- Home

- »

- Medical Devices

- »

-

Dental Bonding Agent Market Size, Share & Trend Report, 2030GVR Report cover

![Dental Bonding Agent Market Size, Share & Trends Report]()

Dental Bonding Agent Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Self-etch, Total-etch), By End Use (Hospitals, Dental Clinics, Ambulatory Surgical Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-987-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

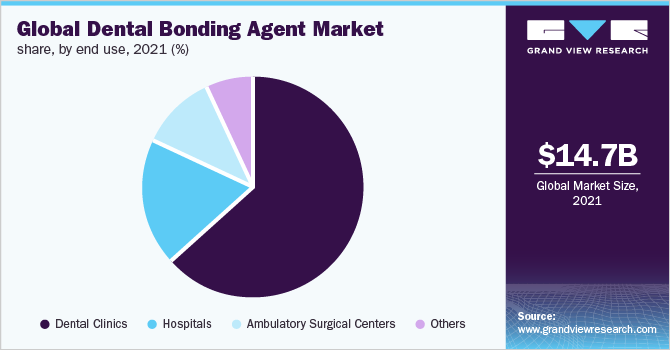

The global dental bonding agent market size was valued at USD 14.7 billion in 2021 and is expected to witness a CAGR of 7.9% in the forecast period from 2022 to 2030. The market for dental bonding agents is driven by the rising dental treatment costs among the developed classes, the rapid rise in the elderly population, and improvements in dental surgery aftercare facilities. Dental bonding procedures are included in cosmetic dentistry and cosmetic dental procedures were closed due to the pandemic; therefore, the COVID-19 pandemic had a negative impact on the dental bonding agent market. Dental clinics were shut down in several nations including the U.S., U.K., Germany, Canada, France, China, India, etc. due to the imposition of lockdowns.

The dental industry was at a standstill because of COVID-19, according to data from the American Dental Association's Health Policy Institute (HPI), as dental practices were only permitted for emergency cases in the early stages of the pandemic. The American Dental Association (ADA) advised the public to put off elective dental operations in March 2020. Oral examinations, annual cleanings, cosmetic procedures, and orthodontic treatments without pain medication were among the procedures that were required to be delayed, according to the ADA.

The growing geriatric population, road accidents, and the increased demand for dental restorations are all expected to increase the demand for the dental bonding agent market. Additionally, it is expected that supportive government measures to enhance oral health outcomes will raise the cost and accessibility of dental bonds. For instance, the Centers for Disease Control and Prevention launched a program referred to as the School Sealant Program, which aims to deliver fissure and pit sealants to millions of students, particularly those enrolled in rural and underfunded schools.

The growing demand for dental restoration and increased advancements in dental materials in terms of technology is expected to drive their demand over the forecast period. Additionally, according to the FDI World Dental Federation, dental caries is one of the most common oral disorders worldwide, and it consumes close to 10% of the healthcare budget in most developing countries such as India. As a result, due to the high frequency of dental caries, the demand for dental bonding agents increased which fueled the dental bonding agent market.

Type Insights

The self-etch segment accounted for the largest market share of 60.3% in 2021due to its ease of use and the offerings including good bond strength to dentin, porcelain surfaces, and enamel. Moreover, the procedure is popular as multiple teeth can be bonded in a single dental session. Composite resin, a tooth-colored substance, is used in bonding.

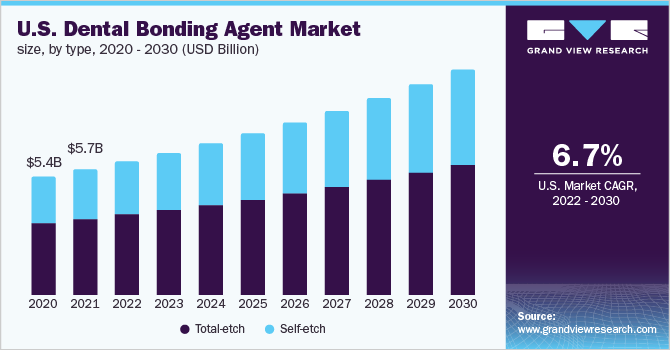

The total-etch segment is expected to witness the fastest CAGR of8.8% over the forecast period, owing to huge investment by private players and new products launched by the companies operating in the dental bonding agent market. For instance, Parkell, Inc., announced the launch of the new Brush&Bond MAX Bonding System in February 2022. It is a next-generation dental bonding agent that focuses on offering optimal performance on tooth surfaces.

End-use Insights

Based on the end-use, the dental clinics segment dominated the market with a revenue share of 63.7% and is likely to grow at the fastest rate of 8.6% CAGR from 2022 to 2030. Due to the availability of specialists, most dental patients visit private practice dental clinics. Proprietors manage more than 80% of dental offices. Globally, the number of independent practices is increasing. Due to the cost-effectiveness, the accessibility of experts, and the use of cutting-edge equipment, this trend is likely to continue in the coming years.

The number of solo dental practices is growing all around the world. Due to increased competition among care providers and the need for cost-effective treatments, independent dentistry clinics are projected to develop in the upcoming decades. Dental clinics are typically located in hospitals, schools, public buildings, and other healthcare-related locations. They serve to educate aspiring dentists and are frequently connected to a university.

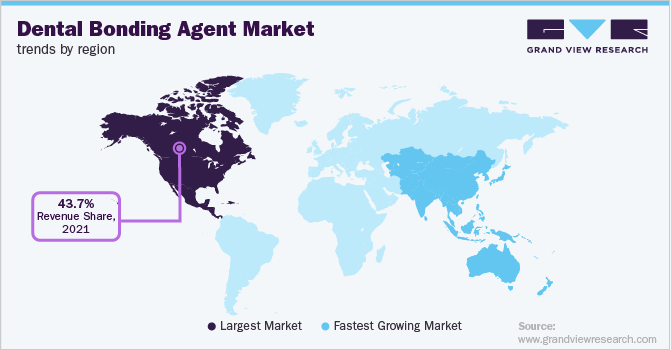

Regional Insights

North America accounted for the largest revenue share of nearly 43.7% in 2021 pertaining to a favorable reimbursement structure and the availability of the product. For instance, the Health Insurance Program for children (CHIP) and Medicaid cover dental sealants, making them more affordable and promoting their use and related treatments.

In Asia Pacific, the dental bonding agent market is anticipated to witness rapid growth over the forecast period with a CAGR of 10.4%, owing to the rapidly aging population, rising dental caries prevalence driven by changing lifestyles, and rising awareness of oral health. Growing social media use and an increase in beauty consciousness are expected to boost demand for "Flawless smiles," driving the market expansion in the region.

Key Companies & Market Share Insights

Companies in the dental bonding agent market are adopting strategies such as partnerships, mergers and acquisitions, product launches, agreements, joint ventures, collaborations, and expansion to strengthen their position. Furthermore, key players are more focused on strategic partnerships with manufacturers, raw material providers, and product innovators in the market. For instance, in December 2020, Kerr Dental launched the ZenFlexTMNiTi, an innovator in endodontic technology offering greater cutting efficiency than other endodontic devices in the market. It has remarkable resistance to torsional stress and cycle fatigue while having the flexibility and regulated memory to handle even the most intricate canal anatomies.

Initial investigations comparing ZenFlex to other top files on the market show that it has remarkable resistance to torsional stress and cycle fatigue while still having the flexibility and regulated memory to handle even the most intricate canal anatomies. Some of the prominent players in the dental bonding agent market include:

-

Ivoclar Vivadent AG

-

VOCO America Inc.

-

DMG America GC America

-

Danaher Corporation

-

BISCO Dental Products

-

Shofu Dental

-

3M Company

-

Pentron Clinical

-

Dentsply

Dental Bonding Agent Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 15.7 billion

Revenue forecast in 2030

USD 28.9 billion

Growth rate

CAGR of 7.9% from 2022 to 2030

Base year for estimation

2021

Historic data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Type, End-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; China; Japan; India; Australia; South Korea; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key Companies Profiled

Ivoclar Vivadent AG; VOCO America Inc.; DMG America GC America; Danaher Corporation; BISCO Dental Products; Shofu Dental; 3M Company; Pentron Clinical; Dentsply

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

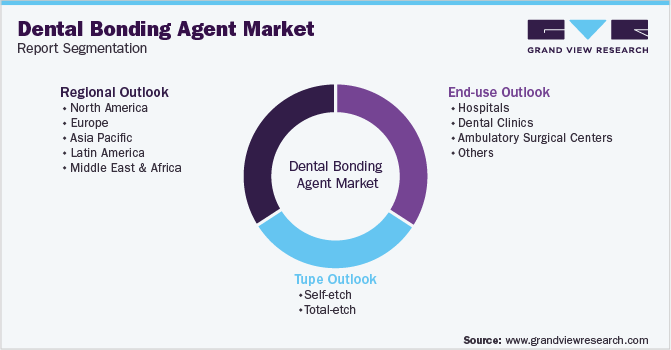

Global Dental Bonding Agent Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global dental bonding agent market based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Self-etch

-

Total-etch

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals

-

Dental Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global dental bonding agent market size was estimated at USD 14.7 billion in 2021 and is expected to reach USD 15.7 billion in 2022.

b. The global dental bonding agent market is expected to grow at a compound annual growth rate of 7.9% from 2022 to 2030 to reach USD 28.9 billion by 2030.

b. North America accounted for the largest revenue share of nearly 43.7% in 2021. This can be attributed to a favorable reimbursement structure, high product availability, and the presence of advanced technologies. For instance, the Children’s Health Insurance Program (CHIP) and Medicaid provide coverage for dental sealants, increasing their affordability and thereby encouraging the adoption of sealants and related services.

b. Some of the key market players operating in the dental bonding agent market are IvoclarVivadent AG, VOCO America Inc., Danaher Corporation, 3M Company, BISCO Dental Products, Shofu Dental, Pentron Clinical, DMG America GC America, and Dentsply.

b. Key factors driving the market growth include continuous research and development directed by key players in the dental bonding agent market are driving the market growth. Moreover, rising dental treatment costs among the developed classes, rapid rise in the elderly population, and improvements in dental surgery aftercare facilities are expected to further propel the market growth in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.