- Home

- »

- Medical Devices

- »

-

Dental Services Market Size, Trends & Growth Report, 2030GVR Report cover

![Dental Services Market Size, Share & Trends Report]()

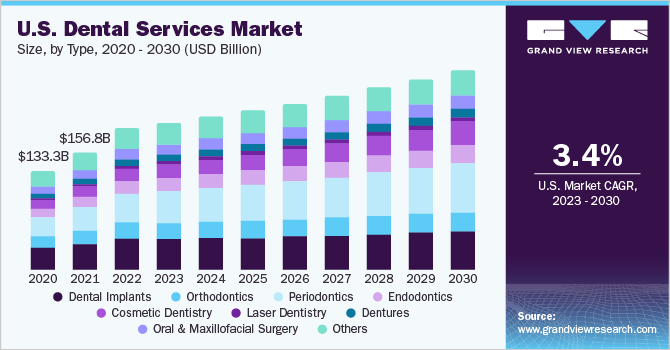

Dental Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Dental Implants, Orthodontics, Periodontics, Endodontics), By End-use (Hospitals, Dental Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-607-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Services Market Summary

The global dental services market size was estimated at USD 433.2 billion in 2022 and is projected to reach USD 610.4 billion by 2030, growing at a CAGR of 4.5% from 2023 to 2030. The diagnosis, prevention, and treatment of dental disorders are covered under dental services that are provided by dentists and dental professionals.

Key Market Trends & Insights

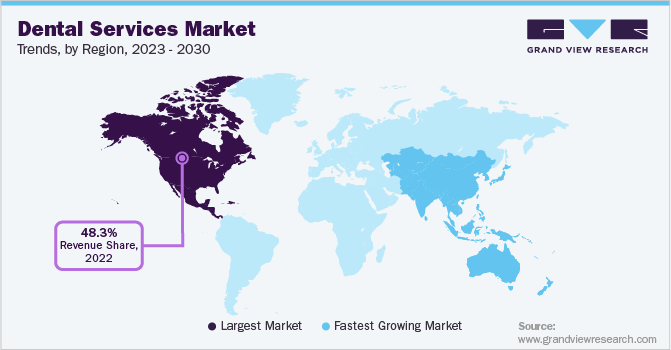

- North America dominated the market with a revenue share of over 48.3% in 2022.

- The U.S. federal funding for Medicare & Medicaid is expected to increase the demand for oral care services as patients are likely to pay less out-of-pocket expenses.

- By type, the dental implants segment dominated the market and held a revenue share of over 21.2%.

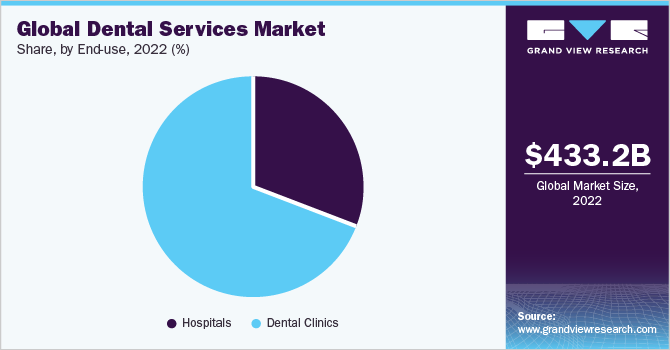

- By end-use, the dental clinics segment held the largest revenue share of more than 68.5% and is likely to grow at a CAGR of over 4.0% from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 433.2 Billion

- 2030 Projected Market Size: USD 610.4 Billion

- CAGR (2023-2030): 4.5%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Some of the key factors contributing to the growth are the growing awareness of dentistry among people, the rising prevalence of dental caries and other periodontal diseases, technological developments in dentistry, and the high demand for cosmetic and laser dentistry.

The ongoing COVID-19 pandemic has significantly impacted the dental care economy. As a result of the imposed strict social distancing guidelines, dental practices were closed in many countries. According to the data from the American Dental Association’s Health Policy Institute (HPI), the dental sector was at standstill due to COVID-19 as dental practices were allowed only in emergency cases in the early stage of the pandemic. In March 2020, the American Dental Association (ADA) issued public guidance to postpone elective dental procedures.

According to the ADA, the procedures that needed to be postponed included oral examinations, routine cleaning, radiographs, cosmetic procedures, and orthodontic treatments without pain management. The emergency dental services included oral bleeding, dental or facial trauma, painful caries, tooth fractures, and abnormal tissue biopsies.

Dental treatments encapsulate a wide array of services that help several patients in improving their oral health. The fillings and cement are being used in various treatments. The ongoing popular trend of smile makeover procedures is gaining attention nowadays. Moreover, the technological developments in endodontics have helped in the adoption of root canal procedures. The invisible braces that help in reshaping and alignment of teeth are in high demand. Hence, the market for dental services is anticipated to witness significant growth over the forecast period due to the introduction of new improved technologies, including dental caps, dentures, and drills.

The recommendations from dentists have helped drive the demand for various dental services. In addition, the shifting focus on marketing efforts to commercialize the practices involves free dental camps, online campaigns, and dental education programs. Moreover, several unmet needs and a wide service portfolio in the field of oral care have encouraged dental equipment manufacturers to invest in R&D activities to develop and capitalize on innovative technologies.

As more innovations emerge in the market, more patients are expected to avail of services in the coming years. In April 2020, Pacific Dental Services (PDS), a leading dental support organization, announced the launch of the TeleDentistry platform for patients in the U.S. The COVID-19 pandemic continues to put pressure on urgent care centers and hospital emergency rooms and the launch of the platform is expected to have a positive impact on the community.

With continuous economic growth and rapid urbanization around the globe, the disposable incomes of people have witnessed relatively steady growth. In addition, per capita consumption expenditure on healthcare services is likely to significantly increase in the years to come. The rising health and wellness consciousness among the millennial population, along with the growing purchasing power, is expected to contribute to the market growth over the forecast period.

Type Insights

In 2022, the dental implants segment dominated the market and held a revenue share of over 21.2%. Dental implant restoration is considered an advanced oral procedure and it provides patients with functional and aesthetically feasible options for tooth replacement.

According to the American Association of Oral and Maxillofacial Surgeons (AAOMS), around 70% of adults aged 35 to 44 have lost at least one tooth permanently due to disease, decay, or an accident. Hence, the demand for implants is on the rise. The research & development in the field of dental implants have increased in the past few years and are anticipated to expand in the future, offering better biomaterials, surface modifications, and improved implant designs.

The cosmetic dentistry segment is expected to witness the fastest growth of 8.0% from 2023 to 2030 owing to the rising adoption of teeth appearance improvement procedures. Some of the cosmetic dental procedures include teeth whitening to remove staining and treat discolorations. Moreover, the patients prefer crowns, inlays and onlays, composite bonding, and veneers, among others, to improve their oral appearance.

End-use Insights

In 2022, the dental clinics segment held the largest revenue share of more than 68.5% and is likely to grow at a CAGR of over 4.0% from 2023 to 2030. The majority of dental patients visit private practice dental clinics due to the availability of specialists. Over 80% of dental practices are run by the owners. The number of independent practices is rising across the globe. This trend is likely to continue in the coming years owing to the cost efficiency, the availability of specialists, and technologically advanced equipment.

During the initial phase of the COVID-19 pandemic, the dental care market faced many issues as the dentists’ offices were at high risk of spreading the infection. The dental clinics were not operating during the initial phase. However, the practices are getting back to their normal operations. In these unprecedented times, dental professionals should be well-informed about the recent guidelines to follow by the regulatory protocols to avoid the spread of the virus.

Regional Insights

In 2022, North America dominated the market with a revenue share of over 48.3% owing to factors including a preventive approach towards oral care and hygiene, the presence of independent clinics, growing R&D activities in dentistry, and rising disposable income. The increasing government funding for dental programs is likely to contribute to market growth. The U.S. federal funding for Medicare & Medicaid is expected to increase the demand for oral care services as patients are likely to pay less out-of-pocket expenses.

Asia Pacific is anticipated to witness the fastest growth of 5.7% from 2023 to 2030 due to the growing number of clinics, rising dental tourism, increasing R&D in manufacturing, and growing awareness about oral care. The majority of dental practices in the Asia Pacific are private. The healthcare infrastructure in the Asia Pacific is expanding with advanced technology and equipment. Various companies and governments in countries, such as China and India, are introducing initiatives to spread awareness regarding dental care. For instance, in June 2021, My Dental Plan announced that it would add 4,000 more clinics, thereby expanding its reach to 250 cities by the end of 2021.

Key Companies & Market Share Insights

Due to the imposed social distancing guidelines in the early phase of the COVID-19 pandemic, dental practices were closed in many countries. The dental care services industry has a severe impact on the business. Therefore, the service providers are focusing on introducing innovative ways to improve patient care experience. In June 2020, Aspen Dental launched its digital check-in platform, which is available in its 820 offices in 41 states. This platform will help patients in managing their dental visits conveniently.

Moreover, dental care practices rely on geographic expansion to strengthen their market presence. As per a July 2021 article, the UK Dental Group plans to launch 400 clinic franchises across the nation in three years. The additional clinics are expected to reduce the waiting time and discourage patients from traveling abroad for dental procedures. The clinics would also provide home services to people with less mobility. With better outreach around the U.K., the clinics will provide quality dental care to more people. Some prominent players in the global dental services market include:

-

Aspen Dental Management Inc.

-

InterDent, Inc.

-

National Health Service England

-

The British United Provident Association Limited

-

Apollo White Dental

-

Abano Healthcare Group Limited

-

Coast Dental

-

Dental Service Group

-

Axis Dental

-

Integrated Dental Holdings

-

Pacific Dental Service

-

Gentle Dental of New England

Dental Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 449.5 billion

Revenue forecast in 2030

USD 610.4 billion

Growth rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Type,end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Aspen Dental Management Inc.; InterDent, Inc.; National Health Service England; The British United Provident Association Limited; Apollo White Dental; Abano Healthcare Group Limited; Coast Dental; Dental Service Group; Axis Dental; Integrated Dental Holdings; Pacific Dental Service; Gentle Dental of New England

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental services market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dental Implants

-

Orthodontics

-

Periodontics

-

Endodontics

-

Cosmetic Dentistry

-

Laser Dentistry

-

Dentures

-

Oral & Maxillofacial Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Dental Clinics

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental services market size was estimated at USD 433.2 billion in 2022 and is expected to reach USD 449.5 billion in 2023.

b. The global dental services market is expected to grow at a compound annual growth rate of 4.5% from 2023 to 2030 to reach USD 610.4 billion by 2030.

b. In 2022, the dental implants segment held a majority of the dental services market share in terms of revenue share. Dental implant restoration is considered an advanced oral procedure and it provides patients with functionally and aesthetically feasible options for tooth replacement.

b. Some of the key players in the dental services market are Aspen Dental Management Inc., InterDent, Inc., National Health Service England, The British United Provident Association Limited, Apollo White Dental, Abano Healthcare Group Limited, Coast Dental, Dental Service Group, Axis Dental, Integrated Dental Holdings, Pacific Dental Service, and Gentle Dental of New England.

b. Some of the key factors contributing to the dental services market growth are growing awareness of dentistry among people, the rising prevalence of dental caries and other periodontal diseases, technological developments in dentistry, and the high demand for cosmetic & laser dentistry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.