- Home

- »

- Medical Devices

- »

-

Dental Implants Abutment Systems Market Size Report, 2033GVR Report cover

![Dental Implants Abutment Systems Market Size, Share & Trends Report]()

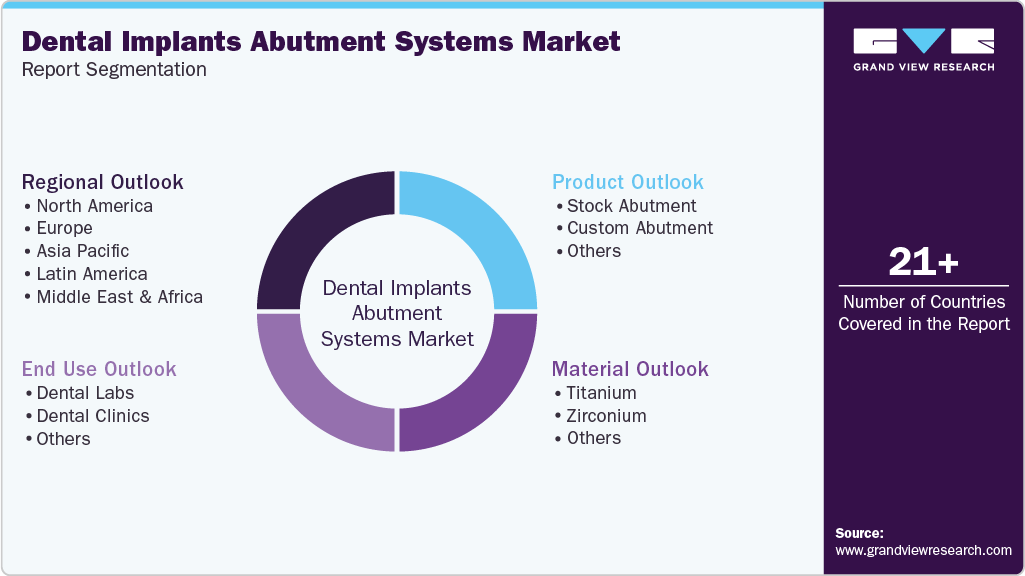

Dental Implants Abutment Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Stock Abutment, Custom Abutment), By Material (Titanium, Zirconium), By End Use (Dental Labs, Dental Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-776-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Implants Abutment Systems Market Summary

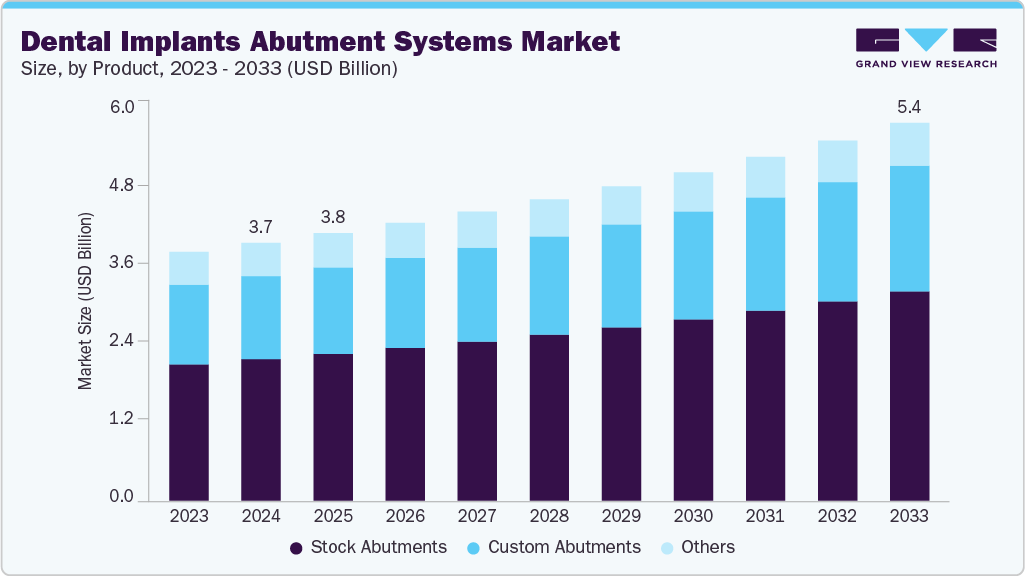

The global dental implants abutment systems market size was estimated at USD 3.66 billion in 2024 and is projected to reach USD 5.37 billion by 2033, growing at a CAGR of 4.41% from 2025 to 2033. The demand for dental implants abutment systems is rising owing to the increasing preference for restorative dentistry and the growing demand for dental implantation. Rising dental tourism is also anticipated to propel market growth.

Key Market Trends & Insights

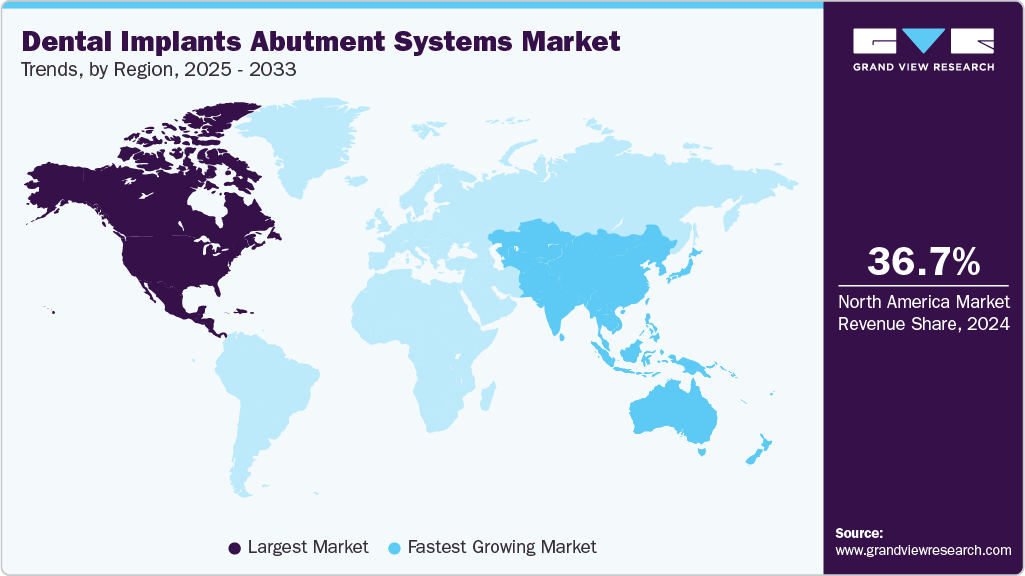

- North America dominated the global dental implants abutment systems industry with the largest revenue share of 36.71% in 2024.

- By product, the custom abutments segment is anticipated to witness the fastest growth with a CAGR of 4.8% during the forecast period.

- By material, the titanium segment led the market with the largest revenue share of 63.12% in 2024.

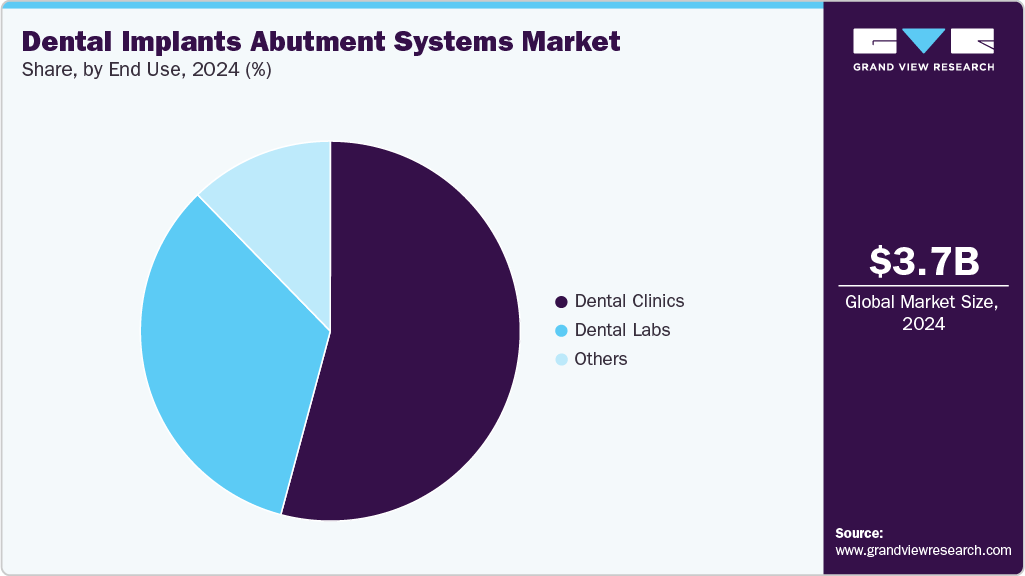

- By end use, the dental clinics segment held the largest revenue share of 54.19% in the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.66 Billion

- 2033 Projected Market Size: USD 5.37 Billion

- CAGR (2025-2033): 4.41%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising demand for dental implantation procedures is anticipated to drive the market growth. Several developed and developing countries are witnessing a rapid increase in dental implantation. According to the data published by Aria Dental Care in October 2024, states like Florida and California are at the top in the number of dental implant procedures performed, with estimates suggesting that California alone accounts for about 20% of all dental implants nationwide. In 2023, about 1.1 million dental implants were placed in California, making it a substantial hub for restorative dentistry procedures. Thus, such high demand for oral implantation procedures is anticipated to drive the demand for the implant abutment systems industry in the coming years.

Moreover, the increasing number of clinical trials focusing on developing and evaluating implant replacement systems for various conditions, such as extraction sockets, bone loss, and gingival disease, among others, is anticipated to create lucrative opportunities for industry players. Several academic institutions, researchers, and industry players are engaged in these trials.

Some of the clinical trials conducted for implant abutment systems are as follows

Study Title

Conditions

Interventions

Sponsor

Enrollment

Completion Date

Impact of Transepithelial Abutment Connection and Disconnection in Dental Implants

Bone Loss|Bacterium; Agent|Satisfaction, Patient

PROCEDURE: abutment placement|PROCEDURE: Ti-base placement

University of Valencia

32

11/1/2025

L-PRF vs Connective Tissue With Customized Healing Abutment in Immediate Implant Placement

Recession, Gingival|Bone Loss in Jaw

PROCEDURE: L-PRF with dental implant and customized healing abutment|PROCEDURE: Connective tissue with dental implant and customized healing abutment

Kafrelsheikh University

16

8/20/2027

Customized CAD/CAM Titanium-Milled Abutments Vs. Custom Abutments Over Immediate Implants in Class II Extraction Sockets in the Esthetic Zone: a Randomized Controlled Clinical Trial

Implant Therapy|Class II Extraction Sockets

DEVICE: Stock Abutment Implant|DEVICE: Customized CAD CAM Titanium Milled Abutment Implant

Ain Shams University

48

12/20/2024

Dimensional Changes of Peri-implant Tissue in Immediate Implants With Individualized Healing Abutments

Dental Implant|Immediate Dental Implant|Wound Heal

DEVICE: Standard healing abutment|DEVICE: Individualized healing abutment

Universitat Internacional de Catalunya

32

7/15/2026

Comparison Between Two Different Healing Abutments in Single Posterior Implants

Dental Implants|Dental Implants, Single-tooth

OTHER: Prefabricated healing abutment with scan peg|OTHER: Customized healing abutment

Alexandria University

24

10/1/2025

RCT Comparing KS Versus TS for Ovedenture

Dental Implant|Dental Implant-Abutment Design|Edentulous Jaw

DEVICE: Implant placement with 3.5 mm diameter KS implants.|DEVICE: Implant placement with 3.5 mm diameter TS implants.

Università degli Studi di Sassari

48

1/30/2028

Comparative Clinical Study of Conventional vs Customized Healing Abutments in Dental Implantology

Peri-implant Soft Tissue Healing|Soft Tissue Management in Subcrestal Dental Implants|Healing Abutment Influence on Gingival Volume

PROCEDURE: Bone-Level Implant Placement with Transmucosal Abutment and One Abutment-One Time Protocol Using Healing Abutments

University of Valencia

75

7/31/2029

Comparison of Abutment Engagement Configurations in Implant Supported Fixed Partial Dentures

Dental Implant

DEVICE: hexed non hexed|DEVICE: non-hexed

University of Jordan

24

11/10/2025

SOI Immediately vs Delayed

Dental Implant|Dental Implant-Abutment Design

DEVICE: Immediately implant placement|DEVICE: Delayed

Università degli Studi di Sassari

70

1/31/2028

Peri-implant Soft Tissue Response to Direct Zirconia-Based Composite Customized Healing Abutment

Missing Tooth

OTHER: Zirconia-based composite customized healing abutment|OTHER: Conventional composite customized healing abutment.

Ain Shams University

22

2026-12

Crestal Bone Response to Narrow vs. Regular Tie-Base in Subcrestal Implants

Bone Loss

DEVICE: Intervention Name (Arm 1): Narrow tie-base abutment Intervention Name (Arm 2): Regular tie-base abutment

Menoufia University

40

12/1/2028

Source: ClinicalTrials.gov

Furthermore, the growing burden of oral disorders such as tooth loss and gum disease is anticipated to propel the market demand in the coming years. According to the data published by the WHO in March 2025, the estimated worldwide average prevalence of tooth loss is nearly 7% among individuals aged 20 years or older. For individuals aged 60 years or older, this figure increases to 23%. Such prevalence of edentulism is anticipated to boost the market growth.

Key Opinion Leaders

Company Name

KOLs

Growth Opportunities

Arjan de Roy, Group Vice President Essential Dental Solutions at Dentsply Sirona.

“CEREC Cercon 4D Multidimensional Zirconia Abutment Block is the world’s first highly esthetic CAD/CAM zirconia abutment block for implant restorations, constructed to mimic a natural tooth. It is currently also the only zirconia abutment block that can be used for both hybrid abutments as well as hybrid abutment crowns. This special block enables dentists to achieve excellent chairside results for their implant patients with confidence.”

- Growing Demand for Chairside CAD/CAM Solutions

- Dual Application Use

- Esthetic-Driven Patient Preferences

Dr. Robert Gottlander, President and CEO of the Neoss Group.

"We are happy to introduce our new Multi-Unit Abutment with the Neoss4+ Treatment Solution to the dental community. Our commitment to innovation has led us to create a solution that will empower dental clinicians to provide great care to their patients. We believe that the Neoss4+ Treatment Solution will give more options for the full arch dental implantology and improve the lives of those seeking to restore their smiles."

- Expansion into Full-Arch Implant

- Appeal to Clinicians Seeking Versatility

Source: Grand View Research Analysis

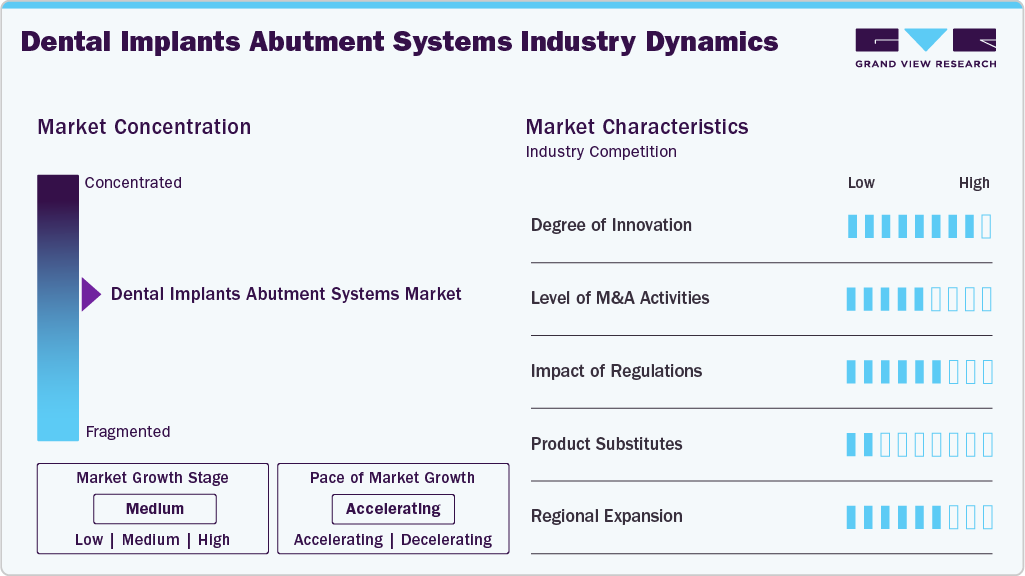

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The dental implants abutment systems industry is characterized by significant growth owing to the rising demand for restorative dentistry procedures, growing developments of innovative products, and increasing clinical trials.

The increasing number of clinical studies and trials focused on implant abutment systems highlights the market's growing emphasis on innovation. Manufacturers are adopting novel technologies such as Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) to develop novel products. For instance, in May 2025, Dentsply Sirona introduced a novel CAD/CAM zirconia block, the CEREC Cercon 4D Multidimensional Zirconia Abutment Block. This block integrates high strength with esthetics for hybrid abutment crowns and abutments. Such developments highlight ongoing innovation in the industry.

Regulations ensure safety, efficacy, and standardization of dental implant abutment systems, impacting product design, material choice, and market entry through mandatory compliance, classification, and premarket approval requirements.

Key Regulatory Authorities

-

U.S.: U.S. Food and Drug Administration (FDA)

-

Canada: Health Canada

-

Europe: European Medicines Agency (EMA)

-

Other national and regional regulatory authorities

Regulatory Focus

-

These bodies oversee dental implant abutment systems' approval, classification, and post-market monitoring.

FDA Classification (as of October 2024 Guidance)

-

The FDA regulates endosseous dental implant abutments as Class II medical devices.

-

These devices fall under the following CFR (Code of Federal Regulations) classification:

-

21 CFR 872.3630 - Endosseous Dental Implant Abutment (Product Code: NHA)

Mergers and acquisitions are vital strategic methods in the industry. They enable companies to expand their product offerings, foster innovation, and improve their market position. For instance, in February 2024, Avista Capital Partners reported its acquisition of Terrats Medical, a global provider of oral care solutions, including abutments and implants. As part of the deal, Terrats’ founders reinvested in the company and are expected to continue leading the business, ensuring management and strategic direction continuity.

Product Insights

The stock abutment segment held the largest share of the market in 2024. These abutments are pre-manufactured and available in standardized sizes. The demand for stock abutment systems can be attributed to their convenience and cost-effectiveness, which increases their adoption in many dentistry practices. In addition, as these components are prefabricated, they can significantly reduce the time required to complete an implant procedure, allowing for quicker restorations. Stock abutments are practical for implant restorations, including bone-level and tissue-level implants. These benefits are expected to drive the growth of this segment.

The custom abutment segment is projected to grow at the fastest CAGR of 4.8% during the forecast period, due to its ability to provide personalized, precise fits that mimic natural teeth, even as gums recede. Custom abutments are made from high-quality materials like titanium, zirconia, or noble metals and offer better control over angulation, emergence profile, and crown preparation. They enhance aesthetic outcomes and allow margins to be placed optimally for improved gingival health and hygiene. These benefits drive demand for custom abutments during the forecast period.

Material Insights

The titanium segment accounted for the largest share, around 63.12%, in the market in 2024. Titanium is widely utilized in oral implantology due to its superior biocompatibility. Titanium-based implant abutments act as intermediaries between implants and crowns, serving as the transmucosal component of the implant systems. Due to the unique properties such as biocompatibility associated with titanium, the growing demand for titanium materials in implant abutments is expected to drive segment growth in the coming years.

The others segment is projected to experience the fastest growth during the forecast period. This category includes polyetheretherketone (PEEK), ceramics, noble metals, and hybrid constructions. Increasing research has highlighted the potential of these materials in implants and prosthetics. For instance, a study published in the Journal of Clinical Advances in Dentistry in October 2023 noted that PEEK is gaining popularity as an alternative to titanium due to its high biocompatibility, natural tooth-like color, cost-effectiveness, and chairside adjustability. PEEK abutments also demonstrate reduced biofilm formation and support bone remodeling. Its semicrystalline structure enhances durability by allowing deformation rather than fracture, making it easier to replace without complications such as broken screw removal. These advantages are expected to drive demand and contribute significantly to the segment's growth.

End Use Insights

The dental clinics segment led the market with a total revenue share of 54.19% in 2024. This growth is primarily driven by the large number of oral procedures conducted in clinics and the increasing prevalence of oral disorders. Furthermore, the growing launches of clinics that can perform restorative dentistry procedures are anticipated to support the segment's growth. For instance, in March 2024, Paras Hospitals introduced a Super-Specialized Dental Implant Clinic to provide affordable dentistry treatments.

The dental labs segment is expected to register the fastest growth over the forecast period. This growth is primarily driven by the increasing demand for customized prosthetics, CAD/CAM technology advancements, and growing partnerships between labs and clinics. These factors enable efficient, precise, and aesthetically superior implant abutment solutions, boosting segment expansion.

Regional Insights

North America dental implants abutment systems industry held the largest global revenue share of 36.71% in 2024. The regional market is driven by the increasing burden of edentulism, the presence of several manufacturers, and advanced healthcare infrastructure. According to data published by Health Canada in October 2024, among individuals aged 18 and older, 4% registered having lost all their natural teeth. Such a high burden of oral diseases is anticipated to support the regional market's growth.

U.S. Dental Implants Abutment Systems Market Trends

The U.S. dental implants abutment systems industry is expected to grow significantly, driven by the presence of several key players and the rising launches of novel products. For instance, in November 2023, Keystone Dental Holdings, a U.S. based company, launched the GENESIS ACTIVE Implant System. This system comes with Multi-Unit Abutment solutions and ELLIPTIBase Abutment. Such product launches are expected to support market growth.

Europe Dental Implants Abutment Systems Market Trends

The European dental implants abutment systems industry is growing due to an aging population and increased focus on regenerative dentistry. Advances in implantology and products are further anticipated to support the regional market growth. For instance, in October 2022, Osstem Europe, an international implant specialist, launched the TS scan healing abutment in the European market. The product combines a healing abutment with a scan body. It allows for a satisfactory completion of the implant impression by scanning the surface of the healing abutment directly in the oral cavity, eliminating the need for a separate body scan.

The dental implant abutment systems industry in the UK is experiencing growth, primarily driven by the increasing burden of an aging population and the rising prevalence of oral diseases. According to the report "State of Ageing 2025," over 10 million people in England are aged 65 and over, accounting for 18% of the population.

France's dental implants abutment systems industry is poised for rapid growth in the coming years. The increasing aging population, favorable government regulations, and supportive reimbursement frameworks are anticipated to support the country's market growth. In November 2024, France's High Authority for Health, the Haute Autorité de Santé (HAS), approved reimbursement for implants. This decision could significantly aid many individuals who struggle to afford expensive dentistry procedures.

Asia Pacific Dental Implants Abutment Systems Market Trends

The Asia-Pacific dental implants abutment systems industry is growing fastest, driven by increasing investments in developing oral care infrastructure and rising oral disease prevalence. Furthermore, growing awareness about oral care and treatment options is anticipated to support the regional market's growth in the coming years.

The Indian dental implants abutment systems industry is anticipated to witness lucrative growth. Increasing launches of oral care clinics across the country and growing knowledge and education about oral care are anticipated to support the country's market growth.

The China dental implants abutment systems industry is expected to grow significantly. The increasing aging population, adoption of novel technologies, and rising preference for restorative dentistry are anticipated to support the country's market growth. In addition, the high burden of oral diseases is expected to drive the national market. The study published by the National Library of Medicine in March 2022 indicates that 5.8% of the population between 65 and 74 years old was edentulous.

Latin America Dental Implants Abutment Systems Market Trends

The Latin America dental implant abutment systems industry is driven by a growing aging population, rising prevalence of tooth loss, and increasing awareness of advanced restoration options. In addition, expanding access to oral care, improving healthcare infrastructure, and the rising popularity of cosmetic dentistry are fueling demand. Moreover, the growing presence of global implant manufacturers and the availability of cost-effective treatment options support market growth across the region.

Middle East and Africa Dental Implants Abutment Systems Market Trends

The Middle East & Africa dental implant abutment systems industry is driven by increasing dental tourism, a growing middle-class population with rising disposable income, and a higher demand for aesthetic dentistry solutions. Furthermore, government initiatives to modernize healthcare systems support the adopting advanced technologies across the region.

Key Dental Implants Abutment Systems Company Insights

Institut Straumann AG, Neoss, and Nobel Biocare Services AG are some of the major players in the dental implants abutment systems industry. Industry players are focusing on expanding their product portfolio by launching innovative products. In addition, they are adopting advanced technologies and acquiring other players to strengthen their position in the market.

Key Dental Implants Abutment Systems Companies:

The following are the leading companies in the dental implants abutment systems market. These companies collectively hold the largest market share and dictate industry trends.

- Institut Straumann AG

- Nobel Biocare Services AG

- ZimVie Inc.

- OSSTEM IMPLANT CO., LTD.

- Dentsply Sirona

- BioHorizons

- MIS Implants Technologies Ltd.

- Zest Dental Solutions

- Neoss

Recent Developments

-

In May 2025, Dentsply Sirona introduced a novel CAD/CAM zirconia block, the CEREC Cercon 4D Multidimensional Zirconia Abutment Block. This block integrates high strength with esthetics for hybrid abutment crowns and abutments.

-

In February 2024, Avista Capital Partners reported its acquisition of Terrats Medical, a global provider of oral care solutions, including abutments and implants. As part of the deal, Terrats’ founders reinvested in the company and are expected to continue leading the business, ensuring management and strategic direction continuity.

Dental Implants Abutment Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.80 billion

Revenue forecast in 2033

USD 5.37 billion

Growth rate

CAGR of 4.41% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Institut Straumann AG; Neoss; Nobel Biocare Services AG; ZimVie Inc.; OSSTEM IMPLANT CO., LTD.; Dentsply Sirona; BioHorizons; MIS Implants Technologies Ltd.; Zest Dental Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Implants Abutment Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dental implants abutment systems market report based on product, material, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Stock Abutment

-

Custom Abutment

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Titanium

-

Zirconium

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Dental Labs

-

Dental Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental implants abutment systems market size was estimated at USD 3.66 billion in 2024 and is expected to reach USD 3.80 billion in 2025.

b. The global dental implants abutment systems market is expected to grow at a compound annual growth rate of 4.41% from 2025 to 2033 to reach USD 5.37 billion by 2033.

b. North America dominated the dental implants abutment systems market in 2024 with a market share of 36.71% owing to the increasing burden of edentulism, the presence of several manufacturers, and advanced healthcare infrastructure.

b. Some key players operating in the dental implant abutment systems market include Institut Straumann AG, Neoss,Nobel Biocare Services AG, ZimVie Inc., OSSTEM IMPLANT CO., LTD., Dentsply Sirona, BioHorizons, MIS Implants Technologies Ltd., and Zest Dental Solutions.

b. Key factors driving the growth of the dental implant abutment systems market include the increasing preference for restorative dentistry and the growing demand for dental implants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.