- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Denmark Liquid Dietary Supplements Market Report, 2030GVR Report cover

![Denmark Liquid Dietary Supplements Market Size, Share & Trends Report]()

Denmark Liquid Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients, By Type, By Application, By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-686-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Denmark Liquid Dietary Supplements Market Summary

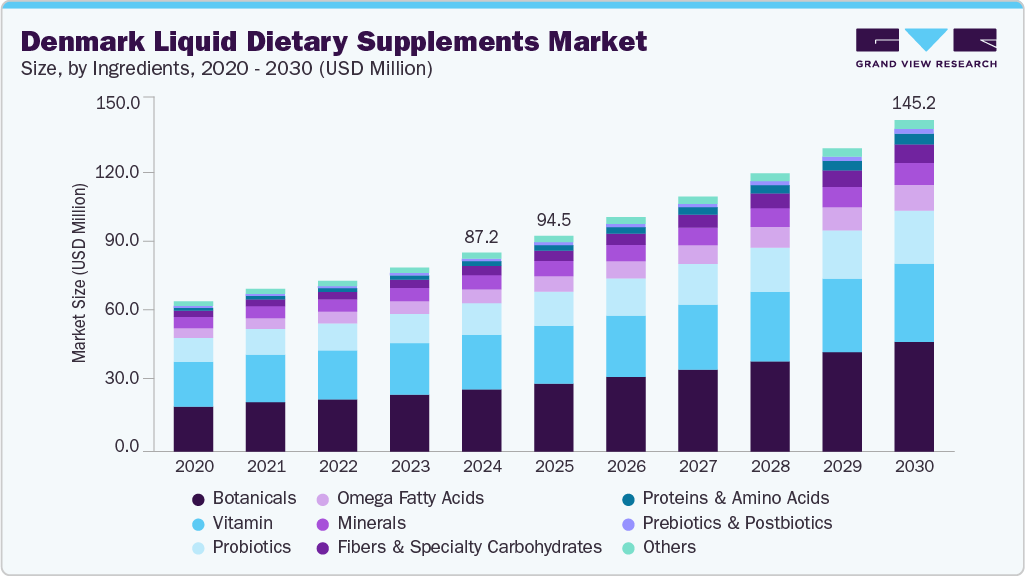

The Denmark liquid dietary supplements market size was estimated at USD 87.2 million in 2024 and is projected to reach USD 145.2million by 2030, growing at a CAGR of 9.0% from 2025 to 2030. Increasing consumer focus on preventive healthcare, growing preference for convenient and fast-absorbing supplement formats, and the rising elderly population are key growth drivers for this market.

Key Market Trends & Insights

- By ingredients, botanicals dominated the market with a share of 31.2% in 2024

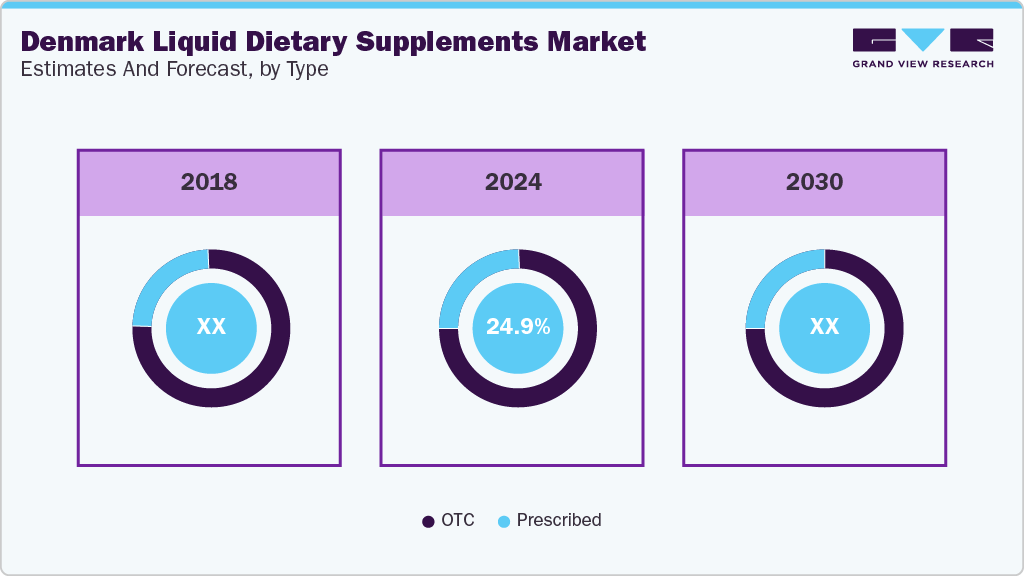

- By type, the OTC segment held the largest share of 75.1% in 2024.

- By application, bone & joint health dominated the market with a share of 12.2% in 2024

Market Size & Forecast

- 2024 Market Size: USD 87.2 Million

- 2030 Projected Market Size: USD 145.2 Million

- CAGR (2025-2030): 9.0%

Denmark's aging population and high prevalence of chronic lifestyle-related conditions have elevated the demand for nutritional interventions. According to the World Health Organization (WHO), non-communicable diseases account for over 90% of all deaths in Denmark, with cardiovascular diseases, cancer, and diabetes being the leading causes. This has led to increased institutional focus on preventive healthcare and dietary improvements.

Innovation in liquid dietary supplements is accelerating in Denmark, with manufacturers introducing plant-based, sugar-free, and clinically backed formulations targeting immunity, digestion, and cognitive health. E-commerce and pharmacy-led online platforms have expanded product accessibility, especially among younger, tech-savvy consumers. Brands also emphasize sustainable packaging and clean-label ingredients to align with Denmark’s strong environmental values. The growing influence of personalized wellness and digital health monitoring further drives demand. Moreover, Copenhagen and other urban hubs are witnessing higher product uptake due to better health infrastructure and consumer awareness.

Consumer Insights

Danish consumers increasingly prioritize preventive health and nutritional self-care, with a strong preference for functional and natural supplements. Many individuals aged 30 and above integrate liquid dietary supplements into their daily routines to support immunity, energy, and digestive health. Convenience and ease of consumption are key motivators for shifting from tablets to liquid formats. Moreover, health-literate consumers actively read ingredient labels and choose products with clean-label claims and scientifically backed formulations.

Sustainability also plays a major role in consumer choices, with a marked preference for brands that offer eco-friendly packaging and plant-based or organic ingredients. Younger consumers, particularly millennials and Gen Z, are more likely to purchase supplements online, influenced by digital health trends, wellness influencers, and lifestyle platforms.

Ingredient Insights

The botanicals segment led the market with the largest revenue share of 31.2% in 2024, driven by increasing consumer preference for natural and plant-based ingredients. Herbal formulations such as echinacea, elderberry, and ginseng are gaining popularity for their perceived benefits in boosting immunity and reducing inflammation. Danish consumers show strong interest in traditional and clean-label remedies, particularly those backed by scientific studies or local herbal traditions. Moreover, regulatory acceptance and the alignment with EU guidelines further support growth in this segment.

The proteins and amino acids segment is expected to witness a significant CAGR of 13.8% over the forecast period, owing to increasing demand from fitness-conscious individuals and aging adults seeking muscle maintenance and recovery support. The trend toward active aging, combined with a surge in home-based fitness routines, is fueling demand for liquid protein blends due to their rapid absorption. In September 2024, Arla Foods launched protein-packed meal-replacement drinks with vanilla hazelnut and chocolate caramel flavors in Denmark to fulfill the demand for a nutritious, convenient option for consumers on the go.

Type Insights

The over-the-counter (OTC) segment led the market with a revenue share of 75.0% in 2024, owing to the high availability of liquid supplements through pharmacies, health stores, and online platforms without the need for a prescription. Danish consumers widely prefer self-directed health management, especially for immunity, energy, and digestive health, making OTC products highly accessible and appealing.

The prescribed segment is expected to grow at the fastest CAGR of 9.3% over the forecast period. This is driven by a growing aging population and rising diagnosis of chronic and nutrient-deficiency-related conditions. Physicians in Denmark are increasingly recommending liquid formulations for patients with swallowing difficulties, gastrointestinal disorders, or specific nutrient absorption issues. Prescribed supplements are gaining traction in clinical nutrition programs, especially in geriatrics and post-operative recovery.

Application Insights

The bone and joint health segment dominated the market with a share of 12.2% in 2024, reflecting the growing demand for musculoskeletal support among aging adults and active individuals in Denmark. Liquid supplements targeting joint flexibility, bone density, and mobility-often enriched with calcium, vitamin D, collagen, and magnesium-are increasingly favored for their faster absorption and ease of use.

The prenatal health segment is expected to witness the fastest CAGR of 14.0% over the forecast period, fueled by heightened awareness of maternal nutrition and government emphasis on improving birth outcomes. Liquid prenatal supplements are gaining popularity due to better tolerability and faster absorption, particularly among women with nausea during pregnancy.

End Use Insights

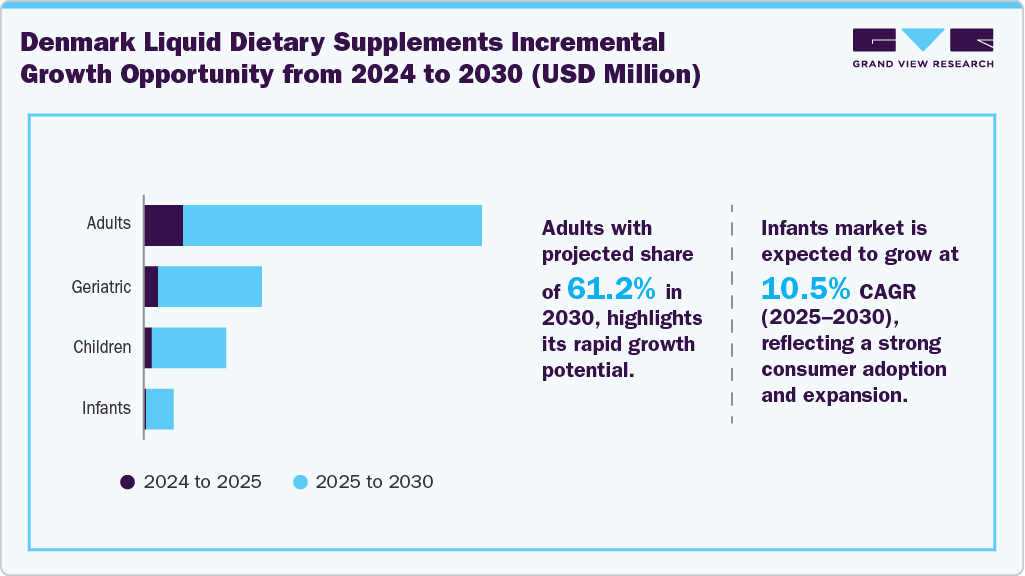

The adult segment dominated the market with a revenue share of 63.0% in 2024, driven by the high adoption of liquid dietary supplements for preventive health, energy support, and lifestyle management. Danish adults increasingly prioritize self-care and holistic well-being, leading to greater demand for supplements targeting immunity, digestion, cognitive function, and bone health. Liquid formats are preferred for their ease of consumption, rapid absorption, and suitability for individuals with swallowing difficulties

The infant segment is projected to grow at the fastest CAGR of 10.5% over the forecast period, supported by rising awareness of early childhood nutrition and preventive healthcare. Pediatricians in Denmark are increasingly recommending liquid supplements for infants to address deficiencies in vitamin D, iron, and omega-3 fatty acids. The preference for gentle, easily absorbable formulations among parents has further accelerated product uptake.

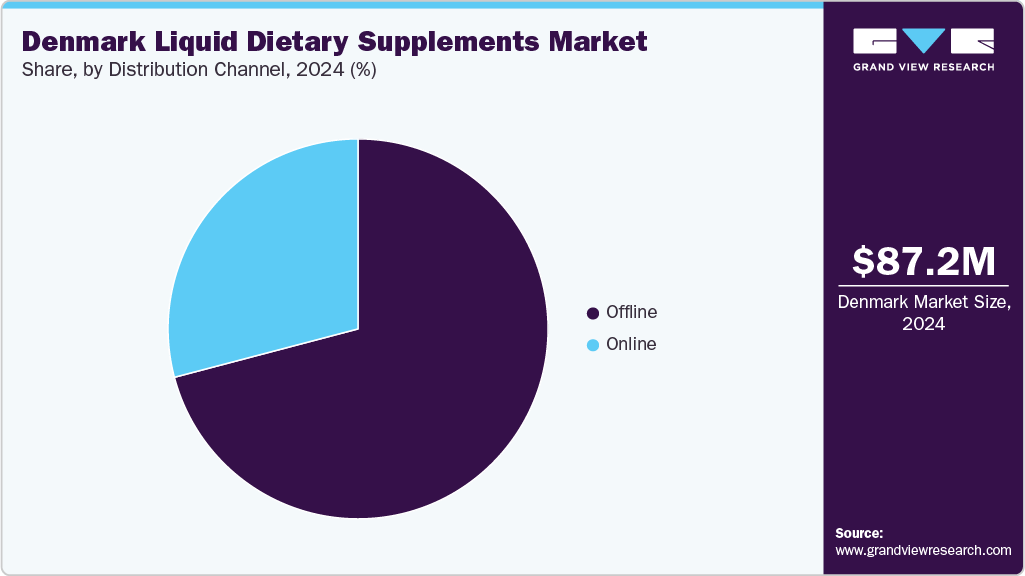

Distribution Channel Insights

The offline segment dominated the market with a revenue share of 70.9% in 2024, supported by the strong presence of pharmacies, health food stores, and supermarkets across Denmark. Consumers continue relying on in-store consultations, pharmacist recommendations, and direct access to trusted brands to purchase liquid supplements. The high credibility of brick-and-mortar outlets, particularly in urban centers like Copenhagen and Aarhus, reinforces consumer confidence and supports continued sales growth through physical retail.

The online segment is anticipated to grow at the fastest CAGR of 9.1% over the forecast period, driven by rising digital adoption and the convenience of doorstep delivery. Younger consumers and busy professionals are increasingly turning to e-commerce platforms and pharmacy-linked websites for supplement purchases. Product comparisons, subscription models, and access to detailed ingredient information online further enhance engagement.

Key Denmark Liquid Dietary Supplements Company Insights

Some key companies operating in the market include Life Extension Europe, Puori, Amway Europe, dsm-firmenich, among others.

Key Denmark Liquid Dietary Supplements Companies:

- Life Extension Europe

- Puori

- Amway

- dsm-firmenich

Denmark Liquid Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 94.5 million

Revenue forecast in 2030

USD 145.2 million

Growth rate

CAGR of 9.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, type, application, end use, distribution channel, country

Country scope

Denmark

Key companies profiled

Life Extension Europe, Puori, Amway, dsm-firmenich

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Denmark Liquid Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Denmark liquid dietary supplements market report based on ingredients, type, application, end use, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.