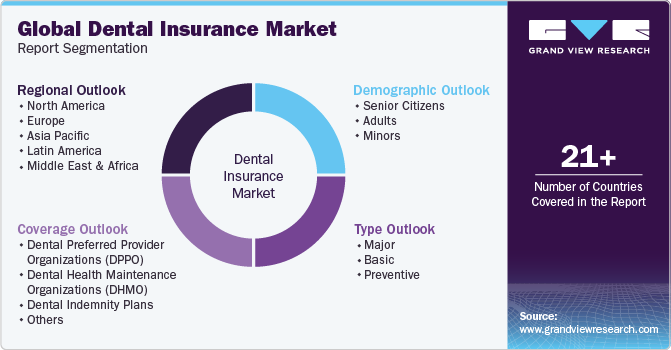

Dental Insurance Market Size, Share & Trends Analysis Report By Coverage (Dental Preferred Provider Organizations, Dental Health Maintenance Organizations), By Type (Major, Basic), By Demographic, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-150-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Dental Insurance Market Size & Trends

The global dental insurance market size was estimated at USD 194.13 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. The market is majorly driven by increased dental care awareness and rising dental health issues. An increase in treatment costs is also expected to boost the market growth in the coming years. COVID-19 significantly impacted the market. At the beginning of the pandemic, many dental clinics postponed non-urgent procedures or limited their services to urgent care. This has led to a decrease in the use of dental services as people avoid routine check-ups and treatment options due to concerns about the spread of the disease. Moreover, due to quarantines, restrictions, and concerns about disease, many people have postponed daily dental exams and preventive care.

As per the CareQuest Institute for Oral Health, in September 2023 approximately 68.5 million adults in the U.S. lacked dental insurance. The findings, derived from the third annual State of Oral Health Equity in America (SOHEA) survey, suggest that this figure may increase substantially by the conclusion of 2023, owing to the loss of coverage by additional household members and the Medicaid redetermination process. A significant portion of the adult population lacks dental insurance, increasing the demand for such plans.

Technological advancement is expected to create growth opportunities for the market. The transition toward SaaS and cloud-based solutions, as opposed to traditional legacy systems, holds the potential to revolutionize the landscape for health and dental insurance providers. This shift eliminates the necessity for maintaining on-premises servers, resulting in cost savings and improved information accessibility. Furthermore, it fosters collaboration, scalability, seamless integrations, simplified upgrades, and enhanced user-friendliness. Collectively, these advantages promise an improved experience for both consumers and healthcare professionals.

Furthermore, several companies in the market are undertaking various strategic initiatives to strengthen their market presence. For instance, in August 2023, Ameritas introduced a lifetime deductible option for its newly launched group dental plans. This modification ensures that once members meet their deductible, they will not need to be concerned about meeting it again while remaining with the same employer.

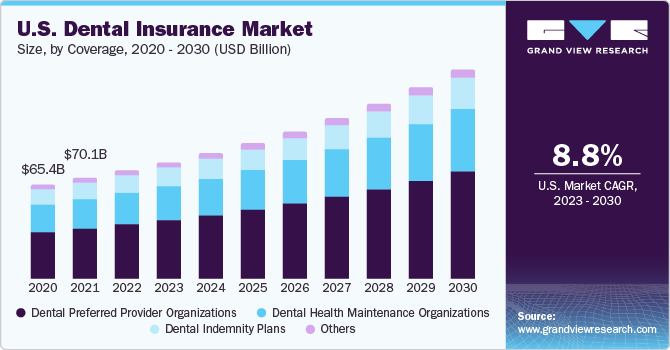

Coverage Insights

Based on coverage, the market is divided into dental preferred provider organizations (DPPO), dental health maintenance organizations (DHMO), dental indemnity plans, and others. The DPPO segment dominated the global market with around 50.0% share in 2022. DPPOs often have a network of dentists who agree to provide services to plan members at a discounted rate. This can reduce consumers' out-of-pocket expenses compared to co-pays for services or medical bills. Many people choose plans that can help them save money on dental care. DPPO plans often come with a billing schedule that outlines the costs of certain procedures. This estimate is attractive to consumers because they can better plan their dental expenses.

Furthermore, the dental health maintenance organizations segment is expected to hold a significant market share during the forecast period. DHMO plans often offer lower monthly premiums compared to other dental insurance options like dental indemnity plans. This affordability can make them an attractive choice for individuals and families looking for dental coverage while keeping their costs manageable.

Type Insights

Based on type, the market has been categorized into major, basic, and preventive segments. The preventive segment dominated the market in 2022 with around 42.0% share of the global revenue. Dental prevention plans generally emphasize regular checkups, cleanings, and early intervention for dental problems. This approach encourages policyholders to maintain their oral health through regular dentist visits. Additionally, premiums for preventive dental insurance plans are generally lower than comprehensive or primary dental insurance plans. This affordability makes them attractive to many individuals and families, thus increasing their market appeal.

Furthermore, the basic plan is anticipated to expand at a significant CAGR during the forecast period. Basic plans are typically the most affordable options available to consumers. They offer essential services or products at a lower cost, making them accessible to a broader range of customers, including those with limited budgets. Moreover, Basic plans serve as entry-level options for customers who are new to a particular product or service category.

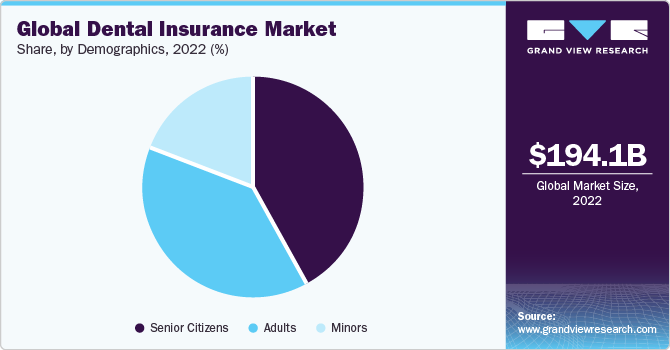

Demographic Insights

Based on demographics, the market has been categorized into senior citizens, adults, and minors. The senior citizens segment dominated the market in 2022. Many countries, including the U.S., have a growing aging population due to increased life expectancy. This demographic trend contributes to the prominence of senior citizens in the dental insurance industry. Moreover, as individuals age, they are more likely to experience dental health issues, such as gum disease, tooth decay, and tooth loss. This leads to a greater demand for dental insurance to cover the costs of preventive care, restorative procedures, and dental treatments.

Furthermore, the adult segment is anticipated to expand at a significant CAGR during the forecast period. Many countries have aging populations, with a substantial number of adults in their 50s and older. As people age, they tend to require more dental care, including preventive, restorative, and potentially major dental procedures. This increased demand for dental services among older adults drives growth in the dental insurance sector.

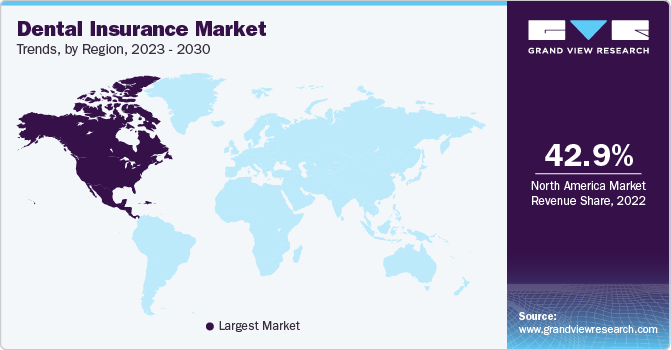

Regional Insights

North America dominated the market with a revenue share of 42.9% in 2022. North America is home to a large and relatively affluent population. The U.S., in particular, has a sizable middle-class population that can afford dental insurance premiums. This creates a substantial customer base for dental insurance providers. Moreover, in the U.S., many employers offer dental insurance as part of their employee benefits packages. This practice encourages a significant portion of the population to have dental insurance coverage.

Asia Pacific is anticipated to experience maximum growth over the forecast period. There is a growing awareness of the importance of dental health in the Asia-Pacific region. People are becoming more proactive about maintaining their oral health, which includes seeking regular dental check-ups and preventive care. This awareness drives the demand for dental insurance to cover these costs.

Key Companies & Market Share Insights

Key players are adopting various strategic initiatives, such as collaboration, partnership, and new insurance plan launches, to hold their position in the market. In May 2022, PNB MetLife India Insurance Company launched a dental health insurance plan in India. The insurance policy encompassed fixed-benefit outpatient expenditures and financial support for various dental health-related expenses. In December 2022, Bupa and YuLife announced a collaboration, enabling group clients to include dental insurance as an option for their employees.Bupa's dental coverage can now be added as an option within YuLife's group life insurance policies, catering to new and current clients.

Key Dental Insurance Companies:

- Cigna

- AXA

- AFLAC Inc

- Allianz SE

- Aetna

- Ameritas Life Insurance Corp

- United HealthCare Services Inc.

- Metlife Services & Solutions

- Delta Dental Plans Association

- HDFC Ergo Health Insurance Ltd

- United Concordia

Dental Insurance Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 209.95 billion |

|

Revenue forecast in 2030 |

USD 390.3 billion |

|

Growth rate |

CAGR of 9.3% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Coverage, type, demographics, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; India, Japan, China, Australia, South Korea, Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Cigna; AXA; AFLAC Inc.; Allianz SE; Aetna; Ameritas Life Insurance Corp.; United HealthCare Services Inc.; Metlife Services & Solutions; Delta Dental Plans Association; HDFC Ergo Health Insurance Ltd.; United Concordia |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Dental Insurance Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental insurance market report based on coverage, type, demographics, and region.

-

Coverage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dental Preferred Provider Organizations (DPPO)

-

Dental Health Maintenance Organizations (DHMO)

-

Dental Indemnity Plans

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Major

-

Basic

-

Preventive

-

-

Demographic Outlook (Revenue, USD Billion, 2018 - 2030)

-

Senior Citizens

-

Adults

-

Minors

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental insurance market size was estimated at USD 194.13 billion in 2022 and is expected to reach USD 209.95 billion in 2023.

b. The global dental insurance market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 390.3 billion by 2030.

b. North America dominated the dental insurance market with a share of 43.16% in 2022. North America is home to a large and relatively affluent population. The U.S., in particular, has a sizable middle-class population that can afford dental insurance premiums. This creates a substantial customer base for dental insurance providers.

b. Some key players operating in the dental insurance market include Cigna, AXA, AFLAC Inc, Allianz SE, Aetna, Ameritas Life Insurance Corp., United HealthCare Services Inc., Metlife Services & Solutions, Delta Dental Plans Association, HDFC Ergo Health Insurance Ltd., United concordia.

b. Key factors that are driving the market growth include increased dental care awareness and rising dental health issues. Furthermore, an increase in treatment costs is also expected to boost the market growth in the coming years.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."