- Home

- »

- Advanced Interior Materials

- »

-

Dehumidifier Market Size, Share And Trends Report, 2030GVR Report cover

![Dehumidifier Market Size, Share & Trends Report]()

Dehumidifier Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Refrigerative Dehumidifier, Desiccant Dehumidifier), By Product, By Application (Residential, Industrial, Commercial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-570-0

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dehumidifier Market Summary

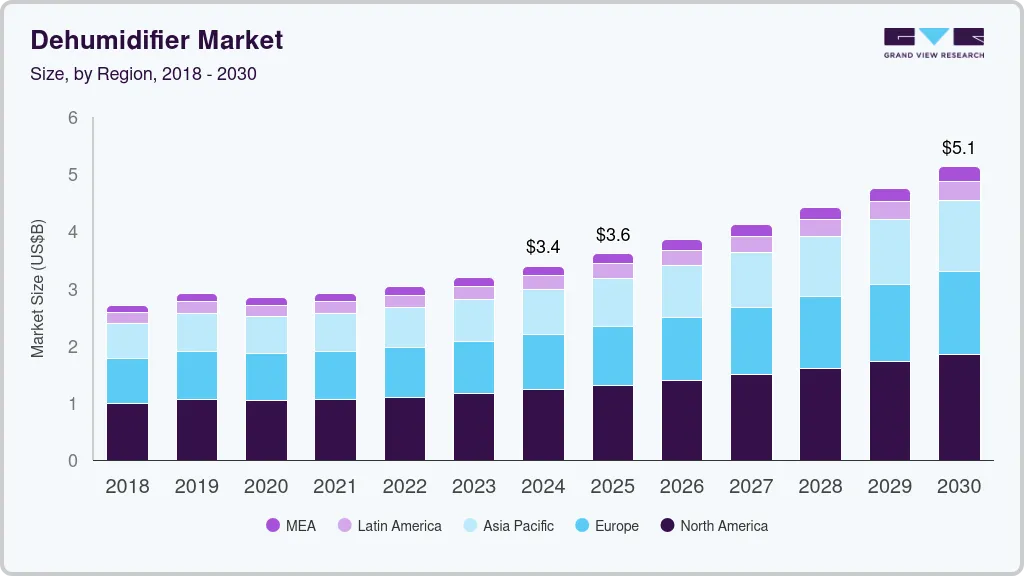

The global dehumidifier market size was estimated at USD 3.39 billion in 2024 and is projected to reach USD 5.12 billion by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The expansion of the construction and real estate sectors contributes significantly to market growth as new buildings often require effective humidity management systems to ensure indoor air quality.

Key Market Trends & Insights

- North America represented a significant revenue share of 36.3% in 2024.

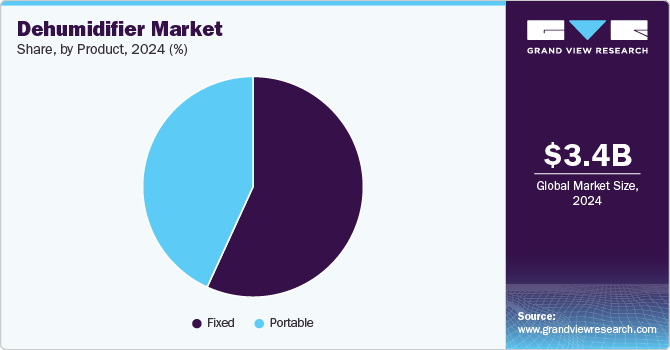

- By product, the fixed dehumidifier segment made up 57.0% of the market share in 2024.

- By application, the industrial segment emerged as the dominant segment, capturing a 45.6% share of global revenue in 2024.

- By technology, the refrigerative dehumidifiers segment represented 30.1% of the global market's revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.39 Billion

- 2030 Projected Market Size: USD 5.12 billion

- CAGR (2025-2030): 7.3%

- North America: Largest market in 2024

Technological advancements in dehumidifier design, including energy-efficient models and smart features, also attract consumers seeking modern solutions.

Increasing humidity levels in various regions, driven by climate change and urbanization, create a higher demand for effective moisture control solutions. The rising awareness of the health risks associated with excess humidity, such as mold growth and respiratory issues, prompts both residential and commercial sectors to invest in dehumidifiers.

Drivers, Opportunities & Restraints

The growth of industries such as pharmaceuticals, food and beverage, and electronics, which require specific humidity levels for production and storage, drives demand for industrial dehumidifiers. Regulatory standards focused on indoor air quality and environmental sustainability further encourage the adoption of dehumidifiers.

A significant factor is the high initial cost of advanced dehumidifiers, which can deter consumers and businesses, particularly in price-sensitive regions. Additionally, the energy consumption of some models raises concerns about operational costs and environmental impact, leading some users to hesitate to adopt these devices

The ongoing urbanization and expansion of the construction industry, particularly in developing regions, provide opportunities for market growth. The integration of smart technology into dehumidifiers, allowing for remote monitoring and control, is also a factor expected to attract tech-savvy consumers.

Technology Insights

“The demand for the desiccant dehumidifier segment is expected to grow at a significant CAGR of 7.5% from 2025 to 2030 in terms of revenue”

Desiccant dehumidifiers have gained widespread acceptance in various commercial and industrial contexts across the globe, particularly in scenarios where specific humidity levels are crucial. These systems find applications in sectors like food processing, pharmaceuticals, and storage facilities. An increase in the construction of manufacturing plants, storage areas, water treatment plants, and lithium-ion battery factories is likely to boost the market for desiccant dehumidifiers.

In 2023, the refrigerative dehumidifiers segment represented 30.1% of the global market's revenue. These dehumidifiers are favored across industrial, commercial, and residential sectors for their cost-effectiveness and ease of use. The market segment for refrigerative dehumidifiers is expanding, thanks to continuous innovation and the introduction of new products worldwide. Investments in research and development for more efficient technologies by manufacturers are propelling revenue growth through the launch of new products.

Application Insights

“The growth of the residential segment is expected to grow at a fast-paced CAGR of 7.7% from 2024 to 2030 in terms of revenue”

Dehumidifiers play a crucial role in residential areas such as bathrooms, basements, kitchens, bedrooms, and storage spaces. In countries like the U.S., Canada, Germany, and other northern regions, the cold winter temperatures necessitate heating, which in turn increases indoor humidity levels. Hence, efficient dehumidification solutions are essential. The rising population in these countries has led to a surge in residential construction, which is expected to boost the demand and sales of residential dehumidifiers worldwide.

In 2024, the industrial segment emerged as the dominant segment, capturing a 45.6% share of global revenue. Dehumidifiers find extensive use in industries like food & beverage, pharmaceuticals, woodworking, and textiles to manage air moisture and prevent product contamination. The anticipated expansion of industrial manufacturing activities is a significant driver for the growth of this segment over the forecast period.

Product Insights

“The growth of the portable segment is expected to grow at a rapid CAGR of 7.6% from 2024 to 2030 in terms of revenue”

In colder countries such as Canada, the U.S., Germany, and Switzerland, heating systems are essential to maintain comfortable temperatures. However, heating can elevate humidity levels, leading to mold growth and dust mite proliferation, as well as corrosion of metal components. Using a portable dehumidifier, which can easily be placed in any room needing moisture control, can prevent these issues. This utility is a key driver behind the rising demand for portable dehumidifiers in the market.

The fixed dehumidifier segment made up 57.0% of the market share in 2024. This segment's growth is propelled by an increase in manufacturing sites, storage spaces, semiconductor production, and the hospitality industry. The burgeoning demand for electronic devices and smart technology necessitates semiconductor manufacturing, where humidity control is critical, thus encouraging the broader adoption of dehumidification systems.

Regional Trends

North America dehumidifier market dominated the global industry in 2024. The region is expected to continue its dominance in the market from 2023 to 2030. The surged industrial production, the increased number of commercial businesses, and the growing awareness among homeowners in North America fuel the growth of the market in this region.

Dehumidifiers are essential in the food & beverages industry for removing the excess amount of humidity that may cause hygiene issues. Snacks, spices, processed meat products, confectionery, etc., require controlled and consistent moisture conditions. Using dry air from dehumidifiers helps in controlling moisture, resulting in the perfect coating of confectioneries and the long shelf life of food products. Surging demand for industrial dehumidifiers in the U.S. is anticipated to drive the growth of the market in the country over the forecast period.

Europe Dehumidifiers Market Trends

The dehumidifier market in Europe is driven by factors such as the ongoing development of the real estate industry, changes in weather conditions, an increase in disposable income, and increasing awareness of healthy and comfortable living.There are several European standards for HVAC systems in both residential and non-residential environments. Their primary focus is always on room air quality and air hygiene. Meanwhile, energy-efficient operations have become increasingly vital. All these factors are expected to boost demand for dehumidifiers.

Germany dehumidifier market dominated the European region, accounting for a share of 25.4% in 2024. The rise in demand for dehumidifiers in Germany can be ascribed to the increased awareness of health and fitness across populations. Customers are actively concerned about maintaining a healthy living environment at home, which increases the need for dehumidifiers to improve indoor air quality. Furthermore, due to an increase in allergy susceptibility of adults and infants, household dehumidifiers are gaining market traction.

The dehumidifier market in France held 18.4% of the region’s market share in 2024. France is one of the largest bread and bakery product markets in the European region. Dehumidifiers reduce the moisture content of the surrounding air while maintaining relative humidity (RH) at a constant level during production, storage, and packing to preserve the freshness of processed food and improve the quality for a longer period. Food's moisture content influences its taste, look, and shelf life. Correctly managing the air moisture and humidity inside a food and beverage manufacturing plant will not only result in the optimization of production processes but will also result in a sanitary and safe working environment. The growing food and beverage industry is expected to boost the demand for dehumidifiers over the forecast period.

Asia Pacific Dehumidifier Market Trends

The dehumidifier market in Asia Pacific is expected to grow significantly over the forecast period, owing to the increased construction activity in India and China. Furthermore, the rising demand for smart buildings, growing awareness about air quality, and increased consumer disposable income are likely to have a positive impact on the market growth over the forecast period.

China dehumidifier market held a 44.0% market share in 2024. Rapid urbanization in China is one of the primary factors boosting the growth of the construction sector. The government has implemented the National New-type Urbanization Plan 2014-2020 to manage excessive growth in urban areas. The growth in the construction industry is also facilitating the growing demand for portable dehumidifiers. Various demographic factors, such as the rising elderly population and increasing standards of living owing to urbanization, are expected to drive the construction industry.

The dehumidifier market in India accounted for a 24.1% market share in 2024, driven by the country's commitment to energy efficiency and sustainability. The growing health awareness and rising standard of living in metro cities in the country are expected to drive the demand for dehumidifiers to keep indoor moisture levels within the desirable range. The rising air pollution and changes in weather have created the risk of asthma triggered by particulate matter. Dehumidifiers are used to prevent such diseases by improving the indoor air quality. In addition, the rising health expenditure is expected to boost the demand for dehumidifiers over the forecast period.

Latin America Dehumidifier Market Trends

Mechanical and metallurgy industries represent more than one-third of the total industrial output in South America. Other prominent industries are chemicals and petroleum industries, which account for one-fourth of the total industrial output. Brazil has emerged as an industrial giant with major manufacturing facilities. Other prominent countries include Argentina, Chile, and Venezuela. Moreover, developed countries are investing actively in the region to utilize its favorable market conditions. These factors are anticipated to boost market growth.

Middle East & Africa Dehumidifier Market Trends

The dehumidifier market in the MEA region is driven by population growth, industrialization, and economic development, which drive the demand for natural gas and crude oil. Over the past few years, the governments of countries such as Saudi Arabia have been increasing expenditure on petrochemical and refining facilities.

Key Dehumidifier Company Insights

Some of the key players operating in the dehumidifier market include Ingersoll Rand and SLB.

-

LG Electronics Inc. is primarily involved in manufacturing home appliances, consumer electronics, and mobile communications. The company operates through four business units, namely, Mobile Communications, Home Entertainment, Home Appliance & Air Solutions, and Vehicle Components. Home Appliance & Air Solutions business unit produces and sells residential and commercial air conditioners, vacuum cleaners, refrigerators, and washing machines.

-

Honeywell International Inc. operates through four business segments, namely aerospace, performance Materials & Technologies, Honeywell Building Technologies, and Safety & Productivity Solutions. The dehumidifier products are offered under the business segment Honeywell Building Technologies. The company sells and distributes its products through a chain of distributors, wholesalers, retailers, and various e-commerce websites.

Key Dehumidifier Companies:

The following are the leading companies in the dehumidifier market. These companies collectively hold the largest market share and dictate industry trends.

- LG Electronics Inc.

- Honeywell International Inc.

- GE Appliances, a Haier Company

- De’Longhi Appliances S.r.l.

- Bry-Air Inc.

- Danby Products Ltd

- Whirlpool Corporation

- Munters Group

- STULZ Air Technology Systems, Inc.

- CondAir Group

Recent Developments

-

In November 2022, Munters Group acquired Hygromedia and Rotor Source. With this acquisition, the company strengthened its position as a supplier of dehumidification technology systems for numerous industrial processes and got an additional channel to the market to serve its different clients.

-

In September 2021, an updated version of the PuriCare wearable air purifier was released by LG Electronics, Inc. to provide houses with a dehumidifier with improved functionality.

Dehumidifier Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.61 billion

Revenue forecast in 2030

USD 5.12 billion

Growth Rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application, region

Key companies profiled

LG Electronics Inc., Honeywell International Inc., GE Appliances, a Haier Company, De’Longhi Appliances S.r.l., Bry-Air Inc., Danby Products Ltd, Whirlpool Corporation, Munters Group, STULZ Air Technology Systems, Inc., and CondAir Group.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dehumidifier Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dehumidifier market report based on technology, product, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigerative Dehumidifier

-

Desiccant Dehumidifier

-

Electronic/Heat Pump Dehumidifier

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable

-

Fixed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Sweden

-

Spain

-

Finland

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global dehumidifier market size was estimated at USD 3.39 billion in 2024 and is expected to reach USD 3.61 billion in 2024.

b. The global dehumidifier market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 5.12 billion by 2030.

b. North America dominated the dehumidifier market in 2024 with a share of 36.3%. The deteriorating quality of indoor air has a widespread and negative impact on the masses. It has resulted in increased public health concerns in North America. This has led to a surge in research and development activities related to dehumidifiers for advancing and modifying them. Moreover, dehumidifiers equipped with the Internet of Things (IoT), which enables their remote controlling and efficiency monitoring, along with their scheduled maintenance, are witnessing increased demand in North America.

b. Some of the key players operating in the Dehumidifier Market include LG Electronics Inc., Honeywell International Inc., GE Appliances, a Haier Company, De’Longhi Appliances S.r.l., Bry-Air Inc., Danby Products Ltd, Whirlpool Corporation, Munters Group, STULZ Air Technology Systems, Inc., and CondAir Group.

b. The growth of dehumidifier market worldwide is driven by the flourishing real estate sector and growing consumer awareness about healthy and comfortable living, along with variations in the weather.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.