- Home

- »

- Medical Devices

- »

-

Dental Chair Market Size & Share, Industry Report, 2030GVR Report cover

![Dental Chair Market Size, Share & Trends Report]()

Dental Chair Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Powered, Non-powered), By Type (Ceiling Mounted, Mobile Independent, Dental Chair Mounted), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-633-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Chair Market Summary

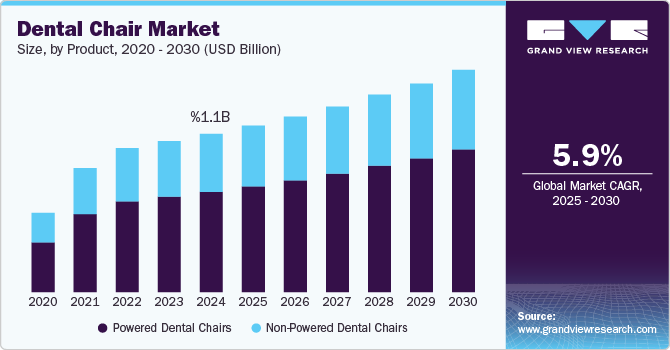

The global dental chair market size was estimated at USD 1.1 billion in 2024 and is projected to reach USD 1.5 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The growth is driven by the increasing number of dental procedures, particularly aesthetic surgeries. Advancements in healthcare infrastructure are expected to propel market expansion further.

Key Market Trends & Insights

- North America dental chair market held the predominant position in the market, with a share of 38.0% in 2024.

- The U.S. accounted for North America's largest share of the dental chair industry in 2024.

- Based on product, the powered dental chairs segment held the largest market share of 63.4% in 2024.

- Based on type, ceiling-mounted design segment held the largest market share of 39.7% in 2024.

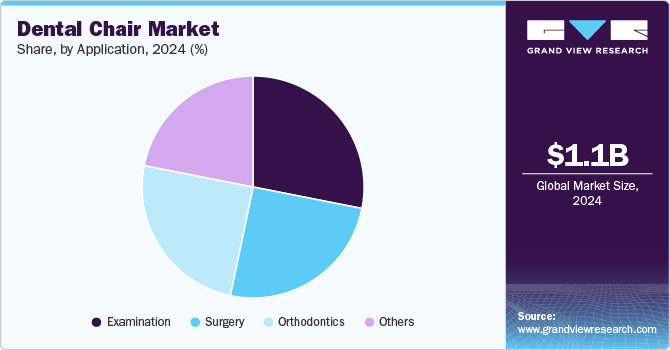

- Based on application, the examination segment dominated the market with a share of 28.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.1 Billion

- 2030 Projected Market Size: USD 1.5 Billion

- CAGR (2025-2030): 5.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As patient comfort becomes a key priority, dental chairs are evolving with innovative features to improve the experience during procedures. This trend fosters the development of more advanced, ergonomic chairs, enhancing the quality of care and operational efficiency in dental practices.

The rise in dental procedures, particularly cosmetic surgeries, is a major growth driver of the dental chair market. In May 2024, the CDC reported that approximately 11% of adults aged 65 to 74 had lost all their teeth. Additionally, around 20% of adults aged 75 and older experienced complete tooth loss. As more patients seek aesthetic treatments like implants, teeth whitening, and orthodontics, the demand for specialized dental equipment, including advanced chairs, continues to grow. These procedures often require longer and more complex treatments, making comfort and support in dental chairs crucial.

Healthcare infrastructure improvements are also contributing significantly to the market growth. The expansion of dental clinics, hospitals, and specialized dental care centers worldwide increases the demand for modern, high-tech equipment. These facilities are adopting cutting-edge technology, which includes more sophisticated dental chairs designed to accommodate advanced procedures. As dental practices expand and modernize, they invest in quality equipment that enhances patient care and operational efficiency. In October 2024, Henry Schein, Inc. launched Henry Schein Marketplace, an online service offering over 8,000 non-clinical products for dental customers. The platform will provide a wide range of office and breakroom supplies from suppliers like Staples, aiming to simplify purchasing and save time for dental practices.

The growing emphasis on patient comfort during dental procedures drives the market growth. Patients are likely to choose practices prioritizing comfort, particularly during long or complex treatments. This has led to the development of dental chairs with adjustable features, ergonomic designs, and improved cushioning. These innovations enhance patient satisfaction and help reduce the physical strain on dental professionals. In December 2022, Planmeca expanded its renowned dental equipment lineup by introducing a new patient chair. The Planmeca Pro50 chair perfectly balances functionality, flexibility, and innovative features, all presented in an elegant and timeless design.

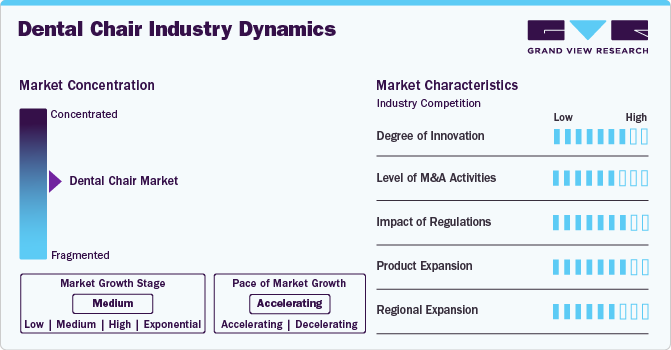

Market Concentration & Characteristics

The degree of innovation in the dental chair market is high, as manufacturers continually strive to incorporate new technologies to improve patient comfort, enhance operational efficiency, and integrate digital tools. Innovations include the development of ergonomic designs, advanced sterilization systems, smart dental chairs with integrated sensors, and connectivity with dental imaging and CAD/CAM systems. The incorporation of wireless features and customizable settings also reflects a strong push toward meeting evolving needs in the healthcare sector.

The market has a moderate level of mergers and acquisitions. While there has been some consolidation, particularly among key players seeking to expand their product portfolios and geographical presence, the market remains fragmented. Large dental equipment manufacturers often acquire smaller companies to access new technologies or expand into emerging markets. However, the overall rate of M&A activity is not as aggressive as in more rapidly evolving sectors.

The impact of regulations on the dental chair industry is high. Regulatory agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose rigorous standards regarding product safety, quality, and environmental considerations. Manufacturers need to adhere to these regulations, as failing to do so can result in penalties or the withdrawal of products from the market. As regulations tighten, companies must continually innovate, invest in research and development, and ensure their products comply with changing standards. This raises operational costs and encourages innovation.

Product expansion in the dental chair industry is high, driven by the growing demand for specialized dental chairs, such as those designed for pediatric dentistry, oral surgery, or orthodontics. Companies are expanding their product offerings by incorporating advanced features like improved patient positioning, enhanced durability, and integrated technology like LED lighting or intraoral cameras. There is an increasing focus on offering complete dental office solutions, where dental chairs are part of a broader suite of products and services.

Regional expansion in the dental chair industry is moderate, with companies focusing on key growth areas like North America, Europe, and Asia-Pacific. While there is notable demand in developed markets, there is also significant potential for growth in emerging regions such as Latin America, the Middle East, and Southeast Asia. However, regional expansion can be challenging due to regulatory hurdles, varying healthcare standards, and market competition, leading to moderate rather than high growth rates in certain regions.

Product Insights

The powered dental chairs segment held the largest market share of 63.4% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The demand for advanced dental chairs is expected to rise as dentists increasingly strive to enhance the quality of their services for patients. Motorized dental chairs, in particular, are gaining popularity due to their quiet operation, easy accessibility, and smooth functionality. Designed to withstand temperature fluctuations, these chairs provide convenience and have pre-programmed settings that streamline operations and improve time management, reducing the need for manual adjustments.

Adjusting a dental chair during treatment can be challenging; however, powered chairs address this issue by allowing operators to adjust height and position effortlessly with the push of a button. This automation saves time and ensures adjustments can be made swiftly in response to varying procedural requirements. In June 2023, A-dec revealed its groundbreaking delivery systems, the A-dec 500 Pro and A-dec 300 Pro, the company’s first to offer digital connectivity. These systems are powered by the A-dec+ software platform, which enhances the integration between dental professionals and their equipment. The A-dec 500 Pro features an intuitive touchscreen interface, whereas the A-dec 300 Pro operates via a Control Pad.

Type Insights

In 2024, ceiling-mounted design held the largest market share of 39.7%. The dental chair industry is segmented into three designs: ceiling-mounted, mobile-independent, and dental chair-mounted. The ceiling-mounted design features mobile storage and adaptable layouts, while the dental chair-mounted design is expected to grow due to its easy maintenance and enhanced mobility. These innovative designs improve the operational effectiveness of dental surgeons.

The dental chair-mounted design segment is anticipated to grow at the fastest CAGR over the forecast period. These chairs provide benefits such as improved mobility and straightforward maintenance. They include features like wireless foot controls and integrated touchpads, enhancing convenience during treatments. Chairs designed for mobile independence typically have locking mechanisms and are either equipped with wheels or can be folded. As they are specifically created for mobile operations, they are frequently used in locations with limited access to dental services.

Application Insights

The examination segment dominated the market with a share of 28.1% in 2024. The dental chair market can be categorized by application into various segments, including examination, surgery, orthodontics, and others. The examination segment’s growth is attributed to the growing oral hygiene awareness. In September 2024, the CDC published preliminary results from the 2023 National Health Interview Survey, revealing that 65.5% of adults aged 18 and older had undergone a dental examination or cleaning in the past year. Regular dental checkups play a crucial role in the early detection and treatment of oral health issues, encouraging young adults to seek dental care and thereby driving the growth of this segment.

The other segment is expected to grow at the fastest CAGR during the forecast period due to poor eating habits and smoking. The rising demand for aesthetic dental procedures and increased awareness of aesthetics are likely to boost the need for cosmetic dental treatments, contributing to the growth of this segment. Additionally, dental chairs are categorized into four application-based segments: examination, surgery, orthodontics, and others.

Regional Insights

In 2024, North America dental chair market held the predominant position in the market, with a share of 38.0% due to advanced healthcare infrastructure and high demand for dental services. The U.S. leads this market, driven by technological advancements in dental equipment, increased dental awareness, and a growing aging population. In February 2024, Carbon announced its Automatic Operation (AO) suite to revolutionize dental lab automation. This innovative suite enhances lab efficiency and precision while significantly reducing print turnaround times and labor requirements.

U.S. Dental Chair Market Trends

The U.S. accounted for North America's largest share of the dental chair industry in 2024. The U.S. is the largest market for dental chairs, supported by a robust healthcare system, a high number of dental professionals, and a rising demand for cosmetic dentistry. Increasing technological integration in dental practices, such as digital diagnostics and integrated patient management systems, is driving the adoption of advanced dental chairs.

Europe Dental Chair Market Trends

Europe is anticipated to grow significantly over the forecast period due to high oral healthcare standards, an aging population, and increasing interest in cosmetic dentistry. Countries like Germany, France, and the UK are key markets, focusing on adopting advanced technologies like digital dental systems and ergonomic chairs to improve patient care and practitioner comfort. In September 2024, Osstem's K3 dental chair unit was noted for increasing its market share in Europe. The chair’s advanced design, comfort features, and competitive pricing have made it popular among dental professionals.

The UK dental chair market is expected to grow over the forecast period. The UK's NHS and private dental practices drive demand for dental chairs. There is a growing interest in advanced equipment that improves patient experience and treatment efficiency. With a high level of dental awareness and a focus on preventive care, demand for ergonomic and multifunctional dental chairs is rising.

The dental chair market in Germany is expected to grow over the forecast period. Germany has a well-established dental market with a high demand for technologically advanced dental chairs. The country’s robust healthcare infrastructure and a strong focus on precision and quality lead to a growing need for ergonomic, customizable dental chairs that improve patient comfort and practitioner efficiency.

The dental chair market in France is expected to grow over the forecast period. France sees steady growth, with an increasing preference for modern, ergonomically designed chairs in private practices. Adopting advanced dental technologies, like integrated lighting and digital systems, also drives the demand for higher-quality dental equipment. In December 2023, HEKA I+ received the "Product of the Year 2024" award in the Equipment category from the French Dental Association during the ADF exhibition held in Paris.

Asia Pacific Dental Chair Market Trends

The Asia Pacific dental chair market is expected to experience rapid growth, with a projected CAGR of 6.4% from 2025 to 2030. The Asia-Pacific market is expanding rapidly due to increasing urbanization, rising dental health awareness, and growing disposable incomes in countries like China, India, and Japan. As the region develops its healthcare infrastructure, demand for basic and advanced dental chairs rises.

The China dental chair market is anticipated to grow over the forecast period. China represents a large and growing market for dental chairs, driven by urbanization, increased disposable income, and rising dental health awareness. With a booming private dental sector and greater access to dental care, demand for high-quality and technologically advanced dental chairs is increasing, particularly in urban areas. In May 2023, Anye Medical introduced a new pediatric dental chair, the AY-215D2, at the Dental South China International Expo. The chair, designed with a giraffe theme, is aimed at children and includes features like a water purification system and disinfectant dispensing unit to meet stricter sterilization requirements.

The Japan dental chair market is expected to grow rapidly over the forecast period. In Japan, the aging population is a key driver for the market, as elderly care and dental health services become more important. In January 2024, Fujitsu announced the launch of a comprehensive health education initiative for its approximately 70,000 employees in Japan. The program encourages proactive measures for maintaining and improving oral and dental health, vital for overall well-being and enhancing quality of life.

The dental chair market in India is anticipated to grow rapidly over the forecast period. India’s dental chair industry is growing, driven by an increasing focus on oral health, higher disposable incomes, and expanding urban centers. In October 2024, JCBL launched a Dental Clinic on Wheels under Project Smile Himalaya, aimed at providing dental care in remote Ladakh villages. The converted Caravan can treat one patient while accommodating 2-3 others, featuring a foldable dental chair and essential tools like a first aid kit and toolbox for accessibility in difficult conditions.

Latin America Dental Chair Market Trends

In Latin America, the dental chair industry is witnessing a significant trend. The market is witnessing moderate growth. Key markets like Brazil are experiencing increased demand for dental equipment, fueled by rising dental awareness, an expanding middle class, and improvements in healthcare infrastructure.

The dental chair market in Brazil is expected to grow over the forecast period. Brazil stands out as the largest market in Latin America for dental chairs, with strong demand driven by a growing number of dental practitioners, rising consumer interest in cosmetic dentistry, and a focus on modernizing dental facilities. The market is also benefiting from increased private-sector investments in healthcare.

Middle East and Africa Dental Chair Market Trends

The dental chair market in the Middle East and Africa is poised to grow in the near future. The market is experiencing moderate growth, with countries like Saudi Arabia and the UAE leading demand. There is an increasing adoption of modern dental technologies, driven by improving healthcare infrastructure, rising dental tourism, and growing awareness of oral health. In September 2024, Dentsply Sirona announced its partnership with Alexandria University in Egypt to establish innovative dental facilities. The collaboration aims to enhance dental education and care with modern technologies and infrastructure.

The dental chair market in Saudi Arabia is expected to grow over the forecast period. Demand for high-quality dental chairs is rising due to significant investments in healthcare and a growing private dental sector. The country’s focus on modernizing its healthcare facilities and providing advanced dental services supports the market.

The dental chair market in Kuwait is anticipated to grow over the forecast period. Kuwait is witnessing a steady demand for advanced dental chairs, supported by a well-developed healthcare system and increasing private dental practices. With a focus on quality care and patient comfort, there is growing interest in ergonomic and technology-driven dental chairs in the market.

Key Dental Chair Company Insights

Some of the key market players operating in the dental chair market include Dentsply Sirona, Henry Schein, Inc., Danaher Corporation, A-dec Inc., Patterson Dental Supply, Inc, and Institut Straumann AG. These companies are making significant infrastructure investments, which enable them to develop, manufacture, and commercialize a high volume of drugs worldwide. In addition, to increase their presence globally, companies engage in several strategic partnerships with distributors and other companies.

Key Dental Chair Companies:

The following are the leading companies in the dental chair market. These companies collectively hold the largest market share and dictate industry trends.

- A-dec Inc.

- Midmark Corporation

- Craftmaster Contour Equipment, Inc.

- XO CARE A/S

- Dentsply Sirona

- Henry Schein, Inc.

- Danaher Corporation

- PLANMECA OY

- Patterson Dental Supply, Inc

- Institut Straumann AG

Recent Developments

-

In October 2024, Midmark Corporation launched a promotion for its Procenter Instrument Delivery Systems, designed to improve the efficiency and comfort of dental and medical offices. The offer includes special pricing on advanced instrument delivery systems and ergonomic chairs to enhance practitioner comfort and patient care.

-

In September 2024, DENTALEZ, Inc. announced the launch of the Forest 6400 dental chair, a significant addition to its well-regarded Forest line of customizable, high-quality dental equipment. This innovative chair enhanced patient comfort and practitioner well-being, representing a notable advancement in oral healthcare.

-

In March 2024, XO CARE A/S introduced a new range of color options for their patient chairs, enhancing customization for dental practices. This move reflects the company’s commitment to blending aesthetic appeal with functionality, allowing dental clinics to personalize their treatment spaces. The new colors are designed to improve patient comfort and align with modern clinic trends, allowing dental professionals to create a more inviting atmosphere

Dental Chair Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.11 billion

Revenue forecast in 2030

USD 1.5 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

A-dec Inc.; Midmark Corporation; Craftmaster Contour Equipment, Inc.; XO CARE A/S; Dentsply Sirona; Henry Schein, Inc.; Danaher Corporation; PLANMECA OY; Patterson Dental Supply, Inc; Institut Straumann AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

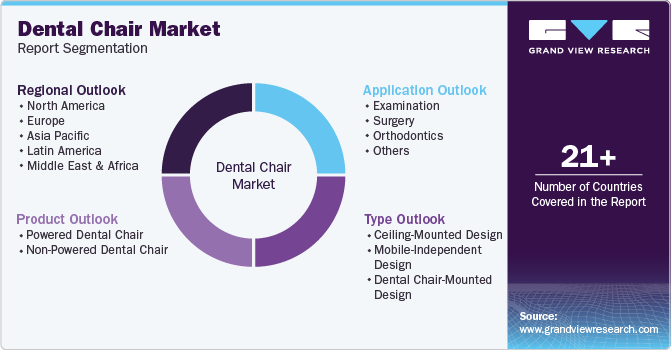

Global Dental Chair Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental chair market report based on product, type, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powered Dental Chair

-

Non-Powered Dental Chair

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceiling-Mounted Design

-

Mobile-Independent Design

-

Dental Chair-Mounted Design

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Examination

-

Surgery

-

Orthodontics

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental chair market size was estimated at USD 1.1 billion in 2024 and is expected to reach USD 1.11 billion in 2025.

b. The global dental chair market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 1.5 billion by 2030

b. North America dominated the dental chair market with a share of 38.0% in 2024. This is attributable to the increasing prevalence of dental disorders, the rising geriatric population, and improving healthcare infrastructure.

b. Some key players operating in the dental chair market include Dental Equipment Company (A-Dec, Inc.); Midmark; Craftsmaster Contour Equipment, Inc.; Henry Schein, Inc.; Danaher Corporation; PLANMECA OY; Patterson Dental Supply, Inc.; and Straumann.

b. Key factors that are driving the dental chair market growth include an increasing number of dental procedures, especially surgeries related to dental esthetics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.