- Home

- »

- Medical Devices

- »

-

Dental Membrane Market Size & Share, Industry Report 2033GVR Report cover

![Dental Membrane Market Size, Share & Trends Report]()

Dental Membrane Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Resorbable Membranes, Non-Resorbable Membrane), By Application (Ridge Augmentation, Sinus Lift, Socket Preservation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-840-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Membrane Market Summary

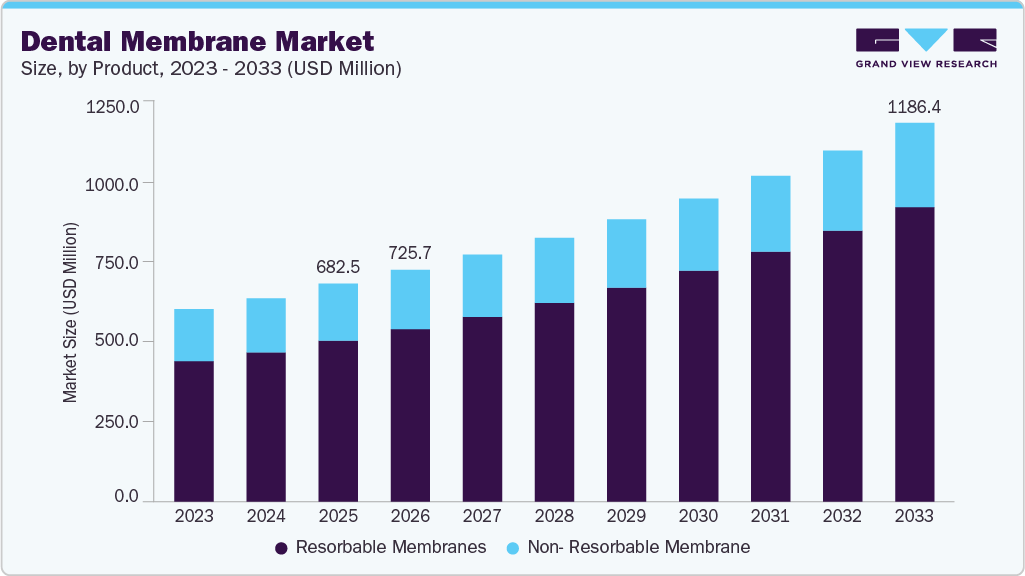

The global dental membrane market size was valued at USD 682.46 million in 2025 and is projected to reach USD 1,186.38 million by 2033, growing at a CAGR of 7.27% from 2026 to 2033. The rising global prevalence of periodontal disease and tooth loss is a key driver of demand in the dental membrane market.

Key Market Trends & Insights

- North America dominated the dental membrane market with the largest revenue share of 37.90% in 2025.

- By product, the resorbable membranes segment led the market with the largest revenue share of 73.92% in 2025.

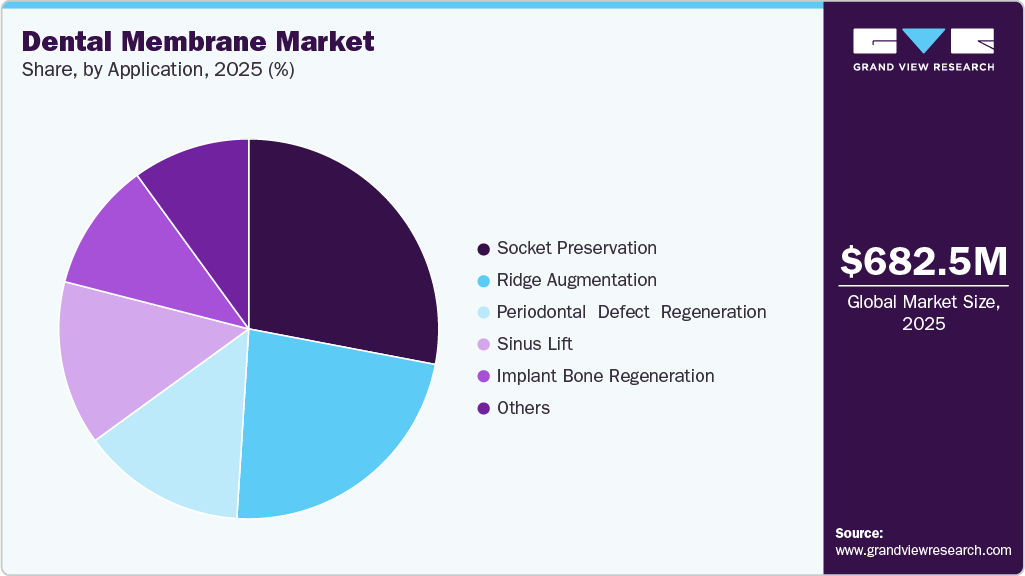

- By application, the socket preservation segment led the market with the largest revenue share of 27.80% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 682.46 Million

- 2033 Projected Market Size: USD 1,186.38 Million

- CAGR (2025-2033): 7.27%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing markets

According to the World Health Organization (March 2025), more than 1 billion people worldwide suffer from severe periodontal disease, a leading cause of alveolar bone loss that often requires guided tissue regeneration (GTR) and guided bone regeneration (GBR) procedures using dental membranes. Additionally, a significant proportion of older adults experience partial or complete tooth loss, thereby increasing the need for dental implants and bone regeneration therapies. As tooth loss is frequently accompanied by jawbone resorption, the use of bone grafts and barrier membranes is critical to support successful implant placement and long-term clinical outcomes, thereby sustaining market growth.

The global rise in periodontal disease and tooth loss is directly increasing the clinical use of dental membranes in guided tissue regeneration (GTR) and guided bone regeneration (GBR) procedures. According to World Health Organization data published in March 2025, over 1 billion people worldwide suffer from severe periodontal disease, a condition that routinely requires barrier membranes to prevent epithelial migration and enable controlled tissue regeneration.

Tooth loss further accelerates membrane utilization. Nearly 7% of adults aged 20 years and above and approximately 23% of individuals over 60 years experience complete tooth loss, creating a large patient pool requiring regenerative interventions where dental membranes are a standard of care. A February 2025 report by Humble Memorial Dental estimates that 3.5 billion people globally are affected by oral diseases, with nearly 50% of adults aged 30 and above experiencing gum disease, underscoring sustained procedural demand.

Growth in dental implant placement is further strengthening the dental membrane market. Dental membranes are routinely used during implant site preparation to stabilize healing sites, isolate soft tissue, and improve regenerative predictability. According to Twin Dental New York, approximately 5 million dental implants are placed annually in the U.S., supporting consistent and repeat demand for dental membranes across clinical settings.

Ongoing clinical studies evaluating membrane material performance, resorption behavior, and handling characteristics are reinforcing clinician confidence and accelerating adoption, positioning dental membranes as indispensable consumables in modern periodontal and implant dentistry.

Some of the recent clinical trials involving dental membranes are mentioned below:

NCT Number

Conditions

Interventions

Sponsor

Completion Date

NCT06252935

Guided Tissue Regeneration|Collagen Membrane|Dental Diseases

DEVICE: FormaAid|DEVICE: Bio-Gide

Maxigen Biotech Inc.

10/31/2025

NCT06987149

Alveolar Ridge Augmentation, Dental Implants|Alveolar Ridge Deficiency in the Anterior Esthetic Zone

DEVICE: CAD/CAM Zirconia Membrane|PROCEDURE: Contour Augmentation

Mohammed Mashhout Eisa Anas

2025-07

NCT06724783

Tooth Extraction|Tooth Replacement

DEVICE: Collagen membrane

Dr. med. dent. Malin Strasding

9/30/2030

NCT06467630

Guided Bone Regeneration

PROCEDURE: Preserving alveolar bone volume after tooth extraction|PROCEDURE: Alveolar crest reconstruction|PROCEDURE: Covering bone defects during immediate implant placement.

Septodont

2025-12

NCT04737525

Immediate Implants

DEVICE: Dental implant placement, bone and soft tissue augmentation on buccal site

Vilniaus Implantologijos Centro (VIC) Klinika

2/10/2031

Source: ClinicalTrials.Gov

Key opinion leaders highlight strategic partnerships and advanced manufacturing technologies as critical enablers for scaling innovative, animal-tissue-free dental membranes, supporting global availability, clinical adoption, and long-term growth opportunities in regenerative dentistry.

Key Opinion Leaders

Company Name

KOLs

Growth Opportunities

Hans Leemhuis, CEO of Fibrothelium.

“Partnering with VIVOLTA marks a key milestone in scaling the production and the global availability of our SimplySilk membrane. Vivolta’s proven know-how in electro spun medical products and its state-of-the-art MediSpin system give us great confidence in the quality, reproducibility and scalability of our product as we ramp up production. We look forward to delivering our SimplySilk membrane to clinicians worldwide as a safe, effective new animal-tissue-free option for regenerative procedures that supports optimal tissue regeneration and patient care.”

- Scalability of Production for Global Demand

- Expansion of Animal-Tissue-Free Solutions

- High-Quality, Electrospun Medical Technology

Source: Grand View Research Analysis

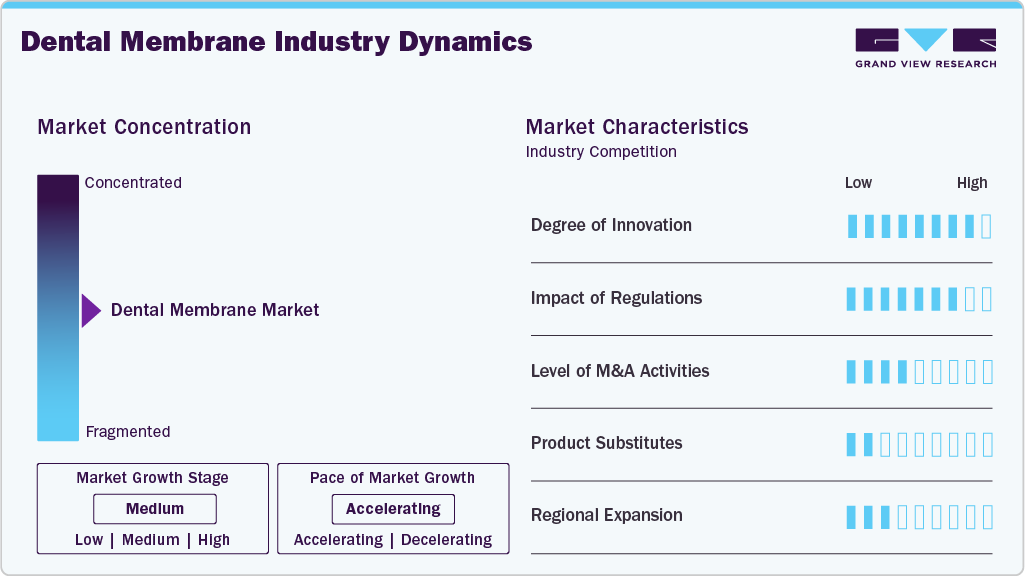

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The dental membrane market is characterized by high growth owing to the rising demand for aesthetic and restorative dentistry, growing launches of novel products, and increasing burden of dental disorders.

The rising number of clinical trials focused on dental membranes reflects the market’s strong emphasis on material innovation, biocompatibility, and predictable regeneration outcomes. Manufacturers are increasingly investing in next-generation resorbable membranes, including products that are entirely free from animal-derived components to address ethical, safety, and regulatory concerns. For instance, in August 2025, VIVOLTA partnered with Fibrothelium to manufacture SimplySilk, a CE-marked resorbable dental membrane engineered using proprietary silk fibroin technology. SimplySilk features a multi-layered electrospun structure designed to deliver extended barrier function and support controlled tissue regeneration in dental surgical procedures. This development highlights the industry’s shift toward synthetic, high-performance membranes that align with clinician expectations for handling performance and patient demand for non-animal-derived materials.

Dental membranes are subject to stringent regulatory oversight by agencies such as the U.S. Food and Drug Administration, Health Canada, and the European Medicines Agency. Regulatory classification is primarily determined by material composition, resorption profile, and intended use. In the U.S., most standard resorbable dental membranes are regulated as Class II medical devices, requiring compliance with special controls and premarket notification pathways. Failure to meet regulatory requirements-including unauthorized distribution or inadequate technical documentation-can result in product recalls, import bans, and enforcement actions, as demonstrated by past interventions from authorities such as the FDA and Australia’s Therapeutic Goods Administration. As a result, regulatory compliance remains a critical barrier to entry and a key determinant of commercial success in the dental membrane market.

Mergers and acquisitions represent an important strategic lever in the dental membrane industry, enabling companies to expand collagen-based membrane portfolios, secure proprietary processing technologies, and strengthen manufacturing capabilities. In November 2024, RTI Surgical completed the acquisition of Collagen Solutions, a global supplier of engineered medical-grade collagen. The transaction enhanced RTI Surgical’s access to advanced collagen technologies relevant to regenerative and barrier membrane applications, reinforcing its position within the dental and surgical biomaterials space.

Dental membrane manufacturers are increasingly pursuing geographic expansion through targeted regulatory approvals, particularly in high-growth Asian markets. Securing local market authorizations enables faster commercialization and strengthens competitive positioning. For instance, in September 2024, Regenity Biosciences received regulatory approval from China’s National Medical Products Administration for its Matrixflex resorbable dental membrane. The product is a crosslinked, bioresorbable collagen membrane intended for oral and periodontal surgical procedures. This approval marked a significant step in Regenity’s Asia-Pacific expansion strategy and underscores the importance of regulatory access in scaling dental membrane adoption globally.

Product Insights

Resorbable membranes dominated the dental membrane market, accounting for 73.92% of total revenue in 2025, driven by strong clinical acceptance, predictable healing outcomes, and ease of use. These membranes resorb in situ, eliminating the need for secondary removal surgery and reducing patient discomfort and complication risk. Regulatory approvals have further strengthened this segment by validating clinical performance and supporting geographic expansion. For example, in September 2024, Regenity Biosciences received approval from China’s National Medical Products Administration for its Matrixflex crosslinked bioresorbable collagen dental membrane. The approval was supported by a six-month multicenter randomized clinical trial involving 174 patients across six hospitals, where Matrixflex demonstrated safety and superior periodontal outcomes compared with Geistlich Bio-Gide, underscoring its effective barrier function and biocompatibility.

Non-resorbable membranes are expected to grow at a moderate rate during the forecast period, driven by their continued use in complex regenerative cases that require prolonged barrier stability. These membranes provide superior space maintenance and structural integrity in large or non-contained defects, particularly in advanced implant placement and ridge augmentation procedures. However, the requirement for a secondary surgical removal and a relatively higher risk of postoperative complications compared to resorbable alternatives constrain wider adoption, resulting in steady but restrained growth.

Ongoing clinical research in 2024-2025 reinforces the segment’s specialized clinical relevance. For instance, clinical study NCT07254494, a prospective randomized controlled trial registered on ClinicalTrials.gov (U.S. National Library of Medicine), was initiated in 2024 and is expected to conclude in 2025. The study compares non-resorbable d-PTFE membranes with resorbable pericardium collagen membranes for horizontal ridge augmentation in patients with atrophic posterior mandibles. The study supports continued, niche clinical use of non-resorbable membranes in complex cases, reinforcing moderate growth expectations.

Application Insights

The socket preservation segment led the dental membrane market, accounting for 27.80% revenue share in 2025, driven by its routine use following tooth extractions to stabilize the socket and prevent alveolar ridge collapse. Dental membranes are widely used to protect extraction sites, prevent soft-tissue ingrowth, and maintain ridge anatomy, particularly where future restorative options may be required. Segment demand is fundamentally supported by the rising volume of tooth extractions, independent of immediate implant placement. NHS data for the 2022-2023 financial year report 47,581 tooth extractions among 0-19-year-olds in England, with 66% attributable to dental decay, representing a 17% year-on-year increase. Elevated extraction rates, particularly in underserved populations, sustain the baseline demand for socket management procedures, thereby supporting the segment’s leading market position.

The sinus lift segment is expected to register the fastest growth in the dental membrane market due to anatomical necessity in posterior maxillary implant placement. Peer-reviewed clinical literature confirms that maxillary sinus pneumatization and vertical bone loss following posterior tooth extraction frequently leave insufficient bone height for implant placement, making sinus augmentation unavoidable in many cases. A 2023 review in the British Dental Journal and 2024 clinical analyses indexed in PubMed report that implants in the posterior maxilla commonly require sinus elevation to achieve primary stability. Dental membranes are mandatory in sinus lift procedures to protect the Schneiderian membrane and maintain graft stability, resulting in higher membrane consumption per procedure and driving faster segment growth despite lower procedural volumes.

Regional Insights

North America accounted for the largest revenue share of 37.97% in the dental membrane market, supported by a high and well-documented burden of oral disease. According to data published by the Centers for Disease Control and Prevention in its 2024 Oral Health Surveillance Report, approximately 42% of U.S. adults aged 30 years and older have periodontitis, a major contributor to tooth loss and extraction procedures. In addition, CDC data released in 2024 indicate that 11-20% of adults aged 65 years and above are completely edentulous. These high and persistent rates of periodontal disease and tooth loss directly translate into sustained procedural demand for extractions, implants, and regenerative interventions, driving both market growth and North America’s dominant revenue position in the dental membrane market.

U.S. Dental Membrane Market Trends

The U.S. dental membrane market is expected to grow steadily, driven by rising volumes of maxillofacial and reconstructive dental procedures and an increasing incidence of trauma-related dental injuries. Road accidents and facial trauma frequently require surgical interventions involving guided tissue and bone regeneration, where dental membranes are routinely used. According to data published by the National Safety Council, motor vehicle crashes in 2023 resulted in 44,762 fatalities and approximately 5.1 million medically consulted injuries in the U.S., highlighting sustained demand for reconstructive dental care. High procedural adoption, advanced clinical infrastructure, and early uptake of innovative resorbable membranes further support market growth.

Europe Dental Membrane Market Trends

The Europe dental membrane market is expanding due to an aging population, rising prevalence of tooth loss and periodontal disease, and strong adoption of implant dentistry. Dental membranes are widely used across periodontal regeneration, ridge preservation, and sinus augmentation procedures. Advances in implantology and membrane materials, along with a growing preference for synthetic and animal-free membranes driven by ethical and safety considerations, are improving clinical acceptance. Favorable regulatory frameworks and high clinician awareness further support steady market expansion across Western and Central Europe.

The UK dental membrane market is growing due to increasing demand for regenerative dental procedures associated with tooth extractions and implant preparation. An aging population and persistent burden of dental caries and periodontal disease continue to drive extraction volumes, increasing the need for socket preservation and guided regeneration. According to data released by the Royal College of Surgeons of England in February 2025, more than 30,500 hospital episodes of tooth extractions were recorded among individuals aged 0-19 years, primarily due to tooth decay, reinforcing sustained procedural demand for dental membranes.

The France dental membrane market is poised for continued growth, supported by the country’s rapidly aging population and rising prevalence of periodontal disease and tooth loss. According to data published by the INSEE in January 2024, 21.5% of the population-approximately 14.7 million people-were aged 65 years and older. This demographic shift increases demand for implant-supported restorations and regenerative dental procedures, where membranes are routinely used to support predictable healing and long-term outcomes.

Asia Pacific Dental Membrane Market Trends

Asia Pacific represents the fastest-growing regional market for dental membranes, driven by rising oral disease prevalence, a large aging population, and improving access to dental care. Increasing awareness of regenerative dentistry, rapid adoption of modern implant techniques, and expansion of private dental clinics are supporting membrane utilization. Medical tourism, particularly in countries such as China, India, Japan, and Australia, further contributes to market growth as clinics adopt advanced membrane technologies to meet international treatment standards.

The India dental membrane market is expected to witness lucrative growth, driven by a high burden of oral disease, increasing patient awareness, and expanding private dental infrastructure. Dentists are increasingly adopting resorbable dental membranes for periodontal regeneration and implant site management. According to data published by The Hindu in March 2025, nearly 60% of India’s population is affected by dental caries, while approximately 85% suffer from gum disease, creating a substantial procedural base for membrane-assisted regenerative treatments.

The China dental membrane market is expected to grow strongly, driven by a rapidly aging population, rising prevalence of tooth loss and oral diseases, and increasing surgical interventions for complex oral conditions, including cancer-related reconstructions. Improving patient awareness, expanding access to advanced dental care, and sustained regulatory momentum are accelerating adoption of dental membranes across clinical settings. These trends are reinforced by ongoing regulatory approvals for innovative membrane products. For instance, in September 2024, Regenity Biosciences expanded its footprint in China after receiving approval from the National Medical Products Administration for its Matrixflex crosslinked collagen dental membrane. Supported by clinical evidence, the approval enables commercialization in China’s rapidly expanding dental market and underscores growing acceptance of advanced resorbable membrane technologies.

Latin America Dental Membrane Market Trends

The Latin America dental membrane market is experiencing steady growth, led by Brazil and Argentina, where rising implant procedures and expanding private dental practices are increasing membrane usage. Improving clinician training, broader regulatory approvals, and adoption of digital dentistry tools are enhancing acceptance of regenerative procedures. Dental membranes are increasingly used in socket preservation and implant site preparation, supporting gradual market expansion across the region.

Middle East and Africa Dental Membrane Market Trends

The Middle East and Africa dental membrane market is growing due to a high prevalence of dental disease, increasing healthcare spending, and the expansion of private dental clinics. Rising dental tourism in countries such as the UAE and Turkey is driving the adoption of advanced regenerative procedures where membranes are essential. Improvements in biomaterial availability and clinician expertise continue to support market development.

The Saudi Arabia dental membrane market is expected to grow robustly, supported by expanding healthcare infrastructure and increased investment in dental services. The country’s Vision 2030 initiative emphasizes preventive and restorative healthcare, including oral health, and improving access to advanced dental treatments. An aging population and rising adoption of implant dentistry are further driving demand for dental membranes in regenerative and reconstructive procedures.

Key Dental Membranes Company Insights

Major players operating in the global dental membrane market include Institut Straumann AG, Dentsply Sirona, Nobel Biocare Services AG, Geistlich Holding, ZimVie Inc., Osteogenics Biomedical, Regenity, BioHorizons, REGEDENT AG, and Bioteck S.p.A.. Additional notable participants include EUCARE Pharmaceuticals (P) Ltd, Curasan, Inc., TBR Dental, DentiumUSA, Tecnoss Dental Srl, Unicare Biomedical, Inc., Neoss, Advanced Medical Solutions Group plc, Maxigen Biotech Inc., and B&B Dental Implant Company.

These companies are actively expanding their dental membrane portfolios, with a strong focus on resorbable and synthetic membrane technologies, while prioritizing regulatory approvals across key markets to support commercialization and geographic expansion. Strategic initiatives such as product innovation, clinical validation, and distribution partnerships remain central to strengthening competitive positioning and addressing the growing demand for regenerative dental procedures.

Key Dental Membranes Companies:

The following are the leading companies in the dental membranes market. These companies collectively hold the largest market share and dictate industry trends.

- Institut Straumann AG

- Dentsply Sirona

- Nobel Biocare Services AG (Envista)

- Geistlich Holding

- ZimVie Inc.

- Osteogenics Biomedical (Envista)

- Regenity

- BioHorizons

- REGEDENT AG

- Bioteck S.p.A.

- EUCARE Pharmaceuticals (P) Ltd

- Curasan, Inc.

- TBR Dental

- DentiumUSA

- Tecnoss Dental Srl

- Unicare Biomedical, Inc.

- Neoss

- Advanced Medical Solutions Group plc

- Maxigen Biotech Inc.

- B&B Dental Implant Company

Recent Developments

-

In October 2025, Geistlich Holding launched Bio-Gide Forte, an advanced resorbable collagen membrane with greater strength and improved handling based on the proven Bio-Gide platform. Available in North America and being prepared for Europe, the membrane unfolds easily, adapts precisely to defects, and supports reliable regeneration in complex cases. Its optimized physical properties aim to enhance clinical efficiency and outcomes for guided tissue and bone regeneration procedures.

-

In April 2025, Orthocell announced that it received regulatory approval from Brazil’s ANVISA for its Striate+ dental membrane, marking the company’s first authorized entry into the Latin American market. The approval enables planned commercial launches through its distribution partner BioHorizons, expanding Striate+ availability across a key emerging region. This clearance supports Orthocell’s global expansion strategy for the resorbable collagen membrane and is expected to drive new revenue opportunities while strengthening market presence in South America’s growing dental regeneration segment.

-

In March 2025, Orthocell announced the first sales of its Striate+ dental membrane in the DACH region (Germany, Austria, Switzerland), marking its commercial debut in Central Europe. The launch follows regulatory authorizations and leverages distribution through partner BioHorizons Camlog. Early sales demonstrate initial market uptake for the resorbable collagen membrane in key European markets and support Orthocell’s broader global commercialization strategy. This milestone is expected to contribute to revenue growth and enhance the company’s presence in the European dental regenerative market.

-

In March 2025, Orthocell announced that it received regulatory approval in Singapore for its Striate+ dental membrane, expanding the product’s market access in Southeast Asia. The clearance enables planned commercial launches through distribution partner BioHorizons, supporting broader regional adoption of the resorbable collagen membrane. This approval complements existing authorizations in other jurisdictions and aligns with Orthocell’s global expansion strategy for Striate+. The Singapore clearance is expected to enhance market penetration and contribute to future sales growth in the Asia-Pacific region.

-

In September 2024, Regenity Biosciences, a global player in regenerative medicine and a Linden Capital Partners portfolio company, received regulatory approval from China’s NMPA for its novel Matrixflex resorbable membrane. This crosslinked, bioresorbable collagen membrane is designed for use in oral surgical procedures.

-

In September 2024, Orthocell announced first commercial sales of its Striate+ dental membrane in Canada, following regulatory approval from Health Canada. The milestone marks entry into a key new market for the resorbable collagen membrane, with distribution supported by partner BioHorizons Camlog. Initial sales reflect early market uptake and validate Orthocell’s global commercialization strategy. The launch is expected to contribute to revenue growth as the company expands Striate+ availability beyond existing territories.

-

In July 2024, Geistlich Holding announced that Chondro-Gide has received EU MDR certification under the updated European Medical Device Regulation, confirming compliance with stringent safety and performance standards. This certification enables continued marketing and distribution of the collagen-based membrane across the EU. The MDR clearance reinforces Geistlich’s commitment to regulatory quality and market continuity for its regenerative membrane portfolio, supporting clinician confidence and uninterrupted availability in European dental and orthopedic applications.

Dental Membrane Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 725.71 million

Revenue forecast in 2033

USD 1,186.38 million

Growth rate

CAGR of 7.27% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026- 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Institut Straumann AG; Dentsply Sirona; Nobel Biocare Services AG (Envista); Geistlich Holding; ZimVie Inc.; Osteogenics Biomedical (Envista); Regenity; BioHorizons; REGEDENT AG; Bioteck S.p.A.; EUCARE Pharmaceuticals (P) Ltd; Curasan, Inc.; TBR Dental; DentiumUSA; Tecnoss Dental Srl; Unicare Biomedical, Inc.; Neoss; Advanced Medical Solutions Group plc; Maxigen Biotech Inc.; B&B Dental Implant Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Dental Membrane Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global dental membrane market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Resorbable Membranes

-

Bovine -derived collagen based

-

Porcine derived collagen based

-

Others

-

-

Non- Resorbable Membrane

-

Expanded PTFE (ePTFE)

-

Dense PTFE (dPTFE)

-

Titanium-Reinforced PTFE

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Ridge Augmentation

-

Sinus Lift

-

Periodontal Defect Regeneration

-

Implant Bone Regeneration

-

Socket Preservation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental membrane market size was estimated at USD 682.46 million in 2025 and is expected to reach USD 725.71 million in 2026.

b. The dental membrane market is projected to grow at a CAGR of 7.27% from 2026 to 2033 to reach USD 1,186.38 million by 2033.

b. Based on product, resorbable membranes dominated the dental membrane market, accounting for 73.92% of total revenue in 2025, driven by strong clinical acceptance, predictable healing outcomes, and ease of use. These membranes resorb in situ, eliminating the need for secondary removal surgery and reducing patient discomfort and complication risk.

b. Key players operating in the global dental membrane market include Institut Straumann AG, Dentsply Sirona, Nobel Biocare Services AG, Geistlich Holding, ZimVie Inc., Osteogenics Biomedical, Regenity, BioHorizons, REGEDENT AG, and Bioteck S.p.A.. Additional notable participants include EUCARE Pharmaceuticals (P) Ltd, Curasan, Inc., TBR Dental, DentiumUSA, Tecnoss Dental Srl, Unicare Biomedical, Inc., Neoss, Advanced Medical Solutions Group plc, Maxigen Biotech Inc., and B&B Dental Implant Company.

b. The dental membrane market is driven by rising dental disorders and tooth loss, increasing dental implant and guided regeneration procedures, ageing populations with greater oral care needs, broader awareness and access to advanced dental treatments, preference for biocompatible resorbable membranes, and expanding healthcare infrastructure with qualified professionals boosting adoption globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.