to 2033. The industry is driven by the increasing need for climate control in extreme and diverse operational environments.

Key Market Trends & Insights

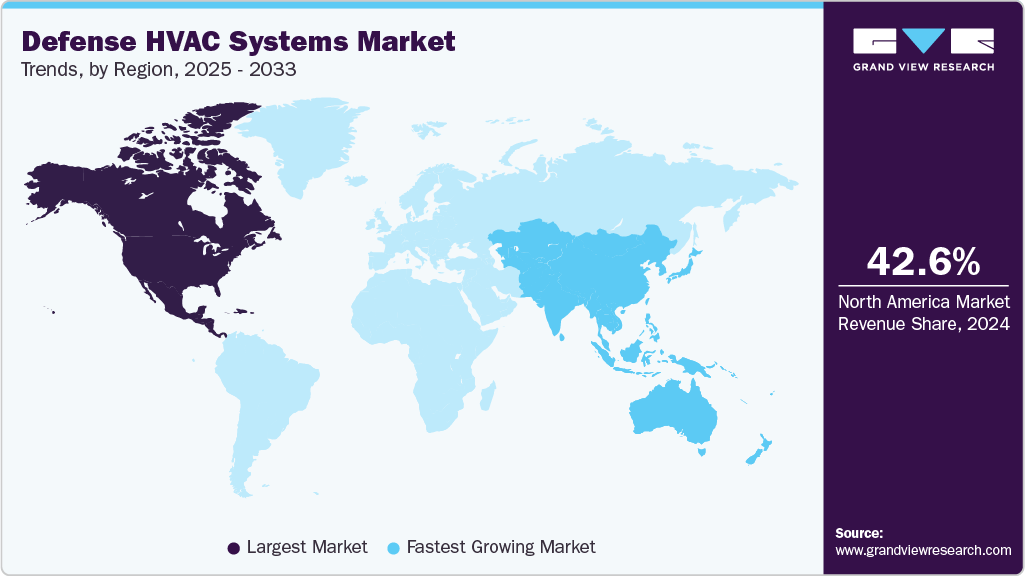

- North America dominated the defense HVAC systems industry with the largest revenue share of 42.6% in 2024.

- The defense HVAC systems market in the U.S. is expected to grow at a substantial CAGR of 4.4% from 2025 to 2033.

- By type, the vehicle HVAC segment is expected to grow at a considerable CAGR of 5.4% from 2025 to 2033 in terms of revenue.

- By end use, military organizations segment is expected to grow at a considerable CAGR of 4.7% from 2025 to 2033 in terms of revenue.

- By equipment, chillers segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 734.4 Million

- 2033 Projected Market Size: USD 1,064.3 Million

- CAGR (2025-2033): 4.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

Defense forces require reliable heating, ventilation, and cooling systems to maintain the efficiency and safety of personnel and sensitive equipment. Another key driver is the rising investment in defense infrastructure such as bases, command centers, and mobile units, which require integrated and energy-efficient HVAC systems. The growing use of specialized military vehicles and aircraft also necessitates compact and rugged HVAC units. Moreover, stricter regulatory standards on environmental performance and energy use are pushing innovation in eco-friendly HVAC solutions. These factors collectively support sustained growth in the defense HVAC systems market.

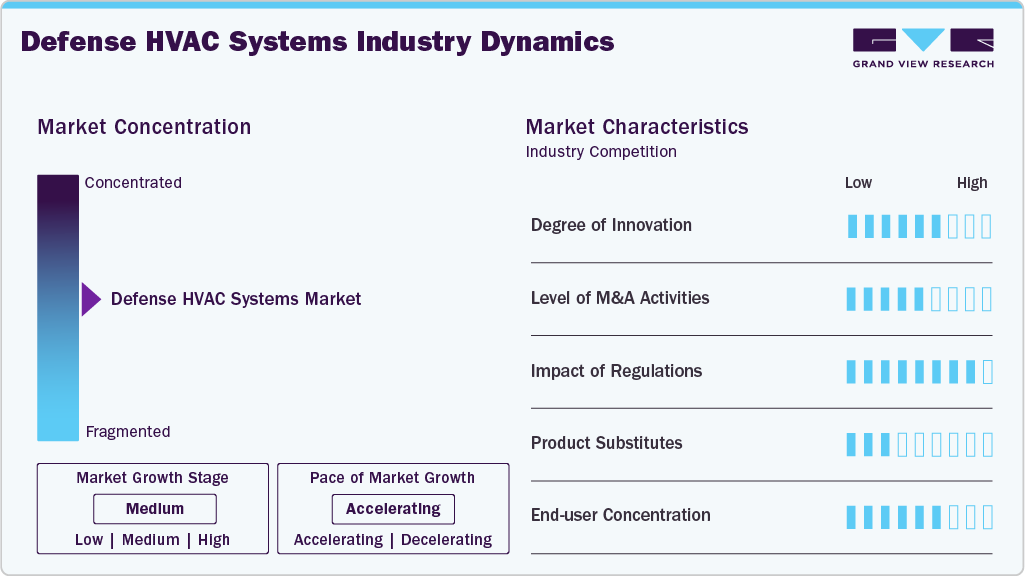

Market Concentration & Characteristics

The industry is moderately concentrated, with a few key players holding significant market share due to high entry barriers and specialized technical requirements. Leading companies often benefit from long-term government contracts and established defense relationships. Smaller firms face challenges entering the market due to strict compliance, certification needs, and capital-intensive R&D. As a result, competition is primarily among a limited number of well-established defense contractors and HVAC manufacturers.

The industry exhibits a moderate to high degree of innovation, with advancements focused on improving energy efficiency, system miniaturization, and operational reliability in harsh conditions. Manufacturers are integrating smart controls and environmentally friendly refrigerants to meet evolving defense needs. Innovation is also driven by the demand for modular and lightweight systems in mobile defense platforms. Continuous R&D investments support the development of next-generation HVAC technologies tailored for military use.

The industry sees a steady level of mergers and acquisitions, primarily driven by the need for technological enhancement and market expansion. Major defense contractors often acquire HVAC specialists to strengthen their system integration capabilities. Strategic partnerships and acquisitions help companies broaden their defense offerings and enter new geographic markets. This trend also supports quicker adaptation to changing defense procurement needs.

Regulations significantly impact the industry, especially those concerning environmental safety, energy efficiency, and military standards. Compliance with defense-specific certifications and international norms is mandatory for suppliers. Governments also enforce policies related to emissions and the use of low-GWP refrigerants. These regulatory requirements influence product design, material selection, and production processes across the industry.

Drivers, Opportunities & Restraints

The increasing demand for advanced HVAC systems in military vehicles, bases, and portable shelters is a key growth driver. Rising defense budgets and modernization initiatives are boosting the adoption of efficient climate control technologies. Extreme weather conditions in deployment zones further necessitate reliable HVAC solutions. Additionally, technological advancements in compact and rugged systems enhance operational readiness.

Growing investments in unmanned systems and mobile command units present new opportunities for HVAC integration. The shift toward green and energy-efficient defense infrastructure creates demand for sustainable HVAC solutions. Emerging markets are expanding their defense capabilities, opening avenues for new installations. Additionally, innovations in smart and remote-controlled HVAC systems offer potential for future growth.

High development and installation costs of specialized HVAC systems can limit market adoption. Stringent defense regulations and certification processes increase time-to-market and operational complexity. Dependence on government contracts makes revenue streams vulnerable to policy and budget changes. Moreover, logistical challenges in integrating HVAC units into compact and mobile platforms pose design limitations.

Type Insights

Vehicle HVAC system is expected to grow at a considerable CAGR of 5.4% from 2025 to 2033 in terms of revenue. The facility HVAC systems segment dominated the market and accounted for a share of 43.5% in 2024, due to their widespread use in military bases, training centers, and command posts. These systems ensure optimal indoor air quality and climate control for personnel and equipment. Their large-scale deployment and longer operational life contribute to a higher market share. Additionally, rising investments in upgrading defense infrastructure support continued demand.

Vehicle HVAC systems are the fastest-growing segment, driven by the increasing use of armored vehicles, tanks, and mobile units in diverse climates. These systems are essential for maintaining comfort and functionality in enclosed military vehicles. The need for compact, durable, and energy-efficient solutions fuels innovation in this segment. Growth is further supported by the rising procurement of tactical and combat vehicles worldwide.

Equipment Insights

The chillers segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2033 in terms of revenue. Heat pumps led the market and accounted for a share of 44.7% in 2024 due to their dual heating and cooling capabilities, offering energy-efficient solutions for military facilities. Their versatility and low environmental impact make them ideal for long-term installations. Defense sectors favor heat pumps for their reduced operational costs and maintenance needs. Growing emphasis on sustainability further drives their widespread adoption.

Chillers are the fastest-growing equipment segment, driven by rising demand for precision cooling in critical military environments. These systems are essential for maintaining optimal conditions in data centers, radar stations, and communication hubs. Technological advancements have improved their efficiency and portability for field applications. The need for high-capacity cooling in advanced defense systems accelerates their deployment.

Application Insights

The command centers segment is expected to grow at a considerable CAGR of 5.1% from 2025 to 2033 in terms of revenue. Military Bases led the market and accounted for a share of 44.8% in 2024 due to their extensive infrastructure and constant operational requirements. These facilities need robust HVAC systems to ensure personnel comfort, equipment safety, and mission readiness. The continuous upgrade of base facilities across countries supports strong demand. Additionally, their size and fixed location make them ideal for large-scale HVAC installations.

Command centers are the fastest-growing application segment, driven by the increasing reliance on advanced technology and data systems. These centers require precise climate control to ensure the performance of sensitive electronics and communication equipment. Growing investments in mobile and fixed command infrastructure boost HVAC needs. The demand for uninterrupted operations in secure environments accelerates adoption.

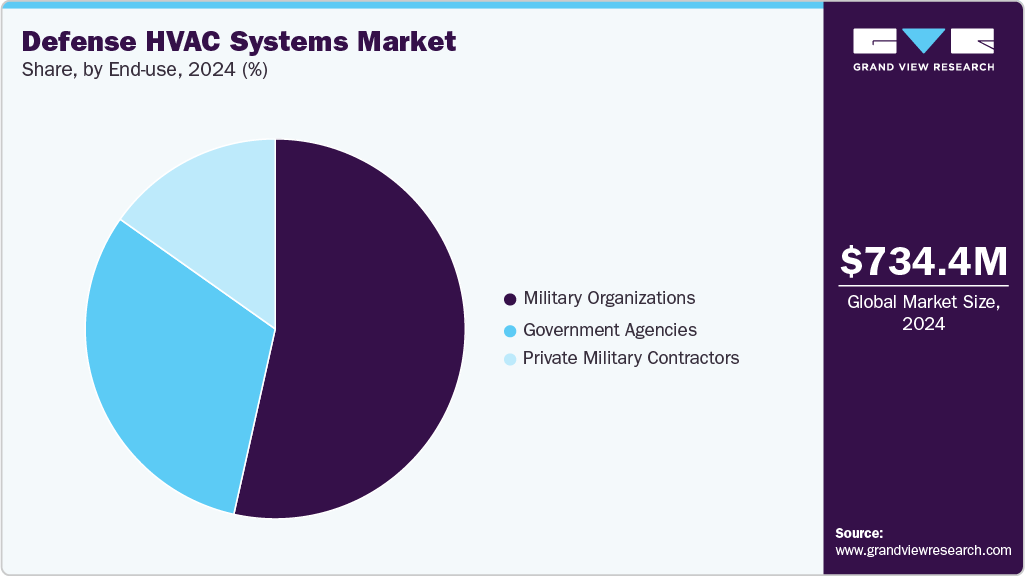

End Use Insights

The government agencies segment is expected to grow at a significant CAGR of 4.6% from 2025 to 2033 in terms of revenue. Military organizations dominated the market and accounted for a share of 53.5% in 2024, owing to their large-scale operations and extensive infrastructure. They require reliable HVAC solutions for bases, field hospitals, and vehicles to ensure operational efficiency. Continuous modernization and global deployments further drive demand in this segment. Long-term defense budgets and procurement programs reinforce their leading position.

Government agencies are witnessing significant growth in HVAC adoption, particularly for border control, disaster response, and emergency services. These agencies increasingly invest in mobile command centers and field units that require efficient climate control. The focus on national security and civil defense boosts their HVAC system needs. Additionally, climate resilience initiatives support further expansion in this segment.

Regional Insights

North America defense HVAC systems market dominated the global industry and accounted for 42.6% share in 2024 due to its high defense spending and advanced military infrastructure. The U.S. Department of Defense consistently invests in modernizing HVAC systems across bases, vehicles, and mobile units. Established defense contractors and technological leadership further support market growth. Additionally, extreme weather zones across the region necessitate reliable climate control solutions.

U.S. Defense HVAC Systems Market Trends

The defense HVAC systems market in the U.S.leads the North American region due to its large-scale military operations and substantial defense budget. Ongoing modernization of military bases and mobile units drives continuous demand for advanced HVAC solutions. The country’s focus on energy-efficient and smart climate control systems supports innovation. Additionally, extreme weather zones across the U.S. necessitate robust and reliable HVAC installations.

Canada defense HVAC systems market is witnessing steady growth, driven by increased investments in Arctic and cold-weather military infrastructure. The government is upgrading bases and mobile units to improve operational efficiency in harsh climates. Emphasis on sustainable and low-emission HVAC systems aligns with national environmental goals. Canada's participation in NATO and peacekeeping missions also supports the need for reliable climate control technologies.

Europe Defense HVAC Systems Market Trends

The defense HVAC system market in Europe is driven by increased military collaboration and rising defense budgets. NATO members are enhancing their operational readiness through infrastructure upgrades and advanced HVAC deployment. The region also focuses on energy-efficient and eco-friendly HVAC technologies in line with EU regulations. Growing security concerns and geopolitical tensions accelerate modernization efforts.

Germany defense HVAC systems market dominates the European region due to its increasing defense budget and infrastructure upgrades. The country is modernizing military bases and enhancing climate control systems in armored vehicles and command centers. Emphasis on energy efficiency and compliance with EU environmental standards drives the adoption of advanced HVAC technologies. Germany’s role in NATO operations also contributes to sustained demand.

The defense HVAC systems market in the UK is the fastest-growing market in Europe, driven by the modernization of naval bases, airfields, and mobile military units. Investments in smart and portable HVAC systems for rapid deployment in overseas operations are rising. The UK government prioritizes energy-efficient and eco-friendly solutions in line with climate policies. Additionally, heightened focus on homeland security and global military presence drives system integration.

Asia Pacific Defense HVAC Systems Market Trends

The defense HVAC systems market in Asia Pacific is the fastest-growing region at a CAGR of 5.5%, due to rapid industrialization, urbanization, and infrastructure development in countries like China and India. A strong automotive base and expanding shipbuilding industry contribute to high equipment demand. Government initiatives supporting manufacturing and skill development also aid market expansion. Low labor costs and rising foreign investments further boost regional growth.

China defense HVAC systems market dominates the Asia Pacific due to large-scale military expansion and infrastructure development. The country is heavily investing in upgrading bases, naval fleets, and mobile units with advanced climate control systems. Harsh regional climates and diverse terrains increase the need for reliable and adaptive HVAC solutions. Additionally, domestic manufacturing capabilities and defense R&D support technological advancements.

The defense HVAC systems market in India is driven by rising defense spending and border infrastructure enhancement. The government’s focus on modernizing military facilities and armored vehicle fleets boosts HVAC system demand. Climatic extremes across deployment zones necessitate efficient and durable systems. The “Make in India” initiative further encourages domestic production and integration of advanced HVAC technologies.

Middle East & Africa Defense HVAC Systems Market Trends

The defense HVAC systems market in the Middle East and Africa region is witnessing steady growth, primarily driven by the oil & gas, construction, and energy sectors. Countries like the UAE and Saudi Arabia are investing in industrial infrastructure and renewable energy projects. However, limited manufacturing capabilities constrain widespread adoption. Growth is expected as diversification efforts and industrial investments increase.

Saudi Arabia defense HVAC systems market is expanding rapidly due to ongoing military infrastructure development and strategic national projects under Vision 2030. The country’s extremely high temperatures create a strong need for efficient and durable cooling systems across bases and mobile units. Growing emphasis on energy-efficient and environmentally friendly technologies supports the adoption of advanced HVAC solutions. Additionally, increased local defense manufacturing and partnerships are driving domestic demand for integrated HVAC systems.

Latin America Defense HVAC Systems Market Trends

The defense HVAC systems market in Latin America is emerging, with Brazil and Mexico leading in industrial growth and automotive production. The demand for welding equipment is rising due to infrastructure projects and regional manufacturing expansion. However, market development is somewhat limited by economic volatility. Increasing foreign investment and industrialization present future opportunities.

Brazil defense HVAC systems market is experiencing steady growth, driven by the modernization of military bases and infrastructure across the country. Rising investments in command facilities, border security, and defense data centers are increasing the need for advanced climate control systems. The country’s diverse climate conditions, from hot, humid zones to cooler regions, demand adaptable and reliable HVAC solutions. Additionally, national efforts to promote energy efficiency and local manufacturing support the adoption of sustainable HVAC technologies in defense applications.

Key Defense HVAC Systems Companies Insights

Key players operating in the defense HVAC systems market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Defense HVAC Systems Companies:

The following are the leading companies in the defense HVAC systems market. These companies collectively hold the largest market share and dictate industry trends.

- Meggitt

- DAIKIN INDUSTRIES Ltd.

- Trans ACNR.

- Eberspächer

- Echoblue Ltd.

- Advanced Cooling Technologies, Inc.

- Grayson

- DC Airco

- ECU Corporation

- Trane

- Munters

- TAT Technologies

- Honeywell International Inc.

- BAE Systems

- Collins Aerospace

Recent Developments

-

In July 2025, ECU Corporation introduced a specialized line of HVAC systems built for highly demanding environments like defense installations and nuclear sites. These systems meet strict military and industrial standards, offering resistance to shock, radiation, and electromagnetic interference. Designed for reliability in critical conditions, they are suited for use in radar stations and containment facilities. The company focuses on custom solutions that prioritize durability, safety, and operational precision.

-

In January 2025, the U.S. Department of Defense invested $90 million to secure a reserve of hydrofluorocarbons (HFCs) essential for military cooling and fire suppression systems. This investment supports operational readiness amid global restrictions on HFC production and usage. The Defense Logistics Agency will manage storage and facility upgrades to safeguard the supply. This initiative ensures continuous climate control capabilities across military operations worldwide.

Global Defense HVAC Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 747.6 million

Revenue forecast in 2033

USD 1,064.3 million

Growth rate

CAGR of 4.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, equipment, application, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Meggitt.; DAIKIN INDUSTRIES Ltd.; Trans ACNR.; Eberspächer; Echoblue Ltd.; Advanced Cooling Technologies, Inc.; Grayson; DC Airco; ECU Corporation; Trane; Munters; TAT Technologies; Honeywell International Inc.; BAE Systems; Collins Aerospace

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Defense HVAC Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global defense HVAC systems market report based on type, end use, equipment, application and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Portable Climate Control Systems

-

Vehicle HVAC

-

Facility HVAC Systems

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Military Organizations

-

Government Agencies

-

Private Military Contractors

-

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Air Handling Units

-

Chillers

-

Dehumidification Systems

-

Air Filtration Systems

-

Air Conditioning Systems

-

Heat Pump

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Military Bases

-

Vehicles

-

Field Operations

-

Command Centers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

- Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global defense HVAC systems market size was estimated at USD 734.4 million in 2024 and is expected to be USD 747.6 million in 2025.

b. The global defense HVAC systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033 to reach USD 1,064.3 million by 2033.

b. The military organizations segment dominated the market and accounted for a share of 53.5% in 2024 owing to their large-scale operations and extensive infrastructure. They require reliable HVAC solutions for bases, field hospitals, and vehicles to ensure operational efficiency. Continuous modernization and global deployments further drive demand in this segment.

b. Some of the key players operating in the global defense HVAC systems market include Meggitt.; DAIKIN INDUSTRIES Ltd.; Trans ACNR.; Eberspächer; Echoblue Ltd.; Advanced Cooling Technologies, Inc.; Grayson; DC Airco; ECU Corporation; Trane; Munters; TAT Technologies; Honeywell International Inc.; BAE Systems; Collins Aerospace.

b. Key factors driving the global defense HVAC systems market include rising military modernization efforts and the need for reliable climate control in extreme environments. Increasing deployment of mobile units and advanced military vehicles further boosts demand for compact and energy-efficient systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.