- Home

- »

- Medical Devices

- »

-

Demineralized Bone Matrix Market, Industry Report, 2030GVR Report cover

![Demineralized Bone Matrix Market Size, Share And Trends Report]()

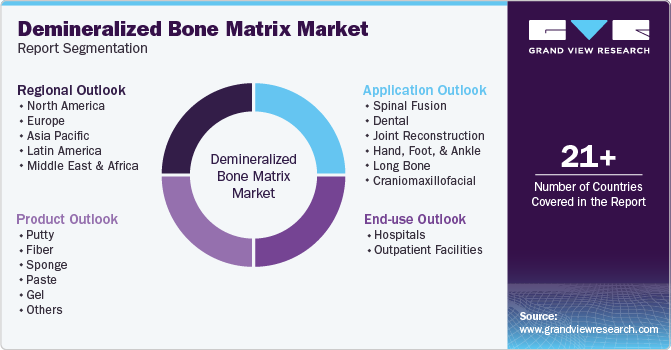

Demineralized Bone Matrix Market (2025 - 2030) Size, Share And Trends Analysis Report, By Product (Putty, Fiber, Paste), By Application (Spinal Fusion, Dental, Joint Reconstruction), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-201-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Demineralized Bone Matrix Market Trends

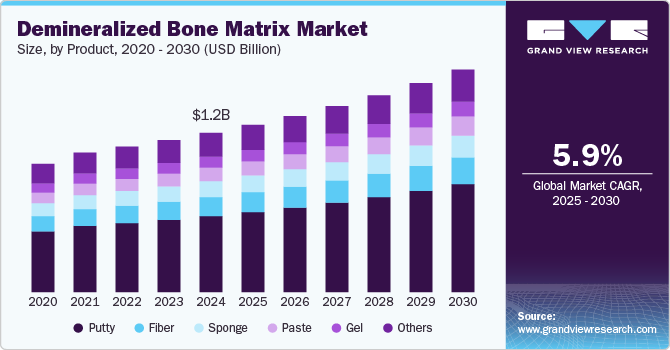

The global demineralized bone matrix market size was estimated at USD 1.24 billion in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2030. The increasing demand for advanced orthopedic procedures, the rising prevalence of bone-related disorders, and the growing preference for minimally invasive surgeries are driving the demineralized bone matrix industry. DBM offers significant advantages in bone regeneration and healing, particularly in spinal fusion surgeries, joint reconstruction, and trauma care. The expanding geriatric population and the rising incidence of sports-related injuries further fuel the demand for DBM products in both clinical and surgical settings.

Growing investment of key market players in research and development activities to strengthen the application of existing products is anticipated to drive demineralized bone matrix industry growth. SeaSpine Inc. conducted a study in November 2020 named "Examination of the Role of Cells in Commercially Available Cellular Allografts in Spine Fusion: An in vivo animal study." The study's findings indicate that the cellular constituent of two commercially available cellular bone matrices (CBMs) did not provide any additional benefits in terms of spinal fusion. Instead, the groups treated with a fiber based DBM exhibited significantly improved fusion outcomes compared to the CBM groups treated with particulate DBM. This implies that the DBM component is the primary factor determining fusion.

The growing cases of trauma & road accidents are driving market growth. According to the World Health Organization report, in 2023, around 1.19 million people lose their lives due to road traffic crashes every year. Moreover, between 20 and 50 million people experience non-fatal injuries, with many being left with a disability. Additionally, as per theRoad Accidents in India report, in 2022, States and Union Territories (UTs) have reported a total of 4,61,312 road accidents in 2022. These accidents resulted in the loss of 1,68,491 lives and injuries to 4,43,366 people. Such increasing cases of injuries owing to road accidents are fostering market growth.

Advancements in tissue engineering and regenerative medicine have brought significant developments in the production of demineralized bone matrix products. The use of innovative processing techniques, such as freeze-drying and lyophilization, has helped to preserve the natural growth factors and extracellular matrix components of DBM grafts, which in turn enhances their osteo-inductive potential. Additionally, the integration of biomaterials and bioactive agents into DBM formulations has resulted in the creation of next-generation bone substitutes that exhibit superior regenerative properties.

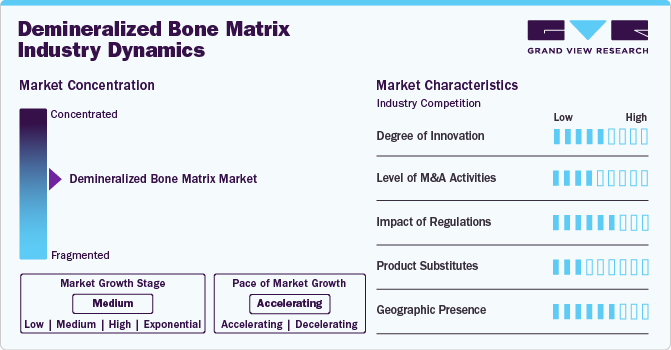

Market Concentration & Characteristics

The applications of demineralized bone matrix (DBM) are constantly emerging, leading to the creation of new opportunities for market players. The market is characterized by a low-to-moderate degree of growth owing to increasing incidence of orthopedic disorders, growing adoption of DBM, and introduction of products by various market players.

The demineralized bone matrix industry is characterized by an ongoing advancement in product development, processing techniques, and clinical applications. Furthermore, manufacturers continuously explore novel biomaterials, growth factors, and bioactive agents to improve the osteoinductive and osteoconductive properties of DBM products. For instance, the next generation of osteoinductive DBM allografts involves cleanroom processing with a low bioburden. This process decreases the need to use high-dose gamma sterilization or hydrogen peroxide, which can reduce the efficiency of bone morphogenic proteins.

The demineralized bone matrix market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for DBM. In September 2023, Globus Medical, Inc completed its merger with NuVasive, Inc. The combined company offers extensive musculoskeletal procedural solutions and enabling technologies for surgeons and patients.

Well-developed regulatory framework and rising approval for the demineralized bone matrix (DBM) products from government regulatory bodies positively impacts market growth. Regulatory agencies such as the FDA (Food and Drug Administration) ensure the safety and efficacy of DBM products through rigorous approval processes.

Several product substitutes exist for demineralized bone matrix (DBM) in orthopedic and regenerative medicine applications. These substitutes may vary in composition, properties, and clinical indications but serve as alternatives to DBM graft materials. Some common product substitutes for DBM include autograft bone, synthetic bone graft substitutes, platelet-rich plasma (PRP) and growth factors.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising research and development activities create more opportunities for market players to enter new regions. In February 2019, Medtronic plc launched Grafton DBM bone grafting product in Japan fororthopedic and spine procedures.

Product Type Insights

The market is divided into putty, fiber, sponge, paste, gel, and others. The putty segment led the market with the largest revenue share of 47.7% in 2024 and is also anticipated to witness at a significant CAGR over the forecast period. The putty formulation offers better moldability and flexibility than other DBM forms such as powders or pastes, making it easier to mold and shape during surgical procedures. This feature simplifies the implantation process, reduces surgical time, and improves procedural efficiency. Furthermore, increasing adoption of strategies by key market players is anticipated to spur market growth. In October 2022, Orthofix Medical announced the full commercial release of its Legacy Demineralized Bone Matrix, along with the successful implantation of the first patient. The Legacy DBM is a putty that has been specifically designed to fill gaps or voids in traumatic injuries or bone defects of the spine, pelvis, or extremities.

The paste segment is anticipated to witness at the fastest CAGR over the forecast period. The ease of handling associated with DBM paste will increase its demand among the healthcare professionals. Moreover, increasing cases of sports injury coupled with growing participation of population in sports is anticipated to boost market growth. For instance, as per the Johns Hopkins Medicine report, 2023, in the U.S., over 30 million children and teenagers engage in an organized sports activity and more than 3.5 million injuries occur annually.

Application Insights

Based on application, the spinal fusion segment led the market with the largest revenue share of 40.5% in 2024, owing to increasing prevalence of degenerative spine disorders and spinal pathologies worldwide. According to an article published in Springer Nature Limited,the incidence of diagnosed spinal degenerative disease is stated to be 27.3% and was observed to increase with advancing age. These conditions typically necessitate surgical interventions, where the use of DBM is of great significance, thereby fueling the expansion of the market.Furthermore, advancements in surgical techniques, such as minimally invasive spine surgery (MISS) and motion-preserving procedures, have expanded the indications for spinal fusion and created new opportunities for DBM products.

The joint reconstruction segment is anticipated to register at a significant CAGR over the forecast period. The increasing cases of osteoarthritis, rheumatoid arthritis, and traumatic joint injuries will drive the need for effective solutions to restore joint function and alleviate pain. As per the Harvard Health Publishing, surgeons in the U.S. carry out over 600,000 knee replacement surgeries and approximately 330,000 hip replacement surgeries per year. Moreover, growing geriatric population is another factor contributing the segmental growth. According to the India Ageing Report 2023 from the United Nations Population Fund, the number of people aged 60 and above is expected to increase to 20.8% by 2050 from the current 10.5% as of July 1, 2022.

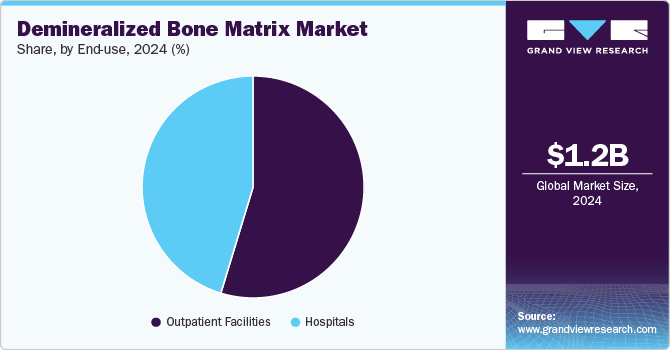

End Use Insights

Based on end use, the outpatient facilities segment led the market with the largest revenue share of 54.7% in 2024. Outpatient facilities such as ambulatory surgery centers (ASCs) and specialty clinics provide medical care to patients requiring surgical interventions for orthopedic conditions, spinal disorders, and sports-related injuries in a more streamlined and cost-effective manner compared to traditional hospital settings.Outpatient facilities offer several advantages over hospitals, including shorter wait times, reduced administrative burdens, and greater convenience for patients. Such factors contribute to the growing preference for outpatient surgeries. Furthermore, an increasing number of ASCs worldwide is expected to boost segmental growth. As per the IBISWorld report, there are 9,307 Ambulatory Surgery Centers businesses in the U.S. as of 2023, an increase of 4.1% from 2022.

The hospitals segment is anticipated to register at a steady CAGR over the forecast period, due to their central role in providing comprehensive healthcare services, including surgical interventions requiring bone graft materials. In addition, hospitals often prioritize the adoption of innovative medical technologies and products that enhance patient outcomes, reduce surgical complications, and improve overall quality of care.Furthermore, hospitals play a crucial role in facilitating research and development initiatives aimed at advancing the field of orthopedic surgery and regenerative medicine, thereby supplementing market growth.

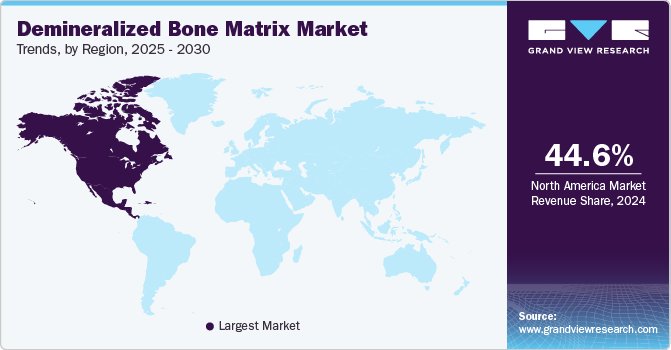

Regional Insights

North America dominated the demineralized bone matrix industry with the largest revenue share of 44.6% in 2024, owing to the increasing prevalence of musculoskeletal disorders and orthopedic conditions across the region. Furthermore, factors such as presence of large number of market players, significant acquisitions and partnerships among major players, and an increase in road accidents are driving the demineralized bone matrix market growth in the region. For instance, in 2021, according to a USA TODAY report, there were an estimated 6,102,936 vehicle accidents reported by the police in the U.S.

U.S. Demineralized Bone Matrix Market Trends

The demineralized bone matrix (DBM) market in the U.S. held the largest share in North America in 2024. Increasing number of spinal fusion surgeries in the U.S. is expected to drive the market growth. For instance, as per theScienceDirect report, over 400,000 spinal fusion surgeries are performed annually in the U.S.

The Canada demineralized bone matrix (DBM) market is anticipated to register at a significant CAGR during the forecast period. Advancements in healthcare infrastructure, technological innovation, and medical research contribute to the adoption of DBM products in Canada.

Asia Pacific Demineralized Bone Matrix Market Trends

The demineralized bone matrix (DBM) market in Asia Pacific is anticipated to register at the fastest CAGR during the forecast period, owing to the increasing geriatric population. For instance, as per the 'India Ageing Report 2023', the population of individuals aged 60 years and above in India has reached 149 million as of July 2022. This accounts for approximately 10.5% of the country's total population.Furthermore, it is predicted that by 2050, this population will double to 20.8%, with the absolute number of senior citizens reaching 347 million. As the aging population is more prone to orthopedic disorders, the demand for DBM is increasing.

The China demineralized bone matrix (DBM) market is anticipated to register at the fastest CAGR during the forecast period. The country's rapidly expanding healthcare infrastructure and the increasing demand for orthopedic surgeries will drive the market growth.Furthermore, the country's large population, aging demographics, and rising incidence of orthopedic conditions such as osteoporosis, osteoarthritis, and traumatic injuries is boosting market growth.

The demineralized bone matrix (DBM) market in India is anticipated to register at a considerable CAGR during the forecast period. Increasing healthcare expenditure, rising disposable incomes, and expanding insurance coverage contribute to the growing accessibility of advanced orthopedic treatments, thereby fueling the demand for DBM products.

The Japan demineralized bone matrix (DBM) market is anticipated to register at the fastest CAGR during the forecast period. Growing aging population and the increasing prevalence of orthopedic conditions such as osteoporosis, degenerative bone diseases, and fractures is anticipated to boost market growth. For instance, as per the ScienceDirect report, for men aged 40-64 years, the projected number of knee arthroplasties in Japan in 2030 was 4052. Men aged 65-74 years were expected to have 6942 knee arthroplasties. For men aged 75 years and above, the projected number of knee arthroplasties was 14,986. Women aged 40-64 years were expected to have 7092 knee arthroplasties in 2030. Women aged 65-74 years were projected to have 22,957 knee arthroplasties, while women aged 75 years and above were expected to have 58,340 knee arthroplasties.

Europe Demineralized Bone Matrix Market Trends

The demineralized bone matrix (DBM) market in Europe is anticipated to register at a significant CAGR during the forecast period. Advancements in orthopedic surgeries and the growing demand for minimally invasive procedures are fostering regional growth. In addition, the region's robust healthcare infrastructure, coupled with well-established regulatory pathways for biologics are supplementing demineralized bone matrix industry growth.

The demineralized bone matrix (DBM) market is anticipated to register at the fastest CAGR during the forecast period.Germany’s advanced healthcare infrastructure and its well-established healthcare system are supplementing market growth.The country's aging population, coupled with a higher prevalence of bone diseases such as osteoporosis and arthritis are escalating market growth.

The UK demineralized bone matrix (DBM) market is anticipated to register at the fastest CAGR during the forecast period. The growing focus on regenerative medicine within the UK, supported by both public funding and private sector investment are fostering market growth.

Latin America Demineralized Bone Matrix Market Trends

The demineralized bone matrix (DBM) market in Latin America is anticipated to register at the fastest CAGR during the forecast period. Increasing cases of fractures in the region is driving market growth. For instance, according to the International Osteoporosis Foundation, it is projected that Latin Americans will experience around 655,648 hip fractures by the year 2050, resulting in an expected direct cost of USD13 billion.

The Brazil demineralized bone matrix (DBM) market is anticipated to register at a significant CAGR during the forecast period.There is a growing demand for advanced bone grafting solutions, with an increasing adoption of biological materials such demineralized bone matrix (DBM) in orthopedic surgeries, particularly for spinal fusion and trauma care.

Middle East & Africa Demineralized Bone Matrix Market Trends

The demineralized bone matrix (DBM) market in Middle East and Africa is anticipated to register at a significant CAGR during the forecast period.The region’s healthcare systems are modernizing rapidly, with countries such as the UAE, Saudi Arabia, and South Africa making significant investments in advanced medical technologies and infrastructure.

The South Africa demineralized bone matrix (DBM) market is anticipated to register at a significant CAGR during the forecast period. Growing cases of fractures is anticipated to boost the adoption of DBM. According to a report by the National Library of Medicine, the annual incidence of hip fractures in South Africa is projected to increase more than twofold between 2020 and 2050, rising from around 11,000 to 26,400 cases each year.

Key Demineralized Bone Matrix Company Insights

Key participants in the global industry are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions. For instance, in February 2021, Kolosis Bio, LLC and MTF Biologics entered a strategic collaboration wherein, the two companies would co-develop and launch Kore Fiber, a demineralized cortical fiber allograft. Some of the key players operating in the market includeZimmer Biomet, Medtronic Plc, DePuy Synthes, Stryker Corporation, and Arthrex Inc.

Key Demineralized Bone Matrix Companies:

The following are the leading companies in the demineralized bone matrix market. These companies collectively hold the largest market share and dictate industry trends.

- Zimmer Biomet

- Medtronic Plc

- DePuy Synthes

- Stryker

- Arthrex Inc

- SeaSpine

- Globus Medical

- Berkeley Advanced Biomaterials

- XTANT MEDICAL

- LifeNet Health

Recent Developments

-

In January 2023, Orthofix merged with SeaSpine to create a leading global spine and orthopedics company.

-

In September 2022, Ossifix Orthopedics, a subsidiary of Umbra Applied Technologies Group Inc. launched a new demineralized bone matrix product.

-

In May 2022, SeaSpine Holdings Corporation, a medical device company launched OsteoTorrent and OstroTorrent C DBM products. The OsteoTorrent product families are built on SeaSpine’s Evo3/OsteoSurge 300 DBMs.

-

In September 2021, Essent Biologics, a nonprofit biotechnology company, launchedhuman demineralized bone matrix (DBM) Bioink for 3D bioprinting and tissue engineering research applications.

Demineralized Bone Matrix Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.30 billion

Revenue forecast in 2030

USD 1.73 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue & Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zimmer Biomet; Medtronic Plc; DePuy Synthes; Stryker Corporation; Arthrex Inc; SeaSpine; Globus Medical; Berkeley Advanced Biomaterials; XTANT MEDICAL; LifeNet Health

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Demineralized Bone Matrix Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global demineralized bone matrix (DBM) market report based on the product type, application, end use and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Putty

-

Fiber

-

Sponge

-

Paste

-

Gel

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Spinal Fusion

-

Dental

-

Joint Reconstruction

-

Hand, Foot, and Ankle

-

Long Bone

-

Craniomaxillofacial

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient facilities

-

Specialized Orthopedic Clinics

-

Ambulatory Surgical Centers

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global demineralized bone matrix market size was estimated at USD 1.24 billion in 2024 and is expected to reach USD 1.30 billion in 2025.

b. The global demineralized bone matrix market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 1.73 billion by 2030.

b. North America dominated the demineralized bone matrix market with a share of 44.6% in 2024, owing to the increasing prevalence of musculoskeletal disorders and orthopedic conditions across the region.

b. Some key players operating in the demineralized bone matrix market include Zimmer Biomet, Medtronic Plc, DePuy Synthes, Stryker Corporation, Arthrex Inc, SeaSpine, Globus Medical, Berkeley Advanced Biomaterials, XTANT MEDICAL, LifeNet Health

b. Key factors that are driving the market growth include growing investment of key market players in research and development activities to strengthen the application of existing products

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.