- Home

- »

- Medical Devices

- »

-

Dental Burs Market Size And Share, Industry Report, 2030GVR Report cover

![Dental Burs Market Size, Share & Trends Report]()

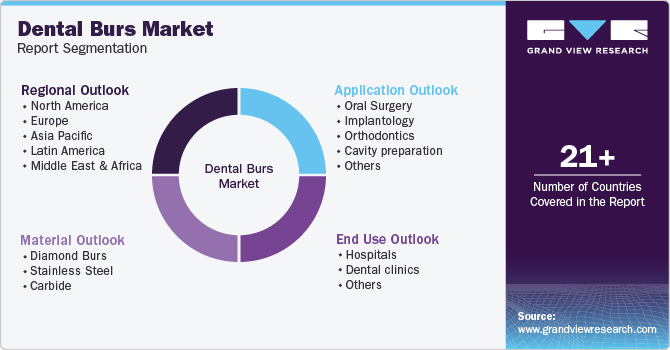

Dental Burs Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Diamond Burs, Stainless Steel, Carbide), By Application (Oral Surgery, Implantology, Orthodontics), By End-use (Hospitals, Dental Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-918-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Burs Market Summary

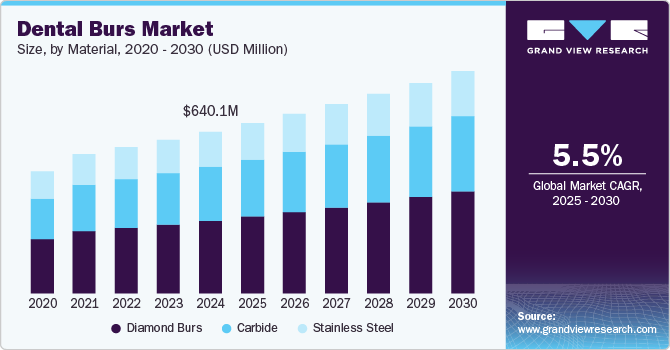

The global dental burs market size was estimated at USD 640.0 million in 2024 and is projected to reach USD 881.6 million by 2030, growing at a CAGR of 5.5% from 2025 to 2030. The market growth can be attributed to the increasing prevalence of oral health issues and a growing awareness among the population about the importance of oral health.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, the UAE is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, diamond burs accounted for a revenue of USD 259.1 million in 2022.

- Diamond Burs is the most lucrative material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 640.0 Million

- 2030 Projected Market Size: USD 881.6 Million

- CAGR (2025-2030): 5.5%

- North America: Largest market in 2022

A rising number of people are facing dental problems such as cavities, gum disease, and tooth decay, creating a demand for restorative treatments that depend on dental burs for tooth shaping and preparation.

The rising popularity of cosmetic dentistry, including procedures such as veneers and crowns, also drives the need for precise tooth shaping using dental burs to achieve the desired aesthetic results. Modern dental burs, made with advanced materials such as diamond coatings, offer improved cutting efficiency, durability, and precision, leading to wider adoption. Additionally, the growing elderly population is contributing to a higher demand for dental procedures such as dentures and implants, which often require dental burs.

Children’s dental issues, such as tooth decay, are becoming common due to poor hygiene, sugar intake from candies, and heredity. Untreated cavities can lead to infections, while misalignments such as cross-bite or open bite can affect speech, chewing, and breathing. As these issues arise, restorative treatments such as fillings and crowns are needed, with dental burs essential for shaping teeth and preparing them for procedures. Dental burs are also used in orthodontics to adjust teeth and appliances, ensuring proper fit and comfort. Furthermore, as dental care becomes more accessible in different regions worldwide, a growing number of dental professionals are performing procedures that require dental burs, leading to their increased usage on a global scale.

Material Insights

The diamond burs market dominated the dental burs market and accounted for the highest revenue share of 45.0% in 2024. This can be attributed to the proven effectiveness of diamond burs for precision shaping and polishing enamel. As diamond is the hardest known material, diamond burs are regularly utilized to cut through or grind zirconia or porcelain during the preparation and placement of veneers and crowns. These materials help to cut with extreme precision and can last longer than other burs in terms of product longevity.

The carbide market in the dental burs market is expected to grow significantly at a CAGR of 5.7% over the forecast period. Carbide burs are used for cavity preparation, tooth shaping, removing old fillings, and other procedures. Carbide, three times stronger than steel and able to withstand high temperatures, allows carbide dental burs to last longer without losing their edge. These features make them ideal for cavity excavation, bone shaping and impacted tooth removal. The blade design also reduces vibrations, minimizing patient discomfort.

Application Insights

The cavity preparation segment dominated the dental burs market and accounted for a revenue share of 28.7% in 2024. The growth is attributed to the increasing prevalence of tooth decay occurrences in children and young people, where the cavity preparation method holds significant importance. According to NCBI, the most common oral traumas worldwide include tooth crown fractures, tooth avulsion, and tooth subluxation. These factors are expected to drive the growing demand for related procedures.

The implantology segment in the dental burs market is expected to grow significantly at a CAGR of 6.1% over the forecast period. Advancements in the field of implants and safety and the high success rate of such implants are expected to boost segment growth. On average, dental implant success rates are around 90% to 98%, with a 2% to 10% failure rate. These implants are the gold standard technique to replace missing or damaged tooth/teeth effectively. Increasing demand for the replacement of teeth has provided good growth potential to the segment. They can also help support a bridge, crown, or dentures.

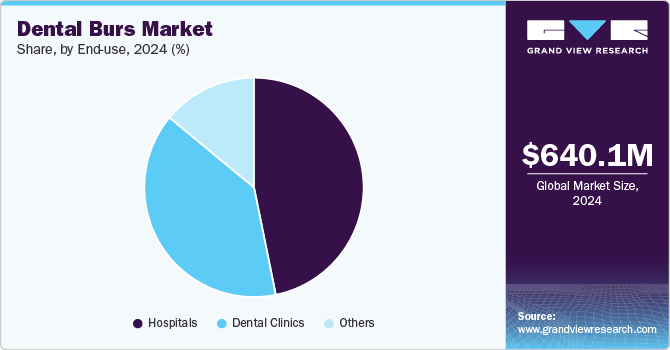

End-use Insights

Hospitals led the dental burs market, accounting for the highest revenue share in 2024. The growth is fueled by the availability of advanced infrastructure, increased investments in developing sophisticated healthcare facilities, a rise in the number of skilled professionals, and improved accessibility. A hospital's dental department can more effectively coordinate with other medical specialists during a serious medical condition, ensuring comprehensive care for patients with complex health requirements. Furthermore, patients may perceive the quality of care in a hospital dental department as superior as part of a larger medical institution.

The demand for dental burs in dental clinics is expected to grow at the fastest CAGR over the forecast period. Easier accessibility, shorter waiting times, and flexible appointment scheduling are directly contributing to the rising need for dental burs. This increased patient flow has amplified the demand for tools such as dental burs, essential for quick, precise treatments. Additionally, with the rise in cosmetic dentistry, including procedures such as teeth whitening, veneers, and implants, dental clinics are seeing more specialized treatments that require advanced burs.

Regional Insights

The North America dental burs market dominated the global market and accounted for the largest revenue share of 38.2% in 2024. The rising access to dental insurance and the prevalence of oral diseases are expected to drive the market's growth. In November 2021, Canada introduced a dental benefit under the Non-Insured Health Benefits (NIHB) program, covering services such as exams and X-rays to reduce dental problems for uninsured individuals. Similarly, in 2020, California increased investments in the Medi-Cal Dental Program, expanding dental services for nearly 13 million beneficiaries and focusing on improving access to oral health through preventive care, which has further increased the demand for dental burs market.

U.S. Dental Burs Market Trends

The dental burs market in U.S. led North America with the highest revenue share in 2024. According to the CDC statistics, more than one in four adults is suffering from tooth decay in the U.S., and approximately 46% of adults over 30 years of age experience signs of gum disease. Expansion of dental insurance in the U.S. has increased early intervention for low-income children, with 9 in 10 now insured. Integrating dental services into pediatric care has improved access, allowing children to receive preventive care during medical visits. Emerging technologies and scientific advancements in craniofacial conditions offer further opportunities to enhance caregivers' oral health knowledge and improve prevention and treatment strategies.

Asia Pacific Dental Burs Market Trends

The Asia Pacific dental burs market is expected to grow at the fastest CAGR of 6.8% over the forecast period. The growing burden of geriatric diseases, an increase in dental care centers, and the rise of dental tourism in the region are driving market growth. Countries in the region are popular for offering affordable dental treatments, making them a top destination for dental tourism. Favorable government initiatives, such as India's National Oral Health Programme, aim to improve oral health by enhancing health determinants, reducing oral disease morbidity, and integrating prevention and promotion services, further boosting market expansion.

The dental burs market in Japan dominated the Asia Pacific market with the highest revenue share in 2024. The Japanese cosmetic dentistry market is expected to reach USD 2,654.5 million by 2030, growing at a CAGR of 12.7%. The country's focus on high dental care standards and regular check-ups further boosts the demand for dental burs. This growth is driven by the rising demand for procedures such as teeth whitening, veneers, and crowns, which require precise tooth shaping with dental burs. Japan's adoption of advanced dental technology enhances procedure precision and efficiency.

Europe Dental Burs Market Trends

The Europe dental burs market held a substantial market share in 2024. The growing prevalence of dental diseases, the increasing geriatric population, and the rising popularity of cosmetic dentistry are key factors driving the expansion of the dental burs market in Europe. According to Dealroom data, 17% of dental startups and scale-ups are based in Europe, which represents nearly 10% of the global population. Alessandro Dentoni, CEO of Osteocom, believes the EU and UK dental sector is ready for disruption, driven by technological advances in equipment and continuing education. Europe's largest orthodontic clinic chain uses 3D scans and machine learning to digitize treatment, which further boosts dental procedures in Europe, hence giving rise to the dental burs market.

Germany dental burs market dominated the Europe market, with the highest revenue share in 2024. Germany's high-quality healthcare system, ranking 20th in the CEOWORLD Magazine Health Care Index (2021), and its dual public-private model, including the Gesetzliche Krankenversicherung (GKV), contribute to its advanced dental care. With Germany ranking second in the 2020 Healthiest Teeth Index and promoting oral health through the annual Day of Dental Health, these factors drive the demand for dental treatments, fueling the growth of the dental burs market.

Key Dental Burs Company Insights

Key companies in the global dental burs market include Dentsply Sirona, COLTENE Inc., SHOFU INC., and MANI,INC. Major companies in the dental burs market maintain global competitiveness by investing in advanced technology, offering high-quality, precision-engineered products, and expanding their product lines to meet diverse consumer needs. They focus on innovation, including the development of durable, efficient burs with cutting-edge materials. Strategic partnerships, strong distribution networks, and compliance with global standards also help them stay ahead in the market.

-

Dentsply Sirona provides dental products and technologies. The company offers a comprehensive range of dental burs designed to meet the needs of dental professionals for precise tooth preparation, restoration, and cosmetic procedures. The company also supports efficient and effective restorative dentistry, orthodontics, and oral surgery treatments.

-

COLTENE Inc.’s dental burs are integral to various applications, including cavity preparation, tooth shaping, and polishing. It offers a range of dental burs, including carbide, diamond, polishing, surgical, and endodontic burs, designed for precision in restorative, cosmetic, oral surgery, and endodontic procedures.

Key Dental Burs Companies:

The following are the leading companies in the dental burs market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona

- COLTENE Inc

- SHOFU INC.

- MANI, INC

- Brasseler USA

- American Orthodontics

- Prima Dental

- Diatech

- Komet Dental

- Envista

Recent Developments

-

In February 2025, MIS, an implant dentistry company, launched the MIS LYNX implant system in the U.S., offering a versatile, reliable solution for various clinical applications. The system includes sharp, sterile, single-use drills with each implant, ensuring adherence to hygiene protocols. Featuring the MIS CLEAR wet surface, it enhances implant quality. This cost-effective system reflects MIS's commitment to supporting dental professionals with innovative, high-quality solutions for predictable, confident patient outcomes.

-

In October 2024,HuFriedyGroup, a company that offers dental products, acquired SS White Dental, a renowned manufacturer of carbide and diamond burs, endodontic instruments, and lab tools. This acquisition aligns with HuFriedyGroup’s commitment to innovation and high-quality dental solutions. It expands its portfolio, enhancing product offerings and global reach, and supports dental professionals in delivering better patient outcomes, improved efficiency, and enhanced safety.

Dental Burs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 673.7 million

Revenue forecast in 2030

USD 881.6 million

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Dentsply Sirona; COLTENE Inc; SHOFU INC.; MANI,INC; Brasseler USA; American Orthodontics; Prima Dental; Diatech; Komet Dental; and Envista

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Burs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental burs market report based on material, application, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Diamond Burs

-

Stainless Steel

-

Carbide

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral Surgery

-

Implantology

-

Orthodontics

-

Cavity preparation

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Dental clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.