- Home

- »

- Next Generation Technologies

- »

-

Demand Planning Solutions Market, Industry Report, 2033GVR Report cover

![Demand Planning Solutions Market Size, Share & Trends Report]()

Demand Planning Solutions Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment, By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Industry (BFSI, IT & Telecom), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-994-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Demand Planning Solutions Market Summary

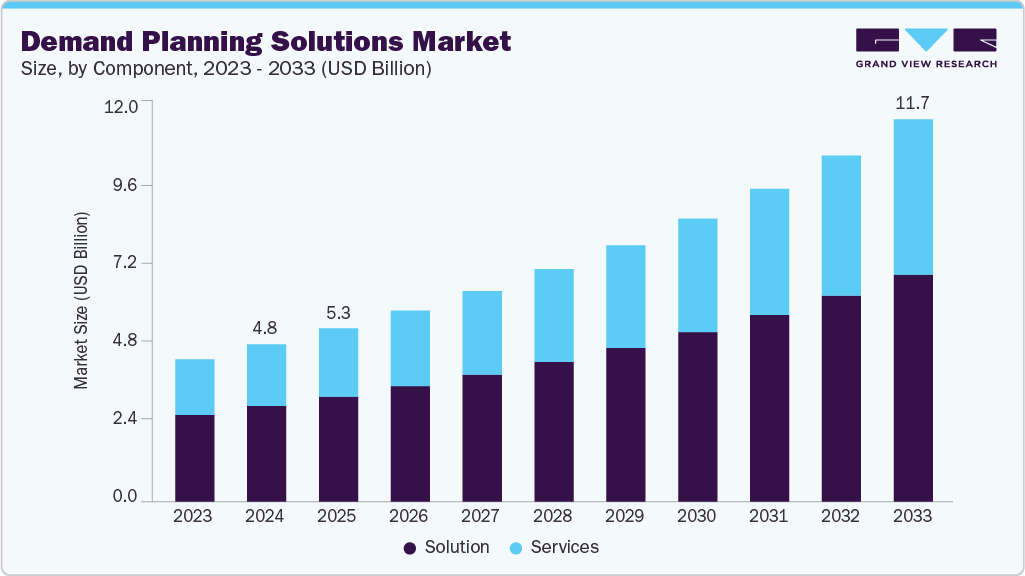

The global demand planning solutions market size was estimated at USD 4.81 billion in 2024, and is projected to reach USD 11.71 billion by 2033, growing at a CAGR of 10.4% from 2025 to 2033. Demand forecasting is a part of the supply chain management process that enables a business to customize its production, whether goods or services, by analyzing customer demands.

Key Market Trends & Insights

- The North America demand planning solutions market accounted for a 39.4% share of the overall market in 2024.

- The demand planning solutions industry in the U.S. held a dominant position in 2024.

- By component, the solutions segment accounted for the largest share of 60.8% in 2024.

- By deployment, the on-premise segment held the largest market share in 2024.

- By enterprise size, the large enterprises segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.81 Billion

- 2033 Projected Market Size: USD 11.71 Billion

- CAGR (2025-2033): 10.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest Market

Growing awareness about the benefits offered by these solutions, including improved customer experience, lowered inventory costs, excess storage costs, and increased efficiency in overall production, is the factor driving the market growth. Also, adopting advanced planning and analytics Solutions and tools among various industries like healthcare, retail, and IT & telecom is anticipated to boost the market growth during the forecast period. Further, the industries mentioned above are adopting solutions to recover from the COVID-19 impact.Companies are also adopting enterprise analytics platforms to enhance the performance of the supply chain management process. Demand planning solutions help to understand the changing market demands and distribution network issues by analyzing historical data and production capabilities. Furthermore, these solutions offer forecasting by using statistical and mathematical functions, clustering algorithms, ML (Machine Learning) technology, and automated data forecasting techniques. Further, it helps improve customer planning by employing predictive analytics to identify future trends and the resources needed for production planning and achieving revenue targets. For instance, Demand Management Systems (DMS) announced to upgrade to the recent version of the Logility digital supply chain platform used by the client, PharmaCare Laboratories.

However, businesses using demand planning tools deal with security and privacy concerns. Companies hold sensitive information that must be protected to prevent theft and data breaches that could damage their market standing. Data from businesses may be exposed online and accessible to unauthorized individuals, which is an increasing risk. Due to this, concerns regarding security and privacy among enterprises are increasing, which is anticipated to restrain the market expansion during the forecast period.

The increasing need for real-time data analytics and predictive forecasting across industries is significantly driving the demand planning solutions industry. With supply chains becoming more complex and customer expectations growing rapidly, businesses are turning to advanced demand planning tools to enhance visibility, reduce stockouts, and optimize inventory levels. The integration of artificial intelligence (AI), machine learning (ML), and cloud-based architectures is enabling companies to process large datasets with greater accuracy and agility.

Component Insights

The solution segment accounted for the largest share of 60.8% in 2024.The solutions segment is further classified into demand planning & optimization, demand sensing & forecasting, pricing & promotion analysis, and others. Demand sensing & forecasting accounted for a significant market share in 2024. It allows responding to shifting customer demand and market trends and enhancing the supply chain pipeline and production in real-time. Demand forecasting analyzes historical data, which includes sales data, trends, and seasonal data, to predict future demand. Furthermore, according to the demand planning solutions provider, demand sensing has enabled clients to improve forecast accuracy by approximately 15-40%, decrease inventory by 10-30%, and improve customer service levels by 2-5%.

The pricing and promotion analysis segment accounted for a significant share of the demand planning solutions market in 2024. Pricing analysis uses machine learning algorithms and price elasticity models to create promotion-influenced forecasts. Many companies use sales promotion analysis to boost interest and create awareness of a good/service among customers. These promotions frequently include higher costs (such as advertising) or revenue losses (such as discounts), as well as additional expenses (such as increased production).

Deployment Insights

The on-premises segment held the dominating share in the demand planning solutions industry in 2024.The cloud-based segment is anticipated to expand at the highest CAGR during the forecast period. With the growing internet adoption, cloud-based systems offer applications that exceed the capabilities of on-premises systems. Adaptability and agility are essential components of any planning system, as seen by the constantly changing supply chain. Also, cloud-based systems are considered to be more cost-effective. However, they are fee-based, which can be treated as an operational cost, whereas on-premises systems are usually capital expenditure.

Previously, on-premises demand planning solutions were mainly used, providing automation, cutting-edge features, and the capacity to raise supply chain productivity and accuracy. However, cloud-based solutions have advanced and dominate over on-premises solutions owing to the growing internet. Today’s cloud-based planning Solutions platform comes with functionality that can be incorporated with other business software. Further, demand planning solutions also provide a configurable, feature-rich platform that can be coupled with other enterprise-level software, such as ERP systems, by leveraging the cloud.

Enterprise Size Insights

The small & mid-sized enterprises segment accounted for a significant market share in 2024. The increasing number of small and mid-sized enterprises across the globe and their rising expenditure on implementing forecasting analysis to hold a position in the demand planning solutions industry and compete against other key players is expected to boost the market's growth over the forecast period. Also, mid-sized enterprises were severely affected by the COVID-19 impact due to the lockdowns, which is indirectly influencing the companies to adopt demand planning solutions.

Further, large enterprises initially used on-premises Solutions to maintain data security and boost operational effectiveness. However, small & mid-sized enterprises with fewer resources could not pay for a comprehensive on-premises system. Small and mid-sized businesses (SMB) can now take advantage of full-featured planning Solutions tools that are more flexible and agile than on-premises alternatives, owing to the development of more adaptable cloud-based demand planning apps.

Industry Insights

The BFSI segment accounted for the largest revenue share of the demand planning solutions industry in 2024 and is expected to continue its dominance during the forecast period. The manufacturing segment is estimated to expand at the fastest CAGR from 2025 to 2030. Manufacturing industries are adopting demand planning and business analytics platforms to improve the performance of the supply chain management process. Utilizing historical data, these companies are implementing these solutions to comprehend shifting consumer demands, manufacturing constraints, and distribution network challenges.

Demand forecasting in retail and e-commerce helps in predicting future sales with the help of past online sales, market trends, and sales cycles. Demand forecasting Solutions used by retailers and CPG (consumer packaged goods) automate time-consuming and difficult decisions and use machine learning to improve forecasts. Further, it also helps e-commerce stores by offering various advantages, which include reduced inventory expenses, a pricing strategy that reflects demand, and improved financial decision-making.

Regional Insights

North America accounted for the largest revenue share of the demand planning solutions industry in 2024 and is expected to continue its dominance in the coming years. The presence of Major tech companies offering demand planning solutions such as IBM, Blue Ridge Solutions Inc., and Demantra (Oracle Corporation), coupled with established technological infrastructure and many adopters of such Solutions, is boosting the market growth in the region. Therefore, owing to these factors, the usage of demand planning Solutions in North America is high and contributes more to revenue generation.

U.S. Demand Planning Solutions Market Trends

The U.S. demand planning solutions industry held a dominant position in 2024,fueled by the widespread adoption of AI-enabled forecasting tools and advanced analytics platforms. Companies across sectors such as retail, healthcare, and manufacturing are increasingly leveraging demand planning solutions to manage supply volatility, optimize inventory, and improve service levels.

Europe Demand Planning Solutions Market Trends

The Europe demand planning solutions industry was identified as a lucrative region in 2024.The region's focus on sustainability and demand-driven planning is pushing large enterprises to replace outdated legacy systems with agile, cloud-based platforms. Advanced demand planning systems that support scenario planning, carbon tracking, and demand sensing are in high demand across sectors such as automotive, food & beverage, and pharmaceuticals. Moreover, EU-wide digital supply chain initiatives and the focus on cross-border trade efficiency are further catalyzing market expansion, particularly in Germany, the Nordics, and the Benelux region.

The UK demand planning solutions market is expected to grow rapidly in the coming years.Government and healthcare institutions are adopting demand planning platforms to forecast critical supplies more accurately and ensure continuity of operations. In the private sector, mid-sized and large enterprises are increasingly moving toward integrated planning systems that offer SKU-level accuracy, improved supplier collaboration, and predictive analytics.

Asia Pacific Demand Planning Solutions Market Trends

The Asia Pacific demand planning solutions industry is expected to grow at the fastest CAGR in 2024.The region is well-equipped with technology for adopting such software, which has increased adoption, supporting the regional market's growth. The pandemic has accelerated digital adoption in economies like China and India, which in turn has positively impacted market growth. Further, increasing the number of tech companies providing demand planning solutions is also a significant factor supporting regional market growth.

The Japan demand planning solutions market is expected to grow rapidly as enterprises focus on enhancing supply chain precision and minimizing operational waste. The country's manufacturing-heavy economy, coupled with a cultural emphasis on quality and efficiency, aligns well with demand planning tools that offer real-time insights and automated planning workflows.

The demand planning solutions market in China held a substantial market share in 2024, driven by its massive industrial output, digital transformation programs, and smart city initiatives. The government’s focus on supply chain modernization-through policies encouraging e-invoicing, digital logistics, and real-time tracking-is pushing enterprises to adopt sophisticated demand planning platforms.

Key Demand Planning Solutions Company Insights

Some of the key companies in the demand planning solutions market include SAP SE; Oracle Corporation (Demantra); Kinaxis Inc.; IBM; and Infor.These organizations are actively focused on expanding their customer base to gain a competitive edge. As a result, leading players are engaging in strategic initiatives such as mergers and acquisitions, partnerships, and technology upgrades to enhance platform capabilities and market reach.

-

SAP is a prominent company in enterprise application software, and its Integrated Business Planning (IBP) platform is widely recognized for robust demand planning capabilities. The solution offers real-time forecasting, inventory optimization, and AI/ML-driven predictive analytics. SAP IBP is widely adopted across industries such as manufacturing, retail, and life sciences.

-

Oracle’s Demantra Demand Management solution continues to be a strong player, especially for enterprises requiring advanced demand sensing, collaborative forecasting, and sales & operations planning (S&OP). Integrated within Oracle Cloud SCM, it offers scalable, cloud-based planning that supports global and complex supply chains.

Key Demand Planning Solutions Companies:

The following are the leading companies in the demand planning solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Aspire Systems

- Blue Ridge Solutions Inc.

- Cognizant Technology Solutions

- Demantra (Oracle Corporation)

- IBM

- Logility, Inc.

- RELEX Oy

- NETSTOCK

- SAP SE

- Syncron AB

Recent Developments

-

In March 2025, Crisp, a company that offers retail data solutions, acquired Shelf Engine, an AI-driven demand forecasting platform focused on perishable goods. The acquisition enhances Crisp’s capabilities in real-time inventory optimization, food waste reduction, and shelf management. By integrating Shelf Engine’s algorithms into its collaborative commerce platform, Crisp aims to empower retailers with actionable insights for SKU-level forecasting and supply chain efficiency. This move reflects Crisp’s strategic expansion into fresh supply chains amid rising retail margin pressures. The combined platform will deliver enhanced forecasting accuracy, supporting CPG brands, distributors, and retailers in building more resilient and data-driven operations.

-

In January 2025, Ikigai Labs launched a new AI-powered Demand Forecasting and Planning solution designed to tackle the complexities of modern supply chains. Leveraging its patented Large Graphical Model (LGM) technology, the platform delivers highly accurate demand predictions, even for new or unpredictable products. It supports advanced features like Time2Vec for trend detection, synthetic data generation for sparse scenarios, and real-time external data integration for dynamic forecasting. The solution also includes Expert-in-the-Loop (XITL) capabilities, allowing human experts to refine AI-driven forecasts for greater accuracy. With these tools, businesses can reduce inventory costs, avoid stockouts, and better navigate demand volatility.

Demand Planning Solutions Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.30 billion

Revenue forecast in 2033

USD 11.71 billion

Growth rate

CAGR of 10.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Aspire Systems; Blue Ridge Solutions Inc.; Cognizant Technology Solutions; Demantra (Oracle Corporation); IBM; Logility, Inc.; RELEX Oy; NETSTOCK; SAP SE; Syncron AB;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Demand Planning Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global Demand Planning Solutions Market report based on component, deployment, enterprise size, industry, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solutions

-

Demand Planning and Optimization

-

Demand Sensing and Forecasting

-

Pricing and Promotion Analysis

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

Industry Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

IT & Telecom

-

Healthcare

-

Retail & e-Commerce

-

Automotive

-

Food & Beverages

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global demand planning solutions market size was estimated at USD 4.81 billion in 2024 and is expected to reach USD 5.30 billion in 2025.

b. The global demand planning solutions market is expected to grow at a compound annual growth rate of 10.4% from 2025 to 2033 to reach USD 11.71 billion by 2033.

b. BFSI segment dominated the demand planning solutions market with a share of 17.9% in 2024. This is attributable to the growing adoption of demand planning and business analytics platforms by BFSI industry to improve the performance of the supply chain management process.

b. Some key players operating in the demand planning solutions market include Aspire Systems, Blue Ridge Solutions Inc., Cognizant Technology Solutions, Demantra (Oracle Corporation), IBM, Logility, Inc., RELEX Oy, NETSTOCK, SAP SE, and Syncron AB.

b. Key factors that are driving the market growth include the growing awareness about the benefits offered by these solutions, and the enhanced performance of the supply chain managment process with the adoption of demand planning solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.