- Home

- »

- Medical Devices

- »

-

Dental Implants Market Size, Share And Growth Report, 2030GVR Report cover

![Dental Implants Market Size, Share & Trends Report]()

Dental Implants Market Size, Share & Trends Analysis Report By Implant Type (Zirconium, Titanium), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-566-3

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Dental Implants Market Size & Trends

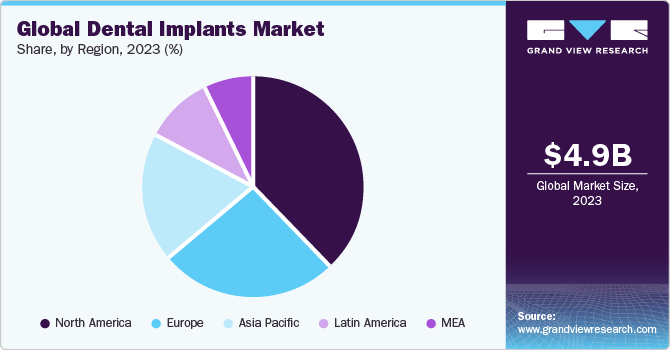

The global dental implants market size was valued at USD 4.99 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.8% from 2024 to 2030. Increasing applications of dental implants in various therapeutic areas along with rising demand for prosthetics are some of the key factors expected to boost the industry growth. Prosthetics play a major role in propelling the demand for these implants through oral rehabilitation, which helps in restoring the oral function and facial form of a patient. Acceptance level for dental implants is increasing among patients and dental surgeons due to limitations of removable prosthetics, such as discomfort, lack of natural appearance, and need for maintenance.

Prosthetics mounted on dental implants do not encroach on soft tissues and enhance aesthetics, which is further expected to drive the industry. The industry witnessed a minor setback due to the COVID-19 pandemic in the second and third quarters of 2020 due to supply chain bottlenecks and the closure of dental clinics. However, after the second quarter of 2020, dental procedures started to resume leading to a full market recovery by 2021. Companies like Straumann, which has a comprehensive portfolio of implants and implant solutions namely Neodent, Medentika, and Anthogyr, reported that their industry share increased from 27% to 29% from 2020 to 2021. This implies that the company expanded its customer base and geographical presence considerably post-pandemic.

An increasing number of dental injuries, owing to road accidents and sports injuries, are also some of the major factors favoring the demand for dental implants. The World Health Organization (WHO) data suggests that nearly 10 million people are injured or disabled due to road accidents every year. In addition, according to the American Academy for Implant Dentistry, over 15 million people in the U.S. undergo bridge and crown replacements for missing teeth every year, thus facilitating the demand for dental implants. Dental implants are long-term replacements preserving adjacent teeth, which are ground in the case of bridges. It is considered the only restorative technique that preserves and stimulates natural bone and also acts as a stable support for prosthetics (dentures).

COVID-19 Impact: A 22% decline in demand was observed

Pandemic Impact

Post COVID Outlook

The dental implant market declined by 22% from 2019 to 2020, as per earlier projections the market was expected to be over USD 4.9 Billion in 2020

Covid has risen the importance of digital connectivity, For, instance over 200,000 visits were recorded on the Straumann Campus online educational platform in April 2020.

The pandemic resulted in serious financial problems for dental offices due to prolonged periods of inactivity and of loss of practice income.

The rate of re-employment in the dental sector outpaces other health care sectors. The U.S. Bureau of Labor Statistics reports that employment at dental offices as of May 2020 is at 70 % of pre-pandemic levels

As dentistry is considered a high-contact service, estimates from the St. Louis Federal Reserve suggest that demand in high-contact industries will decline by 51% and that gross output will fall by 47%

Moreover, dental implants improve the physical appearance of a person and provide comfort and convenience, unlike removable dentures. The U.S. held a substantial share in 2021 due to the growing number of dental implant placement procedures undertaken per year. For instance, each year, nearly 5 million implants are placed in the U.S. as per the American Dental Association. Moreover, as a developed region, the U.S. population has a higher affordability rate for dental implant procedures. High healthcare spending in this region is expected to propel market growth. Two of the major companies, named Biomet and DENTSPLY Sirona are headquartered in the U.S., which contributes to greater penetration of this market.

The National Institute of Dental and Craniofacial Research has found that tooth loss in American adults begins between the ages of 35 and 45, adults over the age of 45 years have lost a few teeth, and more than 24% of adults aged above 74 years are completely edentulous. Thus, indicating a high demand for dental implants market. COVID-19 significantly affected the industry in the initial quarters of 2020. The majority of dental practices were out of work due to regional and state lockdowns and supply chain bottlenecks for essential dental equipment and implants. However, the demand for preventive and cosmetic dental treatments has witnessed a surge and key implant manufacturers like Dentsply, Straumann, Osstem, etc. reported that the sales of their dental consumables, as well as implants, grew significantly in 2021 and this trend is expected to grow further.

Market Concentration & Characteristics

The dental implant market is currently in a high-growth stage, with the pace of expansion accelerating. This market is marked by a significant level of innovation, driven by the increasing incidence of dental issues and a rising geriatric population.

Dental caries is the most prevalent chronic illness globally, leading to tooth loss and fueling the demand for dental implants, prosthetics, and dental services to address significant public health challenges worldwide. For instance, according to a March 2022 update from the World Health Organization (WHO), oral diseases impact nearly 3.5 billion individuals globally. Severe periodontal (gum) disease, a common condition potentially leading to tooth loss, affects nearly 10% of the global population. Caries affecting permanent teeth is estimated to impact around 2 billion people globally, while caries in primary teeth affect 520 million children. The increasing prevalence of dental diseases resulting in tooth loss is expected to propel the demand for dental implants and prosthetics, consequently fostering market growth.

The dental implants market is experiencing heightened regulatory scrutiny, with various regulatory and government authorities actively working to implement more rigorous guidelines. The increasing emphasis on innovative dental implants is expected to contribute to growth over time.

Several companies are expanding their array of dental implant products, emphasizing the importance of widespread product diversification within the industry. These firms are introducing novel products, strategic initiatives, and services to navigate market competition adeptly. For instance, in December 2022, ProSmile introduced SmartArches Dental Implants in the U.S. SmartArches provides an extensive range of affordable and trustworthy dental implant services, encompassing both individual implants and full-mouth reconstruction. Currently, SmartArches serves patients at four locations in Pennsylvania and New Jersey, with intentions to extend its presence to eight states by 2023.

Implant Type Insights

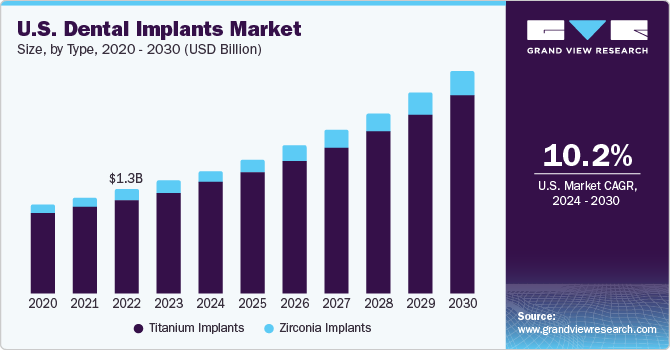

On the basis of types, the global industry is segmented into titanium implants and zirconium implants. The titanium segment held the largest share of more than 91.55% of the overall revenue in 2022 owing to the wide use of dental implants made up of titanium. The biocompatible nature of the pure form of titanium is the main benefit of its use. The crude form of titanium consists of other metals, such as ilmenite, iron, vanadium, zirconium, silicon, and magnesium. The chemical synthesis procedure entails the conversion of crude titanium intermediates through a sequence of extraction and purification reactions into pure titanium ingot.

Titanium dioxide is very toxic to the human body and needs to be removed from the titanium implant. The zirconium segment is anticipated to be the fastest-growing product segment over the forecast period. The material called zirconium functions with nearly the same features as titanium. Titanium implants can be made as one-piece or two-piece systems, whereas, zirconium implants are made as one-piece systems. Two-piece implants offer better features, such as they can be used to support overdentures. Implants are manufactured in different sizes (length and width), which enables the choice of implants as per patients’ bone size.

Regional Insights

In 2022, North America dominated the global industry and accounted for the maximum share of more than 35.50% of the overall revenue. The prominent drivers of the region include the growing geriatric population with a high incidence of dental conditions and high awareness among the population regarding oral preventive & restorative treatments in this region. According to the American Academy of Implant Dentistry, 3 million people already have dental implants, and this number is usually higher in developed countries than in developing countries due to the wide availability of resources, higher per capita income of the population, more concern about aesthetics, and higher awareness.

Asia Pacific is anticipated to be the fastest-growing region over the forecast period owing to increasing economic stability and disposable income. Asian countries have dense populations, with a growing burden of geriatric population. These countries are also popular for their low-cost treatment, which makes them a preferred market for medical tourism. The growing adoption of cosmetic dental implants is one of the significant factors driving the market. Furthermore, the introduction of novel technologies, such as CAD/CAM-based dental restorations, and high awareness about dental procedures are expected to impel growth over the forecast period.

Key Companies & Market Share Insights

Companies are focusing on strategic initiatives, such as the introduction of novel products through customization according to consumers’ needs, partnerships, collaborations, and mergers & acquisitions, to expand their product portfolio and extend leadership positions in the field of dental implantology. Moreover, the competition between key players will turn intense in the coming years as they are focusing more on geographical expansion, strategic collaborations, and partnerships through mergers & acquisitions. In May 2020, Straumann Group announced a new zygomatic implant solution for patients with severe jawbone loss in collaboration with Southern Implants. The new solution combines proven implant design features with the advantages of Straumann’s BLX and BLT implant prosthetic range.

Key Dental Implants Companies:

- BioHorizons IPH, Inc.

- Nobel Biocare Services AG

- Zimmer Biomet Holdings, Inc.

- OSSTEM IMPLANT

- Institut Straumann AG

- Bicon, LLC

- Leader Italy

- Anthogyr SAS

- DENTIS

- DENTSPLY Sirona

- DENTIUM Co., Ltd.

- T-Plus Implant Tech. Co.

- KYOCERA Medical Corp.

Recent Developments

-

In May 2023, Straumann announced the acquisition of GalvoSurge, a manufacturer of dental medical devices based in Switzerland. The company specializes in implant care as well as maintenance solutions, with its concept for supporting peri-implantitis treatment - the GalvoSurge Dental Implant Cleaning System GS 1000 - holding a CE mark and being in the market since 2020.

-

In May 2023, T-Plus announced that its ST implant system had been made available for sale in the Chinese market, post an 8-year NMPA registration procedure.

-

In March 2023, Dentsply Sirona introduced the ‘DS OmniTaper Implant System’ at the 2023 Academy of Osseointegration (AO) Annual Meeting in Phoenix, Arizona. The solution forms a part of the company’s EV Implant Family, alongside the ‘DS PrimeTaper Implant System’ and the ‘Astra Tech Implant System’.

-

In January 2023, Nobel Biocare announced a partnership with Mimetis Biomaterials S.L., launching the ‘creos syntogain’ biomimetic bone graft substitute. This has helped Nobel Biocare to expand its regenerative solutions portfolio under the creos brand, adding to its creos xenoprotect, creos xenogain, creos syntoprotect, and creos mucogain offerings.

-

In March 2022, Nobel Biocare announced the addition of creos syntoprotect to the company’s regenerative portfolio. The creos syntoprotect dense PTFE membranes have been designed for withstanding exposure to the oral cavity for extraction socket management when primary closure cannot be done.

-

In September 2021, Straumann Group and Aspen Dental Management announced a strategic partnership for providing access to dental implant solutions, abutments, and CAD/CAM options for over 1000 ADMI and its affiliated offices across 45 states in the U.S.

Dental Implants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.99 billion

Revenue forecast in 2030

USD 9.62 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Segments covered

Implant type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Austria; The Netherlands; Poland; Romania; Czech Republic; Greece; Sweden; Portugal; Norway, Denmark, Japan; China; India; Australia; South Korea, Thailand, Brazil; Mexico; Argentina, South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

BioHorizons IPH, Inc.; Nobel Biocare Services AG; Zimmer Biomet Holdings, Inc.; OSSTEM IMPLANT; Institut Straumann AG; Bicon, LLC; Leader Italy; Anthogyr SAS; DENTIS; DENTSPLY Sirona; DENTIUM Co., Ltd.; T-Plus Implant Tech. Co.; KYOCERA Medical Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Implants Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global dental implants market report on the basis of implant type and region:

-

Implant Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Titanium Implants

-

Zirconia Implants

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Austria

-

The Netherlands

-

Poland

-

Romania

-

Czech Republic

-

Greece

-

Sweden

-

Portugal

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global dental implant market size was estimated at USD 4.6 billion in 2022 and is expected to reach USD 4.99 billion in 2023.

b. The global dental implant market is expected to grow at a compound annual growth rate of 9.8% from 2023 to 2030 to reach USD 9.62 billion by 2030.

b. North America dominated the dental implant market with a share of 35.6% in 2022. The aging population is prone to loss of tooth and tooth decay as a result of various medications prescribed to them. Hence, the region is expected to influence the dental implant market to a large extent due to its high geriatric population demanding oral care services.

b. The dental implant market is dominated by key industry players such as BioHorizons IPH, Inc.; Nobel Biocare Services AG; Zimmer Biomet Holdings, Inc.; OSSTEM IMPLANT; Institut Straumann AG; Bicon, LLC; Leader Italy; Anthogyr SAS; DENTIS; DENTSPLY Sirona; DENTIUM Co., Ltd.; T-Plus Implant Tech. Co.; and KYOCERA Medical Corporation.

b. Increasing applications of dental implants in various therapeutic areas along with increasing demand for prosthetics are some of the key factors expected to boost the market growth.

b. The titanium segment dominated the dental implant market and accounted for the largest revenue share of 92.3% in 2022 owing to the wide use of dental implants made up of titanium.

b. In the Asia Pacific, the dental implant market is anticipated to grow fast over the forecast period owing to increasing economic stability and disposable income.

Table of Contents

Chapter 1 Dental Implants Market: Methodology and Scope

1.1 Market Segmentation & Scope

1.1.1 Implant Type

1.1.2 Regional Scope

1.1.3 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GVR’s Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis (Model 1)

1.6.2 Volume Price Analysis (Model 2)

1.7 List Of Secondary Sources

1.8 List Of Abbreviations

1.9 Objectives

Chapter 2 Dental Implants Market: Executive Summary

Chapter 3 Dental Implants Market: Variables, Trends, & Scope

3.1 Market Segmentation And Scope

3.2 Market Dynamics

3.2.1 Market Driver Analysis

3.2.1.1 Expanding Applications Of Dental Implants In Various Therapeutic Areas

3.2.1.2 Introduction Of Novel Implants

3.2.1.3 Increasing Demand For Prosthetics

3.2.1.4 Rising Adoption Of Preventive And Restorative Dental Care By The Geriatric Population

3.2.2 Market Restraint Analysis

3.2.2.1 Higher Cost Of Dental Implant Procedure

3.2.2.2 Infection And Sinus-related Problems

3.2.2.3 Prolonged Bone Integration

3.3 Dental Implants: Market Analysis Tools

3.3.1 Industry Analysis - Porter’s

3.3.2 Pestel Analysis

Chapter 4 Covid-19 Impact Analysis

4.1 Impact Of Covid-19 Dental Industry

4.2 Impact Of Covid-19 On Dental Implants Market

4.3 Aftereffect Of Covid-19 Pandemic On Dental Implants Market

4.4 Key Steps Taken By The Market Participants In Identifying Long-term Solutions

4.5 Gap Analysis

Chapter 5 Dental Implants Market: Implant Type Segment Analysis

5.1 Dental Implants: Implant Type Market Share Analysis, 2023 & 2030

5.1.1 Titanium Implants

5.1.1.1 Titanium Implants Market, 2018-2030 (USD Million)

5.1.2 Zirconia Implants

5.1.2.1 Zirconia Implants Market, 2018-2030 (USD Million)

Chapter 6 Dental Implants Market: Regional Analysis

6.1 Dental Implants: Regional Market Share Analysis, 2023 & 2030

6.2 North America

6.2.1 North America Dental Implants Market, 2018 - 2030 (USD Million)

6.2.2 U.S.

6.2.2.1. key Country Dynamics

6.2.2.2. Competitive Scenario

6.2.2.3. Regulatory Framework

6.2.2.4. U.S. Dental Implants Market, 2018 - 2030 (USD Million)

6.2.3 Canada

6.2.3.1. key Country Dynamics

6.2.3.2. Competitive Scenario

6.2.3.3. Regulatory Framework

6.2.3.4 Canada Dental Implants Market, 2018 - 2030 (USD Million)

6.3 Europe

6.3.1 Europe Dental Implants Market, 2018 - 2030 (USD Million)

6.3.2 U.K.

6.3.2.1. key Country Dynamics

6.3.2.2. Competitive Scenario

6.3.2.3. Regulatory Framework

6.3.2.4 U.K. Dental Implants Market, 2018 - 2030 (USD Million)

6.3.3 Germany

6.3.2.1. key Country Dynamics

6.3.2.2. Competitive Scenario

6.3.2.3. Regulatory Framework

6.3.3.1 Germany Dental Implants Market, 2018 - 2030 (USD Million)

6.3.4 France

6.3.4.1. key Country Dynamics

6.3.4.2. Competitive Scenario

6.3.4.3. Regulatory Framework

6.3.4.1 France Dental Implants Market, 2018 - 2030 (USD Million)

6.3.5 Italy

6.3.5.1. key Country Dynamics

6.3.5.2. Competitive Scenario

6.3.5.3. Regulatory Framework

6.3.5.1 Italy Dental Implants Market, 2018 - 2030 (USD Million)

6.3.6 Spain

6.3.6.1. key Country Dynamics

6.3.6.2. Competitive Scenario

6.3.6.3. Regulatory Framework

6.3.6.1 Spain Dental Implants Market, 2018 - 2030 (USD Million)

6.3.7 Austria

6.3.7.1. key Country Dynamics

6.3.7.2. Competitive Scenario

6.3.7.3. Regulatory Framework

6.3.7.1 Austria Dental Implants Market, 2018 - 2030 (USD Million)

6.3.8 The Netherlands

6.3.8.1. key Country Dynamics

6.3.8.2. Competitive Scenario

6.3.8.3. Regulatory Framework

6.3.8.1 The Netherlands Implants Market, 2018 - 2030 (USD Million)

6.3.9 Poland

6.3.9.1. key Country Dynamics

6.3.9.2. Competitive Scenario

6.3.9.3. Regulatory Framework

6.3.9.1 Poland Dental Implants Market, 2018 - 2030 (USD Million)

6.3.10 Romania

6.3.10.1. key Country Dynamics

6.3.10.2. Competitive Scenario

6.3.10.3. Regulatory Framework

6.3.10.1 Romania Dental Implants Market, 2018 - 2030 (USD Million)

6.3.11 Czech Republic

6.3.11.1. key Country Dynamics

6.3.11.2. Competitive Scenario

6.3.11.3. Regulatory Framework

6.3.11.1 Czech Republic Dental Implants Market, 2018 - 2030 (USD Million)

6.3.12 Greece

6.3.12.1. key Country Dynamics

6.3.12.2. Competitive Scenario

6.3.12.3. Regulatory Framework

6.3.12.1 Greece Dental Implants Market, 2018 - 2030 (USD Million)

6.3.13 Sweden

6.3.13.1. key Country Dynamics

6.3.13.2. Competitive Scenario

6.3.13.3. Regulatory Framework

6.3.13.1 Sweden Dental Implants Market, 2018 - 2030 (USD Million)

6.3.14 Portugal

6.3.14.1. key Country Dynamics

6.3.14.2. Competitive Scenario

6.3.14.3. Regulatory Framework

6.3.14.1 Portugal Dental Implants Market, 2018 - 2030 (USD Million)

6.3.15 Denmark

6.3.15.1. key Country Dynamics

6.3.15.2. Competitive Scenario

6.3.15.3. Regulatory Framework

6.3.15.1 Denmark Dental Implants Market, 2018 - 2030 (USD Million)

6.3.16 Norway

6.3.16.1. key Country Dynamics

6.3.16.2. Competitive Scenario

6.3.16.3. Regulatory Framework

6.3.14.1 Norway Dental Implants Market, 2018 - 2030 (USD Million)

6.4 Asia Pacific

6.4.1 Asia Pacific Dental Implants Market, 2018 - 2030 (USD Million)

6.4.2 China

6.4.1.1. key Country Dynamics

6.4.1.2. Competitive Scenario

6.4.1.3. Regulatory Framework

6.4.1.1 China Dental Implants Market, 2018 - 2030 (USD Million)

6.4.3 India

6.4.1.1. key Country Dynamics

6.4.1.2. Competitive Scenario

6.4.1.3. Regulatory Framework

6.4.3.1 India Dental Implants Market, 2018 - 2030 (USD Million)

6.4.4 Japan

6.4.1.1. key Country Dynamics

6.4.1.2. Competitive Scenario

6.4.1.3. Regulatory Framework

6.4.4.1 Japan Dental Implants Market, 2018 - 2030 (USD Million)

6.4.5 Australia

6.4.1.1. key Country Dynamics

6.4.1.2. Competitive Scenario

6.4.1.3. Regulatory Framework

6.4.5.1 Australia Dental Implants Market, 2018 - 2030 (USD Million)

6.4.5 South Korea

6.4.1.1. key Country Dynamics

6.4.1.2. Competitive Scenario

6.4.1.3. Regulatory Framework

6.4.5.1 South Korea Dental Implants Market, 2018 - 2030 (USD Million)

6.4.5 Thailand

6.4.1.1. key Country Dynamics

6.4.1.2. Competitive Scenario

6.4.1.3. Regulatory Framework

6.4.5.1 Thailand Dental Implants Market, 2018 - 2030 (USD Million)

6.5 Latin America

6.5.1 Latin America Dental Implants Market, 2018 - 2030 (USD Million)

6.5.2 Brazil

6.5.1.1. key Country Dynamics

6.5.1.2. Competitive Scenario

6.5.1.3. Regulatory Framework

6.5.2.1 Brazil Dental Implants Market, 2018 - 2030 (USD Million)

6.5.3 Mexico

6.5.1.1. key Country Dynamics

6.5.1.2. Competitive Scenario

6.5.1.3. Regulatory Framework

6.5.3.1 Mexico Dental Implants Market, 2018 - 2030 (USD Million)

6.5.3 Argentina

6.5.1.1. key Country Dynamics

6.5.1.2. Competitive Scenario

6.5.1.3. Regulatory Framework

6.5.3.1 Argentina Dental Implants Market, 2018 - 2030 (USD Million)

6.6 MEA

6.6.1 MEA Dental Implants Market, 2018 - 2030 (USD Million)

6.6.2 South Africa

6.6.1.1. key Country Dynamics

6.6.1.2. Competitive Scenario

6.6.1.3. Regulatory Framework

6.6.2.1 South Africa Dental Implants Market, 2018 - 2030 (USD Million)

6.6.3 Saudi Arabia

6.6.1.1. key Country Dynamics

6.6.1.2. Competitive Scenario

6.6.1.3. Regulatory Framework

6.6.3.1 Saudi Arabia Dental Implants Market, 2018 - 2030 (USD Million)

6.6.4 UAE

6.6.1.1. key Country Dynamics

6.6.1.2. Competitive Scenario

6.6.1.3. Regulatory Framework

6.6.4.1 UAE Dental Implants Market, 2018 - 2030 (USD Million)

6.6.4 Kuwait

6.6.1.1. key Country Dynamics

6.6.1.2. Competitive Scenario

6.6.1.3. Regulatory Framework

6.6.4.1 Kuwaitr Dental Implants Market, 2018 - 2030 (USD Million)

Chapter 7 Competitive Landscape

7.1 Global Company Market Share Analysis

7.2 Regional Company Share Analysis

7.2.1 North America Company Share Analysis

7.2.2 Europe Company Share Analysis

7.2.3 Asia Pacific Company Share Analysis

7.2.4 Latin America Company Share Analysis

7.2.5 MEA Company Share Analysis

7.3 Company Profiles For Dental Implants

7.3.1 Key Revenue Of Dental Implant Manufacturers (2021)

7.3.2 List Of Key Customers

7.3.3 Heat Map Analysis

7.3.3.1 Institut Straumann

7.3.3.2 Envista Holding Corporation (Nobel Biocare Services Ag)

7.3.3.3 Biohorizons Iph, Inc.

7.3.3.4 Zimmer Biomet

7.3.3.5 Dentsply Sirona

7.3.3.6 Osstem Implants

7.6 Company Profiles

7.6.1 Envista Holdings Corporation (Nobel Biocare Services Ag)

7.6.1.1 Company Overview

7.6.1.2 Financial Performance

7.6.1.1 Product Benchmarking

7.6.1.2 Strategic Initiatives

7.6.2 Biohorizons Iph, Inc.

7.6.2.1 Company Overview

7.6.2.2 Product Benchmarking

7.6.3 Institut Straumann Ag

7.6.3.1 Company Overview

7.6.3.2 Financial Benchmarking

7.6.3.3 Product Benchmarking

7.6.4 Zimmer Biomet

7.6.4.1 Company Overview

7.6.4.2 Product Benchmarking

7.6.5 Dentsply Sirona

7.6.5.1 Company Overview

7.6.5.2 Product Benchmarking

7.6.5.3 Strategic Initiative

7.6.5.4 Financial Performance

7.6.6 Osstem Implant

7.6.6.1 Company Overview

7.6.6.2 Financial Benchmarking

7.6.6.3 Product Benchmarking

7.6.6.4 Strategic Initiative

7.6.7 Bicon, Llc

7.6.7.1 Company Overview

7.6.7.2 Product Benchmarking

7.6.7.3 Strategic Initiative

7.6.8 Anthogyr Sas

7.6.8.1 Company Overview

7.6.8.2 Financial Performance

7.6.8.3 Product Benchmarking

7.6.8.4 Strategic Initiative

7.6.9 Kyocera Medical Corporation

7.6.9.1 Company Overview

7.6.9.2 Financial Performance

7.6.9.3 Product Benchmarking

7.6.9.4 Strategic Initiatives.

7.6.10 Dentium Co., Ltd.

7.6.10.1 Company Overview

7.6.10.2 Product Benchmarking

7.6.11 T-plus Implant Tech. Co.

7.6.11.1 Company Overview

7.6.11.2 Product Benchmarking

7.6.12 Dentis

7.6.12.1 Company Overview

7.6.12.2 Product Benchmarking

7.6.13 Cortex Dental Implants Industries Ltd.

7.6.13.1 Company Overview

7.6.13.2 Product Benchmarking

7.6.14 Sweden & Martina S.p.a.

7.6.14.1 Company Overview

7.6.14.2 Product Benchmarking

7.6.15 Neobiotech Inc.

7.6.15.1 Company Overview

7.6.15.2 Product Benchmarking

List of Tables

Table 1 Global Dental Implants Market, By Region, 2018 - 2030 (USD Million)

Table 2 Global Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 3 North America Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 4 U.S. Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 5 Canada Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 6 Europe Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 7 U.K. Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 8 Germany Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 9 France Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 10 Italy Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 11 Spain Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 12 Netherlands Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 13 Sweden Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 14 Romania Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 15 Poland Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 16 Portugal Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 17 Czech Republic Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 18 Greece Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 19 Austria Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 20 Norway Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 21 Denmark Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 22 Asia Pacific Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 23 Japan Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 24 China Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 25 India Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 26 Australia Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 27 South Korea Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 28 Thailand Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 29 Latin America Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 30 Brazil Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 31 Mexico Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 32 Argentina Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 33 Middle East & Africa Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 34 South Africa Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 35 Saudi Arabia Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 36 UAE Dental Implants Market, By Type, 2018 - 2030 (USD Million)

Table 36 Kuwait Dental Implants Market, By Type, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Market formulation & validation

Fig. 6 Commodity flow analysis

Fig. 7 Volume Price Analysis

Fig. 8 Dental implants market snapshot (2023)

Fig. 9 Dental Implants market segmentation

Fig. 10 Market driver relevance analysis (Current & future impact)

Fig. 11 Market restraint relevance analysis (Current & future impact)

Fig. 12 Penetration & growth prospect mapping

Fig. 13 Porter’s five forces analysis

Fig. 14 SWOT analysis, by factor (political & legal, economic and technological)

Fig. 15 Dental Implants market implant type outlook: Segment dashboard

Fig. 16 Dental Implants market: implant type movement analysis

Fig. 17 Titanium Implants market, 2018 - 2030 (USD Million)

Fig. 18 Zirconia Implants market, 2018 - 2030 (USD Million)

Fig. 19 Regional market: Key takeaways

Fig. 20 Regional outlook, 2023 & 2030

Fig. 21 North America market, 2018 - 2030 (USD Million)

Fig. 22 U.S. market, 2018 - 2030 (USD Million)

Fig. 23 Canada market, 2018 - 2030 (USD Million)

Fig. 24 Europe market, 2018 - 2030 (USD Million)

Fig. 25 U.K. market, 2018 - 2030 (USD Million)

Fig. 26 Germany market, 2018 - 2030 (USD Million)

Fig. 27 France market, 2018 - 2030 (USD Million)

Fig. 28 Italy market, 2018 - 2030 (USD Million)

Fig. 29 Spain market, 2018 - 2030 (USD Million)

Fig. 30 Netherlands market, 2018 - 2030 (USD Million)

Fig. 31 Sweden market, 2018 - 2030 (USD Million)

Fig. 32 Austria market, 2018 - 2030 (USD Million)

Fig. 33 Poland market, 2018 - 2030 (USD Million)

Fig. 34 Romania market, 2018 - 2030 (USD Million)

Fig. 35 Czech Republic market, 2018 - 2030 (USD Million)

Fig. 36 Greece market, 2018 - 2030 (USD Million)

Fig. 37 Portugal market, 2018 - 2030 (USD Million)

Fig. 38 Norway market, 2018 - 2030 (USD Million)

Fig. 39 Denmark market, 2018 - 2030 (USD Million)

Fig. 40 Asia Pacific market, 2018 - 2030 (USD Million)

Fig. 41 China market, 2018 - 2030 (USD Million)

Fig. 42 India market, 2018 - 2030 (USD Million)

Fig. 43 Japan market, 2018 - 2030 (USD Million)

Fig. 44 South Korea market, 2018 - 2030 (USD Million)

Fig. 45Thailand market, 2018 - 2030 (USD Million)

Fig. 46 Australia market, 2018 - 2030 (USD Million)

Fig. 47 Latin America market, 2018 - 2030 (USD Million)

Fig. 48 Brazil market, 2018 - 2030 (USD Million)

Fig. 49 Mexico market, 2018 - 2030 (USD Million)

Fig. 50 MEA market, 2018 - 2030 (USD Million)

Fig. 51 South Africa market, 2018 - 2030 (USD Million)

Fig. 52 Saudi Arabia market, 2018 - 2030 (USD Million)

Fig. 53 UAE market, 2018 - 2030 (USD Million)

Fig. 54 Kuwait market, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Dental Implants Type Outlook (Revenue, USD Million, 2018 - 2030)

- Titanium Implants

- Zirconia Implants

- Dental Implants Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- U.S.

- U.S. Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- U.S. Dental Implants Market, By Implant Type

- Canada

- Canada Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Canada Dental Implants Market, By Implant Type

- North America Dental Implants Market, By Implant Type

- Europe

- Europe Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- U.K.

- U.K. Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- U.K. Dental Implants Market, By Implant Type

- Germany

- Germany Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Germany Dental Implants Market, By Implant Type

- France

- France Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- France Dental Implants Market, By Implant Type

- Italy

- Italy Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Italy Dental Implants Market, By Implant Type

- Spain

- Spain Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Spain Dental Implants Market, By Implant Type

- The Netherlands

- The Netherlands Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- The Netherlands Dental Implants Market, By Implant Type

- Sweden

- Sweden Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Sweden Dental Implants Market, By Implant Type

- Austria

- Austria Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Austria Dental Implants Market, By Implant Type

- Romania

- Romania Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Romania Dental Implants Market, By Implant Type

- Portugal

- Portugal Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Portugal Dental Implants Market, By Implant Type

- Poland

- Poland Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Poland Dental Implants Market, By Implant Type

- Czech Republic

- Czech Republic Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Czech Republic Dental Implants Market, By Implant Type

- Greece

- Greece Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Greece Dental Implants Market, By Implant Type

- Europe Dental Implants Market, By Implant Type

- Asia Pacific

- APAC Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Japan

- Japan Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Japan Dental Implants Market, By Implant Type

- China

- China Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- China Dental Implants Market, By Implant Type

- India

- India Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- India Dental Implants Market, By Implant Type

- Australia

- Australia Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Australia Dental Implants Market, By Implant Type

- APAC Dental Implants Market, By Implant Type

- Latin America

- Latin America Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Brazil

- Brazil Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Brazil Dental Implants Market, By Implant Type

- Mexico

- Mexico Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Mexico Dental Implants Market, By Implant Type

- Latin America Dental Implants Market, By Implant Type

- MEA

- MEA Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- South Africa

- South Africa Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- South Africa Dental Implants Market, By Implant Type

- Saudi Arabia

- Saudi Arabia Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- Saudi Arabia Dental Implants Market, By Implant Type

- UAE

- UAE Dental Implants Market, By Implant Type

- Titanium implants

- Zirconia implants

- UAE Dental Implants Market, By Implant Type

- MEA Dental Implants Market, By Implant Type

- North America

Dental Implants Market Dynamics

Drivers: Expanding Applications Of Dental Implants In Various Therapeutic Areas

Dental implants are the gold standard technique to effectively replace missing or damaged teeth. These implants act as sturdy bases for supporting artificial teeth known as crowns. For the treatment of tooth loss, implants with attached crowns are preferred over dentures. These crowns work as natural teeth and help in preserving jaw structure & preventing bone loss. Increasing demand for replacing teeth is creating growth opportunities in the dental implant market. Dental implants also help support a bridge, crown, or denture. According to Prosthodontics 2020, more than 35 million people in the U.S. were missing teeth in one or both jaws. The growing incidence of facial injuries owing to road accidents and sports-associated injuries is also driving the market demand. The use of dental implants for cosmetic dentistry procedures has increased among the urban population. Dental implants are long-term replacements preserving adjacent teeth, and opting for implantation is equivalent to receiving new teeth. In addition, implants are the only restorative procedures that preserve, stimulate, and mimic natural bone. They can function as a stable support for prosthetics (dentures). Moreover, these implants improve the appearance of a person by providing comfort and convenience, unlike removable dentures. These factors are leading to high demand for dental implant procedures, boosting the market growth.

Introduction Of Novel Implants

The introduction of software solutions to design dental implant restorations is increasing. Some of the key players in the dental implant market are focusing on introducing novel implants that can cater to all needs of patients. CAD/CAM dental equipment is highly beneficial for restorative dentistry, as the restorations produced using these techniques are more esthetically appealing & durable and require shorter fabrication time compared to the traditional ones, which aids segment growth. Some of the key players in the dental implant market are focusing on introducing novel implants that can cater to all needs of patients. For instance, in 2022, ZimVie, Inc. announced the launch of T3 PRO tapered dental implant, a next-generation dental solution in the U.S. Moreover, Bredent Medical announced the launch of a new generation of whiteSKY zirconia dental implants. The whiteSKY implant is suitable for a wide range of indications such as short-span bridges in the molar and premolar region, and single restorations in the esthetic zone. These factors are expected to contribute to market growth. In addition, increasing patient awareness and high disposable income are expected to serve as high-impact drivers.

Restraints: Higher Cost Of Dental Implant Procedure

An article in Workforce stated that nearly 77% of the U.S. population is provided dental benefits, out of which 40% do not go to the dentist primarily due to high costs and pain associated with treatment. The cost of dental implant procedures is the most common factor restraining market growth. The average cost of dental implants in the U.S. is approximately USD 5,000. These costs include the service charge, procedure cost, consultation fees, and dental implants. Dental procedures, such as veneers, zirconia crowns, implants, composite bonding, and cosmetic contouring require highly skilled professionals and lab technicians, with specialized qualifications and are considered a luxury in many countries due to their expenses. In addition, imaging through radiographs is a basic and essential part of any dental treatment and the components of such diagnostic dental machines require additional investments as well as sufficient staff time, which affects their commercial viability. These factors are anticipated to hinder market growth, resulting in decreased demand for dental restoration procedures.

What Does This Report Include?

This section will provide insights into the contents included in this dental implants market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Dental implants market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Dental implants market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the dental implants market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for dental implants market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of dental implants market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Dental Implants Market Categorization:

The dental implants market was categorized into two segments, namely implant type (Titanium Implants, Zirconia Implants), and regions (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The dental implants market was segmented into implant type, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The dental implants market was analyzed at a regional level. The global was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into thirty countries, namely, the U.S.; Canada; Germany; the UK.; France; Italy; Spain; Austria; The Netherlands; Poland; Romania; Czech Republic; Greece; Sweden; Portugal; Norway, Denmark, Japan; China; India; Australia; South Korea, Thailand, Brazil; Mexico; Argentina, South Africa; Saudi Arabia; UAE, Kuwait.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Dental implants market companies & financials:

The dental implants market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Colosseum Dental Group, Colosseum Dental Group, one of the leading dentistry groups, provides high-quality dental care in 11 countries. It operates more than 800 clinics and 50 labs. The group invests in innovations, and technologies, and implements digital workflows to benefit patients & clinic teams. Its majority shareholder is Jacobs Holding, a global professional investment firm based in Zürich, Switzerland.

-

GSD Dental Clinics, GSD Dental Clinics provides dental services to patients. The company seeks the highest standards of clinical and scientific precision. It aims to generate new behaviors and attitudes toward dental care and change the image of dentistry differentiate the company from other competitors and allow for building lasting relationships with patients. The company has a presence in Lisbon, Beals, Leiria, Caldas da Rainha, Peniche, and Torres Vedras.

-

Dentelia, Dentelia holds a network of dental clinics that offer modern and innovative dental services. The company is a patient-oriented foundation that supports and educates excellence at work. Dentelia is building a team of experts to set up its dental practice and dental service providers throughout France. The company selects high-quality brands of dental equipment for efficient patient care.

-

Gentle Dental of New England (42 North Dental), Gentle Dental, one of the region’s market leaders, was established on the principle that quality dental care should be accessible to patients and continues with the goal of reducing the restrictions that keep people from achieving high-quality dental health. The company is supported by 42 North Dental, a dental support organization that provides nonclinical administrative and business support services to the practice. 42 North Dental provides dentists with clinical autonomy & equity ownership, as well as non-clinical solutions and business support.

-

Dentex Health, Dentex Health is an operator of dental clinics in Europe. The company offers various dental services to patients, providing them with affordable dental treatments. It offers high-quality dental treatments at affordable prices by providing personalized attention to all patients. The company has a network of more than 350 dental clinics in the UK and other countries in Europe.

-

Vitaldent, Vitaldent is a dental clinic with over 350 clinics in Spain and has treated more than 7 million patients to date. Nearly 3,500 healthcare professionals and 1,500 collaborating dentists are associated with the company. Vitaldent has been investing in the latest technological advancements and innovative treatments for more than 30 years; it continues to provide high-quality dental care services to patients. Advent International has a majority share in Vitaldent.

-

Tandarts Today (Glide Healthcare), Tandarts Today is a chain of dental practices with an individual approach to providing patient care services. It acts as a service organization that manages dental practices and guarantees the continuity of dental services. The company is currently associated with seven practices in its business operations and has its dental laboratory.

-

Bupa Dental Care , Bupa Dental Care delivers high-quality patient care services in the field of dentistry in the UK. The company offers NHS and private dental care, which gives patients and clinicians optimal choice & flexibility. It has over 2,500 dental professionals that offer quality care at over 450 practices across the UK. As a business, the company continues to deliver high-quality cutting-edge equipment to provide best services to patients.

-

European Dental Group (EDG), European Dental Group (EDG) is an association of dental care professionals and organizations that provides high-quality patient care services through more than 400 dental clinics. This group provides the latest technology-enabled services to patients. It consists of more than 260 oral care institutions and over 8,400 dental professionals. The dental group has a presence in seven European countries: Germany, the Netherlands, the UK, Belgium, France, Switzerland, and Norway.

-

Integrated Dental HOLDINGS Limited, Integrated Dental Holdings Limited (IDH) is a dental services company operating in the UK. The company functions through Mydentist, which regulates a network of 674 NHS funded and private pay dental practices, as well as Dental Directory, which provides information about dental services, wholesaling, & supplies business. Through its subsidiaries, the company provides dental services, such as X-ray, cleaning, and other treatments.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Dental Implants Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2023, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Dental Implants Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."